Axisbanklong

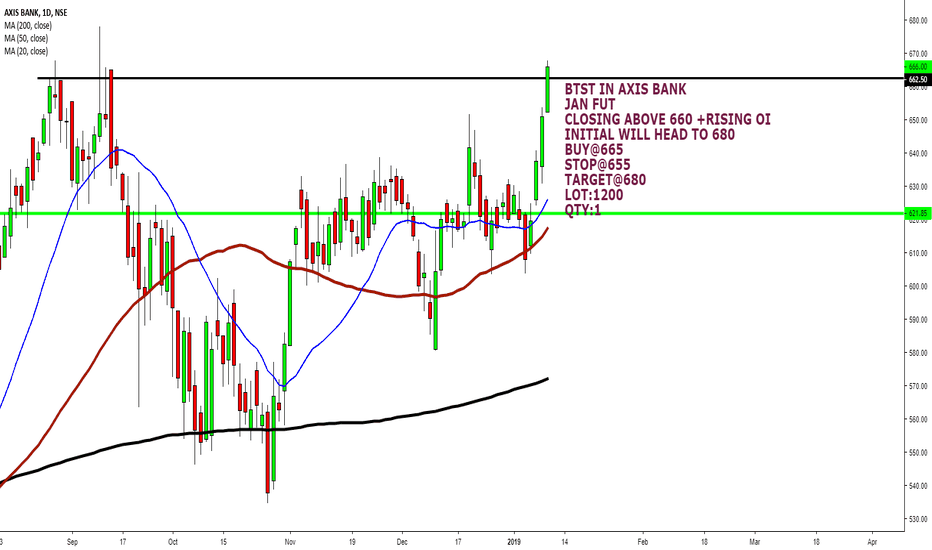

BTST IN AXIS BANK !!(FUT)!!BTST TRADE IN AXIS BANK

VIEW

:-200-DMA TAKEN OUT

:-RISE IN OI+RISE IN PRICE

:-RESISTANCE OF 730 TAKEN OUT

TRADE IN FUTURES 28TH NOV CONTRACT

LEVELS ARE ACCORDING TO SPOT PLEASE ADJUST FOR FUTURE PRICES

BUY@731

STOP@721

TARGET 1@741

TARGET 2@751

LOT:1200

QTY:2

PLEASE NOTE:

ALTHOUGH REAL OI DATA WILL BE AVAILABLE ONLY AFTER 6/7 PM

!!PLEASE NOTE TRADE WITH CAUTION AND AT YOUR OWN RISK PROFILE!!

!!PLEASE DON'T OVER TRADE!!

!!LIVE TO FIGHT ANOTHER DAY!!

!!HAPPY TRADING!!

Axis Bank | Bounced off Rising Channel support - DailyAxis Bank bounced off from rising channel support at 760. That price also seem to be a horizontal support area. If the stock holds on to the channel we can expect a considerable move upwards. Notable resistance is at 820 area where life time high falls as well.

(Disclaimer: Our charts and contents are just for the purpose of analysis, learning and general discussion. Do not consider these as trading tips or investment ideas. Trading in Stocks, Futures and Options carry risk and is not suitable for every investor. Hence it is important to do your own analysis before making any investment or trading decisions based on you personal circumstances and it is always better to take advice from professionals)

AXISBANK Hammer formation - I Have a bullish view.Slight Bullish Harami gives some confidence. This looks interesting because Axis is breathing some fresh air after so many months. If it sustains at this level, I firmly believe that Axis can hit the HHs pretty soon. All because of that YesBank fiasco, I assume.

AXIS long...AXIS break previous high so keep watch and Take Profit...

ENTRY ABOVE 644

Trade manageable lot size and use trail stop to protect your profits from 10 Pips

Disclaimer:

The information contained in this presentation is solely for educational purposes. Does do not constitute investment advice. I may or I may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable for your own financial situation.

I am not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

Hope this idea will inspire some of you! Don't forget to hit the like/follow button if you feel like this post deserves it