BATAINDIA

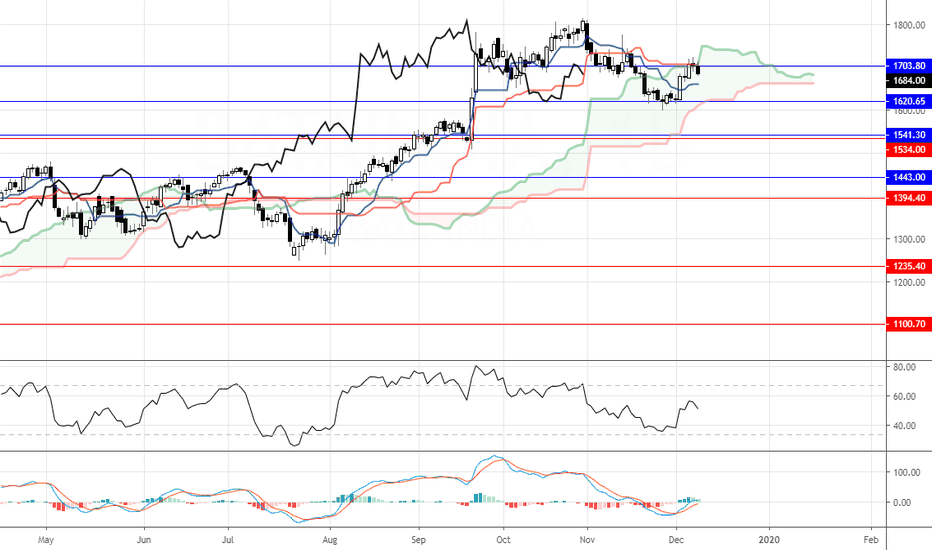

Bata India: Has the trend bent?The stock was into dominant trend up, last few months the stock hasn’t displayed any zeal to move up. Now at a high intensity resistance level, the price consolidated and formed a negative candle pattern. The RSI is into neutral zones creating bearish signs. Macd is into bearish zone. The stock is expected to correct to 1620-1540 levels where it may find support. Above 1735 the bearish analysis is negated.

NSE:BATAINDIA is sitting on a critical trendline supportNSE:BATAINDIA is basically on a trendline taking support at the moment that extends from June 2019 highs to today. This is a critical prize zone for BATAINDIA . Any closes below the trendline on a daily basis will signal a Sell/Short and a strong bounce will a candlestick pattern like a bullish engulfing will signal a low risk Buy with the Stop loss being below the swing low.

Bata India is at an important level.BATA INDIA: The stock is in a dominant trend up though we notice there is a momentum loss which is leading a correction. Now the stock is just at the SPAN support, a good price action (bullish candle) is required here to assert the trend else it may lead to a deeper correction till 1530 levels! We can notice a TK cross. The RSI took resistance at the bear extreme levels and crippled into neutral zone. MACD is also neutral as of now.