XAUUSD (ONDA) IntraSwing Levels For 09th - 10th JAN2026(3.30 am)XAUUSD (ONDA) IntraSwing Levels For 09th - 10th JAN2026(3.30 am)

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Beyond Technical Analysis

Dow Future (DJI) IntraSwing Levels for 09th-10th Jan 2026 (2:30 Dow Future (DJI) IntraSwing Levels for 09th-10th Jan 2026 (2:30 am)

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

GIFTNIFTY IntraSwing Levels for 09th JAN 2026🚀Follow & Compare NIFTY spot Post for Taking Trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

NIFTY 50- Bearish Move | Major Trend Still Intact Above Support📊 NIFTY 50 – Range Bound Near Resistance | Major Trend Still Intact Above Support

🧠 Educational Analysis

NIFTY 50 is currently trading within a rising channel, consolidating after a strong upside move.

Price is facing trendline resistance (red line) on the upside, while it continues to respect major trendline support (green line) from below.

This phase indicates healthy consolidation, not weakness — provided key supports remain intact.

🔍 Technical Highlights

🔴 Red Line: Rising trendline resistance, acting as a supply zone for now.

🟢 Green Line (Major Support): Long-term trendline support keeping the broader uptrend intact.

🟩 Horizontal Green Line: Immediate support zone around 25,650–25,700 area.

📉 Caution Zone: A decisive break below the horizontal support may invite deeper retracement toward the major trendline.

📘 Educational Purpose

This chart highlights an important market lesson:

Consolidation near resistance within an uptrend is normal and healthy.

The Only Matter of Concern Right Now is the Global Unrest and Trumps Tariff wars.

⚠️ Disclaimer

This analysis is shared only for educational purposes and is not financial advice.

Always do your own research or consult a professional before trading.

🏷️ Hashtags

#Nifty #Nifty50 #MarketStructure #Trendline #SupportResistance #TechnicalAnalysis #PriceAction #StockTech #TradingView #EducationalIdea #IndianMarkets

Trending Series: DIXON can reverse from here.TRENDING SERIES: DIXON

Screenshot Daily Trend Analysis with RSI Bullish Divergence

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

NIFTY Analysis for 09th JAN 2026: IntraSwing Spot levels NIFTY Analysis for 09th JAN 2026: IntraSwing Spot levels

🚀Follow GIFTNIFTY Post for NF levels

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

Do comment if Helpful .

Do Comment for In depth Analysis.

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

In depth Analysis will be added later (If time Permits)

________________^^^^^^^^^^^^^^^^_________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

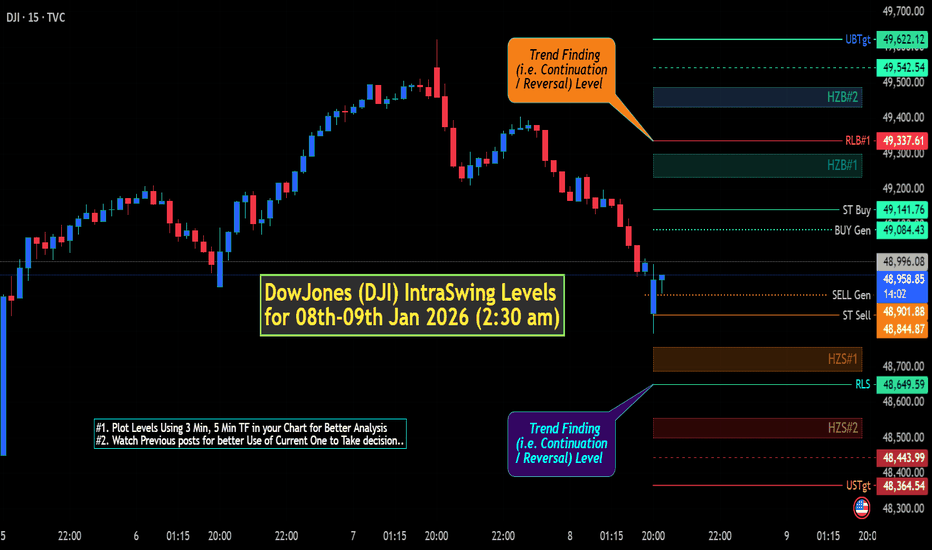

DowJones (DJI) IntraSwing Levels for 08th-09th Jan 2026 (2:30 amDowJones (DJI) IntraSwing Levels for 08th-09th Jan 2026 (2:30 am)

👇🏼Screen shot of Todays DJI FUTURE=>Dow Jones FUT(8th Jan 2026 Till now) trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

Do comment if Helpful .

Do Comment for In depth Analysis.

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

In depth Analysis will be added later (If time Permits)

________________^^^^^^^^^^^^^^^^_________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Gbpjpy Projecting in sellside delivery till weekly imbExpecting GBPJPY short term sell delivery,pric rejected from monthly Order block after taking previous monthly highs, expecting liquidity to take till weekly imbalance, onwards based on confirmation bullish move probably expected (the fundamental idea promotes buy from weekly imb where as GBP interest rates are 3.75% (more strength fundamentally than yen ) and Jpy 0.75%

Dow Future IntraSwing Levels for 08th-09th Jan 2026 (2:30 am)💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

Do comment if Helpful .

Do Comment for In depth Analysis.

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

In depth Analysis will be added later (If time Permits)

________________^^^^^^^^^^^^^^^^_________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

ENGINEERS INDIA LIMITED (EIL) --------------------------------

1. COMPANY OVERVIEW

--------------------------------

Engineers India Limited (EIL) is a Government of India enterprise engaged in engineering consultancy, project management, and turnkey execution (LSTK/EPC) services. The company primarily operates in hydrocarbons, energy, fertilisers, infrastructure, and related sectors, with growing international presence.

EIL’s business is divided into:

- Consultancy & Engineering Services (asset-light, high margin)

- Turnkey / LSTK Projects (execution-heavy, lower margin)

--------------------------------

2. FUNDAMENTALS SNAPSHOT

--------------------------------

Financial Performance (Standalone)

H1 FY26:

- Revenue: ₹1,757 crore (↑ ~37% YoY)

- Profit After Tax: ₹185 crore (↑ ~38% YoY)

- EPS: ₹3.29

- Order Book (Sep 2025): ₹13,131 crore (all-time high)

Profitability & Balance Sheet:

- ROE (FY25): ~23%

- ROCE (FY25): ~25%

- Debt-to-Equity: ~0.01 (effectively debt-free)

- Dividend Yield: ~2%

Segment Economics:

- Consultancy Revenue Mix: ~46–48%

- Consultancy Margin: ~20–25%

- Turnkey Revenue Mix: ~52–54%

- Turnkey Margin: ~5–7%

Key Fundamental Observations:

- Strong revenue and profit growth in FY26 so far

- Margins led by consultancy business

- Balance sheet strength remains a key positive

- Order book provides multi-year revenue visibility

--------------------------------

3. TECHNICALS SNAPSHOT

--------------------------------

Current Price: ~₹200

Trend Indicators:

- EMA Structure: Mixed

- Short-term EMAs below long-term EMA

- Price vs EMA63: Slightly above

- RSI (14): ~50 (neutral)

- RS / ROC Quadrant: Weakening

- Volume: Below average

- 52-week range: ₹142 – ₹255

Technical Interpretation:

- Long-term structure remains intact

- Short-term momentum is weak

- No strong trend confirmation currently

- Stock is in a consolidation / digestion phase

--------------------------------

4. MANAGEMENT COMMENTARY (SUMMARY)

--------------------------------

Execution & Growth:

- Management reported strong execution in H1 FY26

- Revenue growth exceeded initial expectations

- Full-year growth guidance was revised upward after H1 performance

Margins:

- Consultancy margins guided and maintained in the 20–25% range

- Turnkey margins guided at 6–7%, with quarterly volatility acknowledged

- One-time provision write-backs impacted certain quarters

Order Inflows:

- H1 FY26 order inflow: ~₹3,765 crore

- International consultancy orders formed a meaningful portion

- Management indicated confidence in achieving full-year order inflow targets

Joint Venture Update:

- RFCL joint venture reported losses in H1 FY26 due to operational shutdowns

- Management indicated normalization in subsequent quarters

Management Tone:

- Guidance largely data-backed

- Conservative initial commentary followed by upgrades post execution

- Clear disclosure of one-off items and operational issues

--------------------------------

5. KEY RISKS TO MONITOR

--------------------------------

- Volatility in turnkey project margins

- Execution and recovery of joint venture operations

- Sustainability of high consultancy margins

- Timing of large project awards and execution milestones

- Market sentiment and broader PSU valuation cycles

--------------------------------

END OF REPORT

--------------------------------

Tremendous FALL and RECOVERY of LMT on News & Sentiments1st News

- Donald Trump said that he would not permit dividends or stock buybacks for U.S. defense companies until they fix military equipment production and delivery issues.

- Now it is required to understand that dividends are payouts to shareholders out of profits

- Generally, when dividends are not paid, the company uses the retained fund in its development, research, investing, etc.

But what's the matter? Why is he not allowing defense companies to pay dividends to their shareholders??

- Basically, he is criticizing the defense industry for prioritizing shareholder payouts over investing in factories, R&D, and faster production of military equipment.

- He also suggested capping executive pay until those issues are resolved.

Impact: The stock prices of LMT fell 7% during the regular trading hours upon the ban on shareholders' payout

--------------------------------------------------------------------------------------------------------------

2nd News

President Trump announced that he is determined to increase the US Military budget to $1.5 trillion in 2027 due to “tremendous” tariff revenue.

This would be a near 70% increase from 2025 levels.

Impact: Later, in the extended trading hours, prices recovered substantially, rising ~8.30% on the announcement of a hike in the defense budget

GIFTNIFTY IntraSwing Levels For 09th JAN 2026❇️ GIFTNIFTY IntraSwing Levels for 09th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

XAUUSD (ONDA) IntraSwing Levels For 08th - 09th JAN2026(3.30 am)XAUUSD (ONDA) IntraSwing Levels For 08th - 09th JAN2026(3.30 am)

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

MUTHOOT WILL IT HOOT?This stock has been climbing all walls of worry and especially with the yellow metal (gold) northward bound in these uncertain times, would bring ur attention to this stock an sl of 3726 to be maintained.

Buying condition : abv 3785 and below 3824 .... this is mid term idea so patience in the trade is a must albeit with agressive stops at3726 -3700 closing basis daily , and if price starts sustaining below 3724 would look to close out trade and book loss.

How to Move Capital Smartly for Consistent Market ReturnsRotation Strategies Guide:

Rotation strategies are a powerful yet often misunderstood approach to investing and trading. At their core, rotation strategies focus on shifting capital from one asset, sector, or market to another based on changing market conditions, relative strength, and economic cycles. Instead of staying emotionally attached to a single stock or sector, rotation strategies encourage flexibility, discipline, and adaptability—key traits required for long-term success in financial markets.

This guide explains rotation strategies in depth, covering their logic, types, execution methods, benefits, risks, and practical application.

Understanding the Concept of Rotation

Markets are dynamic. Money constantly flows from one area to another. When one sector becomes expensive or loses momentum, capital often moves into another sector offering better growth or value. Rotation strategies aim to track and follow this flow of money rather than fighting it.

For example, during economic expansion, capital may rotate into cyclical sectors such as metals, infrastructure, and banking. In contrast, during uncertainty or slowdown, money may move into defensive sectors like FMCG, pharmaceuticals, or utilities. Rotation strategies attempt to capture these shifts early and ride them efficiently.

Why Rotation Strategies Matter

One of the biggest challenges for traders and investors is stagnation—holding assets that move sideways or decline while other opportunities outperform. Rotation strategies solve this problem by ensuring capital is always working in the strongest areas of the market.

Key reasons rotation strategies are important:

They help avoid long drawdowns

They improve risk-adjusted returns

They reduce emotional decision-making

They align trades with institutional money flow

They adapt naturally to changing market cycles

Instead of predicting tops and bottoms, rotation strategies focus on relative performance, which is more reliable and practical.

Types of Rotation Strategies

Rotation strategies can be applied at multiple levels depending on your trading or investing style.

Sector Rotation

This involves moving capital between sectors such as IT, banking, energy, pharma, and FMCG based on economic cycles, earnings growth, and momentum. Sector rotation is widely used by mutual funds and institutional investors.

Asset Class Rotation

Here, capital is rotated between equities, bonds, commodities, currencies, and cash. For example, during inflationary periods, money may rotate from bonds into commodities and equities.

Market-Cap Rotation

This strategy focuses on shifting between large-cap, mid-cap, and small-cap stocks. In early bull markets, large caps often lead. As confidence increases, capital rotates into mid and small caps for higher returns.

Style Rotation

Style rotation involves switching between growth, value, dividend, and momentum stocks based on market conditions and valuation cycles.

Time-Frame Rotation

Traders may rotate between short-term momentum trades and positional trades depending on volatility, trend strength, and market clarity.

How Rotation Strategies Work in Practice

Rotation strategies rely on relative strength analysis rather than absolute price movement. An asset does not need to be rising strongly; it only needs to perform better than alternatives.

Common tools used include:

Relative Strength (RS) or Relative Strength Index comparison

Sector and index performance ranking

Moving averages and trend analysis

Volume expansion and contraction

Ratio charts (one asset divided by another)

For example, if banking stocks outperform the broader index consistently while IT stocks underperform, rotation logic suggests shifting capital from IT to banking—even if both are rising.

The Role of Economic Cycles

Economic cycles play a crucial role in rotation strategies. Markets generally move through expansion, peak, contraction, and recovery phases. Each phase favors different sectors and assets.

Early Recovery: Banking, infrastructure, industrials

Expansion: Metals, capital goods, mid-caps

Late Cycle: FMCG, healthcare, quality large caps

Recession or Fear Phase: Gold, bonds, defensive stocks

Understanding these cycles allows traders and investors to anticipate rotations instead of reacting late.

Risk Management in Rotation Strategies

Rotation does not mean constant buying and selling without structure. Poor execution can increase transaction costs and emotional stress. Proper risk management is essential.

Important risk controls include:

Clear entry and exit rules

Defined rebalancing frequency (weekly, monthly, quarterly)

Stop-loss or relative underperformance exit

Position sizing based on volatility

Avoiding over-rotation during choppy markets

Rotation strategies work best when markets show clear leadership and trends. During sideways or range-bound conditions, patience is required.

Advantages of Rotation Strategies

Rotation strategies offer several long-term advantages:

Capital Efficiency: Money is allocated to stronger opportunities

Reduced Opportunity Cost: Avoids holding dead or weak assets

Lower Emotional Bias: Decisions are rule-based, not emotional

Adaptability: Works across different market environments

Consistency: Focuses on steady performance rather than big wins

For disciplined traders, rotation strategies often outperform random stock picking over time.

Common Mistakes to Avoid

Many traders fail with rotation strategies due to improper execution rather than flawed logic.

Common mistakes include:

Rotating too frequently without confirmation

Chasing late-stage outperformers

Ignoring transaction costs and taxes

Overcomplicating analysis

Lack of patience during transition phases

Successful rotation requires clarity, patience, and consistency.

Who Should Use Rotation Strategies

Rotation strategies are suitable for:

Swing traders looking for momentum leadership

Positional traders following sector trends

Long-term investors managing portfolios

Professionals seeking systematic allocation methods

They are especially useful for traders who prefer structure over prediction.

Conclusion

Rotation strategies are not about forecasting the future; they are about responding intelligently to what the market is already doing. By tracking relative strength, understanding economic cycles, and managing risk effectively, traders and investors can consistently stay aligned with market leadership.

In a world where markets constantly evolve, rotation strategies provide flexibility, discipline, and a logical framework to grow capital steadily. Those who master rotation learn a crucial truth of the market: money never disappears—it only moves. The key to success is learning how to move with it, not against it.

owJones (DJI) IntraSwing Levels for 07th-08th Jan 2026 (2:30 am)DowJones (DJI) IntraSwing Levels for 07th-08th Jan 2026 (2:30 am)

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

NIFTY Analysis for 08th JAN 2026: IntraSwing Spot levelsNIFTY Analysis for 08th JAN 2026: IntraSwing Spot levels

🚀Follow GIFTNIFTY Post for NF levels

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Sunshine always makes me happy.( SUN &UNIONBANK)Friends,In financial circles, the "Sun Cycle" typically refers to one of two distinct concepts: the Astrological Sun cycle (based on its transit through the zodiac) or the Physical Solar/Sunspot cycle (based on electromagnetic activity).

While traditional financial analysis dismisses these as "extrinsic variables," many astro-traders and even some "econophysics" researchers study them for timing market reversals and sector rotations.

Today we will only talk about Sun -Astro Cycles.

The Astrological Sun Cycle (Annual)

In financial astrology, the Sun is considered the "King"(Market Leaders) or the soul of the market. Its 365-day journey through the 12 zodiac signs is used to predict which sectors will lead or lag.

Sun-Ruled Sectors

Traders who follow this cycle look for strength in specific industries when the Sun is "strong" (e.g., in Aries or Leo):

Gold & Metals: Represent the Sun's physical value.

Government/PSUs: Public Sector Undertakings and government bonds.

Energy & Power: Utilities, solar power, and large-scale infrastructure.

Leadership: Companies with high-profile, charismatic CEOs.

I am going to tell you about the main ways to predict the positive effects of the Sun on the stock market:

Keep track of the Sun's transits.

The Sun changes zodiac signs approximately every 30 days (this is called a Sankranti).

A favorable time occurs when: the Sun is exalted in Aries – this creates strong leadership energy and a dynamic environment.(Mid-April to mid-May)

The Sun is in friendly signs such as Leo (its own sign), Sagittarius, or Aries – this boosts confidence

and benefits stocks in sectors such as pharmaceuticals, government, solar energy, cement, and PSU (Public Sector Undertaking) jewelry companies.

Check Sun's Aspects and Conjunctions

Beneficial aspects from Jupiter (Guru) or Venus enhance gains (e.g., Jupiter aspect on Sun can amplify leadership sector rallies).

Avoid heavy affliction by Rahu/Ketu (eclipses or conjunctions) — can cause sudden volatility or corrections.

There are many other aspects, but if you can understand this much, I'll show you the one-year movement of a particular stock. This will give you an idea of how it works. Let's talk about it.

Friends, this is the Union Bank chart, and you can see that the astrological chart on the left is for 15- April 2023.You can see that Rahu and the Sun are together in the Aries sign.Now, you can see for yourself that when Rahu -Ketu and the Sun are on the same axis, there is usually some turmoil in the market, and you can see the same happening with this stock. As soon as the Sun entered Taurus after May 15th, you saw a consistently excellent upward movement in the stock until October 15th.The part of the graph in the blue box, which represents the rally, worked well until October. As soon as it coincided with the Sun-Ketu conjunction in October, another period of turbulence was observed.And the rally phase started again the very next month(November), driving the stock straight up until next April 2024. Now, that was one factor that I shared with you. You saw how the Sun ruling power in PSU banks and the influence of Rahu and Ketu lead to certain movements and trends.

Similarly, excluding Rahu and Ketu, Saturn and retrograde Mercury give some indications when they are together or their aspects fall on the Sun. Then, some different movements are observed. For now, you can compare this chart with astrology and try to learn for yourself astrology realy work or not relates to the stock market. Thank you, friends.

A little bit of astrology and what else!

EURUSD – 15M | Liquidity Sweep → Demand Reaction →Mean ReversionPrice delivered a clean sell-side liquidity sweep into a higher-timeframe demand zone.

Displacement down exhausted, followed by acceptance and stabilization inside value.

Current structure suggests:

Sell-side taken ✔️

Price reacting from HTF demand ✔️

Expectation: mean reversion toward premium / EQ highs

Plan:

Longs favored only after confirmation on LTF

Ideal entry: sweep + reclaim of intraday lows

Targets aligned toward prior supply / liquidity resting above

Invalidation: clean breakdown and acceptance below demand

Bias stays bullish as long as demand holds.