BSE

Swing Buy Opportunity in Ambuja CementsRefer the chart for Entry,Target and SL.

NOTE: This trade is only for Equity Swing buy and not to be considered for options trading.

Please do follow Position Sizing and Risk Reward Ratio while planning any trades.

Note: This information is for education purpose only and please do your own research and consult your financial advisor prior to taking any action.

TO CONNECT WITH ME CHECK OUT MY BIO.

If you like this Idea, Please do like my ideas and share it with your friends. check my bio.

Please boost my ideas and send cheers as it acts as a motivation to keep posting my analysis.

Thank you

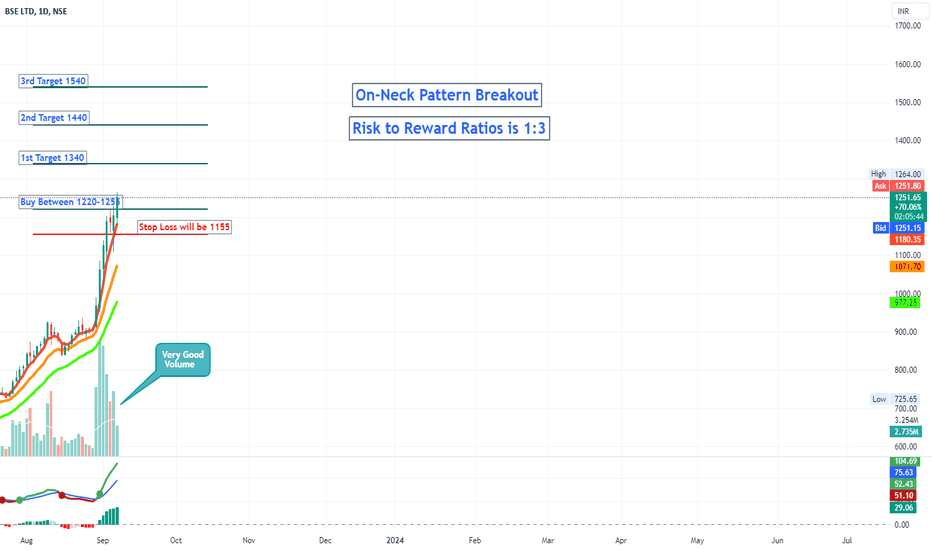

LONG setup in BSE Bullish On-Neck Chart Pattern Breakout happened on the Daily Time frame of NSE:BSE

Price Action is well supported by the volume.

The stock is currently in uptrend making higher highs and higher lows.

One can add this stock into their stocks to buy list.

Initiate the long trade only according to the levels mentioned.

Stop loss will be on Daily closing basis.

Trend Analysis :- UP Trend

Chart Pattern :- Bullish On-Neck

Technical Indicator :- Positive MACD Crossover

Technical Analysis of Bank Nifty for Tomorrow Technical Analysis of Bank Nifty for Tomorrow (26 September 2023)

Support:

44500 (Big Support)

44700/44600

Resistance:

45000 (Big Resistance)

Overall Analysis:

The Bank Nifty index is currently in a consolidation phase, with a strong support zone at 44500 and a strong resistance zone at 45000. If the index breaks below 44500, it could fall further to 44400 or even lower. On the other hand, if the index breaks above 45000, it could rally to 45900 or even higher.

However, it is important to note that the 45000 strike price has a huge concentration of call writers. This suggests that there is strong resistance at this level. Therefore, traders should be cautious before taking any bullish bets on Bank Nifty.

Trading Strategy:

Bullish Traders: If the Bank Nifty index breaks above 45000, bullish traders can enter long positions with a stop loss below 44900.

Bearish Traders: If the Bank Nifty index breaks below 44500, bearish traders can enter short positions with a stop loss above 44700.

Overall, the Bank Nifty index is likely to remain in a consolidation phase tomorrow. Traders should be cautious before taking any bets on the index.

Disclaimer: This is just a technical analysis and should not be considered as a trading recommendation. Please consult your financial advisor before making any trading decisions.

Technical Analysis for Nifty50 for Tomorrow**Technical Analysis for Nifty50 for Tomorrow - September 25, 2023**

**Overall Outlook**

Nifty50 is expected to open negative tomorrow, following the negative global markets. However, if the market opens above 19,700, then the 19,600 level will act as a support. On the upside, the resistance levels are 19,800 and 19,900-20,000.

**Support and Resistance Levels**

**Supports:**

* 19,600 (strong support as per OI data)

**Resistances:**

* 19,800

* 19,900-20,000

**Trading Strategy**

* **Buy:** If the market trades above 19,800 and closes with a 15-minute green candle, then a buying side movement can be expected.

* **Sell:** Wait for a breakdown of 19,600 before selling.

**Note:** Please follow price action and wait for opportunities to trade.

**Additional Comments**

* The global markets are negative due to concerns about rising interest rates and a potential recession.

* Nifty50 is a broad market index, and it is sensitive to global market trends.

* If the global markets continue to remain negative, it could weigh on Nifty50 as well.

* However, if the market opens above 19,700 tomorrow and closes with a 15-minute green candle, then it could signal a bullish reversal.

* Traders should carefully monitor the price action and wait for opportunities to trade.

**Disclaimer:** This is just a technical analysis and is not a recommendation to buy or sell any security. Please do your own research before making any investment decisions.

BEL - A Breakout Opportunity NSE:BEL

Bharat Electronics Limited is engaged in design, manufacture and supply of electronics products/systems for defense as well as for nondefense markets. The Company's principal products include weapon systems, radar and fire control systems etc.

TTM EPS: 10.72

TTM PE: 21.86

Sector PE: 30.84

Book Value Per Share: 45.45

P/B: 5.16

Face Value: 1

Mkt Cap (Rs. Cr.): 57,101

Dividend Yield: 1.71

Some Positives:

Rising Net Cash Flow and Cash from Operating activity

Company with high TTM EPS Growth

New 52 Week High

Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

Company with No Debt

Increasing Revenue every quarter for the past 2 quarters

Strong cash generating ability from core business - Improving Cash Flow from operation for last 2 years

Company able to generate Net Cash - Improving Net Cash Flow for last 2 years

Book Value per share Improving for last 2 years

Company with Zero Promoter Pledge

FII / FPI or Institutions increasing their shareholding

Strong Momentum: Price above short, medium and long term moving averages

Some Negatives:

Companies with growing costs YoY for long term projects

MFs decreased their shareholding last quarter

Inefficient use of assets to generate profits - ROA declining in the last 2 years

Decline in Net Profit with falling Profit Margin (QoQ)

NOT A RECOMMENDATION. JUST FOR EDUCATION PURPOSE. Thanks

TEXRAIL - Doubler in making? NSE:TEXRAIL

Texmaco Rail & Engineering Limited is engaged in the business of manufacturing of rolling stock, hydro mechanical equipment, steel castings, agricultural and other equipment.

TTM EPS: 1.10

TTM PE: 51.27

Sector PE: 27.99

Book Value Per Share: 40.50

P/B: 1.40

Face Value: 1

Mkt Cap (Rs. Cr.): 1,815

Dividend Yield: 0.18

Some Positives:

High Piotroski Score - Companies with strong financials

Strong Annual EPS Growth

New 52 Week High

Bullish Engulfing Pattern (Bullish Reversal)

Increasing Revenue every quarter for the past 2 quarters

Strong cash generating ability from core business - Improving Cash Flow from operation for last 2 years

Stock gained more than 20% in one month

Strong Momentum: Price above short, medium and long term moving averages

Some Negatives:

Red Flag: High Interest Payments Compared to Earnings

Decline in Net Profit with falling Profit Margin (QoQ)

Decline in Quarterly Net Profit with falling Profit Margin (YoY)

Declining profits every quarter for the past 3 quarters

Declining Net Cash Flow : Companies not able to generate net cash

Recent Results: Declining Operating Profit Margin and Net Profits (YoY)

My Opinion: I think the stock can hit 77 from here in next few days. In next 1-2 years it can give good returns.

NOT A RECOMMENDATION. JUST FOR EDUCATION.

Double TopA double top is a bearish technical reversal pattern.

It is not as easy to spot as one would think because there needs to be a confirmation with a break below support.

While a double top is a bearish signal, a double bottom is a bearish signal.

Top tops usually have an upswing, initial peak, trough, second peak, and neckline.

Investors can short trade after the break or place small trades, as double tops may have limited profit potential.

Script = BSE

Time Frame = 1 Day

ELECTCAST : Electrosteel Castings LtdElectrosteel Castings Ltd

CMP : 60.60

1) Stock has broken out above crucial resistance zone and multi year highs

2) Price is consolidating since the last two months between the range of 55 to 65

3) A move above 65 - should generate strong momentum in share prices towards 95 and 105 levels

4) Overall long term structure is very pullish and stock should find support on pull-back between 59 to 61 zone

5) Weakness would extend its phase only below 53

Interesting Set-Up

TIMETECHNO - A good buying opportunityNSE:TIMETECHNO

Time Technoplast Limited is engaged in manufacturing plastics products.

TTM EPS: 8.17

TTM PE: 8.54

Sector PE: 13.70

Book Value Per Share: 86.07

P/B: 0.82

Face Value: 1

Mkt Cap (Rs. Cr): 1,577

Dividend Yield: 1.00

Some Positives:

Company with high TTM EPS Growth

Current price is less than the intrinsic value

Pledged promoter holdings is insignificant

Growth in Net Profit with increasing Profit Margin (QoQ)

Company with Low Debt

Increasing Revenue every quarter for the past 2 quarters

Increasing profits every quarter for the past 2 quarters

Book Value per share Improving for last 2 years

Companies with rising net profit margins - quarterly as well as TTM basis

Some Negatives:

MFs decreased their shareholding last quarter

Inefficient use of capital to generate profits - RoCE declining in the last 2 years

Inefficient use of shareholder funds - ROE declining in the last 2 years

Inefficient use of assets to generate profits - ROA declining in the last 2 years

Declining Net Cash Flow : Companies not able to generate net cash

Annual net profit declining for last 2 years

My Opinion: My opinion is clearly visible on chart :)

NOT A RECOMMENDATION. JUST FOR EDUCATION PURPOSE. Thanks

ITC - A viewpoint NSE:ITC

ITC Limited is a holding company engaged in the marketing of fast moving consumer goods (FMGC). The Company operates through four segments: FMCG; Hotels; Paperboards, Paper and Packaging; and Agri Business.

TTM EPS: 12.01

TTM PE: 21.40

Sector PE: 23.75

Book Value Per Share: 47.87

P/B: 5.37

Face Value: 1

Mkt Cap (Rs. Cr.): 316,769

Dividend Yield: 4.18

Some Positives:

Company with Low Debt

Increasing Revenue every quarter for the past 2 quarters

Increasing profits every quarter for the past 2 quarters

Near 52 Week High

Strong Momentum: Price above short, medium and long term moving averages

Some Negatives:

Inefficient use of capital to generate profits - RoCE declining in the last 2 years

Declining Net Cash Flow : Companies not able to generate net cash

My Opinion: When the stock is in any uptrend, it forms base in stages. One should wait for a new base to form. 265 is an important resistance.

Can ITC cross 310 and go even higher? Absolutely yes. When? You never know.

NOT A RECOMMENDATION. ONLY FOR EDUCATION PURPOSE. Thanks.