Big Move Coming? Watch This Classic VCP Setup on Shriram FinanceHello everyone, i hope you all will be doing good in your trading and your life as well. Today i have brought a setup which name is VCP (Volatility Contraction Pattern) is one of the most powerful base setups, where the price contracts in multiple tight ranges, showing controlled strength. It signals that supply is drying up and the stock is getting ready for a strong move, usually a breakout. What makes it special is the combination of tightening price with lowering volume , and that's exactly what we can observe in Shriram Finance right now.

The stock has taken multiple supports from key EMAs like 9, 21, and 50 during this entire consolidation, a classic VCP sign. With each dip being bought quickly and bounce getting tighter, the stock is preparing for a potential breakout move.

Keep this one on radar , structure is clean, volume behavior is ideal, and if momentum comes, VCP patterns don’t disappoint.

For levels and risk-reward, please refer the chart above.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

Chartanalysis

MAHLIFEMAHLIFE looks good.

Small pullback for the Entry will be good. Keep eyes on it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

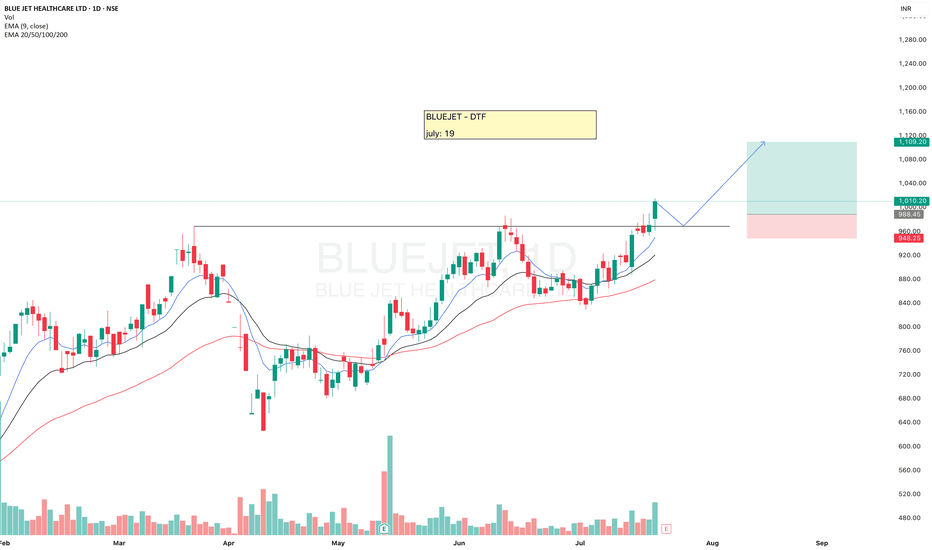

BLUEJETBLUEJET looks strong.

It gave breakout, a small pullback will be good for the Entry as it is bit far away from 20ema, once it touches the 20ema then we may expect a good upside move.

Keep eyes on it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

PVRINOXPVRINOX is looking good.

Making VCP pattern, equal highs and HL formation and good volume. Keep eyes on it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

HDFC Asset Management Company Ltd - Long Setup, Move is ON...#HDFCAMC trading above Resistance of 3844

Next Resistance is at 5237

Support is at 2982

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

ELECONELECON seems to be ready to give an upside move.

Good volume may push it, above 20ema.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Gold Trading Strategy XAUUSD July 18, 2025

Yesterday's trading session, after a strong correction to the 3310 area, the gold price increased sharply again.

Basic news: FED Governor Christopher Waller supports a 25 basis point interest rate cut later this month. The number of weekly unemployment claims in the US fell to 221,000, lower than the forecast of 233,000 and the previous period's level of 228,000; data shows that the US labor market remains stable, strengthening the economic growth outlook.

Technical analysis: The M30 and H1 time frames have not clearly shown the trend of the gold price, when the tug-of-war between buying and selling is quite large. However, in the H4 and D1 frames, there are signs that the gold price will increase again. If the gold price continues to trade in the 3290 - 3300 area, it shows a new multi-frame compression process. This area is very important as it can be a trading point that brings us great profits.

Important price zones today: 3318 - 3323, 3287 - 3292 and 3352 - 3357.

Today's trading trend: BUY (hold).

Recommended orders:

Plan 1: BUY XAUUSD zone 3318 - 3320

SL 3315

TP 3323 - 3233 - 3343 - 3353.

Plan 2: BUY XAUUSD zone 3288 - 3290

SL 3285

TP 3293 - 3303 - 3320 - 3340 - Open.

Plan 3: SELL XAUUSD zone 3353 - 3355

SL 3358

TP 3350 - 3340 - 3330 - 3310.

Wish you a lucky, safe and profitable weekend trading day.🌟🌟🌟🌟🌟

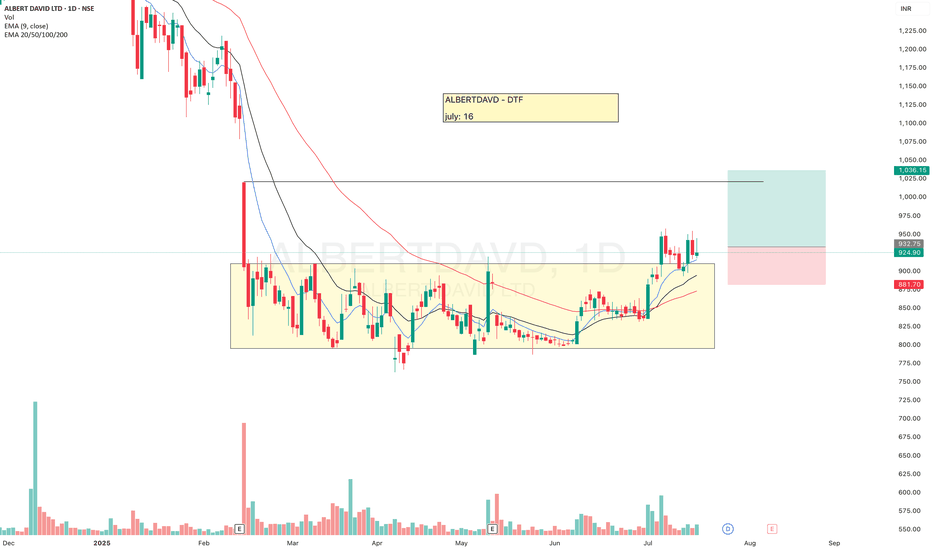

ALBERTDAVDAfter a long consolidation ALBERTDAVD has given breakout, now we may expect a good move from here.

Keep eyes on it.

✅ If you like my analysis, please follow me here as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

AARTIDRUGSAARTIDRUGS is crossing the resistance, moving above 9-20EMAs.

Now there is probability of an upside move, keep watching.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

NATCOPHARMANATCOPHARMA gave BO of long time resistance, looking in a good position.

Now there is probability of an upside move.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

ASTRALASTRAL looks good, has been taking support near 1470 level - above 50ema, and today formed a Hammer candle. Now there is probability of it going up.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

NETWEBNETWEB looks good, it already gave BO then re-tested it, now seems to be getting ready for another move.

Volume + Strong green candle, now need some retracement for entry.

Keep eyes on this.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

SUPREME INDUSTRIESSUPREME INDUSTRIES seems to be ready.

Making HH-HL formation, breakout from here may give a good upside move.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

METROPOLIS – Big Volume Breakout + Price Action + Momentum___________________________________________________________________________

📈 METROPOLIS – Big Volume Breakout | Strong Momentum Building |

Price Action | Volume Structure

🕒 Chart Type: Daily Chart

📆 Date: July 9, 2025

___________________________________________________________________________

Price Action: METROPOLIS HEALTHCARE LTD has delivered a strong breakout on the daily chart, moving out of a multi-week consolidation zone between 1880–1910 with a wide-range bullish candle on July 9. This breakout above the key resistance of 2110.9 comes with a clean structure, strong closing, and sharp momentum — now placing the stock near its 52-week high. The accumulation phase is likely over, and this price action suggests the beginning of a new trend. As a key player in the diagnostics sector, METROPOLIS is gaining renewed attention post-COVID, with the healthcare space showing strong tailwinds and fresh investor interest.

___________________________________________________________________________

Chart Pattern: The chart is showing a Flat Base Breakout following a multi-week consolidation, indicating the potential beginning of a new momentum leg within the broader structure. Notably, the base was tight and shallow, which is considered a strong bullish signal as it reflects controlled accumulation and limited profit-booking. This clean breakout hints at renewed strength and the possibility of sustained upside if volume and structure hold.

___________________________________________________________________________

Candlestick Pattern: NA

___________________________________________________________________________

Volume Analysis: The volume analysis strongly supports the breakout, with trading volume on the breakout day soaring to over 5 times the average of the past 20 sessions. This surge was not just in quantity but also in delivery volume, signaling that the move was backed by genuine long-term accumulation rather than intraday speculation. As the classic saying goes, “volume precedes price” — and this sharp spike clearly points to smart money entering the stock, lending credibility to the breakout and hinting at further upside potential.

___________________________________________________________________________

Technical Indicators: The technical indicators paint a strongly bullish picture. The RSI on the daily timeframe is at 84, which, while overbought, reflects strength and momentum rather than exhaustion. The MACD has triggered a bullish crossover, with a steadily rising histogram indicating a healthy momentum buildup. Both CCI and Stochastic oscillators are deep in bullish territory — CCI above 300 and Stochastic over 88 — highlighting the intensity of the current uptrend. Additionally, the price has expanded beyond the upper Bollinger Band, suggesting the start of a volatility expansion phase, which often accompanies strong directional moves.

___________________________________________________________________________

Support & Resistance: The stock has given a decisive breakout above ₹2110.9, which now acts as a strong reference point and the official top of its recent consolidation range. This level was pierced by a bullish candle backed by high volume, confirming strength and conviction in the move. Ahead, the stock faces its first hurdle at ₹2157, a short-term resistance just above the breakout zone where minor profit-booking may emerge. Beyond that, ₹2256.1 marks a key medium-term resistance aligned with a previous swing high — a level to watch closely if the rally continues on solid volume. For positional traders, ₹2401.3 stands as a distant resistance zone that, while weak, could be relevant if momentum accelerates. On the downside, ₹1912.7 offers immediate support, being the level that held firm during base formation. If deeper retracements occur, ₹1767.5 and ₹1668.4 are layered supports where the price previously showed strength. At the very base lies ₹1315, the major long-term demand zone — a structural support that triggered the prior trend and serves as the final defence in case of any broad weakness.

___________________________________________________________________________

What’s Catching Our Eye: The price has decisively broken above a multi-week resistance zone, and what makes this move stand out is the massive volume backing it. This isn't just a random spike — it's a structured breakout with all the internals lining up beautifully. Momentum indicators like RSI, MACD, CCI, and Stochastic are all in bullish alignment, confirming that the strength is real and not a one-off event. This kind of confluence often signals the start of a meaningful trend, not just a short-lived rally.

___________________________________________________________________________

What We’re Watching For: The key question now is whether the price can sustain above ₹2110.9, the breakout level, without slipping back into the previous range — a crucial sign of breakout validation. We're also keeping an eye out for a healthy pullback toward the ₹1880–₹1910 zone, which could offer a far better risk-reward entry if the uptrend remains intact. Most importantly, the bigger picture is in focus: Is this the beginning of a larger trend aiming for ₹2400+, or are we simply witnessing a short-term momentum burst? The next few sessions will be critical in answering that.

___________________________________________________________________________

Best Buy Level for Equity (Low Risk Idea): A low-risk buying opportunity opens above ₹2110.9, but only if the price sustains this breakout for a day or two — confirming strength and avoiding a false breakout scenario. Alternatively, a pullback to the ₹1880–₹1910 zone could offer an excellent risk-reward setup, especially if accompanied by a clear bullish reversal signal (like a strong candle or volume spike). In both cases, keep a strict stop loss at ₹1839 on a closing basis to protect against deeper downside.

___________________________________________________________________________

Sector Tailwinds: The diagnostic sector continues to build long-term strength in the post-COVID landscape, as healthcare awareness and preventive testing become mainstream. Investors are increasingly allocating capital toward healthcare services, recognizing their structural growth potential. Add to that the rising urban demand for quality diagnostics and the company's strong brand trust, and you get a solid layer of fundamental support fueling this rally — making the technical breakout even more meaningful.

___________________________________________________________________________

Risk to Watch: If the price fails to hold above ₹2110 and starts slipping below ₹1910, there’s a real risk of this breakout turning into a false move. While the current momentum is strong, indicators are overheated, which increases the chances of a short-term pullback or shakeout. Most importantly — no confirmation means no trade. Avoid chasing blindly; let the price action validate the move before committing capital.

___________________________________________________________________________

What to Expect Next: The stock may see a sideways move or a minor pullback toward the ₹1910 zone as it digests the breakout. However, if the price holds above the breakout level, we could see a continuation move toward ₹2157–₹2256 in the near term. The key to watch is volume — if the stock holds near highs with rising volume over the next 2–3 sessions, it could trigger a strong trending move, confirming that smart money is firmly in control.

___________________________________________________________________________

How to Trade METROPOLIS (For Educational Use Only):

Here’s a simple Breakout Trade Plan based on current structure and volume confirmation:

🔹 Entry: Above ₹2110.9 — either on a successful retest of the breakout level or a clean follow-through candle with strength

🔹 Stop Loss: ₹1839 (on closing basis) to protect capital in case of breakdown

🔹 Risk-Reward: Aim for 1:1 initially, then trail for 1:2+ if momentum holds

🔹 Position Sizing: Adjust based on your capital, risk appetite, and SL range — avoid going all-in; stay disciplined with allocation

📌 Always follow your trading plan. This setup is for educational and analysis purposes only.

___________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

___________________________________________________________________________

💬 Found this helpful?

What would be your ideal entry in this METROPOLIS setup — breakout follow-through or demand zone pullback?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this with your trading community

✅ Follow STWP for clean technical setups backed by price action and volume

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

___________________________________________________________________________

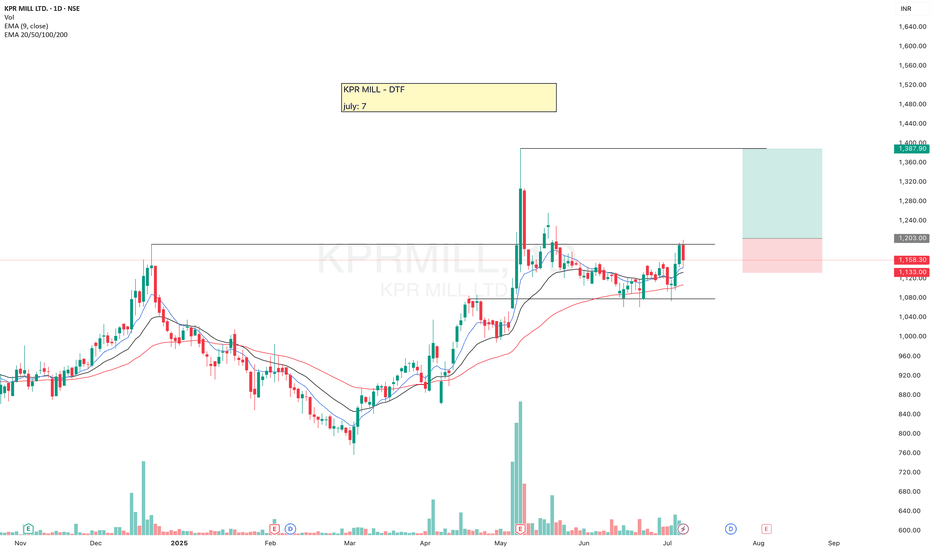

KPRMILL - KPRMILL looks good, trying to break the resistance, moving above 20-50ema.

A breakout from here may give a good upside move.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Gabriel India Limited - Breakout Setup, Move is ON..#GABRIEL trading above Resistance of 518

Next Resistance is at 673

Support is at 415

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Technical Analysis: MERICO LTDTrend and Structure:

The chart shows a strong uptrend leading up to a recent pullback.

After the pullback, price is consolidating between a support zone (~708 INR) and a resistance zone (~720 INR).

There is a clear weekly support level marked around 690-695 INR below the support zone.

Volume is moderate but showing no large spikes, indicating potential consolidation.

Support and Resistance:

Immediate resistance zone is around 718-721 INR, acting as short-term overhead supply.

The support zone is roughly between 707-710 INR, serving as a base for potential bounce.

The weekly level below (roughly 690-695 INR) may act as a strong support if price breaks current support.

Price Projections:

The drawn projection suggests a short-term dip toward the support zone, followed by a strong bounce above the resistance.

This implies a possible bullish continuation after a minor correction or consolidation.

Volume:

Volume during consolidation is relatively steady.

Watch for volume pickup on a breakout above resistance for confirmation.

Trading plan:

Entry:

Consider entering a long position near or just above the support zone (~708-710 INR) when there is confirmation of buying interest (e.g., bullish reversal candlestick or volume spike).

Alternatively, a breakout entry can be taken above the resistance zone (~720-722 INR) with volume confirmation.

Stop Loss:

Place a stop loss below the support zone or slightly below the weekly level, around 700-705 INR to protect against downside risk.

Targets:

Initial target near the resistance breakout level (~720-725 INR).

Secondary target around 745-750 INR based on the upward arrow projection, representing the next resistance area.

Risk-Reward:

Risk: Approximately 8-10 INR per share.

Reward: Potential gain of 35-40 INR per share.

Favorable risk-reward ratio around 3:1 or better.

Additional Notes:

If the price falls below the support zone and weekly level with strong volume, consider exiting or avoiding long positions.

Look for confirmation signals before entry to reduce false breakouts or breakdowns.

Summary:

Table

Parameter Details

Entry Price ~708-710 INR (on support)

Stop Loss ~700-705 INR

Target 1 ~720-725 INR

Target 2 ~745-750 INR

Trend Pullback in uptrend

Risk-Reward Ratio ~3:1 or better

APLLTDAPLLTD is getting ready, moving above 20-50ema, probability of an upside move.

Keep eyes on it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

SANDUMA - (SANDUR MANG & IRON ORES)SANDUMA – After facing strong resistance at the current level for a while, the stock tapped into a demand zone in Feb 2025 and began moving up, forming a consistent Higher Highs - Higher Lows (HH-HL) structure.

It gave a breakout in May, followed by a successful retest of the breakout zone. Currently, it's trading above the 20-50 EMA, indicating strength.

The price action now suggests it's getting ready, there is probability of an upside move.

Keep following.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

DATAPATTNS

DATA PATTERNS has been making HH-HL formation. Recently broke an old resistance, moved up, re-tested and started moving up again.

Keep following it, there is probability of an upside move.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Ambuja Cement Chart Analysis with Confirm Targets 2025 Cement Industry: A Strong Pillar of India’s Growing Economy

India remains the world’s second-largest cement producer as of 2025, and the pace of its growth continues to accelerate.

The demand for cement has surged due to infrastructure development projects such as housing construction, road expansion, railways, metro projects, and Smart Cities initiatives.

To boost infrastructure development, the Indian government has announced an interest-free assistance package of approximately ₹1.5 lakh crore.

Schemes like "Housing for All" and rural-urban housing programs have intensified construction activities across the country.

In this dynamic environment, the cement sector is receiving solid support and is expected to grow significantly in the coming years.

Ambuja Cement Company Profile

Ambuja Cements is one of India’s leading cement companies, established in 1983. It is now a part of the **Adani Group, a diversified and rapidly expanding conglomerate. The company primarily manufactures and sells grey cement and ready-mix concrete (RMC).

As the Smart City Mission, metro rail networks, expressways, flyovers, and industrial corridors progress rapidly, cement consumption continues to rise. Several large-scale cement road and railway infrastructure projects are underway across the country, expected to sustain the sector’s momentum over the next few years.

Ambuja Cement Technical Analysis

Major Resistance Zone: ₹590 – ₹700

₹590 acts as a strong resistance level, where the stock has previously faced multiple rejections.

A weekly candle closing above ₹590 would signal a strong bullish breakout.

Once this level is breached convincingly, the stock may **quickly move towards ₹700, testing its previous all-time high.

Trading Plan:

1.If the stock gives a weekly close above ₹590, it could be a buy signal.

2. The next potential target would be ₹700** based on the breakout confirmation.

Strong Demand Zone: ₹450 – ₹460

Significance of this zone:

1.The range of ₹450–₹460 has consistently shown bounce-back behavior, indicating strong buying interest.

2.Swing traders and investors** can consider accumulating when the stock nears this zone, as historical data shows this level has acted as **strong support**.

Stop-loss Strategy:

If any **weekly candle closes below ₹445, it could indicate a breakdown of support, and exiting the position would be advisable.

Support Zone Trading Plan

If the stock drops to ₹450–₹460 and **buying volume** increases, it could present a good buying opportunity.

Short-Term Potential Targets

First Target: ₹578

Second Target: ₹640

Manoj Strengthen Support – ₹413.50

The level of ₹413.50 is recognized on the chart as a strong psychological and emotional support, named “Manoj Strengthen Support.”

Why is this level important?

1. In case of a sudden market correction due to war, global recession, or political instability, this level may act as a temporary strong support.

2. It may prevent further decline and hold price levels in such events.

Investor Tip:

1. If the stock declines but this level holds, it becomes a **critical risk-management zone**.

2. Investors can look for potential **bounce-back** opportunities and strengthen their conviction around this level.

Ambuja Cement Long-Term Targets (2025–2028)

The long-term structure of Ambuja Cement appears bullish, and based on technical charts, the following major targets have been identified:

First Target: ₹700

Expected during 2025–26 if the stock gives a strong closing confirmation above ₹590.

Second Target: ₹840

If the stock decisively breaks above ₹700 (its all-time high), this target could be achievable in 2026.

Third Target: ₹1040

In the long term, if the stock sustains above ₹840, a move towards ₹1040 is likely by 2027–2028.

This analysis is based on technical breakouts, price action, and support-resistance principles, and can serve as a strategic guideline for long-term investors.

VOLTAMPVOLTAMP may give a good upside move if it gives breakout.

It's been making HH-HL formation, broke resistance and re-tested it, now seems ready.

Keep following it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

HINDCOPPER | Supply-Demand Flip & Structure This chart shows a clean structural shift on the weekly timeframe for Hindustan Copper Ltd (NSE: HINDCOPPER):

🔷 Blue Zone: A key Supply-to-Demand Flip area. Price reacted strongly from this zone after multiple touches, showing its relevance.

📉 CT Line (Compression Trendline): Price was getting compressed under this trendline. It's now visibly breached.

➡️ Arrow Zone: Highlights a smaller supply-demand zone, formed after consolidation and breakout. Marked for structural clarity.

Volume also shows higher activity during this move, indicating strength behind the recent price action.