BANKNIFTY : Trading levels and plan for 02-Sep-2025BANK NIFTY TRADING PLAN – 02-Sep-2025

📌 Key Levels to Watch :

No Trade Zone (Opening Support/Resistance): 53,985 – 54,094

Last Intraday Resistance: 54,211

Major Resistance Above: 54,432

Opening Support: 53,809

Last Intraday Support: 53,694

These levels act as reaction points where traders should expect volatility and directional cues.

🔼 1. Gap-Up Opening (200+ points above 54,094)

If Bank Nifty opens significantly above the No Trade Zone, bulls may attempt to take control.

📌 Plan of Action :

Sustaining above 54,211 (last intraday resistance) can trigger further momentum.

The next upside target will be 54,432, where profit booking pressure could arise.

If price fails to sustain above 54,094 and slips back into the No Trade Zone, expect consolidation and choppy action.

👉 Educational Note: Gap-up openings often result in high option premiums. Instead of chasing, wait for a retest of support or consolidation before entering directional trades.

➖ 2. Flat Opening (Around 53,950 – 54,050)

If the market opens flat within the No Trade Zone (53,985 – 54,094), traders must exercise patience.

📌 Plan of Action :

Avoid trading immediately in the No Trade Zone as false signals are common.

A breakout above 54,094 with strong volume may lead to a move towards 54,211 – 54,432.

A breakdown below 53,985 will shift focus towards 53,809 (opening support).

👉 Educational Note: Flat openings are best approached with discipline. Let the market give clear confirmation before committing to a direction.

🔽 3. Gap-Down Opening (200+ points below 53,809)

If Bank Nifty opens lower, it will test key supports quickly.

📌 Plan of Action :

A gap-down below 53,809 directly exposes the market to test 53,694 (last intraday support).

Buyers may attempt a pullback from 53,694, making it a possible intraday reversal zone.

A decisive break below 53,694 will weaken sentiment further and can accelerate downside momentum.

👉 Educational Note: Gap-downs create panic moves. Avoid chasing shorts at lows; instead, look for pullbacks to resistance zones to enter with better risk/reward.

🛡️ Risk Management Tips for Options Traders

Always trade with a defined stop loss based on hourly close.

Risk only 1–2% of capital per trade.

Use option spreads (like Bull Call or Bear Put) instead of naked buying in volatile markets.

Scale out of trades at important resistance/support zones.

Avoid trading within the No Trade Zone (53,985 – 54,094) where whipsaws are likely.

📌 Summary & Conclusion

🟢 Above 54,211 → Upside momentum towards 54,432 possible .

🟧 Flat Opening → Avoid trades in 53,985 – 54,094 (No Trade Zone), wait for breakout/breakdown .

🔴 Below 53,809 → Weakness towards 53,694; below that, expect further downside .

⚠️ Key Battle Zone: 53,985 – 54,094 (No Trade Zone).

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is shared purely for educational purposes and should not be considered as investment advice. Please consult your financial advisor before trading.

Bankniftyview

BANKNIFTY : Trading levels and plan for 01-Sep-2025💼 BANK NIFTY TRADING PLAN – 01-Sep-2025

📌 Key Levels to Watch :

Opening Resistance Zone: 53,844

Last Intraday Resistance: 53,982

Sideways Resistance Zone: 54,142 – 54,214

Opening Support: 53,466

Buyer’s Zone for Reversal: 53,204 – 53,466

Last Intraday Support: 53,204

These levels will serve as reaction zones where market participants are likely to show strong activity.

🔼 1. Gap-Up Opening (200+ points above 53,844)

If Bank Nifty opens with a significant gap-up above 53,844, bullish traders will have the upper hand.

📌 Plan of Action :

Sustaining above 53,982 (last intraday resistance) can lead to a quick rally.

Upside targets will be 54,142 – 54,214 (sideways resistance zone) where profit booking pressure may arise.

Failure to hold above 53,844 can invite a retracement back toward 53,692 (current reference).

👉 Educational Note: Gap-up moves often look attractive, but chasing high premiums in options can be risky. Waiting for a retest of support levels gives safer entry points.

➖ 2. Flat Opening (Around 53,650 – 53,750)

If the index opens flat near its current zone, price behavior around 53,844 (opening resistance) will decide the trend.

📌 Plan of Action :

Sustaining above 53,844 can take Bank Nifty towards 53,982 and eventually 54,142 – 54,214.

If rejected from 53,844, price could slip back toward 53,466 (opening support).

A break below 53,466 will drag the index into the Buyer’s Zone (53,204 – 53,466), where intraday reversal attempts may happen.

👉 Educational Note: Flat openings provide balanced opportunities—traders should observe first 30 minutes to gauge real strength before taking directional trades.

🔽 3. Gap-Down Opening (200+ points below 53,466)

If Bank Nifty opens sharply lower, it will directly test the Buyer’s Reversal Zone (53,204 – 53,466).

📌 Plan of Action :

Aggressive buyers may defend 53,204 – 53,466, making this zone a potential reversal area.

If 53,204 holds, a recovery towards 53,466 and 53,692 is possible.

A decisive breakdown below 53,204 (last intraday support) can accelerate selling pressure and lead to extended downside.

👉 Educational Note: Gap-downs bring panic—avoid shorting at extreme lows; instead, watch for retracements to enter with better risk/reward.

🛡️ Risk Management Tips for Options Traders

Use hourly close-based stop losses instead of small tick-based stops.

Risk only 1–2% of trading capital per trade.

In volatile moves, prefer option spreads (Debit/Credit spreads) over naked buying.

Scale out profits at key zones like resistance or support—don’t wait for exact tops/bottoms.

Avoid overtrading during sideways phases; wait for clear breakouts/breakdowns.

📌 Summary & Conclusion

🟢 Above 53,982 → Upside momentum towards 54,142 – 54,214 .

🟧 Flat Opening → Watch 53,844 as pivot; above bullish, below cautious .

🔴 Below 53,466 → Weakness towards Buyer’s Reversal Zone (53,204 – 53,466) .

⚠️ Critical battle zones: 53,844 (resistance) & 53,466 (support).

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is shared only for educational purposes and should not be considered investment advice. Please consult your financial advisor before trading.

BANKNIFTY : Trading levels and Plan for 29-Aug-2025💼 BANK NIFTY TRADING PLAN – 29-Aug-2025

📌 Key Levels to Watch :

Opening Resistance Zone: 54,076 – 54,184

Last Intraday Resistance: 54,246

Major Resistance Above: 54,511

Opening Support Zone: 53,669 – 53,767

Last Intraday Support: 53,460

Major Support Below: 53,204

These levels represent intraday turning points where buyers or sellers may step in aggressively.

🔼 1. Gap-Up Opening (200+ points above 54,184)

If Bank Nifty opens with a strong gap above 54,184, bullish momentum is likely.

📌 Plan of Action :

Sustaining above 54,246 (last intraday resistance) may fuel upside towards 54,511, which is the next hurdle for bulls.

Partial profit booking is advisable near 54,511, as it could trigger a pullback.

If the index fails to sustain above 54,246, it may slip back into the 54,076–54,184 resistance band, indicating possible rangebound price action.

👉 Educational Note: On big gap-ups, avoid chasing the first 15 minutes. Wait for a retest of support before entering long trades.

➖ 2. Flat Opening (Around 53,669 – 53,767 Support Zone)

If Bank Nifty opens flat within the opening support band, the market will look for fresh direction.

📌 Plan of Action :

Holding above 53,767 can invite buying, targeting 54,076 → 54,246.

Failure to hold above 53,669 may push the index back towards 53,460, opening the door for more weakness.

Traders should avoid over-leveraging in this consolidation zone, as false breakouts are common.

👉 Educational Note: Flat openings usually demand patience. Allow price to test both sides of support/resistance before committing to a trade.

🔽 3. Gap-Down Opening (200+ points below 53,460)

If Bank Nifty opens with a sharp gap below 53,460, bearish control will likely continue.

📌 Plan of Action :

Below 53,460, the index can slide further towards 53,204 (major support).

The 53,204 zone is critical; strong buying wicks here may signal a reversal opportunity.

If 53,204 breaks decisively, expect extended downside momentum, so shorts can be trailed aggressively.

👉 Educational Note: Gap-down openings often trigger panic. Avoid emotional trades—stick to levels and wait for clear breakdown confirmations.

🛡️ Risk Management Tips for Options Traders

Risk only 1–2% of trading capital per trade.

Use hourly candle close stop-losses for confirmation instead of reacting to noise.

On high-volatility days, prefer spreads (Bull Call/Bear Put) over naked options.

Book profits in tranches, don’t wait for exact targets.

Keep an eye on India VIX to gauge premium decay and volatility risk.

📌 Summary & Conclusion

🟢 Above 54,246 → Upside towards 54,511 (profit booking zone) .

🟧 Flat near 53,669–53,767 → Wait for breakout, either to 54,246 or 53,460 .

🔴 Below 53,460 → Weakness towards 53,204 (critical support) .

🎯 The battle zone: 53,669–53,767 opening support will decide intraday momentum.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is prepared purely for educational purposes and should not be treated as investment advice. Please do your own research or consult a financial advisor before trading.

BANKNIFTY : Trading levels and Plan for 28-Aug-2025💼 BANK NIFTY TRADING PLAN – 28-Aug-2025

📌 Key Levels to Watch :

Opening Resistance: 54,748

Last Intraday Resistance: 54,952

Major Resistance Above: 55,360

No-Trade Zone: 54,428 – 54,562

Last Intraday Support: 54,186

Buyer’s Support Zone: 53,666 – 53,771

These levels act as decision-making zones for intraday setups.

🔼 1. Gap-Up Opening (200+ points above 54,748)

If Bank Nifty opens above 54,748, early strength will be visible.

📌 Plan of Action :

Sustaining above 54,952 (Last Intraday Resistance) can push the index towards 55,360, which will act as a major resistance and profit booking zone.

Failure to hold above 54,952 may drag prices back to retest 54,748 support, giving rangebound moves.

A breakout above 55,360 should be traded cautiously with partial booking at higher levels.

👉 Educational Note: On strong gap-ups, always avoid chasing; instead, wait for price retests near support to manage risk better.

➖ 2. Flat Opening (Around 54,428 – 54,562 No-Trade Zone)

A flat start near the No-Trade Zone means price is indecisive.

📌 Plan of Action :

If Bank Nifty sustains above 54,748, buyers may take it towards 54,952 → 55,360.

If it slips below 54,428, selling pressure may drag it down to 54,186 support.

Avoid aggressive trading inside the no-trade band (54,428 – 54,562), as it can trigger false breakouts.

👉 Educational Note: Flat openings require patience. Allow 30 minutes for trend clarity before entering trades.

🔽 3. Gap-Down Opening (200+ points below 54,186)

If Bank Nifty opens below 54,186, bearish momentum will dominate.

📌 Plan of Action :

Below 54,186, price can slide quickly towards 53,666 – 53,771 Buyer’s Zone.

Watch carefully for reversals in the buyer’s zone; if sustained, a recovery bounce can emerge.

If the buyer’s zone breaks with volume, deeper weakness may continue.

👉 Educational Note: On gap-down days, trend-following trades work better than reversal attempts. Wait for retests before shorting.

🛡️ Risk Management Tips for Options Traders

Risk only 1–2% of capital per trade.

Use hourly close stop-loss for directional moves.

Prefer spreads (Bull Call / Bear Put) on gap days to minimize premium decay.

Do not trade aggressively in the No-Trade Zone (54,428 – 54,562).

Monitor Bank Nifty PCR & India VIX to gauge sentiment and volatility.

📌 Summary & Conclusion

🟢 Above 54,952 → Possible upside to 55,360 .

🟧 Flat near 54,428–54,562 → Avoid trades until breakout .

🔴 Below 54,186 → Downside towards 53,666–53,771 .

🎯 Key Decision Zone: 54,428 – 54,562 (No-Trade Zone) will guide the trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading or investment decisions.

BANKNIFTY : Trading levels and plan for 26-Aug-2025📊 BANK NIFTY TRADING PLAN – 26-Aug-2025

The price action on 25-Aug-2025 has defined critical levels for the next trading session. The Opening Support/Resistance Zone is 55,093 – 55,193, with key upside resistances at 55,322 and 55,528–55,603, while the strong downside support remains in the 54,563 – 54,745 Buyer’s Zone.

Let’s analyze the trading plan for all opening scenarios.

🔼 1. Gap-Up Opening (200+ Points Above 55,322)

If Bank Nifty opens above 55,322, it enters the bullish territory, testing the “Opening Resistance” directly.

📌 Plan of Action:

Watch if the price sustains above 55,322 for 15–30 minutes. Sustaining here will attract buying momentum.

Next target would be the Last Intraday Resistance zone 55,528–55,603.

If momentum continues and buyers hold above 55,603, extension towards 55,920 is possible.

If the index fails to hold above 55,322, then profit booking may pull it back toward 55,193 – 55,093 zone for retesting.

Risk note: Do not chase calls aggressively after a big gap-up 🚫. Always prefer entering on dips toward support for safer risk–reward.

➖ 2. Flat Opening (Around 55,093–55,193)

A flat opening around the Opening Support/Resistance Zone will be a balanced case where the market decides the next trend based on initial strength.

📌 Plan of Action:

If price sustains above 55,193, it can gradually move higher towards 55,322 → 55,528–55,603.

Failure to hold above 55,093 will invite selling pressure and drag the index towards the Buyer’s Zone (54,745–54,563).

First 30 minutes are crucial — let the market structure develop before entering trades to avoid false breakouts.

Risk note: Use hedged option strategies like Bull Call Spreads or Iron Condors if volatility is high. This helps reduce premium decay risk.

🔽 3. Gap-Down Opening (200+ Points Below 54,950)

A sharp gap-down below 55,000 would put pressure on bulls and may activate the Buyer’s Zone.

📌 Plan of Action:

If Bank Nifty opens below 55,000 and fails to reclaim 55,093, then the downside target becomes 54,745 – 54,563.

A bounce from the Buyer’s Zone can give scalping opportunities on the long side, but only with strict stop-loss.

If even 54,563 breaks, expect further downside expansion. Option writers may benefit from selling Calls.

Risk note: After a gap-down, avoid panic entries 🚦. Wait for retests of broken levels before confirming trend direction.

🛡️ Risk Management Tips for Options Traders

Never risk more than 1–2% of capital on a single trade.

Avoid trading immediately in the first 5 minutes after open; let volatility cool down.

Always maintain stop-losses in both futures and options.

Prefer spreads (Bull Call / Bear Put) over naked positions to control risk.

Remember: Protecting capital is more important than chasing every move. 💡

📌 Summary & Conclusion

🟢 Above 55,322 → 55,528–55,603 → 55,920 possible.

🟧 Flat near 55,093–55,193 = decision zone, wait for breakout/breakdown.

🔴 Below 55,093 → 54,745–54,563 Buyer’s Zone will be tested.

Key pivot: 55,093–55,193 zone.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading/investment decisions.

BANKNIFTY : Trading levels for 25-Aug-2025BANK NIFTY TRADING PLAN – 25-Aug-2025

📊 The market is at a decisive zone where price action around the 55,168 support–resistance pivot will guide the day’s direction. With clear intraday resistance at 55,528–55,687 and strong support around 54,563–54,745, let’s break down the trading plan for all three possible opening scenarios.

🔼 1. Gap-Up Opening (200+ Points Above 55,528)

If Bank Nifty opens above 55,528, it directly enters the “Opening Resistance Zone.” Such gaps often trigger profit booking in the early minutes, as traders who carried long positions may book profits.

📌 Plan of Action:

Wait for the first 15–30 minutes to see whether price sustains above 55,528.

If sustained, expect a rally towards the Last Intraday Resistance 55,687 and further into the target zone of 55,954–56,061.

However, if the index fails to sustain and slips back below 55,528, a quick retracement toward 55,168 may occur.

Risk note: Do not chase aggressive calls after a sharp gap-up. Instead, wait for pullbacks to key levels for a favorable risk–reward entry.

➖ 2. Flat Opening (Around 55,150–55,250)

A flat start around 55,168 will be the most balanced case, where both bulls and bears will have opportunities depending on who gains control first.

📌 Plan of Action:

If Bank Nifty sustains above 55,168 with strong buying, expect an upward move toward 55,528. A breakout above this resistance can open the way to 55,687 and eventually 55,954–56,061.

On the contrary, if price fails to hold 55,168 and slips below, selling pressure may drag it toward 54,745–54,563 (Last Intraday Support Zone).

Traders should closely monitor the first 30 minutes’ structure to avoid false breakouts.

Risk note: Options traders can use spreads (Bull Call Spread / Bear Put Spread) instead of naked buying to reduce theta decay and premium risk.

🔽 3. Gap-Down Opening (200+ Points Below 54,950)

A sharp gap-down below 55,000 may lead to panic selling, especially if global cues are weak.

📌 Plan of Action:

If the index opens below 55,000 and fails to reclaim 55,168, expect selling to intensify toward the 54,745–54,563 support zone.

If the support zone holds, intraday pullbacks are possible — traders may look for quick scalps on the long side but with strict stop-losses.

A breakdown below 54,563 will open deeper downside levels, creating opportunities for option writers on the short side.

Risk note: After a gap-down, avoid panic selling at open. Allow the index to retest broken levels — failed retests often provide high-probability trades.

📌 Risk Management Tips for Options Traders

Always trade with a defined stop-loss — never average into a losing trade.

Avoid trading in the first 5 minutes after a big gap; let volatility settle.

Position sizing is key — never risk more than 1–2% of total capital on a single trade.

Use hedged strategies like spreads instead of naked positions when IV (implied volatility) is high.

Remember, missing a trade is better than forcing a wrong trade. Patience pays.

📊 Summary & Conclusion

🟢 Sustaining above 55,528 opens doors to 55,687 → 55,954–56,061.

🟧 Flat opening near 55,168 makes it a decision zone for either breakout or breakdown.

🔴 Below 55,168, weakness may drag Bank Nifty toward 54,745–54,563.

Key pivot for the day: 55,168.

⚠️ Disclaimer: I am not a SEBI-registered analyst. The above analysis is for educational purposes only. Please do your own research or consult a financial advisor before making any trading decisions.

BANKNIFTY : Trading plan and levels for 22-Aug-2025📌 BankNifty Trading Plan for 22-Aug-2025

Key Levels from Chart:

Opening Resistance → 55,849

Opening Support Zone → 55,622 – 55,697

Last Intraday Resistance Zone → 56,097 – 56,135

Last Intraday Support Zone → 55,334 – 55,395

Downside Target Support → 55,174

Previous Close → 55,733.90

🚀 Scenario 1: Gap Up Opening (200+ points above previous close)

If BankNifty opens around 55,950+, buyers will dominate the initial sentiment.

The first major hurdle is Opening Resistance at 55,849. If sustained above, momentum can quickly test 56,097 – 56,135 (Last Intraday Resistance Zone).

A clean breakout above 56,135 can push the index toward 56,355 (Profit Booking Zone).

However, failure near resistance could cause intraday profit booking, dragging it back toward the 55,849 retest zone.

💡 Plan of Action : Go long only above 55,849 with confirmation. Trail stop-loss below 55,697. Book partial profits near 56,135 and tighten stops beyond that. Avoid chasing if price struggles near resistance.

📊 Scenario 2: Flat Opening (within ±100 points of 55,734)

Flat openings often lead to sideways choppiness around support and resistance zones.

If price sustains above 55,849, bullish momentum may extend toward 56,097 – 56,135.

Failure to break 55,849 and slipping below 55,622 – 55,697 (Opening Support Zone) will invite weakness.

Breakdown below 55,622 can accelerate selling toward 55,334 – 55,395 (Last Intraday Support Zone).

💡 Plan of Action : Avoid trading inside 55,622 – 55,849 chop zone. Wait for breakout: long above 55,849 or short below 55,622 for clear momentum trades.

⚠️ Scenario 3: Gap Down Opening (200+ points below previous close)

If BankNifty opens near 55,500 or below, bearish sentiment will dominate.

Immediate cushion lies at 55,334 – 55,395 (Last Intraday Support Zone). Breakdown below this zone can drag the index toward 55,174 strong support.

If 55,334 holds, expect a relief bounce back toward 55,622 zone.

Be cautious of false breakdowns, as gap-downs often lead to short-covering rallies.

💡 Plan of Action : Go short only if 55,334 breaks with volume, keeping SL above 55,395. For long scalps, wait for bullish reversal patterns near 55,334 before targeting 55,622.

📌 Risk Management Tips for Options Traders 💡

Use hedged strategies like spreads or straddles in high volatility instead of naked buying.

Place strict stop-losses on option premiums – don’t average losing positions.

Respect the 2% rule → risk only 2% of total capital per trade.

Avoid overtrading inside congestion zones; wait for directional clarity.

Trail your profits and book partials near resistance/support zones 🎯.

📝 Summary & Conclusion

Above 55,849, targets are 56,097 – 56,135, then 56,355 🚀.

Between 55,622 – 55,849, sideways choppiness likely ⚖️ – avoid trades.

Below 55,622, weakness toward 55,334 – 55,395, and if broken → 55,174 ⚠️.

👉 The day will be trend-driven outside the support/resistance zones. Discipline and patience are key to avoid false moves.

⚠️ Disclaimer

I am not a SEBI registered analyst. This trading plan is shared purely for educational purposes . Please consult with your financial advisor before making trading or investment decisions.

BANKNIFTY - Trading levels and Plan for 22-July-2025📊 BANKNIFTY TRADING PLAN – 22-July-2025 📊

🔍 Market Context:

Bank Nifty closed at 56,916.75, forming a consolidation just below the resistance zone. Price action near the Opening Support (56,740) and Opening Resistance (57,045) will be crucial to watch. Depending on the type of market open, plan your trades with precision and discipline.

📈 GAP-UP OPENING (➕200+ points above 57,100)

In case of a gap-up opening above the Opening Resistance Zone (57,045–57,100), Bank Nifty may directly move into the Supply Zone (57,410–57,567).

Plan of Action:

Wait for the index to hit 57,410–57,565 supply zone.

Look for reversal candles or rejection wicks on lower timeframes (5/15-min) to consider shorting with tight SL above 57,567.

Targets: 57,045 > 56,740 > 56,585

Avoid fresh long trades until a decisive breakout and retest above 57,567.

📘 Educational Note: Never buy straight into a supply zone after a gap-up. Wait for price action confirmation.

📉 Option Strategy: Ideal for Bearish Put Spreads or Intraday ATM/ITM Put Buying near reversal.

📊 FLAT OPENING (within 56,740–57,045)

If Bank Nifty opens flat, expect consolidation or a breakout from the opening box zone.

Plan of Action:

Bullish Setup: If price sustains above 57,045 with strong volume, consider longs.

➤ Targets: 57,410–57,567

Bearish Setup: If price breaks below 56,740, then

➤ Targets: 56,585 > 56,366

📘 Educational Note: Avoid trading in the first 15–30 mins unless clear direction is seen. Let the range settle.

🧠 Discipline Tip: Follow “If-This-Then-That” logic; don’t preempt movement inside the range.

📉 GAP-DOWN OPENING (➖200+ points below 56,700)

A gap-down opening near or below 56,585 or 56,366 may attract panic selling or quick recovery.

Plan of Action:

Below 56,585, watch for 5–15 min candle close. If sustained below 56,366, expect downside till 55,994

If price reclaims 56,740, look for a pullback rally.

Conservative buyers should wait for reclaim of 56,740 with strength before going long.

📘 Educational Note: Panic lows after gap-downs often lead to sharp reversals. Let price prove its strength first.

📉 Option Strategy: Use ITM Put Options or Bearish Call Spreads. Avoid OTM chases post-move.

🛡️ Risk Management & Options Tips:

Always define SL on 15-min or hourly candle close.

Never risk more than 1–2% of your capital per trade.

Avoid trading both sides in volatile markets; stick to the breakout direction.

Avoid buying cheap OTM options post-breakout — prefer ATM/ITM with momentum.

Protect profits by trailing SL or booking in tranches.

📌 Summary & Key Levels:

🔴 Resistance Zone: 57,410–57,567

🟧 Opening Resistance: 57,045

🟨 Opening Support: 56,740

🟦 Gap Support (gap-down): 56,585

🟫 Last Support: 56,366 > 55,994

📢 Conclusion:

22-July could be a decisive session for Bank Nifty as it approaches a critical resistance band. React to price—not predictions. Stay disciplined, don’t overtrade, and adjust to opening scenarios for optimal risk-reward setups.

⚠️ Disclaimer: I am not a SEBI registered analyst. This analysis is for educational purposes only. Please consult your financial advisor before taking any trading decisions.

Bank Nifty spot 56283.00 by Daily Chart view - Weekly updateBank Nifty spot 56283.00 by Daily Chart view - Weekly update

- Resistance Zone 56840 to 57200 and then ATH Level 57628.40

- [ b]*Bank Nifty Index Spot Breakdown below Rising Support Channel*

- Support Zone 59550 to 56285 of Bank Nifty Index *still sustained*

- Next fairly decent Support Zone 55050 to 55450 of Bank Nifty Index Levels

- Bank Nifty Index Gap Down Opening today 18-July-2025 to act as tiny resistance hurdle

BANKNIFTY - Trading levels and Plan for 18-Jul-2025📊 BANK NIFTY INTRADAY TRADING PLAN – 18-Jul-2025

Gap Opening Reference: 200+ Points Considered Significant

📍 IMPORTANT LEVELS TO MONITOR

🟥 Last Intraday Resistance Zone: 57,400 – 57,447

🟧 Opening Resistance: 56,936

🟩 Opening Support Zone: 56,667 – 56,605

🟢 Last Intraday Support (Buyer’s Zone): 56,331 – 56,430

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,136) 📈

(Gap opening considered above 200+ points from the previous close)

If Bank Nifty opens above 57,136 , strength is expected toward Last Intraday Resistance Zone: 57,400 – 57,447 .

Avoid buying immediately after the opening candle; allow 15–30 minutes for price confirmation and volatility settlement.

If price sustains above 57,400 , upside momentum may continue, but consider trailing your stop-loss as this is an exhaustion zone.

Options Tip: Consider ATM or slightly OTM Call Options or Bull Call Spread setups for controlled risk.

📊 SCENARIO 2: FLAT OPENING (Between 56,667 – 56,936) ⚖️

This range marks the equilibrium between buyers and sellers, as defined by Opening Support Zone and Opening Resistance .

Observe the first 15–30 minute candle for clear direction.

If price sustains above 56,936 , bias turns bullish toward 57,400 – 57,447 .

If price breaks below 56,667 , sellers may push Bank Nifty toward Buyer’s Zone: 56,331 – 56,430 .

Options Tip: Employ Strangle or Iron Fly strategies around flat openings with tight ranges.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,467) ⚠️

If Bank Nifty opens below 56,467 , downside momentum may accelerate toward Last Intraday Support: 56,331 – 56,430 .

Avoid instant selling at open. Let first 15–30 minute candle give direction clarity.

If price sustains below 56,331 , weakness could extend further.

Options Tip: Focus on ATM or ITM Put Options , or Bear Put Spreads for safer downside positioning.

💡 OPTIONS TRADING RISK MANAGEMENT TIPS

📏 Risk no more than 1–2% of your capital on any single trade.

⏳ Give at least 15–30 minutes after market open before initiating trades.

🔐 Use Hourly Close-based Stop Losses to avoid getting trapped by wicks.

⚖️ Prefer hedged strategies ( Spreads, Iron Fly, Strangles ) during high IV (Implied Volatility) phases.

🚫 Avoid revenge trading. Accept stop-loss gracefully; focus on next setup.

📌 SUMMARY & CONCLUSION

Bullish Bias: Gap-up above 57,136 → Focus on 57,400–57,447 zone.

Range-bound Bias: Flat between 56,667–56,936 → Watch for breakout confirmation.

Bearish Bias: Gap-down below 56,467 → Eye on 56,331–56,430 support zone.

Prioritize confirmation from 15–30 minute opening range before acting.

Maintain strict risk management discipline using options tools like spreads.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is shared strictly for educational and informational purposes. Please consult your financial advisor before making any trading or investment decisions.

BANKNIFTY : Intraday Trading levels and Plan for 17-July-2025📊 BANK NIFTY INTRADAY TRADING PLAN – 17-Jul-2025

200+ Points Gap Opening Considered Significant | Structured by Psychological Zones

📍 KEY ZONES AND LEVELS TO MONITOR:

🟥 Opening Resistance Zone: 57,395 – 57,513

🔴 Profit Booking Resistance: 57,881

🟧 NO TRADE ZONE: 56,934 – 57,104

🟦 Opening Support: 56,934

🟩 Last Intraday Support: 56,740

🟩 Buyer’s Support Zone: 56,160 – 56,265

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,395) 📈

If BANK NIFTY opens above 57,395 with 200+ points gap-up, the market enters the Opening Resistance Zone (57,395 – 57,513) .

Buyers should be cautious within this zone, focusing only on quick momentum scalps until a 15-minute candle closes above 57,513 .

If 57,513 breaks and sustains, the next target would be 57,881 (Profit Booking Resistance) .

Options Tip: Deploy ATM Call Options with small quantity initially, increase exposure only on candle confirmation. Avoid far OTM calls in strong gap-ups.

📊 SCENARIO 2: FLAT OPENING (Between 56,934 – 57,104) ⚖️

This zone is marked as NO TRADE ZONE on the chart. Prices may behave indecisively here, so patience is key.

If BANK NIFTY sustains above 57,104 after opening flat, expect upside continuation toward the Opening Resistance Zone.

If BANK NIFTY breaks below 56,934 , look for weakness targeting Last Intraday Support 56,740 .

Options Tip: Consider Iron Condor or Strangle Writing setups within this NO TRADE ZONE if volatility is high. Otherwise, wait for breakout confirmation.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,740) ⚠️

If BANK NIFTY opens below 56,740 with a significant gap, bearish momentum is confirmed.

The immediate downside target would be the Buyer’s Support Zone: 56,160 – 56,265 .

Sell-on-rise strategy can be considered after the first 15-minute candle closes below 56,740 .

Options Tip: Prefer ATM or ITM Put Options or build Bear Put Spreads for controlled risk-reward. Avoid naked shorts in case of sudden reversal.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📏 Risk only 1–2% of capital per trade.

⏳ Avoid aggressive entries in the first 15–30 minutes ; let price settle.

🔐 Use Hourly Candle Close for major decision stops, not just wick-based SL.

⚖️ Consider Hedged Strategies (like spreads) during volatile conditions.

📅 Avoid trading just before major news events or expiry if possible.

📌 SUMMARY & CONCLUSION

Bullish Scenario: Gap-up above 57,395 → Target 57,881

Neutral Scenario: Flat between 56,934 – 57,104 → Wait for breakout confirmation

Bearish Scenario: Gap-down below 56,740 → Target 56,160 – 56,265

Trade cautiously around marked zones and follow structured rules. Consistency over prediction!

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This plan is shared for educational and informational purposes only. Please consult your financial advisor before making any investment decisions.

BANK NIFTY view for 16-07-202557193-57213 will act as a crucial resistance followed by there is an upper TL and Broadening top formation.

If it breaks above TL highs will be the targets.

If it takes resistance as mentioned it will reach support level 56600. Once it breaks and closes below 56550 in lower TF we can expect huge downside.

BANKNIFTY : Trading levels and plan for 16-July-2025📊 BANK NIFTY INTRADAY TRADING PLAN – 16-Jul-2025

Based on 15-Min Chart Observation | 200+ Point Gap Considered Significant

📍 IMPORTANT LEVELS TO WATCH

🟥 Resistance Zone: 57,404 – 57,511

⚫️ Opening Resistance / Support: 57,164

🟧 Opening Support Zone: 56,932 – 56,974

🟩 Last Intraday Support: 56,711

🟩 Buyer’s Support Zone: 56,337 – 56,466

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,164) 📈

If BANK NIFTY opens above 57,164 with a gap of 200+ points, expect a continuation toward the Resistance Zone 57,404 – 57,511 .

Aggressive buying should only be considered after a 15-min candle close above 57,164 to confirm strength.

If prices enter the Resistance Zone, avoid fresh longs and look for profit booking opportunities.

Options Tip: Focus on ATM or ITM Call Options . Avoid far OTM options on gap-up days to minimize theta loss.

📊 SCENARIO 2: FLAT OPENING (Between 56,932 – 57,164) 🔄

This range is marked as a mixed zone: Opening Resistance / Support Zone . Price behavior here will set the day’s tone.

If BANK NIFTY sustains above 57,164 , move towards the bullish setup targeting the upper Resistance Zone.

If BANK NIFTY breaks below 56,932 , expect a decline toward Last Intraday Support 56,711 .

Options Tip: Consider Straddle or Strangle setups for premium decay if prices stay sideways between 56,932 – 57,164. Exit quickly if volatility spikes.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,711) ⚠️

A gap-down below 56,711 signals bearish momentum. Initial downside target would be the Buyer’s Support Zone: 56,337 – 56,466 .

Wait for the first 15-minute candle close below 56,711 before shorting to confirm strength.

If prices bounce from Buyer’s Support Zone , observe for reversal signals and manage trailing stop-loss.

Options Tip: Favor ATM or ITM Put Options . On gap-downs, avoid naked far OTM positions—use Bear Put Spreads for balanced risk-reward.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📏 Risk only 1–2% of your trading capital per trade.

⏳ Avoid impulsive entries in the first 15–30 minutes of market opening.

⚖️ Always mark your Stop-Loss based on candle close, not just price spikes.

📈 Choose ATM or ITM options —they offer better Delta and lesser time decay.

💼 Reduce position size when markets open with large gaps to avoid slippage risks.

📌 SUMMARY & CONCLUSION

Bullish Scenario: Above 57,164 → Target 57,404 – 57,511

Range-Bound Scenario: Between 56,932 – 57,164 → Watch closely for breakouts

Bearish Scenario: Below 56,711 → Target 56,337 – 56,466

Stay disciplined and patient. Let the market come to your planned levels instead of chasing moves.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please do your own research or consult a certified financial advisor before making trading decisions.

BANKNIFTY TRADING PLAN – 15-JUL-2025📊 BANK NIFTY TRADING PLAN – 15-JUL-2025

Educational write-up based on key technical levels, considering all opening scenarios with a 200+ points gap threshold

💡 Previous Close: 56,763.60

⏱️ Candle Time Frame: 15-Min Chart

⚠️ Important Note: Allow the first 15–30 minutes to observe price action before committing capital.

Gap Opening Consideration: 200+ points

📌 KEY LEVELS TO WATCH

🟥 Resistance Zone: 57,410

🟥 Last Intraday Resistance: 57,160

🟧 Opening Resistance/Support Zone: 56,932 – 56,974

🟨 Opening Support: 56,629

🟩 Buyer's Zone (Best Buy Area): 56,328 – 56,427

🔴 Extreme Support Zone: 56,139

🚀 SCENARIO 1: GAP-UP OPENING (Above 56,932) 📈

If Bank Nifty opens above 56,932 with strength, immediate upside targets become 57,160 followed by 57,410 .

Do not jump in directly on a gap-up; wait for confirmation via price sustaining above the first 15-minute candle.

Failure to sustain above 56,932 can trigger profit booking. Reversal shorts should be considered below 56,974 if rejection candles form.

Options Traders: Prefer buying ATM/ITM CE options on strength with tight stop-loss. Avoid far OTM as theta burn is higher post gap-up.

📊 SCENARIO 2: FLAT OPENING (Between 56,629 – 56,932) 🔄

Flat opening in this range signals indecision. Observe whether price holds above or below Opening Support 56,629 .

If Bank Nifty sustains above 56,932 after a flat open, momentum can push towards 57,160.

Break below 56,629 increases downside risk. Expect drift towards the Buyer's Zone 56,328 – 56,427 .

Options Traders: Avoid directional trades in the first 15 minutes. Once structure is clear, use ATM strikes for better premium decay protection.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,429) ⚠️

If Bank Nifty opens below 56,429 , immediate attention should be on the Buyer's Zone 56,328 – 56,427 .

This is a key bounce zone. If the zone holds, look for reversal trades; if broken, next possible support lies around 56,139 .

Avoid aggressive puts right at open post-gap-down. Wait for retests and price rejection confirmation before entering.

Options Traders: IV spikes are common post-gap-down. Focus on hedged positions or spreads to avoid overpaying for premiums.

💡 OPTIONS TRADING RISK MANAGEMENT TIPS

Use 1–2% capital allocation per trade.

Respect key support/resistance zones. Avoid chasing prices in emotional setups.

Stick to ATM/ITM strikes to reduce theta and volatility crush.

Be cautious post 2:30 PM – options time decay accelerates heavily.

Always trade with defined stop-loss based on 15-minute candle closes . Avoid relying solely on price ticks.

📌 SUMMARY & CONCLUSION

Bullish Trigger: Gap-up above 56,932 → Targets 57,160 – 57,410.

Neutral Zone: 56,629 – 56,932 → Observe first 15–30 minutes for clarity.

Bearish Trigger: Gap-down below 56,429 → Watch 56,328 – 56,139.

Stay patient. The market often gives second chances even if you miss the first move.

Options premium management and risk control are more important than chasing every move.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is shared for educational and learning purposes only. Please conduct your own research or consult with a financial advisor before making any trading decisions.

Banknifty analysis for the upcoming movement in the index.Banknifty has been trading in a range for a long time and is now trading around the support levels of 56600.

The RSI indicator on the daily charts is showing some bearish divergence and today the market has taken a halt after 2 days of fall.

If the market starts travelling on the lower side there are chances of testing the lower support level of 56120.

The market has been trading in a range of 56600 to 57600. And the support is tested many a times.

Bullish trades can be initiated for intraday play only once the market starts sustaining above today's high of 56900.

Moving averages are also forming a resistance gate around the resistance level. Watch for the breakout and enter only on the retest of the levels.

Major support levels :- 56600, 56270, 56120

Resistance levels :- 56900, 57285

Wait for the price action and trade according to the price action.

BANKNIFTY : Trading levels and Plan for 14-Jul-2025📊 BANK NIFTY INTRADAY PLAN – 14 JULY 2025 (15-Min Chart Analysis)

Educational breakdown for gap-up, flat, and gap-down opening scenarios. Refer to chart zones carefully before executing trades.

📍 Previous Close: 56,712.85

📌 Gap opening threshold: 200+ points

⏱️ Tip: Allow the first 15–30 minutes for price settlement before acting on levels.

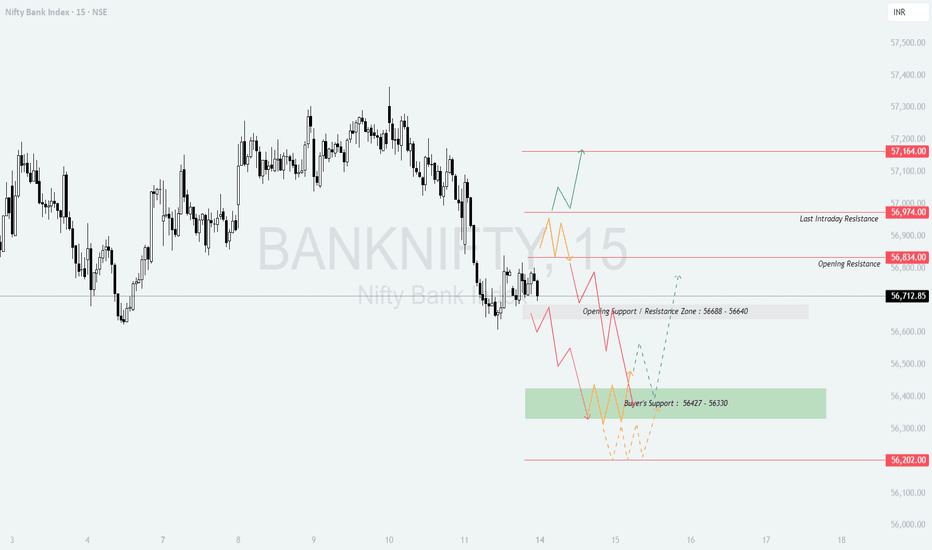

📌 KEY LEVELS TO MONITOR

Resistance Zone: 57,164

Last Intraday Resistance: 56,974

Opening Resistance Zone: 56,834

Opening Support/Resistance Zone: 56,688 – 56,640

Buyer's Support Zone: 56,427 – 56,330

Major Support (Breakdown Zone): 56,202

🚀 SCENARIO 1: GAP-UP OPENING (Above 56,834) 📈

Bias: Bullish with caution at upper resistance zones

If Bank Nifty opens above 56,834 , expect a direct test of Last Intraday Resistance: 56,974 .

Sustainable strength above 56,974 can lead towards 57,164 . This is the final resistance zone where booking profits is advisable.

If prices hit 57,164 early in the day, avoid chasing. Wait for a pullback and observe whether 56,974 holds as support.

On strong bullish momentum, avoid deep OTM call buying — stick with ATM/ITM options for safer theta exposure.

📊 SCENARIO 2: FLAT OPENING (Near 56,712 – 56,688) 🔄

Bias: Neutral-to-bearish depending on first hour structure

If opening is near 56,712 – 56,688 , focus on whether 56,688–56,640 (Opening Support/Resistance Zone) holds.

If price breaks and sustains below 56,640, expect a move toward Buyer’s Support Zone: 56,427 – 56,330 .

Best setups would come if price consolidates above or below this opening zone for 30–45 minutes before directional confirmation.

Wait for breakdown candle confirmation before taking PE trades. Avoid random entries in choppy structure.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,502) ⚠️

Bias: Bearish with buy-on-dip potential at key support

If opening is below 56,502 , Bank Nifty may directly drift towards Buyer’s Support Zone: 56,427 – 56,330 .

Expect sharp reaction candles from this zone. This is where aggressive intraday buyers may step in.

If even 56,330 breaks, a further slide towards 56,202 becomes likely — avoid catching falling knives below this level unless there’s a clear structure forming.

For conservative traders, avoid counter-trading until price reclaims 56,688 after breakdown.

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

Use ATM or ITM options in fast-moving markets; avoid deep OTM trades as theta eats premium quickly.

If VIX is high, apply hedging strategies like vertical spreads to manage risk.

Avoid initiating trades based on the first 5-minute candle alone; confirmation is key.

Never risk more than 1–2% of total capital on any single trade.

Watch Bank Nifty along with Nifty and broader sector indices like PSU Banks for confirmation.

Avoid re-entry into the same trade direction after 2:45 PM to reduce event risk.

📌 SUMMARY & CONCLUSION

Bullish Trigger: Above 56,834 → Target 57,164

Neutral Zone: 56,712 – 56,688 → Wait for structure clarity

Bearish Trigger: Below 56,640 → Watch 56,427 – 56,330 for bounce

Trade with discipline, respect levels, and follow confirmation logic before acting.

Options buyers must avoid holding positions post 3 PM if trades are not in favor.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please do your own research or consult your financial advisor before trading.

Bank Nifty spot 56754.70 by Daily Chart view - Weekly updateBank Nifty spot 56754.70 by Daily Chart view - Weekly update

- Resistance only at Bank Nifty ATH Level 57628.40

- Support Zone 59550 to 56285 of Bank Nifty Index

- *Rising Support Channel seems well respected, just as yet*

- Next Support Zone 55050 to 55450 of Bank Nifty Index Levels

- Support Zone might be tested retested, if not for a breakdown for Bank Nifty Index

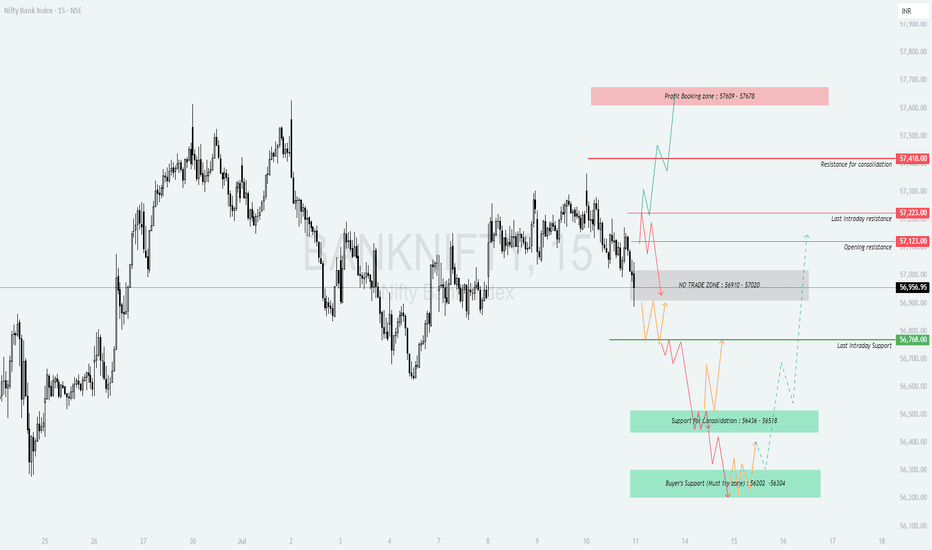

BANKNIFTY : Trading levels and Plan for 11-Jul-2025📊 BANK NIFTY INTRADAY PLAN – 11 JULY 2025 (15min TF)

An educational and actionable trading strategy based on technical zones and opening behavior.

📍 Reference Close: 56,956.95

📈 Gap Opening Threshold: 200+ points

⏱️ Pro Tip: Let the market stabilize in the first 15–30 mins before entering trades for better confirmation.

📌 KEY LEVELS TO WATCH

Opening Resistance: 57,123

Last Intraday Resistance: 57,223

Profit Booking Zone: 57,609 – 57,678

NO TRADE ZONE: 57,020 – 56,910

Last Intraday Support: 56,768

Support for Consolidation: 56,436 – 56,518

Buyer's Support (Must Try Zone): 56,202 – 56,304

📈 SCENARIO 1: GAP-UP OPENING (Above 57,123)

Bias: Bullish, but caution at higher resistances

If Bank Nifty opens above 57,123 , momentum can build toward 57,223 , the last intraday resistance.

A breakout and sustained close above 57,223 opens the door for a move toward the Profit Booking Zone: 57,609–57,678 .

Watch for exhaustion signs like long upper wicks or volume drop at those higher zones to secure profits.

Avoid chasing CE options if IV is high post-gap-up; wait for consolidation or retracement.

📊 SCENARIO 2: FLAT OPENING (Between 57,020 – 56,910) – NO TRADE ZONE 🟧

Bias: Indecisive — Let market choose direction first

A flat open inside the No Trade Zone suggests potential chop and fakeouts.

Avoid fresh positions in this zone unless you get a decisive breakout above 57,123 or breakdown below 56,910 .

Use this time to observe option premium behavior and build directional bias based on price/volume cues.

Patience will be more profitable than premature trades here.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,768)

Bias: Bearish to potential bounce plays

A gap-down below 56,768 puts bears in control, with support at 56,436–56,518 .

If prices break below that consolidation zone, expect a move towards Buyer’s Support Zone: 56,202 – 56,304 , where reversal is possible.

Look for bullish reversal candles at the lower zone for call buying or intraday pullback trade.

If breakdown continues below 56,200, avoid bottom fishing – stick with the trend.

💡 OPTIONS TRADING RISK MANAGEMENT TIPS

Avoid buying OTM options blindly on a gap-up or gap-down – IV crush is real!

Wait for a candle confirmation before jumping into a trade.

Use 15-minute candle close-based SL to prevent getting whipsawed.

Avoid trading in No Trade Zone unless a clear direction is established.

Use vertical spreads to limit risk and hedge positions.

Protect profits after 2 PM – avoid entering new trades in the last hour unless very high conviction.

📌 SUMMARY & CONCLUSION

Bullish Momentum: Above 57,123, target 57,609–57,678

Neutral/Choppy Zone: 57,020 – 56,910 – avoid taking trades here

Bearish Zone: Below 56,768, with bounce watch at 56,202–56,304

Let price action confirm your bias before committing capital

Control risk with predefined SL and avoid emotional trading

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. The above analysis is for educational purposes only. Please consult a certified financial advisor before making trading decisions.

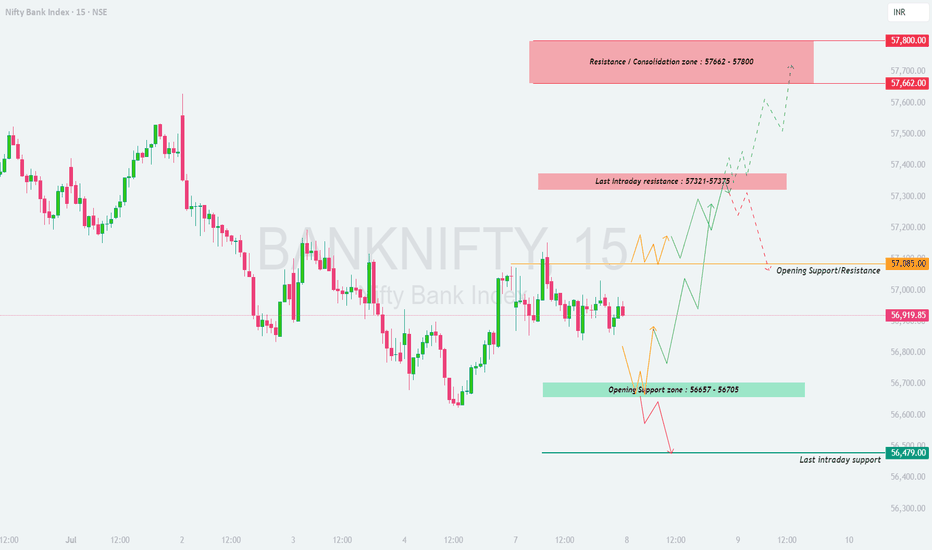

BANKNIFTY : Trading levels and plan for 10-July-2025📊 BANK NIFTY INTRADAY PLAN – 10 JULY 2025 (15min TF)

An educational, level-based strategy plan based on key price zones and expected market behavior

📍 Reference Close: 57,187.85

📈 Gap Opening Threshold: 200+ points

⏱️ Tip: Wait for the first 15–30 minutes post-opening before confirming breakout/breakdown setups

🔍 IMPORTANT LEVELS TO WATCH

Opening Resistance: 57,402

Resistance for Sideways & Consolidation: 57,662 – 57,797

Opening Support Zone: 57,009 – 56,962

Last Intraday Support: 56,766

📈 SCENARIO 1: GAP-UP OPENING (Above 57,402)

Bias: Bullish with potential consolidation at upper zones

A gap-up above 57,402 would signal early bullish strength.

Upside targets could stretch to 57,662–57,797 – a known resistance for consolidation.

If price shows rejection candles or wicks in this zone, consider partial profit booking or reversal setups.

Only continue bullish trades if 15-min candle closes above 57,797 with strong volume.

📊 SCENARIO 2: FLAT OPENING (Between 57,009 – 57,402)

Bias: Neutral to breakout – depends on price reaction

This zone is a battle ground. Price may test both support and resistance.

If Nifty Bank sustains above 57,205 and reclaims 57,402 , a breakout trade may evolve.

On the flip side, if it slips below 57,009 , sellers may try to push it toward 56,766 .

Avoid early trades. Wait for either a breakout above resistance or breakdown below support.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,962)

Bias: Bearish to bounce watch

A gap-down below 56,962 will likely push price towards 56,766 – a key level for intraday reversal or panic selling.

If 56,766 holds, we may see short covering. Look for bullish reversal patterns in this zone.

If it fails, next leg of decline may start and one can ride the downside using puts or short futures with tight SL.

Reversal trades must be confirmed by bullish structure; avoid bottom fishing without confirmation.

💡 OPTIONS RISK MANAGEMENT TIPS

Trade near support/resistance, not inside indecision zones

For uncertain sessions, favor spreads (Bull Call/Bear Put) to limit risk

Avoid averaging down losing options – instead, re-analyze your thesis

Stick to 15-min candle close-based stop-loss to avoid fake moves

Protect capital during sideways zones like 57,009–57,205 – stay nimble

Time decay impacts premium heavily post-2PM – be cautious in scalping late trades

📌 SUMMARY & CONCLUSION

Bullish above 57,402 with upside resistance at 57,797

Sideways zone between 57,009 – 57,402 ; breakout to decide direction

Bearish bias below 56,962 , with last support at 56,766

Use patience and discipline – let the levels guide your trades

⚠️ DISCLAIMER: This is not investment advice. I am not a SEBI-registered analyst. The analysis is purely for educational purposes. Please consult your financial advisor before taking any trading decisions.

BANKNIFTY - Trading plan and levels for 08-Jul-2025# 💼 \ BANK NIFTY INTRADAY PLAN – 08-July-2025\

📉 \ Index CMP:\ 56,919

📍 \ Chart Setup:\ Support/Resistance Zones + Price Reaction Patterns

🔍 \ Key Levels Analyzed for All Opening Scenarios (200+ pts gap considered)]

---

### 🔑 \ Key Zones To Watch:\

🟧 \ Opening Support / Resistance:\ **57,085**

🟥 \ Last Intraday Resistance Zone:\ **57,321 – 57,375**

🟥 \ Profit Booking / Supply Zone:\ **57,662 – 57,800**

🟦 \ Opening Support Zone:\ **56,657 – 56,705**

🟫 \ Last Intraday Support:\ **56,479**

---

## 🟩 \ 1. GAP-UP Opening (200+ points above 57,085)\

If BANKNIFTY opens above **57,285–57,375**, watch how it behaves inside the intraday resistance zone.

\

\ 📈 \ Breakout Opportunity:\

If price breaks above **57,375** with strength, target the higher **supply zone at 57,662–57,800**.

Entry only after a 15-min candle close above 57,375 with volume.

\ 🔻 \ Reversal from Resistance:\

If price opens in this zone and shows rejection (wick, bearish engulfing), short toward **57,085** with SL above 57,400.

\ 🧠 \ Tip:\ Avoid fresh buying directly into 57,662–57,800 unless market shows sustained momentum.

\

## 🟨 \ 2. FLAT Opening (between 56,880 – 57,085)\

Likely to consolidate early; wait for clean directional move from support or breakout level.

\

\ 🎯 \ Upside Trade:\

Buy above **57,085** if price sustains, target 57,321–57,375.

Watch for continuation if that zone breaks (same setup as Gap-Up case).

\ 🔻 \ Downside Trade:\

If price breaks below **56,880**, expect it to head toward **Opening Support Zone at 56,657–56,705**.

Avoid shorting aggressively in the middle of the range; instead trade near zones.

\ 🕒 \ Patience Pays:\

Wait 15–30 minutes post open for confirmation before executing trades.

\

## 🟥 \ 3. GAP-DOWN Opening (below 56,705)\

A bearish open below the Opening Support Zone brings the **Last Intraday Support (56,479)** into focus.

\

\ 📉 \ Short Opportunity:\

If price fails to sustain above 56,657 after a gap down and retests the level, short with a target of **56,479**.

SL should be just above 56,705.

\ 🔁 \ Reversal Opportunity:\

If price bounces strongly from **56,479–56,500**, a reversal trade may be taken back toward **56,705–56,880** zone.

Use bullish engulfing or inside bar breakout as confirmation.

\ 📌 \ Note:\ This zone is the last hope for intraday bulls – trade cautiously.

\

---

## 🧠 \ Risk Management Tips for Options Traders:\

✅ Trade ATM/ITM options to avoid time decay during consolidation.

✅ Avoid holding positions beyond 12:00 PM if direction remains unclear.

✅ Don’t buy CALLS near known resistance zones or PUTS near support without breakout confirmation.

✅ Use **fixed risk-reward ratio** setups – ideally 1:2 or more.

✅ Never average losers in options – especially in volatile zones.

---

## 📌 \ Summary & Conclusion:\

🎯 \ Above 57,375 = Bullish Continuation\ toward 57,800 possible.

⚠️ \ Rejection from 57,375 = Sell-off to 57,085 or lower.\

🧲 \ Buyers expected at 56,657–56,705 and 56,479.\

📊 Structure favors trend continuation if 57,085 holds as support.

---

⚠️ \ Disclaimer:\

This plan is for educational purposes only. I am \ not a SEBI-registered advisor\ . Please do your own research or consult a financial advisor before taking any trade based on this plan.

BANKNIFTY : Trading levels and plan for 07-July-2025📘 BANKNIFTY TRADING PLAN – 07-Jul-2025

🕒 Timeframe: 15-Minute | 📈 Structure: Support & Resistance Reaction Zones | ⚙️ Logic: Price Action-Based Intraday Decisioning

📍 Key Levels to Watch:

🔸 Opening Resistance / Support Zone: 57,086

🔸 Last Intraday Resistance Zone: 57,348 – 57,405

🔸 Profit Booking Zone: 57,732 – 57,880

🔹 Opening & Intraday Support Zone: 56,740

🔹 Minor Support Before Breakdown: 56,899

🟩 1. GAP-UP Opening (200+ points above 57,086)

If Bank Nifty opens near or above 57,300–57,400, it will be entering the Last Intraday Resistance Zone. Wait for price to sustain above 57,405 on 15-min candle close to confirm bullish strength.

📈 Action: Buy on breakout above 57,405, targeting 57,732 – 57,880 zone. Partial profit can be booked at 57,732.

🛑 Stop Loss: Keep SL just below 57,348 zone or use 15-min candle low.

⚠️ Caution: Avoid fresh longs near 57,800, as this is a profit booking zone.

If price fails to hold above 57,405 and shows rejection candles like doji/inverted hammers:

📉 Action: Consider shorting with SL above 57,405, targeting 57,086.

🛑 SL: Above the rejection wick

🎯 Target: Retest of breakout near 57,086

🟨 2. Flat Opening (between 56,899 – 57,086)

This range is the neutral zone, where the index may consolidate or create a directional breakout.

🕒 Wait for the first 15–30 mins to allow price action to unfold.

📈 If price breaks above 57,086 with volume, initiate long trade toward 57,348 – 57,405.

📉 If price rejects from 57,086 or breaks below 56,899, a short trade toward 56,740 becomes viable.

🛑 SLs: Use candle-close basis stops near breakout/breakdown levels.

🟥 3. GAP-DOWN Opening (200+ points below 56,740)

A gap-down below 56,740 brings us directly near the last intraday support breakdown area.

📉 Action: Sell on breakdown retest of 56,740, target 56,500 – 56,410 if downside continues.

🔄 Reversal Trade: If price sharply rebounds from 56,740 and crosses 56,899, consider reversal long trades with target 57,086.

🛑 SL: For short – above breakdown candle; for reversal – below support low.

💡 Risk Management Tips for Options Traders:

✅ Trade near breakout/breakdown zones, avoid chasing after wide moves

✅ Avoid buying deep OTM options in time decay zones (post 1 PM)

✅ Keep risk fixed per trade – e.g., 1%–2% of capital

✅ Use spreads (like bull call spread or bear put spread) when volatility is high

✅ Exit when trade structure invalidates (even before SL hits)

📝 Summary & Conclusion:

🔹 Price is currently reacting around the opening supply zone of 57,086.

🔸 Bulls will need to sustain above 57,405 to push toward the 57,732 – 57,880 zone.

🔻 Bears will gain momentum below 56,740, targeting deeper correction.

🕒 Best trades usually form after 15–30 mins of price stability – avoid rushing entries.

⚠️ Disclaimer:

I am not a SEBI-registered analyst . This analysis is for educational purposes only. Please do your own research or consult a financial advisor before making any trading decisions.

BANKNIFTY : Trading levels and plan for 02-Jul-2025

\ 📊 BANKNIFTY TRADING PLAN – 2-Jul-2025\

📍 \ Previous Close:\ 57,443

📏 \ Gap Opening Consideration:\ ±200 points

🧭 \ Key Zones to Watch:\

🔸 \ No Trade Zone:\ 57,382 – 57,514

🔺 \ Last Intraday Resistance:\ 57,741

🔻 \ Last Intraday Support:\ 57,230

🟦 \ Buyer’s Support for Reversal:\ 57,033 – 57,080

🟥 \ Sharp Resistance for Profit Booking:\ 57,930

---

\

\ \ 🚀 GAP-UP OPENING (Above 57,741):\

A gap-up above \ 57,741\ breaks the intraday resistance and enters a zone where further upside is likely if momentum sustains. However, the \ profit-booking zone near 57,930\ may act as a supply zone.

✅ \ Plan of Action:\

• If price sustains above 57,741 with volume, initiate long trades targeting 57,930

• Watch for signs of exhaustion near 57,930 — trailing stop-loss or partial booking is advised

• Avoid fresh shorts unless reversal candles appear near 57,930

🎯 \ Trade Setup:\

– \ Buy above:\ 57,741 with SL below 57,690, Target: 57,930

– \ Sell only if reversal spotted at 57,930 with SL above 57,960

📘 \ Tip:\ Use trailing stop-loss once in green zone to protect profits.

\ \ ⚖️ FLAT OPENING (Between 57,382 – 57,514):\

Flat opening near the \ No Trade Zone\ suggests indecisiveness. Let the price move outside this range before taking directional trades.

✅ \ Plan of Action:\

• Avoid trading inside 57,382–57,514; fakeouts are likely

• Wait for a breakout above 57,514 to go long or breakdown below 57,382 to go short

• Keep trades light in early session unless trend is clear

🎯 \ Trade Setup:\

– \ Buy above 57,514], SL: 57,440, Target: 57,741

– \ Sell below 57,382], SL: 57,440, Target: 57,230

📘 \ Tip:\ Flat opens often trap early option buyers. Wait for clean structure before entering.

\ \ 📉 GAP-DOWN OPENING (Below 57,230):\

A gap-down below \ 57,230\ brings the price into critical buyer’s support zone between \ 57,033–57,080\ . Expect sharp reversals or further downside based on price action.

✅ \ Plan of Action:\

• Observe price behavior in 57,033–57,080 zone

• Reversal here offers good R\:R long setups

• Breakdown of this zone may trigger fast decline

🎯 \ Trade Setup:\

– \ Buy near 57,050], SL: 57,000, Target: 57,230 / 57,382

– \ Sell below 57,030], SL: 57,080, Target: 56,880

📘 \ Tip:\ Don’t preempt reversals. Wait for candle confirmation or bullish engulfing near support.

---

\ 📌 SUMMARY & TRADE LEVELS:\

✅ \ Bullish Above:\ 57,514 → 57,741 → 57,930

🔽 \ Bearish Below:\ 57,382 → 57,230 → 57,033

🟧 \ No Trade Zone:\ 57,382–57,514 (stay cautious inside this range)

📍 \ Major Action Zones:\

– 🔺 \ Resistance:\ 57,741 & 57,930

– 🔻 \ Supports:\ 57,230 & 57,033–57,080

---

\ 💡 OPTIONS TRADING RISK MANAGEMENT:\

🛡️ \ Do's:\

• Use hedged strategies like Bull Call Spreads in high IV

• Position sizing should be <2% of capital per trade

• Wait for momentum candles to enter directional trades

🚫 \ Don'ts:\

• Avoid naked option selling in volatile zones

• Never average losers

• Don’t rush entry at opening candle

📘 \ Bonus Tip:\ On flat openings, try neutral strategies like Iron Condors if volatility expected to drop.

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. The above content is purely for educational and illustrative purposes. Always consult your financial advisor before taking any trade. Trade at your own risk and always use stop-loss to protect your capital.

BANKNIFTY : TRADING LEVELS AND PLAN FOR 01-JUL-2025

\ 📊 BANK NIFTY TRADING PLAN – 1-Jul-2025\

📍 \ Previous Close:\ 57,278

📏 \ Gap Opening Consideration:\ ±200 points

📈 \ Chart Timeframe:\ 15-min

🧭 \ Zones to Watch:\

🔴 Resistance for Sideways/Profit Booking: \ 57,808 – 57,980\

🔺 Last Intraday Resistance: \ 57,494\

🟦 Opening Support/Resistance Zone: \ 57,198 – 57,166\

🟩 Last Intraday Support Zone: \ 56,801 – 56,882\

---

\

\ \ 🚀 GAP-UP OPENING (Above 57,680):\

If Bank Nifty opens above \ 57,680\ , it directly enters the \ Sideways/Profit Booking Zone\ (57,808–57,980). This area has high chances of resistance or reversal due to past selling pressure and overbought signals.

✅ \ Plan of Action:\

• Wait for price confirmation with a 15-min candle close above 57,980

• Consider short trades near the upper range if price gets rejected

• Avoid fresh longs unless breakout above 57,980 sustains with volume

🎯 \ Trade Setup:\

– \ Sell near:\ 57,950 with tight SL above 58,000

– \ Target:\ 57,494 or lower

– \ Buy above breakout zone 58,000 with SL below 57,800

📘 \ Tip:\ After strong gap-ups, wait for consolidation or trap confirmation before acting.

\ \ ⚖️ FLAT OPENING (Between 57,200 – 57,300):\

If the index opens flat, it will trade near the \ Opening Support/Resistance Zone\ of \ 57,198 – 57,166\ . Expect initial indecision. Price action near this zone will guide the day’s trend direction.

✅ \ Plan of Action:\

• Wait for a clear break above 57,494 for bullish confirmation

• If price holds above 57,166 and makes higher lows, look for longs

• Breakdown below 57,166 = short opportunity targeting 56,882

🎯 \ Trade Setup:\

– \ Buy above:\ 57,494 with SL below 57,300

– \ Sell below:\ 57,166 with SL above 57,300

📘 \ Tip:\ Don’t trade within the 57,166–57,494 chop zone unless a breakout confirms.

\ \ 📉 GAP-DOWN OPENING (Below 57,050):\

Gap-downs can attract dip buyers, but only if the \ 56,801 – 56,882\ support zone holds. Below that, the market turns weak again.

✅ \ Plan of Action:\

• Wait for reversal signs (e.g., hammer candle) at the 56,801 zone

• Avoid long trades unless price reclaims 57,166

• A clean break below 56,800 can trigger panic selling

🎯 \ Trade Setup:\

– \ Buy at reversal near:\ 56,801 with SL below 56,700

– \ Sell below breakdown of:\ 56,800 with SL above 56,950

– \ Target:\ 56,500 or trailing based on structure

📘 \ Tip:\ Avoid buying early in a falling market. Let buyers show strength.

---

\ 🧭 IMPORTANT LEVELS FOR 1-Jul-2025:\

🔺 \ Resistance:\ 57,494 / 57,808 – 57,980

🟧 \ Neutral Zone:\ 57,166 – 57,494 (choppy range)

🟩 \ Support Zones:\ 57,166 / 56,882 / 56,801

---

\ 💡 OPTIONS TRADING – RISK MANAGEMENT TIPS:\

✅ Use \ weekly ATM straddles or strangles\ only after a range breakout

✅ Don’t overpay for premiums on gap-ups or IV spikes

✅ Follow the \ 2:1 risk-reward\ rule strictly

✅ Size your trade based on volatility

✅ Consider spreads (like bull put or bear call) to manage risk in premium decay environments

🛑 Avoid selling naked options on event or trending days.

---

\ 📌 SUMMARY – QUICK ACTION RECAP:\

• ✅ \ Bullish above:\ 57,494 → Target 57,808+

• ❌ \ Bearish below:\ 57,166 → Target 56,882 and 56,801

• ⚠️ \ Neutral chop zone:\ 57,166 – 57,494 → Avoid indecisive trades

🎯 \ Top Opportunity Zones:\

– Long breakout trade above 57,494

– Short breakdown trade below 57,166

– Reversal play from 56,801 if support holds

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is shared purely for educational purposes. Please consult with your financial advisor before taking any trade. Always manage risk with stop-loss and position sizing. Trade responsibly.