BTCUSD Monthly Outlook -Potential Pullback - 0.618 B4 Major Move🔴This analysis is based on the Monthly timeframe, with Fibonacci drawn from the recent swing high to the current low.

The price is currently in a corrective phase, and based on its structure and Fibonacci alignment, there is a high probability of a retracement toward the 0.618 level before the next major directional move.

📊 Key Levels & Expectations

0.618 Fibonacci zone: 105,400 – 105,800

This zone aligns with a strong historical resistance/supply area

Price may attempt a corrective pullback into this region (marked with the small red arrow)

This move should be viewed as a retracement, rather than a trend reversal.

⚠️ High-Risk Area – Not a Buy Zone

Even if the price reaches the 0.618 resistance zone, the overall structure remains weak unless there is: a strong bullish monthly close, Clear volume expansion, and acceptance above the resistance. Without these confirmations, the 0.618 zone is expected to act as a sell-on-strength area.

🩸 Downside Scenario

If rejection occurs from 105.4K – 105.8K, a larger downside move (marked by the big red arrow) becomes highly probable.

Key support to watch:

81,100 – 83,500 (critical structure support)

A break and close below this zone can accelerate bearish momentum.

🧠 Trading Perspective

This is a patience-based market:

Short-term upside is possible

But risk remains elevated

A safer approach is waiting for confirmation at key levels

📌 This idea is shared for educational and market-structure discussion only.

🔔 Note

I’ll be actively sharing structured, level-based BTC analysis here going forward.

Follow if you prefer probability-based setups over emotional bias.

1-BTCUSD

(FOMC) Bitcoin Bybit chart analysis JENUARY 28Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

The FOMC will announce interest rates at 4:00 AM tomorrow.

In the lower left corner, with the purple finger,

I've linked my strategy to the long position entry point I entered yesterday, at $82,276.

*Conditional Long Position Strategy based on the Red Finger Movement Path

1. After touching the purple finger's first section at the top (autonomous short)

-> Switch to a long position at $89,300 at the red finger / Stop-loss price if the purple support line is broken

2. First target for a long position at the top section: $91,612.7 -> Target prices in the order of Good and Great

If the price fails to touch the first section at the top and immediately falls,

the second section at the bottom: $88,782.9 is the entry point for a long position

/ Stop-loss price if the purple support line is broken

If the price breaks the purple support line,

the price may fall to up to section 3 from the bottom.

Please use my analysis to this point for reference only.

I hope you operate safely, adhering to principled trading and stop-loss prices.

Thank you.

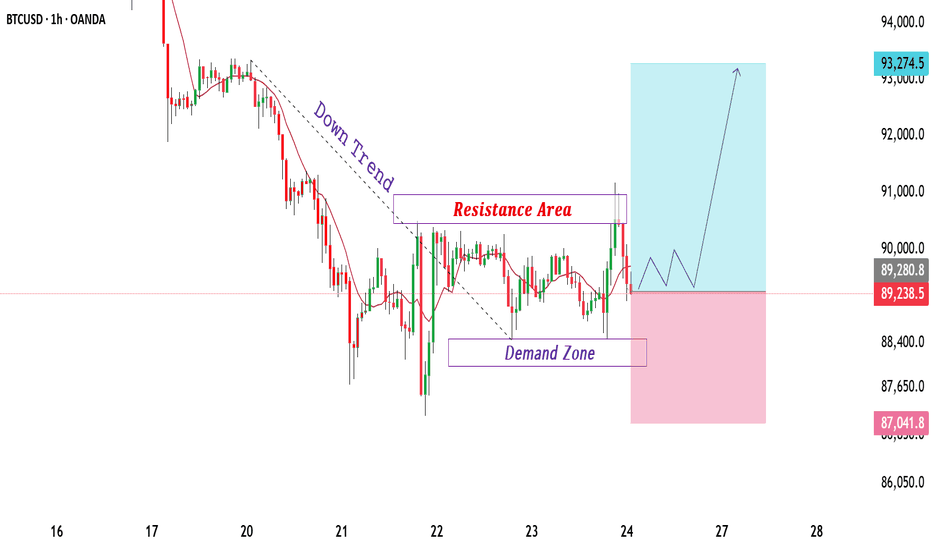

BTCUSD Near Demand Zone as Selling Pressure ContinuesBTCUSD is trading with a clear bearish structure after a strong downward move. The price has been forming lower highs and lower lows, showing that selling pressure is still present in the market. Earlier pullbacks failed near the resistance area of 89,500–90,200, where sellers became active again. This zone remains an important resistance and is limiting upside movement for now.

On the downside, price has reached a major demand zone around 80,800–81,400. This level has shown strong buyer interest in the past and is acting as an important support area. The current reaction from this zone suggests that downside momentum is slowing, and the market may move into short-term consolidation. As long as price holds above this demand, a corrective move on the upside remains possible.

At present, BTCUSD is stabilising near support, indicating a pause after strong selling. Minor upside moves may face resistance near previous reaction zones. If price breaks and holds below the demand area, it would strengthen the bearish view and open the way for further downside. Overall, the market bias stays bearish while price remains below key resistance levels.

BTCUSD 45-Min Chart — Support Reclaim Setup After Sharp Breakdow

Chart Analysis:

Market Structure:

Clear bearish break from the prior range near 87k resistance, followed by a strong impulsive sell-off → confirms a bearish market shift.

Support Zone (Key Area):

Price is reacting around 80,600–81,000, a marked demand/support zone. This is the first meaningful base after the dump.

Current Price Action:

BTC is testing support after a lower high, suggesting sellers are losing momentum. Wicks into support show buying interest, but confirmation is still needed.

Entry Logic:

The marked entry near 80.6k assumes:

Support holds

A bounce + reclaim of minor structure (above ~82k)

Targets:

TP1: ~83.2k (range midpoint / liquidity)

TP2: ~83.7k (previous consolidation)

Final Target: ~87.1k resistance (major supply zone + breakdown origin)

Bias Summary:

Short-term: Tactical long from support

Invalidation: Clean break and close below 80.6k

Overall trend: Still bearish until 87k is reclaimed

Takeaway:

This is a counter-trend long setup — high reward, but only valid if support holds and momentum flips. Conservative traders should wait for a confirmed reclaim above 82–83k before committing.

BTCUSD Demand Zone in Focus After Strong Bearish MoveBTCUSD is currently trading after a strong bearish move, where price broke below the earlier sideways structure with high selling momentum. The market clearly respected a downward trend, forming lower highs and showing consistent selling pressure. The resistance area around 89,800–90,400 worked as a strong selling zone, where price faced rejection and sellers regained control, leading to a sharp fall.

After this decline, price has now reached a major demand zone near 83,500–84,000. This area is supported by earlier buying activity and base formation, making it an important support level. The present reaction from this zone indicates that sellers are slowing down and buyers are trying to hold price. As long as BTCUSD stays above this demand, short-term stability or a corrective move can be seen.

The risk area below demand shows where downside pressure may increase if support breaks. A clear move below this zone would strengthen the bearish trend further. For now, price is consolidating near support, and volatility is expected around these levels. Overall market bias remains cautious, with bearish control still active, but short-term recovery chances remain while demand holds.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

BTCUSDT LONG Trade Of The YEARLonging BTC here for a swing isn’t a bad idea.

TP: ~100k

SL: 78k

BTC is underperforming GOLD and Retail is FOMO’ing into gold & traditional assets.

Narrative shifting to crypto is dead this cycle

Fear & Greed shows crypto traders are scared.

that’s exactly the signal.

that’s when smart money steps in.

I’m taking the long.

— Ommeva

BTCUSD 4H –Demand-to-Resistance Reversal Setup (Structured Long)Market Context

BITSTAMP:BTCUSD is currently reacting from a 4H demand zone after a sharp corrective move from the recent swing high. Price has printed a clear liquidity sweep below prior lows and is now attempting a reclaim of short-term structure.

Technical Breakdown

Strong 4H Demand (D) holding near the 88.9k–89.2k region

Clear reaction + displacement from demand, suggesting active buyers

Price is attempting to reclaim the 4H resistance flip zone (R)

EMA ribbon compression followed by early expansion → momentum shift

Structure aligns with a mean reversion → continuation move

Trade Plan (Illustrative)

Entry: On confirmation above 4H resistance / demand retest hold

Invalidation: Below demand zone low

TP1: ~93.4k (first opposing structure / imbalance fill)

TP2: ~97.7k (daily resistance / premium zone)

R:R remains favorable as long as demand holds and structure is respected

Bias

Neutral → Bullish while price holds above demand

Failure to hold demand invalidates the setup and opens downside continuation

Notes

This is a structure + supply/demand based idea, not a prediction

Best confirmation comes from lower timeframe acceptance and volume expansion

News events may increase volatility—manage risk accordingly

📌 This idea is for educational purposes only. Always manage risk and wait for confirmation.

Bitcoin at Demand: Where Most Traders Panic and Smart Money WaitWhen I look at this chart, I don’t see weakness.

I see price reacting exactly where it should .

Bitcoin is sitting above a clearly defined demand zone, and instead of collapsing, price is slowing down and compressing.

That usually tells me the market is absorbing liquidity, not distributing .

Key things I’m focusing on:

Price is holding above ascending demand , which shows buyers are still defending structure.

Reactions from the demand zone are clean , not impulsive, a sign of controlled participation.

Overhead supply is present , which explains the compression instead of an instant breakout.

RSI bullish divergence adds confidence that downside momentum is weakening near demand.

My mindset here:

I’m not chasing moves.

I’m not panicking into demand.

I’m simply watching how price behaves here , because this zone decides whether the next move expands or fails.

As long as structure holds, patience matters more than prediction.

Disclaimer:

This analysis is for educational purposes only. Not financial advice. Always manage your risk.

Bitcoin Bybit chart analysis JENUARY 27Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

Shortly, there's a Nasdaq indicator release at 12:00 PM.

On the left, with the purple finger,

I've linked the strategy to yesterday's long position entry point, 87.5K.

*Red finger movement path:

One-way long position strategy

1. $87,276 long position entry point / Stop loss if the green support line is broken

2. $88,691.1 long position first target -> Target prices in order from Gap 8 onwards

88.1K in the middle is a useful long position re-entry point.

For those holding long positions yesterday,

I recommend setting a stop loss if the green support line is broken.

Bottom: Light blue support line -> If the first section is broken,

the bottom: $85,238.3 is the final support line.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis JENUARY 26

Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There are no Nasdaq indicators released.

*If the red finger moves,

this is a long position strategy.

1. Confirm the first touch of the purple finger at the top

-> Red finger: $87,538.8, long position entry point

/ Stop-loss price if the green support line is broken

2. $89,210.1, long position first target -> Top: second target

If the strategy is successful, 88.6K is the long position re-entry point.

If the top falls immediately without touching the first point,

Long hold at the second point / Stop-loss price if the green support line is broken

From the green support line breakout, the bottom point / sideways market. Below that, the most important support line remains at $85,238.3.

Please note that if this point is broken, a prolonged correction is possible.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

BTCUSD Trades Between Demand and Resistance Bearish Structure.BTCUSD is currently trading within a corrective structure after a strong bearish move, clearly respecting a descending trend. Price action shows lower highs and lower lows, confirming short-term bearish control. The marked resistance area near 90,800–91,200 has acted as a selling zone where price previously reacted and faced rejection, keeping upside pressure limited. This area remains a key resistance and may continue to attract selling interest on retests.

On the downside, a well-defined demand zone is visible around 88,000–88,600. This zone aligns with previous strong buyer reactions and short-term base formation, making it an important support area. Price has already shown multiple reactions from this demand, indicating active buying interest. As long as price holds above this zone, a temporary recovery or consolidation remains possible.

Current price action suggests range behaviour between demand and resistance, showing signs of accumulation near support. If demand continues to hold, price may attempt a gradual move back toward resistance. However, a sustained break below the demand zone would strengthen bearish momentum and open the path toward lower support areas. Overall structure remains cautious, with bearish bias dominant while price stays below resistance, and volatility expected around the marked zones.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

Bitcoin Bybit chart analysis JENUARY 22Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

Nasdaq indicators will be released shortly at 10:30 AM and 12:00 PM.

*The blue finger path indicates a short-to-long switching or a long-position waiting strategy. (Two-Way Neutral Strategy)

1. Short position entry point at $90,870.1 above / Stop loss if the orange resistance line is broken.

2. Long position switch at $90,170.2 / Stop loss if the green support line is broken.

3. Long position switch at $92,456 / Stop loss if the red resistance line is broken.

4. Long position switch at $91,612.7 / Stop loss if the green support line is broken.

If the price falls directly without touching the blue finger at the top (90.8K),

Pink finger at the bottom (1st section), $89,335.7.

Long position waiting strategy / Stop loss is the same if the green support line is broken.

If the price falls below that point, it could fall up to two times, so be cautious of Nasdaq fluctuations.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

BTC Compression Phase: Where Smart Money Builds Positions!Hey guy's, When I look at this chart, I’m not seeing fear or trend failure.

I’m seeing something far more important, controlled compression above demand .

Bitcoin has pulled back, swept liquidity, and is now holding above a clearly defined demand area while volatility keeps contracting.

This kind of behaviour rarely appears during panic.

It usually appears when the market is absorbing supply quietly .

What I’m seeing on the chart:

Price is still respecting the ascending demand structure , which tells me higher-timeframe buyers are active and defending key levels.

The recent move cleaned out weak hands below demand , but price did not accept lower, a classic liquidity sweep, not a breakdown.

Supply is visible above , which explains why price is compressing instead of expanding immediately. Sellers are present, but they are not overpowering buyers.

The range between ascending demand and overhead supply is tightening . This is where impatience builds, and where strong positioning usually happens.

The psychology part (this matters):

This phase feels uncomfortable.

Price isn’t doing much.

Both sides are frustrated.

And that’s usually a clue.

If Bitcoin wanted to break structure, it had a clean opportunity below demand.

It didn’t take it.

That tells me sellers are getting weaker, not stronger.

So my thinking stays simple:

I don’t want to chase upside after expansion.

I don’t want to panic into a sell-off that already swept liquidity.

I want to watch how price reacts around demand, because this is where real decisions are made.

As long as structure holds:

Pullbacks into the 88k–87k demand zone remain high-probability reaction areas.

Compression above demand keeps the door open for a mean-reversion move toward higher levels.

Only a clean breakdown and acceptance below ~84k would invalidate this structure.

Until then, I’m not trying to predict the next candle.

I’m trying to read behaviour .

Markets don’t move when everyone is excited.

They move when most people get bored, confused, or impatient.

Disclaimer:

This analysis is for educational purposes only. Not financial advice. Always manage risk and trade according to your own plan.

BTCUSD at Key Demand Zone, price seeks stability after pullbackBTCUSD displays a clear change in market behavior after completing a strong bullish phase that pushed price toward all-time highs. Following this peak, momentum weakened and price entered a corrective decline, forming lower highs and lower lows that define a short-term bearish structure. This pullback appears corrective rather than impulsive, suggesting the broader market context remains balanced rather than fully bearish.

Price is now testing a well-defined demand zone around 89,000–88,500. This area previously acted as a base for strong upside expansion and represents a key support region where buyers may re-enter the market. A stable reaction from this zone could signal absorption of selling pressure and the beginning of a recovery phase. Holding above demand keeps the downside controlled and preserves the possibility of a bullish response.

On the upside, the first major resistance is located near 93,000–94,000. This zone marks prior selling activity and is expected to act as a barrier during any rebound. A clean break and acceptance above this resistance would indicate improving momentum and increase the probability of a broader trend shift. Until then, upside moves may remain corrective.

If demand fails, price could extend lower and confirm bearish continuation. Overall, BTCUSD is at a decision area where structure, demand, and resistance will guide the next directional move

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

Bitcoin Bybit chart analysis JENUARY 21Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

The Nasdaq has been acting up lately.

As the Nasdaq is undergoing forced coupling,

please pay close attention to its movements.

*Long Position Strategy:

1. Confirm the touch of the purple finger at the top,

and then switch to a long position at $88,784 at the red finger at the bottom.

/ If the purple support line is broken, set a stop loss.

2. $91,612.7 long position initial target -> Top, then Good in that order.

If the strategy is successful, $90,566.3 is the long position re-entry point.

If the upper level falls immediately without touching the first point,

wait for a final long position at point 2. / If the green support line is broken, set a stop loss.

Today's bottom -> $86,977.3

is a major rebound point on the daily Bollinger Band chart.

Also, the orange resistance line at the top is the center line of the 4-hour Bollinger Band chart.

A strong breakout of this area is necessary for a true rebound.

Please use my analysis to this point for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis JENUARY 20Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There are no Nasdaq indicators released today.

*Conditional red finger long position strategy.

1. After touching the purple finger once at the top,

$91,069.8 is the entry point for a long position at the bottom.

2. $92,611.2 is the initial target for a long position -> Target prices are Top, Good, and so on.

If the strategy is successful, $91,954 can be used as a re-entry point for a long position.

If the price falls immediately without touching the first purple finger at the top, $90,142.8 is the final long position waiting point at the second section,

and the stop loss is set if the green support line is broken.

If the price falls to section 2,

the possibility of a sideways movement increases, and there is an uptrend line below it. If the Nasdaq falls sharply,

the price remains open at $89,029.6,

and from the bottom, $89,029.6 is where Bitcoin's mid-term pattern is likely to recover.

Please use my analysis to this point for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

BTCUSD Bullish Structure: New Demand, Resistance & UpsideBTCUSD shows a continuation of the broader bullish trend after a strong impulsive move higher, followed by a healthy pullback and consolidation. Price previously respected the rising structure and confirmed bullish strength with a clear Break of Structure , indicating trend continuation rather than reversal. The recent highs formed a new resistance area around 97,800–98,300, where selling pressure appeared and slowed momentum. This zone remains a key upside barrier and may trigger short-term reactions if retested.

On the downside, a fresh demand zone is established near 94,000–94,600, aligned with prior consolidation and strong buyer response. This area acts as a major support and potential buy zone, especially if price shows acceptance and bullish confirmation. As long as BTCUSD holds above this demand, the market structure remains bullish.

Current price action suggests accumulation above support, with higher lows forming inside the range. A sustained hold above demand may open the path for a renewed push toward resistance and potentially higher levels. A clean break below demand would weaken bullish structure and shift focus toward deeper support. Overall bias stays bullish while price remains above the marked demand zone, with volatility expected near key levels.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

Bitcoin Bybit chart analysis JENUARY 19Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here's a Bitcoin 30-minute chart.

The Nasdaq is closed today.

I developed a strategy centered around the upper Gap 7.

*When the red finger moves,

One-way long position strategy.

1. $92,756.9 is the entry point for a long position. / Stop loss if the green support line is broken.

2. $95,506.9 is the first target price at the top -> Target prices are Good, Great, and so on.

If the strategy is successful, 94.5K is the point where I can re-enter the long position.

If the purple support line holds, a vertical rise is possible.

The first section below is a sideways market.

Below that is the bottom. The gray line is a mid-term uptrend line.

So, if the price holds at section 1 today, it's good for a long position.

Since the Nasdaq is closed,

Bitcoin also seems likely to move sideways.

As per the rule, I followed the trend-following strategy.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis JENUARY 16Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

There are no separate indicators released today.

Currently, the 6-hour MACD is forming a dead cross.

I've kept it as simple as possible.

*Long position strategy before and after the purple finger touches the top line

1. After the purple finger touches the first line (autonomous short)

-> Red finger: $95,235.6, long position entry point

/ Stop-loss price if the purple support line is broken

2. $97,512.1, long position first target

-> Target price from the top to 104.7K, sequentially over the weekend

If the top fails to touch the first line and immediately falls,

final hold on the long position at the second line (No.2) / Stop-loss price if the purple support line is broken

From the purple support line break,

Bottom -> Open to $93,555.6. If it falls to this level, the medium-term pattern will be broken again, so it may take a long time to rise.

*The price must not move sideways until the weekend,

and must not fall to the bottom.

It will hit 104.7K strongly and may see new highs starting next week.

Please use my analysis to this point for reference only.

I hope you operate safely, with principled trading and stop-loss orders essential.

Thank you.

BTCUSD Structure Break Defines Trend, Demand Zone, Risk AreaBTCUSD shows a well-defined bullish market structure supported by strong price action and a clear shift in momentum. After forming a solid base, price delivered an impulsive move higher, confirming a Break of Structure and aligning with the broader bullish trend. The ascending structure is marked by higher highs and higher lows, reflecting sustained buyer strength and healthy continuation behavior.

The highlighted demand zone near 90,000–91,000 represents a key support area where price previously consolidated before accelerating upward. This zone may act as a potential buy-on-pullback region if price revisits it with stable structure. As long as price holds above this area, the bullish bias remains intact and continuation scenarios stay valid.

On the upside, price is currently testing a newly formed resistance zone around 97,500–98,500. This area is critical, as selling pressure may appear and cause short-term consolidation or a corrective pullback. A clean acceptance above this resistance would signal strength and open the path toward higher psychological levels near 100,000.

If price fails to hold above the resistance and shows rejection, a controlled retracement toward demand would be considered healthy within the trend. A deeper move below demand would indicate a shift in short-term momentum and require reassessment.

Overall, BTCUSD remains structurally bullish while above demand, with price action favoring continuation over reversal.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.