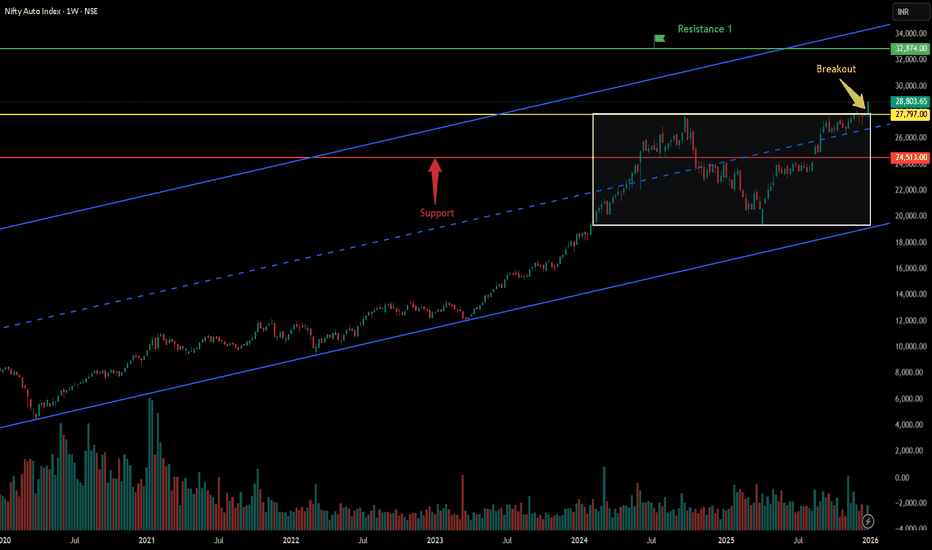

Breakout in Nifty Auto...Chart is self explanatory. Levels of breakout, possible up-moves (where index may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Chartanalysis

Breakout in CSB Bank Ltd...Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Force Motors Ltd - Breakout Setup, Move is ON...#FORCEMOT trading above Resistance of 21123

Next Resistance is at 30646

Support is at 14435

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Laurus Labs Limited - Breakout Setup, Move is ON...#LAURUSLABS trading above Resistance of 1091

Next Resistance is at 1512

Support is at 806

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

ITC 1 Day Time Frame 📌 Current Price (Live / Most Recent)

Approx. ₹350.05 (recent trade / live quote from latest session; price has been under pressure recently due to tax impact sell-offs)

📈 Daily Price Action (1D)

Recent Day’s Range:

Day Low: ~₹345.25

Day High: ~₹360.00

Daily trading has been volatile and downward-biased.

52-Week Range:

Low: ~₹345.25

High: ~₹471.50

(This helps frame where current price sits relative to yearly extremes.)

📍 What This Means for Trading (1-Day Frame)

Bullish scenario:

A sustained close above ₹403–₹406 may unlock upside toward ₹410+.

Bearish scenario:

Failure to hold ₹345–₹350 could expose deeper supports around ₹375–₹385 or lower.

CGPOWER 1 Day Time Frame📊 Daily Price Levels (1D Time Frame)

Current price range (recent session)

• Day’s trading range ~ ₹634–₹651 approx on NSE (latest close ~ ₹637–₹647) (as per recent data)

Pivot / Pivot‑based levels

• Daily Pivot: ~ ₹662 (central reference)

(use this as a neutral baseline — above favors bullish bias, below favors bearish bias)

Immediate Resistance

1️⃣ R1 ~ ₹665–₹668 (zone of immediate selling pressure)

2️⃣ R2 ~ ₹675–₹680 (next upside barrier)

3️⃣ Higher resistance (secondary) ~ ₹685–₹695+ (seen in other pivot data)

Immediate Support

1️⃣ S1 ~ ₹656–₹650 (first support zone)

2️⃣ S2 ~ ₹644–₹640 (next downside support)

3️⃣ S3 ~ ₹627–₹630 (deeper support)

📌 Interpretation (1‑Day)

If price holds above ₹656–₹650, the bias may stabilize and test ₹665–₹675 on the upside.

Break below ₹640–₹630 increases risk of further weakness in the short run.

Daily pivot at ~₹662 helps gauge short‑term trend — sustaining above it hints at short‑term buying interest, below it suggests continued pressure.

(These levels are typical pivot/sr zones used by traders; use live charts for exact current quotes.)

🧠 Extra Context (Technical Indicators)

Short‑term technical indicators (RSI & moving averages) have shown mixed to bearish signals recently, with several daily sell signals noted in external analysis.

IndusInd Bank Ltd || 1 Day || Cup and handle IndusInd Bank Ltd — Detailed Analysis

Company Intro:

IndusInd Bank Ltd is one of India’s leading private sector banks offering retail, corporate, and digital banking services across the country. The bank has a strong footprint in consumer credit, deposits, and transaction banking, catering to millions of customers across urban and semi-urban regions.

Technical Perspective — Cup & Handle Breakout

The daily chart shows a classic Cup & Handle pattern, a bullish continuation setup formed over several months.Price has decisively broken above the key breakout level ~₹890, validating the pattern’s breakout.This breakout suggests a shift from consolidation to an upward trend re-acceleration.

Sustained trading above ₹890 keeps the structure bullish in the short to medium term.

📍 Resistance Levels (Upside):

• ₹930 — immediate minor resistance

• ₹1,030 — major resistance zone above

📍 Support Levels (Downside):

• ₹830 — key support if price retraces below ( Bearish)

• ₹710 — structural support

Trend Bias:

• Bullish above ₹890

• Neutral to Bearish below ₹830 / ₹710

Latest Update

Some macro/sector views indicate a softer Q3 earnings outlook relative to peers.

Source _Business Today

Broader corporate news includes regulatory probes related to past accounting discrepancies which the company is cooperating with.

Source _The Economic Times

👉 If you need analysis on any company or stock, comment below.

This analysis is for educational purposes only and should not be considered as investment advice. The author is not responsible for any losses arising from the use of this information. Investors are advised to consult a SEBI-registered investment advisor before taking any trading or investment decisions.

GOLD/SILVER RatioChart is self explanatory. The price of the TVC:GOLD/TVC:SILVER ratio (XAU/XAG) as of January 1, 2026, is approximately 60.71. This indicates that one ounce of gold is worth roughly 60.71 ounces of silver. Over the past year, the ratio has seen a significant change, trading within a 52-week range of 54.19 to 107.27.

Recent trends

* Market Sentiment and Economic Conditions: When economic uncertainty is high, investors typically flock to gold as a safe-haven asset, which widens the ratio (increases the number).

* Industrial Demand for Silver: Silver has significant industrial applications (electronics, solar panels), so its price often correlates with economic growth and industrial demand, which can narrow the ratio.

* Relative Volatility: Silver is generally more volatile than gold ("high-beta" version of gold); in a bull market for precious metals, silver prices tend to rise faster, lowering the ratio, while in a bear market, gold prices tend to hold up better, increasing the ratio.

Key Insights

* Ratio Fluctuation: The gold-silver ratio is highly volatile. Historically, the all-time high was 125:1 in April 2020.

* Recent Volatility: Both gold and silver have experienced significant price movements in 2025, driven by factors such as interest rate expectations, geopolitical tensions, and industrial demand for silver.

* Price Influences: Domestic gold and silver prices in India are influenced by international market trends, currency exchange rates, local demand, taxes, and import duties.

Gold-Silver Ratio and Future Price Predictions

The gold-silver ratio (calculated by dividing the gold price by the silver price) indicates which metal may be undervalued or overvalued compared to the other and helps anticipate potential out performance.

* High Ratio (e.g., above 80:1 or 90:1): Historically suggests that silver is undervalued relative to gold. This often signals a potential buying opportunity for silver, with expectations that silver's price may rise faster than gold's, causing the ratio to decrease (revert to its mean). A high ratio can also indicate economic uncertainty or a flight to gold's safe-haven appeal.

* Low Ratio (e.g., below 50:1 or 60:1): Historically suggests that silver is overvalued relative to gold. This may signal a potential buying opportunity for gold, with expectations that gold may outperform silver, causing the ratio to increase. A low ratio often coincides with periods of economic optimism and stronger industrial demand for silver.

Current Market Insights

As of late December 2025/early January 2026, the gold-silver ratio has recently fluctuated, with reports placing it around 60.53 to 64:1, down from highs earlier in 2025 that exceeded 100:1. The sharp drop in the ratio during 2025 signaled a strong out performance by silver.

* Silver Out performance Expected: Many analysts believe silver is still cheap relative to its long-term historical average ratio (around 40-60:1 or 60-80:1) and could continue to outperform gold.

* Key Drivers: Silver's strong industrial demand (especially in solar panels and electronics), coupled with persistent supply deficits, provides fundamental support for its price to potentially reach higher levels like $85-$100 per ounce in the medium to long term.

* Volatility and Risk: Silver is generally more volatile than gold, which means it has the potential for higher percentage gains but also larger pullbacks. Investors use the ratio as one of several tools to balance their portfolios, rather than relying on it as a sole predictor.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Chart Patterns (Macro Structure + Psychology + Trading)Chart patterns arise over larger timeframes from the interaction of supply and demand. They help identify continuation or reversal of trends.

⭐ Advantages of Chart Patterns

Helps predict market direction – Shows whether price may continue or reverse.

Easy to understand visually – Patterns are simple shapes (triangles, flags, head & shoulders).

Gives clear entry and exit points – Breakouts and breakdowns guide trading decisions.

Works on all timeframes – Useful for intraday, swing, and long-term trading.

Useful for trend analysis – Helps identify strong or weak trends.

Improves accuracy when combined with volume – Volume confirms true breakouts.

UPL 1 Week Time Frame 📌 Current Price Snapshot

Approx Current Price (NSE): ₹770–₹780 range (varies slightly by source and time) — ~₹774 area recently quoted.

52‑week High: ~₹786.30

52‑week High: ~₹786.30

📊 Weekly Support & Resistance (Accurate Levels)

🔥 Key Weekly Pivot (Bias Level)

Weekly Pivot: ~₹770.8–₹773.8 — central reference zone for weekly trend.

Above = bullish bias

Below = bearish/weak bias

🟢 Support Levels (Weekly Frame)

1️⃣ Immediate Support: ~₹769–₹770

2️⃣ Next Support: ~₹764–₹765

3️⃣ Lower Support: ~₹758–₹760

4️⃣ Stronger Lower Zone: ~₹736–₹721 (secondary structurals)

🔴 Resistance Levels (Weekly Frame)

1️⃣ Immediate Resistance: ~₹779–₹780

2️⃣ Next Zone: ~₹785–₹790

3️⃣ Higher Weekly Resistances: ~₹805–₹824+ (if breakout happens)

🧩 Summary Table — Weekly Levels

Level Category Approx Level (₹)

Weekly Pivot 770–774

Support 1 769–770

Support 2 764–765

Support 3 758–760

Resistance 1 779–780

Resistance 2 785–790

Higher Resistance ~805–~824

Note: These reflect technical pivot & Fibonacci zones on the weekly frame.

📌 How to Use These Levels

✅ Above Pivot (~771–774) → Weekly bias tends bullish.

✅ Sustain above ~780–785 → Breakout zone — next leg could aim towards ~800+.

✅ Break below ~764 → Weakness may extend toward lower supports.

JSL 1 Day Time Frame 🔑 Daily Levels (1‑Day Time Frame)

Level Price (₹) Description

R3 ~₹820 Major resistance zone

R2 ~₹812 Secondary resistance

R1 ~₹805 Immediate resistance (near recent highs)

Pivot Point (PP) ~₹796‑₹797 Daily pivot reference

S1 ~₹786 First support zone

S2 ~₹780 Second support (near recent lows)

S3 ~₹773‑₹774 Strong downside support

🔎 Additional short‑term support/resistance context:

• Short‑term support around ₹772 and resistance near ~₹813 on daily charts/intraday pivot models.

📌 How To Use These Levels Today (1‑Day Strategy)

Bullish continuation

✔ Above ₹805–₹810 — next upside target towards ₹812–₹820.

✔ Break and hold above ₹820 signals strong bullish momentum.

Range / Neutral zone

↔ Between ₹786 – ₹805 — likely range‑bound unless heavy volumes break one side.

Bearish scenario

✘ Below ₹780 — opening further downside toward ₹773‑₹770 levels.

📈 Technical Sentiment Snapshot (Daily)

• Some daily indicators lean bullish (strong buy signals on technicals as per some platforms) but momentum oscillators like RSI/MACD show mixed short‑term signals.

[INTRADAY] #BANKNIFTY PE & CE Levels(30/12/2025)A flat opening is expected in Bank Nifty, with the index trading near the 59,000 zone, which continues to act as a short-term balance area. Price action over the last few sessions shows sustained selling pressure from higher levels, followed by a mild pullback and sideways movement. This indicates that the market is still in a consolidation-to-weak structure, where buyers are attempting to defend lower supports while sellers remain active near resistance.

On the upside, the 59,050–59,100 zone is the immediate resistance and a crucial trigger for bullish momentum. If Bank Nifty manages to hold above this zone, buying opportunities in buying can be considered, with upside targets at 59,250, 59,350, and 59,450+. A sustained move above this resistance may lead to short covering and a recovery toward higher levels.

On the downside, failure to hold the 58,950–58,900 zone can invite renewed selling pressure. In such a scenario, selling positions may be considered with downside targets at 58,750, 58,650, and 58,550-, where stronger demand is expected to emerge. Until a clear breakout or breakdown occurs, traders should continue to trade range to range, avoid aggressive positions, and strictly follow risk management in this consolidation-driven setup.

INFY 1 Day Tim Frame 📌 Current Live Price Snapshot

Current trading price: ~₹1,644 – ₹1,658 range (approx real‑time)

Today’s High/Low: ~₹1,673 / ₹1,645 (intraday)

52‑Week Range: ₹1,307 – ₹1,982 approx

📊 Daily Pivot Points & Levels (Standard Pivot)

(Source: Pivot analysis data)

Pivot (Daily): ₹1,658.87

Resistance Levels:

R1: ₹1,666.0

R2: ₹1,675.97

R3: ₹1,683.13

Support Levels:

S1: ₹1,648.93

S2: ₹1,641.77

S3: ₹1,631.83

Central Pivot Range (CPR): ~₹1,657–₹1,660

📌 Price above pivot/CPR → bullish bias; below CPR → bearish / consolidation zone.

🔹 Intraday Bias

Bullish above: ₹1,658 – ₹1,666 (break above this zone can attract upside)

Bearish/Weak if below: ₹1,648 – ₹1,642 (break below may open deeper support)

📊 Strategy Notes

✅ Bullish if closes above pivot & R1 (~₹1,666) with volume.

⚠️ Neutral day if it stays between S1 & R1.

❌ Bearish if breaks and sustains below S2/S3 (~₹1,642/₹1,632).

Breakout in Silver (Ag)...Chart is self explanatory. Levels of breakout, possible up-moves (where silver may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

ASIANTILES 1 Day Time Frame 📊 Current Price Context

Asian Granito India is trading around ₹72–73 on the NSE in today’s session.

📈 1‑Day Key Levels (based on recent pivot/technical data)

🔹 Pivot Point (daily reference): ~ ₹73 (central level)

📌 Resistance Levels:

R1: ~ ₹75 – Immediate upside hurdle (recent 52‑week high area)

R2: ~ ₹77 – Secondary resistance if price breaks above R1

R3: ~ ₹79 – Extended resistance zone

📉 Support Levels:

S1: ~ ₹72 – Nearest support below the pivot

S2: ~ ₹70 – Short‑term support zone

S3: ~ ₹68 – Deeper support if market weakens

🛠️ How to Use These Levels

Bullish entry: Above the daily pivot (~₹73) with volume confirmation.

Stop loss: Below ₹70–₹68 if long.

Profit targets: ₹75 → ₹77 → ₹79 on sustained upside.

Chart Patterns CHART PATTERNS

Chart patterns represent big-picture market structures formed over dozens or hundreds of candles. They reveal accumulation, distribution, reversal, and continuation phases.

Patterns are grouped into:

A. Reversal Chart Patterns

B. Continuation Chart Patterns

C. Bilateral / Indecisive Patterns

Chart Patterns

Larger structures for strong trades

Indicate trend continuation or reversal

Higher reliability when combined with candles

Help set clear targets & stop-loss levels

Real Knowledge of Chart Patterns CHART PATTERNS (Market Structure Patterns)

Chart patterns are formed by price movements over a longer period and help traders understand the bigger picture. They indicate whether the trend is likely to continue, reverse, or break out after consolidation. These patterns can be grouped into three major categories:

1. Continuation Patterns

These suggest that the existing trend (uptrend or downtrend) will likely continue after a temporary pause.

2. Reversal Patterns

These indicate a possible change in trend direction.

3. Bilateral Patterns

These can break either up or down, signaling indecision.

Let’s study them in detail.

MCX 1 Day Time Frame 📌 MCX Latest Daily Price Snapshot

Approx. Last Traded Price: ~₹10,172 – ₹10,307 range (recent sessions)

Today’s Intraday Range: ~₹10,181 – ₹10,365 (approx)

52‑Week High: ~₹10,847 and 52‑Week Low ~₹4,408

📊 Daily Time‑Frame Levels (1D)

🔹 Pivot Point

Daily Pivot: ~₹10,386 – ₹10,442 zone (central reference)

🔸 Resistance Levels

R1: ~₹10,519 – ₹10,600

R2: ~₹10,596 – ₹10,650

R3: ~₹10,729 – ₹10,800

These levels act as potential upside barriers on daily closes. A sustained breakout above R1/R2 suggests strength into the next resistance zone.

🔻 Support Levels

S1: ~₹10,309 – ₹10,300

S2: ~₹10,176 – ₹10,170

S3: ~₹10,020 – ₹9,993

If price breaks below S1/S2 on daily close, deeper support may be tested near S3.

📈 Trend & Technical Tone

Technical indicators on daily charts signal a bullish bias / strong buy on daily based on moving averages and buy signals vs. sell signals.

📊 How to Use These Levels (1‑Day)

Bullish View

Long/buy setups near S1‑S2 with targets around R1‑R

A breakout above R2 could extend toward R3

Bearish/Correction View

Failure at R1/R2 with reversal momentum could target S1/S2

JSWENERGY 1 Day Time Frame📌 Live Price (Approx Latest)

Current price: ~ ₹478.2 – ₹478.3 per share (latest close/near real‑time) on the NSE.

Today’s range: Low ~ ₹468.3 | High ~ ₹479.9 (intraday range).

📊 Daily Key Levels (1‑Day Time Frame)

🔹 Pivot (Daily Reference)

Pivot Point: ~ ₹475.5 – central reference for daily trend.

📈 Resistance Levels

R1: ~ ₹482.7

R2: ~ ₹487.1

R3: ~ ₹494.3

(Higher resistances mark potential upside targets if the price moves up today.)

📉 Support Levels

S1: ~ ₹471.1

S2: ~ ₹463.9

S3: ~ ₹459.5

(Below these, risk of deeper pullbacks increases.)

📌 What These Levels Mean Today

✅ Bullish scenario:

A sustained trade above ₹482–₹487 could push toward ₹494+ resistance zones.

❌ Bearish scenario:

A break below ₹471 may open the path to ₹464–₹459 support.

📊 Pivot reference:

Trading above the pivot ~₹475–₹476 suggests positive short‑term bias; below it leans bearish.

PFC 1 Day Time Frame 📊 Daily Pivot Levels

Pivot Point (Daily): ~₹343.00–₹343.30

Central Pivot (CPR):

• Top: ₹343.60

• Mid: ₹343.00

• Bottom: ₹342.40

📈 Resistance Levels (Daily)

R1: ~₹344–₹346

R2: ~₹347–₹348

R3: ~₹350–₹351

📉 Support Levels (Daily)

S1: ~₹338–₹341 (minor support)

S2: ~₹335–₹337

S3: ~₹332–₹334

🔍 Intraday Range to Watch

Near‑term range: ₹337–₹354, with crucial rejection/resume zones at ~₹337 (support) and ~₹352–₹354 (upper resistance).

📌 How to Use These Levels

Bullish breakout: Sustained close above the pivot ~₹343 with volume could target R1 → R2 (~₹347–₹350).

Bearish continuation: Failure below S1 (~₹338–₹341) increases odds of a drop toward S2/S3 (~₹335 / ₹332).

Pivot flips: Pivot pivots often act as support if price stays above, and as resistance if below.

RIL 1 Day Time Frame 📊 Current Price Context (approx):

RIL is trading near ₹1,540 – ₹1,550 intraday range today.

📈 1‑Day Resistance Levels

These are levels where the stock may face selling pressure or pause on the upside:

Intraday Daily Resistances (Pivots & Speed Levels):

R1: ~₹1,549 – ₹1,550

R2: ~₹1,557 – ₹1,557

R3: ~₹1,562 – ₹1,563

(above current price)

Extended intraday pivot R4 (if breakout):

~₹1,570+ (from broader pivot series)

📉 1‑Day Support Levels

Key levels where buyers may step in on dips:

Intraday Daily Supports:

S1: ~₹1,536 – ₹1,537

S2: ~₹1,531 – ₹1,532

S3: ~₹1,523 – ₹1,524

(below current price)

Weekly pivot support band (if selling accelerates):

Around ₹1,531 – ₹1,505+ (broader support zone)

IOC 1 Month Time Frame 📊 Current Context

IOC is trading around the ₹166–₹168 range as of mid‑December 2025.

Over the last month, the stock has seen a slight decline (~‑2.7% to ‑3.6% depending on source).

🟢 Key 1‑Month Support Levels

These are levels where the price may find buying interest if the stock pulls back:

✅ Primary Support: ~₹164–₹162

➡️ Near recent lows and pivot zone where short‑term buyers could step in.

✅ Lower Support: ~₹160–₹158

➡️ Broader support band from slight chart congestion.

⚠️ Deep Support: ~₹138–₹135

➡️ A deeper correction zone identified by longer‑term indicators — likely only relevant if broader markets turn very weak.

🔴 Key 1‑Month Resistance Levels

These are price points that may cap upside near‑term:

🚧 Immediate Resistance: ~₹170–₹171

➡️ Short‑term hurdle around recent highs.

🚧 Next Resistance: ~₹172–₹173

➡️ Slightly stronger resistance if stock breaks above ₹171.

🚧 Higher Resistance: ~₹176–₹177+

➡️ Breakout zone toward the upper end of the near‑term range.

IRFC 1 Day Time Frame 📊 Current Price Context

Recent IRFC price ~ ₹112–₹114 (NSE) as of mid-Dec 2025.

📉 Daily Support & Resistance Levels

🔹 Daily Pivot Levels

These are typical daily pivot points used by traders:

Support

S1 ~ ₹112.6–₹113.0

S2 ~ ₹112.0–₹112.6

S3 ~ ₹111.4–₹112.0

(Support zones where price may find buying interest)

Pivot / Median

Pivot ~ ₹113.5–₹116.6

(If price stays above pivot – short-term bullish bias; below pivot – bearish bias)

Resistance

R1 ~ ₹113.7–₹114.0

R2 ~ ₹115–₹117

R3 ~ ₹118–₹119+

(Levels where selling pressure may emerge)

📌 How to Use These Levels

Bullish scenario (short trades):

Break above ₹116–₹118 may open resistance at ₹120+

Bearish scenario:

A break below ₹112 → ₹111 opens the path toward lower support ~ ₹108–₹110 (near recent swing lows).