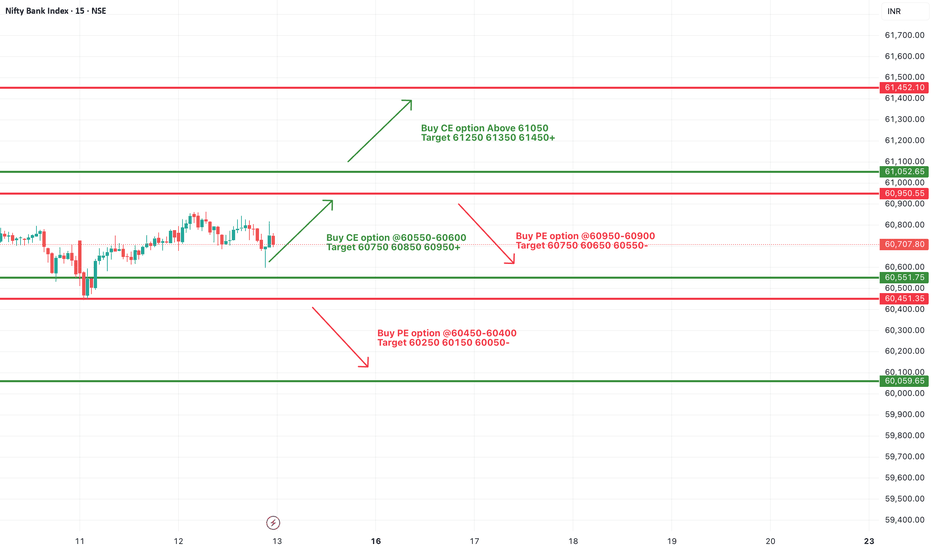

#BANKNIFTY PE & CE Levels(13/02/2026)Bank Nifty is expected to open with a slight gap down today around the 60700–60750 zone, indicating mild early weakness compared to yesterday’s close. Price is currently trading near an important intraday support area around 60550. The overall structure suggests that the market is opening near a decision zone, where either a bounce or further downside continuation can develop depending on the first 15–30 minutes’ price action.

On the upside, 61050 remains a strong resistance level. A sustained move and 15-minute candle close above 61050 can trigger bullish momentum, where CE options may perform well with targets around 61250, 61350, and 61450+. However, considering the gap down opening, traders should wait for confirmation instead of immediately chasing longs near resistance.

On the downside, if price breaks below 60550 and sustains, selling pressure can intensify. In that case, PE positions can be considered around 60450–60400 with targets near 60250, 60150, and 60050. A clean breakdown below 60050 would further weaken the intraday trend and may open the door for extended downside.

Overall, with a gap down opening near support, the first hour will be crucial. Either we may see a quick recovery toward 60950–61050 (gap filling attempt) or continuation selling below 60550. Avoid trading in the middle zone and focus only on breakout or breakdown levels with proper stop loss and trailing management.

Bankniftytrend

#BANKNIFTY PE & CE Levels(12/02/2026)Bank Nifty is expected to open flat today, with no major changes compared to yesterday’s closing levels. The overall structure remains range-bound, and price is still trading between clearly defined support and resistance zones. Since there is no significant gap up or gap down, the market is likely to respect the same key levels during the initial session, and traders should focus on reaction around these zones rather than expecting immediate breakout momentum.

On the upside, the immediate resistance zone remains around 60950–61050. A strong move and sustained trading above 61050 can trigger fresh bullish momentum. In that case, CE buying can be considered with upside targets around 61250, 61350, and 61450+. However, confirmation is important. A simple spike above resistance without follow-through should be avoided, and traders should wait for a 15-minute candle close above the breakout level before entering aggressive long positions.

In the middle range, 60550–60600 continues to act as an important intraday pivot zone. As long as price sustains above this level, the bias remains slightly positive and dips may get bought. CE buying near this zone can offer targets towards 60750, 60850, and 60950+. This area is likely to act as decision-making support during the first half of the session.

On the downside, if Bank Nifty fails to hold 60550 and breaks below 60450–60400 with strong selling pressure, PE buying can be considered for targets around 60250, 60150, and 60050. A clean breakdown below 60050 would further weaken the structure and may lead to extended downside movement.

Overall, with a flat opening and no major structural change, the market is expected to remain level-based and reactive. Traders should avoid overtrading in the opening minutes and wait for confirmation near key support and resistance. Proper risk management and trailing stop loss will be important, especially if the index continues to consolidate within the current range before giving a decisive move.

#BANKNIFTY PE & CE Levels(11/02/2026)Bank Nifty is expected to open with a gap-up, indicating positive sentiment at the start of the session. This kind of opening generally brings initial buying interest, but traders should stay alert near the immediate resistance zones as gap-up openings often see early profit booking before a clear direction is established.

On the upside, the 60550–60600 zone is the first crucial support area to hold. Sustaining above this region can trigger fresh long positions, with upside targets placed at 60750, 60850, and 60950+. A stronger bullish continuation will be confirmed only if Bank Nifty moves and sustains above 61050, where positional call buying can aim for higher levels around 61250, 61350, and 61450+.

On the downside, any rejection or failure to hold above 60950–61000 can invite selling pressure. A reversal short setup may emerge near this zone, with downside targets towards 60750, 60650, and 60550. If weakness deepens and the index breaks below 60450–60400, selling momentum could extend further towards 60250, 60150, and 60050, which act as important demand areas.

Overall, despite the gap-up opening, the market may initially remain volatile within defined levels. Traders are advised to wait for price confirmation near key supports and resistances, avoid impulsive entries, and manage risk strictly, as today’s move is likely to be driven by how Bank Nifty behaves around the 60550 and 61050 zones.

#BANKNIFTY PE & CE Levels(10/02/2026)Bank Nifty is expected to open flat, indicating a neutral start to the session with no major overnight trigger influencing sentiment. A flat opening after recent volatility usually signals indecision, where the market is likely to spend initial time in consolidation before choosing a clear directional move. Traders should avoid aggressive positions at the open and wait for price action to confirm strength or weakness around key levels.

On the upside, the 60550–60600 zone is the immediate resistance and also a critical trigger area for bullish momentum. If Bank Nifty sustains above this range with strong volumes, CE buying can be considered, as this would signal continuation of the broader uptrend. In such a scenario, upside targets are placed at 60750, 60850, and 60950+, where partial profit booking is advisable due to potential supply near higher levels. A decisive move above 60950 could further strengthen bullish sentiment for the day.

On the downside, 60450–60400 remains an important rejection and supply zone. If the index fails to hold above this area and shows bearish candles or rejection patterns, PE buying opportunities may emerge, with immediate downside targets at 60250, 60150, and 60050. The 60060–60000 region is a strong intraday support zone; any breakdown below this level can increase selling pressure and may shift the intraday bias towards the bears.

Overall, the structure suggests a range-bound market with a slight bullish bias, provided Bank Nifty holds above 60000. Directional clarity will likely emerge only after a breakout or breakdown from the 60550–60400 range. A level-to-level trading approach with strict stop-loss and partial profit booking remains the best strategy for today’s session, especially considering the flat opening and potential intraday whipsaws.

BANKNIFTY : Detailed Trading plan for 10-Feb-2026📘 BANKNIFTY Trading Plan – 10 Feb 2026

(Timeframe: 15-Min | Instrument: BANKNIFTY | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 61,312 – Last Intraday Resistance

🟢 60,800 – Upper Resistance Band

🟠 60,705 – 60,799 – Opening Support / Resistance Zone

🟢 60,589 – Opening Support

🟢 60,430 – Last Intraday Support

🟢 60,291 – Major Breakdown Support

🧠 Market Structure & Price Psychology

BANKNIFTY has shown a strong recovery from lower levels, forming a short-term higher-low structure.

However, price is now approaching a key supply band near 60,700 – 60,800, where profit booking can emerge.

👉 Direction on 10 Feb will depend on acceptance above supply or rejection back into support.

🚀 Scenario 1: GAP UP Opening (200+ Points)

(Opening near / above 60,750 – 60,850)

🧠 Psychology

A large gap up reflects overnight bullish sentiment + short covering, but institutions often sell near prior resistance.

🟢 Bullish Plan

🔵 Sustaining above 60,800 on 15-min close

🔵 Upside opens towards 61,312

🔵 Break & hold above → Momentum continuation

🔴 Rejection Plan

🔴 Failure to sustain above 60,800

🔴 Pullback towards 60,705 → 60,589

📌 Why this works

True breakouts require price acceptance, not emotional gap-up spikes.

➖ Scenario 2: FLAT Opening

(Opening between 60,550 – 60,700)

🧠 Psychology

Flat opening inside supply indicates indecision & liquidity absorption.

🟠 Decision Zone

🔸 60,705 – 60,799

🔸 Expect whipsaws until breakout

🟢 Upside Plan

🔵 Break & hold above 60,800

🔵 Targets: 61,312

🔴 Downside Plan

🔴 Breakdown below 60,589

🔴 Drift towards 60,430 → 60,291

📌 Why this works

Consolidation resolves with expansion — patience gives clarity.

🔻 Scenario 3: GAP DOWN Opening (200+ Points)

(Opening near / below 60,430)

🧠 Psychology

Gap down signals profit booking or fear selling, but demand zones can trigger relief rallies.

🟢 Bounce Setup

🔵 If 60,430 holds on 15-min basis

🔵 Expect bounce towards 60,589 → 60,705

🔴 Breakdown Setup

🔴 Clean break below 60,291

🔴 Downside momentum may accelerate

📌 Why this works

Strong supports either create sharp reversals or fast continuation breakdowns.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk option spreads

🟢 Avoid aggressive buying near resistance ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at key levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 BANKNIFTY is in post-recovery consolidation near supply

📌 60,800 & 60,589 are key intraday triggers

📌 Break above 61,312 confirms bullish continuation

📌 Trade price reaction, not bias 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

#BANKNIFTY PE & CE Levels(06/02/2026)Bank Nifty is expected to open flat, indicating a continuation of the ongoing consolidation phase. Price action over the last few sessions shows that the index is trading within a tight range, reflecting indecision among participants. There is no strong gap or momentum bias visible at the open, so the first half of the session may remain range-bound with false breakouts possible around key levels.

On the upside, the 60050–60100 zone is the immediate resistance and trigger area. A sustained move above this zone with acceptance can open the door for upside targets at 60250, 60350, and 60450+. This level has acted as a supply zone earlier, so only a clean breakout with volume should be considered for fresh long positions. Until that happens, upside moves may face selling pressure near resistance.

On the downside, 59950 is the key support to watch. If Bank Nifty breaks and sustains below 59950, selling pressure can increase, leading to downside targets at 59750, 59650, and 59550, where the next demand zone is placed. This lower zone is expected to attract buyers, so aggressive shorts should be cautious near those levels and consider booking profits.

Overall, the structure clearly favors a range-trading approach for the day. Traders should avoid positional bias and focus on trading confirmation at levels rather than predicting direction. Scalping or short-term trades near support and resistance with strict stop-losses will be more effective until Bank Nifty gives a decisive breakout or breakdown from this consolidation range.

BANKNIFTY : Trading levels and Plan for 06-Feb-2026📘 BANKNIFTY Trading Plan – 6 Feb 2026

(Timeframe: 15-Min | Instrument: BANKNIFTY | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 60,530 – Higher Timeframe Resistance

🟢 60,280 – Opening / Last Intraday Resistance

🟠 59,758 – 59,829 – Opening / Last Intraday Support Zone

🟢 59,205 – Major Breakdown Support

🟢 60,047 – 60,055 – Current Reference Price Area

🧠 Market Structure & Price Psychology

BANKNIFTY has shown a sharp recovery from lower levels, but is now facing rejection near resistance.

Price is consolidating inside a decision range, indicating a battle between short covering vs fresh selling.

👉 Direction on 6 Feb will depend on acceptance above resistance or breakdown below support.

🚀 Scenario 1: GAP UP Opening (200+ Points)

(Opening near / above 60,250 – 60,350)

🧠 Psychology

A large gap up signals overnight bullish sentiment, but higher supply zones often attract profit booking.

🟢 Bullish Plan

🔵 If price sustains above 60,280 on a 15-min close

🔵 Upside opens towards 60,530

🔵 Break & hold above 60,530 → Momentum expansion

🔴 Rejection Plan

🔴 Failure to sustain above 60,280

🔴 Pullback towards 59,829 – 59,758

📌 Why this works

Gap-up continuation requires acceptance at higher value, not just emotional buying.

➖ Scenario 2: FLAT Opening

(Opening between 59,950 – 60,150)

🧠 Psychology

Flat opening inside the range reflects indecision & liquidity absorption.

🟢 Upside Plan

🔵 Break & hold above 60,280

🔵 Targets: 60,530

🔴 Downside Plan

🔴 Breakdown below 59,758

🔴 Drift towards 59,205

📌 Key Note

🟠 60,280 acts as range breakout trigger

🟠 59,758 acts as range breakdown trigger

🔻 Scenario 3: GAP DOWN Opening (200+ Points)

(Opening near / below 59,758)

🧠 Psychology

Gap down indicates renewed fear or profit booking, but strong supports may trigger short covering.

🟢 Bounce Setup

🔵 If 59,758 – 59,829 holds

🔵 Expect bounce towards 60,047 → 60,280

🔴 Breakdown Setup

🔴 Clean break below 59,758

🔴 Downside opens towards 59,205

📌 Why this works

Demand zones either create sharp reversals or accelerated breakdowns.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk spreads in gap markets

🟢 Avoid aggressive buying near resistance ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at key levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 BANKNIFTY is in range consolidation after recovery

📌 60,280 & 59,758 are key intraday decision levels

📌 Break above 60,530 confirms bullish continuation

📌 Trade price reaction, not assumptions 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

BANKNIFTY : Trading levels and Plan for 05-Feb-2026📘 BANKNIFTY Trading Plan – 5 Feb 2026

(Timeframe: 15-Min | Instrument: BANKNIFTY | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 61,356 – Higher Timeframe Resistance

🟢 60,812 – Last Intraday Resistance

🟠 60,492 – Opening Resistance

🟠 60,120 – Opening Support / Resistance Pivot

🟢 59,754 – 59,826 – Last Intraday Support Zone

🟢 59,130 – Major Breakdown Support

🧠 Market Structure & Price Psychology

BANKNIFTY has shown a strong recovery bounce from lower levels and is now consolidating in a rising structure.

This suggests short covering + gradual fresh buying, but price is still approaching major supply zones above.

👉 Direction on 5 Feb will depend on acceptance or rejection near opening pivot levels, not emotional bias.

🚀 Scenario 1: GAP UP Opening (200+ Points)

(Opening near / above 60,350 – 60,450)

🧠 Psychology

A large gap up reflects bullish overnight sentiment, often driven by short covering. But resistance zones attract institutional selling.

🟢 Bullish Plan

🔵 If price sustains above 60,492 (15-min close)

🔵 Upside opens towards 60,812

🔵 Break & hold above 60,812 → Expansion towards 61,356

🔴 Rejection Plan

🔴 Failure to hold 60,492

🔴 Pullback towards 60,120 pivot

📌 Why this works

True breakouts require price acceptance — not just gap-up spikes.

➖ Scenario 2: FLAT Opening

(Opening between 60,000 – 60,250)

🧠 Psychology

Flat opening inside consolidation reflects indecision. Market seeks liquidity before directional move.

🟢 Upside Plan

🔵 Break & hold above 60,492

🔵 Targets: 60,812 → 61,356

🔴 Downside Plan

🔴 Breakdown below 60,120

🔴 Drift towards 59,826 – 59,754

📌 Key Note

🟠 60,120 acts as intraday pivot — watch price behavior closely.

🔻 Scenario 3: GAP DOWN Opening (200+ Points)

(Opening near / below 59,826)

🧠 Psychology

Gap down indicates profit booking or renewed fear, but strong supports often trigger short covering.

🟢 Bounce Setup

🔵 If 59,754 – 59,826 holds

🔵 Expect pullback towards 60,120 → 60,492

🔴 Breakdown Setup

🔴 Break below 59,754

🔴 Downside opens towards 59,130

📌 Why this works

Demand zones either produce fast reversals or accelerated breakdowns.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk spreads in gap markets

🟢 Avoid aggressive buying near resistance ❌

🟢 Risk max 1–2% capital per trade

🟢 Book partial profits at next levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 BANKNIFTY is in recovery + consolidation phase

📌 60,492 & 60,120 are key intraday decision levels

📌 Break above 60,812 confirms bullish continuation

📌 Trade price reaction, not assumptions 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Trend Channel Explained | Base chart MAX Financial Services LtdTrend channels are one of the most practical tools in technical analysis, helping traders visualize price movement within parallel boundaries. Currently, Max Financial Services (NSE: MFSL) is trading around ₹1685, and its chart shows the stock moving in an uptrend channel, offering a real-time example of how traders can anticipate moves and manage risk.

📈 What is a Trend Channel?

A trend channel is formed by drawing two parallel lines:

Upper line (resistance): Connects swing highs.

Lower line (support): Connects swing lows.

Price tends to oscillate between these boundaries, creating a visual “channel” that reflects the prevailing trend direction.

Types of channels:

Uptrend channel: Prices move higher with rising support and resistance.

Downtrend channel: Prices move lower with declining support and resistance.

Sideways channel: Prices consolidate within horizontal boundaries.

🔑 Importance of Trend Channels

Trend identification: Quickly shows whether the market is bullish, bearish, or neutral.

Entry & exit points: Traders can buy near support and sell near resistance.

Anticipating breakouts: A breakout above resistance may signal strong bullish momentum, while a breakdown below support may indicate trend reversal.

Risk control: Channels provide clear invalidation levels for stop-loss placement.

📊 Example: Max Financial Services (MFSL)

Current price: ₹1685 (NSE).

Chart observation: The stock is moving within an ascending channel, with higher highs and higher lows.

Implication:

Buying near the lower boundary (~support zone) increases probability of success.

Profit-taking near the upper boundary (~resistance zone) helps lock gains.

A breakout above the channel could indicate acceleration in bullish momentum.

⚠️ Risk Management in Trend Channels

Stop-loss placement: Always place stops just outside the channel boundary to protect against false moves.

Position sizing: Avoid over-leveraging; channels can break unexpectedly.

Confirmation tools: Use indicators (RSI, MACD, volume) to confirm signals before acting.

Avoid chasing: Enter trades near support rather than at resistance to reduce risk.

📌 Traders’ Key Takeaways

Trend channels are visual guides that simplify decision-making.

They help traders anticipate moves by showing where price is likely to bounce or reverse.

In MFSL’s case, the uptrend channel suggests bullish sentiment, but traders should remain cautious of potential breakdowns.

Risk management is essential—channels are not foolproof, and false breakouts can occur.

Combining channels with other technical indicators enhances reliability.

✅ In summary: Trend channels provide traders with a structured framework to anticipate price movement, manage risk, and make disciplined trading decisions. With Max Financial Services trading at ₹1685 in an uptrend channel, traders can use this live example to understand how channels guide entries, exits, and risk control in real-world markets.

BANKNIFTY : Trading levels and Plan for 03-Feb-2026📘 BANKNIFTY Trading Plan – 3 Feb 2026

(Timeframe: 15-Min | Instrument: BANKNIFTY | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 60,367 – Higher Timeframe Resistance

🟢 59,574 – Last Intraday Resistance

🟠 58,922 – Opening Support / Resistance (Decision Level)

🟢 58,232 – Opening Support (Gap-Down Case)

🟢 57,973 – Last Intraday Support

🧠 Market Structure & Price Psychology

BANKNIFTY witnessed a sharp sell-off followed by a recovery bounce, indicating short covering from lower levels.

However, price is still trading below major resistance, so trend reversal is not confirmed yet.

👉 Tomorrow’s direction will depend on acceptance or rejection at opening levels, not assumptions.

🚀 Scenario 1: GAP UP Opening (200+ Points)

(Opening near / above 58,900)

🧠 Psychology

A big gap up after a fall usually signals short covering, but higher zones still carry institutional selling pressure.

🟢 Bullish Plan

🔵 If price sustains above 58,922 on a 15-min closing basis

🔵 Expect move towards 59,574

🔵 Break & acceptance above 59,574 can open path towards 60,367

🔴 Rejection Plan

🔴 Failure to sustain above 58,922

🔴 Expect pullback or consolidation towards 58,232

📌 Why this works

Only acceptance above resistance confirms fresh buying, not emotional gap-up trades.

➖ Scenario 2: FLAT Opening

(Opening between 58,500 – 58,800)

🧠 Psychology

Flat opens indicate balance between buyers and sellers. Market often expands after testing key levels.

🟢 Upside Plan

🔵 Acceptance above 58,922

🔵 Targets: 59,574 → 60,367

🔴 Downside Plan

🔴 Failure to cross 58,922

🔴 Drift towards 58,232

📌 Key Note

🟠 Expect range-bound movement until breakout or breakdown confirmation.

🔻 Scenario 3: GAP DOWN Opening (200+ Points)

(Opening near / below 58,232)

🧠 Psychology

Gap down reflects renewed fear & panic selling. Strong supports decide whether bounce or continuation happens.

🟢 Bounce Setup

🔵 If 58,232 holds on a 15-min basis

🔵 Expect short-covering bounce towards 58,922

🔴 Breakdown Setup

🔴 Clean break below 57,973

🔴 Downside momentum may accelerate sharply

📌 Why this works

Strong supports either give fast bounces or aggressive breakdowns—confirmation is key.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk option spreads in volatile moves

🟢 Avoid aggressive buying during gap-up opens ❌

🟢 Risk maximum 1–2% of total capital per trade

🟢 Book partial profits at pre-defined resistance/support

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 BANKNIFTY remains volatile and reactive

📌 58,922 & 58,232 are the most important intraday decision levels

📌 Break above 59,574 needed for bullish continuation

📌 Trade price reaction, not market noise 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

#BANKNIFTY PE & CE Levels(02/02/2026)Bank Nifty is expected to open with a slightly positive gap, but the overall structure still reflects weakness after the sharp sell-off seen in the previous session. The index has decisively broken below the important 59050–58950 support zone, which earlier acted as a strong demand area. This breakdown has shifted the short-term trend clearly on the bearish side, and the gap-up opening should be treated more as a pullback rather than a trend reversal unless key levels are reclaimed.

From a technical perspective, the fall from the 59550–59600 region confirms strong supply at higher levels. The current price action is forming lower highs and lower lows on the 15-minute timeframe, indicating sustained selling pressure. Any bounce toward 58950–59050 is likely to face resistance, as this zone now turns into a supply area. If Bank Nifty fails to hold above this range after the opening, fresh selling pressure can re-emerge quickly.

On the downside, the immediate support lies near 58550–58450. A break below 58450 can accelerate the bearish momentum further, opening the gates for deeper targets around 58250, 58150, and potentially 58050. These levels are critical intraday and positional supports, and increased volatility can be expected if they are tested. As long as the index remains below 59000, bears will continue to have an upper hand.

On the upside, only a strong and sustained move above 59050 can provide some relief to the bulls. If Bank Nifty manages to reclaim and hold above 59050–59100, a short-covering bounce toward 59250, 59350, and 59450+ is possible. However, such a move should be confirmed with follow-through buying; otherwise, it may turn into a selling-on-rise opportunity.

Overall, despite the slightly gap-up opening, the market context remains cautious to bearish. Traders should avoid aggressive long positions near resistance zones and focus more on sell-on-rise or breakdown-based strategies. Strict risk management is essential, as volatility is expected to stay elevated after the recent sharp move. Patience during the opening minutes and confirmation of price action near key levels will be crucial for safer trades.

#BANKNIFTY PE & CE Levels(28/01/2026)A gap-up opening in Bank Nifty indicates a positive start to the session, supported by short-covering and fresh buying interest from lower levels. The index has opened above the immediate intraday support zone, which suggests that bulls are attempting to regain control after recent consolidation. However, despite the gap-up, the market is still trading within a broader range, so confirmation through price sustain is crucial before assuming a strong trending move.

From a technical structure point of view, the 59050–59100 zone is acting as a major demand and decision area. Holding above this region keeps the bullish bias intact for the intraday session. If Bank Nifty sustains above 59050, buying Call options becomes favorable, with upside targets placed near 59250, followed by 59350, and then 59450+. These levels correspond to previous supply zones and minor swing highs, where profit booking or partial exit should be considered due to potential resistance.

A stronger bullish continuation will only be confirmed if the index manages to break and sustain above 59550. Above this level, momentum buying can accelerate, opening the path towards 59750, 59850, and eventually 59950+, which is a major resistance area marked by previous rejections. This zone is critical, as failure to cross it decisively may again push the index back into consolidation or minor correction.

On the downside, 59450–59400 is the first intraday support. A breakdown below this zone may trigger short-term weakness, making Put options attractive with targets around 59250, 59150, and 59050. If selling pressure increases and Bank Nifty slips below 58950, the structure turns weaker, and further downside targets open up towards 58750, 58650, and 58550, which are stronger demand zones from where bounce-back attempts can emerge.

Overall, the gap-up opening reflects positive sentiment, but the market is still trading near crucial resistance bands. Traders should avoid chasing the gap and instead focus on price acceptance above key levels. A sustained move above resistance confirms bullish strength, while rejection from higher zones can quickly lead to a pullback. Maintaining strict stop-losses, booking partial profits near targets, and trading strictly based on levels will be essential due to expected volatility around these zones.

#BANKNIFTY PE & CE Levels(23/01/2026)A flat opening is expected in Bank Nifty, indicating a pause after the recent volatile swings and suggesting that the market is entering a short-term consolidation phase. Price action over the last few sessions clearly shows sharp intraday moves on both sides, followed by quick pullbacks, which reflects indecision and lack of strong directional conviction among participants. This kind of structure usually favors level-based trading rather than aggressive trend-following trades, especially during the first half of the session.

From a technical perspective, the 59050–59100 zone is acting as a crucial intraday pivot and demand area. As long as Bank Nifty holds above this region, the bias remains mildly positive with scope for a gradual upside move. Sustained trading above 59100 can trigger fresh long interest and short covering, which may push the index towards 59250, followed by 59350 and 59450+. However, this upside is likely to be slow and grindy, not impulsive, unless there is a strong breakout candle with volume confirmation above the higher resistance.

On the flip side, the 59450–59400 zone continues to behave as a strong supply and selling area. Any rejection from this region, especially if the price forms long upper wicks or fails to sustain above it, can invite renewed selling pressure. In such a scenario, PE buying near 59450–59400 becomes valid, with downside targets towards 59250, then 59150, and 59050. This makes the 59400–59500 band a critical area where traders should be extremely cautious and avoid chasing breakouts without confirmation.

If selling pressure intensifies and Bank Nifty breaks decisively below 59050, the structure may again turn weak. A breakdown below this support can open the gates for a deeper correction towards 58950–58900, and further down to 58750, 58650, and 58550. These lower levels are strong higher-timeframe supports, so any sharp fall into these zones could again attract bounce-based buying, keeping volatility elevated.

Overall, the broader trend still leans sideways to mildly bearish, with repeated failures near resistance and limited follow-through on rallies. Traders should focus on support-resistance reactions, avoid overtrading during choppy moves, and wait for clear confirmation before committing to large positions. A disciplined approach with strict risk management will be crucial, as Bank Nifty is likely to remain range-bound with sudden spikes on either side during the session.

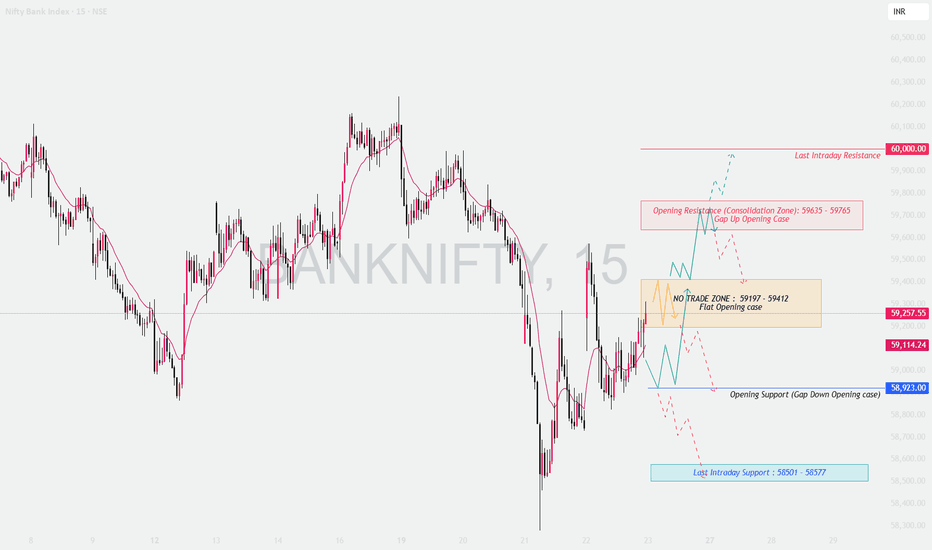

BANKNIFTY : Intraday Trading levels and Plan for 23-Jan-2026📘 BANK NIFTY Trading Plan – 23 Jan 2026

Timeframe: 15-Minute

Gap Consideration: 100+ points

Market Structure: Short-term pullback within a volatile range, key decision zones clearly defined

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If Bank Nifty opens above the previous close with a strong gap-up, price action near resistance becomes crucial.

Opening Resistance / Consolidation Zone: 59,635 – 59,765

This zone may act as supply as it aligns with prior rejection and intraday selling pressure.

Bullish Continuation:

Sustained 15-min close above 59,765 signals strength → upside extension towards 60,000.

Rejection Setup:

Failure to hold above 59,635 may lead to pullback towards the flat opening range.

Options Strategy:

Bull Call Spread (Buy ATM CE + Sell OTM CE) to reduce theta risk.

➡️ SCENARIO 2: FLAT / RANGE OPENING ⚖️

A flat open indicates indecision; patience is key.

No-Trade / Chop Zone: 59,197 – 59,412

Expect whipsaws and option premium decay.

Bullish Bias:

Acceptance above 59,412 → targets 59,635 → 59,765.

Bearish Bias:

Breakdown below 59,197 → drift towards 58,923.

Options Strategy:

Short Strangle / Iron Condor only if price remains inside range with strict SL.

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

A gap-down open tests buyer strength immediately.

Opening Support (Gap Down Case): 58,923

First reaction zone for buyers.

Intraday Support Breakdown:

Below 58,923 → increased probability of move towards 58,501 – 58,577.

Pullback Short Setup:

If price retests 59,197 and rejects, short continuation trades are favored.

Options Strategy:

Bear Put Spread (Buy ATM PE + Sell lower strike PE) to cap risk.

🛡️ OPTIONS RISK MANAGEMENT TIPS 🧠

Avoid naked option buying near no-trade zones.

Use spreads to control theta decay.

Risk only 1–2% of capital per trade.

Book partial profits quickly in volatile markets.

No revenge trades after SL hit.

📌 SUMMARY & CONCLUSION ✨

59,197 – 59,412 remains the key decision zone.

Directional trades only after clear acceptance or rejection.

Gap days demand discipline, not aggression.

Let price confirm, then execute with defined risk.

⚠️ DISCLAIMER

This analysis is for educational purposes only. I am not a SEBI registered analyst. Markets are risky, and trades can go wrong. Please consult your financial advisor before trading. 🙏

Hindustan Copper Limited – A Case in Point📊 Understanding the Rounding Bottom Pattern in Long-Term Charts

Hindustan Copper Limited, currently trading near ₹538, has displayed a rounding bottom formation since its listing in 2010. After years of decline and consolidation, the stock is now approaching its listing highs, reflecting a long-term structural recovery. This setup highlights how patience in long-term charts can reward investors, while disciplined risk management ensures traders don’t get caught in false moves.

Understanding the Rounding Bottom Pattern in Long-Term Charts

📈 What is a Rounding Bottom Pattern?

A rounding bottom pattern (also called a saucer bottom) is a long-term technical chart formation that signals a gradual shift from a bearish phase to a bullish one. It typically develops over months or years, showing a slow decline in price, stabilization at the bottom, and then a gradual recovery. The shape resembles a "U" or a bowl, reflecting investor sentiment moving from pessimism to optimism.

Key characteristics:

Extended duration: Often spans several years.

Gradual transition: No sharp reversals; instead, a slow and steady change in trend.

Volume behavior: Declines during the downtrend, stabilizes at the bottom, and rises as the breakout nears.

🌍 Importance on Long-Term Charts

Signals structural reversal: Especially powerful when seen on monthly or weekly charts, as it suggests a fundamental change in market perception.

Applicable to newly listed stocks: For companies that fell after listing, a rounding bottom can mark the end of long-term underperformance.

Investor confidence: Breakouts from such patterns often attract institutional interest, as they indicate sustained demand.

⚖️ Risk Management in Such Criteria

Even though rounding bottoms are strong reversal signals, risk management is crucial:

False breakouts: Prices may test resistance multiple times before a clean breakout.

Stop-loss placement: Traders should place stops below the midpoint of the pattern or recent support.

Position sizing: Avoid overexposure; long-term setups require patience and capital discipline.

Macro factors: Always consider industry cycles, commodity prices, and broader market sentiment.

💡 Traders’ & Investors’ Takeaways

For traders: The breakout above the neckline (previous highs) is the key entry point. Momentum traders often ride the rally post-breakout.

For investors: The pattern reflects a fundamental turnaround. Long-term investors may accumulate during the consolidation phase, anticipating sustained growth.

Psychological shift: The pattern embodies a transition from despair to renewed optimism, making it a powerful sentiment indicator.

[INTRADAY] #BANKNIFTY PE & CE Levels(21/01/2026)A flat opening is expected in Bank Nifty, indicating indecision after the recent sell-off and rejection from higher levels. The index is currently trading below its immediate resistance zone, reflecting weak momentum and cautious sentiment among market participants. Early trade is likely to remain volatile but range-bound, as both buyers and sellers wait for confirmation near the marked support and resistance levels before committing to fresh positions.

On the upside, the key resistance zone is placed near 59,550–59,600. If Bank Nifty manages to sustain above 59,550, it can trigger a buy-on-breakout setup with upside targets of 59,750, 59,850, and 59,950+. A move above this zone would indicate short-covering and fresh buying interest, potentially leading to a recovery rally towards the upper resistance band near 59,950. Long trades should be considered only after clear acceptance above resistance with stable price action.

On the downside, the immediate support is seen around 59,450–59,400. Failure to hold this level can invite fresh selling pressure, making buy PE options favorable for downside moves. In such a case, targets are placed at 59,250, 59,150, and 59,050, where partial profit booking is advisable. A stronger breakdown below 58,950–58,900 would further weaken the structure and open deeper downside targets near 58,750, 58,650, and 58,550, which are major demand zones and potential bounce areas.

Overall, the broader structure suggests a sell-on-rise and range-trading strategy unless a decisive breakout above resistance occurs. Traders should avoid aggressive positions during the initial flat phase and instead focus on level-based trades with strict stop-loss management. Scalpers and intraday traders can capitalize on moves near support and resistance, while positional traders should wait for a confirmed directional breakout before taking larger exposure.

Understanding Trend Breakouts, RSI Signals and Risk Management📈 Understanding Trend Breakouts, RSI Signals, and Risk Management in Trading : Base Chart UNION BANK OF INDIA

Union Bank of India’s stock currently presents a compelling opportunity as it has successfully broken out of its long-term downtrend and is sustaining above the trendline, signaling a confirmed reversal in sentiment. The price action is now forming higher highs and higher lows, a classic bullish structure that often precedes further upward momentum. With the RSI holding above 50 and now approaching the 70 zone, momentum indicators are aligning with price strength, suggesting strong buying interest. For investors and traders, this setup highlights a favorable risk-reward scenario, where disciplined risk management—such as using stop-losses and position sizing—can help capitalize on the breakout while safeguarding against volatility.

Lets elobrate the study....

🔹 The Significance of Long-Term Downtrends

Definition: A long-term downtrend occurs when a stock consistently makes lower highs and lower lows over an extended period.

Investor Psychology: It reflects persistent bearish sentiment, where sellers dominate buyers.

Why It Matters: Recognizing a downtrend helps traders avoid premature entries and understand the broader market context.

✅ Breakout Above the Downtrend Line

Trendline Break: When a stock sustains above its long-term downtrend line, it signals a potential trend reversal.

Confirmation: Sustained price action above the line, supported by volume, indicates that buyers are gaining control.

Implication: This often marks the beginning of a new bullish phase, where higher highs and higher lows start forming.

🔹 RSI (Relative Strength Index) as a Momentum Indicator

RSI Basics: RSI measures momentum on a scale of 0–100.

Below 30 → Oversold (potential reversal upward).

Above 70 → Overbought (potential reversal downward).

Importance of RSI Above 50:

RSI consistently above 50 suggests bullish momentum.

It indicates that average gains outweigh average losses.

RSI Moving Toward 70:

Crossing into the 70+ zone reflects strong buying strength.

While it can signal overbought conditions, in trending markets it often supports continued bullishness.

🔹 Risk Management Principles

Even with strong technical signals, risk management is essential:

Position Sizing: Never allocate more capital than you can afford to lose.

Stop-Loss Orders: Protect against sudden reversals by setting predefined exit points.

Diversification: Avoid concentrating all investments in one stock or sector.

Avoid Emotional Trading: Stick to your plan; don’t chase prices or panic sell.

🔹 Key Takeaways for Investors & Traders

Trend Reversal: Sustained breakout above a long-term downtrend line is a powerful bullish signal.

Momentum Confirmation: RSI above 50, moving toward 70, strengthens confidence in the trend.

Breakout Opportunities: Higher highs and higher lows formation confirms the stock’s bullish structure.

Risk Discipline: Technical signals are valuable, but risk management ensures long-term survival in markets.

Balanced Approach: Combine technical analysis with sound trading psychology and portfolio management.

📌 Final Thought: Technical indicators like trendlines and RSI provide valuable insights, but they are not foolproof. The most successful traders blend technical signals with disciplined risk management, ensuring they ride profitable trends while protecting themselves from unexpected market shifts.

DO OR DIE ZONE – BANDHAN BANK

Timeframe: Weekly

Current Price: ~₹145

Primary Trend: Long-term downtrend transitioning into a potential base formation

🔍 Chart Pattern & Market Structure

Bandhan Bank has been trading inside a long-term falling channel, respecting both upper and lower trendline boundaries.

The price structure reflects a 5-wave Elliott decline (Wave 1–5), with Wave 5 likely completed near the lower channel support.

Post Wave 5, the stock is attempting a trendline resistance breakout, followed by a pullback into a Golden Retracement Zone (50%–78.6%), which is technically healthy.

📌 Key Technical Observations:

Golden Retracement Zone:

50% retracement: ~₹160

78.6% retracement: ~₹141

Price is currently holding above 78.6% retracement, suggesting buyers are still defending structure.

₹133–135 zone is marked as a “Do or Die” level, where a weekly close below would invalidate the bullish recovery thesis.

🟢 Swing Trading Strategy (Medium-Term)

✅ Swing Buy Zone:

₹142 – ₹150 (on pullbacks with price stabilization)

🎯 Swing Targets:

Target 1: ₹175

Target 2: ₹200

Extended Swing Target: ₹225–₹240 (only if momentum sustains)

🛑 Swing Stop Loss (Strict):

₹133 (Weekly close basis)

📐 Risk–Reward (Approx.):

Risk: ~₹12

Reward: ₹30–₹90

Risk–Reward Ratio: 1:2.5 to 1:7 (favorable if SL respected)

🔵 Investment Strategy (Positional / Long-Term)

📌 Investment Thesis:

Completion of a multi-year corrective cycle improves the probability of a structural mean reversion.

If price sustains above the broken trendline and holds the golden retracement zone, Bandhan Bank may enter a larger corrective Wave 4 (3-to-4 retracement).

🎯 Investment Upside Zones (Based on Fibonacci Extension):

113% Extension: ~₹282

127% Extension: ~₹302

These levels are long-term objectives, achievable only if the stock builds higher highs and higher lows above ₹200.

🛑 Investment Stop Loss:

₹133 (Weekly close below)

Conservative investors may use ₹125 as a hard capital protection level.

⚠️ Caution & Concerns

The broader trend is still technically bearish until the stock:

Sustains above ₹175–₹180

Breaks and holds above the falling channel decisively

Banking stocks remain sensitive to:

Asset quality concerns

Credit cycle shifts

Macro interest rate dynamics

Failure to hold ₹133 on a weekly closing basis would signal:

Loss of buyer interest

Possible continuation of the long-term downtrend

🚀 Opportunities & Positive Triggers

Successful defense of the Golden Retracement Zone indicates:

Strong hands accumulating

Reduced downside risk

A weekly close above ₹175 can act as a trend reversal confirmation.

The current price structure offers:

Defined risk

Asymmetric upside

Clear invalidation point

📌 Conclusion

Bandhan Bank is at a critical inflection point. While the long-term trend remains cautious, the completion of Wave 5 and support at the golden retracement zone present a high-quality risk-defined opportunity for swing traders and patient investors. Discipline around stop loss will be key.

⚠️ Disclaimer

This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please consult your financial advisor and manage risk responsibly.

[INTRADAY] #BANKNIFTY PE & CE Levels(14/01/2026)A flat opening is expected in Bank Nifty, with price hovering around the 59,500–59,600 zone, which is acting as an intraday equilibrium area. Recent price action shows range-bound behavior with sharp intraday swings, indicating indecision and a lack of fresh directional cues.

On the upside, a sustained move above 59,550 will be important to trigger bullish momentum. If the index holds above this level, CE buying can be considered with upside targets at 59,750, 59,850, and 59,950+. A decisive breakout above 59,950 may open the door for a stronger recovery move.

On the downside, rejection near current levels and a break below 59,450–59,400 can invite selling pressure. In that case, PE positions may work for targets at 59,250, 59,150, and 59,050, where strong support is placed near 59,050. A breakdown below this support could accelerate downside momentum.

Overall, the structure remains range-bound. It is advisable to trade only after a clear level breakout or breakdown, maintain strict stop-losses, and avoid overtrading until a decisive move emerges.

[INTRADAY] #BANKNIFTY PE & CE Levels(13/01/2026)A flat opening is expected in Bank Nifty, with the index trading near the 59,500–59,550 zone, which is acting as an important intraday pivot area. Price action suggests continued consolidation after the recent sharp recovery from lower levels, indicating balanced participation from both buyers and sellers. The overall structure remains range-bound, and a decisive move beyond key levels is required for clear direction.

On the upside, a sustained move above 59,550 will be the key trigger for bullish momentum. Holding above this level can open the door for long trades, with upside targets placed at 59,750, 59,850, and 59,950+. A strong breakout above the 59,950 resistance may further accelerate upside toward higher zones.

On the downside, if Bank Nifty fails to hold the 59,450–59,400 support, selling pressure may re-emerge. In such a scenario, short positions can be considered with downside targets at 59,250, 59,150, and 59,050-. Until a clear breakout occurs on either side, traders are advised to stick to range-based trading, maintain strict stop-loss discipline, and avoid aggressive directional positions.

[INTRADAY] #BANKNIFTY PE & CE Levels(12/01/2026)A flat opening is expected in Bank Nifty, with the index continuing to trade within the same downward structure seen over the last few sessions. Price is currently hovering around the 59,250–59,300 zone, which is acting as an intraday equilibrium area where minor pullbacks and short-covering are visible, but no strong buying conviction has emerged yet. Overall sentiment remains cautious unless a clear breakout occurs.

On the upside, a sustained move above 59,550 will be the key trigger for bullish momentum. If Bank Nifty manages to hold above this level, long trades / CE positions can be considered with upside targets at 59,750, 59,850, and 59,950+. A clean breakout above 59,950 may further open the gates toward higher resistance zones.

On the downside, if the index fails to hold 59,250–59,200, selling pressure may intensify. In such a scenario, PE positions can be considered with downside targets at 59,050, 58,950, and 58,750. A decisive breakdown below 58,950 could extend the move toward 58,650 and 58,550-. Until a clear directional move is confirmed, traders are advised to stick to level-based trades with strict risk management and avoid aggressive positions.

[INTRADAY] #BANKNIFTY PE & CE Levels(09/01/2026)A flat to slightly gap-down opening is expected in Bank Nifty, with price continuing to trade under selling pressure after the recent decline. The index is currently hovering around the 59,650–59,700 zone, which is acting as a short-term consolidation area. This zone remains critical, as buyers are attempting to defend lower levels while overall sentiment stays cautious.

On the upside, a sustained move above 59,950–60,050 will be the first sign of recovery. If Bank Nifty manages to hold above this zone, long (CE) positions can be considered with upside targets at 59,750, 59,850, and 59,950+ initially. A stronger breakout above 60,050 may further extend the rally toward 60,250, 60,350, and 60,450+, confirming bullish continuation.

On the downside, failure to hold the 59,550 support may invite fresh selling pressure. In such a case, short (PE) positions can be considered, with downside targets at 59,450, 59,250, and 59,150, followed by 59,050- if weakness persists. Until a clear breakout or breakdown is seen, traders should remain range-bound, trade with confirmation, and strictly manage risk in this volatile zone.