$XRP PRICE PREDICTION | MULTI-YEAR BREAKOUT TOWARD $10+?CRYPTOCAP:XRP is trading above a confirmed multi-year breakout zone on the higher timeframe after completing a long accumulation phase.

Price has already delivered a strong expansion move and is now building structure for the next leg higher.

TECHNICAL OVERVIEW (HTF):

✔ Descending Wedge Breakout (2020–2024)

✔ 600%+ Expansion From $0.60 Breakout

✔ Fair Value Gap / Accumulation Zone: $1.30 – $1.90

✔ Higher-Timeframe Bullish Structure Intact

✔ Bullish Bias While Price Holds Above $1.30

TARGETS (CryptoPatel): $3.50 / $5.00 / $8.70 / $10+

INVALIDATION:

❌ HTF Close Below $1.30

Technical analysis only. Not financial advice. DYOR.

ALTS

$FET Price Prediction | 5000% Potential From Macro Support?Market Context

NYSE:FET is currently trading at a major Higher Timeframe (HTF) support zone after a deep corrective move from cycle highs.

Price has retraced ~97% from ATH, a level historically associated with long-term re-accumulation phases.

Technical Overview (HTF)

✔ Macro ascending channel support intact (since 2020)

✔ Strong HTF demand zone at $0.20 – $0.19

✔ 97%+ retracement from ATH completed

✔ Channel support + demand confluence holding

✔ Bullish structure as long as price holds above $0.19

This area represents a high-risk / high-reward macro support with asymmetric upside potential.

Upside Targets (CryptoPatel Levels) $0.60 / $1.00 / $2.80 / $5.00 / $10.00

➡️ This implies a potential ~50x (5000%) move if the macro structure plays out.

⚠️ Invalidation Level

❌ HTF close below $0.19

A breakdown below this level would invalidate the macro bullish thesis.

Conclusion

As long as FET/USDT holds above $0.19, the macro bullish bias remains valid.

This zone could act as a long-term accumulation base before the next expansion phase.

TA Only | Not Financial Advice

Always manage risk and DYOR.

$AXS Crashed 98% From Its ATH. Now It Just Pumped 65% In One DayNYSE:AXS Crashed 98% From Its ATH. Now It Just Pumped 65% In One Day. Here’s What Changed:

After A Brutal -99.67% Drop From Its $166 ATH to $0.55, NYSE:AXS Is Finally Showing Strength.

Price Surged 65%+, Reclaiming $2 With $1.18 Billion+ Volume And Is Up Over 190% In The Past Month

Driven By A Major Tokenomics Upgrade:

🔹 Launch Of bAXS (1:1 Backed By AXS)

🔹 Rewards Stay Inside The Ecosystem

Technical View

Strong Bounce From $0.80–$1.00 Accumulation Zone

Now Holding $1.50–$2.00 As Support

New Accumulation Zone: Around $1.50-$1.20

Next Resistance Sits Around $3.80

Key Invalidation Below $0.75

Narrative: Gaming Tokens Are Catching Bids Again:

RON +20% | SAND +30% | MANA +21%

#AXS Was The King Last Cycle: Is NYSE:AXS Setting Up For A Run Back To Its $166 ATH?

NFA | DYOR

Altseason 2026 Will Be Bigger Than 2017 & 2021 Combined Altseason 2026 Will Be Bigger Than 2017 & 2021 Combined 🚀

OTHERS/BTC (Altcoins Vs Bitcoin) Is Back At The Same Support Level That Triggered Every Major Altcoin Cycle.

2017: +423% Rally

2021: +503% Rally

2026: ~702% Projected Move

Every Cycle This Ratio Bounces, Small Caps Go Parabolic And 10x–100x Opportunities Are Born.

The Only Question That Matters Now:

Are You Early Or Too Late?

NFa & Always DYOR

$TAO PRICE PREDICTION | IS $3,000 POSSIBLE? | CRYPTOPATELGETTEX:TAO Is Trading At A Key HTF Accumulation Zone On The Weekly Chart After A Deep Correction From The 2024 Highs.

Market Structure Continues To Suggest Smart Money Re-Accumulation At Long-Term Demand.

Weekly Technical Structure:

• Bullish Order Block Holding: $260–$285

• Strong Historical Reactions From This Demand Zone

• Range Compression After Liquidity Sweep

• Key Strength Trigger: Weekly Close Above $440 (S/R Flip)

CryptoPatel Targets:

$1,000 / $1,500 / $3,000+

As Long As TAO/USDT Holds Above $260, The Macro Bullish Bias Remains Intact.

A Clean Break Above The $700–$800 Supply Zone Opens The Door For Price Discovery.

Invalidation: Weekly Close Below $260

TA Only. Not Financial Advice. DYOR.

$XMR Hits New ATH $650: But Here’s My WarningOMXSTO:XMR Hits New ATH $650: But Here’s My Warning

Privacy Coin Just Hit An All-Time High Exactly When Dubai Banned Privacy Coins.

Classic Crypto, They Ban It, We Pump It 😂

The Returns:

2 Years → 6x

1 Year → 3.5x

2026 (Just 13 Days) → +57%

My Honest View:

🔹 Global Regulations Are Tightening Hard On Privacy Coins Like OMXSTO:XMR And $ZEC.

🔹 Remember What Happened To CRYPTOCAP:ZEC ?

🔹 Pumped To $775 → Crashed To $300

🔹 That’s A 61% Dump In Just A Few Days.

When Regulators Target Something This Aggressively, These Pumps Can Turn Into Exit Liquidity Before Major Crashes.

My Suggestion:

❌ No Fresh Entries At This Level

✅ If Holding: Consider Booking Profits

⚠️ If You Still Want In (FOMO Mode): ALWAYS Use Stop Loss

Risk Here Is HIGH. Potential Reward Is LIMITED.

This Isn’t FUD: This Is Risk Management.

Stay Smart. Book Profits. Protect Capital.

Not Financial Advice & DYOR: Just Awareness For My Community 🙏

$TON BREAKOUT SETUP | MACRO CHANNEL TARGET $30 | CRYPTOPATELLSE:TON / USDT: Weekly Price Forecast | CryptoPatel

TON is trading at a major HTF support confluence on the weekly timeframe after a prolonged corrective move from the 2024 highs.

Technical Structure:

Price continues to respect a macro ascending channel in play since 2022. Within this structure, TON has been correcting inside a descending channel from the ~$8 high, indicating a controlled correction rather than trend failure.

The current price is reacting from the lower boundary of the descending channel, which also aligns with long-term ascending trendline support — a key accumulation zone historically.

Key Levels & Confirmation:

• Weekly close above $2.70 = descending channel breakout

• Reclaim of $3.50 = bullish trend resumption

• Measured move projects toward $28–$30 zone (upper macro channel)

Targets: $3.50 → $7 → $15 → $30+

Invalidation: Weekly close below $1.20

This is a high time-frame accumulation setup with asymmetric risk-reward, best suited for spot and long-term positioning.

TA Only. Not Financial Advice. Always Manage Risk.

BTC | 8H Technical Structure UpdateBTC | 8H Technical Structure Update

Price Is Printing A Clear Ascending Triangle With Consistent Higher Lows Pressing Into A Well-Defined Horizontal Supply Zone At $94,500

Key Technical Levels:

🔹 Range High / Supply: $94,500 → $107,000

🔹 Ascending Trendline (Dynamic Demand): ~$88,000

🔹 HTF Demand / Structural Support: $78,000

Market Structure Read:

🔹 Compression Phase Ongoing

🔹 Volatility Expansion Imminent

🔹 Trendline Continues To Act As Acceptance Support

🔹 Liquidity Resting Above Range High

Scenarios:

✔️ 8H Close Above $94500 → Range Expansion Toward $106K+

❌ Loss Of Ascending Trendline → Structural Rotation To $78K

Market Is At Decision Point. Wait For Acceptance, Not Anticipation.

$AVAX PRICE FORECAST | IS $200 POSSIBLE? | ANALYSIS BY CPCRYPTOCAP:AVAX PRICE FORECAST | IS $200 POSSIBLE? | ANALYSIS BY CRYPTOPATEL

#AVAX Is Holding A Strong High-Timeframe Accumulation Zone On The Weekly Chart After A Deep Multi-Year Correction From The 2021 ATH. Current Structure Suggests Smart Money Re-Accumulation Near Long-Term Demand.

Weekly Technical Structure:

✅ Strong All-Time Support / Accumulation Zone: $11 – $13.80

✅ Multiple Confirmed Reactions From This Zone Since 2022

✅ Macro Descending Trendline From ATH Still Capping Price

✅ Recent Sell-Side Liquidity Sweep Into Demand

✅ Bullish Confirmation Trigger: Weekly Close Above $15

CryptoPatel Targets (HTF Expansion):

🎯 TP1: $32.7

🎯 TP2: $57.9

🎯 TP3: $114.5

🎯 TP4 (Cycle Extension): $200+

As Long As AVAX/USDT Holds Above $11, The Macro Bullish Bias Remains Valid.

This Is A Patience-Based Weekly Setup With Asymmetric Risk-Reward, Best Suited For Spot & Swing Traders Using HTF Confirmation.

Invalidation:

❌ Weekly Close Below $10

TA Only. Markets Are Probabilistic. Always Manage Risk & DYOR.

$TRX PRICE FORECAST | IS $5 POSSIBLE? | ANALYSIS BY CRYPTOPATELCRYPTOCAP:TRX PRICE FORECAST | IS $5 POSSIBLE? | ANALYSIS BY CRYPTOPATEL

#TRX Is Quietly Building A Massive Multi-Year Base On The 2W Chart.

Price Has Respected The Same Rising HTF Trendline Since 2020 — A Clear Sign Of Long-Term Strength.

Technical Highlights:

✅ Clean Higher Highs & Higher Lows

✅ Multi-Year Ascending HTF Trendline Holding

✅ Strong HTF Demand Zone Holding At ~$0.25

✅ Extended Consolidation → Expansion Setup

✅ Macro Trend Bias Remains Bullish

CryptoPatel Targets: $1 → $2 → $5+

Invalidation: ❌ Weekly Close Below ~$0.20

As Long As TRX/USDT Holds Above $0.25, The Bullish Structure Remains Intact.

A Loss Of This Level Would Break The Macro Thesis.

Cycle Outlook:

2025 = Compression Phase

2026–2027 = Potential Parabolic Expansion

TA Only | DYOR | Not Financial Advice

$SUI PRICE FORECAST | IS $20 POSSIBLE? CRYPTOCAP:SUI PRICE FORECAST | IS $20 POSSIBLE? | ANALYSIS BY CRYPTOPATEL

CRYPTOCAP:SUI Is Showing A Clear High-Timeframe Smart Money Re-Accumulation Structure On The Weekly Chart After A Deep Correction From 2024 Highs.

Market Structure Overview

After A ~76% Drawdown, Price Swept Liquidity At The Lows And Printed A Strong Reversal, Signaling Demand Absorption And Institutional Interest.

Technical Confluence

Weekly Bullish Order Block: $1.50 – $1.30

OB Aligned With Fair Value Gap (Strong Demand Zone)

~45% Impulse Move Already Delivered From This Area

Price Structure Respects A Rising Channel

HTF Bias Turning Bullish

👉 Best Entry Zone ($1.50 – $1.30) Was Shared Earlier, Cleanly Filled, And Has Already Given ~45% Profit On A Short-Term Swing.

Targets (HTF Expansion)

TP1: $4.8 (Previous Weekly Resistance)

TP2: $18 – $20 (HTF Expansion + Psychological Zone)

⚠️ Invalidation

Weekly Close Below $1.20 Breaks The Bullish Structure

Final Thoughts

This Is A Patience-Based Weekly Setup, Not A Short-Term Trade. As Long As Price Holds Above The Bullish OB, Upside Expansion Remains The Higher Probability Scenario.

Disclaimer: TA Only. Not Financial Advice. Markets Are Probabilistic. Always Do Your Own Research.

BTC Dominance (BTC.D) – Macro Structure BreakdownBTC Dominance Is Respecting A Multi-Year Symmetrical Triangle Structure That Has Been In Play Since 2017. Price Recently Tagged The Upper Resistance / Altcoins Accumulation Zone Around 64–66%, Where Strong Supply Entered The Market.

🔴 Technical Confluence:

Price Tapped A Bearish Order Block Near 65–66%

Resistance Retest Completed → Failure To Reclaim

Market Structure Turning Bearish Below 64%

Fair Value Gap (FVG) Formed At Resistance Acting As Supply

Momentum Weakness With Acceptance Below Prior Support

Downside Projection:

If This Breakdown Confirms, BTC.D Could Expand Lower Toward The Macro Support Trendline / Altcoins Take-Profit Zone Around 38–40%, Representing A Potential −25% To −36% Move Into Late 2026–2027.

Market Implication:

Bitcoin Dominance Decreasing = Big Altseason Rally Loading

Capital Rotation From BTC Into Altcoins Historically Aligns With This Phase.

Key Level To Watch:

Sustained Acceptance Below 58% Confirms Bearish Continuation.

❌ Invalidation:

Strong Reclaim And Acceptance Above 64–66% Resistance.

Bias: Bearish BTC Dominance → Bullish Altcoins

$ONDO PRICE FORECAST | IS $7.65+ POSSIBLE? | CRYPTOPATEL TALSE:ONDO Is Trading At A High-Timeframe Fibonacci Demand Zone, Holding The 0.618 Retracement (~$0.45) After A Deep Corrective Move — A Textbook Accumulation Structure.

Technical Structure

Accumulation Zone: $0.40–$0.45

Bullish Order Block / Deeper Demand: $0.25–$0.30 (0.786 Fib)

HTF Structure Remains Valid Above $0.25

Structural Flip Can Trigger Impulsive Expansion

Price Targets: $0.82 → $1.20 → $2.15 → $7.65+

As Long As Demand Holds, ONDO Remains Positioned For A Multi-Leg Cycle Expansion With 2000%+ Upside Potential.

Accumulation Phase In Progress — Patience Is Key.

Technical Analysis Only | Not Financial Advice

$ONDO PRICE FORECAST | IS $7.65+ POSSIBLE?LSE:ONDO is currently trading inside a high-timeframe Fibonacci demand zone after a deep corrective move. Price is holding above the 0.786 retracement, suggesting a potential accumulation phase rather than continuation to the downside.

This structure is consistent with HTF accumulation behavior, where patience is required before expansion.

\

Technical Structure Overview:

HTF Accumulation Zone: $0.45 – $0.35

Bullish Order Block / Deeper Demand: $0.30 – $0.25 (0.786 Fib)

HTF Market Structure Remains Valid Above: $0.25

Breakout Potential: Once local structure flips bullish

Current Phase: Accumulation → No confirmation yet

As long as demand holds above the key HTF support, LSE:ONDO remains technically positioned for a multi-leg expansion during the next impulsive phase.

Upside Targets (HTF):$1.00/$2.00/$4.00/$7.65 – $8.00+

A sustained move from this base could support a strong cycle expansion, provided market conditions align.

TA only | Not financial advice | Always DYOR

$XRP Price Forecast | Is $10 Possible?CRYPTOCAP:XRP Is Currently Retesting A Breakout That Took Nearly 8 Years To Form — A Rare, High-Timeframe, Cycle-Level Structure That Typically Precedes Major Market Expansions.

The Last Time This Exact Structure Appeared (2017), XRP Delivered An Extraordinary 40,000% (400x) Move Following The Breakout.

Current High-Timeframe Technical Structure:

✅ Multi-Year Descending Structure Broken

✅ ~57% Corrective Pullback From Recent ATH

✅ Price Holding Within The $2–$1.50 Demand Zone

✅ Strong Macro Support Identified At $1–$0.80

As Long As Price Respects This Support Region, The Primary Technical Projection Remains $8–$10 XRP Over The Cycle, Based On Measured Move And Historical Structure Behavior.

Why Expect Only 5x–10x From Here?

The Previous Multi-Year XRP Breakout Resulted In A 400x (40,000%) Expansion.

Historically, Large Bases Lead To Large Moves — Not Modest Returns.

From A Purely Structural Perspective, A Move Toward $10–$20 Cannot Be Ruled Out In The Next Market Cycle If The Breakout Holds And Momentum Confirms.

Disclaimer:

This Analysis Is For Educational Purposes Only And Does Not Constitute Financial Advice. Technical Analysis Is Probabilistic, Not Predictive. Always Apply Proper Risk Management And Conduct Your Own Research.

ETHEREUM 2026 ATH Price Forecast | Bitcoin Halving Cycle AnalysiThis study observes Ethereum’s historical behavior relative to Bitcoin halving events. The purpose is to highlight recurring market structure patterns, not to provide financial or investment advice.

Observed Historical Cycles

2016 Bitcoin Halving

~70% drawdown in ETH

~546 days of sideways accumulation

Followed by a multi-year expansion phase (~22,800% peak move)

2020 Bitcoin Halving

~75% drawdown in ETH

~546 days of consolidation

Subsequent expansion to ~$4,693 (+2,600% approx.)

2024 Bitcoin Halving (Current Cycle)

~66% drawdown observed

~609 days of consolidation (ongoing)

Market structure remains comparable to prior accumulation phases

Key Observation

ETH trading within the $2,600–$3,000 range aligns with previous long-term accumulation zones seen before historical expansion phases.

Forward-Looking Scenario (Cycle-Based Projection)

If historical rhythm continues, the next expansion window may extend into 2026, with hypothetical price zones often discussed by market participants between:

$10,000

$15,000

$18,500+

These levels represent cycle-based projections, not price guarantees.

Conclusion

Ethereum has historically followed a pattern of deep drawdowns, prolonged consolidation, and later expansion after Bitcoin halving events. Whether this cycle continues to rhyme remains to be confirmed by future market behavior.

This analysis is for educational and informational purposes only. Always conduct independent research and risk assessment.

Will Bitcoin Hit $50,000 or $500K In Next Cycle ?Most People Still Don’t Understand What This #Bitcoin Chart Is Saying.

This Is The 12-Month CRYPTOCAP:BTC Structure.

It Has Been Respected For 15 Years.

Every Cycle:

Excess → Reset → Higher Floor → Expansion.

All Called “The End.”

All Were Structural Resets.

Here’s The Part Retail Misses:

Bitcoin Is Now Holding Above Its Previous Cycle High, Historically The Most Bullish Phase Of The Cycle.

That’s Not Optimism.

That’s Market Memory.

No Price Targets.

No Narratives.

Just Structure Doing What It Always Does.

If You’re Waiting For Certainty, You’ll Buy Late.

If You Understand Cycles, You Already Know What Comes Next.

🟠 Bitcoin Doesn’t Need Belief. It Needs Time.

IMO:

2026 For Bitcoin Will Likely Be Bearish, And We Could See Bitcoin Under $50K Based On Previous Fractals And Cycle Analysis.

However, 2027–2028 Could Be Massive For Bitcoin, And We May See $500K Within The Next 4 Years, In My Opinion.

This Is Just My Personal View, Not Financial Advice.

Always DYOR Before Any Investment Decisions.

$ETH at a Critical HTF Support Inflection.CRYPTOCAP:ETH at a Critical HTF Support Inflection.

$2,890 is the Structural Demand level.

Acceptance above this level Preserves Bullish Market Structure.

If Support Holds → Upside Continuation Toward $3,650 and $4,250.

Failure to Hold → Bullish Thesis Invalidated.

Binary Zone. Directional Expansion Pending.

NFA & DYOR

SILVER | Monthly TA – High-Risk ZoneSILVER | Monthly TA – High-Risk Zone

#Silver is in a vertical Expansion Phase and Trading far above Long-Term Trend Support.

Price is testing a macro Supply / Distribution Zone after a Parabolic advance.

If Distribution Confirms:

→ Mean Reversion Toward 0.382–0.5 Fib ($39–$31)

→ Extended Correction into 0.618 Fib (~$24) Possible

Momentum is Climactic — Risk > Reward at Highs.

This is a Decision Zone, not a Chase Zone.

Monthly Timeframe | Structure > Noise

⚠️ Disclaimer: This is Pure TA. Markets involve Risk. NFA & DYOR Before Making any Trading or Investment Decisions.

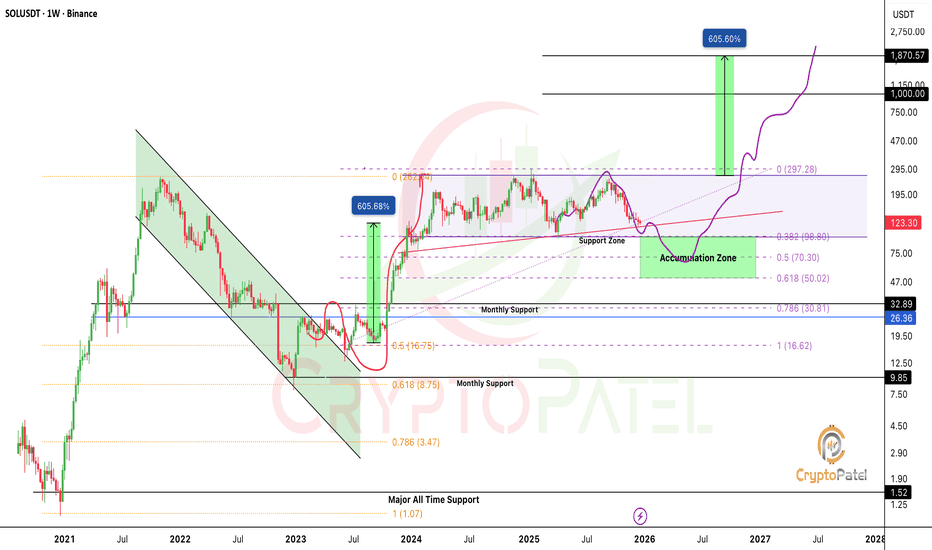

Will SOLANA potentila to $1000?Many people are emotionally attached to Solana and the $1,000 target and that may be possible long term.

But markets never move straight up.

Corrections are part of every cycle, and CRYPTOCAP:SOL is currently in a correction phase.

If the $120 support breaks, I’m expecting SOL to drop below $100.

A move under $100 could offer a strong long-term accumulation opportunity.

My accumulation zone: $98 – $50

Long-term outlook: $500 – $1,000

Crypto is highly volatile and risky.

Always DYOR, manage risk properly, and this is not financial advice (NFA).

$FLOW CRASH ALERT – WHAT JUST HAPPENED?AMEX:FLOW just got destroyed, dropping over 52% in 24 hours.

Price action

High: $0.174

Low: $0.079

Current: ~$0.10

Major Red Flags Today:

🔹 Upbit & Bithumb Suspended Deposits and Withdrawals

🔹 South Korea’s DAXA Issued a Trading Risk Warning

🔹 Flow Foundation confirmed they are investigating a potential security incident on the Flow network

What On-Chain Data Shows:

🔹 Top 100 holders Reduced Holdings by ~2.79M FLOW

🔹 No Smart Money Accumulation signal

🔹 Heavy Selling by Public Wallets During Peak Hours

🔹 ~1.69M FLOW moved to Exchanges (Selling Pressure)

🔹 Late buyers Jumped in During the Crash, Not Before

Market Behavior:

🔹 Panic selling dominated

🔹 Whales appear to have distributed near highs

🔹 Some wallets aggressively bought the dip amid fear

🔹 Reports of a large whale dumping on DEXs

Uncertainty Remains:

🔹 Cause of the “security incident” is still unclear

🔹 CEX suspensions increase fear and volatility

🔹 Short-term sentiment remains extremely bearish

This Move Was Driven by Fear, Uncertainty, and Heavy Selling Pressure. Until Clarity Comes from the Flow Foundation, Risk Remains Very high.

Investors are Waiting for clear Answers from Flow Blockchain

Trade Carefully. Volatility is Brutal Right Now.

NFA & DYOR

Is $MONAD Bullish? Technical Structure Suggests 10x PotentialPrice is Consolidating in a range-bound Structure Between Well-Defined Support and Resistance, indicating active Accumulation.

🟦 Demand Zone: $0.020–$0.022

🟥 Supply Zone: $0.025–$0.027

A Confirmed Breakout and close above Resistance Would signal a Bullish Structure Shift and Continuation of the Uptrend.

Trend Remains Bullish above $0.016, the recent swing low. A breakdown below invalidates the setup.

Based on Structure and Expansion Potential, 10x Upside is possible in a Strong Altseason.

Volatility remains High, Risk Management is Mandatory.

NFA & DYOR