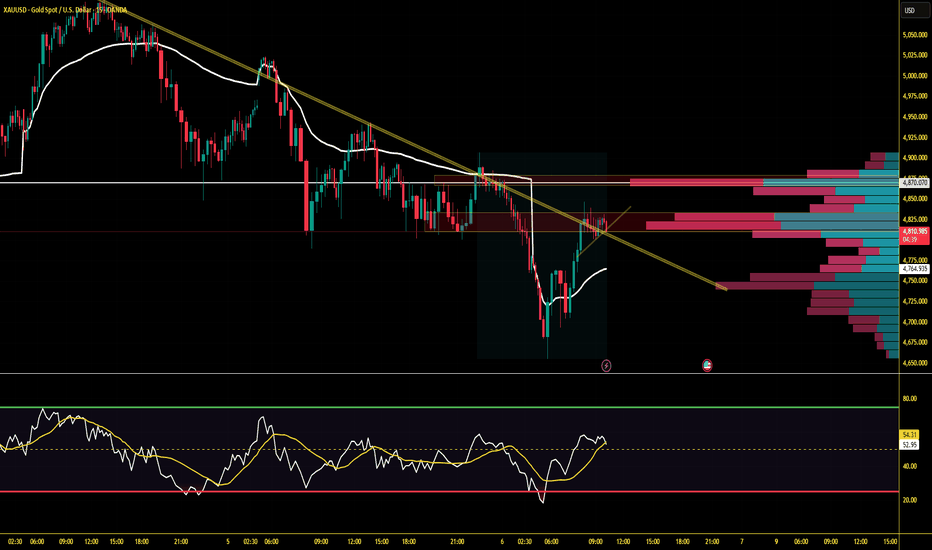

XAUUSD | 15-Minute Intraday Analysis | Sell on Rise(Intraday)XAUUSD | 15-Minute Intraday Analysis | Sell on Rise(Intraday)

Symbol: XAUUSD

Timeframe: 15 Minutes

Bias: Bearish (Intraday)

🧠 Trade Logic

In a bearish trend, pullbacks are for selling, not buying.

Wait for rejection confirmation near resistance.

🔍 Technical Breakdown

The market is respecting a strong descending trendline

EMA cluster acting as a dynamic resistance

Price is currently testing EMA + trendline + volume resistance

VoLume Profile shows heavy supply around 4830–4860

RSI recovered from oversold but stuck near 50–55, no trend reversal confirmation

🔴 Sell Scenario (High Probability)

📍 Sell Zone: 4830 – 4860

📉 Targets:

TP1: 4800

TP2: 4765

TP3: 4720

🛑 Invalidation:

Strong 15M candle close above 4880

🟢 Buy Scenario (Only if Condition Met)

⚠️ Counter-trend setup

Buy only if 15M closes above 4880

EMA Structure must flip bullish

Targets: 4910 → 4950

📌📌📌 Notes📌📌📌

Best suited for intraday traders

Avoid emotional entries inside the range

Trade with confirmation, not prediction

📊 Indicators Used

EMA (Multi)

RSI

Volume Profile

Trendline Structure

B-market

IM LONG IN XAUUSD: HTF 0.5 Fibonacci Magnet in Play (4950–5000)*Gold is holding trendline support and targeting the 0.5 Fibonacci level of the higher timeframe.

What I Have Mentioned is the Clear HTF bias, defined by zone, defined reaction zone, which shows both bullish & corrective scenarios

****Strongly it educates, not hypes***

XAUUSD Price ( 4950 – 5000 ) remains the key upside zone if support continues to hold.

Market Context:

XAUUSD is currently trading around 4810, holding above a rising yellow trendline support.

Technical Confluence:

• Higher timeframe 0.5 Fibonacci retracement lies between 4950 – 5000

• This zone is marked as a major reaction area (highlighted rectangle)

• Trendline support + structure holding adds bullish probability

Price Expectation:

As long as the price respects the trendline support, gold can continue its move higher towards the 0.5 HTF Fibonacci zone.

The green and red projected paths indicate possible market reactions based on support and resistance behavior — not prediction, but preparation.

Trading Insight:

This is a buy-on-support, sell-into-resistance setup.

Strength near 4950–5000 must be watched closely for either continuation or rejection.

Let price confirm at HTF levels — patience pays more than prediction.

DMART 1 Week Time Frame 📊 Recent Price Range (Last Week)

Stock was trading around ₹3,780–₹3,900 in the recent trading sessions.

Weekly price change has been relatively modest, showing a small rise over the past week (~+1–2%) in some data and a slight variation in others due to different closing levels.

🛑 Weekly Support Levels

These are key zones where the price may find buying interest / downside support over a short 1‑week horizon:

1. ₹3,665–₹3,705 — Short-term pivot/support cluster (near prior recent lows).

2. ₹3,531–₹3,597 — Lower support range that may act if the stock breaks below near‑term levels.

3. ₹3,340 — Broader 52‑week low area (reference of major historical support).

📈 Weekly Resistance Levels

These are zones where the price may see selling pressure / upside barriers in the near term:

1. ₹3,841–₹3,881 — Near current pivot and first resistance for short‑term trading.

2. ₹3,929–₹3,950+ — Next upside resistance from classic pivot methods.

3 .Above ~₹4,000 — Psychological and technical interest level (also broker target levels in wider timeframe).

📌 Summary — 1‑Week Key Levels to Watch

Level Type Price Zone

Immediate Support ₹3,665 – ₹3,705

Deeper Support ₹3,531 – ₹3,597

Short‑Term Resistance ₹3,841 – ₹3,881

Higher Resistance ~₹3,929 – ₹3,950+

SHORT OPPORTUNITY ON GBPJPYWe can short GBPJPY if it comes to my mark black zone as when market comes here it will comes with buyers liquidity available at downside so as soon as we can see market has broke trendline on 15min time frame and form some "M" type structure in lower time frame that can be 5min we can go for a short side scalp.

DMART – Earnings Incoming________________________________________________________________________________📈 DMART – Earnings Incoming: What’s the Right Time to Enter an Options Trade?

📆 Result Date: 11th July 2025 (Friday)

🕒 Strategy Style: Beginner + STWP HNI Learning Setup

🔍 For Educational Purposes Only

________________________________________________________________________________

🧠 What's the Setup?

DMART is announcing results on Friday, 11th July. We’re expecting a strong move — either up or down — because of mixed expectations around revenue and margins.

When you trade options around results, timing your entry is just as important as selecting the right strikes.

Let’s simplify it ⬇️ ________________________________________________________________________________✅ Option 1: Enter on 10th July (Thursday, After 2 PM)

💡 This is the ideal time for most traders.

🟢 Better option prices (not too inflated yet)

🟢 Good liquidity for smooth entry

🟢 Gives you overnight time to plan

🟢 You avoid the Friday panic crowd

🎯 STWP Suggested Strategy:

Buy 4300 CE + 4100 PE = ~₹180 total premium

This is called a Long Strangle – You win if the stock moves sharply up or down after results.

________________________________________________________________________________⚠️ Option 2: Enter on 11th July (Friday, Before 2 PM)

🔸 You might think, "Let me wait till Friday to get more clarity" — but there’s a catch:

❌ Option prices become expensive (high IV)

❌ Bid-ask spreads get wide (hard to enter)

❌ No time to react if results come intraday

❌ You’re stuck with weekend gap risk without prep

Unless you're experienced or scalping early, it’s not ideal for beginners.

________________________________________________________________________________🎯 Best Timing Rule – STWP Style:

📌 Enter on 10th July between 2:00 PM – 3:15 PM

Why?

You’ll lock in a clean setup with decent pricing and avoid stress.

📆 Exit Plan:

Hold through the weekend → Exit on Monday (14th July) if stock moves sharply 🔥

________________________________________________________________________________🧠 Alert:

Set alerts at:

₹4450 (Upside)

₹3950 (Downside)

If either hits on Monday, trail the winning side and exit the losing leg.

________________________________________________________________________________

📚 This is a learning example – not a trade recommendation.

Options carry risk. Please manage your capital and don’t trade blindly.

________________________________________________________________________________⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

XAUUSD in a Daily Channel — Bears Eyeing a Break at Trendline Re📊 Cycle Structure:

HWC (Higher Wave Cycle): Bearish with a mild slope 🔽

MWC (Middle Wave Cycle): Bullish 🔼

LWC (Lower Wave Cycle): Bullish 🔼

While both the mid and short-term cycles are pushing upward, the dominant bearish trend in the higher timeframe still weighs heavier, tilting the bias toward short setups.

📐 Market Structure:

Price is moving within a descending daily channel.

There's a 1H ascending trendline that has been tested four times already — currently heading into a fifth test.

The previous (fourth) reaction was weak, which statistically increases the chance of a breakout on the fifth touch.

The 3290 zone remains a strong resistance and a good target for short-term profit-taking on short positions.

📈 Alternate Long Scenario:

If buying pressure intensifies and price breaks above the 3345 key resistance, it could trigger a shift toward a bullish bias and challenge the integrity of the descending channel. This would invite breakout traders to join the move. However, this remains a secondary scenario, not the primary focus right now.

📌 Main focus remains on identifying short opportunities near resistance with proper risk management in place.

📌 If you'd like a specific pair or coin analyzed, drop it in the comments — I’ll choose from there.

⚠️ Without proper risk management, you're just a ticking time bomb.

— PXA

Very good investment opportunity in TATAMOTORSTatamotors is in monthly demand zone which has a very good logout. And it is also retesting the important level of 606 which was stocks high in year 2015. Retest of that level was pending which has happened now and it has also given a very good weekly candle closing. We can target 70% returns in this stock. Trade with proper risk management

S&P 500 sliding down! Markets under pressure #SP500S&P 500 sliding down! Markets under pressure #SP500

📉 The S&P 500 is trending downward today as market volatility rises. Investors react to economic data, Fed policy expectations, and global uncertainties. Stay alert and manage risk accordingly! #SP500 #StockMarket #Investing #trade #markets #finance #money

Dmart - Avenue Supermarkets cmp 4020.00 by Weekly Chart viewDmart - Avenue Supermarkets cmp 4020.00 by Weekly Chart view

- Resistance Zone at 4200 to 4300 Price Band

- Back to Back repeated Bullish Rounding Bottoms but is facing good strong hurdle at Resistance Zone neckline

- Falling Resistance Trendline breakout seems to be sustained but the Resistance Zone breakout remains and needs to be breached thru

option trading Options are a type of contract that gives the buyer the right to buy or sell a security at a specified price at some point in the future. An option holder is essentially paying a premium for the right to buy or sell the security within a certain time frame.

When options are better. Options can be a better choice when you want to limit risk to a certain amount. Options can allow you to earn a stock-like return while investing less money, so they can be a way to limit your risk within certain bounds. Options can be a useful strategy when you're an advanced investor.

Option and database trading ow Options Trading Is Different.

Relative Strength Index (RSI)

Bollinger Bands.

Intraday Momentum Index (IMI)

Money Flow Index (MFI)

Put-Call Ratio (PCR) Indicator.

Open Interest (OI)

FAQs.

An option chain, sometimes referred to as an option matrix, is a fundamental tool in the world of options trading. It provides traders and investors with a comprehensive view of available options for a particular underlying asset, such as stocks, indices, or commodities.

Learn Option ChainTo study an option chain, focus on the current market price, displayed in the centre. Analyse the built-up data to understand market direction based on recent changes in open interest and price. ITM call options are typically highlighted in yellow, making it easier to distinguish them from other options.

Nifty option chain is considered to be the best advance warning system of sharp moves or break outs in the index.

MACD In Trading The Moving Average Convergence/Divergence indicator is a momentum oscillator primarily used to trade trends. Although it is an oscillator, it is not typically used to identify over bought or oversold conditions. It appears on the chart as two lines which oscillate without boundaries.

Traders often use MACD with longer-term moving averages like the 50-day or 200-day moving average. If the price is above these averages and MACD signals a buy, it reinforces the bullish trend. On the flip side, if the price is below the moving averages and MACD signals a sell, it indicates a strong bearish trend.

Option chain in tradingAn option chain lists all option contracts, including put and call option for given security. However, several traders focus on net change,' 'bid,' 'last price,' and 'ask,' columns to assess current market conditions. Option chain is also called the option matrix.

How does an option chain work? An option chain displays available call and put options for a specific underlying asset, with their strike prices, premiums, and open interest. It provides a snapshot of market sentiment and potential price movements.

TECHNICAL CLASS of trading Technical trading is a broader style that is not necessarily limited to trading. Generally, a technician uses historical patterns of trading data to predict what might happen to stocks in the future. This is the same method practiced by economists and meteorologists: looking to the past for insight into the future.

Algo Trading Made Easy.

Technical Trading Made Easy: Online Certification Course.

Stock Valuation Made Easy.

Candlesticks Made Easy: Candlestick Pattern Course.

Options Trading Made Easy: Options Trading Course.

Commodity Markets Made Easy: Commodity Trading Course.

Option trading // Options are a type of contract that gives the buyer the right to buy or sell a security at a specified price at some point in the future. An option holder is essentially paying a premium for the right to buy or sell the security within a certain time frame.

When options are better. Options can be a better choice when you want to limit risk to a certain amount. Options can allow you to earn a stock-like return while investing less money, so they can be a way to limit your risk within certain bounds. Options can be a useful strategy when you're an advanced investor.

SONACOMS (TF|W|) Bullish view .SONACOMS stock analysis Potential breakout opportunity

Chart Analysis : SONACOMS is displaying a strong breakout chart , indicating the upward movement in it's stock price.

CUP & HANDLE Pattern : The cup and handle is considered a bullish signal, with the right-hand side of the pattern typically experiencing lower trading volume. The pattern's formation may be as short as seven weeks or as long as 65 weeks. A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift.

VOLUME BUILDUP: volume buildup near the breakout zone . Increased trading volume is a positive indicator, suggesting more interest in stock and potential momentum

Veto switchgear Market Cap

₹ 346 Cr.

Current Price

₹ 181

High / Low

₹ 186 / 106

Stock P/E

19.5

Book Value

₹ 129

Dividend Yield

0.55 %

ROCE

12.0 %

ROE

7.49 %

Face Value

₹ 10.0

Debt

₹ 22.6 Cr.

OPM

10.2 %

Promoter holding

45.1 %

Sales growth

-1.30 %

Profit growth

-4.11 %

Industry PE

59.0

Pledged percentage

0.00 %

Reserves

₹ 227 Cr.

Sales growth 5Years

6.57 %

Profit Var 5Yrs

9.18 %

Return over 6months

20.4 %

High price all time

₹ 266

Camlin fine science While the company carries a significant amount of debt (₹683.03 crore), its ongoing operations and market strategies might help in leveraging this debt effectively if managed well. The stock is currently trading at ₹122.59, and its historical high suggests there is significant potential for upside if market conditions and company performance align positively.