EUR/USD: Strong Bullish SignalsEUR/USD is currently in an uptrend, with support at 1.1645 USD. If the price retraces and forms a rejection candle at this support level, it could present an opportunity to buy. The first target to the upside is the 1.1789–1.1802 USD range. If this level is broken, EUR/USD could continue rising toward the 1.1854 USD area.

Technically, EUR/USD has held strong at the 1.1645 USD support level, indicating strong buying pressure. This support level remains crucial in maintaining the uptrend. Traders should monitor the support and resistance levels to make informed trading decisions.

#eurusd#forex

EURUSD – Wave 5 Long SetupIdea: EURUSD has completed a clean Elliott Wave (1-2-3-4) structure on the 1H chart and is now setting up for the final Wave (5) push to the upside. Price has broken above short-term resistance and is aiming for the next liquidity zone.

🔹 Entry: 1.16609

🔹 Target: 1.17015 🎯

🔹 Stop Loss: 1.16271 ❌

✅ Reasons for Long Bias:

Clear Elliott Wave progression with Wave 5 in play.

Strong recovery from Wave 4 support zone.

Next resistance aligns with Wave 5 target around 1.1700 psychological level.

Favorable R:R ratio, keeping risk well defined.

⚠️ Risk Management: Always trade with position sizing that suits your account. Stop loss is placed below Wave 4 to protect from invalidation.

📌 Disclaimer

This is purely for educational purposes and not financial advice. Please do your own research before entering any trades.

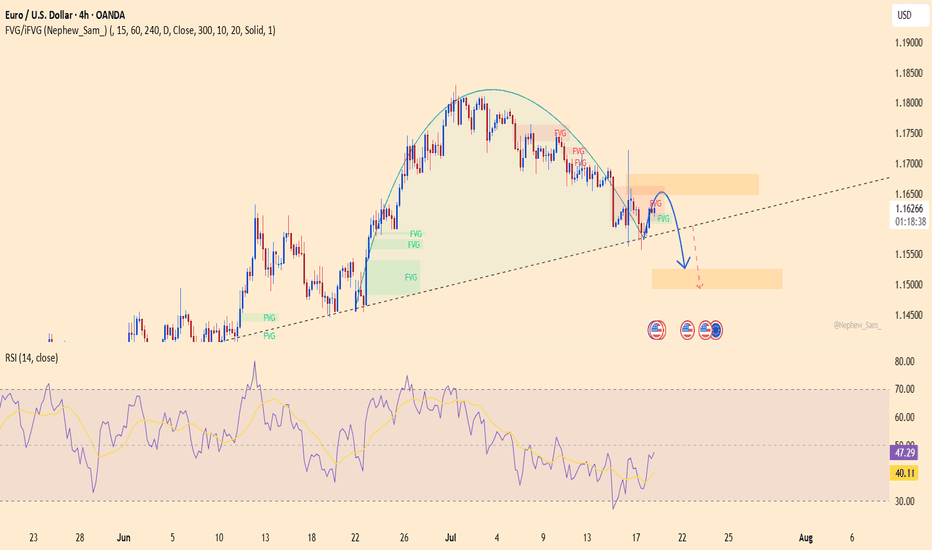

EURUSD: Support About to Break, Bearish Trend Continues!EURUSD is currently trading in a clear downward channel. After failing to break the resistance at 1.17200, the price reversed and is now testing support at 1.16000. If this support is broken, the price may continue to decline towards 1.16297 and 1.15500.

The current market structure shows that selling pressure is dominant. If 1.16000 is broken, the bearish trend will continue. Traders should prepare to enter a sell position if this support level is broken, with targets towards lower support levels.

EURUSD: Bearish OutlookFrom the chart, EURUSD is currently trading in an ascending price channel, but signs of a pullback have emerged from the 1.17300 level, suggesting a potential continuation of the decline in the short term. Recent economic data, particularly the PPI index from the U.S., has put significant pressure on the EUR, strengthening the USD and weakening the Euro. This may continue to maintain bearish pressure on EURUSD.

Technically, the key support level to watch is 1.16264. If this level breaks, EURUSD could continue to decline towards lower support levels such as 1.16000. Bearish signals from technical indicators also support this pullback.

Trading Strategy:

Sell: Wait for a break below 1.16264 to enter a short position, with the next target at 1.16000.

Stop-loss: Set a stop-loss above the resistance at 1.17300 to protect the account in case of a reversal.

EURUSD – Continuing the Uptrend, New Targets AheadEURUSD is experiencing a strong recovery after testing the 1.16600 support level. The chart shows price moving within an ascending channel, continuing to form higher highs and higher lows, with the near-term target at 1.18000 and further at 1.18600. Buying pressure has returned as the price failed to break below the 1.16600 support, driving the uptrend momentum.

In terms of news, although U.S. Core Retail Sales came in weaker than expected (0.3% vs 0.5%), indicating slower consumer spending, this provides an opportunity for EURUSD to rise. However, the overall sentiment remains tilted toward a weaker USD, which supports the uptrend for EURUSD.

If price continues to hold above 1.16600 and breaks through 1.18000, EURUSD could continue its upward momentum towards higher levels. However, if the price breaks the 1.16600 support, the uptrend will be at risk.

EUR/USD – Bullish Momentum Still DominatesIn July, the USD rose sharply by around 3.2% thanks to strong GDP data and tax-cut expectations, but this momentum is now fading quickly. Weak employment figures and concerns over the independence of the BLS, following Trump’s dismissal of its head, have undermined confidence in the USD. Goldman Sachs, Citi, and Barclays remain bearish, projecting that EUR/USD could reach the 1.20 area in the medium term.

EUR/USD has maintained an upward trendline since early August, rebounding strongly from 1.1450–1.1500, breaking through FVG, and consolidating above 1.1627. The HH–HL structure confirms the bullish trend. Above 1.1630, price could target 1.1750; a breakout above 1.1750 would open the way to 1.1780–1.1800 (top of the long-term channel).

Trading Plan:

Main Trend: Bullish

Potential Buy Zone: 1.1630 – 1.1650 (upon confirmation signal)

Short-term Targets: 1.1750 → 1.1780

Medium-term Targets: 1.1900 and potentially 1.2000

Sop-loss: Below 1.1600

EURUSD – recovery aiming to test resistance zoneThe euro is benefiting from the weakening pressure on the US dollar as the market expects the Fed to loosen its monetary policy, combined with positive signals of trade cooperation between the US and Europe. This risk-on sentiment is supporting the short-term uptrend of EUR/USD.

The price is moving within a short-term bullish structure and is approaching the resistance zone around 1.1770 , after rebounding strongly from the support area near 1.1630 . Recent pullbacks have been shallow and quickly absorbed, indicating that buyers still hold the upper hand.

Base scenario: EUR/USD may consolidate in a tight range before breaking above 1.1770, opening room for further upside. As long as the 1.1630 support holds, any pullback can be seen as an opportunity to add long positions in line with the prevailing trend.

EUR/USD – Uptrend Strengthens as USD WeakensMacro backdrop is favoring the euro:

Weaker U.S. labor market (only 73,000 new jobs) is boosting expectations of a Fed rate cut in September.

Political pressure on the Fed raises concerns about its independence → USD loses credibility.

EU–US trade deal eases tensions and supports confidence in the euro.

Technical Outlook

On the H4 chart, price has broken the downtrend line from July , forming a classic higher low structure – a hallmark of an uptrend.

Price is moving within a short-term ascending channel , targeting the 1.1780 resistance zone.

RSI has broken above 70, indicating strong buying momentum but also signaling a potential short-term pullback.

Suggested Trading Strategy

Prefer to Buy on dips toward the 1.1570–1.1600 support zone.

Near-term target: 1.1780

Stop loss: Below 1.1520

EURUSD – Bottoming out, poised for breakoutAfter a sharp decline since late July, EURUSD is consolidating around the key support zone of 1.1520–1.1580. On the H4 chart, price remains within a descending channel but is beginning to form a compression pattern — often a precursor to a strong breakout. Bullish momentum is building as price rebounds from the 1.1480 low and holds a modest upward bias.

On the macro front, the USD is weakening as markets increasingly expect the Fed to cut interest rates in September, especially after a string of weak labor data. In contrast, the EUR is supported by stable inflation and the ECB’s persistent hawkish stance. If the current support zone holds, EURUSD could break out of the descending channel and target the resistance levels at 1.1680 and 1.1770.

EURUSD TankThis looks like a very good spot to SELL the EURUSD. Economic factors are showing slightly weak US dollar, but COT reports indicate Commercials still have a lot of LONG contracts. This gives a very nice confluence with a 61.8% retracement of last week's bearish move, also paired with an attractive $1.70 price tag along with it.

EURUSD – bearish trend remains dominantEURUSD is trading within a clearly defined descending channel. After a slight rebound from the 1.14800 support zone, the price is now retesting the resistance area around 1.16000 – a zone filled with multiple previous Fair Value Gaps (FVGs). If the price fails to break above this level, the bearish trend is likely to continue with a potential move down toward 1.14000.

Latest news:

Weaker-than-expected US job data initially pressured the USD, but growing expectations that the Fed will maintain its tightening stance are helping the dollar recover – putting downward pressure on the euro.

Summary:

If EURUSD fails to break above 1.16000, a continuation of the downtrend toward 1.14000 is likely in the coming days.

EURUSD remains in a downtrendEUR/USD continues to move within a descending channel, with the 1.1600 area acting as strong resistance. Recent price action suggests the current rebound may be just a retest before the downtrend resumes. The next bearish target is around the 1.1390 support zone.

On the news front, although a strong U.S. PMI puts slight pressure on EUR, the USD faces mixed forces:

Weak NFP data increases expectations of a Fed rate cut.

The new US–EU trade deal imposing a 15% tariff has sharply weakened the euro.

Eurozone PMI improved but remains below 50, indicating a still-fragile recovery.

EURUSD – Euro tumbles under strong dollar pressureAfter a brief uptick following the US–EU trade agreement, EUR/USD quickly sank under a wave of strong US economic data. While import tariffs on EU goods were reduced to 15%, the US dollar gained more as capital kept flowing into the US thanks to a Q2 GDP growth above 3%, steady PCE, and a strong ADP report.

On the H4 chart, the bearish structure is clear: EUR/USD broke below key support and formed a series of unfilled FVGs, signaling sellers are still in control. The current pullback towards the 1.14300 resistance zone could act as a bull trap, with the next target eyed near 1.12300 — a likely liquidity zone.

If this area breaks, the 1.1200 mark may be triggered next. Meanwhile, USD strength shows no signs of fading — especially as the Fed maintains a cautious stance with no easing in sight. The euro is no longer seen as a safe haven, and investors are gradually pulling out.

EURUSD: Short-term rebound signals after sharp dropEURUSD has just reacted to a key demand zone and is showing signs of a technical rebound. A small double bottom pattern is forming on the 3H chart, indicating that buyers are starting to return. If the price holds above this recent low, the short-term bullish scenario could continue.

On the news front, the US JOLTS data came in lower than expected, reflecting a cooling labor market. This reduces the likelihood of further Fed tightening, creating room for the euro to recover slightly.

Strategy: Favor buying if price remains above the support zone, with a potential move to retest the upper FVG area before the market makes its next decision.

EURUSD – Bullish momentum fades, signs of a reversal emergeEURUSD is approaching the key resistance zone at 1.1780, a level that has been rejected multiple times in the past. On the H4 chart, the pair remains firmly within a descending channel since early July, with several FVG zones stacked above—indicating growing selling pressure. The recent upside momentum is clearly weakening, raising the risk of a deeper pullback.

Market context:

– The US dollar continues to gain support from strong economic data, while the Eurozone lacks clear signs of recovery.

– Traders are holding their breath ahead of upcoming Eurozone inflation data and the US PCE report—events that could trigger significant moves.

Trade setup: If EURUSD fails to break above 1.1780, a drop toward the 1.1610 support zone becomes increasingly likely.

EURUSD: The Rally Was Just a Trap – Bears Are Ready to Strike!After a strong rebound toward the 1.18400 zone driven by short-term optimism, EURUSD is now facing a potential reversal as price stalls within multiple Fair Value Gap zones. The chart reveals weakening bullish momentum, with lower highs forming inside a key resistance area.

Fresh U.S. data: Jobless claims dropped more than expected, giving the USD a solid boost. Meanwhile, the ECB remains hesitant, showing little conviction as Eurozone inflation cools.

A bearish scenario is unfolding: price forms a flag pattern → breaks the ascending channel → targets 1.17300. A break below this level could send EURUSD toward 1.16500 or even lower.

Bulls, beware! This could be a bull trap — and the bears are gearing up for a counterattack.

SELL setup: Look for bearish reversal signals around 1.18300–1.18400. Stop-loss above the high, first target at 1.17300.

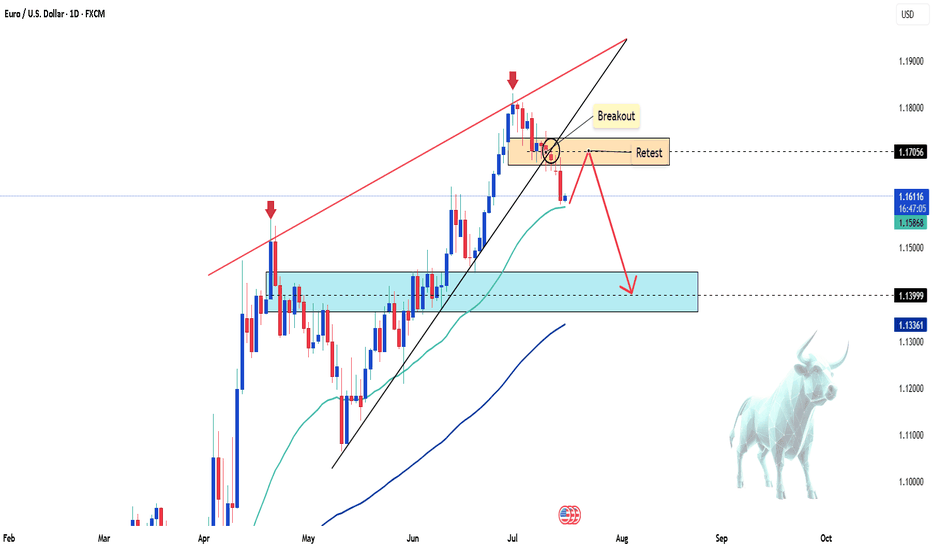

EUR/USD breaks key trendline – Is a bearish reversal underway?At the start of the week, the EUR/USD pair has officially broken its months-long upward trendline, signaling a potential short-term bearish reversal.

As of now, EUR/USD is trading around 1.169, performing a retest of the broken trendline. If the pair closes below this key level, it may confirm the breakout and open the door for a deeper decline.

Do you agree with my view?

EURUSD – Trend broken, bearish momentum accelerating!EURUSD is maintaining a clear downtrend structure within a well-defined descending channel, with consistently lower highs forming. Fair Value Gaps (FVGs) keep getting rejected, signaling that sellers are firmly in control. The current scenario points to a technical bounce toward the 1.164 zone, followed by a likely rejection back down to the lower boundary near 1.148.

Technical signals confirm the bearish bias as price respects both the trendline and the supply zones, failing to break above recent resistance levels.

On the fundamental side, the ECB has recently struck a more dovish tone due to cooling inflation, while the USD is regaining strength amid expectations that the Fed will keep rates elevated longer — all of which continue to pressure the euro lower.

EURUSD on the verge – a trap waiting for the carelessThis pair has just completed a classic rounding top, with a sharp rejection near 1.16500. Buying momentum is fading, RSI is dropping, and the recent retest of the broken trendline might have been the final warning – the “kiss of death” could already be in play.

On the fundamental side, the U.S. keeps fueling the dollar: consumer spending is rising, jobless claims are falling, and the Fed shows no sign of easing up. Meanwhile, the ECB is still searching for direction, leaving the euro exposed and vulnerable.

If the current support level breaks, EURUSD could slide quickly to lower zones. This is no longer a time for hope – it’s time to choose a side and act.

EURUSD under pressureEURUSD is moving within a well-defined descending channel, forming consistent lower highs and lower lows. The price has recently rejected the resistance zone near 1.16100, showing signs of continued bearish momentum.

On the fundamental side, stronger-than-expected U.S. retail sales—especially in the core figure—have boosted the U.S. dollar, putting downward pressure on the euro. Coupled with ongoing concerns about Eurozone economic growth, the pair is likely to continue its decline toward the 1.15400 support area. RSI remains below the neutral zone, confirming short-term bearish bias.

Traders should watch closely for reactions at support to assess further short opportunities.

EUR/USD Faces Strong Sell-off, Is a Deeper Correction Coming?The FX:EURUSD pair continued its sharp decline this morning, currently trading around 1.161, after breaking through the bullish wedge pattern on the daily chart. This key technical signal suggests that the previous uptrend has ended, opening the possibility for a deeper correction in the short term. The inability to hold the 1.171 resistance after two attempts further confirms the ongoing downtrend.

The selling pressure is driven by the strong recovery of the USD, as investors seek refuge in safe-haven assets amid concerns about global growth and geopolitical instability. Additionally, U.S. bond yields have rebounded following strong economic data, reducing the appeal of the euro. The expectation that the Fed will maintain high interest rates for a longer period also contributes to the downward pressure on EUR/USD.

In the short term, if EUR/USD fails to hold the 1.158 support, there is a high likelihood of a drop towards 1.140, a level that acted as strong support in the past. Traders should closely monitor signals from the Fed and the upcoming PMI data for the Eurozone to assess the next trend direction.

EURUSD: are the bulls taking control?EURUSD is currently trading around 1.1691 and maintaining a bullish structure with consistently higher lows. On the H4 chart, a symmetrical triangle is forming, and price may break out toward the 1.1823 target if it can overcome the resistance trendline.

On the news front, the US dollar has weakened as the Fed has yet to provide a clear signal on rate cuts. Meanwhile, Eurozone economic sentiment is improving, supported by a slight uptick in manufacturing and services data. This reinforces the euro's recovery and keeps upward pressure on EURUSD.

If the 1.1660 support zone holds firm, the upcoming breakout could trigger a strong bullish move. Buyers are waiting for confirmation — are you in the game?

EURUSD – Failed Breakout, Bearish Momentum Takes OverEURUSD attempted to break out of the upper edge of a consolidation triangle but was swiftly rejected around the 1.17450 region, forming a classic “failed breakout” — a pattern that often precedes strong reversals. The pair is now pulling back and appears to be heading toward the 1.16800 support zone.

On the news front, the market is under pressure from rising expectations that the Federal Reserve will maintain higher interest rates for longer, following stronger-than-expected U.S. job data. This has driven a notable recovery in the U.S. dollar, putting downward pressure on the euro. In this context, EURUSD risks a deeper correction if the 1.1700 support fails to hold. Keep a close eye on price action — this pullback could be the start of a new bearish leg.