Aditya Birla Capital – Demand Zone📌 Demand Zone:

Demand Zone High: 350.80

Demand Zone Low: 344.40

The stock has triggered a clean 52-week breakout supported by a sharp MACD crossover and strong expansion through the Bollinger bands, signaling fresh momentum entering the structure. The recent wide-range green candle reflects decisive buyer dominance, supported by improving volumes and a steady higher-low sequence that kept the broader trend intact even during consolidation. Momentum indicators such as RSI, CCI, and Stochastics all remain in strong territory, confirming that buyers are still in control despite the price being stretched in the short term. The small demand zone between 353.80–347.95 acts as the immediate retest pocket where institutional flows can re-enter if the stock pulls back. EMA compression has fully expanded, relative strength vs the index has turned positive, and overall the price structure indicates a momentum-driven continuation setup with a favourable trend, strong buying pressure, and stable risk levels as long as the stock holds above the newly formed demand zone.

________________________________________

⚠️ STWP Legal Disclaimer (SEBI-Compliant)

This document is strictly for educational and informational purposes. All examples, charts, levels, and option structures discussed are illustrative and are not intended as buy, sell, or hold recommendations. STWP does not provide investment advice, trading tips, signals, or personalized financial guidance of any kind, nor is it a SEBI-registered intermediary or research analyst. The analyses, illustrations, and risk–reward structures included here are generic in nature and based on publicly available data and observed market behaviour, which may change without notice. Financial markets involve significant risk; derivatives in particular carry the potential for substantial losses. Option premiums, implied volatility, open interest, delta, and other market variables can fluctuate rapidly and unpredictably.

Readers are solely responsible for their trading decisions, capital management, and risk assessment. Before making any investment or trading decision, please consult a SEBI-registered investment advisor. STWP, its representatives, and affiliates shall not be liable for any direct or indirect loss arising from the use of this material. Historical patterns or past market behaviour do not guarantee future outcomes. Nothing in this document should be interpreted as a promise of performance, accuracy, or returns.

Position Status: No active position in ABCAPITAL at the time of analysis.

Data Source: TradingView & NSE India (Past Chart Reference for any charts used).

________________________________________

ABCAPITAL

Aditya Birla Capital | Bullish Momentum with Exceptional Volume 💹 Aditya Birla Capital Ltd (NSE: ABCAPITAL)

Sector: Financial Services | CMP: ₹326.80 | View: Bullish Continuation Setup

📊 Price Action:

Aditya Birla Capital witnessed a bullish breakout from a tight consolidation range, confirming renewed buying interest.

Price action shows strong momentum as the stock reclaimed short-term resistance with conviction.

Sustaining above 325 can open the path toward 340–347 in the short term, supported by high-volume expansion.

💼 HNI Trade Levels (STWP Setup):

Aggressive Entry: 326.80–328.81 | Stop Loss: 310.58

Low-Risk Entry: 323.14 | Stop Loss: 305.51

HNI and institutional traders have shown clear accumulation interest backed by strong volumes.

The bullish structure with expanding range candles indicates smart money positioning early into the trend.

Momentum continuation is likely as long as price sustains above 314–316 support.

📉 VCP Analysis:

Aditya Birla Capital displays a classic Volatility Contraction Pattern, tightening across the last few weeks before the breakout.

Today’s 20-day volume breakout confirms the end of contraction and the beginning of a volatility expansion phase.

The setup indicates strong institutional intent aligning with the final stage of the VCP breakout.

📈 STWP Trading Analysis:

Entry: 328.80 | Stop Loss: 310.58

Strong bullish candle supported by a 5x surge in volume highlights aggressive participation.

The trend structure remains positive with a series of higher highs and higher lows.

Holding above 320 will keep the bias firmly bullish and validate the ongoing uptrend.

📏 Fibonacci Analysis:

The Fibonacci retracement from the recent swing low at 269.84 to swing high at 350.50 places the price near the 38.2% zone, maintaining a healthy correction within trend.

Holding above 314–316 (23.6%) keeps the pattern intact and supports trend continuation.

A breakout above 333.87 (resistance 1) could drive a move toward 347–353, aligning with the Fibonacci extension projections.

🧭 STWP Support & Resistance:

Resistances: 333.87 | 340.93 | 353.07

Supports: 314.67 | 302.53 | 295.47

While resistance zones near 333–353 may face mild supply, supports between 302–314 appear strong with institutional defense.

Major demand zones are visible near 283–295, confirming deep accumulation pockets.

The setup structure remains bullish with strong support and relatively weak resistance above 333.

📊 STWP Volume & Technical Setup:

Today’s session recorded exceptional volume at 27.94M vs 5.43M average, a 5.14x surge, confirming institutional activity.

The yellow label highlights multiple confirmations — bullish engulfing candle, RSI breakout, and Bollinger Band expansion, signaling volatility release from compression.

Indicators like MACD and Stochastic remain bullish across daily to weekly timeframes, strengthening the continuation outlook.

🧩 STWP Summary View:

Final Outlook:

Momentum: Strong | Trend: Bullish | Risk: Moderate | Volume: High

Aditya Birla Capital is showing a strong technical structure with institutional footprints, rising volumes, and momentum confirmation.

Sustaining above 320 keeps risk controlled, while a decisive move above 333 could accelerate momentum toward higher resistance zones.

The bias remains bullish with trend continuation potential in the near term.

⚠️ Disclosure & Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice.

I am not a SEBI-registered investment adviser, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading—whether in stocks or options—carries risk. Markets can move unexpectedly, and losses can sometimes exceed the money you have invested.

Past performance or past setups do not guarantee future results. Always assess your risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial adviser before making any real trading decision.

Position Status: No active position in (ABCAPITAL) at the time of analysis.

Data Source: TradingView & NSE India (Past Chart Reference)

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

👉 “If you liked this breakdown, follow for more clean, structured setups with discipline at the core.”

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

Which stock you should buy and when?1. Before Major Events (e.g., “Before Corona Come”)

Stock was in a downtrend or sideways zone, forming resistance levels (horizontal blue lines).

No buying yet — this phase helps identify historical resistance and potential breakout zones.

2. Breakout During a Key Period (e.g., “Corona-Time Breakout”)

Stock breaks out of its long-term resistance with strong volume.

This indicates accumulation and trend reversal.

✳️ Ideal action: Watch for a confirmed breakout with a daily or weekly close above resistance.

3. Re-testing and Consolidation

After breakout, price usually comes back to test the breakout level (support retest).

If it holds above that level instead of falling below — it confirms strength.

✳️ Ideal action: This is the best buy zone — when the stock retests the breakout successfully.

4. New Higher Highs and Breakouts

Stock makes new highs and again breaks minor resistances (smaller breakout levels).

Each breakout, followed by successful retest, builds a strong uptrend structure.

✳️ Ideal action: You can add on every breakout and retest in a trending stock.

5. Corrections & Retests (Mid-2024 to 2025 example)

Healthy corrections happen — price may fall to earlier support zones.

If it bounces back strongly from support and breaks previous highs again → trend continuation.

✳️ Ideal action: Buy on dips when price holds above strong supports.

6. Fresh Breakout Again (Recent Phase)

The latest breakout (2025) from ~₹175–₹185 zone to above ₹300 indicates a new long-term bullish phase.

Strong volume and structure show renewed investor interest.

✳️ Ideal action: Enter on pullback near ₹255–₹275 zone if retested, or hold for long-term if already in.

✅ Summary – How to Identify and Buy Such Stocks

Look for multi-year resistance breakout on weekly charts.

Confirm with high volume during breakout.

Wait for retest and hold above support — that’s your best entry.

Add on every breakout and successful retest.

Avoid buying after a big rally without retest — wait for price to cool down.

Volcanic Cup & Handle Breakout Imminent! (Swing/Positional)Script: NSE:ABCAPITAL | Timeframe: Daily | Pattern: Cup and Handle | Idea: Swing/Positional

Idea Analysis:

Aditya Birla Capital is demonstrating exceptional strength! After a brilliant bullish run that defined the right side of its Cup, the stock is now completing a bullish consolidation and is primed for its next major breakout.

The Powerful Run: The stock exhibited explosive momentum as it rounded off the bottom of its Cup, rallying powerfully from its lows to re-test the key resistance near ₹290. This strong impulse move is a clear sign of dominant buying interest.

The Short Rest: Following every strong run comes a period of rest. Since its peak, the price has been forming the Handle of a large Cup & Handle pattern. This isn't a sign of weakness, but a healthy bullish consolidation—a catch of breath where the stock digests its previous gains.

The Next Leg: This handle has now tightened sufficiently, bringing volatility to a contraction point. The stock is coiling at the handle's upper trendline, suggesting the "short rest" may be over. A breakout would signal the beginning of the next leg up in the larger bullish narrative.

Why This Looks Bullish:

Strong Momentum: The prior run proves there are strong buyers in this stock.

Constructive Action: The handle is a classic bullish continuation pattern or VCP (Volatility Contraction Pattern)

Volume Confirmation: A breakout with high volume will confirm the resumption of the uptrend.

Trade Strategy:

For Both Swing & Positional Traders:

Entry: On the closing of a candle that breaks above the trendline. The ideal candle is thick and green with minimal upper wick, confirming the end of the rest period.

Stop Loss (SL): Low of the breakout candle or ₹267 (Placed below the very recent low).

Stop Loss (SL) (Positional): ~₹243 (Low of the handle's low)

Target 1 (Swing): Initial Risk-to-Reward 1:2. Trail stops after.

Potential Long-term Target : ~₹410 (2-3 months horizon)

Key Levels:

Pattern Breakout: Above the trendline.

Major Support/Stop Level: ₹243

Positional Target (Pattern Projection): ₹400/410

⚠️ Disclaimer:

This post is for educational purposes only and does not constitute financial advice. Trading stocks involves substantial risk of loss and is not suitable for every investor. The price targets and levels are hypothetical projections based on technical analysis and are not a guarantee of future performance. Always conduct your own research and consider your risk tolerance before making any investment decisions.

👍 If you agree with this analysis, please give it a Boost!

💬 Which stock would you like to see featured in the next technical breakdown? Let me know in the comments!

ABCapital’s Daily Retest: Bullish Bounce IncomingOn the Daily timeframe, price is revisiting the ₹244–₹248 zone, which had capped rallies three times before the breakout on 17 June 2025. After carving out a classic rounding bottom, ABCapital surged—now it’s offering a second chance to enter:

- Zone to Watch: ₹244–₹248 (prior resistance → new support)

- Timeframe: Daily

- Trend: Strongly bullish in both short and long term

- Upcoming Catalyst: Q2FY26 earnings on 4 August 2025

- Entry Strategy:

1. Look for bullish price action (pin‑bar, bullish engulfing, etc.) on daily candles

2. Verify with a volume pickup on the bounce before initiating a long 👍

Why It Works

- Daily retests of former resistance zones often lead to reliable bounces

- Rounding bottom reflects deep accumulation by smart money

- Daily trend remains intact until broken with conviction

Risk Management

• Stop‑loss just below ₹242

• Trail stops higher as price confirms strength

Targets

- Short‑term: ₹260

- Long‑term: ₹280+ and keep trailing.

🚀 A textbook daily‑timeframe retest in a powerful uptrend—perfect for fresh entries or scaling in.

Disclaimer: This is not financial advice. Conduct your own due diligence and manage risk prudently.

If this resonates, 👍 Boost, 💬 Comment, and 📝 Share your take!

❓ Got another stock in mind? Feel free to ask me which ticker you’d like analyzed next!

Ask ChatGPT

AUBANK back to All Time High.AUBANK is a few points away from the price where it started.

The trading strategy is to wait for the resistance range 250-246.90 for a retest of the all-time high and upper targets of 261.50 to 268 as new highs.

Upon rejection or confirmation of rejection of this resistance level, prices will fall to 231 and 221, respectively, as T1 and T2.

#ABCCAPITAL looking bullish on monthly & weekly timeframe#ABCCAPITAL has given a breakout at 260 on a weekly timeframe. Upside potential: 100%+. Stop loss: 238. A few things to note:

The stock has given a breakout on weekly level. Risk-averse traders can wait for June monthly close above 260

This stock will require immense patience as this could turn a multi-bagger

The volumes have been increasing over the last few months

This is not a buy/sell recommendation. Research carefully and invest at your own risk.

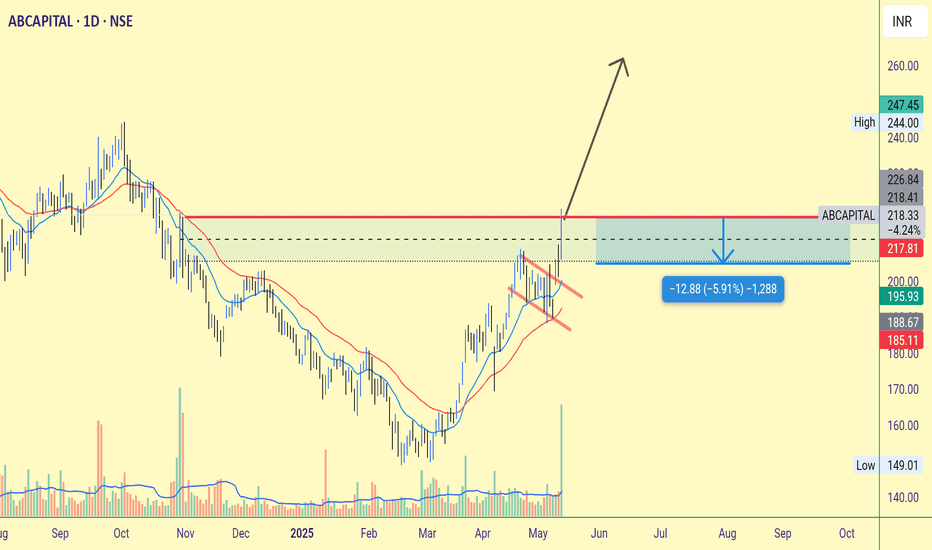

A B CAPITAL : Unfolding one more opportunityStock trying hard to consolidate and go up

But as we can see there lies an opportunity on the upside with Drop - Base - Drop range (168 - 172)

If stock reaches and pauses in the above mentioned area, It may be possibly give an sell opportunity in Lower Time Frame

Keep an eye

Sl will be above 175

Targets on the downside can be expected up to 150

Advance alerts and preparation gives sufficient time to prepare entry with peace of mind

ABCAPITAL Trading Above Fresh Weekly Demand ZoneABCAPITAL is currently trading at ₹183.01, above its demand zone between ₹178.4 and ₹174.55, established on 5th April 2024. This fresh zone has not been tested yet, indicating potential buying interest if the price pulls back to this range. Investors may monitor for a potential entry opportunity near this support level.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Please conduct your own research or consult a financial advisor before making any investment or trading decisions.

ABCAPITAL: Potential Short Setup with Key LevelsStock Name: ABCAPITAL

Entry Point: Considering a short position if the price breaks below today's low, supported by strong open interest (OI).

Stop-Loss (SL): Placed above candle high to control risk effectively.

Target: Near the next key support level or adjusted based on real-time price movement.

Disclaimer:

This analysis is shared purely for educational purposes and is not a recommendation to trade. Please perform your own research and consult a financial advisor before making any investment decisions.

ABCAPITALABCAPITAL - need to break range move upside

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

ABCAPITAL - Cup and Handle- Breakout- WklyABCAPITAL - Cup and Handle- Breakout - Wkly

Name - ABCAPITAL

Pattern - Cup and Handle

Timeframe - Wkly

Status - Breakout

Volume - Very Good

Cmp - 226

Target - 354

SL - 196

Pattern: Cup and Handle

The Cup and Handle pattern is a bullish continuation pattern often used in technical analysis.

Fundamental ratios:

Here are some key fundamental ratios and metrics for Aditya Birla Capital Ltd. (ABCAPITAL):

Key Financial Ratios:

Price to Earnings (P/E) Ratio: 16.80

Price to Book (P/B) Ratio: 2.24

Return on Equity (ROE): 13.87%

Debt to Equity Ratio: 8.17

Net Profit Margin: 9.43%

Operating Profit Margin: 28.73%

EBITDA Margin: 29.91%

Financial Highlights:

Market Capitalization: ₹57,539.7 crore

Revenue Growth (YoY): 30.54%

Net Profit: ₹3,424.19 crore

Earnings Per Share (EPS): ₹13.17

These metrics provide a snapshot of Aditya Birla Capital Ltd.'s financial health and performance.

AB CAPITAL, LONGAditya Birla Capital, AB Capital stock has seen huge correction (value erosion after IPO) from Yr 2017 upto Yr 2020, from the High of 255 to Low of 39 in the span of 3yrs. The stock rode the wave of bullish sentiments in the stock market after Covid19 and touched the high of 199 in July 2023. The stock is close to giving multi-year breakout (7yr) based on Cup-Handle pattern. The fall and rise is very close to rounding bottom pattern which gives the specified target. The lines are key support / resistance levels.

Daily Bullish Flag Breakout in Aditya Birla CapitalHi,

NSE:ABCAPITAL has given a Bullish Flag Breakout on Daily charts with very good volume.

MACD is also on the bullish side on daily, weekly time frames. RSI is also on the bullish side on daily and weekly time frames.

In the current market scenario I am expecting that the bullish momentum will continue.

Complete price projection like entry, stoploss and targets mentioned on the charts for educational purpose.

Please share your feedback or any queries on the study.

Disclaimer: Please consult your financial advisor before making any investment decision.