CALLED IT - Bitcoin $107K TO $66K (-40% DROP) 🚨 CALLED IT - $107K TO $66K (-40% DROP)

Remember my warning on October 18, 2025?

When everyone was screaming "TO THE MOON" at $107K, I showed you the bearish divergence and said:

"$104K breakdown could trigger a crash to $73K and $49K."

👉 RESULT: Bitcoin dropped from $107K → $66,700

That's -40% Correction, EXACTLY as predicted.

🔰PROFIT BOOKED:

→ Short from $107K to $66,700

→ $40,000+ per CRYPTOCAP:BTC move captured

→ Those who followed saved their portfolio from -40% destruction

🔰 WHAT THE CHART SHOWED:

✓ Weekly bearish divergence confirmed

✓ $104K support trendline broken

✓ Support 1 ($73K) - SMASHED

✓ Now testing $66K-$68K zone

✓ Support 2 ($48K) still possible if this breaks

🔰 THE LESSON:

This is WHY I always tell you: Never blindly follow moonboys.

Everyone wants to hear "$200K coming" but nobody wants to hear "protect your capital."

Retracements happen in EVERY market. Even in bull runs.

Am I bullish long-term? YES.

Do I ignore warning signs? NEVER.

🔰 If you followed this analysis, you either:

Saved your portfolio from -40% crash

Made massive profit on the short

Bought the dip at better prices

This is the power of REAL technical analysis, not hopium.

👉 Share this with someone who needs to see it.

More updates coming. Stay connected.

Btc!

BTC/USD: Rebound from 2026 Lows – Path to $100K Re-Accumulation?Based on the detailed technical analysis: Bitcoin is showing signs of life after a sharp weekend flush that saw prices hit a fresh 2026 low near $74,500. My current analysis highlights a potential structural shift as we defend critical support levels and look to reclaim mid-range liquidity.

The Technical Setup:

Support Defense: We have successfully held the $74,000 - $75,000 zone. This level has proven pivotal, acting as a base for the current relief rally.

Immediate Resistance: The first major hurdle is the $78,500 - $79,200 supply zone (gray box). A clean breakout and retest of this level as support is essential to confirm a shift in momentum.

Secondary Target: Once above $80k, I am eyeing a move toward the $90,000 psychological barrier. This was a heavy rejection point in January and will likely act as a major profit-taking zone.

The Strategy: I am anticipating a zig-zag recovery pattern. The goal is to see a series of higher highs and higher lows:

A push through $79k, followed by a shallow retracement to confirm the floor.

A secondary impulsive leg toward $90k.

Consolidation before a final push toward the $100,000 target by late Q1/early Q2.

Risk Management: While the "whale" accumulation at these discounts is encouraging, the overall trend remains heavy. A daily close below $74,000 would invalidate this bullish path and likely lead to a deeper correction toward the $72k liquidity pool.

Note: This is for educational purposes only. Market conditions are highly volatile; always manage your risk and stick to your plan.

The Ugly Truth Behind Cathie Wood's $1.5M Bitcoin Prediction⚠️ The Ugly Truth Behind Cathie Wood's $1.5M Bitcoin Prediction Nobody Talks About (The $1M Bitcoin Trap Exposed)

Cathie Wood Just Predicted $1.5M Bitcoin By 2030. Before You Get Excited, Let Me Show You Something Important.

Her Prediction Track Record:

1️⃣ November 2020: Target: $400K-$500K

2️⃣ May 2021: Target: $500K By 2026

3️⃣ September 2021: Target: $500K by 2026

4️⃣ January 2022: Target: $1M+ by 2030

5️⃣ February 2023: Target: $1M-$1.48M by 2030

6️⃣ January 2024: Target: $1.5M by 2030 (Raised 50%)

6️⃣ November 2024: Target: Base $650K, Bull $1.5M by 2030

7️⃣ February 2025: Target: Bull $1.5M, Base $710K, Bear $300K

8️⃣ April 2025: Target: Up to $2.4M by 2030

9️⃣ November 2025: Target: $1.2M by 2030 (Reduced from $1.5M)

Notice The Pattern? The Target Year Keeps Shifting But The Big Numbers Stay In Headlines.

🔰 Ask Yourself This:

If Institutions Truly Believed Bitcoin Will 15x From Here, Why Would They Tell You?

Why Reveal Their “Secret” To Millions Of Retail Investors?

Think About It. When They Announce Massive Targets, Retail Holds Expecting $1M While Institutions Quietly Take Profits. Then They Buy Back Cheaper When You Panic Sell The Dip.

This Is How Exit Liquidity Works.

🔰 The Reality Check:

I Am Not Against Bitcoin Reaching $1M. It Absolutely Can Happen.

But Here Is What Nobody Tells You: Bitcoin Is Not Magic. It Does Not 10x Overnight Because Someone On TV Said So.

$1M Bitcoin Is Possible But Realistic Timeframe Is 5–10 Years Of Holding Through Multiple Cycles, Crashes And Recoveries.

🔰 My Honest Take:

➡️ Institutions Are Not Your Friends. They Are Not Sharing Alpha, They Are Creating Liquidity.

➡️ When ARK Says Buy, Ask Yourself: Who Are They Selling To?

➡️ Big Targets Make Great Headlines But Terrible Trading Strategies.

🔰 What You Should Do Instead:

👉 Never Make Financial Decisions Based On Influencer Predictions.

👉 Do Your Own Research With Proper Calculations.

👉 Have Your Own Entry And Exit Strategy.

👉 Understand That Wealth Building Takes Time Not Tweets.

CryptoPatel Summary:

🔹 Yes Bitcoin Can Reach $1M. I Support That Long Term Vision.

🔹 But It Will Take Years Of Patience, Not Months Of Hopium.

🔹 The Difference Between Retail And Institutions? They Have A Plan. Do You?

🔹 Stop Being Exit Liquidity. Start Being Strategic.

Save This Post. Your Future Self Will Thank You.

Follow @CryptoPatel For Real Talk, Not Hype.

NFA & DYOR

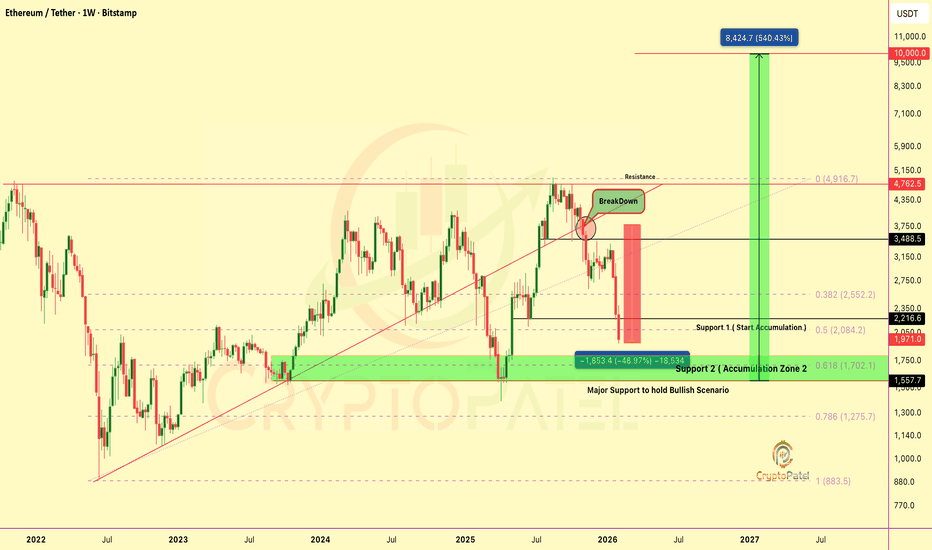

$ETH UPDATE: NOW 48% DOWN FROM MY WARNINGCRYPTOCAP:ETH UPDATE: NOW 48% DOWN FROM MY WARNING

When #ETHEREUM Broke $3,700-$3,600 Support, I warned you about a major breakdown.

✅ From $3,700 → $1,928 (48%) in Just 3 Months

✅ Previous Entry at $2,200-$2000 FILLED

NEW ACCUMULATION ZONE:

🔹 $2,000 - $1,500 (Start Building Positions)

🔹 $1,700 (0.618 Fib - Strong Support, Bid Placed)

🔹 $1,300 (0.786 Fib - Worst Case Scenario Bid)

Why I'm Still Confident:

→ $10K Target (5x from current levels)

→ $15K Target (Extended cycle target)

This is NOT for short-term trades.

This is LONG-TERM spot accumulation.

The best opportunities come when everyone else is fearful.

Fibonacci levels don't lie:

0.618 at $1,700 = Historical bounce zone

0.786 at $1,300 = Maximum pain / Maximum opportunity

My Approach:

Scale in. Don't all-in.

Place bids at key levels.

Let the market come to you.

Remember: In crypto, 500-1000% moves happen every cycle. But only for those who accumulate during fear, not FOMO.

NFA. ALWAYS DYOR.

$WLFI CRASH ALERT: TRUMP's Crypto - Dump to $0.07 or Pump to ATH⚠️ $WLFI CRASH ALERT: TRUMP's Crypto at Critical Zone - Dump to $0.07 or Pump to ATH?

World Liberty Financial ($WLFI), President Donald Trump's Crypto Project Continues Trading in a Clear Bearish Structure on the Daily TF. $WLFI Now Down 78% from ATH $0.4780, Now Trading at $0.1306.

Bullish Scenario:

If Price Holds $0.113 – $0.125 Support, Expect A Relief Bounce Toward $0.18 – $0.20 (+40%) Resistance (Still Within Bearish Channel).

Breakout Confirmation:

Break Above $0.20 With High Volume + HTF Candle Close → Opens Path Toward NEW ATH Targets Around $1.00

Bearish Scenario:

Breakdown Below $0.113 Support → Expect Another 40% Drop From Breakdown Level.

Downside Target: $0.07

Risk Warning:

Never Trade Blindly. Always Trade With Confirmations And Strict Stop Loss.

Educational Purpose Only – Not Financial Advice

$BTC UPDATE: 22% DOWN FROM MY SHORT ZONECRYPTOCAP:BTC UPDATE: 22% DOWN FROM MY SHORT ZONE

When Most MoonBoys Were Calling $200K–$500K... I Shared Shorts at $95K-$98K.

Today: Bitcoin Touched $75,500 ✅

Results Without Leverage: +22%

With 5x Leverage: ~100%+ ProfitIf You Followed the Setup and Now Time to Book Profits.

The Trend Was Clear:

→ Bear Flag Breakdown

→ H&S Failure

→ Lower Highs, Lower Lows

This is Why We Trade Structure, Not Hopium.

Risk Management Saved Portfolios.

Stop Losses Kept You in the Game.

Moon Boys Don't Teach You Risk Management.

Charts do.

Always Trade with a Plan. Always manage Risk.

Hope You Saved Capital & Banked Gains.

Not financial Advice. ALWAYS DYOR.

UPDATE: $BTC Breakdown Playing OutUPDATE: CRYPTOCAP:BTC Breakdown Playing Out

Bitcoin dumped below $85k, now trading near $84.4k.

We called shorts at $95k–$98k, and price rejected from ~$98k, delivering nearly 12% downside already.

The bear flag breakdown remains active, downside continuation favored.

Targets: $75k → $70k

Invalidation: HTF close above $90,600

Until then: sell rallies, respect the trend.

Not financial advice. DYOR.

$PUMP MACRO SETUP | 1,000%+ UPSIDE IF HTF BASE HOLDSNYSE:PUMP MACRO SETUP | 1,000%+ UPSIDE IF HTF BASE HOLDS

#PUMP Is Trading Inside A HTF Accumulation Zone After Completing A Long-Term Descending Wedge, Signaling A Potential Macro Trend Reversal.

Technical Structure:

✅ Multi-Month Descending Wedge Breakout Confirmed

✅ Clean Breakout + Retest Of HTF Neckline

✅ Inverse H&S Pattern NeckLine Very Close to Breakout

✅ Strong Demand Holding Inside $0.0025 – $0.0022

✅ Structure Invalidate Below $0.00168 (HTF Close)

✅ Sustained Acceptance Above Accumulation Signals Continuation

CryptoPatel Expansion Targets: $0.00504 → $0.00867 → $0.01500 → $0.02297+

High R:R Setup If HTF Demand Holds And Expansion From The Base Continues.

❌ Invalidation: HTF Close Below $0.00168 Opens Downside Risk And Invalidates The Reversal Structure.

TA Only. Not Financial Advice. ALWAYS DYOR.

$RIVER Turned $1K Into $52K In 41 Days But Here’s Why I’m Not BuCRYPTOCAP:RIVER Turned $1K Into $52K In 41 Days But Here’s Why I’m Not Buying

CRYPTOCAP:RIVER Pumped 5,221% In 41 Days. From $1.616 (Dec 17) → $86 (Yesterday)

What Caused This Pump?

🔹 Arthur Hayes + Justin Sun ($8M) Backed It

🔹 $12M Funding Round With Big Investors

🔹 Sui Network Partnership

🔹 Listed On Binance, OKX, Bybit, Coinone

🔹 Only 20% Tokens In Circulation

🔹 One Whale Bought 50% Supply At $4

⚠️ My Warning:

👉 Don’t Try To Catch This Knife Now

👉 Strong Support Is At $8–$12 - High Chance Price Revisits $10–$15

👉 Fresh Longs At ATH = Very Risky

Key Risks:

🔴 Whale Controls 50% Supply: Dump Risk Anytime

🔴 Pump Driven By Leverage, Not Organic Demand

🔴 80% Tokens Still Locked

Conclusion:

Wait For A Proper Pullback

Don’t Become Exit Liquidity

DYOR

My Take:

Good Project, Very Risky Price Right Now

Wait For Cooldown Or Proper Structure

FOMO Is Not A Strategy

BTC Confirms Bearish Structure After Neckline RejectionBTC Confirms Bearish Structure After Neckline Rejection

#Bitcoin has rejected the 94k–98k neckline resistance, confirming a bearish market structure.

➡️ Resistance: 94k–98k

➡️ Supports: 80k → 75k → 70k

Structure shows a confirmed Head & Shoulders Pattern Failed, Followed by a bear flag breakdown, trend remains decisively bearish.

Outlook:

Below 90k, downside continuation is favored.

Measured move points to 75k–70k (~22% downside).

Bullish bias only returns on a strong reclaim and acceptance above 92k.

Until then: sell the rallies, respect the trend.

Not financial advice. DYOR.

Bitcoin Investment strategyTime-Based Accumulation & Distribution Idea

Bitcoin has historically respected long-term time cycles. Rather than focusing on short-term price noise, this idea explores a time-window approach that aligns with structural supply shocks and market psychology.

The concept is simple but powerful:

identify a accumulation phase well before the event, and a distribution window once the cycle matures. These windows are not about exact tops or bottoms, but about positioning within a broader asymmetric opportunity.

This approach assumes volatility, drawdowns, and false signals along the way — but the edge lies in time in the market, not timing the market.

With the next accumulation already on the clock, the question isn’t if the cycle repeats — but how it expresses itself this time.

More insights as we get the next signal

$ONDO ALTSEASON SETUP | 5,000%+ EXPANSION IF MACRO DEMAND HOLDSONDO is currently trading at a major weekly demand zone after an ~85% drawdown from ATH. While price action remains weak, on-chain data suggests silent accumulation, indicating potential smart money positioning ahead of the next cycle.

Market Structure (Weekly)

Bearish divergence confirmed at $2.14, marking the macro top

Breakdown + retest of the $0.73–$0.80 support zone → now acting as resistance

Price has entered a high-timeframe demand zone between $0.30–$0.20

A final retracement into bullish order flow ($0.32–$0.20) remains possible

Bullish bias remains valid above $0.20 (weekly close)

On-Chain Context (Jan 18, 2026 – 1.94B ONDO Unlock):

Whale spot orders dominating market activity

$0.35–$0.40 acting as an accumulation range

90D CVD trending higher → buy pressure outweighs sell pressure

Taker-buy dominance → aggressive smart money absorption

This behavior suggests unlock supply is being absorbed, not distributed.

Upside Projections (HTF Expansion)

Targets: $0.70 → $1.00 → $2.00 → $5.00–$10.00

Structure supports a potential RWA-led expansion into 2026 if demand holds

Key Level to Watch

Invalidation: Weekly close below $0.20

This $0.32–$0.20 zone may be the final bullish base for ONDO ahead of the next alt-season cycle

TA Only. Not Financial Advice. DYOR.

$XRP PRICE PREDICTION | MULTI-YEAR BREAKOUT TOWARD $10+?CRYPTOCAP:XRP is trading above a confirmed multi-year breakout zone on the higher timeframe after completing a long accumulation phase.

Price has already delivered a strong expansion move and is now building structure for the next leg higher.

TECHNICAL OVERVIEW (HTF):

✔ Descending Wedge Breakout (2020–2024)

✔ 600%+ Expansion From $0.60 Breakout

✔ Fair Value Gap / Accumulation Zone: $1.30 – $1.90

✔ Higher-Timeframe Bullish Structure Intact

✔ Bullish Bias While Price Holds Above $1.30

TARGETS (CryptoPatel): $3.50 / $5.00 / $8.70 / $10+

INVALIDATION:

❌ HTF Close Below $1.30

Technical analysis only. Not financial advice. DYOR.

$PUMP PRICE OUTLOOK | 500%–1000% POTENTIAL? #PUMP Is Trading In A Bullish Expansion Zone After Breaking Long-Term Descending Resistance On The Daily Chart.

Price Has Completed A Prolonged Distribution → Correction Phase And Is Now Showing Early Reversal Signals.

Current Technical Structure:

✅ Long-Term Descending Trendline Break Confirmed

✅ Descending Wedge Breakout Structure

✅ Strong HTF Demand Zone Holding (0.0023–0.0021)

✅ Multiple Support Reclaims Indicate Accumulation

✅ Strength Signal: Bullish Above $0.0021

CryptoPatel Targets: $0.00449 / $0.00644 / $0.00872 / $0.015 / $0.026

As Long As PUMP/USDT Holds Above $0.0021, The Bullish Bias Remains Intact.

This Is A High-Risk, High-Reward Accumulation Setup With Asymmetric Upside Potential.

Invalidation: Daily Close Below $0.0021

TA Only. Not Financial Advice. DYOR.

$FET Price Prediction | 5000% Potential From Macro Support?Market Context

NYSE:FET is currently trading at a major Higher Timeframe (HTF) support zone after a deep corrective move from cycle highs.

Price has retraced ~97% from ATH, a level historically associated with long-term re-accumulation phases.

Technical Overview (HTF)

✔ Macro ascending channel support intact (since 2020)

✔ Strong HTF demand zone at $0.20 – $0.19

✔ 97%+ retracement from ATH completed

✔ Channel support + demand confluence holding

✔ Bullish structure as long as price holds above $0.19

This area represents a high-risk / high-reward macro support with asymmetric upside potential.

Upside Targets (CryptoPatel Levels) $0.60 / $1.00 / $2.80 / $5.00 / $10.00

➡️ This implies a potential ~50x (5000%) move if the macro structure plays out.

⚠️ Invalidation Level

❌ HTF close below $0.19

A breakdown below this level would invalidate the macro bullish thesis.

Conclusion

As long as FET/USDT holds above $0.19, the macro bullish bias remains valid.

This zone could act as a long-term accumulation base before the next expansion phase.

TA Only | Not Financial Advice

Always manage risk and DYOR.

$AXS Crashed 98% From Its ATH. Now It Just Pumped 65% In One DayNYSE:AXS Crashed 98% From Its ATH. Now It Just Pumped 65% In One Day. Here’s What Changed:

After A Brutal -99.67% Drop From Its $166 ATH to $0.55, NYSE:AXS Is Finally Showing Strength.

Price Surged 65%+, Reclaiming $2 With $1.18 Billion+ Volume And Is Up Over 190% In The Past Month

Driven By A Major Tokenomics Upgrade:

🔹 Launch Of bAXS (1:1 Backed By AXS)

🔹 Rewards Stay Inside The Ecosystem

Technical View

Strong Bounce From $0.80–$1.00 Accumulation Zone

Now Holding $1.50–$2.00 As Support

New Accumulation Zone: Around $1.50-$1.20

Next Resistance Sits Around $3.80

Key Invalidation Below $0.75

Narrative: Gaming Tokens Are Catching Bids Again:

RON +20% | SAND +30% | MANA +21%

#AXS Was The King Last Cycle: Is NYSE:AXS Setting Up For A Run Back To Its $166 ATH?

NFA | DYOR

$TAO PRICE PREDICTION | IS $3,000 POSSIBLE? | CRYPTOPATELGETTEX:TAO Is Trading At A Key HTF Accumulation Zone On The Weekly Chart After A Deep Correction From The 2024 Highs.

Market Structure Continues To Suggest Smart Money Re-Accumulation At Long-Term Demand.

Weekly Technical Structure:

• Bullish Order Block Holding: $260–$285

• Strong Historical Reactions From This Demand Zone

• Range Compression After Liquidity Sweep

• Key Strength Trigger: Weekly Close Above $440 (S/R Flip)

CryptoPatel Targets:

$1,000 / $1,500 / $3,000+

As Long As TAO/USDT Holds Above $260, The Macro Bullish Bias Remains Intact.

A Clean Break Above The $700–$800 Supply Zone Opens The Door For Price Discovery.

Invalidation: Weekly Close Below $260

TA Only. Not Financial Advice. DYOR.

$TON BREAKOUT SETUP | MACRO CHANNEL TARGET $30 | CRYPTOPATELLSE:TON / USDT: Weekly Price Forecast | CryptoPatel

TON is trading at a major HTF support confluence on the weekly timeframe after a prolonged corrective move from the 2024 highs.

Technical Structure:

Price continues to respect a macro ascending channel in play since 2022. Within this structure, TON has been correcting inside a descending channel from the ~$8 high, indicating a controlled correction rather than trend failure.

The current price is reacting from the lower boundary of the descending channel, which also aligns with long-term ascending trendline support — a key accumulation zone historically.

Key Levels & Confirmation:

• Weekly close above $2.70 = descending channel breakout

• Reclaim of $3.50 = bullish trend resumption

• Measured move projects toward $28–$30 zone (upper macro channel)

Targets: $3.50 → $7 → $15 → $30+

Invalidation: Weekly close below $1.20

This is a high time-frame accumulation setup with asymmetric risk-reward, best suited for spot and long-term positioning.

TA Only. Not Financial Advice. Always Manage Risk.

BTC | 8H Technical Structure UpdateBTC | 8H Technical Structure Update

Price Is Printing A Clear Ascending Triangle With Consistent Higher Lows Pressing Into A Well-Defined Horizontal Supply Zone At $94,500

Key Technical Levels:

🔹 Range High / Supply: $94,500 → $107,000

🔹 Ascending Trendline (Dynamic Demand): ~$88,000

🔹 HTF Demand / Structural Support: $78,000

Market Structure Read:

🔹 Compression Phase Ongoing

🔹 Volatility Expansion Imminent

🔹 Trendline Continues To Act As Acceptance Support

🔹 Liquidity Resting Above Range High

Scenarios:

✔️ 8H Close Above $94500 → Range Expansion Toward $106K+

❌ Loss Of Ascending Trendline → Structural Rotation To $78K

Market Is At Decision Point. Wait For Acceptance, Not Anticipation.

$AVAX PRICE FORECAST | IS $200 POSSIBLE? | ANALYSIS BY CPCRYPTOCAP:AVAX PRICE FORECAST | IS $200 POSSIBLE? | ANALYSIS BY CRYPTOPATEL

#AVAX Is Holding A Strong High-Timeframe Accumulation Zone On The Weekly Chart After A Deep Multi-Year Correction From The 2021 ATH. Current Structure Suggests Smart Money Re-Accumulation Near Long-Term Demand.

Weekly Technical Structure:

✅ Strong All-Time Support / Accumulation Zone: $11 – $13.80

✅ Multiple Confirmed Reactions From This Zone Since 2022

✅ Macro Descending Trendline From ATH Still Capping Price

✅ Recent Sell-Side Liquidity Sweep Into Demand

✅ Bullish Confirmation Trigger: Weekly Close Above $15

CryptoPatel Targets (HTF Expansion):

🎯 TP1: $32.7

🎯 TP2: $57.9

🎯 TP3: $114.5

🎯 TP4 (Cycle Extension): $200+

As Long As AVAX/USDT Holds Above $11, The Macro Bullish Bias Remains Valid.

This Is A Patience-Based Weekly Setup With Asymmetric Risk-Reward, Best Suited For Spot & Swing Traders Using HTF Confirmation.

Invalidation:

❌ Weekly Close Below $10

TA Only. Markets Are Probabilistic. Always Manage Risk & DYOR.

$TRX PRICE FORECAST | IS $5 POSSIBLE? | ANALYSIS BY CRYPTOPATELCRYPTOCAP:TRX PRICE FORECAST | IS $5 POSSIBLE? | ANALYSIS BY CRYPTOPATEL

#TRX Is Quietly Building A Massive Multi-Year Base On The 2W Chart.

Price Has Respected The Same Rising HTF Trendline Since 2020 — A Clear Sign Of Long-Term Strength.

Technical Highlights:

✅ Clean Higher Highs & Higher Lows

✅ Multi-Year Ascending HTF Trendline Holding

✅ Strong HTF Demand Zone Holding At ~$0.25

✅ Extended Consolidation → Expansion Setup

✅ Macro Trend Bias Remains Bullish

CryptoPatel Targets: $1 → $2 → $5+

Invalidation: ❌ Weekly Close Below ~$0.20

As Long As TRX/USDT Holds Above $0.25, The Bullish Structure Remains Intact.

A Loss Of This Level Would Break The Macro Thesis.

Cycle Outlook:

2025 = Compression Phase

2026–2027 = Potential Parabolic Expansion

TA Only | DYOR | Not Financial Advice

$LINK Price Outlook | Is $100+ On The Table? | CryptoPatelBIST:LINK Price Outlook | Is $100+ On The Table? | CryptoPatel

BIST:LINK Is Showing Strong Signs Of A Macro Bullish Reversal After Holding A Multi-Year Support Zone On The 2W Timeframe. The Current Structure Suggests A High-Timeframe Trend Shift That’s Been Building Since The 2021 Top.

Technical Breakdown (HTF):

✅ Breakout And Retest Confirmed

✅ Strong Accumulation Zone: $9 – $12

✅ Holding Above The 0.618 Fibonacci Level ($9.88)

✅ Higher Lows Forming → Macro Trend Turning Bullish

✅ Major Resistance Zone: $25 – $31 (Expansion Trigger)

Upside Targets (CryptoPatel): $31/$52/$90 – $100 (~780% Potential Cycle Move)

Bullish Thesis:

As Long As BIST:LINK Holds Above $7, The Macro Bullish Structure Remains Valid. This Is A Patience-Based, High-Timeframe Setup With A Strong Risk-To-Reward Profile For Spot Positions.

Invalidation:

❌ Weekly Close Below $7

Disclaimer:

Technical Analysis Only. Not Financial Advice. Markets Are Probabilistic—Always Do Your Own Research.

$ONDO PRICE FORECAST | IS $7.65+ POSSIBLE? | CRYPTOPATEL TALSE:ONDO Is Trading At A High-Timeframe Fibonacci Demand Zone, Holding The 0.618 Retracement (~$0.45) After A Deep Corrective Move — A Textbook Accumulation Structure.

Technical Structure

Accumulation Zone: $0.40–$0.45

Bullish Order Block / Deeper Demand: $0.25–$0.30 (0.786 Fib)

HTF Structure Remains Valid Above $0.25

Structural Flip Can Trigger Impulsive Expansion

Price Targets: $0.82 → $1.20 → $2.15 → $7.65+

As Long As Demand Holds, ONDO Remains Positioned For A Multi-Leg Cycle Expansion With 2000%+ Upside Potential.

Accumulation Phase In Progress — Patience Is Key.

Technical Analysis Only | Not Financial Advice