Fiem Industries - Long Setup, Move is ON...#FIEMIND trading above Resistance of 2317

Next Resistance is at 3624

Support is at 1510

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Breakout!

MASK 3.7x PUMP — Is a BIG DIP Coming?MASK 3.7x PUMP — Is a BIG DIP Coming?

MASK just delivered a MASSIVE rally from the Bullish Order Block at $1.2–$1.3 — and filled the FVG around $3.5.

Here’s what’s next 👇

🟢 Short-Term Outlook:

👉 After pumping from $0.927 → $3.50 → that’s a 3.7x move WITHOUT any major retracement.

👉 High chances of a healthy pullback next.

👉 Strong Accumulation Zone: If price drops towards 0.5 Fib retracement at $1.80 → This will be a key area for Smart Money to re-enter.

🟢 Mid-Term Potential:

👉 Once accumulation is done → breakout above $3.5 highly likely.

👉 First big target → Bearish Order Block at $5–$7.

🟢 Long-Term Vision:

👉 If BTC supports and MASK maintains bullish structure → can aim for $15/$30/$50 🚀

👉 Huge upside still left on higher timeframes.

Key Levels to Watch:

✅ $3.5 → Resistance

✅ $2.1–$1.5 → Retracement buy zone (Unfilled FVG + Fib confluence)

✅ $1.80 → 0.5 Fib — Strong Accumulation Zone

✅ $5–$7 → Major target zone

✅ $15/$30/$50 → Long-term moonshot

My Play → Waiting patiently for retracement → looking to accumulate in $2.1–$1.5 zone, ideally around $1.80 → position for next rally!

👉 What’s YOUR strategy on MASK? Buying the dip or waiting higher? Comment below 👇👇👇

NFA & DYOR

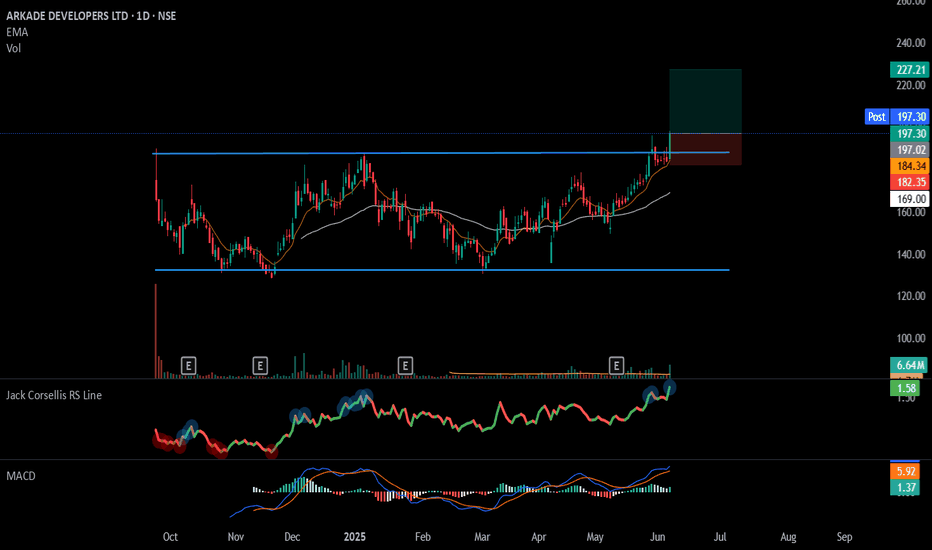

#ARKADE - IPO Base Breakout📊 Script: ARKADE

Key highlights: 💡⚡

📈 IPO Base Breakout in Daily Time Frame.

📈 Price consolidating near Resistance, then Breakout.

📈 Volume spike seen during Breakout.

📈 MACD Cross

📈 Can go for a swing trade

BUY ONLY ABOVE 197 DCB

⏱️ C.M.P 📑💰- 197.34

🟢 Target 🎯🏆 – 14%

⚠️ Stoploss ☠️🚫 – 7%

⚠️ Important: Market conditions are Okish, Position size 50% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

ICICIGIICICIGI has given triangle breakout with very decent volume. In recent time traction in insurance sector has been observed. At current level 2000-10 there is resistance. But if it crosses and closes above this resistance level then it may do wonder! On lower side 1860 is very strong support. And upper end momentum can be played up to 2210 level. But strong upside play is possible only above 2010 closing

HERITGFOOD - Cup & Handle Breakout with RSI Confirmation | Daily📊 HERITAGE FOODS LTD (HERITGFOOD) – Cup & Handle Breakout with RSI Confirmation | Daily Chart

📅 Chart Date: June 5, 2025

📈 CMP: ₹446.10 (+5.94%)

📍 Ticker: NSE:HERITGFOOD

🔍 Technical Analysis Overview

☕ Cup & Handle Pattern Breakout

HERITGFOOD has successfully broken out of a Cup & Handle pattern, signaling the end of a long downtrend and a potential start of a new bullish wave. The breakout zone lies around ₹435–₹440.

💥 Breakout Volume: Supported by a strong surge in volume (~1.32M), adding conviction to the breakout.

📉 RSI Indicator:

RSI is at 69.30, just below overbought territory, indicating strong momentum.

RSI crossover above signal line confirms bullish strength.

📍 Key Price Levels

✅ Breakout Zone: ₹435–₹440

🚀 Upside Targets (based on pattern projection and past resistance):

₹470 – minor resistance

₹510 – medium-term swing target

₹550+ – extended target if momentum sustains

🛡️ Support Levels:

₹435 – breakout retest zone

₹415 – minor base

₹390 – handle bottom (critical invalidation)

🔻 Stop Loss Zone: Below ₹415–₹420 for risk-managed swing positions

🛠️ Trading Strategy

Entry: After confirmation candle above ₹440 or on pullback to retest breakout zone

Stop Loss: Below ₹415

Targets: ₹470 → ₹510 → ₹550+

Risk/Reward: Attractive R:R setup with confirmation indicators

⚠️ Disclaimer

This chart is for educational and analysis purposes only. Please consult a SEBI-registered financial advisor before taking any trading decision.

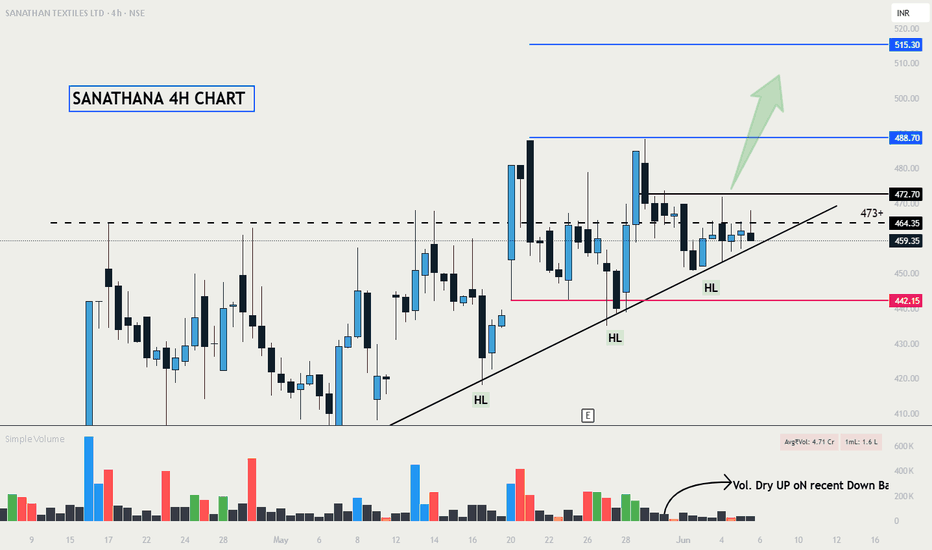

Trend Continuation in SANATHAN TEXTILES LTDNSE:SANATHAN

Timeframe - 4H CHART 📊

Base after Breakout 📈

An early entry above - @473 will make Good good RR.

Stock is maintaining clear HH HL structure.

And Recent Down candles are on very low Volume signals sellers getting absorbed.

Keep on radar. ⏳

Keep Learning, Happy Trading.

Inside Bars After High Volume – CERA Setting Up Near Key CT📌 Timeframe: Weekly (WTF)

📌 Type: Technical Observation / Swing Structure

📌 Concept: Counter Trendline Breakout Setup

CERA is currently navigating a highly constructive zone from a swing trading lens. Here's what's developing technically:

🔹 Higher Low Formation:

The stock has established a higher low structure, with the white internal trendline offering visible support across recent weeks. Interestingly, this aligns perfectly with the 200-period EMA on the weekly timeframe, enhancing its significance as a dynamic support layer.

🔹 Volume Clues:

Two of the highest volume candles on the weekly chart have now been followed by inside bars, a potential sign of absorption or base building. This tightening within volume zones signals institutional interest and a possible buildup phase.

🔹 Supply Zone Identified:

An overhead supply (marked in orange)

🔹 EMA Context: The blue 200 EMA further reinforces the idea of Supportive price behavior around this line validates its role.

🔍 This post is for educational discussion only. No recommendation or forecast is implied. Please conduct your own due diligence.

DYCL STRONG BREAKOUT CANDIDATENSE:DYCL

Cable and WIre Industry Stock Good for Swing

#DYCL Strong Conviction - Increasing day by day.

Study the Price and Volume action closely.

Spikes are grabbing supplies from top and low volatility closing showing - accumulation.

Today price respected the previous day close and formed a higher high higher low structure.

All Major Levels are marked on chart.

Keep Learning,

Happy Trading.

$ME/USDT Technical Breakdown – What’s Happening?$ME/USDT Technical Breakdown – What’s Happening?

1️⃣ Market Shift:

We finally got a CHoCH (Change of Character) — the downtrend is likely over!

2️⃣ Support Bounce:

Price respected the strong support zone at $0.76–$0.83 and bounced hard 💪

3️⃣ Trendline Breakout:

A major descending trendline has been broken — signaling bullish momentum 🚀

4️⃣ Next Steps:

There’s an unfilled Fair Value Gap (FVG) below at $0.86–$0.95 — price might dip there to grab liquidity before flying again.

Possible Upside Targets: $1.40 → $1.70 → $2+

Don’t chase. Wait for the pullback = best entry!

QPOWERQPOWER is recently listed IPO stock and now it has given triangle breakout with decent volume. 355-60 is very strong support. Closing below this may change my view. Upper side we may see momentum till 470-510. Risk reward is quite favorable. Another thing which i observed is today it is trading at all time high volume after listing day. So probability of holding and continuing momentum is quite high. keep it on radar.

YESBANK: Riding the Bullish WaveYes Bank has exhibited a notable breakout above the resistance level established in December 2024. This breakout is accompanied by a classic flag pattern formation, which has resolved to the upside—typically interpreted by technical analysts as a continuation signal within an existing trend.

A significant increase in trading volume during the breakout phase adds weight to the move, suggesting heightened market participation. Furthermore, the 20-day EMA has crossed above the 200-day EMA, a crossover often referred to as a "Golden Cross" , which is generally viewed as a bullish signal indicating potential for continued upward momentum.

The RSI is currently positioned above 60, reflecting sustained buying interest without yet entering overbought territory.

From a structural perspective:

Immediate resistance may be encountered near the 24.75 level.

A secondary resistance zone appears around 28.54.

On the downside, the stock seems to have established a support base near 19.54, which could act as a cushion in the event of a pullback.

Disclaimer:

This analysis is intended solely for informational and educational purposes. It does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Market conditions can change rapidly, and all trading involves risk. Individuals should conduct their own due diligence or consult with a qualified financial advisor before making any investment decisions.

CAMS - Cup and Handle Braekout CAMS has created a nice Cup and Handle Pattern on a Daily Chart.

It has give a strong breakout from the Pattern @4100 levels

Pattern Target Range is 1000+ Points (Approx 25% Return)

Target : 5200++

SL 3830

TImeframe : Short Term (6 months approx)

During the breakout today has seen huge volumes which is positive for the stock

#FIEMIND - Cup & Handel BreakOut in Daily Time Frame📊 Script: FIEMIND

Key highlights: 💡⚡

📈 Cup & Handel BreakOut in Daily Time Frame.

📈 Price consolidating near Resistance.

📈 Volume spike during Breakout

📈 MACD Cross

📈 RS Line Making 52WH

📈 Can go for a swing trade

BUY ONLY ABOVE 1735 DCB

⏱️ C.M.P 📑💰- 1734

🟢 Target 🎯🏆 – 14%

⚠️ Stoploss ☠️🚫 – 7%

⚠️ Important: Market conditions are Okish, Position size 50% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Price Action Case Study: Weekly Price action chart of SIGACHI 🔹 Key Structural Elements:

-White Solid Line: Primary Counter-Trendline (CT) connecting multiple swing highs, acting as dynamic resistance over several months.

-White Dotted Lines: Hidden supply lines derived from intermediary highs, often acting as secondary resistance.

-Yellow Lines: Higher timeframe resistance zones (MTF) — offering confluence markers for potential supply zones ahead.

🔹Volume Expansion:

The breakout candle is supported by significant volume (~36M), indicating strong participation. Volume here acts as a confirmation trigger, suggesting institutional interest or broad-based buying.

🔹Structure:

The breakout occurs after an extended consolidation and a series of higher lows.

RELIANCE POWER lONGTERM BULLISH -Price Seen Breaking Out Key Supply Area Of 50.80 TO 55

Key Points To Note

- Continues Trendline Support

- Breakout Above Key Area

- Good Possiblities Of Upside

- Breakout With Big Bar Candle

- Volume Accumulation Over Time

Till Then, Stay Focused, Keep Following The Markets

Welspun Corp - Breakout Setup, Move is ON...#WELCORP trading above Resistance of 750

Next Resistance is at 916

Support is at 614

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Hitachi Energy (PowerIndia) - Breakout Setup, Move is ON...#POWERINDIA trading above Resistance of 12845

Next Resistance is at 17702

Support is at 9481

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Cummins India Break out stock for 28% Gain

Breakout above 200 SMA with Rising volume and positive MACD Divergence

Here's my analysis of Cummins India's financials:

**Net Profit:**

- Net profit for FY 2023-24: ₹2,533 crores ¹

- Net profit for FY 2022-23: ₹2,345 crores ¹

- Net profit for FY 2021-22: ₹1,944 crores ¹

- Net profit for FY 2020-21: ₹1,566 crores ¹

**Yearly Results:**

- Revenue growth: 15% CAGR over the last 5 years ¹

- Profit growth: 20% CAGR over the last 5 years ¹

- Operating margin: 15.6% in FY 2023-24 vs 14.5% in FY 2022-23 ¹

- Return on Equity (ROE): 23.1% in FY 2023-24 vs 21.5% in FY 2022-23 ¹

Overall, Cummins India has shown consistent revenue and profit growth over the years.

Note : May have open positions in this entity at various price levels.