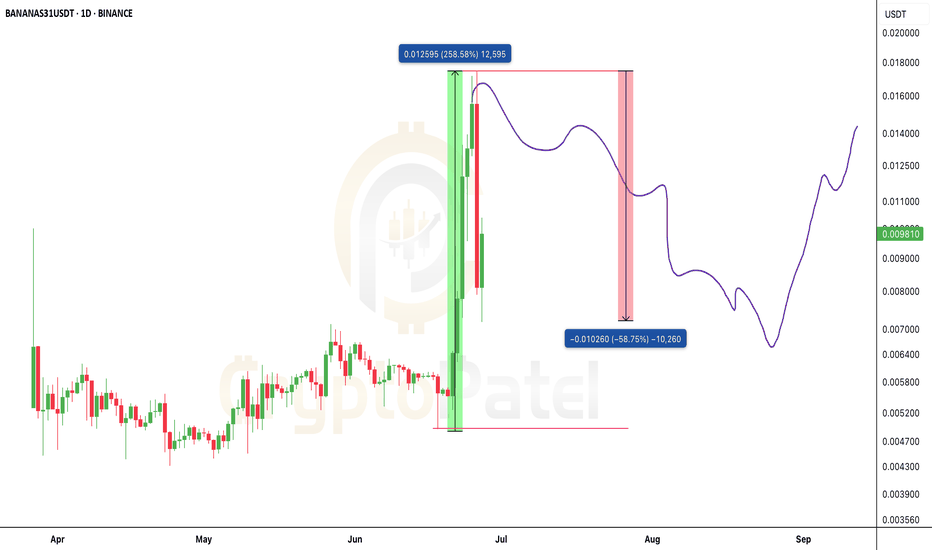

$BANANAS31 Dumped 58% — Hope You Took Profits, Not Pain.$BANANAS31 Dumped 58% — Hope You Took Profits, Not Pain.

It just dumped 58% within hours. Brutal.

Yesterday: $0.016–$0.018

Now: $0.0071 and still sliding…

Hope you enjoyed huge profit with $BANANAS31 short trade —

and not by buying the top.

This is why I always say:

Never chase green candles.

Don’t be exit liquidity.

Learn the game or pay the price. What’s your biggest FOMO trade?👇

Bitcoin (Cryptocurrency)

BTCUSDT – Is a Breakout Imminent?Bitcoin is once again testing the descending trendline that previously triggered three strong rejections, hovering around the 106,500–106,600 USDT zone. A clear rounded bottom has formed, with strong support holding around 104,200–104,700, fueling the recent rebound.

Price action is now consolidating just below the key resistance, setting the stage for a potential bullish continuation pattern. A clean breakout above this zone could open the door for a rally toward 108,600 and even 110,200 – both previous highs.

However, if the trendline holds again, the highlighted support zone is likely to attract fresh buying interest. The overall market bias leans bullish, but confirmation via breakout is crucial for the next move.

Are you ready to ride the next BTC wave?

Bitcoin isn’t fully bullish yet — most people are falling for thBitcoin isn’t fully bullish yet — most people are falling for the trap

BTC just bounced beautifully from the $97.8K–$98K demand zone.

It tapped into key confluences:

✅ FVG filled

✅ 0.618-0.786 Fib level

🟪 Bullish Order Block just above 0.786

But let’s be real — we’re not in full bullish mode yet.

This looks more like a short-term pullback, not a trend reversal.

What I'm Watching Closely:

🔹 BTC is forming two HH & HL patterns.

🔹 Super important for us to track both — they’ll guide the next big move.

🟥 LTF last HH = $108,900

🟥 HTF last HH = $110,654

As long as BTC stays below these, the structure is still bearish.

We only flip bullish when candles break and close above them.

If Bullish Breakout happens? We’re eyeing new ATH targets toward $150K 🚀

My Plan Right Now:

🔹 Watching $107K & $109K levels for clean short setups.

Why?

👉 Low-risk entries

👉 Tight SL

👉 Big reward — Targeting around $100K

Stay alert, don’t chase. Let the levels come to us.

Let me know in the comments 👇 Are you flipping bullish, or still cautious?

NFA & DYOR

BITCOIN DOMINANCE ANALYSIS – Altseason Loading?BITCOIN DOMINANCE ANALYSIS – Altseason Loading?

This is the Bitcoin Dominance (BTC.D) chart.

Remember: BTC Dominance moves inversely with altcoins —

✅ When dominance goes down, altcoins usually go up.

✅ When dominance goes up, altcoins often struggle.

Current Situation

🔹 BTC Dominance is now testing a major resistance level, also known as the Altcoins Accumulation Line.

🔹 This level has historically marked the end of altcoin sell-offs and the beginning of altseason.

🟥 A clear Bearish Order Block and a Fair Value Gap (FVG) zone have formed at this resistance.

These are signs of potential reversal and weakness ahead for BTC Dominance.

If Rejected...

If BTC.D fails to break above this resistance, we could see a sharp drop of ~36%, targeting the long-term support line — an area that often signals profit-taking from alts.

Historical data shows a repeating pattern every ~4 years. This structure lines up perfectly with that cycle — a strong signal.

🔹 We’re likely at the final stage of the altcoin correction.

🔹 The market structure hints that a strong altcoin season could follow if dominance starts falling from this zone.

➡️ It’s a good time to start accumulating strong altcoins before momentum shifts.

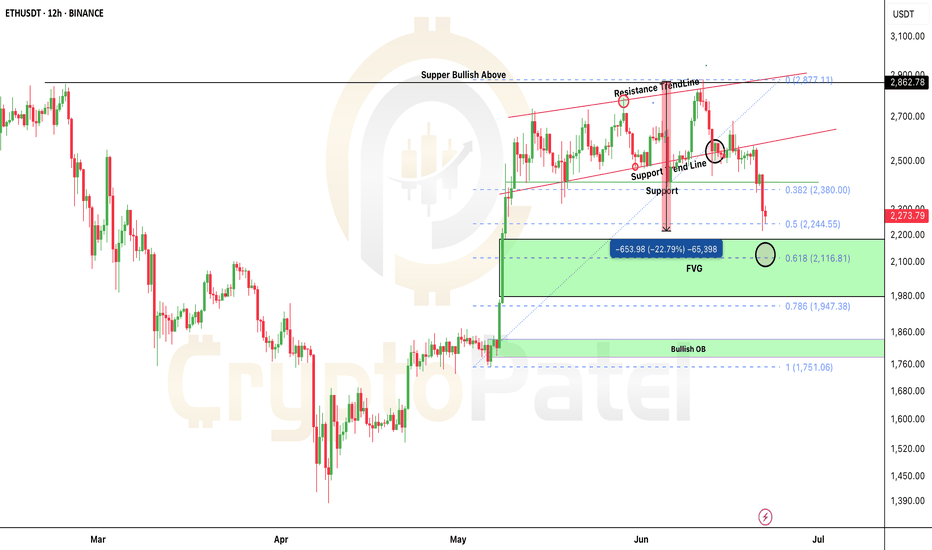

ETH/USDT Dumped hard as I predicted and next Target?ETH SHORT HIT — As Predicted!

Hey fam

Hope you enjoyed the ETH short setup I shared earlier when price was around $2700–$2800

ETH is now down 22% from that level.

Broke support just like we discussed…

And remember I said — if $2500 breaks, we could see $2200.

Well… we’re already there now ✅

What Now?

This is where we start accumulating on spot.

Why?

Because ETH is currently at the 0.5 Fib level — could hold.

If not, we target 0.618 Fib for next entry.

Best Accumulation Zone: $2200–$1800

Strong bullish OB around $1782–$1840

If price drops there, expect a solid bounce!

I’m personally watching this zone for spot entries targeting $8000–$10,000 next run 🚀

Let me know below if you're buying this dip!

And as always… stay tuned for the next sniper setup.

NFA & DYOR

$BTC Technical Breakdown – As Predicted!CRYPTOCAP:BTC Technical Breakdown – As Predicted!

I already warned you at $110K to exit or short — and guess what?

We’re now up with 8% profit from that exact call!

#Bitcoin broke structure with a Bearish Divergence, and the trendline is looking weak.

If this war doesn’t stop, I expect further downside below $100K.

Key levels to watch:

🔻 Support 1: $73,500

🔻 Support 2: $48,700

If $100K breaks, don’t be surprised to see $90K → $80K → even $70K.

Don’t say I didn’t alert you.

I clearly told you to short or exit at the top.

Booked profits? Let me know below 👇

Will Bitcoin Hit $80k Before $171,000 ?Bitcoin is Forming a Inverse Head & Shoulders on the 2D chart...

And if this plays out — we could be looking at a move to $171,000

Here’s what you need to know:

Structure Breakdown:

▪️ Left Shoulder: Completed

▪️ Head: Completed

▪️ Right Shoulder: (in progress)

Neckline: ~$112.5K-$115k

Breakout above neckline = $171K target

That’s a +49% upside move from here.

But here’s the catch...

When too many spot the same pattern — whales love to trap.

Fakeouts, stop hunts, liquidations — you’ve seen it before.

❌ If BTC drops below $100K (Right Shoulder base), this setup flips bearish fast.

Key Support Zones:

▪️ $93,940 (Fib 0.382)

▪️ $80,780 (Fib 0.786)

Trade with confirmation, not emotion.

Respect your invalidation levels and protect capital.

What’s your play if we tap $112K? 👇

NFA & DYOR

BTC Traders: Crucial Levels Incoming 🚨 BTC Traders: Crucial Levels Incoming 👇

Bitcoin is hovering around $105,399 — and things are heating up.

$106K = Resistance.

A clean break could send us to the Bearish Order Block ($108K–$108.95K).

But here’s the danger zone:

🟥 OB = Last drop's origin.

Rejection here = major sell-off risk.

🔻 $102K = Liquidity pool.

Lose this level, and sub-$100K is on the table.

Current Bias:

– Hold below OB = Bearish

– Reclaim OB = Relief bounce

– Drop below $102K = Trend Accelerates Down

What’s your game plan here?

💬 Comment your next move

🔁 Retweet if useful

🔖 Bookmark for later

Bitcoin Ready to Blast or Waiting under $100k?BTC is currently trading near $105,399, showing a corrective bounce after a recent sell-off.

Resistance Ahead – $106k:

Price is approaching a key resistance level. A break above could lead to a short-term move toward the Bearish Order Block at $108000–$108950.

🟥 Bearish Order Block (OB):

This is the supply zone that initiated the previous drop. If price fails to break and hold above this OB, we could see renewed selling pressure and continuation of the downtrend.

🔻 Liquidity Pool – $102k:

This level holds resting sell-side liquidity. A failure to hold this area may trigger a sweep — and if $102K breaks, it could unlock deeper downside potential, possibly sending BTC below $100K.

Summary Outlook:

▪️ Rejection from OB = strong bearish continuation

▪️ Break of $106K = short-term bullish move toward OB

▪️ Break of $102K = high probability of sub-$100K levels

▪️ Overall bias remains bearish unless price reclaims and holds above the OB zone with strength.

NFA & DYOR

$MASK dropped 65% in 12 days — but I’m still buying, here’s why?NASDAQ:MASK Crashed 65% — I Sold at the Top, Buying at the Bottom, and Aiming for 10x

The NASDAQ:MASK token has crashed -65% in just 12 days — that’s a massive drop, and honestly, no one saw it coming. Even I didn’t expect this much of a dump.

But remember — no one can predict the market 100%.

✅ I did post a chart earlier to short NASDAQ:MASK around $3.50, and that call hit perfectly. If you took that short, it was a high-profit setup.

Now here's the important part

I mentioned earlier — if price drops below $1.50, that’s a good entry point for long-term spot buyers (NOT for leverage).

Personally, I’ve started accumulating from $1.30, and if we see a deeper dip, I’ll be buying more for the long run.

My long-term target for NASDAQ:MASK is $10+.

NFA — always DYOR

Pump.fun Sells $741M in SOL After X Suspension – What’s Really?Pump.fun Sells $741M in SOL After X Suspension – What’s Really Happening?

PumpFun (@pumpdotfun), a popular Solana-based meme token launch platform, was recently suspended from X — but they’ve been making major moves behind the scenes.

Since May 19, 2024, the platform has sold around 4.1 million SOL, worth nearly $741 million, at an average price of $180.

Here’s the full breakdown:

🔹 264,373 SOL sold for $41.64 million USDC at $158

🔹 3.84 million SOL, worth $699 million, sent to Kraken at $182

Why is Pump.fun selling so much?

Is this an exit strategy, or are they just managing risk?

TRX NEXT EXPLOSION INCOMING? TRX NEXT EXPLOSION INCOMING?

TRX is showing a strong bullish setup after breaking out of a long-term consolidation pattern.

🔹 Price has cleanly broken out of a multi-year descending structure

🔹 Retested the key support zone around $0.21–$0.23

🔹 Still respecting the long-term ascending trendline from 2020

🔹 Historical move: 6,469% rally in the previous cycle — current structure suggests similar potential

Key Technical Levels to Watch:

🟩 Support Zone: $0.209–$0.230

🟩 As long as TRX holds above this level, bias remains bullish

🟩 This is a breakout + retest scenario.

🟩 Potential Upside Targets: $0.65 → $1.20 → $2.20+

The chart structure is indicating the possibility of a strong uptrend continuation, with bullish momentum building on higher timeframes.

TRX is technically strong and could be gearing up for a major leg higher if key support holds.

Add it to your watchlist. NFA & DYOR

$IO Could Be the Next 100x AI Coin?SEED_ALEXDRAYM_SHORTINTEREST2:IO Could Be the Next 100x AI Coin — Don’t Miss This Supercloud Revolution

SEED_ALEXDRAYM_SHORTINTEREST2:IO is showing early signs of strength after bouncing from the key accumulation zone ($0.51–$0.73).

Structure still bullish.

A breakout above $0.92 = confirmation for next leg up.

If volume kicks in, SEED_ALEXDRAYM_SHORTINTEREST2:IO has macro breakout potential.

▶️ Entry Zone: $0.51–$0.73

▶️ Breakout Trigger: $0.92

▶️ Resistance Zone: $1.20–$1.60

▶️ Target: $5/$9/$15/$20

▶️ ROI Potential: 10x / 20x

❌ Invalidation: Break below $0.50

🔥 Long-term holders and breakout traders — don’t miss this.

io.net is turning idle GPUs into a supercloud to power AI, ML & big data — without relying on AWS or GCP.

✅ 90% cheaper than trad cloud

✅ 16,000+ GPUs live

✅ Built on Solana

✅ Backed by Multicoin, Delphi, Solana Ventures

🔰 Token Utility: Pay for compute | Staking rewards | Governance rights

This is DePIN + AI — a powerful combo. If adoption scales, SEED_ALEXDRAYM_SHORTINTEREST2:IO could be massive.

📢 If this analysis helped you, please RT & drop your thoughts in comments 👇

Let’s spread the alpha.

NFa & DYOR

BTC Decision Point – Are You Watching This?BTC Decision Point – Are You Watching This?

Bitcoin is reclaiming momentum after sweeping liquidity at $102.7K. It's now pushing toward major resistance at $106.1K.

But the real battle? The bearish OB at $107.2K–$108.9K — where price nuked last time.

✅ Break above = clear skies toward new ATHs

❌ Rejection = another trip to $102K or even Under $100K

🔁 Retweet if this helped

💬 Drop your bias below: Long or short?👇

$ETH BLOODBATH: -15% Dump! Next Stop $2100? CRYPTOCAP:ETH BLOODBATH: -15% Dump! Next Stop $2100?

I shorted right from $2862 — nailed the move.

Now trading below critical $2550 support.

👉 Hold $2550? Reversal towards $3000-$4000 possible.

👉 Lose it? We likely fill $2100-$2200 FVG — 0.618 fib at $2116.

$2860 remains THE level to watch for a New ATH.

💬 Comment your ETH target!

🔁 Retweet if this helps your gameplan.

BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY!🚨 BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY! 🚨

Hope you followed our last BTC analysis — and DID NOT open any longs at the top.

If you followed: Congrats — you either made big profits on the short, or at least saved your money by not longing.

✅ We clearly warned when BTC was around $110K — more correction was coming.

Result? Bitcoin is now 7% DOWN since that call.

❗ Now the situation is DANGEROUS:

👉 BTC broke my Bullish Order Flow at $105K.

👉 If this $105K support doesn’t hold soon → we may see a deep correction towards $90K.

$105K is the level to watch like a hawk.

👉 Iran-Israel news just accelerated the fall — but we already predicted this move before the news.

🚫 NEVER gamble with your hard-earned money.

✅ Always wait for solid confirmation before entering trades.

👉 Stay smart. Stay safe. Stay patient.

💬 Comment your thoughts below.

🔁 Forward this to your crypto friends — they NEED to see this!

BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY! BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY!

Hope you followed our last BTC analysis — and DID NOT open any longs at the top.

If you followed: Congrats — you either made big profits on the short, or at least saved your money by not longing.

We clearly warned when BTC was around $110K — more correction was coming.

Result? Bitcoin is now 7% DOWN since that call.

Now the situation is DANGEROUS:

👉 BTC broke my Bullish Order Flow at $105K.

👉 If this $105K support doesn’t hold soon → we may see a deep correction towards $90K.

$105K is the level to watch like a hawk.

Iran-Israel news just accelerated the fall — but we already predicted this move before the news.

🚫 NEVER gamble with your hard-earned money.

✅ Always wait for solid confirmation before entering trades.

Stay smart. Stay safe. Stay patient.

Comment your thoughts below.

Forward this to your crypto friends — they NEED to see this!

BTC/USD 4H Trade Setup – Demand Zone Reversal Play🔵 1. Demand Zone 🧲💎

📍 Range: 100,418.83 – 102,253.51

🟦 Strong support zone

💡 This is where buyers are expected to step in

📉 Price is currently testing this zone — potential reversal area

🚀 2. Entry Point 🎯

📍 Zone: 102,232.52 – 102,264.33

✅ Just above demand zone for safe entry

🧘♂️ Wait for bullish confirmation (wick rejections, engulfing candles)

🛑 3. Stop Loss 🔻

📍 Zone: 100,498.77 – 100,538.74

🔒 Below demand zone — protects you from false breakouts

⛔ Invalidates setup if price breaks below this level

🎯 4. Target Point 💰

📍 Target: 108,800.00

🧱 Major resistance zone

📈 Offers a solid Risk/Reward setup (approx. 1:4)

🪜 Possible take-profit scaling around 108,656.78 – 109,256.50

🔁 5. CHoCH – Change of Character 🔄

📍 Confirmed structural break above a lower high

🕵️♂️ Indicates shift from bearish to bullish

🔁 Needs confirmation with higher low near demand zone

📏 6. EMA 70 (Exponential Moving Average) 📉

📍 Level: 106,849.30

🔴 Price is currently below EMA = short-term bearish

🧗♂️ Reclaiming the EMA will strengthen the bullish bias

✅ Quick Summary with Emojis

📌 Plan:

🔵 Buy near: 102,250

🛑 Stop Loss: 100,500

🎯 Take Profit: 108,800

📊 Trend:

🔻 Bearish short-term (below EMA)

🔁 Potential reversal from demand zone

⚠️ Watch For:

🔍 Bullish confirmation at demand zone

🔄 Reclaim of EMA (106.8k)

🧱 Resistance near 108.8k

Is $SOL about to DUMP… or set up a MASSIVE BUY ZONE?Is CRYPTOCAP:SOL about to DUMP… or set up a MASSIVE BUY ZONE?

Solana is now at a critical level on the higher timeframe chart:

✅ After a breakdown, SOL is now retesting the bearish retest zone

✅ Strong resistance seen at $170–$180

✅ If rejected → price could dip toward the $100 range

But here’s the key: A dip to $100 would be a massive long-term buying opportunity for many investors (including me).

Long-term targets? I’m still eyeing $500 → $1000 if the macro trend plays out.

👉 Keep a close eye — the next few weeks could set up the next big move for $SOL.

Are you ready? Will you be buying the dip? Comment below! 👇

NFA & DYOR

#Ethereum Breakout Attempt #Ethereum Breakout Attempt 📢

After weeks of consolidation inside this range → CRYPTOCAP:ETH is now testing a breakout above major resistance $2750

👉 If this breakout holds → we could see a BIG upward rally toward $3500–$4000 in the coming weeks. 🚀

Keep an eye on this level — the next move could be massive.

Bitcoin is just 2% away from a new all-time high —will it break?Bitcoin is just 2% away from a new all-time high — will it break or fake? 🚀

BTC is currently trading near $109K–$110K, only 2% below the $112K ATH level.

Strong supports: $94,000 / $80,000

Bullish Case:

If BTC breaks $110K–$112K with strong volume + a bullish weekly close → we could see a rally toward: $135K → $150K

Bearish Case:

If BTC rejects at $110K–$112K, a deep retracement below $100K is possible. Watch for strong support at $100K and $80K levels.

My Personal Take:

I'm bullish overall — but since we’re this close to ATH, I’m opening a short trade with 3% stop loss targeting near $100K.

👉 Not financial advice — do your own research. The crypto market is highly volatile.

Watch this level closely — next big BTC move may be starting NOW. 👀

Founder’s Wallet HACKED → $4M Gone → $MASK Crashes! Full Story IFounder’s Wallet HACKED → $4M Gone → NASDAQ:MASK Crashes! Full Story Inside

Dropped -51% in few hours! 😱

*Here’s the FULL story you need to know:*

🟥 Founder’s Wallet HACKED → $4M stolen!

🟥 Big WHALE dumped $2.1M worth of MASK on Binance!

🟥 Binance DELISTING rumors caused PANIC SELLING!

Result? Massive crash — from $3.73 → $1.735 in just HOURS!

🔥 Is this the BOTTOM? Or will it DUMP more?

🔥 Are smart traders BUYING this DIP?

👉 I’ll be tracking NASDAQ:MASK LIVE — join my channel & stay ahead of the next BIG MOVE!

Bitcoin Bulls vs Bears — Battle Zones Mapped Out#Bitcoin Bulls vs Bears — Battle Zones Mapped Out

🔰 $105K–$106.7K = Bearish Order Block:

Below this zone = CRYPTOCAP:BTC stays bearish unless HTF closes above $106.7K

🔰 Next Moves:

▪️ Likely retest $105K–$106K before next leg ↓

▪️ Target: $97K–$95K zone

🔰 Key Levels:

✅ Holding 0.618 Fib (support)

✅ Unfilled FVG: $97K–$98.3K

✅ Bullish OBs: $95.7K–$97K | $93.5K–$94.7K

If $97,000 holds strong → Expect BIG bounce!