BITCOIN CRASH TO $40K INCOMING? Critical Levels You MUST Know!BITCOIN CRASH TO $40K INCOMING? Critical Levels You MUST Know!

Current Status: BTC forming Lower Lows & Lower Highs - Weakness Confirmed.

After breaking below $90K, Bitcoin tested sub-$70K as predicted, reaching a low of $59,809 yesterday before bouncing to $71,750. This volatility liquidated both high-leverage longs and shorts.

Key Levels to Watch:

Bearish Order Block: $77,516 - $79,290

Bearish Order Flow: $86,035 - $90,585

Expecting price to visit these levels before the next leg down.

Trading Plan:

✅ Short Entry Zones: $80K and $90K levels

✅ Strategy: Wait for price reaction at bearish order blocks

✅ Current LL Confirmation: Any HTF candle close above $79,290

Scenarios:

Bearish Case: If rejected from order blocks → Potential test of $50K-$40K range

Bullish Invalidation: HTF candle close above CHOCH at $97,900

Current LL at $59,809 NOT confirmed yet - waiting for HTF confirmation above $79,290.

Best Strategy: WAIT for clear confirmations at key levels before taking positions. Patience is key in this market structure.

Not Financial Advice & ALWAYS DYOR

BTC-D

$ADA ALTSEASON SETUP | 4,500%+ EXPANSION IF SUPPORT HOLDSCRYPTOCAP:ADA ALTSEASON SETUP | 4,500%+ EXPANSION IF SUPPORT HOLDS

#ADA Is Trading Inside A HTF Bullish OB After A ~93% Corrective Move From Its Local Macro High, Positioning Price At A Critical Accumulation Vs Invalidation Zone.

Technical Structure

✅ Previous Cycle ATH At $3.1 (+1,300% Expansion)

✅ BIG Correction PHASE: −78% From $1 Local High Within Last 6 Months

✅ Multi-Year Strong Support Holding Above $0.24 Level

✅ HTF Bullish OB Active At $0.18–$0.13

✅ Structure Remains Bullish As Long As $0.13 Holds (HTF Close)

✅ Strict STOP LOSS For High Risky Trader: $0.0755 (HTF Close)

Historical Context:

2021 Bull Run: +3,400% Expansion To $3.10

2021-2026 Correction: -92.89% Decline Into Accumulation Phase

HTF Demand Zone: $0.18–$0.13 (Accumulation & Liquidity Absorption)

Reclaim Zone: $0.4374 (Trend Confirmation Area)

Bull Market Expansion Targets: $1.20 → $3 → $5 → $10+ (Full Cycle Expansion Projection)

This $0.18–$0.13 Zone May Be The Last Accumulation Opportunity For ADA Bulls Before The Next Parabolic Phase.

Invalidation: Weekly Close Below $0.13

Disclaimer: This Is TA Only. Not Financial Advice. Always Do Your Own Research And Manage Risk.

From $6 to $0.10 – The $5 Comeback Story Nobody's Talking About MIL:ENA : From $6 to $0.10 – The $5 Comeback Story Nobody's Talking About Yet

As Predicted, Price dumped 60% after breaking down from $0.24 support, now sitting at $0.10.

Current Status:

✅ $0.08–$0.10 = Prime accumulation zone activated

⚠️ Still possible dip to $0.06 (best long-term entry if it hits)

Long-Term Outlook: Potential target: $5+

This is where patience pays off. Down 94% from ATH means deep value territory but volatility remains high.

Risk Management:

➤ Only invest what you can hold 2-3+ years

➤ DCA strategy recommended

➤ Watch for $0.06 level confirmation

NFA. Always DYOR.

$HYPE MASTERCLASS: 60% DOWN, 86% UP From My AnalysisGETTEX:HYPE MASTERCLASS: 60% DOWN, 86% UP - THIS IS WHY YOU FOLLOW THE CHARTS

Remember My Analysis? Let me Break Down the FULL Trade:

WHAT I CALLED ON 23 OCTOBER 2025:

➜ SHORT Setup Signal at $50

➜ Predicted Dump to $20

➜ Marked $20-$15 as PRIME Accumulation Zone

WHAT HAPPENED:

✅ Price dumped EXACTLY to $20

✅ 60% profit on SHORT from $50 to $20

✅ Strong Bounce from Predicted Accumulation Level

Now Trading at $35-$38 Which is 86% Profit on LONG From $20 Entry.

THE RESULTS:

If You Followed the Complete Plan:

✅ Booked 60% SHORT Profits

✅ Flipped to LONG at $20

✅ Now Sitting on 86% SPOT Gains (No Leverage!)

THE LESSON: This is What SMART Trading Looks Like:

Don't Buy Tops

Don't Sell Bottoms

NO FOMO

LONG TERM POTENTIAL: $50 / $100 / $200 / $500

Did You Catch BOTH Moves?

Not financial advice. ALWAYS DYOR.

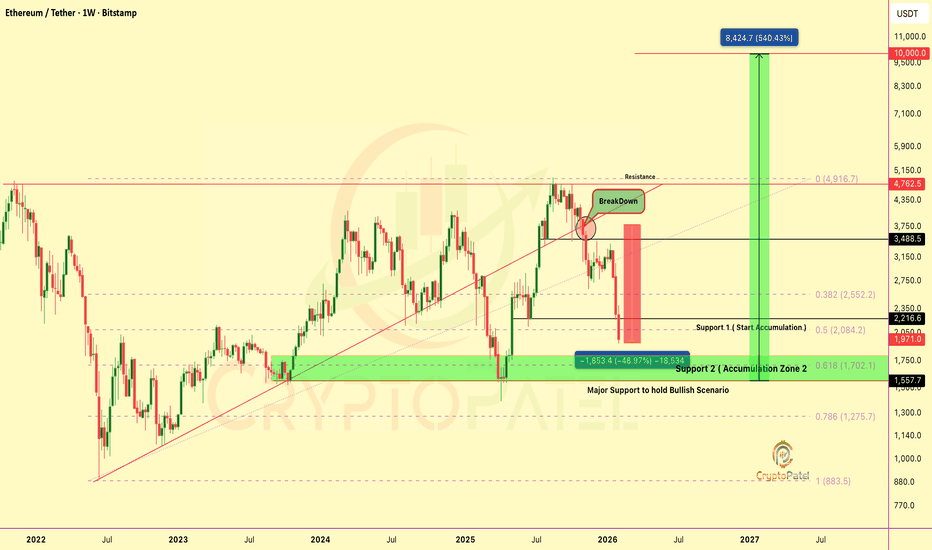

CALLED ETH CRASH AT $3,700. NOW 65% DOWN. CALLED ETH CRASH AT $3,700. NOW 65% DOWN. ACCUMULATION ZONE ACTIVATED

REMEMBER MY WARNING?

When ETH Broke $3,700-$3,600 Support, I told you: "Major Breakdown Incoming"

THE RESULT:

✅ Entry Warning: $3,700

✅ Current Price: ~$1,700

✅ Total Drop From Our Entry: -54% (65% from Peak in Last 6 months)

ACCUMULATION ZONES:

✅ Zone 1: $2,000-$1,800 - FILLED (First Bids Triggered)

🎯 Zone 2: $1,400-$1,270 (0.786 Fib) - BIDS PLACED

→ This is maximum Pain Zone

→ Historical Bounce Level

→ Best Long-Term Entry

WHY I’M LONg-TERM BULLISH ON CRYPTOCAP:ETH :

→ U.S. ETH ETFs Have Accumulated 6M ETH ($55B) in ~18 months

→ Bitmine Continues aggressive Accumulation, Now Holding 4.28M ETH (~$13B+)

→ Combined with Other ETH-Strategy Firms, Institutions Now Control ~13M ETH

This Level of Structural, Long-Term Demand is Extremely Bullish for Ethereum’s Next Cycle.

Long-Term Targets: $10,000-$20,000 (5-10x Potential)

MY APPROACH:

1️⃣ Scale in Slowly (Not All-In)

2️⃣ Place Bids at Key Technical Levels

3️⃣ Let Market Come to Me

4️⃣ Think in Years, Not Weeks

THE MINDSET (THE REALITY):

❌ Most Bought at $3,700 (Greed)

✅ I'm Buying at $1,800 (Fear)

This is how generational wealth is built in crypto.

IMPORTANT:

This is NOT Short-term Trading, This is LONG-TERM Accumulation

65-80%% Corrections = Normal in Crypto

Next Bull Run = 500-1000% Moves

THE FIBONACCI PROOF:

0.618 Fib ($1,700) = Current Support Test

0.786 Fib ($1,270) = Maximum Opportunity

More Downside Possible Before Reversal.

But When $10K-$20K Hits, You'll Remember this Post.

NFA. ALWAYS DYOR. Scale in Smart.

OCTOBER 18: I CALLED $107K CRASH. TODAY: BITCOIN -44% AT $60K.OCTOBER 18: I CALLED $107K CRASH. TODAY: BITCOIN -44% AT $60K. RECEIPTS INSIDE.

They Called Me "FUD Spreader" When I Warned You On October 18, 2025.

Bitcoin Was At $107K.

Everyone Screamed "BUY THE DIP"

I Showed You The Bearish Divergence And Said: "Protect Your Capital."

THE NUMBERS DON'T LIE:

Bitcoin: $107,000 → $60,000

Total Drop: -44%

Short Profit: $47,000 Per BTC

IF YOU FOLLOWED THIS ANALYSIS:

✅ You Saved Your Portfolio From -44% Destruction

✅ You Made Massive Profits On The Short

✅ You're Now Positioned To Buy At 44% Discount

✅ You Ignored The Noise And Followed The Chart

WHAT HAPPENED:

Weekly Bearish Divergence ✓ CONFIRMED

$104K Support Breakdown ✓ BROKE

$73K Support Level ✓ SMASHED

$66K Zone ✓ CRUSHED

Now At $60K Testing Critical Support

WHAT'S NEXT:

$48K-$49K Zone Still In Play If $60K Breaks.

This Is NOT About Being Bearish.

This Is About PROTECTING CAPITAL And Buying Smart.

Bull Market Will Continue.

But Corrections Are PART Of The Journey.

Now You Can Start Accumulation Bitcoin From $60K Level Slowly

THE DIFFERENCE:

❌ Moonboys: "Buy At $107K, HODL Forever"

✅ Real Analysis: Save 44%, Re-Enter Lower

This Is Why Technical Analysis Matters.

This Is Why You Don't Follow Blind Hopium.

Drop Comment If You Followed This Call.

More Updates Coming. The Opportunity Isn't Over.

$ETH UPDATE: NOW 48% DOWN FROM MY WARNINGCRYPTOCAP:ETH UPDATE: NOW 48% DOWN FROM MY WARNING

When #ETHEREUM Broke $3,700-$3,600 Support, I warned you about a major breakdown.

✅ From $3,700 → $1,928 (48%) in Just 3 Months

✅ Previous Entry at $2,200-$2000 FILLED

NEW ACCUMULATION ZONE:

🔹 $2,000 - $1,500 (Start Building Positions)

🔹 $1,700 (0.618 Fib - Strong Support, Bid Placed)

🔹 $1,300 (0.786 Fib - Worst Case Scenario Bid)

Why I'm Still Confident:

→ $10K Target (5x from current levels)

→ $15K Target (Extended cycle target)

This is NOT for short-term trades.

This is LONG-TERM spot accumulation.

The best opportunities come when everyone else is fearful.

Fibonacci levels don't lie:

0.618 at $1,700 = Historical bounce zone

0.786 at $1,300 = Maximum pain / Maximum opportunity

My Approach:

Scale in. Don't all-in.

Place bids at key levels.

Let the market come to you.

Remember: In crypto, 500-1000% moves happen every cycle. But only for those who accumulate during fear, not FOMO.

NFA. ALWAYS DYOR.

CALLED IT - Bitcoin $107K TO $66K (-40% DROP) 🚨 CALLED IT - $107K TO $66K (-40% DROP)

Remember my warning on October 18, 2025?

When everyone was screaming "TO THE MOON" at $107K, I showed you the bearish divergence and said:

"$104K breakdown could trigger a crash to $73K and $49K."

👉 RESULT: Bitcoin dropped from $107K → $66,700

That's -40% Correction, EXACTLY as predicted.

🔰PROFIT BOOKED:

→ Short from $107K to $66,700

→ $40,000+ per CRYPTOCAP:BTC move captured

→ Those who followed saved their portfolio from -40% destruction

🔰 WHAT THE CHART SHOWED:

✓ Weekly bearish divergence confirmed

✓ $104K support trendline broken

✓ Support 1 ($73K) - SMASHED

✓ Now testing $66K-$68K zone

✓ Support 2 ($48K) still possible if this breaks

🔰 THE LESSON:

This is WHY I always tell you: Never blindly follow moonboys.

Everyone wants to hear "$200K coming" but nobody wants to hear "protect your capital."

Retracements happen in EVERY market. Even in bull runs.

Am I bullish long-term? YES.

Do I ignore warning signs? NEVER.

🔰 If you followed this analysis, you either:

Saved your portfolio from -40% crash

Made massive profit on the short

Bought the dip at better prices

This is the power of REAL technical analysis, not hopium.

👉 Share this with someone who needs to see it.

More updates coming. Stay connected.

BTC/USD: Rebound from 2026 Lows – Path to $100K Re-Accumulation?Based on the detailed technical analysis: Bitcoin is showing signs of life after a sharp weekend flush that saw prices hit a fresh 2026 low near $74,500. My current analysis highlights a potential structural shift as we defend critical support levels and look to reclaim mid-range liquidity.

The Technical Setup:

Support Defense: We have successfully held the $74,000 - $75,000 zone. This level has proven pivotal, acting as a base for the current relief rally.

Immediate Resistance: The first major hurdle is the $78,500 - $79,200 supply zone (gray box). A clean breakout and retest of this level as support is essential to confirm a shift in momentum.

Secondary Target: Once above $80k, I am eyeing a move toward the $90,000 psychological barrier. This was a heavy rejection point in January and will likely act as a major profit-taking zone.

The Strategy: I am anticipating a zig-zag recovery pattern. The goal is to see a series of higher highs and higher lows:

A push through $79k, followed by a shallow retracement to confirm the floor.

A secondary impulsive leg toward $90k.

Consolidation before a final push toward the $100,000 target by late Q1/early Q2.

Risk Management: While the "whale" accumulation at these discounts is encouraging, the overall trend remains heavy. A daily close below $74,000 would invalidate this bullish path and likely lead to a deeper correction toward the $72k liquidity pool.

Note: This is for educational purposes only. Market conditions are highly volatile; always manage your risk and stick to your plan.

$WLFI CRASH ALERT: TRUMP's Crypto - Dump to $0.07 or Pump to ATH⚠️ $WLFI CRASH ALERT: TRUMP's Crypto at Critical Zone - Dump to $0.07 or Pump to ATH?

World Liberty Financial ($WLFI), President Donald Trump's Crypto Project Continues Trading in a Clear Bearish Structure on the Daily TF. $WLFI Now Down 78% from ATH $0.4780, Now Trading at $0.1306.

Bullish Scenario:

If Price Holds $0.113 – $0.125 Support, Expect A Relief Bounce Toward $0.18 – $0.20 (+40%) Resistance (Still Within Bearish Channel).

Breakout Confirmation:

Break Above $0.20 With High Volume + HTF Candle Close → Opens Path Toward NEW ATH Targets Around $1.00

Bearish Scenario:

Breakdown Below $0.113 Support → Expect Another 40% Drop From Breakdown Level.

Downside Target: $0.07

Risk Warning:

Never Trade Blindly. Always Trade With Confirmations And Strict Stop Loss.

Educational Purpose Only – Not Financial Advice

The Ugly Truth Behind Cathie Wood's $1.5M Bitcoin Prediction⚠️ The Ugly Truth Behind Cathie Wood's $1.5M Bitcoin Prediction Nobody Talks About (The $1M Bitcoin Trap Exposed)

Cathie Wood Just Predicted $1.5M Bitcoin By 2030. Before You Get Excited, Let Me Show You Something Important.

Her Prediction Track Record:

1️⃣ November 2020: Target: $400K-$500K

2️⃣ May 2021: Target: $500K By 2026

3️⃣ September 2021: Target: $500K by 2026

4️⃣ January 2022: Target: $1M+ by 2030

5️⃣ February 2023: Target: $1M-$1.48M by 2030

6️⃣ January 2024: Target: $1.5M by 2030 (Raised 50%)

6️⃣ November 2024: Target: Base $650K, Bull $1.5M by 2030

7️⃣ February 2025: Target: Bull $1.5M, Base $710K, Bear $300K

8️⃣ April 2025: Target: Up to $2.4M by 2030

9️⃣ November 2025: Target: $1.2M by 2030 (Reduced from $1.5M)

Notice The Pattern? The Target Year Keeps Shifting But The Big Numbers Stay In Headlines.

🔰 Ask Yourself This:

If Institutions Truly Believed Bitcoin Will 15x From Here, Why Would They Tell You?

Why Reveal Their “Secret” To Millions Of Retail Investors?

Think About It. When They Announce Massive Targets, Retail Holds Expecting $1M While Institutions Quietly Take Profits. Then They Buy Back Cheaper When You Panic Sell The Dip.

This Is How Exit Liquidity Works.

🔰 The Reality Check:

I Am Not Against Bitcoin Reaching $1M. It Absolutely Can Happen.

But Here Is What Nobody Tells You: Bitcoin Is Not Magic. It Does Not 10x Overnight Because Someone On TV Said So.

$1M Bitcoin Is Possible But Realistic Timeframe Is 5–10 Years Of Holding Through Multiple Cycles, Crashes And Recoveries.

🔰 My Honest Take:

➡️ Institutions Are Not Your Friends. They Are Not Sharing Alpha, They Are Creating Liquidity.

➡️ When ARK Says Buy, Ask Yourself: Who Are They Selling To?

➡️ Big Targets Make Great Headlines But Terrible Trading Strategies.

🔰 What You Should Do Instead:

👉 Never Make Financial Decisions Based On Influencer Predictions.

👉 Do Your Own Research With Proper Calculations.

👉 Have Your Own Entry And Exit Strategy.

👉 Understand That Wealth Building Takes Time Not Tweets.

CryptoPatel Summary:

🔹 Yes Bitcoin Can Reach $1M. I Support That Long Term Vision.

🔹 But It Will Take Years Of Patience, Not Months Of Hopium.

🔹 The Difference Between Retail And Institutions? They Have A Plan. Do You?

🔹 Stop Being Exit Liquidity. Start Being Strategic.

Save This Post. Your Future Self Will Thank You.

Follow @CryptoPatel For Real Talk, Not Hype.

NFA & DYOR

$BTC UPDATE: 22% DOWN FROM MY SHORT ZONECRYPTOCAP:BTC UPDATE: 22% DOWN FROM MY SHORT ZONE

When Most MoonBoys Were Calling $200K–$500K... I Shared Shorts at $95K-$98K.

Today: Bitcoin Touched $75,500 ✅

Results Without Leverage: +22%

With 5x Leverage: ~100%+ ProfitIf You Followed the Setup and Now Time to Book Profits.

The Trend Was Clear:

→ Bear Flag Breakdown

→ H&S Failure

→ Lower Highs, Lower Lows

This is Why We Trade Structure, Not Hopium.

Risk Management Saved Portfolios.

Stop Losses Kept You in the Game.

Moon Boys Don't Teach You Risk Management.

Charts do.

Always Trade with a Plan. Always manage Risk.

Hope You Saved Capital & Banked Gains.

Not financial Advice. ALWAYS DYOR.

UPDATE: $BTC Breakdown Playing OutUPDATE: CRYPTOCAP:BTC Breakdown Playing Out

Bitcoin dumped below $85k, now trading near $84.4k.

We called shorts at $95k–$98k, and price rejected from ~$98k, delivering nearly 12% downside already.

The bear flag breakdown remains active, downside continuation favored.

Targets: $75k → $70k

Invalidation: HTF close above $90,600

Until then: sell rallies, respect the trend.

Not financial advice. DYOR.

$PUMP MACRO SETUP | 1,000%+ UPSIDE IF HTF BASE HOLDSNYSE:PUMP MACRO SETUP | 1,000%+ UPSIDE IF HTF BASE HOLDS

#PUMP Is Trading Inside A HTF Accumulation Zone After Completing A Long-Term Descending Wedge, Signaling A Potential Macro Trend Reversal.

Technical Structure:

✅ Multi-Month Descending Wedge Breakout Confirmed

✅ Clean Breakout + Retest Of HTF Neckline

✅ Inverse H&S Pattern NeckLine Very Close to Breakout

✅ Strong Demand Holding Inside $0.0025 – $0.0022

✅ Structure Invalidate Below $0.00168 (HTF Close)

✅ Sustained Acceptance Above Accumulation Signals Continuation

CryptoPatel Expansion Targets: $0.00504 → $0.00867 → $0.01500 → $0.02297+

High R:R Setup If HTF Demand Holds And Expansion From The Base Continues.

❌ Invalidation: HTF Close Below $0.00168 Opens Downside Risk And Invalidates The Reversal Structure.

TA Only. Not Financial Advice. ALWAYS DYOR.

$RIVER Turned $1K Into $52K In 41 Days But Here’s Why I’m Not BuCRYPTOCAP:RIVER Turned $1K Into $52K In 41 Days But Here’s Why I’m Not Buying

CRYPTOCAP:RIVER Pumped 5,221% In 41 Days. From $1.616 (Dec 17) → $86 (Yesterday)

What Caused This Pump?

🔹 Arthur Hayes + Justin Sun ($8M) Backed It

🔹 $12M Funding Round With Big Investors

🔹 Sui Network Partnership

🔹 Listed On Binance, OKX, Bybit, Coinone

🔹 Only 20% Tokens In Circulation

🔹 One Whale Bought 50% Supply At $4

⚠️ My Warning:

👉 Don’t Try To Catch This Knife Now

👉 Strong Support Is At $8–$12 - High Chance Price Revisits $10–$15

👉 Fresh Longs At ATH = Very Risky

Key Risks:

🔴 Whale Controls 50% Supply: Dump Risk Anytime

🔴 Pump Driven By Leverage, Not Organic Demand

🔴 80% Tokens Still Locked

Conclusion:

Wait For A Proper Pullback

Don’t Become Exit Liquidity

DYOR

My Take:

Good Project, Very Risky Price Right Now

Wait For Cooldown Or Proper Structure

FOMO Is Not A Strategy

BTC Confirms Bearish Structure After Neckline RejectionBTC Confirms Bearish Structure After Neckline Rejection

#Bitcoin has rejected the 94k–98k neckline resistance, confirming a bearish market structure.

➡️ Resistance: 94k–98k

➡️ Supports: 80k → 75k → 70k

Structure shows a confirmed Head & Shoulders Pattern Failed, Followed by a bear flag breakdown, trend remains decisively bearish.

Outlook:

Below 90k, downside continuation is favored.

Measured move points to 75k–70k (~22% downside).

Bullish bias only returns on a strong reclaim and acceptance above 92k.

Until then: sell the rallies, respect the trend.

Not financial advice. DYOR.

Bitcoin Investment strategyTime-Based Accumulation & Distribution Idea

Bitcoin has historically respected long-term time cycles. Rather than focusing on short-term price noise, this idea explores a time-window approach that aligns with structural supply shocks and market psychology.

The concept is simple but powerful:

identify a accumulation phase well before the event, and a distribution window once the cycle matures. These windows are not about exact tops or bottoms, but about positioning within a broader asymmetric opportunity.

This approach assumes volatility, drawdowns, and false signals along the way — but the edge lies in time in the market, not timing the market.

With the next accumulation already on the clock, the question isn’t if the cycle repeats — but how it expresses itself this time.

More insights as we get the next signal

$ONDO ALTSEASON SETUP | 5,000%+ EXPANSION IF MACRO DEMAND HOLDSONDO is currently trading at a major weekly demand zone after an ~85% drawdown from ATH. While price action remains weak, on-chain data suggests silent accumulation, indicating potential smart money positioning ahead of the next cycle.

Market Structure (Weekly)

Bearish divergence confirmed at $2.14, marking the macro top

Breakdown + retest of the $0.73–$0.80 support zone → now acting as resistance

Price has entered a high-timeframe demand zone between $0.30–$0.20

A final retracement into bullish order flow ($0.32–$0.20) remains possible

Bullish bias remains valid above $0.20 (weekly close)

On-Chain Context (Jan 18, 2026 – 1.94B ONDO Unlock):

Whale spot orders dominating market activity

$0.35–$0.40 acting as an accumulation range

90D CVD trending higher → buy pressure outweighs sell pressure

Taker-buy dominance → aggressive smart money absorption

This behavior suggests unlock supply is being absorbed, not distributed.

Upside Projections (HTF Expansion)

Targets: $0.70 → $1.00 → $2.00 → $5.00–$10.00

Structure supports a potential RWA-led expansion into 2026 if demand holds

Key Level to Watch

Invalidation: Weekly close below $0.20

This $0.32–$0.20 zone may be the final bullish base for ONDO ahead of the next alt-season cycle

TA Only. Not Financial Advice. DYOR.

$XRP PRICE PREDICTION | MULTI-YEAR BREAKOUT TOWARD $10+?CRYPTOCAP:XRP is trading above a confirmed multi-year breakout zone on the higher timeframe after completing a long accumulation phase.

Price has already delivered a strong expansion move and is now building structure for the next leg higher.

TECHNICAL OVERVIEW (HTF):

✔ Descending Wedge Breakout (2020–2024)

✔ 600%+ Expansion From $0.60 Breakout

✔ Fair Value Gap / Accumulation Zone: $1.30 – $1.90

✔ Higher-Timeframe Bullish Structure Intact

✔ Bullish Bias While Price Holds Above $1.30

TARGETS (CryptoPatel): $3.50 / $5.00 / $8.70 / $10+

INVALIDATION:

❌ HTF Close Below $1.30

Technical analysis only. Not financial advice. DYOR.

$PUMP PRICE OUTLOOK | 500%–1000% POTENTIAL? #PUMP Is Trading In A Bullish Expansion Zone After Breaking Long-Term Descending Resistance On The Daily Chart.

Price Has Completed A Prolonged Distribution → Correction Phase And Is Now Showing Early Reversal Signals.

Current Technical Structure:

✅ Long-Term Descending Trendline Break Confirmed

✅ Descending Wedge Breakout Structure

✅ Strong HTF Demand Zone Holding (0.0023–0.0021)

✅ Multiple Support Reclaims Indicate Accumulation

✅ Strength Signal: Bullish Above $0.0021

CryptoPatel Targets: $0.00449 / $0.00644 / $0.00872 / $0.015 / $0.026

As Long As PUMP/USDT Holds Above $0.0021, The Bullish Bias Remains Intact.

This Is A High-Risk, High-Reward Accumulation Setup With Asymmetric Upside Potential.

Invalidation: Daily Close Below $0.0021

TA Only. Not Financial Advice. DYOR.

$FET Price Prediction | 5000% Potential From Macro Support?Market Context

NYSE:FET is currently trading at a major Higher Timeframe (HTF) support zone after a deep corrective move from cycle highs.

Price has retraced ~97% from ATH, a level historically associated with long-term re-accumulation phases.

Technical Overview (HTF)

✔ Macro ascending channel support intact (since 2020)

✔ Strong HTF demand zone at $0.20 – $0.19

✔ 97%+ retracement from ATH completed

✔ Channel support + demand confluence holding

✔ Bullish structure as long as price holds above $0.19

This area represents a high-risk / high-reward macro support with asymmetric upside potential.

Upside Targets (CryptoPatel Levels) $0.60 / $1.00 / $2.80 / $5.00 / $10.00

➡️ This implies a potential ~50x (5000%) move if the macro structure plays out.

⚠️ Invalidation Level

❌ HTF close below $0.19

A breakdown below this level would invalidate the macro bullish thesis.

Conclusion

As long as FET/USDT holds above $0.19, the macro bullish bias remains valid.

This zone could act as a long-term accumulation base before the next expansion phase.

TA Only | Not Financial Advice

Always manage risk and DYOR.

$AXS Crashed 98% From Its ATH. Now It Just Pumped 65% In One DayNYSE:AXS Crashed 98% From Its ATH. Now It Just Pumped 65% In One Day. Here’s What Changed:

After A Brutal -99.67% Drop From Its $166 ATH to $0.55, NYSE:AXS Is Finally Showing Strength.

Price Surged 65%+, Reclaiming $2 With $1.18 Billion+ Volume And Is Up Over 190% In The Past Month

Driven By A Major Tokenomics Upgrade:

🔹 Launch Of bAXS (1:1 Backed By AXS)

🔹 Rewards Stay Inside The Ecosystem

Technical View

Strong Bounce From $0.80–$1.00 Accumulation Zone

Now Holding $1.50–$2.00 As Support

New Accumulation Zone: Around $1.50-$1.20

Next Resistance Sits Around $3.80

Key Invalidation Below $0.75

Narrative: Gaming Tokens Are Catching Bids Again:

RON +20% | SAND +30% | MANA +21%

#AXS Was The King Last Cycle: Is NYSE:AXS Setting Up For A Run Back To Its $166 ATH?

NFA | DYOR

$TAO PRICE PREDICTION | IS $3,000 POSSIBLE? | CRYPTOPATELGETTEX:TAO Is Trading At A Key HTF Accumulation Zone On The Weekly Chart After A Deep Correction From The 2024 Highs.

Market Structure Continues To Suggest Smart Money Re-Accumulation At Long-Term Demand.

Weekly Technical Structure:

• Bullish Order Block Holding: $260–$285

• Strong Historical Reactions From This Demand Zone

• Range Compression After Liquidity Sweep

• Key Strength Trigger: Weekly Close Above $440 (S/R Flip)

CryptoPatel Targets:

$1,000 / $1,500 / $3,000+

As Long As TAO/USDT Holds Above $260, The Macro Bullish Bias Remains Intact.

A Clean Break Above The $700–$800 Supply Zone Opens The Door For Price Discovery.

Invalidation: Weekly Close Below $260

TA Only. Not Financial Advice. DYOR.