### EMIL Price AnalysisElectronics Mart India Ltd (EMIL) recently closed at around ₹144, showing a modest uptick after a period of volatility. The stock has rebounded sharply over the past month, gaining over 16%, yet it remains well below its 52-week high of ₹262. The past year has been challenging, with the share price down more than 35%, underperforming both its sector and the broader market.

Technically, EMIL is trading above key short-term moving averages, suggesting a short-term uptrend. The price is above the 20-day and 50-day averages, but still below the long-term 200-day average, indicating that while momentum has improved, the broader trend remains cautious. The stock’s volatility is notably high, with weekly price swings above the market average.

Momentum indicators like MACD and RSI are showing positive signals, but there are early signs of momentum loss, and volume-based indicators suggest some recent selling pressure. The stock is currently near a resistance zone, and a sustained move above ₹150 could trigger further upside, while support is seen around ₹138.

Fundamentally, EMIL has demonstrated steady revenue and profit growth over the last few years, but recent quarters have shown a decline in profitability. The company’s price-to-earnings ratio is on the higher side, suggesting it is not undervalued relative to its earnings. Analyst forecasts indicate moderate growth potential, with a one-year price target in the ₹160–₹190 range.

In summary, EMIL is showing signs of a short-term recovery with improving technicals, but long-term investors should remain cautious given its recent underperformance and valuation concerns. A clear breakout above resistance levels would strengthen the bullish case, while failure to hold above support could lead to renewed weakness.

Bullishpattern

Nifty price actionNifty 50 closed at 25,461 with a modest gain, reflecting cautious optimism after recent profit booking and volatility. The index formed a bullish hammer candlestick, which is often interpreted as a sign of potential short-term reversal or support. Buying interest in heavyweight stocks like Bajaj Finance, Infosys, Dr. Reddy’s, ICICI Bank, and Wipro helped offset declines in sectors such as metals and auto.

Technically, Nifty found support near its near-term EMA trendline, and the RSI remains healthy in the low 60s, suggesting the trend is still neutral to positive. Immediate support levels are at 25,240 and 25,103, while resistance is seen at 25,682 and 25,819. Sustained trading above 25,682 could trigger further upside, possibly toward 26,000, but a break below 25,240 would increase the risk of a deeper correction, with 25,000 and 24,500 as the next key supports.

Market sentiment remains cautiously optimistic, with advances outnumbering declines. However, overbought oscillators and low ADX readings indicate limited momentum, so the index may remain rangebound unless a clear breakout or breakdown occurs. Traders are advised to watch for a decisive move above 25,600 for bullish confirmation, or below 25,240 for signs of renewed weakness.

Banknifty price actionBank Nifty closed at 57,031.9 on July 4, 2025, up 0.42%, showing resilience after a brief dip earlier in the week. The index has been consolidating near all-time highs, maintaining a bullish structure with higher highs and higher lows on the daily chart. Despite some profit booking, Bank Nifty remains above its key moving averages, and technical indicators like RSI and MACD continue to support the broader uptrend.

Short-term support is seen around 56,500–56,600, which aligns with the 20-day EMA. As long as Bank Nifty holds above this zone, the bias remains positive and the index could attempt to move towards resistance levels at 57,540 and 57,854. A decisive close above 57,800 would likely open the path to 58,500. However, overbought oscillators and a weak ADX suggest the trend strength is moderate and the market could remain rangebound unless a breakout occurs.

Constituent performance has been mixed, with ICICI Bank, AU Bank, HDFC Bank, and Axis Bank contributing to gains, while Bank of Baroda, IndusInd Bank, and Federal Bank saw mild declines. Overall, the structure favors a buy-on-dips approach as long as the index stays above its immediate support. A close below 56,500 would be the first sign of a deeper correction.

MOTILALOFS Price actionMotilal Oswal Financial Services Ltd (MOTILALOFS) has experienced **strong price momentum over the past year, rising more than 50%**. The stock recently traded between ₹854 and ₹929, with its all-time high of ₹1,064 reached in October 2024 and a 52-week low near ₹488.

**Short-term action:**

In the last week, the stock moved up by about 0.4%, and in the past month, it gained nearly 7%. Over three months, the gain was especially notable at nearly 40%. However, the stock is highly volatile—about 3.8 times as volatile as the Nifty index—and has a high beta of 1.79, indicating large price swings.

**Recent trend:**

After peaking above ₹1,000 in late 2024, MOTILALOFS saw a correction, dropping to the ₹700-800 range by mid-2025. Since then, it has rebounded, climbing back above ₹850. The last few sessions show a mix of minor gains and losses, reflecting ongoing volatility and active trading interest.

**Volume and liquidity:**

Trading volumes have been robust, with some sessions seeing over a million shares traded, especially during sharp moves. This indicates strong liquidity and sustained investor interest.

**Valuation and fundamentals:**

The stock is considered overvalued relative to market averages, with a price-to-earnings ratio above 20 and a price-to-book ratio above 4. Its dividend yield is modest at 0.58%. Despite high volatility, the company has delivered solid profitability and efficiency metrics, with return on equity above 25%.

**Outlook:**

Analysts remain optimistic, with some forecasting potential upside toward ₹1,150, though downside risk remains to ₹763. The company’s business is diversified across broking, asset management, investment banking, and housing finance, and recent results show strong revenue growth, especially in wealth management and housing finance. However, there have been short-term challenges, such as a decline in cash market share and weaker performance in private wealth management.

**Summary:**

MOTILALOFS is in a recovery phase after a sharp correction, showing renewed upward momentum but with high volatility. The outlook is positive, supported by strong fundamentals and sector growth, but investors should remain cautious due to the stock’s elevated valuation and price swings.

AIIL Price actionAuthum Investment & Infrastructure Ltd (AIIL) has shown significant price appreciation over the past year, rising by more than 120%. The stock recently reached an all-time high near ₹2,600, with its lowest point in the past year being around ₹730. In the last month, AIIL gained over 17%, and in the past week alone, it rose by more than 6%.

The stock is considered volatile, with price swings that are sharper than the broader market. Technical indicators, such as moving averages, generally point to a bullish trend, with the short-term average staying above the long-term average. However, there have been recent signals of a possible short-term correction, including a minor sell indication from the MACD and a pivot top formation. Key support levels to watch are around ₹2,440 and ₹2,050; a drop below these could suggest further downside.

Trading volumes have increased as the price moved higher, which is typically a positive technical sign. The company’s fundamentals remain strong, with a high promoter holding and steady dividend payouts, although the dividend yield is low. Overall, AIIL’s trend remains positive, but the stock’s high volatility means that price corrections can be sharp, and investors should manage risk accordingly.

GLENMMAR PHARMACUITCAL- Bullish Flag & Pole Breakout (Daily T/F)Trade Setup

📌 Stock: GLENMARK PHARMACUITICALS ( NSE:GLENMARK )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹1680.00 (Breakout Confirmation)

🛑 Stop Loss: ₹1579.00 (Daily Closing Basis) (-6 % Risk)

🎯 Target Levels:

₹1725.65

₹1775.65

₹1826.70

₹1878.45

₹1926.35

₹1977.00 (Final Target)

Technical Rationale

✅ Bullish Flag & Pole Breakout - Classic bullish pattern confirming uptrend continuation

✅ Strong Momentum - Daily RSI > 60, Weekly RSI >60 Monthly rsi >60

✅ Volume Confirmation - Breakout volume 1.93M vs previous day's 1.16M

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear price & volume breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching NSE:GLENMARK for this breakout opportunity? Share your views in the comments!

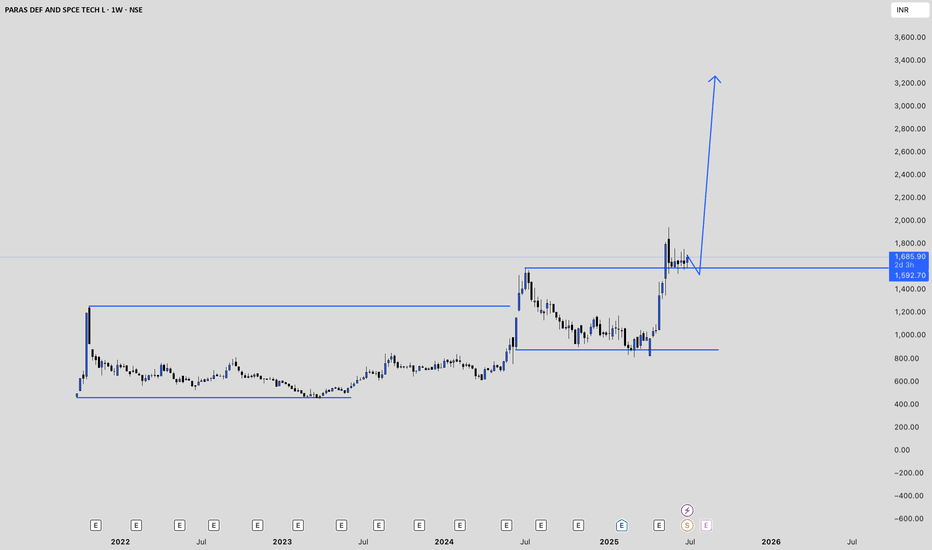

Paras Defence Price ActionParas Defence and Space Technologies is currently trading near ₹1,630, having delivered a substantial rally over the past year and outperformed many of its peers in the defence sector. The stock has risen more than 100% from its 52-week low and is trading close to its all-time high, reflecting strong investor confidence and robust momentum. Year-to-date, the stock is up over 60%, though it has shown some short-term volatility with a recent pullback of about 9% in just two days, suggesting a phase of consolidation or correction after its sharp rally.

Fundamentally, the company has demonstrated impressive growth, with recent quarterly results showing revenue up nearly 36% year-on-year and net profit more than doubling. Its return on equity is healthy, and the business remains largely debt-free, which supports its financial stability. The company is also preparing for its first-ever stock split, with a record date set for July 4, 2025. This move is expected to enhance liquidity and attract more retail investors.

Despite these positives, Paras Defence is trading at a high price-to-earnings ratio, indicating that the stock is priced for strong future growth and leaving little room for disappointment. Analyst sentiment is generally positive for the long term, but there is near-term caution due to the recent run-up in price and some signs of weakening momentum. Technical analysts point to key support levels around ₹1,500–₹1,570, with a need for the stock to reclaim ₹1,630 for renewed bullishness.

Overall, Paras Defence is benefiting from strong sector tailwinds, government investment in defence, and its own technological capabilities. While the long-term outlook remains promising, investors should be mindful of the elevated valuation and the potential for further short-term corrections as the stock digests its recent gains.

Sudarshan Price ActionSudarshan Chemical Industries is currently trading around ₹1,256, having gained nearly 5% in the past week and over 6% in the last month. The stock has delivered a strong 10% return over six months and nearly 40% over the past year, reflecting robust momentum. Its 52-week high is ₹1,315, while the low stands at ₹796, placing the current price close to its yearly peak.

Valuation-wise, Sudarshan Chemical trades at a high price-to-earnings ratio above 80 and a price-to-book ratio above 8, signaling that the stock is richly valued compared to sector norms. Despite the premium valuation, the company has attracted positive sentiment, with most analysts maintaining a buy or hold stance, though the average target price is slightly below current levels, suggesting limited near-term upside.

Financially, the company has shown steady revenue growth and improved profitability in recent quarters, with net profit margins expanding from previous periods. However, promoter holding has decreased recently, and the company’s sales growth over the past year has been modest. The stock’s low beta indicates relatively lower volatility compared to the broader market.

In summary, Sudarshan Chemical Industries is exhibiting strong price momentum and positive investor sentiment but is trading at expensive valuations. While its recent financial performance has improved, the high valuation and reduced promoter holding may warrant caution for new investors.

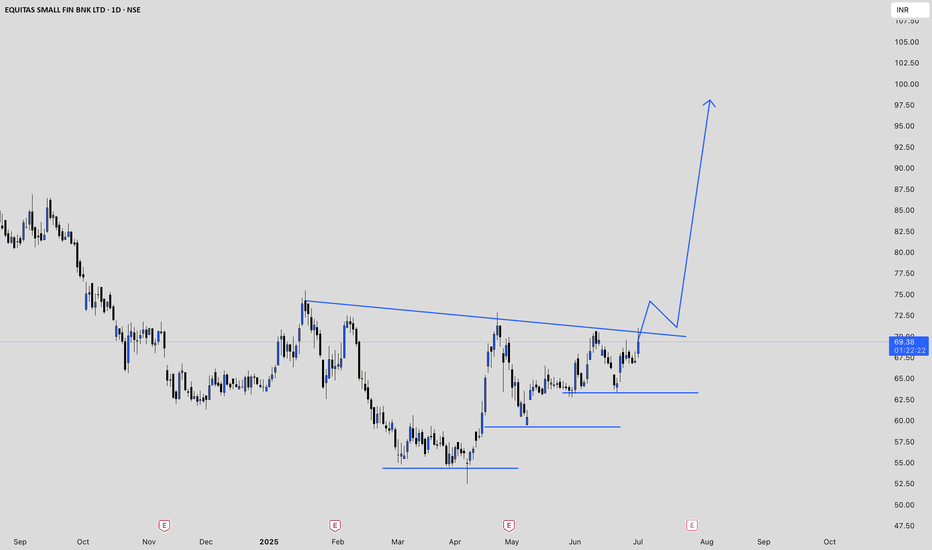

EQUITASBNK Price ActionEquitas Small Finance Bank is currently trading around ₹69, showing a strong gain of over 5% on July 1, 2025, and outperforming its sector in the short term. The stock has been volatile, with a day range between ₹67.50 and ₹71.00. Its 52-week high is ₹97.21, while the 52-week low stands at ₹52.52, placing the current price closer to the lower end of this range. The all-time high for the stock is ₹116.50.

Market capitalization is approximately ₹7,950 crore, and trading volumes remain robust, with recent daily volumes exceeding 6.5 million shares. This liquidity ensures ease of entry and exit for investors. Over the past year, the stock has declined about 30%, reflecting broader challenges in the sector and some company-specific headwinds.

Financially, Equitas Small Finance Bank has reported revenue of about ₹6,312 crore and a net profit of ₹147 crore. However, the company’s interest coverage ratio is low, indicating some pressure on its ability to service debt from operating profits. The stock is generally considered to have average financial strength but is recognized for its high growth trend, albeit currently priced at high valuations. The trailing twelve-month EPS has declined sharply year-on-year, and the stock is trading at a high price-to-earnings multiple relative to sector norms.

In summary, Equitas Small Finance Bank is showing short-term momentum and strong trading activity but remains well below its yearly highs. The company faces profitability and valuation challenges, and while growth prospects are present, investors should be mindful of the recent volatility and underlying financial pressures.

ONGC | ascending (bullish) trend channelTechnical Setup Overview:

Chart Type: 2-hour (Intraday)

Trend Channel: Clearly drawn ascending (bullish) trend channel.

Support line: Currently testing or near the lower support of the channel (~242).

Resistance line: Upper channel has been tested multiple times near 257–260 range.

#LTF looking bullish on monthly timeframe#LTF has given a breakout at 200 on a monthly timeframe. Upside potential: 100%+. Stop loss: 184. A few things to note:

This stock will require immense patience as this could turn a multi-bagger

The volumes have been increasing over the last few months

This is not a buy/sell recommendation. Research carefully and invest at your own risk.

RBL bank price actionRBL Bank's stock price has shown notable activity recently, influenced by both technical and fundamental factors. Below is a detailed analysis:

## **Current Price Action**

- **Latest Price**: RBL Bank's shares rose by 4.86% on March 24, 2025, reaching ₹176.40, breaking out of a consolidation range of ₹150–170

- **Technical Indicators**: The stock's breakout is supported by robust trading volumes and a daily RSI above 60, indicating bullish momentum

## **Fundamental Analysis**

- **Valuation Metrics**:

- P/E Ratio: 10.28 (lower than the sector average of 19.47), indicating undervaluation

- P/B Ratio: 0.69, suggesting the stock is trading at a discount compared to its book value

- **Intrinsic Value**: Estimated at ₹267.23, reflecting significant upside potential from the current price

## **Recent Financial Performance**

- **Q3 FY25 Results**:

- Revenue grew by 16% YoY to ₹4,610 crore

- Net profit declined sharply by 80.7% YoY due to higher provisions for NPAs in microfinance and credit card portfolios.

- Gross NPA ratio improved marginally to 2.92%, while net NPA reduced to 0.53%, indicating mixed asset quality trends

## **Long-Term Outlook**

- Despite short-term challenges in profitability, RBL Bank's fundamentals remain strong, with healthy loan growth (13% YoY) and improving operational efficiency. Analysts suggest it may be suitable for long-term investment due to undervaluation and expected recovery in profitability metrics.

Investors should monitor RBL Bank's asset quality trends and earnings growth closely while considering its low valuation as an attractive entry point for medium to long-term gains.

RAYMONDLSL Price actionRaymond Lifestyle Ltd (RAYMONDLSL) is currently trading in the range of ₹1,088 to ₹1,179 as of June 26, 2025, showing a strong rebound in the last few days after a prolonged period of decline. Over the past year, the stock has been highly volatile, reaching a 52-week high of ₹3,100 and hitting a low of ₹911.35 in May 2025. The share price has dropped significantly, with a decline of about 64% over the last year and nearly 48% over the last six months.

Despite this correction, the stock has recently shown some positive momentum, climbing over 11% in the past week and about 8% in a single session. Its market capitalization is around ₹7,185 crore. The price-to-earnings (P/E) ratio is low at 2.72, and the price-to-book (P/B) ratio is also relatively modest, indicating the stock may now be trading at more reasonable valuations compared to its recent past.

Raymond Lifestyle has demonstrated exceptional revenue growth, with annual growth far outpacing its three-year compound annual growth rate. However, the company has also taken on new debt for the first time in five years, which could impact its financial flexibility going forward. Technical signals, such as a recent 50-day moving average crossover, suggest that there could be further short-term upside, as this pattern has historically led to gains in the following month.

Overall, Raymond Lifestyle Ltd is recovering from a sharp correction and is currently showing signs of short-term strength. The company’s fundamentals reflect strong revenue growth but also new debt obligations. Investors should be aware of the stock’s high volatility and recent history before making decisions, as the long-term trend remains cautious despite recent gains.

BAJAJINDEF Price ActionBajaj Indef (BAJAJINDEF) has experienced a period of high volatility and rapid price movement in June 2025. After a sharp rally from around ₹225 in late May to a peak near ₹478.90 by mid-June, the stock has since corrected and is now trading in the ₹400–₹420 range. This recent surge was accompanied by significant spikes in trading volume, indicating heightened market interest and participation.

The stock’s price action shows a pattern of large daily swings, with both double-digit percentage gains and losses within short intervals. This suggests speculative activity and possibly profit-booking after the strong rally. The valuation of the stock has shifted from not qualifying to being considered very expensive, reflecting the sharp run-up in price relative to its fundamentals.

Short-term momentum appears to have cooled, with the stock pulling back from its highs and now consolidating. Investors should be cautious, as the recent volatility and elevated valuation may lead to further price fluctuations. The underlying trend remains positive compared to levels a month ago, but the risk of sharp corrections is high given the stock’s recent behavior.

JUBILANT PHARMOVA- Bullish Flag & Pole Breakout (Daily T/F)Trade Setup

📌 Stock: JUBILANT PHARMOVA ( NSE:JUBLPHARMA )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹1470.00 (Breakout Confirmation)

🛑 Stop Loss: ₹1058.00 (Daily Closing Basis) (-9.5 % Risk)

🎯 Target Levels:

₹1221.15

₹1269.55

₹1319.90

₹1373.55

₹1433.55

₹1500.00 (Final Target)

Technical Rationale

✅ Bullish Flag & Pole Breakout - Classic bullish pattern confirming uptrend continuation

✅ Strong Momentum - Daily RSI > 60, Weekly RSI >60 Monthly rsi >60

✅ Volume Confirmation - Breakout volume 520.55K vs previous day's 203.99K

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear price & volume breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching NSE:JUBLPHARMA for this breakout opportunity? Share your views in the comments!

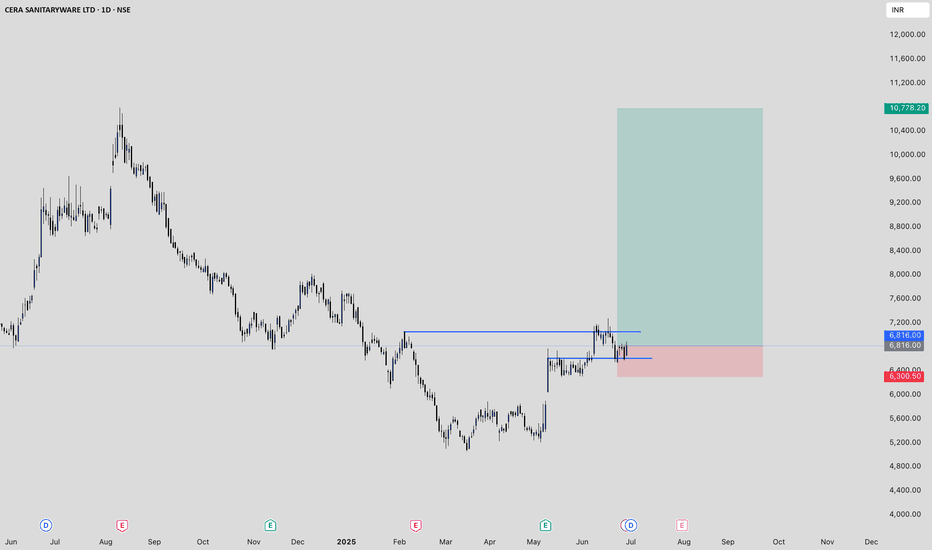

CERA Price action**CERA Sanitaryware (NSE: CERA) Price Analysis – June 2025**

- **Current Price:** As of June 27, 2025, CERA closed at ₹6,816, showing a 3.33% gain from the previous session.

- **Recent Trend:** The stock has been volatile in June, with prices fluctuating between ₹6,573 and ₹7,275. Over the past week, it declined by about 2.8%, but remains up 6% for the month and nearly 17% over the past three months.

- **Long-Term Performance:** Despite recent weakness, CERA has delivered a 62% return over three years and nearly 198% over five years. However, the stock is down about 27% year-on-year and 8.5% over the last six months, reflecting sectoral and company-specific challenges.

- **Valuation:** The price-to-earnings ratio is around 34.5, and price-to-book is 6.2. The dividend yield is close to 1%. These metrics are moderate compared to sector peers, with CERA’s PE below Kajaria Ceramics but above Somany Ceramics.

- **Fundamentals:** Revenue growth has averaged 7.2% annually over five years, slightly above the industry average. Net income growth is strong at 15.7% per year. The company recently reported modest revenue growth but faced margin pressures, with EBITDA declining in the latest quarter.

- **Outlook:** Analysts remain mostly positive, with a majority suggesting a buy rating. The company is focusing on operational efficiency and expanding its luxury product range to counter retail market challenges. Recovery in the real estate sector and government initiatives are expected to support future growth.

**Key Takeaway:**

CERA’s stock is stabilizing after a period of volatility, supported by solid long-term fundamentals but facing near-term headwinds in profitability and demand. The medium-term outlook is constructive, especially if margin recovery strategies succeed and sector demand improves.

Infy Price actionInfosys (INFY) is currently trading around ₹1,608, with recent fluctuations between ₹1,606 and ₹1,629. Over the past year, the stock has delivered modest gains, slightly underperforming broader market indices and the IT sector. Financially, Infosys remains robust, maintaining strong revenues, healthy profit margins, and a debt-free balance sheet. The company continues to reward shareholders with consistent dividends, including a recent payout of ₹22 per share.

Looking ahead, growth expectations for Infosys are muted. The company has projected revenue growth of just 0–3% for the upcoming fiscal year, citing macroeconomic uncertainties and cautious client spending in its key markets. This represents one of the lowest growth forecasts for Infosys in over a decade and reflects broader industry headwinds, including delayed client decision-making and a focus on cost optimization.

Analyst sentiment is generally positive but cautious, with most maintaining a buy or hold rating. Price forecasts for the next year range from ₹1,667 to ₹1,945, indicating limited upside from current levels. Technical analysis shows immediate support near ₹1,579 and resistance around ₹1,633, suggesting the stock is likely to remain range-bound in the near term.

In summary, Infosys is financially sound and offers stable dividends, but near-term growth is expected to be subdued due to global economic challenges and restrained client budgets. The stock is more attractive for investors seeking stability and income rather than aggressive capital appreciation at this stage.

OIL Price ActionOil India Limited is currently trading at ₹433.40 as of June 27, 2025. The stock has seen a notable decline over the past week, falling by nearly 7%. Over the last month, the price has remained relatively flat, with a slight gain of about 0.5%. Looking at a broader time frame, the stock is up 12% over the past three months and has gained just under 2% in the last six months.

The 52-week high for Oil India stands at ₹767.90, while the low is ₹325.00, indicating that the stock is trading well below its peak for the year. Recent sessions have shown increased volatility, with sharp movements both up and down. For example, the stock dropped over 5% in a single day on June 24, after previously rallying above ₹470 earlier in the month.

Oil India’s price-to-earnings (PE) ratio is 10.98, and the price-to-book (PB) ratio is 1.32, suggesting the stock is reasonably valued compared to its historical averages and sector peers. The company maintains a market capitalization of around ₹70,500 crore, ranking it among the larger players in India’s gas and petroleum sector.

In summary, Oil India Limited is currently in a correction phase after a strong run-up earlier this year. The stock is trading closer to its recent lows than its highs, with moderate valuation metrics and ongoing volatility. Investors should watch for further price stabilization before considering new positions.

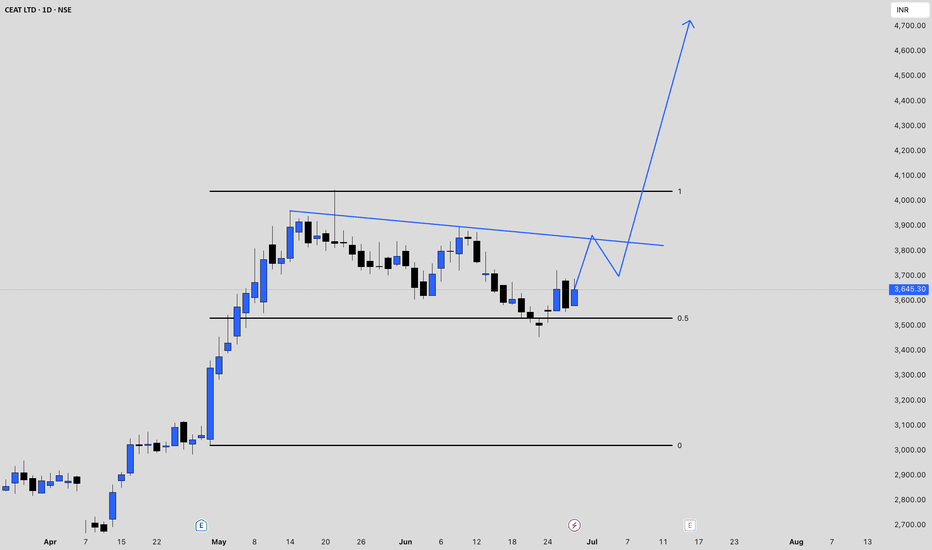

CEATLTD Price actionCEAT Ltd has recently shown a recovery in its price action after a period of volatility. The stock closed at ₹3,645.30, rebounding over 2% in the latest session following a brief dip earlier in the week. Over the past month, CEAT experienced a mild correction, with the price dropping about 4%, but the three-month return remains strong at over 25%. On a one-year basis, the stock has delivered a solid gain of more than 37%, reflecting sustained investor interest and underlying business strength.

Trading volumes have picked up during the recent upswings, indicating renewed buying interest at lower levels. The price has oscillated between ₹3,500 and ₹3,700 in the past week, suggesting the presence of both support and resistance in this range. Despite the recent volatility, the long-term trend remains positive, with the stock having nearly tripled over the past three years.

Fundamentally, CEAT is trading at a premium to its book value, and its return on equity has been moderate. The company’s overall financial health and growth prospects continue to support the stock’s medium- to long-term outlook, though short-term moves may remain choppy as the market digests recent gains. In summary, CEAT is in a consolidation phase after a strong rally, with a positive longer-term trend and renewed buying interest evident on recent dips.

REDINGTON Price ActionRedington has shown strong upward momentum in recent sessions, with the stock surging over 8% in a single day to close above ₹322. This rally follows a period of consolidation and marks a new 52-week high, reflecting robust buying interest and high trading volumes. Over the past month, the stock has delivered a return of more than 23%, and its three-month gain exceeds 32%, highlighting sustained positive sentiment.

Technically, multiple bullish signals have emerged, including short-term moving average crossovers and a positive shift in candlestick patterns, suggesting the potential for further gains in the near term. Despite the sharp rise, the stock is trading at higher valuations compared to its sector, but its financial strength and growth trajectory remain solid.

In summary, Redington is currently in a strong uptrend, supported by technical momentum and strong fundamentals, though the elevated valuation may prompt some profit booking if the rally extends further.