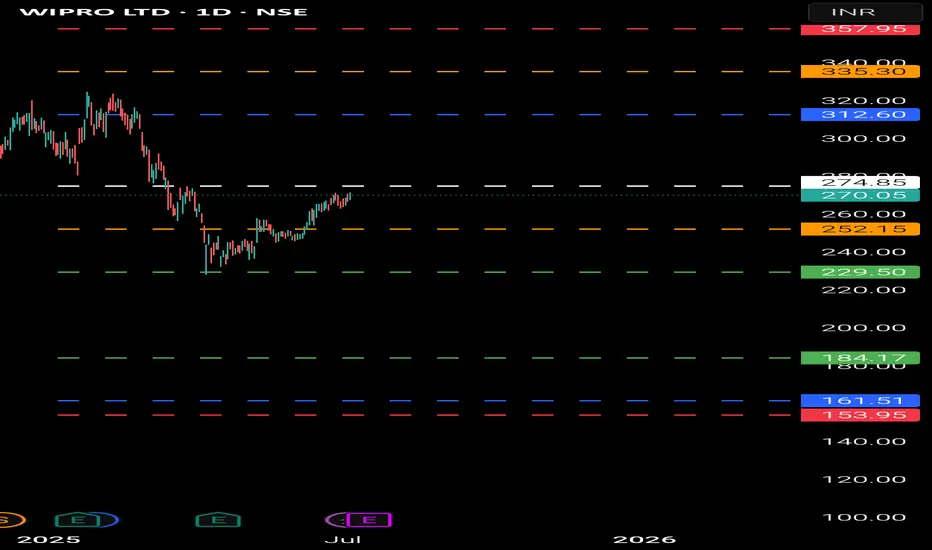

Wipro appears to be entering an attractive buying zone if its price falls between ₹161 and ₹184. A stop-loss should be set at ₹153 to manage potential downside.

On the other hand, if Wipro's price consistently stays above ₹274, it signals a bullish trend. Should it then maintain levels above the ₹312-₹335 range, the outlook becomes even more strongly bullish. In that scenario, we could target further upside, potentially reaching around ₹400, ₹500, and even ₹600.

**Consider some buffer points in above levels

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

On the other hand, if Wipro's price consistently stays above ₹274, it signals a bullish trend. Should it then maintain levels above the ₹312-₹335 range, the outlook becomes even more strongly bullish. In that scenario, we could target further upside, potentially reaching around ₹400, ₹500, and even ₹600.

**Consider some buffer points in above levels

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.