GMDC 1 Day Time Frame from NSE data:

📊 Daily Pivot & Key Levels (1D Timeframe)

📌 Daily Pivot Point (PP): ₹606.73 – This is the central bias level. Above this suggests short-term bullish control; below may signal weakness.

💥 Resistance Levels (Upside)

R1: ₹627.46 – first major resistance above the pivot

R2: ₹640.38 – medium-term barrier

R3: ₹661.11 – stronger supply zone / higher target

🛡️ Support Levels (Downside)

S1: ₹593.81 – immediate daily support

S2: ₹573.08 – deeper pullback level

S3: ₹560.16 – stronger lower support area

✔ How to use these levels (Daily view):

📈 Bullish conditions:

If price sustains above Pivot (₹606.73) → bias turns bullish

Stronger breakout confirmation if price closes above R1/R2 with volume

📉 Bearish conditions:

If price breaks below S1 (₹593.81) → watch for next supports (S2/S3)

Failure at resistance zones can lead to pullbacks

💡 Summary Daily Chart Levels (1D)

Level Price (Approx)

R3 661

R2 640

R1 627

Pivot 606

S1 594

S2 573

S3 560

(Levels rounded for clarity)

Chart-patterns

HAVELLS 1 Day Time Frame 📌 Current Market Snapshot (NSE)

• Current Price: ~₹1,345–₹1,352 range (intra‑day) — varies by source/data feeder 👆

📈 Daily Pivot & Key Levels (Daily Timeframe)

📊 Pivot Point Levels

Level Price (Approx)

🧮 Pivot (Daily) ₹1,270–₹1,275

🔼 Resistance 1 (R1) ₹1,287–₹1,291

🔼 Resistance 2 (R2) ₹1,301–₹1,305

🔼 Resistance 3 (R3) ₹1,316–₹1,318

🔽 Support 1 (S1) ₹1,259–₹1,265

🔽 Support 2 (S2) ₹1,243–₹1,245

🔽 Support 3 (S3) ₹1,230–₹1,232

(Classic pivot daily levels)

📊 Alternative Daily Support / Resistance Levels (Trendlyne / Research360)

✔ Pivot: ~ ₹1,324–₹1,325

✔ Support Levels:

• S1: ~ ₹1,294–₹1,294

• S2: ~ ₹1,276–₹1,276

• S3: ~ ₹1,245–₹1,246

✔ Resistance Levels:

• R1: ~ ₹1,342–₹1,343

• R2: ~ ₹1,373–₹1,373

• R3: ~ ₹1,391–₹1,391**

🔍 Short‑Term Daily Reference (Intraday Pivot)

From intraday pivot analysis (updated today):

• Central Pivot (CPR): ~ ₹1,319–₹1,320

• Daily R1: ~ ₹1,333–₹1,334

• Daily R2: ~ ₹1,349–₹1,350

• Daily R3: ~ ₹1,363–₹1,363

• Daily S1: ~ ₹1,290–₹1,291

• Daily S2: ~ ₹1,289–₹1,289

• Daily S3: ~ ₹1,303–₹1,303

(based on multiple pivot calculation methods including Standard & Camarilla)

📌 How to Use These Levels Today

Bullish scenario:

✅ Holding above Pivot / CPR (~₹1,270–₹1,324) → bias to R1 → R2 → R3 zones.

Bearish scenario:

❌ Break below S1/S2 (~₹1,259 / ₹1,243) → weakness toward S3.

Short traders often watch CPR for pullbacks and reversals within the day.

IIFL 1 Day Time Frame 📊 Daily Pivot & Key Levels (1‑Day Timeframe)

📍 Daily Pivot:

• ₹520.28 (reference level for bias)

📈 Resistance Levels:

• R1: ₹532.57 — first upside hurdle

• R2: ₹543.28 — next barrier above

• R3: ₹555.57 — extended resistance zone

📉 Support Levels:

• S1: ₹509.57 — immediate support

• S2: ₹497.28 — next support zone

• S3: ₹486.57 — deeper support below

📌 How to Use These Levels Today

📈 Bullish view:

Break above ₹532.5 – ₹543.3 can open room toward ₹555+ for the day.

📉 Bearish view:

If price drops below ₹509.5, sellers could push toward ₹497 and then ₹486.5.

🟡 Pivot reaction:

Holding above the pivot ₹520.28 suggests bias toward upside today.

Falling below pivot suggests weakness intraday.

🔍 Note on Current Price Trend

Some data (delayed) shows moving averages and indicators near oversold, but pivot levels remain useful for intraday decisions.

DIXON 1 Day Time Frame 📍 Live Price Snapshot

🔹 Approx Current Price: ~₹11,566 (INR) (up strong recently)

🔹 52-Week Range: ~₹9,835 – ₹18,471

📊 Daily Pivot & Support/Resistance Levels (1D Timeframe)

These are commonly used by traders to judge intraday/daily trend bias, entry/exit zones, and key price reactions:

Level Price (Approx) Type

R3 ₹11,551 – ₹11,600 Major Resistance

R2 ₹11,375 – ₹11,380 Resistance Zone

R1 ₹11,203 Near-Term Resistance

Pivot ~₹11,027 Daily Center / Bias Level

S1 ₹10,855 Support

S2 ₹10,679 Support Zone

S3 ₹10,507 Strong Support

👉 Price above Pivot & R1–R3: Bullish bias

👉 Price below Pivot & heading toward S1–S3: Bearish/neutral pressure

These are classic pivot levels updated for today’s trading range.

📈 Short-Term Technical Structure

Bullish / Positive signs:

Price recently moved above short EMAs (e.g., 5-, 9-day), showing short-term strength.

RSI around mid-range suggests room to run upside without overbought stress.

Bearish / Caution flags:

Longer moving averages (50/100/200) still overhead as resistance — trending bias remains cautious.

Technicals from some chart views still show a weak structure on daily if price fails below pivot.

📌 How to Use These Levels Today

✔ Bullish bias only if price sustains above pivot (~₹11,027)

✔ Near-term breakout zone: Clear move above R2 (~₹11,375) / R3 (~₹11,550)

✔ Support watches: Monitor S1 (~₹10,855) and S2 (~₹10,680) for pullbacks

✔ Break below S3 (~₹10,507) — could signal deeper intraday bearish pressure

🧠 Quick Context

Shares recently rebounded and are above short-term EMAs, indicating some short-term strength.

Overall broader market influences (mid-cap pressure / sector flow) still matter for this stock’s direction.

Price near multimonth lows, so risk and volatility remain elevated.

OIL 1 Day Time Frame 📊 Current Approx Price (as per today data): ₹488.90 – ₹514.4 range (varies by platform/time) — OIL has recently traded around this area near daily pivot/major levels.

📈 Daily Pivot & Key Levels (Classic method)

Level Price (₹) Role

R3 (3rd Resistance) 507.45 Strong upside hurdle

R2 499.40 Secondary resistance

R1 491.35 Near-term resistance

Daily Pivot 483.30 Trend bias line

S1 (1st Support) 475.25 Immediate support

S2 467.20 Next downside cushion

S3 459.15 Major support zone

👉 Interpretation (1-day frame):

Price above pivot (~483-484) = bullish bias on the daily.

Near-term resistance cluster: ₹491–₹499–₹507 — watch breakout closes above these for continuation.

Downside support cluster: ₹475 → ₹467 → ₹459 — breakdown below these suggests short-term correction.

📊 Short Summary (Daily Momentum & Indicators)

Technical bias:

• RSI near bullish/neutral zone — showing positive momentum without being extremely overbought.

• MACD / ADX generally leaning bullish indicating trend strength at the moment.

Overall daily structure favors bullish to sideways — supports holding and resistance being tested.

🧠 How to use these levels (Daily)

📍 Bullish setup:

• If price stays above pivot ~483 and holds above R1 (~491) → next target R2 ~499 → R3 ~507.

📍 Bearish setup:

• If price falls below pivot ~483 and breaks S1 (~475) → move down to S2 (467) & potentially S3 (459).

📍 Key breakouts:

• Clear daily close above 507 → strong bull confirmation.

• Close below 459 → negates short-term bull view.

KAYNES 1 Week View 📌 Current Price Context

• Latest traded price around ₹3,640–₹3,720 on NSE (live varies by exchange and time) — showing recent rebound after volatility.

📈 Weekly Pivot & Support/Resistance Levels (1-Week Timeframe)

📍 Weekly Pivot Reference

• Weekly Pivot Point (central level): ~₹3,702 (midpoint guiding sentiment)

🔼 Weekly Resistance Levels (Upside)

• R1: ~₹3,734 – ₹3,745

• R2: ~₹3,760 – ₹3,770

• R3: ~₹3,790 – ₹3,880

🔽 Weekly Support Levels (Downside)

• S1: ~₹3,675 – ₹3,678

• S2: ~₹3,640 – ₹3,635

• S3: ~₹3,280 – ₹3,280+ (broader deeper support zone)

📊 How Traders Interpret These Weekly Levels

Bullish Signals (Weekly Close Above)

✅ A weekly close above R1 (~₹3,740+) supports continuation of near-term recovery.

➡ Next upside targets become R2 (~₹3,760–₹3,770) and then R3 (~₹3,790–₹3,880) as next resistance layers.

Bearish Signals (Weekly Break Below)

⚠ Break and weekly close below S1 (~₹3,675) increases risk of deeper weakness, with S2 (~₹3,635) and S3 (~₹3,280) as key downside floors.

Neutral/Range Scenario

↔ If price holds between S1–R1 (~₹3,675–₹3,745), expect sideways/consolidation before a clear breakout direction takes shape.

📌 Key Notes on Trend & Structure

• Price is below longer historical mid/long-term averages, reflecting a wider downtrend from prior highs, but short-term technicals show stabilization and bounce risk.

• Recent volatility (big swings) suggests support/resistance zones matter more than trend at the moment — breakouts through these weekly levels tend to signal next directional move.

🧠 Practical Weekly Trade Levels

Level Type Approx Zone

Weekly Pivot ~₹3,702

Resistance R1 ~₹3,734–₹3,745

Resistance R2 ~₹3,760–₹3,770

Resistance R3 ~₹3,790–₹3,880

Support S1 ~₹3,675–₹3,678

Support S2 ~₹3,635–₹3,640

Support S3 ~₹3,280+

🧾 Quick Takeaway

Bullish weekly bias if price closes above ₹3,740–₹3,760 with momentum.

Bearish pressure remains if weekly closes below ₹3,675–₹3,640.

Range trade likely between those pivot bands until directional breakout occurs.

BSE 1 Day Time Frame 📌 Current Price & Daily Range (Live Context)

Estimated current market price: ~₹2,850–₹2,880 (indicative from multiple sources citing latest live price movement).

Today’s daily high/low range: Approx ₹2,793–₹2,929 (observed current session variation).

⚠️ Exact live price can differ by minutes — check your trading platform for exact tick.

📈 1‑Day Pivot & Levels (Daily timeframe)

Classic Pivot Zone:

Pivot Point: ~₹2,647–₹2,663 (key balance level)

Immediate Resistance (Upside Targets):

R1: ~₹2,765–₹2,775

R2: ~₹2,828–₹2,830

R3: ~₹2,940 or higher (extended resistance)

Key Support (Downside Levels):

S1: ~₹2,584–₹2,625

S2: ~₹2,466–₹2,575

S3: ~₹2,403–₹2,537 — major downside pivot safety zone.

👉 Price above pivot generally signals bullish intraday bias; below pivot suggests weakness.

📊 Trend & Momentum (Daily)

Indicators & moving averages:

Price is trading above 20/50/100/200‑day EMAs, indicating a bullish trend on the daily chart.

RSI near neutral‑to‑positive zone (~50), showing room for further continuation before overbought.

This suggests bullish bias on daily timeframe, but resistance zones near ₹2,828–₹2,940 are key to break for sustained upside.

🧠 How to interpret the daily levels today

Bullish scenarios (1‑Day):

✔ Above ₹2,828–₹2,830 — expands move toward ₹2,940+.

✔ Sustained above pivot ~₹2,650+ — retains short‑term bullish structure.

Neutral / consolidative:

➡ Between ₹2,650 – ₹2,828 — range balance, sideways action likely.

Bearish scenarios (1‑Day):

✘ Break below ₹2,584 — could pull toward ₹2,466 / ₹2,403 supports.

MTARTECH 1 Week Time Frame 📊 Current Price Snapshot

MTAR Technologies closed around ₹2,931–₹2,932 recently.

📈 Weekly Pivot & Support/Resistance Levels

(Important zones likely to act as reference over ~1 week)

🔹 Pivot Levels

These are calculated based on recent price activity and help gauge short-term bias:

Central Pivot ≈ ₹2,909–₹2,954 (key balance level)

🔹 Resistance Levels

Potential upside barriers where price may slow/reverse:

₹2,995–₹3,031 near short-term upper range

₹3,100–₹3,178 next resistance cluster

Above ₹3,200 breakout target (longer weekly/extension)

🔻 Support Levels

Important zones to watch if price pulls back:

₹2,741–₹2,762 area (S1) — near immediate short-term support

₹2,562–₹2,600 range (S2) — strong secondary support

₹2,461–₹2,500 (S3/S4) — deeper pullback zone

These resistances/supports are based on pivot point calculations & Fibonacci extensions covering multiple pivot methods.

📊 Technical Indicators (Short-Term Context)

Moving averages (20, 50, 100, 200 DMA) are largely bullish in daily/weekly analysis, supporting upward momentum.

RSI is near bullish territory but approaching overbought on shorter frames — indicating possible consolidation ahead.

Some technical tools show short-term buy signals; others show neutral — indicating range movement with upside bias.

📌 How to Use These Levels

Bullish Scenario:

➡ Price sustaining above the pivot (~₹2,890-₹2,950) suggests continuation toward ₹3,000 → ₹3,100+ resistance levels.

Bearish/Retracement Scenario:

➡ Failure below pivot or key support near ₹2,740 could trigger pullbacks toward ₹2,600 → ₹2,500 support zones.

This setup works well for 3–7 day trading or planning entry/exit zones.

TEJASNET 1 Month Time Frame 📊 Current Price Snapshot (Approx)

Last traded price ~ ₹330-₹345 on NSE/BSE during late Jan 2026, after recent volatility and sell-offs.

📉 1-Month Timeframe — Key Levels

🔻 Support Levels (Downside)

These are levels where the stock could find buyers or pause losses on a 1-month chart:

Support Zone Significance

₹320 – ₹325 Immediate support; recent intraday floor (current price region)

₹301 – ₹315 Secondary support zone from pivot breakdowns

₹285 – ₹300 Deeper support if broader bearish momentum continues

📈 Resistance Levels (Upside)

Resistance Zone Importance

₹355 – ₹360 1st resistance from short-term moving average relevance

₹370 – ₹375 Next resistance cluster near recent intraday reactions

₹390 – ₹395 Higher resistance if bounce gains strength

🧠 Technical Indicator Context (1-Month)

📉 Trend Bias: Bearish overall, price trading significantly below major moving averages (20-day, 50-day, etc.).

📊 RSI: Near oversold but not confirmed bottom — suggests bearish momentum but potential for short-term rebounds.

📉 MACD & STOCH: Bearish signals persist, indicating weak price action on the 1-month chart.

🗂 Summary — 1-Month View

⚠️ Bearish Bias: The stock is in a short-term downtrend, trading below key moving averages and suffering weak momentum.

🛑 Support in Focus: ₹320-₹315 first; further deeper zone near ₹285-₹300 if bears intensify.

📈 Resistance Roadblock: ₹355-₹360 key for initial bounce; stronger rally needs break above ₹370+.

📉 Bearish Technicals: RSI not strongly indicating reversal yet; MACD remains bearish.

HINDZINC 1 Month Time Frame 📍 Current Price Snapshot (latest close / recent trade)

HINDZINC is trading around ~₹628–₹630 on NSE/BSE — after some volatility in recent sessions. Its 52‑week high is ~₹733 and 52‑week low ~₹378.15, showing wide longer‑term movement.

🛠 1‑Month Technical Levels (Support & Resistance)

These are the key zones traders watch for a 1‑month period based on pivot analysis and recent price action:

🔼 Resistance Levels (Upside Targets)

1. ₹705 – ₹715: Immediate resistance zone around recent highs and pivot R1/R2 cluster.

2. ₹735 – ₹750: Next major supply/resistance area — crossing this would signal stronger upside continuation.

3. ₹760 – ₹780+: Extended breakout zone if sentiment turns sharply bullish (higher targets from pivot extensions).

📌 Overall, ₹705–₹715 is the near‑term hurdle the stock needs to clear for a bullish run.

🔽 Support Levels (Downside Price Floors)

1. ₹690 – ₹700: First strong support near recent consolidation lows/pivot S1.

2. ₹670 – ₹680: Secondary support — a deeper pullback zone.

3. ₹650 – ₹660: Key base area — breakdown below this can signal more downside pressure.

4. ₹620 – ₹630: Major structural support if broad market or metals weakness intensifies.

📌 The ₹670–₹700 band acts as the core support area this month.

⚠️ Quick Summary

✔ Above ₹705–₹715 = bullish continuation likely.

✔ Between ₹670–₹700 = consolidation zone.

✔ Below ₹650 = risk of deeper retracement.

STARHEALTH 1 Week Time Frame 📊 Weekly Price Range (1‑Week History)

High (last week): ~₹469.8

Low (last week): ~₹442.45

(Source: Marketscreener weekly price extremes)

📌 Key Weekly Support Levels

Support zones you may watch on the weekly timeframe:

1. Support 1: ~₹440–₹442 (recent weekly low)

2. Support 2: ~₹430 area (round‑number psychological / pivot cluster)

3. Support 3: ~₹408–₹415 range (broader structural support from pivot supports seen on shorter pivots)

Weakness below ₹430 could open the lower band towards ₹405–₹410.

📌 Key Weekly Resistance Levels

Potential weekly resistance zones to monitor:

1. Resistance 1: ~₹470–₹472 (recent weekly highs & EMA cluster)

2. Resistance 2: ~₹480–₹485 (psychological and medium MA area)

3. Resistance 3: ~₹495+ (upper pivot / longer‑term range top)

A weekly close above ₹480–₹485 would indicate stronger upside pressure.

📈 Technical Indicator Context (Weekly)

RSI and weekly momentum indicators on some platforms suggest neutral‑to‑slightly bullish conditions rather than extreme overbought levels.

Weekly pivot and moving average positions (when available) confirm ₹462–₹470 as an important zone for bullish continuation.

JLHL 1 Day Time Frame 📌 Current Live Price (1‑Day)

Last traded price: ~₹1,305–₹1,322 range today on NSE/BSE.

Day’s range: ~₹1,301–₹1,359.

📊 Intraday Technical Levels (1‑Day Time Frame)

🔹 Pivot & Reference

No concrete official pivot published for today across many free data sites, but general intraday pivot technique (based on brokers’ short‑term screens) focuses around mid‑range prices near ₹1,310–₹1,320 as neutral area.

🔼 Resistance Levels (Upside)

These are zones where the price may face selling pressure on the same trading day:

1️. ₹1,350–₹1,360 — initial resistance zone (recent intraday high area).

2️. ₹1,375–₹1,390 — secondary resistance if price clears the initial zone.

🔽 Support Levels (Downside)

These are zones where buyers may step in intraday:

1️. ₹1,290–₹1,300 — nearest support band (recent intraday low).

2️. ₹1,270–₹1,280 — next lower support cluster (near the 52‑week low region).

🧠 Intraday Trading Interpretation

Bullish bias intraday if:

Price breaks above ₹1,350–₹1,360 with volume → could test higher around ₹1,375–₹1,390.

Bearish bias intraday if:

Price loses ₹1,290 support → risk of slide toward ₹1,270+ zone.

Range‑bound scenario:

Price oscillates between ₹1,290–₹1,350 if participation stays muted.

CONCOR 1 Day Time Frame 📊 CONCOR — 1‑Day Time Frame Key Levels (Indicative)

Current Price (recent session)

• ~₹478–₹480 (down intraday) — trading near session lows.

🔁 Pivot & Classic Levels (from standard technical calculation)

These are typical pivot/SR levels used by traders for one‑day setups:

Pivot Point: ~₹520

➡️ The central reference level where bias may shift.

If price trades above this level intraday → bullish bias; below → bearish bias.

Resistance Levels:

• R1: ~₹524

• R2: ~₹527

• R3: ~₹531

➡️ Levels where selling pressure may emerge if price rallies.

Support Levels:

• S1: ~₹516

• S2: ~₹513

• S3: ~₹509

➡️ Key intraday levels where buyers may step in on pullbacks.

📉 Today’s Range & Observations

Day’s High: ~₹497–₹498

Day’s Low: ~₹477–₹478

➡️ CONCOR is trading nearer its session low, showing short‑term selling pressure.

52‑Week Context:

• 52‑week low ~₹472–₹478

• 52‑week high ~₹652 (prior broader trend)

📌 How Traders Use These Levels (1 Day Time Frame)

Bullish Scenarios (intraday):

✔ If price breaks above Pivot (~₹520) with volume → potential move toward R1 ~₹524 and beyond.

✔ Strength above R1/R2 indicates buyers stepping in.

Bearish Scenarios (intraday):

✔ Price staying below pivot and failing at R1/R2 → continuation lower.

✔ Breakdown below S1 (~₹516) and S2/S3 amplifies downside pressure.

HINDZINC 1 Day Time Frame 📌 Current Price (intraday basis):

• ~ ₹667–₹670.8 (range seen today) with highs near ~₹694 and lows near ~₹652.65 earlier in the session.

📈 Intraday Pivot Levels (Daily)

These are calculated from recent price action and are widely used by traders to gauge intraday support and resistance:

📊 Pivot & Levels (Standard Daily)

• Pivot Point (PP): ~₹705.45

• Resistance

• R1: ~₹713.35

• R2: ~₹725.70

• Support

• S1: ~₹685.20

• S2: ~₹672.85

• S3: ~₹664.95

📍 Central Pivot Range (CPR)

• Top CPR: ~₹695.32

• Middle CPR: ~₹693.10

• Bottom CPR: ~₹690.88**

(Note: Pivot and CPR may shift slightly as market updates.)

📍 Summary – 1D Intraday Levels

Level Price (₹) Role

R2 ~725.70 Major upside resistance

R1 ~713.35 Near‑term resistance

Pivot ~705.45 Key directional trigger

CPR Top/Mid/Bottom ~695–690.9 Important intraday range

S1 ~685.20 Near‑term support

S2 ~672.85 Secondary support

S3 ~664.95 Lower support zone

DIXON 1 Day Time Frame 📉 Intraday Price Action (Today’s Range)

Day’s Range: ~₹10,274 – ₹10,790

This indicates where the stock has been trading so far today.

📊 Key Intraday Levels for 1‑Day Time Frame

🟢 Support Levels

S1: ~₹10,545 – ₹10,550

S2: ~₹10,359 – ₹10,360

S3: ~₹10,016 – ₹10,020

🔴 Resistance Levels

R1: ~₹11,070 – ₹11,075

R2: ~₹11,410 – ₹11,420

R3: ~₹11,600 – ₹11,605

These pivot‑derived support/resistance levels are typical for intraday reference (classic pivot methodology).

🧠 How to Use These Levels (Intraday)

Bullish bias: A sustained break above R1 ~₹11,070 with volume can open moves toward R2 ~₹11,410.

Bearish bias: If price loses S1 ~₹10,545, next support guards are S2 ~₹10,360 and S3 ~₹10,016.

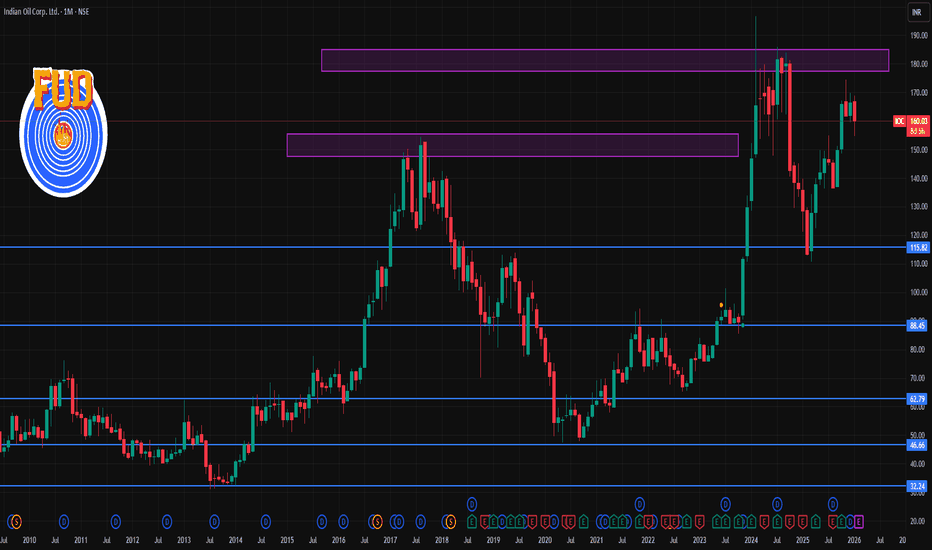

IOC 1 Month Time Frame 📌 CURRENT PRICE (as of 22 Jan 2026)

IOC share price: ~₹159.9 per share (NSE/BSE).

📊 1‑Month Technical Levels (Current & Accurate)

Resistance (Upside Levels)

These are levels where price may find selling pressure in the near term:

R1 – Immediate Resistance: ~₹160.6–₹162.5

R2 – Mid Resistance: ~₹162.5–₹163.9

R3 – Higher Resistance: ~₹164–₹165.2

A broader longer‑range resistance zone near ₹170–₹171+ remains significant if the market strengthens.

Why these matter:

Resistance levels show where the stock has historically paused or reversed on recent charts — useful for targets or exits.

Support (Downside Levels)

These are key near‑term supporting price zones:

S1 – Immediate Support: ~₹156.8–₹159.4

S2 – Secondary Support: ~₹154.7–₹157.9

S3 – Deeper Support: ~₹152.9–₹155.0

Note: If price breaks below ~₹155, it could signal further weakness in the short term.

🧠 How to Use These Levels

Swing traders: Use support zones for entry zones and resistance levels as targets.

Breakouts: A clear close above ₹164–₹165 could open room toward the ₹170+ zone.

Breakdown: A close below ₹155 could escalate selling into deeper support.

HINDCOPPER 1 Month Time Frame 📊 Current Reference Price

The stock is trading around ₹540 – ₹560 on the NSE today.

🧠 1‑Month Timeframe Key Levels

📈 Resistance (Upside Barriers)

These are levels where the stock might face selling pressure or pauses if it continues higher:

1. ₹570 – ₹575 — Immediate near‑term resistance zone (recent highs).

2. ₹580 – ₹585 — Next resistance cluster above current price — psychological plus pivot area.

3. ₹595 – ₹600+ — Extended upside target if price breaks above the near zone.

Interpretation: A daily/weekly close above ~₹575–₹580 can confirm strength on the 1‑month chart and open the move toward ~₹600+.

📉 Support (Downside Floors)

These are levels where buyers may step in if price corrects:

1. ₹522 – ₹525 — Near pivot support on medium timeframe.

2. ₹500 – ₹510 — Secondary support zone that has seen demand historically on pullbacks.

3. ₹480 – ₹490 — Deeper short‑term support — a key level if price weakens further.

Interpretation: Holds above ~₹520–₹525 are bullish for the 1‑month swing; breaks below that raise risk of deeper pullback toward ₹500 or lower.

✍️ 1‑Month Trading Perspective (Short Summary)

📌 Bullish Scenario

Sustained daily closes above ~₹575–₹580 → watch ₹590–₹600+ as next short‑term targets.

📌 Neutral / Range Scenario

Price consolidates between ₹525 and ₹575 — likely choppy movement before next directional breakout.

📌 Bearish / Correction Scenario

Close below ~₹522–₹525 → deeper support zones around ₹500–₹490 may get tested.

⚠️ Important Notes

✅ These are technical reference levels, not buy/sell recommendations.

✅ Price action can change quickly with market news, global copper trends, or broader index moves (e.g., Nifty/commodity dynamics).

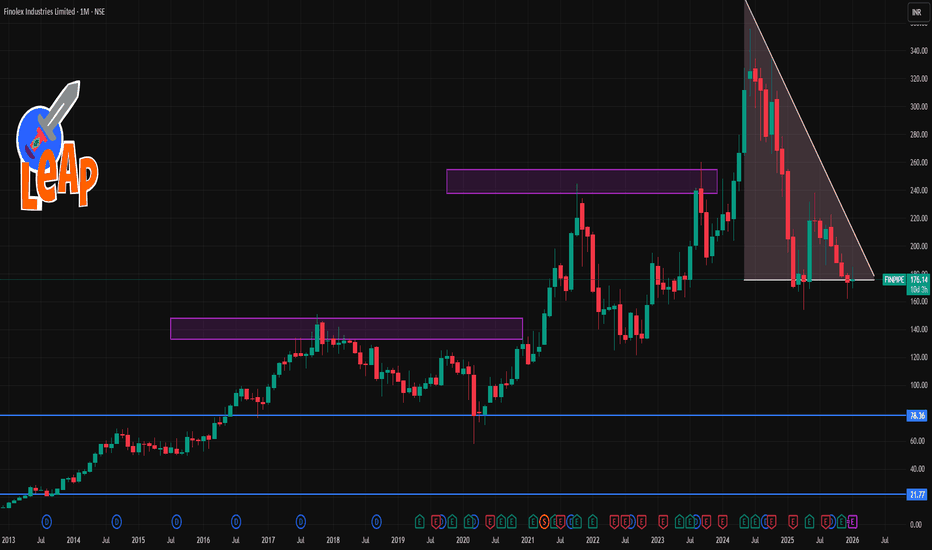

FINPIPE 1 Month Time Frame📊 Current Context

The share has been moderately positive over the past month (~+5–8% gains) in recent price data.

Recent share price (late Jan 2026) is near ₹175–177 levels.

📈 Key Levels (1‑Month Timeframe)

🔹 Resistance Levels

These are levels where the price may face selling pressure:

1. ~₹177–179 — Immediate resistance seen on short‑term pivot structure.

2. ~₹185–189 — Next meaningful resistance zone based on recent moving average clusters (20–50 day EMAs/SMAs).

3. ~₹194–198 — Higher resistance around 50–100 day average / upper consolidation of the last month/quarter.

Break above ₹185–189 with volume could signal a stronger short‑term uptrend continuation.

🔻 Support Levels

Important price floors where the price may find buyers:

1. ~₹173–175 — Near short‑term support and recent intraday pivot levels.

2. ~₹169–170 — Lower support seen from short swing lows over the past month.

3. ~₹164–165 — Deeper support from prior month low levels before recent recovery. (Estimated from recent historical lows.)

A close below ~₹169 on daily charts could indicate weakening short‑term structure.

🗺️ Trading Mindset (not financial advice)

Bullish view: A sustained move above ₹185–189 with increased volumes may target higher resistance near ₹195+.

Bearish view: A close under ₹170–169 could restart short‑term weakness toward lower support levels.

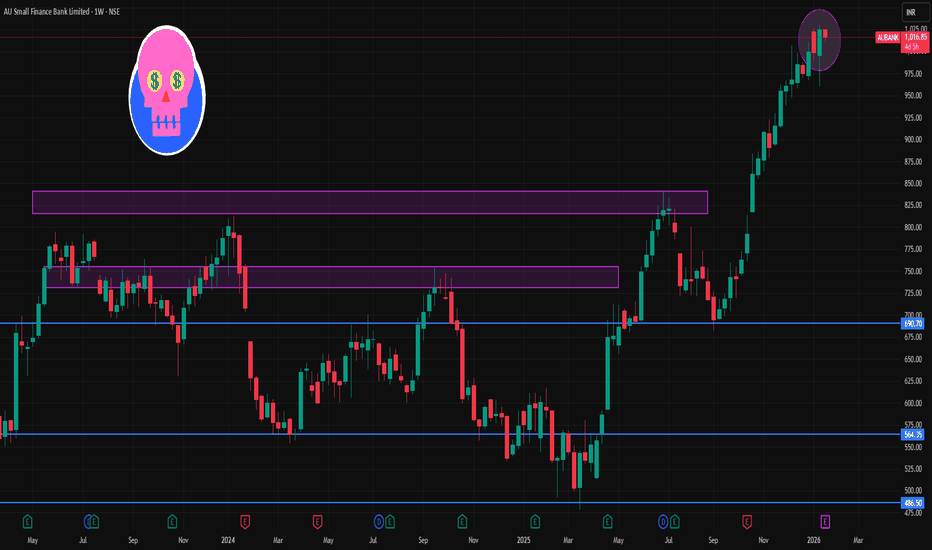

AUBANK 1 Week Time Frame 📌 1‑Week (Current) Key Levels

📍 Current Price Context

The stock has been trading around ₹1,020–₹1,030 area recently on NSE technical feeds.

🧱 Resistance Levels (Upside Targets)

1. Immediate Resistance (R1): ~₹1,050.35 – first barrier on the upside.

2. Major Resistance (R2): ~₹1,075.30 – next meaningful supply zone.

3. Higher Resistance (R3): ~₹1,120.65 – extended bullish breakout territory.

🛡️ Support Levels (Downside Defenses)

1. Immediate Support (S1): ~₹980.05 – crucial for weekly structure.

2. Major Support (S2): ~₹934.70 – deeper correction zone if S1 breaks.

3. Lower Support (S3): ~₹909.75 – extended bearish support for the week.

📊 Weekly Trading Range Projection

Bearish range: ~₹909–₹980

Bullish range: ~₹1,050–₹1,120 +

Price needs to hold above ₹980 weekly close to maintain bullish bias for the week.

📈 Trend & Indicators (Weekly)

Moving averages and oscillators on short‑term charts show neutral to mildly bullish momentum around ₹1,020–₹1,030.

EMA & SMA structures on daily charts support trend continuation if above key moving averages.

🔎 How to Use These Levels This Week

📌 Bullish setup:

Break and sustain above ~₹1,050 → potential run to ~₹1,075 → ₹1,120.

📌 Bearish setup:

Close below ~₹980 support → target ~₹935 → ₹910 on a deeper correction.

📌 Neutral / Swing range:

Between ₹980 and ₹1,050 → sideways action and range trades.

JSWSTEEL 1 Day Time Frame 📌 Daily Pivot Reference

Pivot (Daily): ~ ₹1,184 – ₹1,185 (central reference point)

📈 Resistance Levels (Upside)

1. R1: ~₹1,199 – ₹1,200 (first resistance)

2. R2: ~₹1,216 – ₹1,217 (second resistance)

3. R3: ~₹1,230 – ₹1,231 (third resistance / extended resistance)

📉 Support Levels (Downside)

1. S1: ~₹1,167 – ₹1,168 (first support)

2. S2: ~₹1,153 – ₹1,155 (second support)

3. S3: ~₹1,135 – ₹1,136 (third support)

📊 How to interpret on a 1D chart

A break above ₹1,200–₹1,216 with strong volume may open room for testing ₹1,230+ short-term.

On the downside, a slip below ₹1,167 could accelerate to ₹1,153 and then ₹1,135.

The pivot around ₹1,184–₹1,185 acts as a baseline: closes above suggest bullish bias intraday; closes below suggest bearish bias.

TATACAP 1 Hour Time Frame 📊 Current Price (approx, delayed)

₹355 – ₹358 range today (intraday high ~361.65 & low ~354.00).

📈 Intraday / 1‑Hour Key Levels (Indicative)

🧠 Pivot & Resistance Levels

These are useful for short term/1‑hour chart bias:

Level Price (₹ approx) Role

R3 368.4 Extended upside resistance

R2 363.2 Secondary resistance

R1 359.0 – 359.1 First resistance zone — breakout confirmation above boosts

bullish bias

Pivot (PP) 353.8 – 354.0 Central pivot — above = bullish, below = bearish

Source: ICICI Direct / Kotak Securities pivot data

📉 Support Levels

Level Price (₹ approx) Role

S1 349.7 Immediate support

S2 344.5 Next downside support

S3 340.3 – 340.4 Deeper support zone

Source: ICICI Direct / Kotak pivot data

📌 How To Use These Levels (1‑Hour Context)

Bullish Scenario

Above Pivot (~354) → bulls in control.

Break above R1 (~359) → stronger upside probability toward R2 (363) and R3 (368).

Bearish Scenario

Below Pivot (~354) → bias turns neutral → bearish if it closes below S1 (~349.7).

A close below S2 (~344) opens swing toward S3 (~340).

Intraday Strategy Tips

In fast moves, use R1/S1 on the 1‑hour chart as your initial entry/exit reference.

Confirm move with volume + RSI/MACD (positive signals add confidence).

SOLARINDS 1 Day Time Frame 📊 Live Price Snapshot (approx)

Current NSE price: ~₹13,190 – ₹12,875 range (end of last session)

📈 Daily Pivot & Key Levels (1-Day Timeframe)

These come from recent pivot point calculations and live technical feeds:

Resistance Levels (Upside)

R1: ~₹13,577

R2: ~₹13,963

R3: ~₹14,214

(Potential upside barriers / targets)

Pivot Point

Pivot (Daily Reference): ~₹13,300 zone (approx midpoint)

Support Levels (Downside)

S1: ~₹12,940

S2: ~₹12,689

S3: ~₹12,303

(Zones where buying interest often emerges intraday)

🔍 Short-Term Bias & Indicators

Technical indicator signals today (1D):

RSI: Neutral/around mid-range → neither overbought nor oversold.

MACD: Bullish crossover on short timeframe.

Moving Averages (short & mid DMA/EMA): Mixed (some short EMAs bullish, some bearish), signaling consolidation bias around current price.

🕒 Summary for Today (1D)

Neutral to slightly bullish near current levels with balanced indicator setup

Key levels to watch:

Upside: 13,577 → 13,963 → 14,214

Downside: 12,940 → 12,689 → 12,303

Immediate pivot bias around ₹13,300 will determine intraday direction.

VEDL 1 Moth Time Frame 📌 Latest Market Context

• The stock is trading near multi‑month and all‑time highs (around ₹670+ on NSE) on strong momentum and positive sentiment after broker upgrades and structural catalysts.

• RSI readings suggest strong upside momentum but near overbought in some sources.

📈 1‑Month Timeframe Key Levels

(These combine pivot, swing support/resistance & recent price action ranges)

Resistance (Upside Targets)

₹656–₹660 — Upper daily pivot resistance zone.

₹650–₹656 — R2–R3 levels from technical pivot indicators.

Above ₹670–₹680 — Near current multi‑week highs / psychological zone (strong breakout if sustained).

Support (Downside Floors)

₹630–₹635 — Immediate pivot support (~S1) & short‑term cushion.

₹622–₹625 — Secondary demand zone near moving average clusters.

₹616–₹620 — Deeper swing support if short correction unfolds.

📊 What These Levels Mean

✅ Holding Above ₹630–₹635

Maintains bullish momentum in the 1‑month view.

Prospects for retesting ₹650+ and potentially ₹670–₹680 if buying continues.

⚠️ Break Below ₹620

Could open a pullback toward ₹616 and lower pivot zones before buyers re‑emerge.

A close below ~₹616 on monthly/daily charts may signal short‑term loss of structure.

📍 How to Use These Levels

Bullish Trade Setup (1M swing)

Buy or add near support ₹630–₹620 with stops slightly below ₹616

Targets: ₹650 → ₹670+

Neutral/Profit‑Taking Zone

₹650–₹670+ is the next potential resistance breakeven/exit zone

Bearish/Defensive

If price decisively closes below ₹620–₹616, reduce risk exposure and watch for support at lower levels.