Marubozu Candlestick Pattern.....The Marubozu is a unique and powerful single candlestick pattern that signals strong momentum in the market.

📌 What is a Marubozu?

A Marubozu candlestick has "no wicks or small wicks" — just a full body from open to close. This shows that the buyers or sellers were in complete control during that period.

🔵 Bullish Marubozu

A Bullish Marubozu opens at the low and closes at the high, showing strong buying pressure. It often appears at the beginning of a bullish move or during a breakout.

🔴 Bearish Marubozu

A Bearish Marubozu opens at the high and closes at the low, indicating strong selling pressure. It can mark the start of a downtrend or a continuation of bearish strength.

🧠 Interpretation

Marubozu patterns are seen as signs of conviction. When spotted at support or resistance zones, they can strengthen breakout signals or confirm reversals.

⚠️ Tip :

Always combine Marubozu with volume analysis or other indicators to avoid false signals and improve accuracy.

🔍 Use this pattern to identify strong momentum shifts and trade in the direction of the breakout!

Disclaimer :

This post is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

Candlestick Analysis

Gallantt Ispat Ltd - Up Flag PatternGallantt Ispat Ltd. displays a strong bullish setup with multiple confluences suggesting potential upside:

📊 Technical Analysis Summary:

✅ 1. Bullish Flag / Pennant Pattern

After a strong uptrend (flagpole), the price is consolidating in a tight descending channel, forming a bullish pennant.

These patterns are continuation setups, and a breakout above the upper trendline usually signals a resumption of the uptrend.

✅ 2. Volume Spike

There is a clear increase in volume, confirming institutional interest.

Breakouts with volume are more reliable—this spike could indicate accumulation before breakout.

✅ 3. MACD (CM_Ult_MacD_MTF)

MACD line is above the signal line and both are rising, indicating positive momentum.

Histogram turning blue and increasing, further confirms bullish momentum.

✅ 4. Entry/Exit Setup

Entry zone: Around ₹554.70 (current price), or on breakout above ₹562.40.

Stop loss: Around ₹523.75 (below pattern and recent support).

Target: ₹639.80 (based on flagpole projection).

🧠 Trade Idea:

Risk-Reward: Favorable (Approx. 1:2.7 R:R).

Ideal Entry: Wait for breakout candle with high volume above ₹562.40.

Safe Entry: Enter in retest after breakout, if it occurs.

Precision Meets Patience | SAKSOFT Chart WTF🔻 A clean Control Trendline (CT) drawn from the all-time peak (🔺) on the Weekly Time Frame (WTF) shows a long-term price memory resistance finally getting tested.

📏 Overlapping that is a hidden horizontal resistance (⚪ dotted white line), representing the final hurdle before the stock can challenge the supply zone.

🟧 Mother Candle Structure: A powerful consolidation candle has now been broken with strength, giving us structure + intent in one move.

🔊 Volume speaks! We’ve seen two separate clusters of high volume, confirming active participation—not a lonely breakout.

📈 The trendline from bottom left is giving both body and wick supports—a technically clean angle where structure meets sentiment.

📝 Note:

This is a structural breakdown meant for educational and analytical purposes. Not a forecast or recommendation.

ITC will start going downwards soonTECHNICAL INDICATORS -

DOUBLE TOP PATTERN :

Recently NSE:ITC has formed a double top pattern indicating strong bearish potential for the stock

Double top is formed when 2 consecutive peaks are formed with a dip or low between them

HANGING MAN CANDLESTICK :

The stock has also formed a hanging man candlestick which denotes reversal of upward trend to downward trend

Hanging man is formed when a candlestick has long lower shadow and small upper body at the top

STRONG SUPPORT-RESISTANCE ZONE :

The stock has also taken reversal from a very strong support-resistance zone twice in the last 1 month indicating very stong momentum for the stock to go downwards

PROFIT TARGET :

411

STOP LOSS :

435

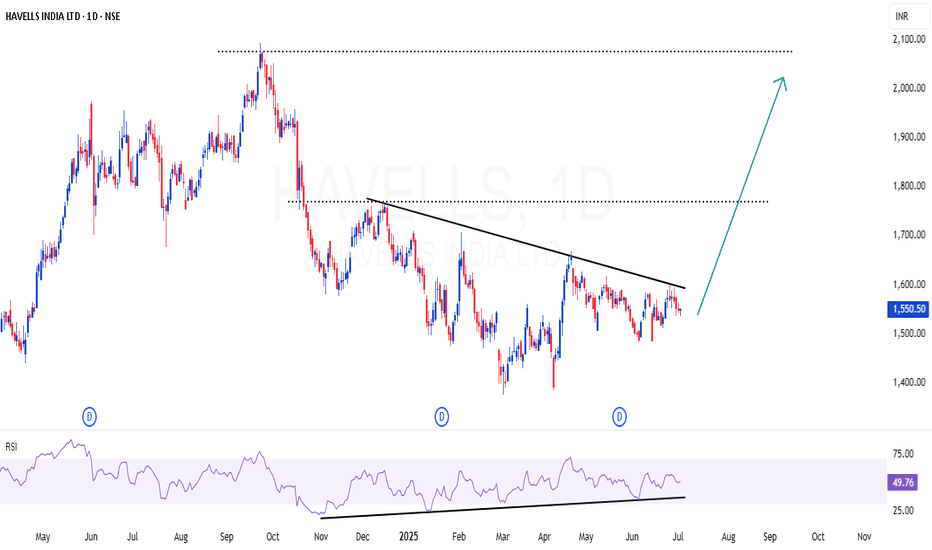

HAVELLS | Pleasant set up - INHS & RSI divergenceHAVELLS | Pleasant set up - INHS & RSI divergence

Strong RSI divergence in daily time frame

Inverted Head & Shoulder setup also in visual

A small dip may be possible for 8-10% in this stock , as market (NIFTY) is over heated. But we can consider that as opportunity to scale up the position

CMP : 1550 (Dip : 1480)

BLUE STAR LTD. – TECHNICAL ANALYSIS📈 BLUE STAR LTD. – TECHNICAL ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range (Resistance): 2417

• 🟢 Bottom Range (Support): 1521

________________________________________________________________________________

🔹 Chart Pattern: ✅

Rectangle/Box Consolidation Breakout – Price was range-bound in a tight zone and has given a strong breakout on high volume, indicating bullish intent.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns

• Top Range (2417): ⛔ No recent candlestick activity visible at the top range.

• Bottom Range (1521): Todays Candle

✅ Bullish Engulfing + Strong Bullish Candle

✅ RSI Bounce + Volume Spike

✅ Confirmed by Price Action and Momentum Indicators

________________________________________________________________________________

📊 Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade Setup:

• Entry: 1715 (Breakout Candle Close)

• Stop Loss: 1614.45 (Below consolidation and bullish candle)

• Target 1: 1850

• Target 2: 1980

• Reason:

o Strong breakout with above-average volume

o Multiple confirmations (RSI, Bollinger Band, Supertrend)

o Box breakout with previous supply cleared

________________________________________________________________________________

🔽 Bearish Trade Setup:

• If price fails to sustain above 1715 and closes back below 1680 zone

• Entry: Below 1665 (Fakeout confirmation)

• SL: Above 1715

• Target: 1615 / 1550

• Reason: Potential failed breakout & liquidity trap

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Britannia?

Drop your thoughts and chart setups

________________________________________________________________________________

BRITANNIA INDUSTRIES LTD. – INTRADAY ZONE ANALYSIS📈 BRITANNIA INDUSTRIES LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________

🔹 Price Action Zones

🔴 Top Range (Resistance): ₹5869.50

🟢 Bottom Range (Support): ₹5721

⚪ Neutral Zone: Between ₹5732 – ₹5804 (No clear directional bias until breakout from either zone)

________________________________________

🧩 Chart Pattern: No

There’s no prominent chart pattern (e.g., flag, wedge, triangle) seen in the current snapshot. This is primarily a demand-supply structure with price action analysis.

________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range: No textbook reversal candle observed yet. However, the previous rejection from ₹5822–₹5804 still makes this zone valid for bearish observation.

🟢 Bottom Range: ✅ Morning Star pattern identified near ₹5721.

This is a strong bullish reversal pattern indicating potential buyer strength emerging from the demand zone.

________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: Go long if price retests ₹5732–₹5721 and holds with bullish confirmation (preferably another higher low or volume spike).

Stop Loss: Below ₹5715

Risk-Reward: 1:1 | 1:2+

Logic: Presence of a valid Morning Star reversal at demand zone suggests buyer strength and potential upside toward ₹5800+.

________________________________________

🔽 Bearish Trade:

Idea: Short if price rallies to ₹5822–₹5804 and shows rejection (bearish wick, reversal candle, volume drop).

Stop Loss: ₹5827.25

Risk-Reward: 1:1 | 1:2+

Logic: Previously reacted supply zone with strong rejection. If tested again without volume confirmation, short setup is valid.

________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone: ₹5822 – ₹5804

SL: ₹5827.25

Plan: Enter short only if price rejects the zone again with bearish confirmation.

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: ₹5732 – ₹5721

SL: ₹5715.60

Plan: Enter long if the zone holds, ideally using the Morning Star as confirmation.

Risk-Reward: 1:1 | 1:2+

________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________

💬 Comments

What’s your view on Britannia?

Will the Morning Star at the demand zone lead to a reversal, or will supply pressure dominate again?

Drop your thoughts and chart setups below 👇

________________________________________

Tweezer Top and Tweezer Bottom Candlestick PatternsTweezer Top and Tweezer Bottom are powerful reversal candlestick patterns often spotted at the end of trends.

🔻 Tweezer Top

Appears at the top of an uptrend. It consists of two consecutive candles with similar highs. The first candle is usually bullish, followed by a bearish candle of almost the same high, signaling a potential bearish reversal.

🔺 Tweezer Bottom

Appears at the bottom of a downtrend. It consists of two candles with matching lows. The first candle is bearish, followed by a bullish candle of nearly equal low, indicating a possible bullish reversal.

📌 Key Characteristics:

• Both candles have equal highs (top) or lows (bottom)

• Second candle shows hesitation or rejection of the previous trend

• Often found near resistance or support zones

• Works best with volume confirmation or other confluence signals

Disclaimer :

This idea post is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

MEDIASSIST | High probable setup - Looks good for 30%MEDIASSIST | High probable setup - Looks good for 30%

Technically, the stock is strong and recent news—like the Star Health deal—is positive. The coming lock-in expiry, however, could trigger volatility. With solid digital expansion but elevated valuation, it's likely attractively positioned yet not without risk.

CMP : 532 (Dip : 500)

SL : 470

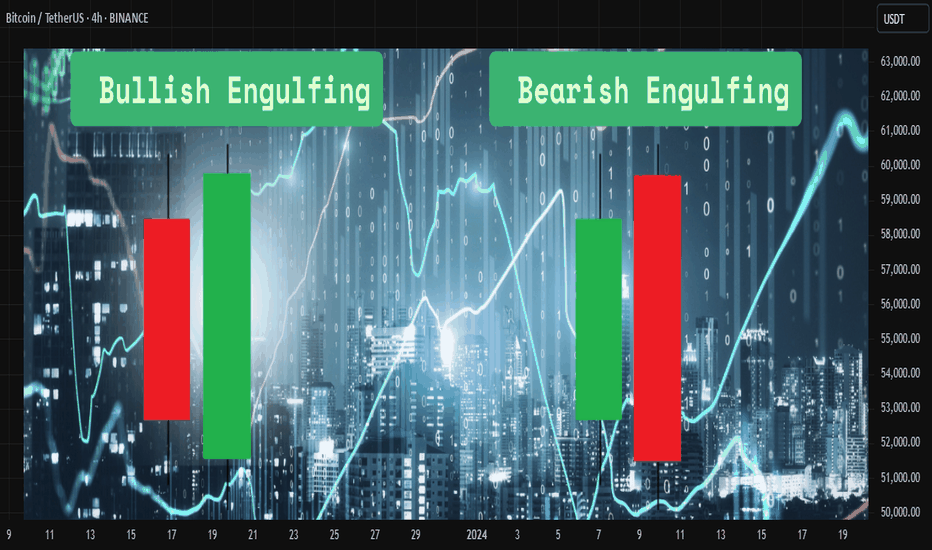

Engulfing Candlestick Pattern Explainedthe engulfing candlestick pattern is a powerful price action signal used by traders to identify potential reversals in the market. it consists of two candles:

🟢 bullish engulfing

* occurs during a downtrend

* the first candle is bearish (red)

* the second candle is bullish (green) and completely engulfs the body of the first candle

* it signals a potential reversal to the upside

🔴 bearish engulfing

* occurs during an uptrend

* the first candle is bullish (green)

* the second candle is bearish (red) and completely engulfs the body of the first candle

* it signals a potential reversal to the downside

📍 key points to remember

* the second candle must fully engulf the body (not just the wicks) of the first candle

* higher volume during the engulfing candle increases its reliability

* it works best when combined with support and resistance levels or trendlines

💡 confirmation

always wait for confirmation before entering a trade. for bullish engulfing, a break above the high of the engulfing candle is ideal. for bearish engulfing, a break below the low adds strength to the signal.

📈 How to use it ?

many traders use this pattern as part of their entry or exit strategy. combining engulfing patterns with indicators like rsi, moving averages, or trend filters can improve accuracy.

⚠️ risk management

like any pattern, engulfing candles are not 100% accurate. always use proper risk management and stop-loss placement to protect your capital.

Disclaimer :

This Video is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

Bullish and Bearish harami candlestick patternthe harami pattern is a two-candle reversal formation seen on candlestick charts. it reflects indecision and a possible shift in momentum, making it useful for spotting early signs of a trend change.

🔵 bullish harami

this pattern forms during a downtrend. the first candle is a large bearish one, followed by a smaller bullish candle that fits completely within the body of the first candle. this shows that selling pressure is weakening and a potential upward reversal may occur.

🔴 bearish harami

this pattern appears during an uptrend. the first candle is a strong bullish one, followed by a smaller bearish candle that is completely inside the previous candle’s body. this suggests that buying strength is fading, and a downward move might follow.

📌 key characteristics

* second candle is smaller and opposite in direction

* body of the second candle is fully within the body of the first candle

* confirmation from volume or the next candle increases reliability

✅ usage tips

* combine with support and resistance levels or trendlines

* look for confirmation from indicators like rsi or macd

* avoid using it alone in sideways or noisy markets

Disclaimer :

This post is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

Weekly CT Breakout + 200EMA Flip | GALAXYSURF Structure📉 Main CT Line (Dotted White)

A well-defined counter-trendline finally gave way after weeks of price compression. The breakout was clean, with a strong bullish candle closing decisively above it.

📊 Volume Confirmation

Breakout candle posted a solid spike in volume — the highest weekly volume in months. 💥

📈 200 EMA Broken (Blue Line)

Price has also cleared the 200-week EMA, a key dynamic resistance, now potentially flipping to support. 📉

🟧 Higher Timeframe Supply (Orange Line) / ⚪ (White Lines)

The breakout candle has also stepped into a tight zone between Weekly + Monthly supply, marked by the orange line.

📌 As always, the chart tells the story. No predictions. No assumptions, just structure.

BCHUSD Trendline Breakdown and RetestBCHUSD has broken its trendline on the 1-hour timeframe and has retested with a large doji and a subsequent inside candle.

This is a great bearish signal with the SL of the high of the Retest/Doji candle.

My target will be at the 222-225 level which is second trendline point.

Bandhan Bank June Futures at a crucial zone.Bandhan Bank is at a crucial zone for continued upward momentum after a steep fall towards the support zone. The bullish momentum today has been pretty strong, although the price is coming at a halt near the 178-179 range, upon the break of 179.5 and upwards, I expect the price to continue upto 183, 188 in the coming 2 weeks, and 200, 212 (upon extreme optimism and market’s current momentum).

Buy trade executed at 173.5.

Simplified Approach to read Candlesticks -Easy Candles ~ Part 1MARKETSCOM:OIL

Introduction

⦿ Candles form the basis of chart creation and analysis.

⦿ A weak foundation can destabilise your entire structure. This thread will clarify and simplify your understanding of price candles.

I use two types of candles on charts:

1. Momentum/trending candles

2. Ranging/trading candles

Understanding these eliminates the need to memorize complex candle names (e.g., Marubozu, Harami bullish) cause every candlestick pattern is formed with combination of these 2 candels only.

Definitions:

⦿ Momentum candle: Body >50% of total size

⦿ Range candle: Body <50% of total size

Decode Momentum Candle

⦿ Only Buyers here - Clear Trend

Decode Range Candle

⦿ Both Buyers & Sellers here - No Trend

⦿ Indecision mode among participants.

⦿ Understand what major players did in the last candle to predict their next move.

⦿ Don't just memorise candle names; grasp the psychology behind them.

⦿ I'll share the levels of candle strength to elevate your candle reading.

♦️Stay tuned and follow for more educational

content.

ELECTCAST Triple Bottom Pattern🔍 1. Understanding the Triple Bottom

The Triple Bottom is a classic bullish reversal pattern that typically forms after a prolonged downtrend or consolidation phase. It signifies strong buying interest at a consistent support level, leading to three distinct price lows (or “bottoms”) occurring near the same price zone.

📌 Key Characteristics:

Formation Time: Typically spans 2–6 months

Touchpoints: Three distinct lows formed at or near the same support level

Pattern Zone (for ELECTCAST): ₹87 – ₹88

Trade Entry: Entry is typically considered on a breakout above the neckline, which is the horizontal resistance connecting the interim highs between the bottoms. In this case, a breakout confirmation would be around ₹96.

Stop Loss (SL): Just below the third bottom, e.g., ₹85

Target: Based on pattern depth projection, conservative ₹104, aggressive potential up to ₹120–₹140, once momentum sustains

📉 2. Triple Bottom Formed at ₹87–₹88 Zone

Electrosteel Castings has tested the ₹87–₹88 level three times, showing that this price zone has acted as a strong accumulation support. The repeated defense of this level suggests significant buying interest by institutional players or informed investors.

1st Bottom: Initial rejection near ₹88

2nd Bottom: Retest with similar rejection zone

3rd Bottom: Confluence with bullish reversal candlestick (Morning Star)

The pattern is visually symmetric and clean, enhancing its reliability.

At the third bottom near ₹87, a Morning Star was observed, marking the first visual confirmation of bullish reversal. This adds significant strength to the pattern because the third bottom often acts as a psychological pivot point, triggering buying from traders watching for a reversal.

📈 3. Higher Top – Higher Bottom Structure Emerging

Following the Morning Star, the stock has started forming a higher bottom and higher top structure—a fundamental trait of an uptrend. However:

🟡 Caution: One more higher bottom formation is required to confirm the start of a sustainable uptrend.

Once the uptrend is firmly established, a close above ₹140 will act as a major breakout signal, potentially propelling the price toward new 52-week highs or an all-time peak.

🧠 4. Accumulation Zone and Triple Bottom – The Relationship

An Accumulation Zone is a price range where informed investors quietly accumulate shares over a period, usually when a stock is undervalued or consolidating.

🔗 Connection to Triple Bottom:

The Triple Bottom pattern often forms within the Accumulation Zone

Each dip to the support level attracts buyers, revealing hidden demand

The formation acts as a transition from accumulation to markup phase

The breakout from the Triple Bottom signals the end of accumulation and the start of an uptrend

Hence, the Triple Bottom is not just a technical pattern, but a visual representation of accumulation dynamics playing out.

📝 Disclaimer

This report is intended purely for educational and training purposes. It is not a recommendation to buy or sell securities. Always conduct your own research or consult a certified financial advisor before making trading decisions.