Bitcoin Long-Term Monthly Chart: Parabolic Advance Meets DistribMacro Trend

Bitcoin is still in a long-term bullish structure. Each cycle shows higher highs and higher lows since inception.

The move from ~20k to ~90k happened in very few monthly candles, which signals a parabolic phase rather than healthy trend growth.

2. Current Candle Structure

The most recent candles show:

Large bullish impulse followed by

Strong rejection wicks and consecutive red monthly candles

This usually indicates profit-taking and distribution, not immediate trend continuation.

3. Volatility & Momentum

The current red candle (~-10%) after a blow-off green candle suggests:

Momentum is cooling

Buyers are no longer in full control

Historically, after similar structures (2013, 2017, 2021), BTC entered extended consolidation or deep pullbacks.

4. Volume Insight

Volume peaked during the explosive green candles and is now declining, which often means:

Smart money already positioned

Late buyers are absorbing supply

5. Key Levels to Watch

78k–80k: Current support (short-term)

60k–65k: Strong macro support (prior cycle top zone)

45k–50k: Extreme but historically reasonable retracement in bull cycles

6. Probable Scenarios

Base Case (Most Likely):

Sideways to downward consolidation over several months (range expansion).

Bull Continuation:

Needs a strong monthly close above prior highs with increasing volume.

Bearish Extension:

Loss of 60k opens the door for a deeper macro correction.

Btcusdtanalysis

BTCUSD (45-Min) — Bearish Structure With Weak Momentum, WatchingMarket Structure

Price is forming lower highs, respecting a descending trendline (red dashed line).

This indicates a short-term bearish trend.

Current price is around 95,090, struggling to break above recent minor highs.

2. Price Action

Recent candles show small-bodied candles → lack of strong buying pressure.

Rejections near 95,200–95,300 suggest this area is acting as near-term resistance.

Downside pressure remains dominant unless the trendline is clearly broken.

3. RSI (14)

RSI is around 46, below the neutral 50 level.

This confirms bearish momentum, but not oversold.

No strong bullish divergence visible yet → sellers still have control.

4. AO (Awesome Oscillator)

AO is negative (-65) and flattening.

Indicates weak bearish momentum, not aggressive selling.

Often precedes either consolidation or a continuation move.

5. MACD

MACD lines are below zero and moving sideways.

Histogram is weak → momentum is bearish but slowing.

No bullish crossover yet, so trend reversal is not confirmed.

6. Key Levels

Resistance:

95,200 – 95,300

Trendline resistance above current price

Support:

94,650

94,400 (next major downside target if support breaks)

7. Bias & Scenarios

Bearish Bias: While below the descending trendline.

Bearish Continuation:

Break below 94,650 → possible move toward 94,400 or lower.

Bullish Invalidation:

Strong close above 95,300 + trendline break → shift toward 95,600–95,800.

BTCUSD Daily Chart – Rising Trendline Holds, Momentum ImprovingPrice Structure

Bitcoin is trading around $95,000, respecting a rising trendline from the December lows.

The market has shifted from a strong downtrend (Nov) into a higher-low / higher-high structure, suggesting a short-term bullish recovery.

Price recently pulled back slightly after testing the $98k–$99k resistance zone, which is acting as near-term supply.

Trend & Support/Resistance

Key Support:

Trendline support: $92k–$93k

Horizontal support: $88k–$90k

Key Resistance:

Immediate: $98k–$99k

Major psychological level: $100k–$107k (next upside zone if breakout occurs)

RSI (14)

RSI is around 61–62, above the neutral 50 level.

This indicates bullish momentum without being overbought yet.

No clear bearish divergence at the moment; momentum remains constructive.

MACD

MACD lines are crossed bullish and flattening slightly.

Histogram remains positive, suggesting upside momentum is still present but losing some acceleration.

AO (Awesome Oscillator)

AO has turned positive (green bars), supporting the bullish continuation bias.

Momentum is improving compared to December.

Overall Bias

Short-term bias: Bullish to neutral

As long as price holds above the rising trendline, buyers remain in control.

A clean daily close above $99k could open the door to a $100k+ breakout.

A breakdown below $92k would weaken the bullish structure and signal a deeper pullback.

BTCUSDAs price has rejected from green dashed line, so we will take it as a resistance

So If any 15 min candle close above that green dashed line, then chances are high it could test above dashed line resistance at 91320 and even beyond that level.

Disclaimer :

It's a personal view not a financial advice and I assume no responsibility and liability whatever outcome arises.

BTCUSD (4H) – Consolidation Below Key Volume Node After PullbackMarket Structure: On the 4H timeframe, BTCUSD shows a strong impulsive rally followed by a corrective pullback and current sideways consolidation. Price is holding above prior higher lows, so the medium-term structure remains bullish, but momentum has clearly cooled.

Price Action: After topping near the recent swing high (~93k area), price retraced and is now ranging around 90,500. The candles show indecision (overlapping bodies and wicks), suggesting balance rather than trend at the moment.

Volume Profile (Right Side):

A high-volume node (HVN) is visible roughly around 90k–91k, indicating a fair value area where buyers and sellers agree.

Below, another significant volume cluster appears near 88k–89k, which should act as strong support if price breaks down.

Above current price, thinner volume up toward 92k–93k suggests that if price breaks and holds above the HVN, movement could be relatively fast.

RSI (14): RSI is around the mid-40s, below the neutral 50 level. This confirms lack of bullish momentum, but it is not oversold—more consistent with consolidation than reversal.

Bias & Scenarios:

Bullish scenario: Acceptance above ~91k suggests continuation toward 92.5k–93k, where prior supply sits.

Bearish scenario: Loss of ~89.8k–90k acceptance could lead to a rotation down toward 88k, aligned with the next major volume node.

Most likely near-term: Continued range-bound price action until a clear breakout from the volume area.

BTCUSD 1H – Bullish Structure with Short-Term Resistance and PotTechnical Analysis (1-Hour Chart)

Market Structure

Bitcoin is in a clear bullish market structure on the 1H timeframe.

Multiple BOS (Break of Structure) labels confirm continuation to the upside.

Earlier CHoCH (Change of Character) marked the transition from consolidation/bearishness into the current uptrend.

Price is respecting higher highs and higher lows, indicating strong trend control by buyers.

Price Action & Key Levels

Current price: ~91,395 USD

Price is trading near recent highs, just below a descending trendline resistance (blue dashed line).

A premium zone is visible near the highs, suggesting price may be temporarily overextended.

Below price:

FVG (Fair Value Gap) zone acts as a strong bullish retracement area.

This zone is a logical area for pullback and continuation if the trend remains intact.

Momentum Indicators

RSI (~64.7):

Bullish but approaching overbought territory.

Suggests momentum is strong, but upside may be limited short term without consolidation.

MACD:

MACD lines remain above zero with a mild bullish crossover.

Momentum is positive, but histogram shows slowing acceleration → possible short-term cooldown.

Volume

Volume is steady, not showing major distribution yet.

No clear bearish divergence, which supports trend continuation after a retracement.

Bias & Scenarios

Bullish Scenario (Preferred)

Price pulls back into the FVG / demand zone, holds structure, then continues upward.

A clean break and close above 91,800–92,000 USD would open continuation toward 93,500+.

Bearish / Correction Scenario

Rejection from the trendline + premium zone could trigger a healthy pullback.

Loss of the FVG would expose deeper retracement toward 89,800–88,800 USD, still within bullish structure unless that support fails.

Bitcoin (BTCUSD) Daily Chart – Potential Bullish Reversal Above Market Structure

BTC experienced a strong downtrend from the October high, followed by a base formation in December.

Price is now forming higher lows, suggesting a potential trend reversal or early-stage uptrend.

The ascending trendline (dashed blue) indicates growing bullish structure if respected.

2. Support & Resistance

Key Support:

~$89,150 (marked level)

Psychological zone: $85,000–$88,000

Immediate Resistance:

$92,000–$94,000

Major Resistance Target:

$100,000–$102,000 (previous breakdown area)

3. RSI (Relative Strength Index)

RSI is around 54, moving upward.

This shows bullish momentum building, but not yet overbought.

Confirms a healthy recovery, not an exhausted move.

4. MACD

MACD lines are converging upward.

Histogram is improving toward zero → bearish momentum is fading.

A bullish crossover would strengthen upside confirmation.

5. Momentum / Volume

Selling pressure has clearly weakened.

Momentum indicators suggest accumulation rather than distribution.

Bias & Outlook

Short-term bias: Mildly bullish

Confirmation needed: Daily close above $92k with volume

Invalidation: Break below $88k would weaken the bullish case

itcoin (BTC/USD) Daily Chart: Downtrend Pressure with Early Stab

Trend: BTC is still trading below a clear descending trendline, confirming a broader bearish structure since the mid-year highs. Lower highs and lower lows remain intact.

Price Action: Current price is around $90,160, consolidating after a sharp sell-off in November. This looks like a pause or base-building phase, not yet a confirmed reversal.

RSI (≈44): RSI is below 50, indicating weak momentum, but it has stabilized above oversold territory. This suggests selling pressure is easing, though bulls are not in control yet.

MACD: MACD remains below the signal line, but histogram contraction hints at bearish momentum slowing. A bullish crossover would be an early reversal signal.

Momentum/Volume Indicator: Negative values persist, showing dominant bearish momentum, but the flattening bars imply reduced downside strength.

Key Levels:

Resistance: $95,000–$100,000 (trendline + prior support)

Support: $85,000, then $78,000

Outlook:

BTC is in a bearish-to-neutral transition zone. A daily close above the descending trendline with RSI reclaiming 50 would favor a trend reversal. Failure to hold $85,000 increases the risk of another leg down toward $78,000.

BTCUSD 15-Minute Chart – Symmetrical Triangle Consolidation withAnalysis:

Market Structure: After a sharp bearish impulse (strong sell-off), BTC entered a consolidation phase, forming a symmetrical triangle. This indicates balance between buyers and sellers after high volatility.

Trend Context: The impulse move before the triangle was downward, but price has stabilized and volatility is compressing — often a precursor to a strong breakout.

Pattern Details:

Lower highs and higher lows are clearly converging.

Price is currently near the apex, where breakout probability increases.

Bias:

The drawn plan suggests a bullish breakout scenario.

Entry is placed slightly above triangle resistance to avoid false breakouts.

Trade Plan (as illustrated):

Entry: On confirmed breakout above the triangle resistance

Target: Measured move projection upward (roughly equal to the triangle’s height)

Stop Loss (SL): Below triangle support to invalidate the setup

Risk–Reward:

Favorable R:R, as the stop is tight relative to the projected upside.

Confirmation to Watch:

Strong bullish candle close above resistance

Increase in volume on breakout

Failure signal if price breaks down instead and closes below support

Conclusion:

BTCUSD is coiling inside a symmetrical triangle after a high-momentum drop. The setup favors a volatility expansion trade, with a bullish breakout being the planned direction — but confirmation is essential. A downside breakout would invalidate the bullish bias and shift momentum back to sellers.

BTCUSDT Price Action Analysis: Buy/Sell Zones, SL/TP, and Market1. Overall Trend

Your chart shows short-term bullish momentum inside a larger descending structure

(you have drawn a falling wedge / descending channel top).

👉 Short-term: bullish – strong impulsive green candle breaking through multiple intraday levels.

👉 Higher timeframe: bearish resistance overhead – price is approaching the major trendline.

🟢 2. Buy Zones (Bullish Setups)

BUY AREA #1 – Retest of 0.382 / 0.50 Fib Zone (~$90,000–$91,200)

Your strong bullish candle started from this zone.

A pullback back into this demand area = ideal entry.

Why Buy:

Bullish impulse → correction → continuation

Clear demand zone (multiple rejections)

Confluence with your ascending black trendline

Previous consolidation + liquidity grab

Entry:

→ $90,500–$91,200

SL:

→ Below $89,800 (last swing low)

TP1: $92,400

TP2: $93,700

TP3: $94,500 (1.0 Fib + supply zone)

BUY AREA #2 – Break & Retest of $92,465

If price breaks above $92,465 and retests, bullish continuation likely.

Why Buy:

Break of structure (BOS)

Retest of resistance turned support

Strong bullish pressure in previous candle

Entry: After retest & bullish candle confirmation.

SL: Below $92,000

TP: $93,800 / $94,500

🔴 3. Sell Zones (Bearish Setups)

SELL AREA #1 – Major Resistance $93,700–$94,550

Price is currently inside this zone (your dotted blue horizontal line + Fib 1.0).

This is a strong sell zone because:

Why Sell:

Major resistance + 1.0 Fibonacci

Intersection with descending trendline

Previous supply zone

Impulsive move → likely to retrace

Entry:

→ Bearish rejection candle on resistance

(HR wick + small body)

SL:

→ Above $94,800

TP1: $92,400

TP2: $91,200

TP3: $89,800

SELL AREA #2 – Break Below $89,800

If price breaks this key support, we will see strong downside.

Why Sell:

Break of structure

Loss of bullish demand

Below trendline

Entry: Retest of $89,800 from below

SL: Above $90,200

TP: $88,000 / $87,700 liquidity zone

⚠️ 4. No-Trade Zones

Avoid trading in these areas:

NO TRADE ZONE #1 – Between $91,200 and $92,400

Why?

Choppy range

No clear direction

Middle of structure

Poor risk-reward

NO TRADE ZONE #2 – Inside the triangle squeeze before breakout

Price often becomes unpredictable inside a wedge apex.

Wait for break → retest → trade.

📝 5. Summary (Quick Guide)

🟢 BUY

✔ Retest of $90,500–$91,200

✔ Break & retest of $92,465

🔴 SELL

✔ Rejection from $93,700–$94,550

✔ Break & retest of $89,800

🛑 NO TRADE

⚠ Between $91,200–$92,400

⚠ Inside wedge compression area

PRICE ACTION ANALYSIS OF YOUR CHART (BTCUSDT)PRICE ACTION ANALYSIS OF YOUR CHART (BTCUSDT)

🟢 BUY SETUP (Bullish Scenario)

1️⃣ BUY ENTRY #1 — Break & Retest of 92,240 – 92,500 Zone

This zone is a major resistance.

A breakout above it confirms strong bullish momentum.

📌 ENTRY

Buy: 92,300 – 92,450

(After a breakout + retest candle, not inside consolidation)

📌 STOP LOSS (SL)

SL below retest zone: 91,700

📌 TAKE PROFIT (TP)

TP1 → 94,000 – 94,200

TP2 → 95,800

TP3 → 97,100

📌 PRICE ACTION REASON

Structure break above major resistance

Trendline break confirmation

Higher-high formation

Large liquidity zone above (clean traffic)

2️⃣ BUY ENTRY #2 — Pullback Into 90,300 Support

Your chart shows a horizontal blue line near 90,300–90,130.

📌 ENTRY

Buy at: 90,300 – 90,150

(Wait for bullish rejection wick)

📌 STOP LOSS

SL below structure: 89,800

📌 TAKE PROFIT

TP1 → 91,200

TP2 → 92,300

TP3 → 94,000

📌 PRICE ACTION REASON

Support formed around previous accumulation zone

Fake-out followed by impulse up (bullish sign)

Price respecting trendline + horizontal support

🔴 SELL SETUP (Bearish Scenario)

The red arrows on your chart highlight bearish continuation levels.

1️⃣ SELL ENTRY #1 — Break & Retest of 89,200 Zone (Major Level)

Price repeatedly reacts to this purple level → strong liquidity.

📌 ENTRY

Sell at: 89,200 – 89,100

(After bearish retest rejection)

📌 STOP LOSS

SL above level: 89,500

📌 TAKE PROFIT

TP1 → 88,200

TP2 → 87,000

TP3 → 86,700 (trendline bottom)

📌 PRICE ACTION REASON

Loss of support → becoming resistance

Bearish market structure (lower highs)

Clean traffic to downside (no strong support until next purple line)

2️⃣ SELL ENTRY #2 — Pullback to 90,300 Becomes Resistance

If the 90,300 level breaks DOWN, it becomes a good sell zone on retest.

📌 ENTRY

Sell at: 90,200–90,350

(Only if retested as resistance)

📌 STOP LOSS

SL: 90,700

📌 TAKE PROFIT

TP1 → 89,200

TP2 → 88,200

TP3 → 87,000

📌 PRICE ACTION REASON

Role reversal: support → resistance

Continuation in bearish channel

Lower-high formation

🟡 NO-TRADE ZONE

Avoid trading inside the black descending channel mid-area, especially around:

❌ 90,800 – 91,400

Because:

Price is choppy

Weak volume area

No clean structure

High chance of fake breakouts

Wait for clear breakout or breakdown.

BTCUSD – Buy/Sell Zones + No-Trade Zone Here is a clean, price-action based analysis of your chart with:

✅ Buy zones

❌ Sell zones

🚫 No-trade zone

🎯 TP levels

🛑 SL levels

📌 Overall Market Condition

BTCUSDT is moving inside a big consolidation range.

The zone you highlighted is correct — NO TRADE AREA — because price is stuck in a sideways block with no directional confirmation.

🚫 NO TRADE ZONE

Price: 91,800 – 92,500 USDT

Reason:

Choppy structure

No direction

Liquidity building

Dangerous to open positions inside the block

🔔 Wait for breakout and retest confirmation only.

⬆️ BUY SETUPS (LONG ENTRIES)

1️⃣ Breakout Buy

Buy above → 94,250

📌 Conditions:

Candle must close above the level

Retest + bullish confirmation

🎯 TP targets (Upside green arrows)

TP1 → 96,850

TP2 → 99,640

TP3 → 100,970 (major resistance)

🛑 SL:

Below 93,700 (safe stop)

2️⃣ Pullback Buy (from lower demand)

Buy near → 89,700 – 90,000

This is first strong demand after breakdown.

🎯 TP:

TP1 → 92,300 (back to no-trade zone)

TP2 → 94,250

🛑 SL:

Below 89,150

⬇️ SELL SETUPS (SHORT ENTRIES)

1️⃣ Sell breakdown below support

Sell below → 89,700

🎯 TP levels (red arrows)

TP1 → 88,820

TP2 → 86,140

TP3 → 81,950

TP4 → 79,330 (final target)

🛑 SL:

Above 90,200

2️⃣ Pullback Sell

If price breaks below 89,700, then returns to retest:

Sell zone: 89,700 → 90,000

Confirm rejection wick.

🎯 TP:

Same as above

86,140 → 81,950 → 79,330

🛑 SL:

Above 90,300

📌 FINAL SUMMARY TABLE

Setup Entry TP SL

Breakout Buy Above 94,250 96,850 → 99,640 → 100,970 93,700

Pullback Buy 89,700 – 90,000 92,300 → 94,250 89,150

Breakdown Sell Below 89,700 88,820 → 86,140 → 81,950 → 79,330 90,200

Pullback Sell Retest 89,700 – 90,000 Same as above 90,300

No-Trade Zone 91,800 – 92,500

Buy Setup (Safer After Pullback)✅ Buy Setup (Safer After Pullback)

Because price already pumped hard, the safe buy is after a retracement — not at the top.

Buy Entry

👉 Buy: 92,820 – 92,900 retest zone

(Price must retest old resistance → new support)

Targets

TP1: 93,600

TP2: 94,400

TP3: 95,480 (major resistance)

Stop-Loss

SL: 92,300

(Below breakout structure)

❌ Sell Setup (Countertrend – aggressive)

Only if price rejects sharply from resistance.

Sell Entry

👉 Sell around: 93,300 – 93,500 rejection area

(You already have a wick rejection forming)

Targets

TP1: 92,820

TP2: 91,950

TP3: 90,374 Monday High

Stop-Loss

SL: 93,900

(Close above this breaks bearish idea)

🎯 Summary

Direction Condition Entry TP SL

BUY Retest & hold 92,820 92,820–92,900 93,600 → 94,400 → 95,480 92,300

SELL Rejection from 93,300–93,500 93,300–93,500 92,820 → 91,950 → 90,374 93,900

⭐ My View

Market is bullish, so buy on retracement is the safer and higher-probability trade.

BTCUSD – Key Level Rejection with Potential Liquidity Sweep TowaChart Analysis

1. Price Context

BTCUSD is trading around $90,675.

The chart shows price rejecting the Key Level and failing to hold above the Daily CLS (daily close level).

Recent candles indicate loss of bullish momentum with a series of lower highs forming.

2. Key Zones on Your Chart

🔴 Daily CLS (Resistance)

Marked in red.

Price tried to break and hold above this level but rejected, showing it is acting as strong overhead resistance.

The shaded gray area above looks like the stop-loss zone for shorts, suggesting a bearish setup.

🟢 Key Level

Marked slightly below the Daily CLS.

Price broke above it earlier but is now retesting from the top, failing to reclaim.

This retest-rejection pattern signals a shift from bullish to bearish sentiment.

3. Trade Bias Indicated by the Chart

Your marked zone suggests a short position setup:

Entry around current price or just under the Key Level.

Stop-loss in the gray shaded box above the Daily CLS.

Take Profit 1 at 50% CLS TP1, a midpoint liquidity target.

Final TP near the green support at the bottom.

This structure reflects a liquidity-based short setup, expecting:

A sweep of local highs → rejection → push down to fill inefficiencies or revisit liquidity pools below.

4. Market Structure

Price printed a strong move up earlier, leaving inefficiency below.

Now forming lower highs and lower lows on the lower timeframe.

Hold below Key Level suggests continuation downward.

5. Bearish Confirmation Signals

✔ Failure to hold above Daily CLS

✔ Break of Key Level and retest as resistance

✔ Weak bullish follow-through

✔ Liquidity target below at 50% CLS

BTC Wave 4 Bounce Looks Like a Trap! Is it?BTC is still moving inside a clear corrective channel, with the current bounce likely forming wave 4 before one final drop toward the 1.618 extension near 79,650 . The highlighted red zone shows a potential trap area where price may lure traders into thinking a reversal has started. Until BTC breaks above the channel convincingly, the broader structure still favors a wave 5 decline. The wave count from 1–2–3 supports this final leg down before any major recovery.

Stay Tuned!

@Money_Dictators

BTC/USD Bullish Pennant – Breakout Entry SetupBTC/USD Bullish Pe✅ BTC/USD Pennant Breakout – Technical Analysis

Chart Breakdown

The chart shows Bitcoin forming a bullish pennant pattern on the 45-min timeframe.

A pennant typically forms after a strong impulsive move (pole), followed by price compression between:

Descending trendline (upper)

Ascending/flat trendline (lower)

This usually signals continuation in the direction of the previous trend, which in this case is upward.

Key Levels

Entry Zone: Just above the pennant resistance (breakout zone).

Stop-Loss: Below the pennant support — good risk management.

Target: Projected by measuring the previous impulse (the pennant pole) and extending it upward.

Market Signals

✔ Price is squeezing near the apex — breakout imminent.

✔ Buyers appear to be defending the lower trendline.

✔ If price breaks and closes above resistance, upside continuation becomes likely.

✘ But if price rejects and falls below support, the setup invalidates.

Bias

Bullish Continuation – If breakout occurs with strong volume.

BTCUSD - RESISTANCE RETEST IN PROGRESSSymbol - BTCUSD

Bitcoin continues to consolidate beneath the previously breached ascending trendline, with no distinct signs indicating the end of the corrective phase or the emergence of strong bullish momentum. A retest of the resistance zone is currently forming.

Bitcoin is trading within a defined range between 1,11,650 & 1,06,250 At present, there are no clear bullish reversal signals, and price action suggests a corrective move toward resistance before a potential decline into the liquidity pool near 1,06,250, shaped by prior consolidation and retesting activity.

Two critical resistance zones lie ahead — 1,11,650 and 1,13,600 Resistance at 1,11,650 has been validated. However, failure to sustain rejection here may lead to a test of the upper boundary. A false breakout in that area could trigger a subsequent pullback. Overall, the cryptocurrency market remains relatively subdued, reflecting ongoing uncertainty and caution surrounding broader macro and policy factors.

Resistance levels: 1,11,650 - 1,13,600

Support levels: 1,08,650 - 1,07,375 - 1,06,250

Current price action indicates a developing consolidation phase within a localized downtrend. A confirmed breakout above 1,13,000 and subsequent consolidation above 1,13,500 would strengthen the case for a potential trend reversal. Until such confirmation emerges, a pullback from resistance into the zone of interest remains the primary expectation.

BTCUSD SHOWING A GOOD UP MOVE WITH 1:10 RISK REWARD BTCUSD SHOWING A GOOD

UP MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

BTC/USD 15/09/2025: Bullish Potential Pre-Fed DecisionMarket Overview: Steady with Huge Potential

Bitcoin remains the king of crypto with a market cap of 2.31 trillion USD, dominating the space. The 24-hour trading volume is at 33.29 billion USD (+4.72%), showing decent buying interest but not enough for a massive rally yet. With only 19.92 million BTC circulating (94.86% of the 21 million total supply), there’s low inflationary pressure, which is great for long-term value. Can BTC keep its 92.27% yearly gain? Drop your thoughts in the comments below! 📊

Technical Analysis: Double Bottom and Bullish Channel Looking Hot

Support & Resistance: Strong support at 114,000 - 115,000 USD (holding since early September). Resistance is at 116,000 - 116,500 USD—break this, and we could see 120,000 USD next! If it fails, expect a retest of 114,000 USD. Watch for a breakout, traders! ⚠️

Trend: The chart shows a double bottom pattern from September’s low, with the bullish channel still intact. The Fear & Greed Index is at 53-55 (Neutral), meaning no one’s panicking or getting too excited. RSI is neutral, MACD is slightly soft, but the daily timeframe screams “Buy”! 📉

Macro News & Triggers: Fed Decision to Steal the Show?

The market is glued to the Fed’s expected 0.25% rate cut this week—if it happens, risk assets like Bitcoin could see a flood of cash! 🌊 On the bullish side: Billionaire Tim Draper is pushing for BTC adoption, predicting 250,000 USD by December 2025, and Capital Group turned a 1 billion USD investment into 6 billion USD profits. But watch out for whale selling and weak altcoins (like SHIB, down 3.22%)—they could drag BTC lower. Ready for some volatility? 🔥

Forecast & Trading Strategy: Your Game Plan

Short-Term (1-7 Days): BTC likely to trade between 114,000 - 117,000 USD, with the Fed as the big trigger. A rate cut could push it to test 120,000 USD; if not, it might dip to 114,000 USD. There’s a 60% chance of an upside if it holds above 115,000 USD—perfect for a long trade! 📈

Long-Term (2025-2030): Super bullish! Changelly predicts 116,220 USD today, rising to 117,978 USD tomorrow; Investing Haven sees stability around 116,087 USD. With the last halving and institutional buying, BTC could smash past 200,000 USD by year-end. But diversify your portfolio to stay safe! 💡

Fellow traders, it’s time to make your move! Keep the BTC/USD chart open on TradingView and share your predictions in the comments. Do your own research (DYOR) and trade smart! 🙌

#Bitcoin #BTCUSD #CryptoAnalysis #TradingView #FedRateCut #BullishBTC #Crypto2025 #Altcoins #WhaleWatch #FearAndGreed

Accumulate liquidity, and then move up toward 113,697

• Current Price: Around 110,138 USD.

• Highlighted Zones:

• BSL (Buy-Side Liquidity) zone near 117,000 – 118,000 USD.

• SSL (Sell-Side Liquidity) zone around 109,000 USD.

• Levels Marked:

• PDH (Previous Day High) at 113,697 USD.

• PDL (Previous Day Low) at 109,409 USD.

• Market Structure:

• The price is currently trading near the PDL/SSL zone, suggesting possible accumulation or liquidity grab before a potential upward move.

• A projected path (dotted lines) indicates a possible consolidation, then a move up toward PDH, and further toward the BSL zone.

• A support/resistance flip (S/S) is marked around the 111,000 USD level, suggesting a key zone to watch for validation of bullish momentum.

Interpretation:

The chart suggests a potential bullish scenario: price might retest the SSL zone, accumulate liquidity, and then move up toward 113,697 (PDH) and possibly the 117k BSL zone.

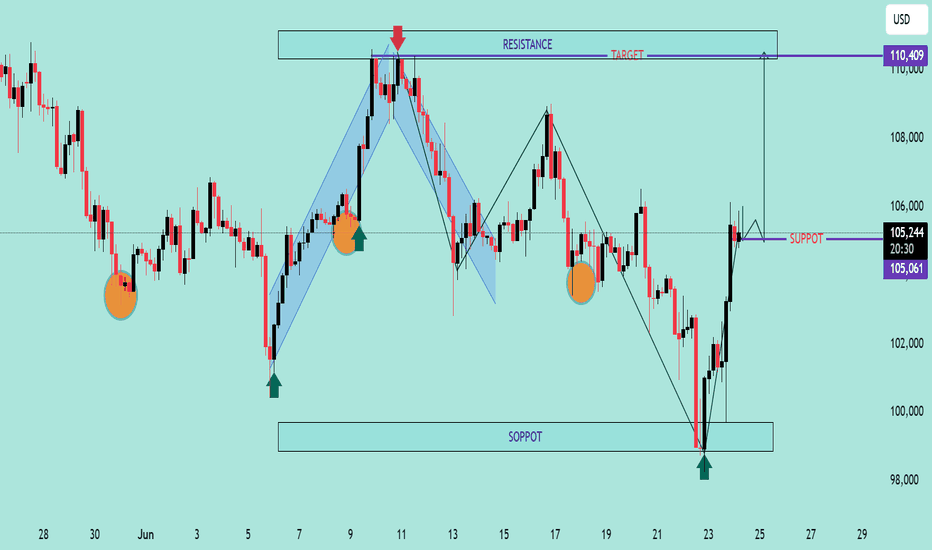

USD Index (DXY) Bullish Reversal & Breakout PotentialUSD Index (DXY) Bullish Reversal & Breakout Potential 🚀

The DXY chart displays a strong bullish reversal structure from the support zone near the 99,800–100,200 area. Here’s a professional breakdown of the technical setup:

🔍 Key Observations:

🟢 Bullish Reversal Formation

The price rebounded aggressively from a strong demand zone (support), marked by a green arrow and orange highlight.

Multiple historical reaction zones confirm this level's validity as a reliable support.

📉 Previous Decline & Correction

After reaching the resistance area near 110.400, the price corrected with a bearish channel.

This pullback formed a classic bull flag, a bullish continuation pattern, eventually leading to the current breakout.

🟦 Current Price Action

The market has broken out of the recent downtrend and is forming higher highs and higher lows.

A strong bullish impulse candle confirms renewed buying interest.

🧱 Support & Resistance Levels:

🔵 Resistance Zone (Target): 110.409 — a historically respected area and target for the bullish move.

🟣 Current Support Zone: 105.061 — previously resistance, now likely to act as support after the breakout.

🎯 Bullish Target Projection

If price retests and holds the support at 105.061, the next potential leg can extend towards 110.409, offering a strong risk-to-reward setup.

⚠️ Caution

Watch for a pullback and retest near the support level.

A failure to hold above 105.061 could invalidate the bullish structure.

🧠 Conclusion

The DXY is showing a bullish trend continuation after a breakout from a corrective structure. A successful retest of support could propel price towards the 110.400 target zone 📊.

Bias: ✅ Bullish above 105.061

Invalidation: ❌ Below 105.000