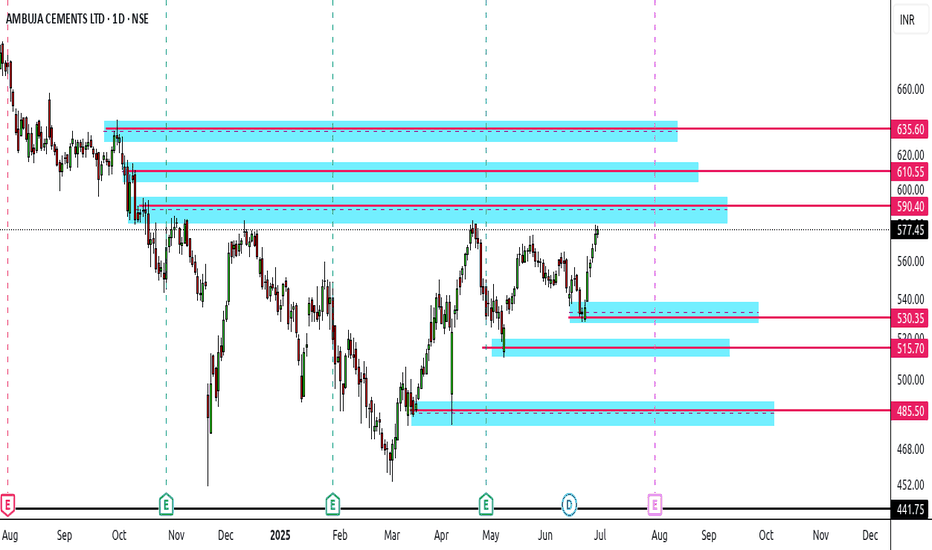

Ambuja Cements - Levels to watchAs market mood is choppy and result season is approaching soon

Its important to note the upcoming important levels for Ambuja Cements

Recently the stock gave a good rally but is now approaching towards its first strong resistance level of 590

Post that it has 2 more strong upside resistance at 610 and 635

Downside right now the nearest and strongest support levels are at 530 - 515 - 485

Take confirmation bias from lower Tf before entering any trade & play accordingly

Ambuja

Ambuja Cement: Is it a good Buy now? My perspective on the stock

I'm no expert with respect to understanding financials in details so cannot comment on Debt of Ambuja cement and allegations made by certain group.

Fundamentally , If we are to look at business potential, India is still a developing country and demand for Cement is going to be there and it will rise...

Risk factor : Adani has huge expansion plans for which it has taken debt too. If demand rises then the additional supply that additional capacity will bring in will be taken care of. However if demand for cement increases at slower pace than anticipated based on which additional capacity has been planned then it could put the whole pressure on capacity utilization and thereby on Profit margins.

Again let me reiterate, I'm no Fundamental Analyst but that is my understanding of the fundamentals of the business.

___________________________________________________________________________________________________________

That being said, as a Technical chartist, let's look at Ambuja cement based on charts.

On October 28, 2022, I had mentioned that the Upside target for Ambuja Cement has almost been done and the next opportunity is on the short side.

With the stock now 40% down, is it a good level to buy now?

If we look at charts,

- the stock has traded above 500 odd levels for 4 and a half months. And now has suddenly taken a big dip entrapping a lot of Bulls.

- it has broken important Line of breakout / breakdown ( I have marked that in the chart)

- any up move from here and lot of trapped traders might look to exit.

- It does not give confidence to go long as Supply could be very high if the stock moves up.

The next line of support is around 266-293 where Risk::Reward ratio would look better.

So any dips towards that zone Looks for signs of stability

- one can look to nip in slowly. Don't go all in... Spread your buy across days / weeks.

- If 266 is being breached don't add further immediately. Wait for further cues.

- Below 266 next important zone is around 233-240 odd levels and below that 190-202 odd levels.

These are my decision making levels. I go by levels and let market tell me what to do next.

Before Budget I had given my POA (Plan of Action) based on charts. and that was to short if market comes around 18000.

Today when those levels came in, I executed my Plan on the short side (again it was updated during market hours).

At that point of time it might have seemed foolish...

as market was giving illusion of being Bullish...

However charts and data were not supporting bullish view

Results are in front of you of what happened next.

If I talk about Nifty Index, chart is still looking weak and I'm yet to see improvement in derivatives data.

So Don't be in a hurry.

Posting this as I have got requests as to whether it is a good time to buy Ambuja cement (or for that matter Adani stocks).

So giving my perspective on the stock and my Plan.

Before taking any decision do review your Risk tolerance and Time tolerance. Trust you find the analysis helpful in planning your trade.

If you too any stock queries you can let me know in the comment section below. I would try to answer them over the weekend.

Take care of your health and mind.

Disclaimer

- The view expressed here is my personal view

- Past performance is not a guarantee for future predictions

- Use this for educational purpose

- Any decision you take, you need to take responsibility for the same

- It's your hard earned money. Treat it wisely

- Trade / Invest keeping in mind your trading style, goals and objectives, time horizon & risk tolerance

- if trading in F&O, understand that F&O trading involves risk

- Do take proper risk management measures

- Do your own analysis and consult your financial adviser if need be

Ambuja Cement - A buy in cash segment.Feels like Ambuja cement has completed 2 waves of major trend

If this is the 3rd impulse wave structure, we can see a sub wave (impulse) in it.

Have a look at the RSI and volume in hourly chart.

Buy zone :495-500

SL zone:465 levels

Final target for this wave is 645.But depends on how we manage the trade.

Managing the trade:

If the trade goes in our way

*Exit half Quantity @1:1 Risk/Reward Target and Shift to SL to cost

*Exit Half of the remaining with 1:1.5 or 1:2 Risk/Reward (by looking at momentum) and trail the SL.

*Exit remaining with trailing Stop loss.

*SECURING THE TRADE AND PROTECTING THE CAPITAL SHOULD BE YOUR FIRST PRIORITY.

*NOT A SUGGESTION VIEWS ARE FOR EDUCATIONAL PURPOSES.

Today a big move is expected in Ambuja CementThere is a specific indicator that is giving a high probability of UP^ move today after yesterday's closing. Expect 9-10% move today.

Disclaimer: Consult your financial adviser before investing.

Note: I am not a financial adviser.

Conclusion: You are responsible for your own trades!

🥂 Cheers! 🥂

AMBUJA CEMENTS WEEKLY BREAKOUTAmbuja cements given a breakout on disjoint channel pattern and seems it is gaining volumes for coming bullishness in this stock, one more thing is there that Relative strength indicator is giving bullish signals and gives a breakout on it too.

CAUSE OF LONG-:

1- Disjoint channel breakout.

2- Relative strength indicator breakout.

3- Volume breakout.

4- Combination of breakouts.

AMBJACEM -- Breakout soon... ?? Ambuja Cements -- Currently in consolidating phase from past 7-8 weeks with the flat trend.

Currently trading with No Supply - indicates possible up-move.

Also - the during recent market fall AMBJACEM - didn't fall and hovering around the support level.

Need to break 365.25 levels to see upside momentum.

Next targets - 390 / 410 / 433

Please spend time on your own research before investing.

Ambuja Cement Chart Analysis !!📈 Ambuja Cement Ltd. 📉

My Findings :-

1. Breakout from a Swing High.

2. Close Above March 2022 High.

Bias - Long

Target - 350, 383, 408, 431 and 442

SL - 292

RR- 1:4

All Important Supports and Resistances are drawn in chart. All levels are on closing basis.

Please have a look and revert back if you need some more study on it.

Disclaimer : Consult Your Financial Advisor Before Taking Any Decision On This Analysis.

Simple Trade Setup | AMBUJACEMENT | 23-09-2021NSE:AMBUJACEM

Trade Setup for Date 23-09-2021:

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level.

4) Avoid gap up or gap down chase. Wait and trade between levels.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with Strict SL. It may or may not hit all the levels. So one can book profit / loss at respsective level considering how price action works near that level.

Simple Trade Setup| AMBUJA CEMENT | 30-08-2021NSE:AMBUJACEM

Observations:

1) On Daily time frame it reversal and break 21DMA and closed above it. But it is below it's nearest resistance range of 410-415.

Please refer below chart : daily time frame.

2) On 1hr time frame, you can see this resistance range 410-415 giving resistance multiple time and only one time it has broke it but couldn't able to stay above it.

And now it is critical moment for this, if it breaks this range then it will be good upmove but if it fails then again there will be down move.

Please refer below chart: 1hr time frame.

-------------------------------------

Trade Setup for Date 30-08-2021:

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level tomorrow.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.