Bajaj

RELIANCE 1D Time frameClosing Price: ₹1,395.00

Day's Range: ₹1,380.50 – ₹1,396.30

52-Week High: ₹1,551.00

52-Week Low: ₹1,114.85

Market Cap: ₹18,87,780 crore

P/E Ratio (TTM): 25.30

Dividend Yield: 0.85%

Book Value: ₹1,100.00

EPS (TTM): ₹55.00

Face Value: ₹10.00

Volume: 7.4 million shares

VWAP: ₹1,388.40

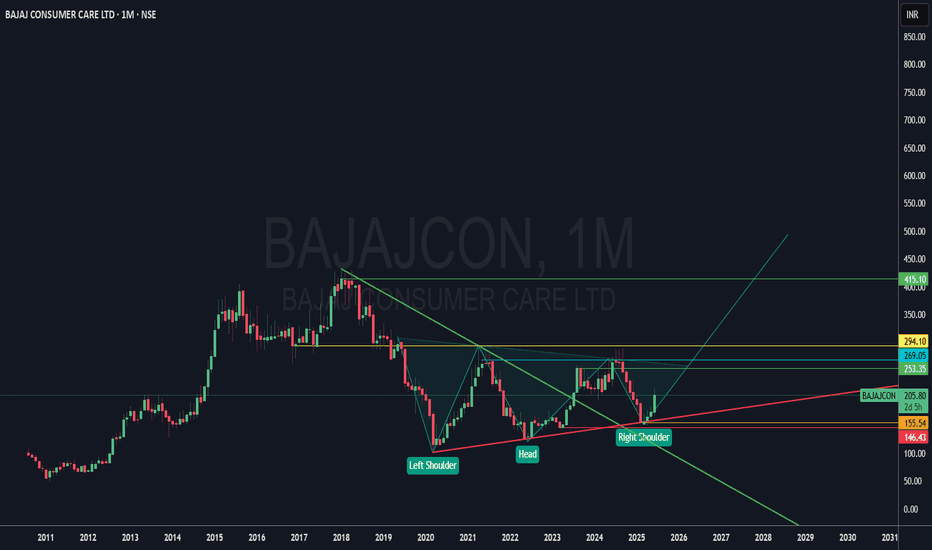

Boond Boond mein poshan!Bajaj Consumer Care Ltd

Risk to reward ratio looks good. Strong support 150. Made proper inverse head and shoulder pattern.

About

Bajaj Consumer Care is engaged in the business of cosmetics, toiletries and other personal care products. The Company has presence in both domestic and international markets.(Source : 201903 Annual Report Page No: 98)

Key Points

Product Portfolio

a) Hair Care Products

The segment is led by its flagship product, Bajaj Almond Drops Hair Oil (ADHO) — a premium, non-sticky oil that commands strong brand recognition. The Almond Drops brand has diversified into shampoos, conditioners, serums, and a cooling variant. The other products include Ayurvedic and functional oils like Brahmi Amla, Amla Aloe Vera, Sarson Amla, and Coco Onion. Their 100% Pure Coconut Oil has shown notable growth (19% in FY25), capturing a 2% all-India market share, with 6–10% shares in key states.

b)Skin Care Products

Bajaj extended its Almond Drops equity into personal care with products like Almond Drops Lotion, Soap, and Serum. It also offers the Nomarks range — known for its anti-marks positioning — including creams, face washes, and soaps, targeting consumers with skin blemish concerns.

c) Digital First & Premium Brands

The segment caters to evolving, health-conscious consumers. The Bajaj 100% Pure Series features chemical-free, cold-pressed oils like Castor, Olive, Jojoba, and Virgin Coconut, sold primarily online. Natyv Soul, a premium brand, sources exotic ingredients globally — offering Argan Oil products, enriched hair oils (with Marula, Rosehip, Apple Seed), and specialized serums and masks using ingredients from Peru, Brazil, and France.

Source: Screener.in

Leadership Changes at the Top:

The surge followed an exchange filing announcing key management changes by Bajaj Consumer:

Naveen Pandey has been appointed Managing Director with effect from July 1, 2025, subject to the approval of the members at the ensuing 19th Annual General Meeting. He succeeds Jaideep Nandi, whose tenure concludes on June 30.

Mr. Pandey previously served as Managing Director at Marico Bangladesh Ltd from 2016-2018, and currently as CEO of Unibic Foods India Pvt Ltd.

He brings over 20 years of experience across sales, strategic planning, and category innovation in the FMCG space.

The company also appointed Aakash Gupta as Head - Finance, replacing Richard D’Souza on the same date.

What Investors Need to Know:

The sharp rise in share price appears to be driven more by sentiment than by any change in business fundamentals.

While Naveen Pandey brings strong FMCG experience from companies like Marico and Unibic, there is no clarity yet on his specific plans or priorities for Bajaj Consumer. The company has not outlined any new strategy or directional change since his appointment.

For now, the stock seems to be reacting to the potential for leadership-driven change, not actual financial improvement. Investors may wait to see if the new MD introduces initiatives that can improve growth, expand margins, or revive demand in core categories.

Until real performance indicators emerge, this remains a speculative re-rating.

Conclusion:

The 20% jump in Bajaj Consumer’s share price was triggered by a leadership change, not by a shift in fundamentals. While the new MD brings relevant FMCG experience, the company’s recent performance remains weak, with declining profit and muted revenue growth. There’s been no strategic update or operational shift yet. For now, the rally looks like a sentiment-driven move. Whether it sustains will depend on what direction the new leadership takes and how soon the business sees a pickup. Until then, the core story remains unchanged.

Source: Indmoney.com

📝 Chart Purpose & Disclaimer:

This chart is shared purely for educational and personal tracking purposes. I use this space to record my views and improve decision-making over time.

Investment Style:

All stocks posted are for long-term investment or minimum positional trades only. No intraday or speculative trades are intended.

⚠️ Disclaimer:

I am not a SEBI registered advisor. These are not buy/sell recommendations. Please consult a qualified financial advisor before taking any investment decision. I do not take responsibility for any profit or loss incurred based on this content.

BAJAJ HOLDINGS - Bullish Flag & Pole Breakout (Daily T/F)Trade Setup

📌 Stock: BAJAJ HOLDINGS ( NSE:BAJAJHLDNG )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹14251.00 (Breakout Confirmation)

🛑 Stop Loss: ₹13318.00(Daily Closing Basis) (-6.3% Risk)

🎯 Target Levels:

₹14791.95

₹15355.45

₹15936.25

₹16479.70

₹17073.40 (Final Target)

Technical Rationale

✅ Bullish Flag & Pole Breakout - Classic bullish pattern confirming uptrend continuation

✅ Strong Momentum - Daily, Weekly & Monthly RSI >60 (Bullish zone)

✅ Volume Confirmation - Breakout volume 503.23K vs previous day's 39.22K (Nearly 13x surge)

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear price & volume breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching NSE:BAJAJHLDNG for this breakout opportunity? Share your views in the comments!

Maruti Suzuki India Ltd // 4hour Support and ResistanceAs of May 2, 2025, the 4-hour intraday chart for Maruti Suzuki India Ltd (NSE: MARUTI) indicates a bullish trend, with the stock trading at ₹12,257. The following support and resistance levels are derived from recent price action and technical analysis:

📈 4-Hour Intraday Support and Resistance Levels

Immediate Support Levels:

S1: ₹12,232

S2: ₹11,955

S3: ₹11,717

Immediate Resistance Levels:

R1: ₹12,806

R2: ₹13,261

R3: ₹13,717

These levels are based on recent price action and volume analysis, indicating potential breakout points and areas where the stock may find support.

🔍 Technical Indicators

RSI (14): 64.81, indicating bullish momentum.

MACD: 215.3, with a signal line of 116.03, suggesting upward momentum.

MFI (14): 76.87, indicating buying pressure.

EMA (50): ₹12,553.90, with the stock trading above this level, indicating a bullish short-term trend.

EMA (200): ₹12,348.91, with the stock trading above this level, indicating a bullish long-term trend.

These indicators suggest a continuation of the bullish trend, with potential for further upside movement.

📊 Chart Patterns

A recent Cup and Handle pattern has been observed, with the price breaking out from the handle formation. The measured move suggests a potential target of ₹13,280, contingent upon sustained volume and price momentum.

⚠️ Important Notes

Risk Management: Always use appropriate stop-loss orders to manage risk.

Market Conditions: Intraday levels are subject to change based on market conditions and news events.

NIFTY BANK INDEX🏦 Nifty Bank Index Overview (BANKNIFTY)

The Nifty Bank Index is one of the most widely tracked sectoral indices in India. It represents the performance of the 12 most liquid and large-cap Indian banking stocks listed on the National Stock Exchange (NSE). It serves as a benchmark for the Indian banking sector, and is frequently used by institutional investors, traders, and fund managers.

📌 Key Highlights (as of April 29, 2025)

Index Level: ₹48,511.20

1-Day Change: ▼ 0.97%

52-Week Range: ₹45,828.80 – ₹54,467.35

Market Cap (approx.): ₹40.02 trillion

P/E Ratio: 12.63

P/B Ratio: 1.59

Dividend Yield: 1.31%

Bajaj Finance - Elliot Wave Counts - Major top done?Bajaj Finance has been in a sideways consolidation since Sep 2021, where it had completed a Major top from March 2009 lows (as per my counts).

So, there are two Possibilities from here:

P1. Major top -> sideways action -> Finall blow-out correction/ capitulation and then a start of next leg up.

P2. Major top -> sideways consolidation for 4 years (till Jan 2025) -> Next leg up started

P1: Reason could be re-rating of P/BV (which stands at 6.6), to industry avearge of around 4. Bajaj has been growing fast on account of unsercured lending. There could be bad assets building and the bubble can burst anytime, leading to the de-rating (P.S.: It has already de-rated from P/BV of 12.3 in Sep 2021 to 6.6 currently)

Elliot Counts: The correction from Sep 21 to June 22 was a W. the entire upmove from June 22 till date has been an overlapping corrective move in an X. What is to follow is Y, which should ideally re-test W at 5300 (that's a 43% fall)

P2: In this case we have completed the correction from Sep 21 till Jan 25 and started a new move up.

The five wave completion is just the Wave 1, and what is to follow is Wave 2, which can correct 38% to 50% of Wave 1 (i.e. from Jan 25 lows till the highs). Expect min 8300 to come, which again is a more than 10% correction.

Good thing is in both cases, we get a good enough correction to trade. All the best!

Bajaj Finance on the Move!The stock had been consolidating for quite some time, forming an ascending triangle within the pattern. I've marked a critical resistance zone, and a weekly close above this level could indicate a breakout signal. The move has already begun—let’s see how it unfolds! 🚀

Given Bajaj Finance’s strong fundamentals and robust business model, it's definitely a stock worth keeping an eye on. Fun fact: Did you know Bajaj Finance is one of the largest and most trusted NBFCs in India with a diversified lending portfolio across retail, SME, and commercial segments? 🔍

Are you tracking this potential breakout too? Share your views below! 📊

Bajaj Auto Ltd.: Descending Wedge - Breakout or Breakdown?Bajaj Auto Ltd. is currently trading within a descending wedge pattern, indicating potential consolidation or a breakout scenario. Here’s the technical breakdown:

Key Observations

Descending Wedge:

The price is narrowing, with lower highs and lows, signaling reduced selling momentum.

Support Zone:

₹8,800–₹8,900 serves as a strong support level. A breakdown below this could lead to further downside.

Resistance Levels:

₹9,262.90: Immediate resistance.

₹9,642.45 and ₹9,995.55: Higher levels to watch in case of a breakout.

Trade Outlook

Bullish View:

A breakout above the wedge’s upper trendline signals upward momentum, targeting ₹9,262 and beyond.

Bearish View:

A breakdown below ₹8,800 could push the price to ₹8,600 or ₹8,400.

BAJAJ FINSERV LTD - LARGECAP STOCK FOR LONG TERMCan Enter at 1515

if again falls then you need to average at 1210 level

Target - 2030,2400

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Request your support and engagement by liking and commenting & follow to provide encouragement

HAPPY TRADING 👍

bajajfinance 10k ?Hi

This stock is consolidation from a long time since 2021, forming a ascending triangle pattern which is a good sign. this stock have a good potential to go up as per fundamentals too.

We can accumulate this stock with a last swing stop loss which is around 6200

and we can same thing in bajaj finserv this stock is in uptrend during the time period of bajaj housing

you can share your views in comment.

Thanks

After falling 25% Nifty50 stock is giving good entry to go long Hello Everyone, i hope you all will be doing good in your trading and your life as well. Today i have brought Bajaj-Auto stock which has fallen 25% from all time high and now trading at importance support zone, There is higher probability for reversal from these levels. It is giving good entry for short term to long term traders and investors.

Bajaj Auto, the flagship company of Bajaj Group, is a two-wheeler and three-wheeler manufacturing company that exports to 79 countries across several countries in Latin America, Southeast Asia, and many more. Its headquarter is in Pune, India.

It has acquired 48% of the KTM Brand which manufactures sports and super sports two-wheelers, which was 14% in 2007 when the company first acquired KTM.

Market Leadership:-

The company is the 2nd-largest player in the domestic motorcycle segment in terms of volume. It is the largest 3W producer in the world and the largest exporter of 2W and 3W from India.

Manufacturing Capacity:-

The company has five manufacturing plants, of which two are in Chakan and one each in Waluj, Akurdi, and Pantnagar, with a total installed capacity of 7.1 million units per annum.

Expansion:-

In FY24, the company set up a new plant in Brazil with an initial capacity of 20k units/ month that commenced commercial production on Jun 24. It will incur capex of Rs. 600 Cr -Rs. 700 Cr in FY25-FY26, largely towards maintenance activities.

Vehicle Financing:-

Its wholly-owned captive financing company Bajaj Auto Credit Ltd. commenced business in Maharashtra and Goa on 1st Jan 24 and expanded to Kerala, Karnataka, Tamil Nadu, Andhra Pradesh, Telangana, Rajasthan, and Gujarat. It plans to cover all the balance states by FY25. On Apr 24, the board approved additional investment in BACL of Rs. 2250 Cr, in addition to the existing Rs. 600 Cr approved earlier, to fund its expansion plans.

Market Cap

₹ 2,72,363 Cr.

Current Price

₹ 9,753

High / Low

₹ 12,774 / 5,285

Stock P/E

36.9

Book Value

₹ 1,109

Dividend Yield

0.80 %

ROCE

33.5 %

ROE

26.5 %

Face Value

₹ 10.0

Industry PE

64.6

Debt

₹ 5,245 Cr.

EPS

₹ 263

Promoter holding

55.0 %

Intrinsic Value

₹ 3,891

Pledged percentage

0.01 %

EVEBITDA

25.8

Change in Prom Hold

-0.01 %

Profit Var 5Yrs

10.7 %

Sales growth 5Years

8.13 %

Return over 5years

25.2 %

Debt to equity

0.17

Net profit

₹ 7,371 Cr.

ROE 5Yr

21.8 %

Profit growth

7.74 %

Earnings yield

3.64 %

PEG Ratio

3.46

Disclaimer:- Please always do your own analysis or consult with your financial advisor before taking any kind of trades.

Dear traders, If you like my work then do not forget to hit like and follow me, and guy's let me know what do you think about this idea in comment box, i would be love to reply all of you guy's.

Thankyou.

Bajaj Hind SugarBajaj Hind Sugar best opportunity investment

Sugar Manufacturing: BHSL is a major producer of sugar in India. It has a large sugarcane crushing capacity of 136,000 tonnes crushed per day (TCD). The company produces sugar in different sizes and grades, such as large, medium, and small.

Ethanol Production: BHSL is also a leading manufacturer of ethanol. It has six distilleries with a capacity to produce 800 kilo liters per day (KLPD) of industrial alcohol.

Power Generation: The company generates power from bagasse, a byproduct of sugarcane crushing. It owns 14 co-generation plants with a total power generating capacity of 449 MW.

Byproducts: BHSL produces various byproducts from its manufacturing processes, including molasses, bagasse, fly ash, press mud, and bio-compost/bio-manure products.

Investor Relations: BHSL remains committed to protecting investor interests through strong financial performance and profitability. The company consistently works on enhancing its operational and financial efficiencies.

Bajaj Hind SugarBajaj Hind Sugar best opportunity investment

Sugar Manufacturing: BHSL is a major producer of sugar in India. It has a large sugarcane crushing capacity of 136,000 tonnes crushed per day (TCD). The company produces sugar in different sizes and grades, such as large, medium, and small.

Ethanol Production: BHSL is also a leading manufacturer of ethanol. It has six distilleries with a capacity to produce 800 kilo liters per day (KLPD) of industrial alcohol.

Power Generation: The company generates power from bagasse, a byproduct of sugarcane crushing. It owns 14 co-generation plants with a total power generating capacity of 449 MW.

Byproducts: BHSL produces various byproducts from its manufacturing processes, including molasses, bagasse, fly ash, press mud, and bio-compost/bio-manure products.

Investor Relations: BHSL remains committed to protecting investor interests through strong financial performance and profitability. The company consistently works on enhancing its operational and financial efficiencies.

Symmetrical Triangle Pattern followed by chart from 20/11/2020Interesting! Symmetrical Triangle pattern started on 20th Nov 2020 and stock is wondering in this pattern till 14th July 2024. We are waiting for a breakout but can't expect a huge target because it started long ago. If it breaks after the white line is marked on both sides, I have given an expected level. It's a probability that it will follow the levels. It's a Bajaj Finserv Ltd chart on your Radar.