Title: 🌾 WHEAT CFD: The "Money Looting" Thief Plan (Bullish Breakout Setup) ⚡🤑

Executive Thief Summary 🦹

Ladies & Gentleman, Thief OG's! 👋 Ready to execute a precision heist on the Wheat markets? This plan uses a layered entry strategy (a.k.a. The Thief Strategy) to loot some profits from a potential bullish breakout. We're stacking limit orders like cash stacks and making a clean escape before resistance shows up. Alarm bells are ringing! 🔔

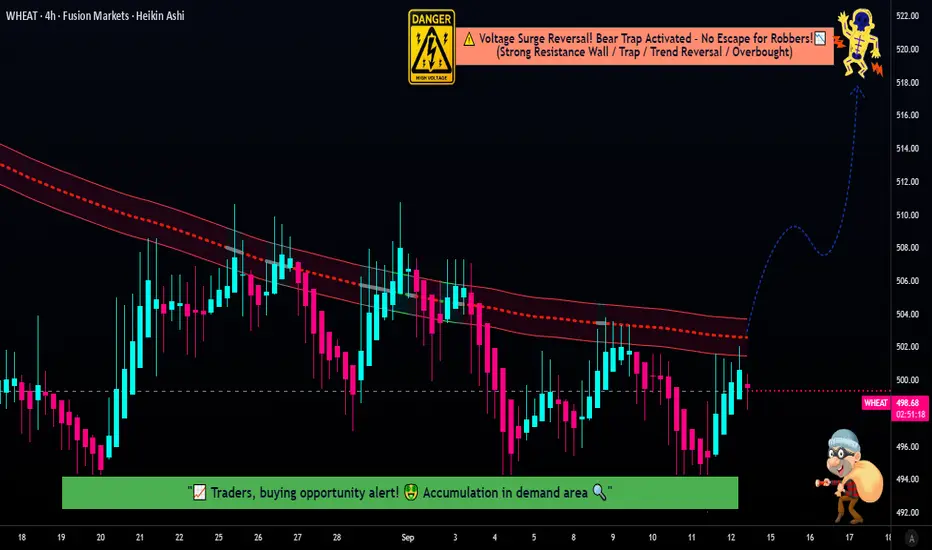

📈 The Technical Thief Plan (Swing/Day Trade)

Asset: WHEAT (Wheat CFD)

WHEAT (Wheat CFD)

Bias: Bullish ⬆️

Trigger: A breakout and close above 504 on the LSMA Moving Average.

🎯 Entry Strategy (The "Thief" Layering Method):

Step 1: SET AN ALARM at 504 to notify you the moment the breakout happens!

Step 2: Upon confirmation of the breakout, deploy multiple BUY LIMIT orders on any pullback at the following layers:

Layer 1: @ 502

Layer 2: @ 500

Layer 3: @ 498

Layer 4: @ 496

Pro Thief Tip: You can add or adjust these layers based on your capital and risk appetite. The goal is to get a better average entry price.

⛔ Stop Loss (Escape Route):

A collective Stop Loss can be placed at 493, ideally after the breakout and a pullback into your layers occurs.

⚠️ Disclaimer: Dear Thief OG's, I am not a financial advisor. You MUST adjust your SL based on your own strategy and risk tolerance. Protect your capital!

✅ Take Profit (The Getaway Car):

Our primary target to escape with the stolen money is at 520, a strong resistance zone where overbought conditions and traps may lurk.

⚠️ Disclaimer: This is MY plan. You are the master thief of your own trade. Take profits based on your own analysis and risk management. Run when you've got the bag! 💰

🔍 Why This Plan? The Fundamental Intel

This isn't just a technical play; the macro backdrop provides a compelling narrative for a potential move north.

🌍 Fundamental & Macro Score: 5.5/10 (Stable but Vulnerable)

Supply/Demand (6/10): Production is steady (EU & Russia with big crops), but record utilization and booming feed demand in Brazil/EU are supportive. US exports are forecast at a multi-year high.

Macro Factors (5/10): Black Sea geopolitical tensions add a risk premium. Strong global trade offsets ample stocks. Inflation and potential Fed cuts support commodities, though China's import cuts are a headwind.

😊📊 Trader Sentiment Outlook (Mixed but Leaning Cautious)

Retail: 38% Bullish 🟢 | 62% Bearish 🔴 (Cautious due to recent dips)

Institutional: 45% Bullish 🟢 | 55% Bearish 🔴 (Slightly more optimistic on export recovery)

The crowd is cautious, which can often be a contrarian signal for opportunities.

⚖️😨 Fear & Greed Gauge: Neutral (45/100)

Balanced between fear of abundant production and greed from tightening global stocks. Weather concerns in Europe/US and strong Asian demand are key drivers. No extreme emotions mean room for a sentiment shift.

🚀 Overall Market Outlook: Mild Bull (Long) 🟢

Expect gradual upside in H2 2025 from declining global stocks and solid demand. The trigger for a rally could be disappointing Russian yields or an acceleration in exports. Avoid shorts below $500 support.

👀 Related Pairs/Assets to Watch

CORN (Corn CFD)

CORN (Corn CFD)

SOYBEAN (Soybean CFD)

SOYBEAN (Soybean CFD)

FX:

USDRUB (US Dollar/Russian Ruble - for Black Sea export risk)

USDRUB (US Dollar/Russian Ruble - for Black Sea export risk)

DXY (US Dollar Index)

DXY (US Dollar Index)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Wheat #Trading #Commodities #CFD #TradingStrategy #Breakout #Bullish #SwingTrading #DayTrading #TechnicalAnalysis #FundamentalAnalysis #TradingViewIdea #Investing #SupplyDemand

Executive Thief Summary 🦹

Ladies & Gentleman, Thief OG's! 👋 Ready to execute a precision heist on the Wheat markets? This plan uses a layered entry strategy (a.k.a. The Thief Strategy) to loot some profits from a potential bullish breakout. We're stacking limit orders like cash stacks and making a clean escape before resistance shows up. Alarm bells are ringing! 🔔

📈 The Technical Thief Plan (Swing/Day Trade)

Asset:

Bias: Bullish ⬆️

Trigger: A breakout and close above 504 on the LSMA Moving Average.

🎯 Entry Strategy (The "Thief" Layering Method):

Step 1: SET AN ALARM at 504 to notify you the moment the breakout happens!

Step 2: Upon confirmation of the breakout, deploy multiple BUY LIMIT orders on any pullback at the following layers:

Layer 1: @ 502

Layer 2: @ 500

Layer 3: @ 498

Layer 4: @ 496

Pro Thief Tip: You can add or adjust these layers based on your capital and risk appetite. The goal is to get a better average entry price.

⛔ Stop Loss (Escape Route):

A collective Stop Loss can be placed at 493, ideally after the breakout and a pullback into your layers occurs.

⚠️ Disclaimer: Dear Thief OG's, I am not a financial advisor. You MUST adjust your SL based on your own strategy and risk tolerance. Protect your capital!

✅ Take Profit (The Getaway Car):

Our primary target to escape with the stolen money is at 520, a strong resistance zone where overbought conditions and traps may lurk.

⚠️ Disclaimer: This is MY plan. You are the master thief of your own trade. Take profits based on your own analysis and risk management. Run when you've got the bag! 💰

🔍 Why This Plan? The Fundamental Intel

This isn't just a technical play; the macro backdrop provides a compelling narrative for a potential move north.

🌍 Fundamental & Macro Score: 5.5/10 (Stable but Vulnerable)

Supply/Demand (6/10): Production is steady (EU & Russia with big crops), but record utilization and booming feed demand in Brazil/EU are supportive. US exports are forecast at a multi-year high.

Macro Factors (5/10): Black Sea geopolitical tensions add a risk premium. Strong global trade offsets ample stocks. Inflation and potential Fed cuts support commodities, though China's import cuts are a headwind.

😊📊 Trader Sentiment Outlook (Mixed but Leaning Cautious)

Retail: 38% Bullish 🟢 | 62% Bearish 🔴 (Cautious due to recent dips)

Institutional: 45% Bullish 🟢 | 55% Bearish 🔴 (Slightly more optimistic on export recovery)

The crowd is cautious, which can often be a contrarian signal for opportunities.

⚖️😨 Fear & Greed Gauge: Neutral (45/100)

Balanced between fear of abundant production and greed from tightening global stocks. Weather concerns in Europe/US and strong Asian demand are key drivers. No extreme emotions mean room for a sentiment shift.

🚀 Overall Market Outlook: Mild Bull (Long) 🟢

Expect gradual upside in H2 2025 from declining global stocks and solid demand. The trigger for a rally could be disappointing Russian yields or an acceleration in exports. Avoid shorts below $500 support.

👀 Related Pairs/Assets to Watch

FX:

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Wheat #Trading #Commodities #CFD #TradingStrategy #Breakout #Bullish #SwingTrading #DayTrading #TechnicalAnalysis #FundamentalAnalysis #TradingViewIdea #Investing #SupplyDemand

Order cancelled

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.