SBICARD 1 Month Time Frame 📌 Latest Price Context:

• Stock is trading around the mid ₹750-₹760 zone.

• It has recently tested 52-week lows near ₹725 and remains below key moving averages — a bearish technical structure in the very short term.

📊 1-Month Timeframe Key Levels (Support & Resistance)

🔻 Support Levels (Buy Zones)

S1: ~₹745–₹747 — immediate support zone for dips.

S2: ~₹735–₹738 — stronger support beneath the first fold.

S3: ~₹725–₹729 — major support near 52-week low; breaking below risks extra downside.

➡ A breakdown below ₹725 on monthly closes would be bearish.

📈 Resistance Levels (Targets / Sell Zones)

R1: ~₹762–₹763 — near the pivot/resistance in current 1-month profile.

R2: ~₹769–₹770 — resistance zone at recent short term swing highs.

R3: ~₹778–₹780+ — higher resistance – breakout above helps bullish recovery.

➡ Sustained closes above ~₹770–₹780 can shift short-term bias to neutral/bullish.

🔍 Trading Bias Guidance

📉 Bearish to Neutral if price stays below ₹762–₹770

📈 Bullish structure if breaks and holds above ₹770–₹780

Chartartist

VOLTAS 1 Week Time Frame 💹 Current price range (approx): ₹1,430–₹1,485 (varies across platforms).

📊 Key Levels for Next Week

🔼 Upside / Resistance Levels

These are levels where price might face supply/selling pressure this week:

₹1,480–₹1,500 — near recent peaks and psychological zone

₹1,500–₹1,520 — secondary resistance (historical / pivot region)

🔽 Downside / Support Levels

Important zones where buyers might step in if price dips:

₹1,380–₹1,395 — near short-term support from pivots

₹1,350–₹1,370 — broader support zone where price has bounced recently

₹1,320–₹1,330 — deeper support if weakness continues

📌 Pivot Reference

Some pivot calculations for weekly help gauge trend direction:

Weekly Pivot ~₹1,381

R1 ~₹1,492 / R2 ~₹1,550 / S1 ~₹1,354 / S2 ~₹1,312 (depends on calculation method)

📉 What Technical Indicators Suggest

Short-term price action has shown strength in momentum indicators on intraday and daily (e.g., strong buy signals).

Some weekly indicators show mixed signals (momentum present but not overly strong).

Analyst screens show a variety of bias — some strong buy on short term, others neutral/weak on weekly.

🧠 Quick Strategy Notes (for traders)

Bullish break above ₹1,500 could open room toward ~₹1,520–₹1,550+ (short-term).

Sustained break below ₹1,380 may signal deeper pullback toward ~₹1,350–₹1,320.

Keep an eye on volume and candlestick signals around these key zones.

BLUESTARCO 1 Day Time Frame 🔹 Current Price (latest session)

• ~₹1,880.9 – ₹1,880 range (latest live price on 6 Feb 2026) — price fluctuated between ~₹1,834–₹1,886 during the session.

📊 Daily Pivot & Levels (Classic Pivot Style)

Pivot Point (PP): ~ ₹1,817–₹1,818

Resistance:

• R1: ~ ₹1,869 – ₹1,899

• R2: ~ ₹1,918 – ₹1,951

• R3: ~ ₹1,951 – ₹1,995

Support:

• S1: ~ ₹1,786 – ₹1,824

• S2: ~ ₹1,768 – ₹1,815

• S3: ~ ₹1,732 – ₹1,796

📌 What This Implies (Daily Price Action)

Bullish bias if price stays above pivot (~₹1,817):

▪ Break above R1 ~₹1,869–₹1,899 → stronger upside momentum

▪ Sustained moves above R2 ~₹1,918–₹1,951 → further strength

Bearish or corrective pressure if price drops below pivot:

▪ Slide below S1 ~₹1,786–₹1,824 → watch S2 & S3 as deeper supports

▪ Breach of S2/S3 zones suggests weakening of daily structure

📌 Note: These levels are approximate and slightly vary across data providers. Always confirm with live charts from your trading platform before placing trades or orders.

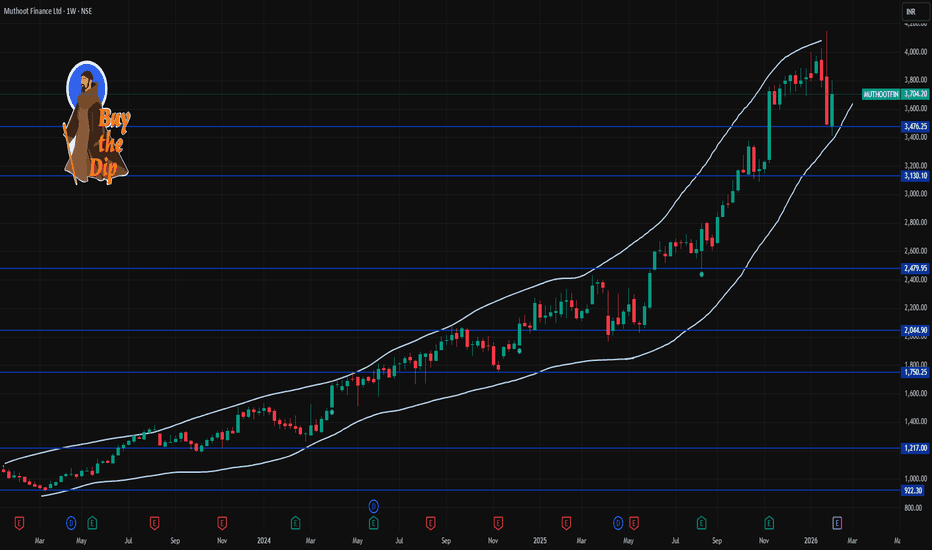

MUTHOOTFIN 1 Week Time Frame 📊 📍 Current Weekly Price Context

• Current price (recent trade close) is around ₹3,704.20.

🔹 KEY WEEKLY LEVELS (Support & Resistance)

📈 Weekly Resistance Levels — possible upside barriers where selling pressure could appear:

R1: ~₹3,805–₹3,810 — first major resistance zone.

R2: ~₹3,830–₹3,880 — next higher resistance.

R3: ~₹3,900+ — extended resistance from recent highs.

📉 Weekly Support Levels — zones that can act as buyers on dips:

S1: ~₹3,740–₹3,750 — first support.

S2: ~₹3,690–₹3,700 — secondary support.

S3: ~₹3,650–₹3,670 — deeper buyer interest area.

📌 Weekly Pivot (Mid-Point): ~₹3,770–₹3,775 — key pivot that often acts as dynamic support/resistance on weekly TFs.

📅 HOW TO USE THESE WEEKLY LEVELS

Bullish Scenario:

A weekly close above ₹3,805–₹3,810 increases the probability of an extension toward the higher resistance zones around ₹3,830–₹3,880+.

Neutral / Range:

Price oscillation between ₹3,740–₹3,830 suggests consolidation on the weekly chart — until breakout or breakdown volume confirms direction.

Bearish Scenario:

A sustained break below ₹3,740 could expose deeper supports around ₹3,690–₹3,670 on the weekly view.

📌 Note: These are purely technical reference levels from common weekly pivot/resistance frameworks on Indian stock charts — not investment advice. Always combine with volume, trend indicators (e.g., RSI/MACD) and risk management for your strategy.

GMDC 1 Day Time Frame from NSE data:

📊 Daily Pivot & Key Levels (1D Timeframe)

📌 Daily Pivot Point (PP): ₹606.73 – This is the central bias level. Above this suggests short-term bullish control; below may signal weakness.

💥 Resistance Levels (Upside)

R1: ₹627.46 – first major resistance above the pivot

R2: ₹640.38 – medium-term barrier

R3: ₹661.11 – stronger supply zone / higher target

🛡️ Support Levels (Downside)

S1: ₹593.81 – immediate daily support

S2: ₹573.08 – deeper pullback level

S3: ₹560.16 – stronger lower support area

✔ How to use these levels (Daily view):

📈 Bullish conditions:

If price sustains above Pivot (₹606.73) → bias turns bullish

Stronger breakout confirmation if price closes above R1/R2 with volume

📉 Bearish conditions:

If price breaks below S1 (₹593.81) → watch for next supports (S2/S3)

Failure at resistance zones can lead to pullbacks

💡 Summary Daily Chart Levels (1D)

Level Price (Approx)

R3 661

R2 640

R1 627

Pivot 606

S1 594

S2 573

S3 560

(Levels rounded for clarity)

IIFL 1 Day Time Frame 📊 Daily Pivot & Key Levels (1‑Day Timeframe)

📍 Daily Pivot:

• ₹520.28 (reference level for bias)

📈 Resistance Levels:

• R1: ₹532.57 — first upside hurdle

• R2: ₹543.28 — next barrier above

• R3: ₹555.57 — extended resistance zone

📉 Support Levels:

• S1: ₹509.57 — immediate support

• S2: ₹497.28 — next support zone

• S3: ₹486.57 — deeper support below

📌 How to Use These Levels Today

📈 Bullish view:

Break above ₹532.5 – ₹543.3 can open room toward ₹555+ for the day.

📉 Bearish view:

If price drops below ₹509.5, sellers could push toward ₹497 and then ₹486.5.

🟡 Pivot reaction:

Holding above the pivot ₹520.28 suggests bias toward upside today.

Falling below pivot suggests weakness intraday.

🔍 Note on Current Price Trend

Some data (delayed) shows moving averages and indicators near oversold, but pivot levels remain useful for intraday decisions.

OIL 1 Day Time Frame 📊 Current Approx Price (as per today data): ₹488.90 – ₹514.4 range (varies by platform/time) — OIL has recently traded around this area near daily pivot/major levels.

📈 Daily Pivot & Key Levels (Classic method)

Level Price (₹) Role

R3 (3rd Resistance) 507.45 Strong upside hurdle

R2 499.40 Secondary resistance

R1 491.35 Near-term resistance

Daily Pivot 483.30 Trend bias line

S1 (1st Support) 475.25 Immediate support

S2 467.20 Next downside cushion

S3 459.15 Major support zone

👉 Interpretation (1-day frame):

Price above pivot (~483-484) = bullish bias on the daily.

Near-term resistance cluster: ₹491–₹499–₹507 — watch breakout closes above these for continuation.

Downside support cluster: ₹475 → ₹467 → ₹459 — breakdown below these suggests short-term correction.

📊 Short Summary (Daily Momentum & Indicators)

Technical bias:

• RSI near bullish/neutral zone — showing positive momentum without being extremely overbought.

• MACD / ADX generally leaning bullish indicating trend strength at the moment.

Overall daily structure favors bullish to sideways — supports holding and resistance being tested.

🧠 How to use these levels (Daily)

📍 Bullish setup:

• If price stays above pivot ~483 and holds above R1 (~491) → next target R2 ~499 → R3 ~507.

📍 Bearish setup:

• If price falls below pivot ~483 and breaks S1 (~475) → move down to S2 (467) & potentially S3 (459).

📍 Key breakouts:

• Clear daily close above 507 → strong bull confirmation.

• Close below 459 → negates short-term bull view.

KAYNES 1 Week View 📌 Current Price Context

• Latest traded price around ₹3,640–₹3,720 on NSE (live varies by exchange and time) — showing recent rebound after volatility.

📈 Weekly Pivot & Support/Resistance Levels (1-Week Timeframe)

📍 Weekly Pivot Reference

• Weekly Pivot Point (central level): ~₹3,702 (midpoint guiding sentiment)

🔼 Weekly Resistance Levels (Upside)

• R1: ~₹3,734 – ₹3,745

• R2: ~₹3,760 – ₹3,770

• R3: ~₹3,790 – ₹3,880

🔽 Weekly Support Levels (Downside)

• S1: ~₹3,675 – ₹3,678

• S2: ~₹3,640 – ₹3,635

• S3: ~₹3,280 – ₹3,280+ (broader deeper support zone)

📊 How Traders Interpret These Weekly Levels

Bullish Signals (Weekly Close Above)

✅ A weekly close above R1 (~₹3,740+) supports continuation of near-term recovery.

➡ Next upside targets become R2 (~₹3,760–₹3,770) and then R3 (~₹3,790–₹3,880) as next resistance layers.

Bearish Signals (Weekly Break Below)

⚠ Break and weekly close below S1 (~₹3,675) increases risk of deeper weakness, with S2 (~₹3,635) and S3 (~₹3,280) as key downside floors.

Neutral/Range Scenario

↔ If price holds between S1–R1 (~₹3,675–₹3,745), expect sideways/consolidation before a clear breakout direction takes shape.

📌 Key Notes on Trend & Structure

• Price is below longer historical mid/long-term averages, reflecting a wider downtrend from prior highs, but short-term technicals show stabilization and bounce risk.

• Recent volatility (big swings) suggests support/resistance zones matter more than trend at the moment — breakouts through these weekly levels tend to signal next directional move.

🧠 Practical Weekly Trade Levels

Level Type Approx Zone

Weekly Pivot ~₹3,702

Resistance R1 ~₹3,734–₹3,745

Resistance R2 ~₹3,760–₹3,770

Resistance R3 ~₹3,790–₹3,880

Support S1 ~₹3,675–₹3,678

Support S2 ~₹3,635–₹3,640

Support S3 ~₹3,280+

🧾 Quick Takeaway

Bullish weekly bias if price closes above ₹3,740–₹3,760 with momentum.

Bearish pressure remains if weekly closes below ₹3,675–₹3,640.

Range trade likely between those pivot bands until directional breakout occurs.

BSE 1 Day Time Frame 📌 Current Price & Daily Range (Live Context)

Estimated current market price: ~₹2,850–₹2,880 (indicative from multiple sources citing latest live price movement).

Today’s daily high/low range: Approx ₹2,793–₹2,929 (observed current session variation).

⚠️ Exact live price can differ by minutes — check your trading platform for exact tick.

📈 1‑Day Pivot & Levels (Daily timeframe)

Classic Pivot Zone:

Pivot Point: ~₹2,647–₹2,663 (key balance level)

Immediate Resistance (Upside Targets):

R1: ~₹2,765–₹2,775

R2: ~₹2,828–₹2,830

R3: ~₹2,940 or higher (extended resistance)

Key Support (Downside Levels):

S1: ~₹2,584–₹2,625

S2: ~₹2,466–₹2,575

S3: ~₹2,403–₹2,537 — major downside pivot safety zone.

👉 Price above pivot generally signals bullish intraday bias; below pivot suggests weakness.

📊 Trend & Momentum (Daily)

Indicators & moving averages:

Price is trading above 20/50/100/200‑day EMAs, indicating a bullish trend on the daily chart.

RSI near neutral‑to‑positive zone (~50), showing room for further continuation before overbought.

This suggests bullish bias on daily timeframe, but resistance zones near ₹2,828–₹2,940 are key to break for sustained upside.

🧠 How to interpret the daily levels today

Bullish scenarios (1‑Day):

✔ Above ₹2,828–₹2,830 — expands move toward ₹2,940+.

✔ Sustained above pivot ~₹2,650+ — retains short‑term bullish structure.

Neutral / consolidative:

➡ Between ₹2,650 – ₹2,828 — range balance, sideways action likely.

Bearish scenarios (1‑Day):

✘ Break below ₹2,584 — could pull toward ₹2,466 / ₹2,403 supports.

MTARTECH 1 Week Time Frame 📊 Current Price Snapshot

MTAR Technologies closed around ₹2,931–₹2,932 recently.

📈 Weekly Pivot & Support/Resistance Levels

(Important zones likely to act as reference over ~1 week)

🔹 Pivot Levels

These are calculated based on recent price activity and help gauge short-term bias:

Central Pivot ≈ ₹2,909–₹2,954 (key balance level)

🔹 Resistance Levels

Potential upside barriers where price may slow/reverse:

₹2,995–₹3,031 near short-term upper range

₹3,100–₹3,178 next resistance cluster

Above ₹3,200 breakout target (longer weekly/extension)

🔻 Support Levels

Important zones to watch if price pulls back:

₹2,741–₹2,762 area (S1) — near immediate short-term support

₹2,562–₹2,600 range (S2) — strong secondary support

₹2,461–₹2,500 (S3/S4) — deeper pullback zone

These resistances/supports are based on pivot point calculations & Fibonacci extensions covering multiple pivot methods.

📊 Technical Indicators (Short-Term Context)

Moving averages (20, 50, 100, 200 DMA) are largely bullish in daily/weekly analysis, supporting upward momentum.

RSI is near bullish territory but approaching overbought on shorter frames — indicating possible consolidation ahead.

Some technical tools show short-term buy signals; others show neutral — indicating range movement with upside bias.

📌 How to Use These Levels

Bullish Scenario:

➡ Price sustaining above the pivot (~₹2,890-₹2,950) suggests continuation toward ₹3,000 → ₹3,100+ resistance levels.

Bearish/Retracement Scenario:

➡ Failure below pivot or key support near ₹2,740 could trigger pullbacks toward ₹2,600 → ₹2,500 support zones.

This setup works well for 3–7 day trading or planning entry/exit zones.

HINDZINC 1 Month Time Frame 📍 Current Price Snapshot (latest close / recent trade)

HINDZINC is trading around ~₹628–₹630 on NSE/BSE — after some volatility in recent sessions. Its 52‑week high is ~₹733 and 52‑week low ~₹378.15, showing wide longer‑term movement.

🛠 1‑Month Technical Levels (Support & Resistance)

These are the key zones traders watch for a 1‑month period based on pivot analysis and recent price action:

🔼 Resistance Levels (Upside Targets)

1. ₹705 – ₹715: Immediate resistance zone around recent highs and pivot R1/R2 cluster.

2. ₹735 – ₹750: Next major supply/resistance area — crossing this would signal stronger upside continuation.

3. ₹760 – ₹780+: Extended breakout zone if sentiment turns sharply bullish (higher targets from pivot extensions).

📌 Overall, ₹705–₹715 is the near‑term hurdle the stock needs to clear for a bullish run.

🔽 Support Levels (Downside Price Floors)

1. ₹690 – ₹700: First strong support near recent consolidation lows/pivot S1.

2. ₹670 – ₹680: Secondary support — a deeper pullback zone.

3. ₹650 – ₹660: Key base area — breakdown below this can signal more downside pressure.

4. ₹620 – ₹630: Major structural support if broad market or metals weakness intensifies.

📌 The ₹670–₹700 band acts as the core support area this month.

⚠️ Quick Summary

✔ Above ₹705–₹715 = bullish continuation likely.

✔ Between ₹670–₹700 = consolidation zone.

✔ Below ₹650 = risk of deeper retracement.

IDEA 1 Day Time Frame📈 Current Snapshot (Daily)

📍 Approx Price Range Today: ₹10.00 – ₹11.00 per share (indicating recent heavy trading and a bounce)

📍 RSI (Daily): ~38.5 – showing slightly weak momentum but not deeply oversold yet

📍 50 / 100 / 200 DMA: ~₹10.58 / ₹9.94 / ₹9.34 – price around these averages suggests mixed consolidation near crucial pivot zones

🔑 1-Day Key Levels (Pivots)

✔ Pivot Point

Pivot: ~ ₹9.98 → Daily balance point (trend bias flips above / below)

🟢 Support Levels

S1: ~ ₹9.75 → 1st immediate support

S2: ~ ₹9.46 → secondary support zone

S3: ~ ₹9.23 → lower daily support

👉 Below ₹9.23 — increased bearish risk on intraday breakdown.

🔴 Resistance Levels

R1: ~ ₹10.27 → first resistance

R2: ~ ₹10.50 → near daily average resistance

R3: ~ ₹10.79 – ₹11.00 → stronger daily resistance & psychological level

👉 Sustained move above ~₹10.50-₹10.80 can shift short-term bias toward recovery.

📌 Important Context (Market News)

Today’s market action showed a strong positive catalyst: Vodafone Idea shares surged ~13% to ~₹11.36 on Jan 30 2026 after management revealed a large turnaround plan including ₹45,000 cr capex strategy and AGR relief news — indicating significant bullish sentiment shift.

Recent fundamentals: Q3 loss narrowed and ARPU increased, which supports sentiment.

These news catalysts can influence price reaction at key technical levels, so combine them with the pivot levels above for better context.

PIRAMALFIN 1 Day View 📌 Current Price (Live NSE)

• ~₹1,750.30 (down ~‑2.16%)

• Day Low ~₹1,741.00

• Day High ~₹1,779.90

📊 Daily Pivot Levels (Classic)

(calculated from previous trading session price range)

Level Value

Pivot Point (PP) ₹1,776.93

Resistance 1 (R1) ₹1,838.37

Resistance 2 (R2) ₹1,882.83

Resistance 3 (R3) ₹1,944.27

Support 1 (S1) ₹1,732.47

Support 2 (S2) ₹1,671.03

Support 3 (S3) ₹1,626.57

📌 Intraday Interpretation (1D TF)

Bullish if:

✔ Price holds above Pivot ~₹1,777

✔ Break above R1 ~₹1,838 signals stronger upside bias

Bearish if:

🔻 Price stays below Pivot ~₹1,777

🔻 Break below S1 ~₹1,732 could open slide toward S2/S3 levels

Today’s trading bias (current):

• Price below pivot — short‑term bearish/neutral tone intraday

• Key support to watch: ₹1,732 → ₹1,671 zone

📈 Other Intraday Technicals (from recent session)

• RSI (short‑term) around ~58 (neutral/upper range)

• EMA/SMA 20 day near ~1,772–1,783 — acting as dynamic resistance area

• Volume & range suggest typical NBFC trading volatility today.

STARHEALTH 1 Week Time Frame 📊 Weekly Price Range (1‑Week History)

High (last week): ~₹469.8

Low (last week): ~₹442.45

(Source: Marketscreener weekly price extremes)

📌 Key Weekly Support Levels

Support zones you may watch on the weekly timeframe:

1. Support 1: ~₹440–₹442 (recent weekly low)

2. Support 2: ~₹430 area (round‑number psychological / pivot cluster)

3. Support 3: ~₹408–₹415 range (broader structural support from pivot supports seen on shorter pivots)

Weakness below ₹430 could open the lower band towards ₹405–₹410.

📌 Key Weekly Resistance Levels

Potential weekly resistance zones to monitor:

1. Resistance 1: ~₹470–₹472 (recent weekly highs & EMA cluster)

2. Resistance 2: ~₹480–₹485 (psychological and medium MA area)

3. Resistance 3: ~₹495+ (upper pivot / longer‑term range top)

A weekly close above ₹480–₹485 would indicate stronger upside pressure.

📈 Technical Indicator Context (Weekly)

RSI and weekly momentum indicators on some platforms suggest neutral‑to‑slightly bullish conditions rather than extreme overbought levels.

Weekly pivot and moving average positions (when available) confirm ₹462–₹470 as an important zone for bullish continuation.

CONCOR 1 Day Time Frame 📊 CONCOR — 1‑Day Time Frame Key Levels (Indicative)

Current Price (recent session)

• ~₹478–₹480 (down intraday) — trading near session lows.

🔁 Pivot & Classic Levels (from standard technical calculation)

These are typical pivot/SR levels used by traders for one‑day setups:

Pivot Point: ~₹520

➡️ The central reference level where bias may shift.

If price trades above this level intraday → bullish bias; below → bearish bias.

Resistance Levels:

• R1: ~₹524

• R2: ~₹527

• R3: ~₹531

➡️ Levels where selling pressure may emerge if price rallies.

Support Levels:

• S1: ~₹516

• S2: ~₹513

• S3: ~₹509

➡️ Key intraday levels where buyers may step in on pullbacks.

📉 Today’s Range & Observations

Day’s High: ~₹497–₹498

Day’s Low: ~₹477–₹478

➡️ CONCOR is trading nearer its session low, showing short‑term selling pressure.

52‑Week Context:

• 52‑week low ~₹472–₹478

• 52‑week high ~₹652 (prior broader trend)

📌 How Traders Use These Levels (1 Day Time Frame)

Bullish Scenarios (intraday):

✔ If price breaks above Pivot (~₹520) with volume → potential move toward R1 ~₹524 and beyond.

✔ Strength above R1/R2 indicates buyers stepping in.

Bearish Scenarios (intraday):

✔ Price staying below pivot and failing at R1/R2 → continuation lower.

✔ Breakdown below S1 (~₹516) and S2/S3 amplifies downside pressure.

KFINTECH 1 Week Tme Frame 📌 Current Price Context

Last close / recent price: ~₹1,018–₹1,019 per share on NSE.

The stock has been weakening over the past week (down ~‑4‑5%).

Price range today: high ~₹1,053 / low ~₹1,016.

📊 Key Pivot & Weekly Levels (1‑Week Focus)

🔹 Pivot (Reference)

Weekly pivot: ~₹1,024 area (central weekly level).

📉 Support Levels (Downside Zones)

Level Price Area What it Means

Near‑term support (S1) ₹1,006 Immediate floor — first downside buffer.

Short support (S2) ₹978–₹980 Next support if selling accelerates.

Deeper support (S3) ₹955–₹960 Stronger lower support on weekly chart.

Below ~₹1,006 weakens short‑term structure and increases bearish risk.

📈 Resistance Levels (Upside Barriers)

Level Price Area What it Means

R1 ₹1,056 Immediate resistance — key 1‑week upside test.

R2 ₹1,079 Secondary barrier — sellers often near here.

R3/Strong resistance ₹1,106–₹1,110 Major breakout zone above recent range.

Above ~₹1,056–₹1,060 would signal less bearish pressure and possibly range recovery.

🔍 Quick Reference Levels (1‑Week)

Support: ~₹1,006 → ₹978 → ₹955

Pivot: ~₹1,024

Resistance: ~₹1,056 → ₹1,079 → ₹1,106+

HINDZINC 1 Day Time Frame 📌 Current Price (intraday basis):

• ~ ₹667–₹670.8 (range seen today) with highs near ~₹694 and lows near ~₹652.65 earlier in the session.

📈 Intraday Pivot Levels (Daily)

These are calculated from recent price action and are widely used by traders to gauge intraday support and resistance:

📊 Pivot & Levels (Standard Daily)

• Pivot Point (PP): ~₹705.45

• Resistance

• R1: ~₹713.35

• R2: ~₹725.70

• Support

• S1: ~₹685.20

• S2: ~₹672.85

• S3: ~₹664.95

📍 Central Pivot Range (CPR)

• Top CPR: ~₹695.32

• Middle CPR: ~₹693.10

• Bottom CPR: ~₹690.88**

(Note: Pivot and CPR may shift slightly as market updates.)

📍 Summary – 1D Intraday Levels

Level Price (₹) Role

R2 ~725.70 Major upside resistance

R1 ~713.35 Near‑term resistance

Pivot ~705.45 Key directional trigger

CPR Top/Mid/Bottom ~695–690.9 Important intraday range

S1 ~685.20 Near‑term support

S2 ~672.85 Secondary support

S3 ~664.95 Lower support zone

DIXON 1 Day Time Frame 📉 Intraday Price Action (Today’s Range)

Day’s Range: ~₹10,274 – ₹10,790

This indicates where the stock has been trading so far today.

📊 Key Intraday Levels for 1‑Day Time Frame

🟢 Support Levels

S1: ~₹10,545 – ₹10,550

S2: ~₹10,359 – ₹10,360

S3: ~₹10,016 – ₹10,020

🔴 Resistance Levels

R1: ~₹11,070 – ₹11,075

R2: ~₹11,410 – ₹11,420

R3: ~₹11,600 – ₹11,605

These pivot‑derived support/resistance levels are typical for intraday reference (classic pivot methodology).

🧠 How to Use These Levels (Intraday)

Bullish bias: A sustained break above R1 ~₹11,070 with volume can open moves toward R2 ~₹11,410.

Bearish bias: If price loses S1 ~₹10,545, next support guards are S2 ~₹10,360 and S3 ~₹10,016.

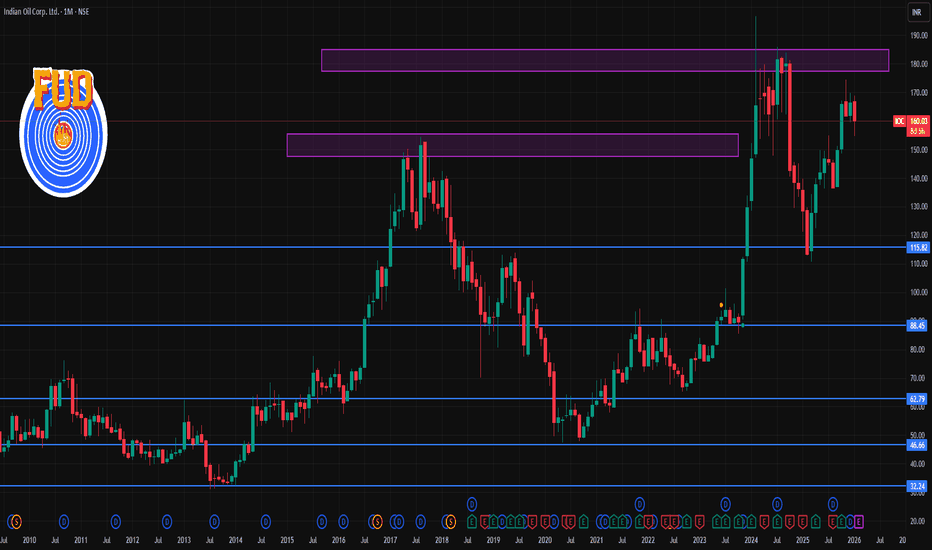

IOC 1 Month Time Frame 📌 CURRENT PRICE (as of 22 Jan 2026)

IOC share price: ~₹159.9 per share (NSE/BSE).

📊 1‑Month Technical Levels (Current & Accurate)

Resistance (Upside Levels)

These are levels where price may find selling pressure in the near term:

R1 – Immediate Resistance: ~₹160.6–₹162.5

R2 – Mid Resistance: ~₹162.5–₹163.9

R3 – Higher Resistance: ~₹164–₹165.2

A broader longer‑range resistance zone near ₹170–₹171+ remains significant if the market strengthens.

Why these matter:

Resistance levels show where the stock has historically paused or reversed on recent charts — useful for targets or exits.

Support (Downside Levels)

These are key near‑term supporting price zones:

S1 – Immediate Support: ~₹156.8–₹159.4

S2 – Secondary Support: ~₹154.7–₹157.9

S3 – Deeper Support: ~₹152.9–₹155.0

Note: If price breaks below ~₹155, it could signal further weakness in the short term.

🧠 How to Use These Levels

Swing traders: Use support zones for entry zones and resistance levels as targets.

Breakouts: A clear close above ₹164–₹165 could open room toward the ₹170+ zone.

Breakdown: A close below ₹155 could escalate selling into deeper support.

PAYTM 1 Day Time Frame 📌 Live/Recent Price:

Around ₹1,240 – ₹1,300 range intra‑day (varying by source/time) — showing recent session weakness.

📊 Daily Pivot & Support/Resistance Levels

These levels are typical pivot analysis (daily frame) used by traders to identify short‑term sell/buy pressure points:

Pivot Zone (Daily): ~₹1,307–1,325

Resistances:

R1: ₹1,325–₹1,330

R2: ₹1,354–₹1,355

R3: ₹1,372–₹1,373

Supports:

S1: ~₹1,278–₹1,280

S2: ~₹1,259–₹1,260

S3: ~₹1,231–₹1,232**

📌 Interpretation:

Above Pivot (₹1,307–₹1,325) ➜ short‑term bullish bias.

Below Pivot ➜ bearish bias with S1→S2 as key downside zones today.

🧠 Key Daily Zones to Watch

🎯 Bullish Break Zones

Strong intraday upside trigger: RSI/Vol can push price back above ₹1,307 pivot

Next upside targets: ₹1,325 → ₹1,354 → ₹1,372

⚠️ Bearish Breakdown Zones

If drops below S1 (~₹1,278), next key downside to watch is ₹1,259 (S2)

Breaking below ₹1,231 (S3) may accelerate intraday selling

HINDCOPPER 1 Month Time Frame 📊 Current Reference Price

The stock is trading around ₹540 – ₹560 on the NSE today.

🧠 1‑Month Timeframe Key Levels

📈 Resistance (Upside Barriers)

These are levels where the stock might face selling pressure or pauses if it continues higher:

1. ₹570 – ₹575 — Immediate near‑term resistance zone (recent highs).

2. ₹580 – ₹585 — Next resistance cluster above current price — psychological plus pivot area.

3. ₹595 – ₹600+ — Extended upside target if price breaks above the near zone.

Interpretation: A daily/weekly close above ~₹575–₹580 can confirm strength on the 1‑month chart and open the move toward ~₹600+.

📉 Support (Downside Floors)

These are levels where buyers may step in if price corrects:

1. ₹522 – ₹525 — Near pivot support on medium timeframe.

2. ₹500 – ₹510 — Secondary support zone that has seen demand historically on pullbacks.

3. ₹480 – ₹490 — Deeper short‑term support — a key level if price weakens further.

Interpretation: Holds above ~₹520–₹525 are bullish for the 1‑month swing; breaks below that raise risk of deeper pullback toward ₹500 or lower.

✍️ 1‑Month Trading Perspective (Short Summary)

📌 Bullish Scenario

Sustained daily closes above ~₹575–₹580 → watch ₹590–₹600+ as next short‑term targets.

📌 Neutral / Range Scenario

Price consolidates between ₹525 and ₹575 — likely choppy movement before next directional breakout.

📌 Bearish / Correction Scenario

Close below ~₹522–₹525 → deeper support zones around ₹500–₹490 may get tested.

⚠️ Important Notes

✅ These are technical reference levels, not buy/sell recommendations.

✅ Price action can change quickly with market news, global copper trends, or broader index moves (e.g., Nifty/commodity dynamics).

CUBEXTUB 1 Week Time Frame 📊 Current Price Context

Latest trading range (approx): ₹99–₹103 per share.

📈 Weekly Key Levels (Approximate)

🎯 Resistance Levels

These are areas where upside price movement may slow or reverse:

1. First Resistance: ~₹108–₹109 — near recent pivot resistance.

2. Next Resistance: ~₹113–₹116 — upper weekly resistance zone.

3. Higher Target: ~₹118–₹120+ — longer weekly resistance/extension.

📉 Support Levels

These are areas where price may find buying interest or a bounce:

1. Immediate Support: ~₹101–₹102 — just below recent price and short‑term pivot support.

2. Secondary Support: ~₹98–₹99 — next downside zone.

3. Lower Support: ~₹94–₹95 — deeper support if weakness continues.

📌 Weekly Pivot Reference

Pivot Level (central reference): ~₹106 — roughly the fulcrum of bulls vs. bears this week.

🛠 How to Use These Levels (Weekly Basis)

Bullish scenario:

✅ If the weekly close breaks and holds above ₹108–₹109, next resistance targets of ₹113–₹116 become active.

Bearish scenario:

❌ Failure below ₹101–₹102 could open the path toward ₹98–₹95 support.

Range bias:

🟡 Price may oscillate between ₹101–₹113 in the absence of a decisive trend signal.

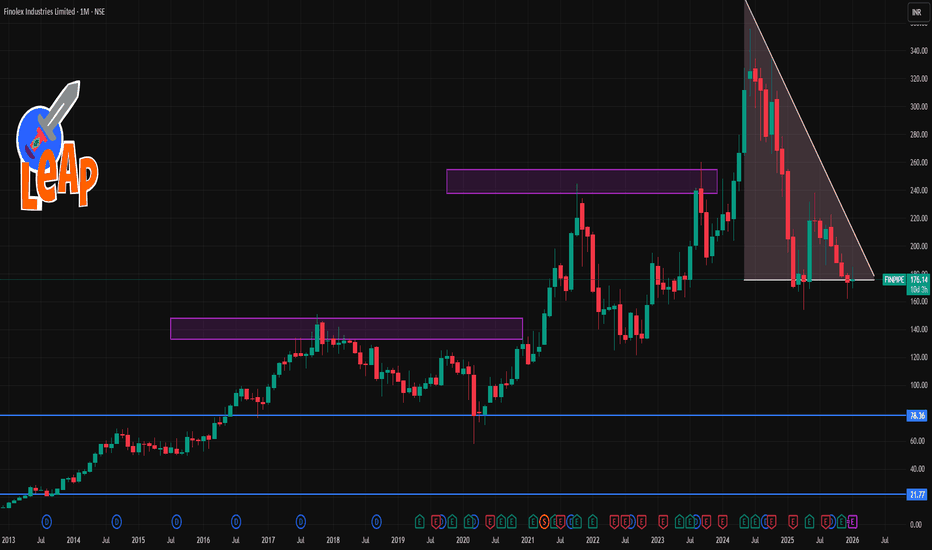

FINPIPE 1 Month Time Frame📊 Current Context

The share has been moderately positive over the past month (~+5–8% gains) in recent price data.

Recent share price (late Jan 2026) is near ₹175–177 levels.

📈 Key Levels (1‑Month Timeframe)

🔹 Resistance Levels

These are levels where the price may face selling pressure:

1. ~₹177–179 — Immediate resistance seen on short‑term pivot structure.

2. ~₹185–189 — Next meaningful resistance zone based on recent moving average clusters (20–50 day EMAs/SMAs).

3. ~₹194–198 — Higher resistance around 50–100 day average / upper consolidation of the last month/quarter.

Break above ₹185–189 with volume could signal a stronger short‑term uptrend continuation.

🔻 Support Levels

Important price floors where the price may find buyers:

1. ~₹173–175 — Near short‑term support and recent intraday pivot levels.

2. ~₹169–170 — Lower support seen from short swing lows over the past month.

3. ~₹164–165 — Deeper support from prior month low levels before recent recovery. (Estimated from recent historical lows.)

A close below ~₹169 on daily charts could indicate weakening short‑term structure.

🗺️ Trading Mindset (not financial advice)

Bullish view: A sustained move above ₹185–189 with increased volumes may target higher resistance near ₹195+.

Bearish view: A close under ₹170–169 could restart short‑term weakness toward lower support levels.