Bitcoin Bybit chart analysis October 29 (FOMC)Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here's a 30-minute Bitcoin chart.

Shortly, at 11 AM, there will be Nasdaq data releases.

At 3 AM, the FOMC releases data.

Unfortunately, yesterday's BTC move, which involved long and short positions, led to a strategy failure, so today's analysis will be completely public.

I ask for your support.

On the left, the purple finger connects yesterday's final long position entry point, the third section at $112,307.4.

While the interest rate cut is fundamentally positive,

I calculated the Nasdaq price fluctuations and implemented my strategy.

While there may be significant movements early in the morning,

BTC has many important elements, so I recommend reading carefully.

*Conditional Long Position Strategy: When the Red Finger Moves

1. After confirming that the purple finger touches the first section at the top,

the red finger marks the entry point for a long position at $112,851.6.

/ If the green support line is broken, set a stop loss price at $115,881.6.

1st target for a long position: $115,881.6 -> Target price at Top, Good, in that order.

If the strategy succeeds until the first target is touched, $114,969.8 is the point where the long position can be re-entered.

If the red resistance line is broken,

an uptrend could immediately resume.

If the price fails,

there's a possibility of another strong correction.

If the top section is touched before tomorrow's daily candlestick formation,

since this is the resistance line on the daily Bollinger Band chart,

a strong correction is likely,

it would be a good idea to enter a short position and then wait for a long position.

From the first section at the top to the orange resistance line,

a strong rebound is possible, so I don't recommend shorting.

If the price drops immediately without touching the first section,

then I recommend waiting for a final long position in the second section. If the green support line is broken,

then a pullback to the Gap 8 section at the bottom is highly likely.

Please note that if the green support line is broken,

then a pullback to the Gap 8 section at the bottom is highly likely.

Up to section 3 is open,

but this section is connected to the medium-term uptrend line,

so long positions should be held at all costs.

Yesterday's move also broke the first and fourth sections without any support,

breaking the medium-term pattern.

Since the 12-hour MACD dead cross isn't yet considered risky,

I proceeded as safely as possible, as the Nasdaq's movements were in line with it.

Please use my analysis to this point for reference only.

I hope you operate safely, adhering to principled trading and a stop-loss system.

Thank you.

Bybit

Bitcoin Bybit chart analysis October 28Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

There's a Nasdaq indicator release coming up at 11:00 AM.

Bit has broken its short-term pattern by touching the center line of the 3-hour Bollinger Bands chart.

On the left, the purple finger indicates the entry point for the long position at $114,507.8, which we entered yesterday.

I've followed the same strategy. *Red Finger Movement Path:

Long Position Strategy

1. Confirm that the purple finger touches the first section at the top.

Red finger: $113,799.4 is the entry point for a long position.

/ If the green support line is broken, set a stop loss.

2. $117,065.1 is the first target for a long position. Target prices are set at Top and Good in that order.

If the strategy is successful, 115.9K is the point where the long position can be re-entered.

If the good section is reached before tomorrow's daily candlestick formation,

a correction may occur at the daily Bollinger Band resistance line.

A short position switch can be made.

If the price touches Section 1 at the top and rebounds strongly,

or if Section 2 is touched and rebounds within the purple support line,

a vertical rise is expected.

When the green support line breaks,

I've marked the support line from Bottom to up to Section 3.

Those who entered long yesterday at 114.5K should follow the same stop-loss order today when the green support line breaks.

I hope you'll continue to operate effectively, starting with Section 1 above.

By organizing this,

those who are long, those without a position, and those who are short

will all be able to utilize it.

Please use my analysis to this extent for reference only.

I hope you operate safely, adhering to principled trading and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis October 23

Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

There's a Nasdaq release coming up at 11:00 AM.

At the bottom left, with the purple finger,

I've linked the strategy to yesterday's long position entry point, $107,146.8.

The Nasdaq is correcting after its medium-term pattern has broken,

and Bitcoin is on track for a golden cross on the 4-hour and daily MACD charts.

XAUUSD is losing strength in gold,

and yesterday, there was some decoupling on the Nasdaq.

It will be important to see whether Bitcoin gains strength.

*When the red finger moves,

I'm considering a one-way long position strategy.

1. $108,136.7 long position entry point / Stop loss price if the green support line is broken

2. $110,837.9 long position primary target -> Top, Good, in that order.

If the strategy is successful, 110.2K is the long position re-entry point.

If a successful rebound occurs within the purple support line of the first section above, a vertical rise is possible, so please keep this in mind.

Due to the Nasdaq correction today,

we will operate a little more safely.

If the bottom section is pushed today,

the mid-term uptrend line will also break,

which is not good for a long position.

Since points 2 and 3 are both double bottoms, they can be risky.

Since a touchdown could trigger a variable,

we recommend utilizing a 5-minute trend reversal.

Please note that my analysis so far is for reference only.

I hope you operate safely, adhering to principled trading and stop loss orders.

Thank you.

Bitcoin Bybit chart analysis October 17Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

There are no Nasdaq data releases today.

Bit has been falling sharply since yesterday and today, as it has been coupled with the Nasdaq.

I've been thinking a lot about the possibility of further declines.

*When the light blue finger moves,

Bidirectional neutral

Short->Long switching or final long position strategy

1. $106,728.7 short position entry point / Stop-loss price upon breaking the pink resistance line

2. $103,375.7 long position switching / Stop-loss price upon breaking the green support line

3. Long position target prices, starting from the top section at the top

If the price falls immediately without touching the short entry point at 106.7K,

the final long position is at the bottom section at the bottom.

The bottom section is a double bottom, where the previous low is broken.

Because the lower tail may be pushed to $98,514.5, indicated at the bottom,

rather than placing a limit order,

we recommend switching long positions after confirming a trend reversal on the 5-minute chart.

More importantly, the Nasdaq movement appears to be the most important. It's frustrating that Bitcoin is coupled with the Nasdaq, which plummets at crucial moments, but it seems the coin market has never been easy.

At least if you're trading in real time, in a market where some people lose money while others make money, giving up would only hurt you.

In times like these, it's crucial to stay focused and practice principled trading and stop-loss orders.

Thank you for your hard work this week.

Bitcoin Bybit chart analysis October 2Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

The bottom left shows yesterday's long position re-entry point, $116,914.7, indicated by a purple finger.

We will continue with the trend-following strategy.

*Red finger movement path:

Long position strategy

1. $118,668.2 long position entry point / Stop loss price if the green support line is broken

2. $119,161.2 long position primary target -> Target prices in order from the top to the miracle level

If the strategy is successful, the first section is the long position re-entry point,

and a new high is reached after the great breakout.

The second section is the final long position entry point.

If the green support line is maintained until the second section,

it will become an upward sideways market.

If the light blue support line holds through the weekend and next week,

it could continue to rise as it's a mid-term uptrend line.

Please keep this in mind.

Bottom -> I've left up to three sections.

You can check the prices of the major support and resistance lines above and below the section I've left or by dragging.

Please use my analysis as a reference only.

I hope you operate safely, with a principled trading strategy and stop-loss orders in place.

Have a nice holiday until next Friday.

I'll be back on Friday.

Thank you.

September 29 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There are no Nasdaq indicators released today.

I developed a strategy based on the rising pattern.

*Red finger movement path:

One-way long position strategy

1. $111,597.2 long position entry point / Stop loss if the purple support line is broken

2. $113,733.7 long position first target -> Good second target

If the strategy is successful, the 112,8K level indicated

can be used as a long position re-entry point.

Up to the first section below, the price is moving sideways to the right.

From the bottom section touch, there's a high probability of a decline to the Gap 8 retracement level.

Please check the bottom support line and section 2 indicated below.

Up to this point,

I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis September 23Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

There's an indicator release near 11:00 AM on the Nasdaq,

and I expected a small fluctuation.

I proceeded as safely as possible, considering the current situation.

*When the red finger moves,

One-way long position strategy:

1. Long position entry point at $112,302.1 / Stop loss price if the green support line is broken.

2. Long position initial target at $114,345.1 -> Target prices in order of Top, Good, Great.

After reaching the target price of $114.3K,

you can re-enter the long position at the indicated price of $113.6K.

In the case of 1->2 above,

there's a strong possibility of an upward movement along the purple parallel line. (The 5+15 pattern is still in place.)

The current rebound has already formed a double bottom,

so a drop below the bottom

is not a good move for long positions.

In case of a delay, I've indicated up to section 3 at the bottom.

Thanks to the recent interest from newcomers,

I've made this post publicly available for the first time in a while.

Please use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis September 11 (CPI)Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The CPI indicator will be released shortly at 9:30 AM.

I implemented the strategy based on Nasdaq movements.

*When the red finger moves,

Long position strategy

Confirm the upward wave by touching the first section above (autonomous shorting)

1. $113,727 long position entry point / Stop loss if the light blue support line is broken

2. $114,764.3 long position 1st target -> Top 2nd -> Good 3rd target

If the daily candlestick forms before 9:00 AM tomorrow,

you can switch to a short position if the top section is touched.

You can also use the first section shown as a long position switching point.

If the price falls immediately without touching the purple finger at the top, the final long position is at the second level. The strategy was to place a stop-loss order from the breakout of the light blue support line until the possibility of a sideways movement.

From the breakout of the light blue support line, the price opens up to the bottom -> level 3, so long positions should be cautious.

Please use my analysis to this point for reference only.

I hope you operate safely, adhering to principled trading and a stop-loss order.

Thank you.

Bitcoin Bybit chart analysis September 3Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

The Nasdaq indicators will be released at 11:00 AM.

At the bottom left is the long position entry point from the 1st, $108.032.

Above that is the purple finger at $110,762.5.

I've linked the strategy to the long position re-entry point.

*If the red finger follows the path,

it's a one-way long position strategy.

1. Long position entry point at $111,276.6 / Stop loss if the green support line is broken.

If the price falls sharply from the current level,

it's a long position waiting point up to section 2.

If the price touches or breaks the green support line,

it breaks the short-term pattern, which is not a good strategy for long positions.

2. Long position at $112,974.1, first target -> top section, second target

When it reaches 112.9K, the first section is the upper section for re-entry into a long position.

The uptrend line is the green support line -> the deep blue support line.

From the second section, it could fall to the bottom -> the third section -> 108K.

From the deep blue support line,

a medium- to long-term correction and sideways trading may follow, so please keep this in mind.

As long as the Nasdaq doesn't crash today, that's fine.

Please use my analysis as a reference only.

I hope you operate safely, with a strict trading strategy and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis August 28Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

Although not visible on the screen,

I've used the same strategy as the long position entry point two days ago, at $109,950.4.

*If the red finger moves,

this is a conditional long position strategy.

1. After touching the first section at the top, the red finger indicates a long position entry point of $112,715.8. Stop-loss price if the green support line is broken.

(Since the purple finger touches the market, it's likely to immediately connect with an uptrend, so it's best not to open a short position. Check for an upward wave. Also, it's important to check whether the purple support line is broken first.)

2. Long position: $113,881.1. 1st target -> Top. 2nd target -> Target price up to the final gap.

If the price falls immediately without touching the purple finger at the top, hold for the final long position at section 2. Stop-loss price if the light blue support line is broken. Since the light blue support line is a mid-term uptrend line,

it's crucial for long positions not to break out today.

Below that, the bottom is open to $110.5K.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis August 22Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is the Nasdaq 30-minute chart.

There are no separate indicators released.

Roughly speaking,

the strategy is to switch from short to long at the light blue finger, or to wait long at the bottom.

The bottom is today's major support line and the 6+12 pattern recovery point.

If the price moves along the light blue finger path,

there's a possibility that it will eventually fall to touch the 6+12 level again.

Please note this.

I applied this directly to Bitcoin.

This is a 30-minute Bitcoin chart.

The Nasdaq is moving sideways in a downward trend,

while Bitcoin has continued its vertical decline after hitting a new high.

*If the blue finger moves along the path,

switch from short to long. Or, if it immediately declines, wait long in the second section.

This is a two-way neutral strategy.

1. $116,568.4 short position entry point / Stop loss price if the orange resistance line is broken.

2. $114,959.5 long position switch / Stop loss price if the purple support line is broken.

3. $117,330.4 long position first target / 116.5K long position re-entry point.

After this, long position target prices are listed in order of Top, Good, and Great.

The first point above is the best short position entry point for today.

If the price declines around the first touch, hold long at the second point.

Stop loss price if the green support line is broken.

In the case of Bitcoin, the candlestick is breaking out of the 12+ daily pattern,

and the downside is open.

If the bottom point is maintained, the mid-term uptrend will be broken.

-> If the bottom point is broken out, the mid-term uptrend will be broken. A medium-term downtrend may be forming.

(MACD dead cross on weekly chart)

If the Nasdaq only moves sideways, that's good,

but if it declines, BTC could fall even more sharply.

Due to low participation, I decided to take a break this week,

but I've had some free time, so I'm sharing this with everyone for the first time in a while.

Please use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

Bitcoin Bybit chart analysis July 22Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

Nasdaq indicators will be released at 9:30 in a little while.

Although Bitcoin's mid-term pattern is broken,

it looks like a strong upward trend based on signals and candlestick positions.

In the case of Nasdaq, the 6-hour and 12-hour charts MACD dead cross is in progress,

and even if there is no plunge and only a sideways movement,

it seems likely that today's strategy will be successful.

In the bottom left, from the analysis article on the 18th,

the final long position entry point of $116,465.4 Bottom

is connected as is.

*Red finger movement path

One-way long position strategy

1. $118,461.9 long position entry section / green support line breakout, stop loss price

2. $120,338 long position 1st target -> Good, Great in order of target price

See the 1st section at the top as a touch section for an upward wave rather than a short position entry,

and if this section breaks through right away, an upward trend can be connected.

If the purple parallel line support line is maintained without breaking away,

there is a possibility of a vertical rise.

If the top section is touched,

after the first liquidation,

it would be good to use the 1st section to re-enter a long position.

The 2nd section at the bottom is important,

and if it is pushed to this section according to the movement of Nasdaq today,

it can fall strongly.

Please check the real-time support line shape.

From the breakout, Bottom -> 3 sections are open.

If you touch the 3rd section after tomorrow, the mid-term pattern will be restored.

This is the 12+ day section.

Up to this point, I ask that you simply use my analysis for reference and use only.

I hope that you will operate safely with the principle of trading and stop loss.

Thank you.

Bitcoin Bybit chart analysis July 18

Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Bitcoin 30-minute chart.

There is no Nasdaq indicator announcement today.

The mid-term pattern was broken in the morning wave,

but I proceeded as safely as possible.

At the bottom left, I connected the final long position switching section in the analysis article on the 15th with a purple finger.

*When the blue finger moves,

Bidirectional neutral

Short->Long or long waiting strategy

1. Short position entry section of $120,338 / Stop loss price when orange resistance line is broken

2. Long position switching of $118,886.8 / Stop loss price when blue support line is broken

3. Long position 1st target of $121,756.2 -> Target price in the order of Good and Great

If it falls immediately from the current position or

touches the top once and falls, it is a vertical decline condition.

If it falls immediately, it is the final long waiting in section 2.

(When the sky blue support line breaks, the stop loss price is the same)

From the sky blue support line break, the 6+12 section is where the mid-term pattern is restored,

and it is roughly the bottom section.

If the strategy is successful, I have left a simulation with a pink finger on the right,

so please check the switching and profit-taking section,

and operate safely in each position, long, short, and no position, based on whether the purple support line breaks from the current position.

From the green support line break, the low point of today's daily candle is broken,

so it would not be good for a long position, right?

Up to this point, please use my analysis article only for reference and use,

and operate safely with principle trading and stop loss price.

Thank you.

July 14 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There is no separate Nasdaq indicator announcement.

Nasdaq upper gap reversal condition and

Bitcoin is moving sideways after a sharp rebound until the afternoon.

I created today's strategy based on the vertical decline condition based on the 5-minute trend reversal in Tether Dominance.

On the lower left, I connected the long position entry section of 117,451.1 dollars that I entered on the 11th.

* In the case of the red finger movement path,

This is a one-way long position

current position chase purchase strategy.

1. Chasing purchase at 121,897.1 dollars / Stop loss price when the green support line is broken

2. 124,639.5 dollars long position 1st target -> Good, Great in order of target price

Since I left a simulation in the middle,

I think it would be good to use it for re-entry after liquidating the long position.

The movement within the 1st section at the top and the 2nd section at the bottom

is an extreme sideways movement, and from a long position,

if it succeeds in rebounding within the 2nd section, it becomes a strong upward condition.

From the 3rd section breakout today,

the low point is broken in the newly created weekly and daily chart candles this week,

so please note that the upward trend may be delayed.

The next support line is the Gap8 section created last week.

Up to this point, I ask that you simply refer to and utilize my analysis

and I hope that you operate safely with principle trading and stop loss prices.

Thank you.

Bitcoin Bybit chart analysis July 10Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here is the Bitcoin 30-minute chart.

There will be a Nasdaq indicator announcement at 9:30 in a little while.

There is a high possibility that Nasdaq will shake up and down significantly,

but Bitcoin still looks safe in terms of signal and pattern.

In the analysis article on July 7,

I connected the strategy as it was at the last long position entry point of 107,484 dollars.

*When the red finger moves,

it is a one-way long position strategy.

1. 110,707.4 dollars long position entry point / stop loss price when the sky blue support line breaks

2. 111,783.3 dollars long position 1st target -> Top 2nd -> Good 3rd target price

The 1st section at the top is today's best short position entry point,

and the 2nd section at the bottom is a sideways market.

In the middle, with a pink finger,

I left a re-entry position after liquidating a long position, so

I think it would be good to use it.

From the breakout of the sky blue support line, it can be pushed to Bottom -> 109,116 dollars.

The report is not yet renewed,

but from now on, it will be very important, right?

This week, it seems like it will continue to shake up and down,

so I hope you operate safely with principle trading and stop loss prices.

Thank you.

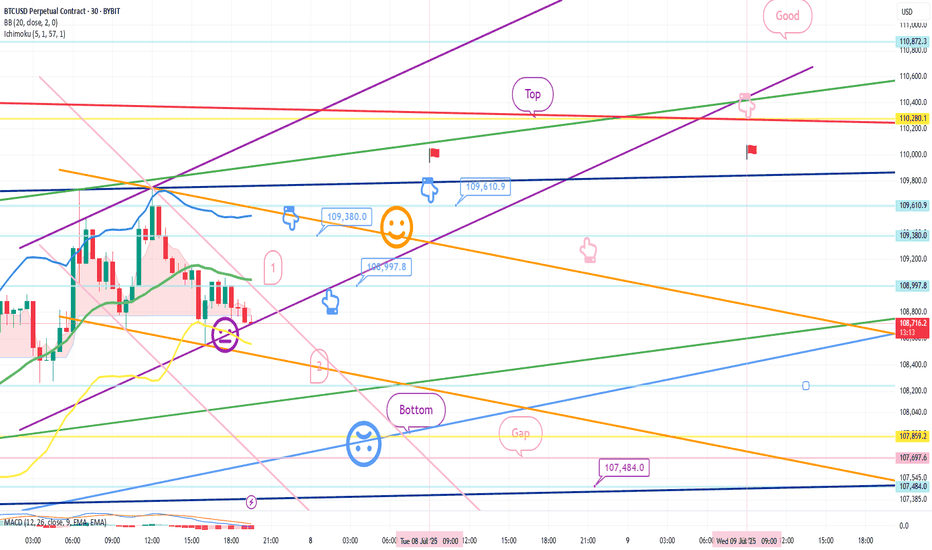

Bitcoin Bybit chart analysis July 7 Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here is the Bitcoin 30-minute chart.

There is no separate Nasdaq indicator announcement today.

I think the Nasdaq lower gap section retracement will be the focus.

Recently, sideways movement or adjustments have been coming out before the trend,

So I proceeded safely in preparation for variables.

*When the blue finger moves

Bidirectional neutral

Short->long switching or 2nd section long waiting strategy

1. $109,380 short position entry section / cut-off price when orange resistance line is broken

2. $108,997.8 long position switching / cut-off price when purple support line is broken

3. $109,610.9 long position 1st target -> Top 2nd target -> Good 3rd target

It seems important whether the purple support line is broken from the current position. If the first section at the top touches 108,997.8 dollars and comes down,

it may become a vertical decline section.

If it comes down right away, it is a long-waiting strategy in the final second section,

and if it deviates from the bottom section today

(6+12 pattern)

because it is a full candle when the gap section is touched,

it may fall to 107,484 dollars indicated at the very bottom.

I have important work to do tomorrow,

so I will take a day off and come back on Wednesday.

Please use my analysis so far for reference and

I hope you operate safely with principle trading and stop loss prices.

Thank you.

Bitcoin Bybit chart analysis July 4Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here is the Bitcoin 30-minute chart.

There is no Nasdaq index announcement today.

There is a possibility that Nasdaq will fall sharply,

but even if it moves sideways, the probability of the strategy succeeding increases.

On the left, with the purple finger,

I connected the 2nd section of the long position that I entered yesterday.

*When the blue finger moves,

Bidirectional neutral

Short->Long or long waiting strategy

1. 109,638.1 dollars short position entry section / cut-off price when orange resistance line is broken

2. 108,764.4 dollars long position switching / cut-off price when green support line is broken

3. 110,273.1 dollars long position 1st target -> target price in order from Miracle

If the strategy is successful, I left a simulation with the pink finger,

so please refer to it.

Those who held long positions yesterday, please check if the purple support line is broken,

If it falls immediately from the current position or

If the pink resistance line is not broken when the 1st section at the top is touched,

It is a vertical decline section,

And if the 109,638.1 dollar short position entry section at the top is not touched,

It is a long waiting strategy at the 2nd section at the bottom.

I think it would be good to think of it as a game in the 1+4 section.

From the 2nd section breakout, I have marked the Bottom -> 3rd section at the bottom.

Up to this point, please just refer to and use my analysis,

I hope you operate safely with principle trading and stop loss prices.

Thank you for your hard work this week.

Bitcoin Bybit chart analysis July 3Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here is the Bitcoin 30-minute chart.

There will be a Nasdaq index announcement at 9:30 and 11:00 in a little while.

I created today's strategy based on the Nasdaq pattern and Tether dominance vertical decline conditions.

*One-way long position strategy when the red finger moves

1. $109,838 long position entry point / stop loss price when the purple support line is broken

2. $111,549.7 long position 1st target -> Great 2nd target

The 1st section at the top and the 2nd section at the bottom are sideways sections.

Even if the strategy fails, if the green support line is not broken,

it is good for a long position.

Below that

Bottom -> Please note that it is open up to 107,841.4 dollars

Up to this point, I ask that you simply use my analysis for reference and use only

I hope that you operate safely with principle trading and stop loss prices.

Thank you.

Bitcoin Bybit chart analysis July 1

Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here is the Bitcoin 30-minute chart.

Shortly later at 10:30 PM and 11:00 PM, there will be a NASDAQ index announcement.

On the left, with a purple finger,

I connected the long position entry point of $106,775.9, which I entered yesterday, to today's strategy.

Since the rebound was not strong yesterday,

the 12-hour chart -> daily chart MACD dead cross is currently under pressure.

Depending on the situation, it can drop strongly to the 3rd section at the bottom,

and since there may be some people who are maintaining long positions yesterday,

I will explain in detail the operating method such as the loss cut price,

so please check it carefully.

*When the blue finger moves,

Bidirectional neutral

Short->Long switching strategy

1. 107,300.3 dollars short position entry section / stop loss price when orange resistance line is broken

2. 106,222.2 dollars long position switching / stop loss price when section 2 is touched

3. Top section long position 1st target -> Good 2nd target

It is important until 9 o'clock when the 12-hour candle is created.

After 9 o'clock, the blue finger 106,222.2 dollars at the bottom

Becomes the main support line

If it comes down from the current position, section 2

The main support line is divided.

In terms of the pattern, it is section 6+12.

If section 2 is touched right away,

There is a high possibility of a strong drop today,

So you should be careful.

- Those who are maintaining a long position

If you touch the 2nd section before 9 PM without touching the short position entry point at the top

You should operate at a loss cut price.

I think it would be good to adjust it according to leverage.

If it falls after touching the 1st section at the top

It becomes a vertical decline condition.

From the bottom, from the 3rd

Maximum Bollinger Band daily chart support line section

Please note that it can be pushed up to 100,685.5 dollars.

I have never changed my perspective suddenly or irresponsibly after leaving an analysis article.

I did my best until the end today.

Please use my analysis article so far only for reference and use

I hope you operate safely with principle trading and loss cut prices.

Thank you.

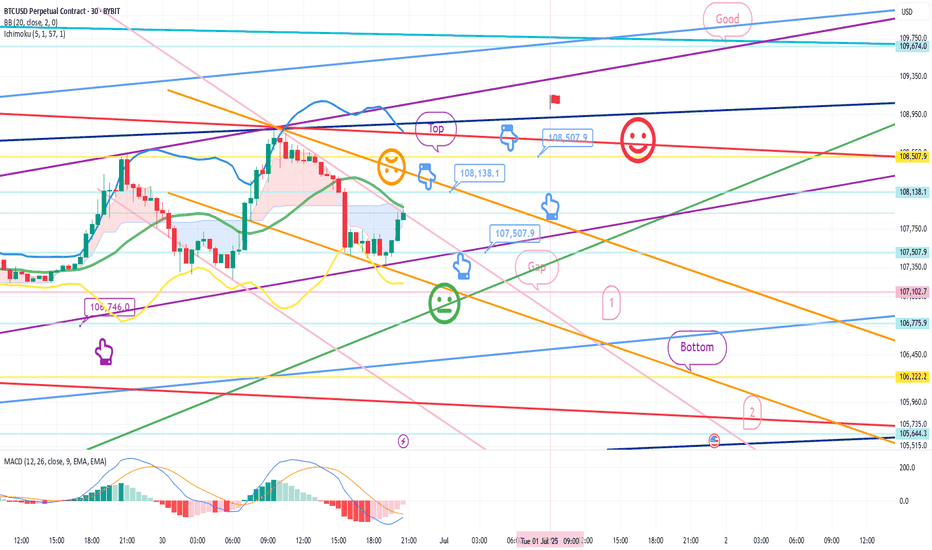

Bitcoin Bybit chart analysis June 30 Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is the Bitcoin 30-minute chart.

There is no separate indicator announcement today.

The weekly and daily charts are being adjusted at the same time as they are created.

The strategy was carried out based on the Nasdaq pattern and the Tether dominance pattern.

The long position entry section on the 25th, $106,746, was connected as is.

*When the blue finger moves,

It is a two-way neutral

short->long switching or long waiting strategy.

1. $108,138.1 short position entry section / stop loss price when orange resistance line is broken

2. $107,507.9 long position switching / stop loss price when green support line is broken

3. $108,507.9 long position 1st target -> Good 2nd target price

You can also use the long position re-entry indicated in the middle.

If it comes down right away without touching the short entry section at the top,

it is a long waiting strategy at the gap section of 107,102.7 dollars,

and the stop loss price is the same.

And, if it succeeds in rebounding within the purple support line today,

the reason it is safe from a long position is

because the low point of the weekly and daily candles created this week is maintained without additional deviation.

Please note that the 1st section at the bottom is a sideways market / the 2nd section is open up to the bottom.

Please use my analysis article so far only for reference and use,

and I hope you operate safely with the principle trading and stop loss price.

Thank you.

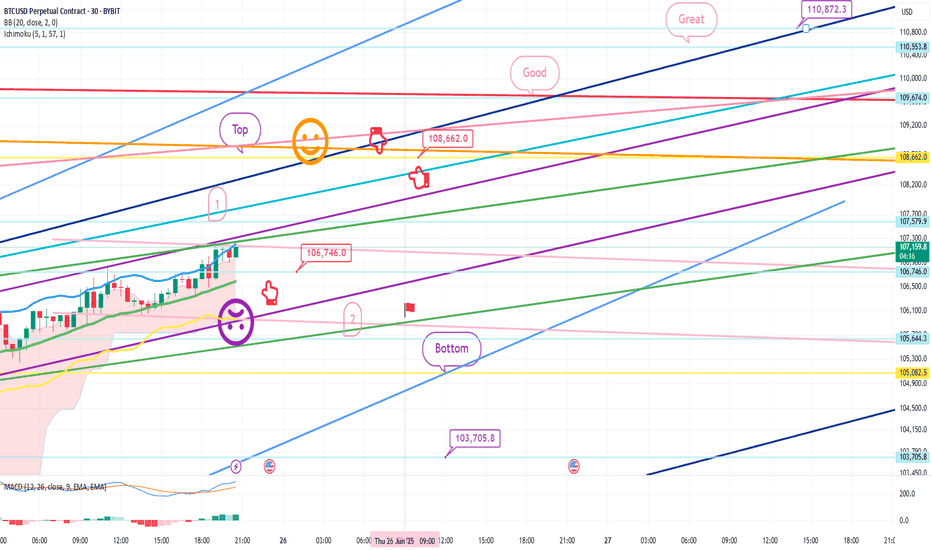

Bitcoin Bybit chart analysis June 25Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is the Bitcoin 30-minute chart.

Nasdaq indicators will be announced at 11 o'clock shortly.

Nasdaq is rising vertically + renewing its all-time high.

Accordingly, I ignored the weekly MACD dead cross and

proposed the strategy for the pattern by substituting Tether dominance.

Although it is not visible on the screen,

I created today's strategy with the condition of maintaining the long position of $100,587.9 that was confirmed on the 23rd.

* One-way long position strategy when the red finger moves

1. $106,746 long position entry section / When the purple support line is broken

or when section 2 is touched, stop loss price

2. $108,66 long position 1st target -> Good 2nd -> Great 3rd target price

When section 1 at the top touches, it can be connected to an upward trend,

and section 2 is a sideways market.

At the very bottom and the very top,

I have indicated the maximum possible trend until tomorrow afternoon.

Up to this point, I ask that you simply use my analysis for reference and use only

I hope that you will operate safely with the principle of trading and stop loss.

Thank you.

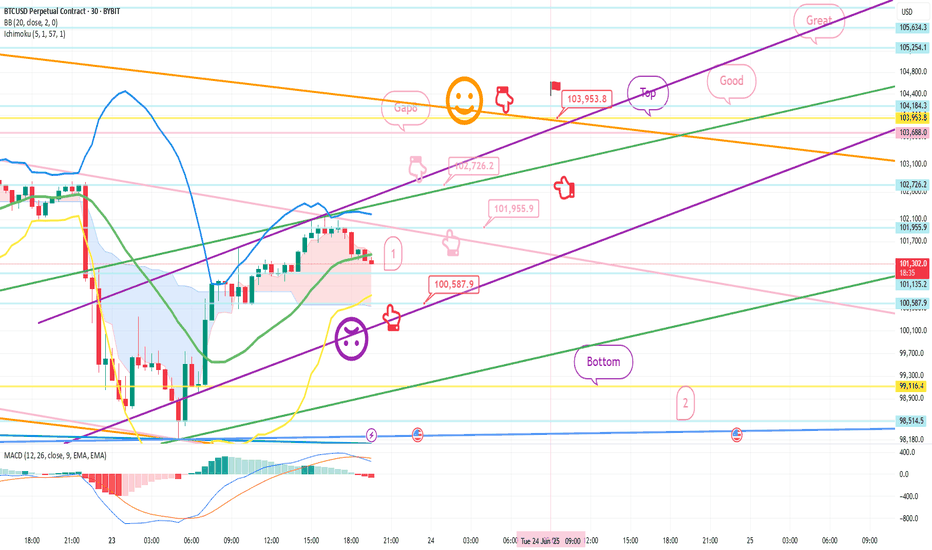

Bitcoin Bybit chart analysis June 23Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is the Bitcoin 30-minute chart.

The Nasdaq seems to be rising without any problems,

but Bitcoin is under pressure from the MACD dead cross on the weekly chart as it has been adjusted strongly over the weekend.

Depending on the real-time situation, it seems advantageous to operate safely

short-term trading or both-way trading this week.

I created today's strategy based on the Nasdaq movement and the Tether dominance pattern.

*One-way long position strategy when the red finger moves

1. $100,587.9 long position entry section / hand drop when the purple support line is broken

2. $103,953.8 long position target price / Good 2nd target price thereafter

From the purple support line breakout, the weekly chart

candle low point created this week is broken, so it is better to maintain it without breaking out from the long position position.

If it breaks out, it can be pushed to the bottom -> 2nd section.

The 1st section marked in the middle

If it doesn't come down to the long entry point today

It is a vertical rise section

And the pink finger in the middle indicates the short-term target price -> additional long entry section

And the Gap8 section was created at the top due to last week's movement

I think it would be good to refer to it while trading.

Up to this point, I ask that you simply use my analysis for reference and use

I hope that you operate safely with principle trading and stop loss prices.

Thank you.

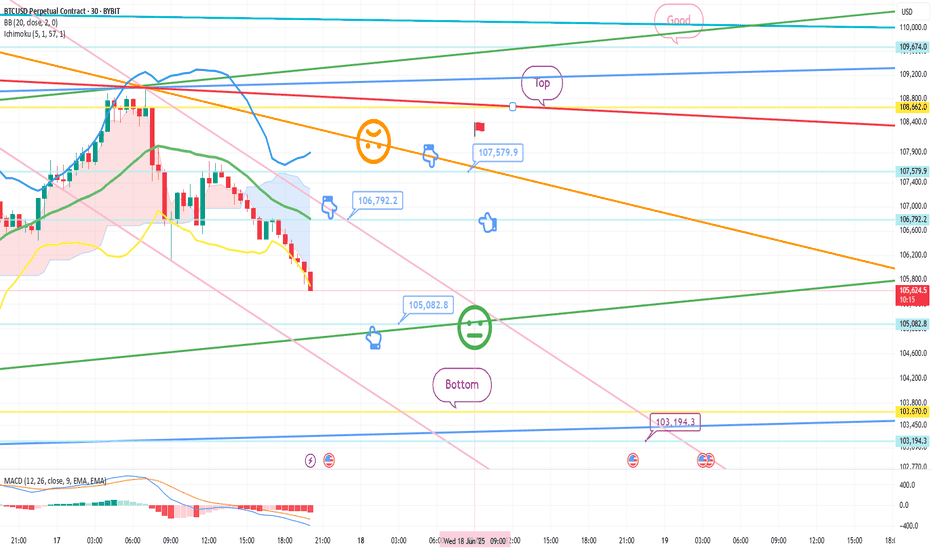

Bitcoin Bybit chart analysis June 17Hello

This is Bitcoin Guide.

It's been a while.

I took a break recently because the participation rate was not good.

Since it's been a while since I did an analysis, I did it in a short form,

I hope you enjoy it.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here is the Bitcoin 30-minute chart.

I created a strategy based on the possibility of sideways movement in Nasdaq and the rebound of Tether Dominance.

* When the blue finger moves,

It is a two-way neutral short->long switching strategy.

1. $106,792.2 short position entry point / stop loss price when orange resistance line is broken

2. $105,082.8 long position switching / stop loss price when green support line is broken

3. $107,579.9 long position 1st target -> Top 2nd target price

If it goes down from the current position,

Check the bottom section -> up to $103,194.3.

Please use my analysis as a reference only

I hope you operate safely with principle trading and stop loss price.

Thank you.