I. Market Background and Recent Developments

Fundamental Drivers

Rising Expectations of a Fed Rate Cut: Recent weak US economic data (non-farm payrolls, manufacturing PMI, etc.) has reinforced market bets on a September rate cut, which is bullish for gold in the medium and long term.

Safe-haven Demand: Intensified global trade tensions (such as the US-China tariff issue) and geopolitical risks are increasing safe-haven buying for gold.

Impact of the US Dollar's Trend: If the US dollar weakens due to expectations of a rate cut, gold may rise further; conversely, a rebound in the US dollar could suppress gold prices.

II. Key Technical Analysis

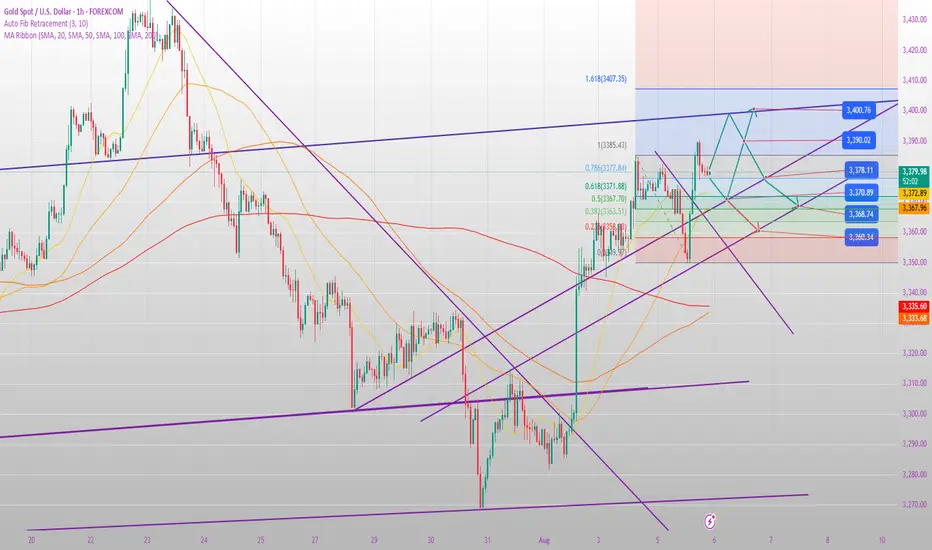

1. Short-Term Trend: Weak and volatile, focusing on the 3340-3390 range.

Key Support:

3345-3340 (38.2% Fibonacci retracement level)

3335 (if broken, the decline could accelerate to 3328).

Key resistance:

3365 (mid-line watershed, if it holds, it will turn into a volatile market)

3385-3390 (previous high, strong pressure, a breakout opens up upside potential).

2. MACD and Momentum Analysis

MACD Divergence Correction: Yesterday's decline corrected the overbought condition. If it stabilizes around 3340, it may rebound again.

RSI (4H): Currently below 50, the short-term trend remains bearish, but approaching the oversold zone (below 30) may trigger a rebound.

III. Today's Trading Strategy

1. Low-to-Long Strategy (3340-3350 Area)

Entry Point: 3350-3352. Try buying with a light position. If it falls to 3340-3345, add to your position.

Stop Loss: Below 3340 (3338) to prevent false breakouts.

Target: 3365 (first take-profit) → 3375 (second target).

2. High-Sell Strategy (3395-3400 Area)

If the market first touches the 3395-3400 area: Set up a short position with a stop-loss at 3405 and a target of 3380-3370.

3. Breakout Strategy

If the market breaks through 3385: Go long if it stabilizes at 3370, with a target of 3400.

If the market breaks below 3340: Wait and see if it stabilizes near 3330 before considering a low-level long position.

IV. Risk Warning

Focus on US market data: Fed officials' speeches may impact market sentiment.

Adhere to a strict stop-loss order: Avoid large losses caused by one-sided market movements.

Adjust your strategy flexibly: If the market breaks through key levels quickly, adjust your strategy promptly.

Trade active

Latest Gold Market Trend Analysis:

📌Core Logic: Risk aversion and rate cut expectations support gold prices

Positive News Factors

Expectations of a Fed rate cut are rising: Weak US economic data (such as employment and manufacturing) strengthens the probability of a September rate cut, while the US dollar's rebound is weak (hovering around 98.7), benefiting gold.

Escalating geopolitical conflicts: The US has imposed tariffs on India and other countries, exacerbating trade frictions and driving up market risk aversion.

Political Uncertainty: Personnel changes in the Trump administration (the dismissal of the Director of the Bureau of Labor Statistics) have raised concerns about policy continuity.

Key Technical Signals

Weekly: A bullish candlestick with a long lower shadow confirms support in the 3340-3350 area. The medium-term trend remains bullish, with a target of 3460-3470.

Daily:

Triangle Convergence Breakout: Last Friday's large bullish candlestick indicates a strengthening short-term trend.

Moving Average Support: A golden cross between the 5-day and 10-day moving averages (3360-3350). A pullback is expected to continue the upward trend. Key resistance levels: 3400 (psychological barrier), 3450 (previous high breakout point).

🎯Trading strategy: Buy low and go long as the primary strategy, short high as a supplementary strategy.

Strategy

Buy Opportunities

Entry Point: Go long with a small position on a pullback to the 3360-3350 area, with a stop-loss below 3340.

Target: 3390-3400 (hold to 3450 after a breakout).

Short Opportunities

Entry Point: If the price breaks through 3400 and doesn't break, try shorting with a small position, with a stop-loss above 3410.

Target: 3370-3360 (quick entry and exit).

Breakout Tracking

Break above 3400: Go long, target 3450, stop-loss 3380.

Break below 3340: Short-term weakness, wait and see or reverse short.

⚠️Risk Warning

A rebound in the US dollar: If US economic data is unexpectedly strong , it could weigh on gold.

Geopolitical easing: If there are signs of easing in the trade dispute, risk aversion will subside.

📆This week's focus: Fed officials' speeches and developments in the global trade situation.

Conclusion: The short-term trend of gold is strong, and the technical and fundamental aspects resonate with each other. It is recommended to mainly go long on pullbacks, and be cautious in chasing highs at key pressure levels.

Trade closed: target reached

August 7th Gold Analysis and Trading Strategy:

Core Drivers

Bullish for Gold

Expectations of a Fed Rate Cut: Weak US economic data (narrowing trade deficit, stagnant services sector) strengthens the probability of a September rate cut, putting pressure on the US dollar and boosting gold.

Risk aversion: The escalation of Trump's tariff policy and the uncertainty of the Federal Reserve's personnel changes have increased market volatility, and gold is favored as a safe-haven asset.

The technical side is strong: the daily line has four consecutive positive lines, and after the big positive K at the bottom, it oscillates to digest the short momentum, and the lower track support of the convergence triangle is effective (3350-3355).

Potential Bearish Factors

Inflation Data Risk: May weaken expectations of a rate cut, triggering a gold price correction.

Russia-Ukraine ceasefire agreement: If reached, it will weaken safe-haven demand and dampen gold's upward momentum.

Technical Pullback Risk: The previous two rounds of gains have both experienced five-wave pullbacks. Be wary of downside risks after a break of 3350.

Key Technical Levels

Support:

3355-3360 (lower band of the daily convergence triangle + 5-day moving average + middle band of the 4-hour moving average).

3350 (bull-bear watershed). If it breaks, the market will fluctuate and shift to a bearish bias, with a target of 3320-3300.

Resistance:

3375 (hourly middle line; a break above this level could lead to short-term strength).

3390 (previous high; a break above this opens up upside potential to the upper triangle line at 3406).

Today's Trading Strategy

1. Long Scenario (60% probability)

Entry Condition: Gold price holds support at 3355-3360 and closes above 3375 on the hourly chart.

Target: 3390 → 3406 (upper band of the converging triangle).

Stop Loss: Below 3350 (confirmation of a breakout).

2. Short Scenario (40% probability)

Entry Condition: Gold price falls below 3350 and closes below it on the hourly chart.

Target: 3320 (previous support low) → 3300 (psychological barrier). Stop loss: above 3360 (false breakout and covering).

Trading Recommendations

Conservative: Wait until the US market opens, confirming a breakout above 3350 or 3390 before entering the market.

Aggressive:

Take a light position to buy near 3365, with a stop-loss at 3350 and a target of 3375 → 3390.

If 3375 fails to break through before the US market opens, reverse into a short position targeting 3355.

Risk Warning

Event Risk: Speech by Federal Reserve officials or sudden changes in geopolitical dynamics could trigger sharp short-term fluctuations.

Position management: Currently at the end of the triangle, it is advisable to operate with a light position before breaking through to avoid two-way losses.

Conclusion: Gold is likely to fluctuate upward in the short term, but be wary of the risk of a pullback after a breakout of 3350. The recommended range is 3350-3390.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.