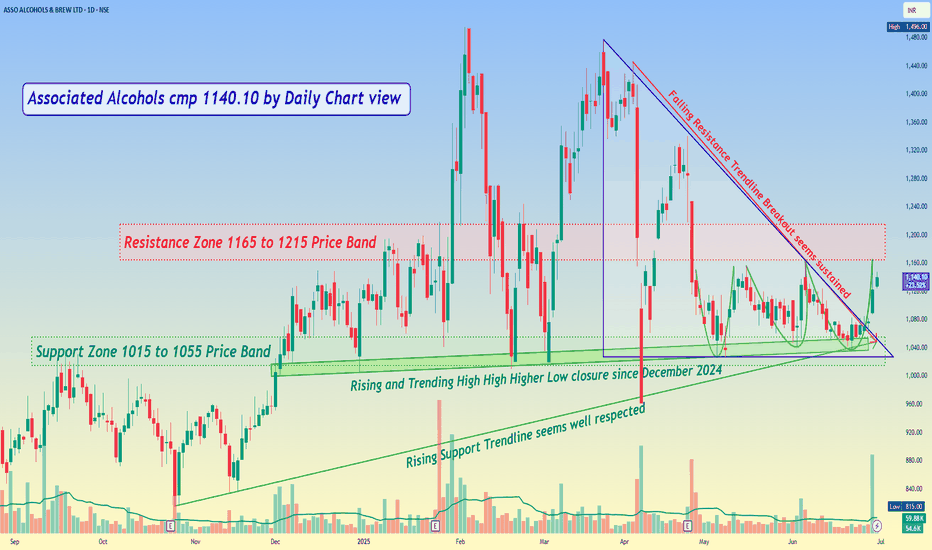

Associated Alcohols cmp 1140.10 by Daily Chart view**Associated Alcohols cmp 1140.10 by Daily Chart view*

- Support Zone 1015 to 1055 Price Band

- Resistance Zone 1165 to 1215 Price Band

- Rising Support Trendline seems well respected

- Falling Resistance Trendline Breakout seems sustained

- Rising and Trending High High Higher Low closure since December 2024

- Descending Triangle Breakout seems well sustained by rising Price and Volumes momentum

- Back to Back Bullish Rounding Bottoms formed awaiting for the Resistance Zone neckline crossover

ASALCBR

ASALCBRNote:

1. Views are personal and for educational purposes only. Recheck and take the trade as per your RR.

2. Always remember SL is your lifeline, not the big target...

3. Follow us for more patterns and like, share so that we feel it is helpful to many and share more patterns...

3. Views given here is not a tip rather it is for educational purpose... Aftermarket opens, the condition might change so learn to handle different conditions...

4. To learn more about patterns, Psychology behind the trade, and price action trading... contact us... Thanks...

Keep an eye ladies and gentlemen. Cheers and Happy Trading

ASALCBR is a good Medium Term BetASALCBR

Associated Alcohols & Breweries Ltd

Chart Structure:

- After listing in Feb'20, the stock is in an upward trend since Mar'20

- Stock right now is consolidating after making an All-Time High.

- During the consolidation, the stock has taken support multiple times near previous resistance and Avg. Buy price of last Huge Accumulation.

Volatility Contraction:

- In Day TF, price is forming a triangle pattern.

- Stock's Volatility is contracting. As before it was pushed down 20% after making ATH.

- Stock rose up again from the support area, and this time it was pushed only 11% down, hence creating a Triangle Pattern.

Relative Strength:

- Stock is outperforming its sector & Nifty50 in 3m, 6m & 1y TF. It is underperforming in lower tf due to stock being in consolidation.

- Stock has turned RS+ again on 8th Oct and is keeping above Laxman Rekha.

- Spread chart of the stock has formed a triangle pattern and is near a breakout.

Volume Activity:

- Stock saw huge Volume Activity from 4th to 12th October 2021.

- In that period 14.76 lac shares were delivered with an average of 1.84 lac shares/day with an average buying price of 548/-

- Previous average deliveries were 37k shares/day.

Financial Performance:

- Stock beat its QoQ & YoY Quarterly numbers in Q2.

- Sales Growth +50% QoQ & +21% YoY

- PBT Growth +36% QoQ & +6% YoY

- EPS Growth +41% QoQ & 8% YoY

Fundamental Notes:

- The company plans to expand its capacity from 45 MLPA to 90 MLPA. The project is expected to be completed by June-2022. That means the Co. will see the double output in 7-8 months.

- Company Distil, Blend, Bottle & Market are some of the key brands of United Spirits such as Bagpiper, Blue Riband, Flavored Mischief, Director's special gold & McDowell's Rum.

- The contract of this franchise has been extended up to April 2025.

- Some other brands which are produced under contract manufacturing are Black Dog, Vat 69, Black&White, McDowells, Royal Challenge, Signature, etc.

Target 1 (20%) achieved in Associated Alcohol. Target 2 is ON...This is follow-up on Associated Alcohol and Breweries. Can check link to related ideas.

Target 1 achieved. More than 20%. Target 2 is ON.

Chart is self explanatory. Entry, Targets and Trailing Stop Loss are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Associated Alcohols & Breweries | ASALCBRTechnical:

1)Trading in Channel

2)Morning Star Candle formation at Weekly support. A good sign of reversal.

3)Daily momentum indicators also showing positive signals.

Fundamental:

1)Amazing YoY Balance sheet.

2)Increasing YoY Net Profit.

3)Increasing YoY EPS.

4)Increasing YoY ROCE.

5)Almost debt free.

Lucrative stock from Investment perspective. Study it!!

#ASALCBR .. reached ATH high today..Another 20% move up can be expected once stock bounces back from the green trend line. tgt arnd 580-600

Full Disclaimer: I own this stock as part of my portfolio. For me it was a value pick as the fundamentals are amazing and business has picked up really well in last few years..

However, at this price it is not a value pick..

#WHIRLPOOL CMP2351 #TARGET 2663 #FMCG #ITC #DABUR #HINDUNILVR DAILY CHART ANALYSIS

#WHIRLPOOL

NSE: WHIRLPOOL

Short Term Quick Profit

CMP 2351.20

Target 2663.70

SL : 2190

Timeframe < 60 Days

Can hold for longer time

Factors:

BULLISH WEDGE BREAKOUT

Trend Following

Rising Volume with rising Prices.

Flag pattern breakout.

Pennant Pattern Breakout with Bullish Candle.

Retest Successful.

Higher Highs & Higher Lows.

Broken above RESISTANCE levels

Trading at SUPPORT levels

Earnings are strong.

Bullish Wedge Breakout

Risk Return Ratio is healthy.

And

Rising from Double Bottom Pattern to Flag Pattern forming.

If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations.

With 💚 from Rachit Sethia

ASALCBR Continuing trend BO opportunityAsso Alcohol is on an uptrend since last year..

Ascending triangle forming in short term.. Wait for weekly candle to close above resistance.. check daily charts for any retesting..

Target Open.. I am very Bullish on this ASALCBR.. Extremely Strong fundamentals.. good branding and major supplier of ENA..

They have over 20% ROIC (Rare...)

Bullish for next 2-3 years..

DAILY SWING CALL // Monday 15th of March 2021 / NSE: ASALCBRDAILY SWING CALL // Monday 15th of March 2021 / NSE:ASALCBR

// This is a swing trade call and not an intra-day trade. Please do not expect the stock to go up on the same day of posting or within a few sessions. Please follow the notes along with the posting before, during and after entering the trade //

CMP / LTP: 388.2

TARGET: + 450 (15% Around)

STOP LOSS: 350 (10% Max)

Standard Notes:

- Please follow the Stop Loss strictly and preferably on a daily closing basis.

- Recommended Profit Booking / Exit is on +12-15% & If you still want to hold the stock, trail the SL once this target is achieved.

- Duration: 15-20 Trading Days is suggested for all my trades and is an indicative period.

- If SL / Target are not triggered and you still wish to hold the trade, this can be done as long as SL is followed or trailed.

Disclosure: I may or may not have a position in this trade.

Disclaimer: All the recommendations are subject to market conditions. Please trade at your own risks.

ASALCBRNote:

1. Views are personal and for educational purposes only. Recheck and take the trade as per your RR.

2. Always remember SL is your lifeline, not the big target...

3.Follow us for more patterns and like, share so that we feel it is helpful to many and share more patterns...

3. Views given here is not a tip rather it is for educational purpose... Aftermarket opens, the condition might change so learn to handle different conditions...

4. To learn more about patterns, Psychology behind the trade, and price action trading... contact us... Thanks...

Keep an eye ladies and gentlemen. Cheers and Happy Trading