TATA MOTORS Hello & welcome to this analysis

The stock in daily time frame has given a double breakout

Inverse Head & Shoulder

Bullish Harmonic Seahorse

The upside levels as per IHS are 740 & 790 while the Seahorse pattern is indicating 775.

Both patterns have strong support at 690-700 and both would be considered invalid below 665

All the best

Autostocks

CNXAUTOCNXAUTO index has given long term trend-line and Inverted H&S breakout after so long. We may see a rally up to 28000 which is approx 11-12% from current price. 22800 is very crucial support. Closing below this may change my view. Tax cut news might be leading the rally. Choose stock which are currently strong in this consolidation phase. Keep a closer watch on auto stocks.

"All-electric Future. From India. For the world."Ola Electric Mobility Ltd

About

Founded in 2017, Ola Electric Mobility Limited is an electric vehicle company that primarily manufactures electric vehicles and core components for electric vehicles. These components include battery packs, motors, and vehicle frames, all produced at the Ola Futurefactory.

Key Points

Market Leadership Co. is the largest E-Scooter Manufacturing company in India, with 31% market share in the E2W sector, selling 329,618 scooters in FY24.

Product Portfolio

1. Ola S1 Pro: A premium scooter with a 195 km range, 120 kph top speed, and a 7-inch touchscreen.

2. Ola S1 Air: Offers a 151 km range, 6 kW motor power, and a 7-inch touchscreen.

3. Ola S1 X+: A budget-friendly model with a 151 km range, keyless unlock, and a 5-inch display.

4. Ola S1 X: Mass-market scooters with up to 190 km range, available in 2 kWh, 3 kWh, and 4 kWh battery options, with a 3.5-inch display.

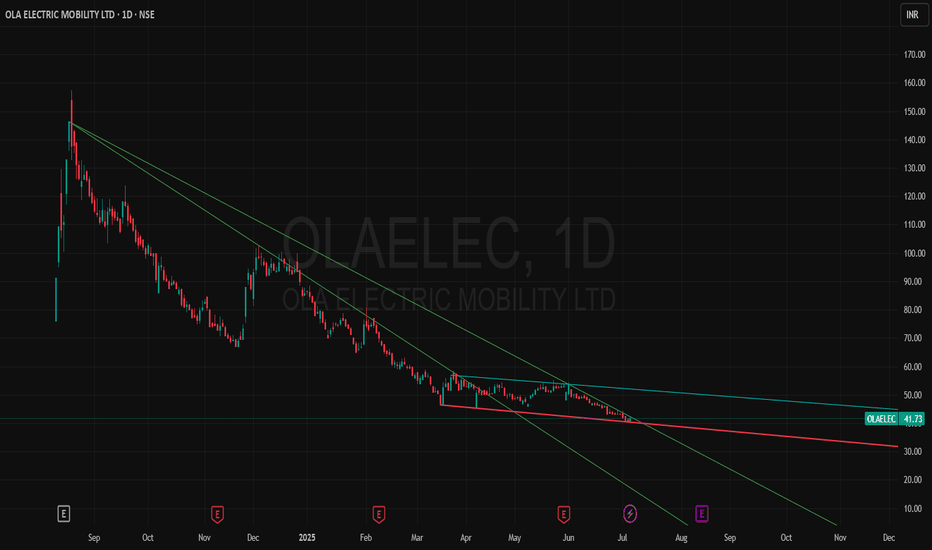

⚡ Ola Electric – Early Signs of Revival?

CMP: ₹41.73 | View: High-Risk Accumulation | Timeframe: Daily Chart | Sector: EV

🛵 Technical View:

Ola Electric has been in a steady downtrend since its listing but now showing signs of base formation near ₹40.

MACD on multiple settings is flattening and attempting crossover.

RSI has bounced from oversold zones and moving upward.

ADX/DMI showing reduction in negative strength – trend reversal possible.

Ichimoku cloud flattening – early signal for sideways to positive shift.

🔹 Key Price Levels:

🔸Support: ₹38.5 – ₹40

🔸Breakout Zone: ₹44.5 – ₹47

🔸Resistance: ₹51.5 / ₹60

📊 Volume:

Gradual rise in volumes with sideways consolidation. First green daily candle after long lower highs.

🔍 Fundamentals & Progress:

From Screener:

Not yet profitable, but business is capital-intensive and scaling.

Valuations currently not attractive, but price is near listing lows, making risk-reward favorable for high-risk investors.

🚀 Company Developments:

✅ Ola is rapidly expanding its EV scooter sales & showroom network

✅ Ola official site: Announced upcoming electric motorcycles and focus on battery innovation

✅ Government push for EV adoption will benefit Ola long-term

✅ Founder Bhavish Aggarwal aims to build an EV ecosystem (batteries + charging infra + vehicles)

🧠 Why Watch This Stock?

Sentiment may shift as markets look for beaten-down growth stories

Ola has brand recall, scale, and distribution

Any positive update (sales, production ramp-up, JV) can trigger a move

⚠️ Disclaimer:

This is a high-risk idea, suitable only for long-term investors or speculators with risk appetite. Not a recommendation. Do your own research.

📝 Note: Please do your own due diligence. This is not a recommendation, just a view based on charts and fundamentals.

🧠 Disclaimer: For educational and research purposes only. No buy/sell advice.

📝 Chart Purpose & Disclaimer:

This chart is shared purely for educational and personal tracking purposes. I use this space to record my views and improve decision-making over time.

Investment Style:

All stocks posted are for long-term investment or minimum positional trades only. No intraday or speculative trades are intended.

⚠️ Disclaimer:

I am not a SEBI registered advisor. These are not buy/sell recommendations. Please consult a qualified financial advisor before taking any investment decision. I do not take responsibility for any profit or loss incurred based on this content.

ASHOK LEYLAND LONG IDEA......Pros

Ashok Leyland chart looks good for reversal.

Auto sector looks relatively strong compared to other sectors in this fall.

Risk:Reward

Stoploss is Trend line breakdown. Target is ATH. Which gives best Risk:Reward.

Cons: Broader Market is very bad currently. One +ve thing in this market is "It is oversold". So Risk Management is very important now.

Note This is Technical view only. No idea about Fundamentals.

The Wheels are Turning: Auto Sector Sees Major GainsIndian auto stocks surged on January 2, 2025, fuelled by impressive December sales numbers, which propelled the Nifty Auto index to its highest daily gain in six months.

◉ Key Players

1. Eicher Motors NSE:EICHERMOT

● Surged 7%, with December sales up 25% YoY to 79,466 units, and exports rising 90% YoY.

2. Ashok Leyland NSE:ASHOKLEY

● Rose 5%, with December sales exceeding estimates, up 5% YoY, and Medium and Heavy Commercial Vehicles sales up 8% YoY.

3. Maruti Suzuki India NSE:MARUTI

● Extended gains for the second straight day, rallying 5%, driven by strong December car sales and bullish management commentary.

4. Mahindra & Mahindra NSE:M&M

● Up over 3% for the second consecutive day, with December SUV sales jumping 18% YoY to 41,424 units, driven by strong demand.

◉ Overall Outlook

The Indian automotive market is poised for continued growth, driven by a resilient economy and robust consumer demand. Potential interest rate cuts are expected to further fuel this growth, making vehicle financing more accessible and affordable for consumers. As a result, the road ahead looks promising for FY26, with expectations of sustained growth and increased sales in the automotive sector.

Ashok LeylandHello & welcome to this analysis

Stock is in a strong uptrend which has now come close to its weekly upper channel with a bearish harmonic deep crab pattern in the daily time frame.

Strong support between 180-150 while resistance at 210

It would be a buy the dip stock or fresh additions above the weekly channel

Happy Investing

MARUTI Hello and welcome to this analysis

Maruti has been a rank outperformer now for 2 decades. Stock has currently reacted to a resistance suggesting probability of some more pullback.

Overall stock has tremendous potential for further upside over medium to long term. Investors could look at an opportunity to add via SIP in the broader range 9500-11000 while traders can look for swing trading opportunities with resistance near 10400-500 and support at 9800-9600.

Happy Investing

Auto indexThe auto index is showing exhaustion, which means the auto stock may take a pause here. so if you have auto space stocks in your portfolio keep a watch on them and do a re-analysis of the stocks. closing below the horizontal line may reverse the trend of the index.

Disclaimer - I am not a SEBI-registered technical analyst and advisor so contact your financial advisor and make a self-decision. I will not be responsible for any profit and loss

CNX AUTO chart studyCNX AUTO index cmp 13650

Daily time frame

Elliot wave study.

Index is trading in (V) of wave 5 of motive phase.

as per mega phone structure, resistance confluence around the maturity area of wave 5.

AS per RSI and MACD index is over bought and any time this move can come to pause.

Bulls should be cautious going further in auto stocks. once wave 5 matures and we get a reversal confirmation of daily and weekly basis. corrective phase might unfold and sharp retracement can be seen in auto stocks.

Keep watch, index is trading at cautious levels.

MARUTI Set to Outperform Nifty 50Attached: MARUTI/ NIFTY 50 Daily Chart as of 5th May 2023

This Ratio Chart has just given a Fresh Breakout Buy Signal implying that for the coming days/ few weeks NSE:MARUTI is all ready to Outperform and take Leadership for Nifty 50

Buy Strength and Sell Weakness

Hence, expect Buying Action in MARUTI Stock from here on is what the Charts say!

MARUTI: Ascending TriangleThis is also a converging triangle formed with one flat horizontal line on the top & an inclined line meeting at a common point as illustrated in the chart.

The flat horizontal line act as a resistance for the prices & the on the inclined line the prices take support. It’s not necessary that the ascending triangle formation takes place only in the bull market, they can be formed in a bearish trend also.

Here also you should concern with the key point “The Third Touch”. The five significant points help us to make our decision in a better way. Here, each points suggesting a reversal point & as soon as price got it’s third touch on the inclined supporting line the price shoot up & a breakout happened.

The target for this pattern is the maximum vertical range of the triangle.

Trading strategy:MARUTI: BUY 9285-75 SL: 9050 TGT: 9545/9850

Why Stock Has Higher Book Value Than CMP ?What is Book Value ?

Book value per share (BVPS) is the ratio of equity available to common shareholders divided by the number of outstanding shares. This figure represents the minimum value of a company's equity and measures the book value of a firm on a per-share basis.

---------------------------

Here I am explaining you one of the reason why Book value per share exceed the CMP, the reason is related to , company's portfolio current valuation.

It is been very common that one company buys shares of other company , the dividend income is reported as other income, and the current valuation of these stocks is added to company's Book value.

----------------------------

For example Let us study this share name : Maharashtra Scooter

A well known brand of Geared scooter in early days. I think every body has a childhood memory attached to it's scooter . Now from a well known established scooter manufacturer to a holding company the journey is very different from usual.

Some interesting fact about Maharashtra scooter , that I found reading it's fundamental

Market Cap : 4,204 Cr ( opp .. That is not so great finding ✏️✏️✏️)

Book Value of Company : 22702 Cr (That is interesting)

Story is not over yet , wait

👇🏻👇🏻

Maharashtra scooter is holding 🫴🏻🫴🏻🫴🏻

💵💸💸💵💸💸💵💸

1) Bajaj Finance Ltd

Number of shares : 18974660

Holding Percentage : 3.13 %

CMP : 5519

Current Value : 10472.11 Cr .

🅱️🅱️🅱️🅱️🅱️🅱️🅱️🅱️

2) Bajaj Holding & Investment Ltd.

Number of shares : 3387036

Holding Percentage : 3.04%

CMP : 4640

Current Value :1571.58

🛵🛵🛵🛵🛵🛵🛵🛵

3) Bajaj Auto Ltd .

Number of shares : 6964277

Holding Percentage : 2.41%

CMP : 3607

Current Value :2512.01Cr

These three stocks announced dividends recently where ex date was 30 June , Dividend of 20 , 25 , 140 per share Respectively.

If I multiply and calculate the dividend earning of Maharashtra scooter that it stands at 143.92 Cr .

When I checked it's shareholding than I found more interesting things

1) All these companies are Bajaj Group Companies where Chairman is Mr. Sanjeev Bajaj .

2) Bajaj Holding has 51% stake in Maharashtra scooter and Maharashtra scooter has 3.04% stake in Bajaj Holding.

3) Company's ( FY 21-22)

Sales : 17Cr while

Expense : -20 Cr

But,

EBITA : +174CR (because of the dividend income got the point ? Comment Below )

If I add current portfolio value of these three stocks only (According to CMP) it it around 9605 Cr.

That is Why the book value of this stock is exceeding its cmp.

Escorts Break Down !! #AutoStock📈 Escorts Ltd. 📉

This Stock broke Down from a Down Trending Chanel after testing three times. It was in consolidation inside Channel since last four months and today that ended on Short side So I am biased on sell side as todays candle closed is strong red.

On Sell Side I am looking for Targets of 1595 and 1434.

StopLoss should be kept at 1860.

It offers 1 : 1.5 Risk Reward.

All Important Supports and Resistances are drawn in chart. All levels are on closing basis.

Please have a look and revert back if you need some more study on it.

Disclaimer : Consult Your Financial Advisor Before Taking Any Decision On This Analysis.

BUY Bajaj auto Buy bajaj auto above 3924 for the target of 4000 and 4121. After a very long consolidation, The Auto stock is showing bullishness so keep good Auto stock on your watch list.

Disclaimer This is only for educational purposes, Please do your own analysis before investing hard-earned money.