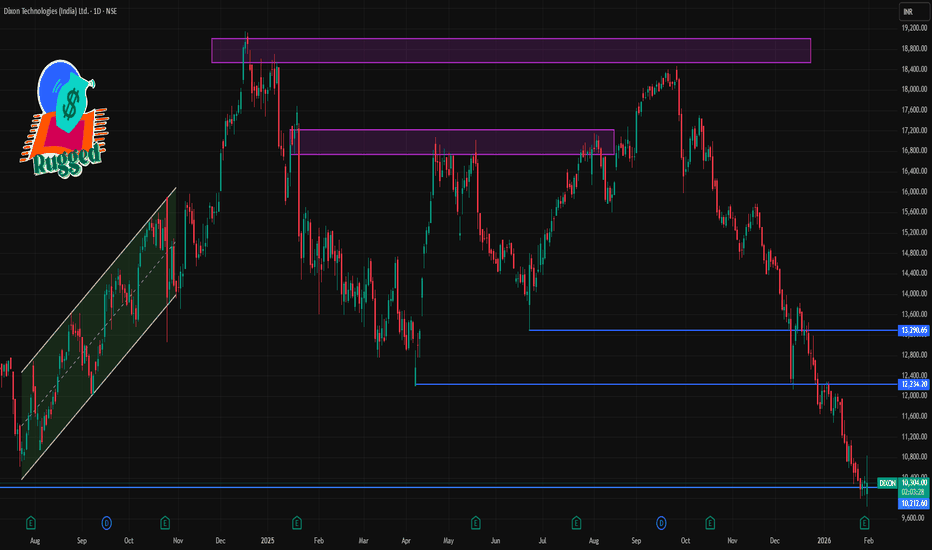

DIXON 1 Day Time Frame 📊 Current Price Snapshot (Daily)

Latest traded price: ~₹10,300 – ₹10,460 approx on NSE/BSE (mid-day range).

Today’s price range: ₹9,835 (low) – ₹10,843 (high).

52-week range: ₹9,835 – ₹18,471.

Bias: The stock remains below key short-term averages (e.g., 20/50/100-day EMAs), indicating a bearish daily trend until price successfully closes above resistance levels.

📈 Daily Pivot & Technical Levels (1-Day Time Frame)

🔹 Pivot Point (Daily Centre)

• Pivot: ~₹10,276 – ₹10,496 (central reference for today’s bias)

🚧 Resistance Levels (Upside)

1. R1: ~₹10,496 – ₹10,500 (1st resistance zone)

2. R2: ~₹10,656 – ₹10,660 (daily push-back region)

3. R3: ~₹10,876 – ₹10,880 (higher barrier)

👉 A sustained daily close above ~₹10,500–₹10,650 is needed to reduce near-term bearish momentum.

📉 Support Levels (Downside)

1. S1: ~₹10,116 – ₹10,120 (initial support)

2. S2: ~₹9,896 – ₹9,900 (secondary cushion)

3. S3: ~₹9,736 – ₹9,740 (deeper support)

👉 Breach of ₹9,900 and then ₹9,740 could expand downside risk on the daily chart.

💡 Quick Trading Reference — Today

Bullish bias resume only if price closes above:

✔️ ₹10,500 (initial breakout)

✔️ ₹10,650+ (confirmation of relief rally)

Bearish pressure sustained while below these:

⏬ ₹10,116 → first downside target

⏬ ₹9,896 – ₹9,740 → strong support zones

Chartbychart

TEJASNET 1 Month Time Frame 📊 Current Price Snapshot (Approx)

Last traded price ~ ₹330-₹345 on NSE/BSE during late Jan 2026, after recent volatility and sell-offs.

📉 1-Month Timeframe — Key Levels

🔻 Support Levels (Downside)

These are levels where the stock could find buyers or pause losses on a 1-month chart:

Support Zone Significance

₹320 – ₹325 Immediate support; recent intraday floor (current price region)

₹301 – ₹315 Secondary support zone from pivot breakdowns

₹285 – ₹300 Deeper support if broader bearish momentum continues

📈 Resistance Levels (Upside)

Resistance Zone Importance

₹355 – ₹360 1st resistance from short-term moving average relevance

₹370 – ₹375 Next resistance cluster near recent intraday reactions

₹390 – ₹395 Higher resistance if bounce gains strength

🧠 Technical Indicator Context (1-Month)

📉 Trend Bias: Bearish overall, price trading significantly below major moving averages (20-day, 50-day, etc.).

📊 RSI: Near oversold but not confirmed bottom — suggests bearish momentum but potential for short-term rebounds.

📉 MACD & STOCH: Bearish signals persist, indicating weak price action on the 1-month chart.

🗂 Summary — 1-Month View

⚠️ Bearish Bias: The stock is in a short-term downtrend, trading below key moving averages and suffering weak momentum.

🛑 Support in Focus: ₹320-₹315 first; further deeper zone near ₹285-₹300 if bears intensify.

📈 Resistance Roadblock: ₹355-₹360 key for initial bounce; stronger rally needs break above ₹370+.

📉 Bearish Technicals: RSI not strongly indicating reversal yet; MACD remains bearish.

ASIANPAINT 1 Week Time Frame 📊 Current Price Context

Recent share price was trading around ₹2,423–₹2,515 range (latest intraday/previous close range) according to market data.

📈 Weekly Timeframe Levels — Asian Paints (NSE)

🔴 Resistance (Upside)

These are levels where price may face selling pressure or pause on the upside in the coming week:

1. ₹2,560–₹2,565 — Immediate near‑term resistance zone seen from short weekly consolidations.

2. ₹2,720–₹2,760 — Mid resistance zone where upside moves often stall on weekly/daily clusters.

3. ₹2,820–₹2,860+ — Higher weekly resistance zone — breakout above this could indicate stronger momentum.

🟢 Support (Downside)

These are levels where price might find buying interest or a floor on weekly charts:

1. ₹2,440–₹2,460 — Immediate support from weekly lower bands and short pivot support.

2. ₹2,340–₹2,380 — Secondary support zone seen from historical price clusters and volatility bands.

3. ₹2,300–₹2,250 — Major structural support — breakdown here could lead to deeper correction.

📉 Pivot Zone

₹2,500–₹2,530 — A central pivot/neutral range this week; trading above suggests short bullish bias, below suggests bearish.

📌 Weekly Technical Bias (Summary)

Bullish Scenario: A sustained weekly close above ₹2,560–₹2,565 opens path toward ₹2,720–₹2,860.

Bearish Scenario: Failure to hold ₹2,440–₹2,460 could drag price toward ₹2,340–₹2,300 on the weekly chart.

Range Play: Price oscillating between ₹2,440 – ₹2,560 indicates consolidative behavior typical in neutral markets.

JLHL 1 Day Time Frame 📌 Current Live Price (1‑Day)

Last traded price: ~₹1,305–₹1,322 range today on NSE/BSE.

Day’s range: ~₹1,301–₹1,359.

📊 Intraday Technical Levels (1‑Day Time Frame)

🔹 Pivot & Reference

No concrete official pivot published for today across many free data sites, but general intraday pivot technique (based on brokers’ short‑term screens) focuses around mid‑range prices near ₹1,310–₹1,320 as neutral area.

🔼 Resistance Levels (Upside)

These are zones where the price may face selling pressure on the same trading day:

1️. ₹1,350–₹1,360 — initial resistance zone (recent intraday high area).

2️. ₹1,375–₹1,390 — secondary resistance if price clears the initial zone.

🔽 Support Levels (Downside)

These are zones where buyers may step in intraday:

1️. ₹1,290–₹1,300 — nearest support band (recent intraday low).

2️. ₹1,270–₹1,280 — next lower support cluster (near the 52‑week low region).

🧠 Intraday Trading Interpretation

Bullish bias intraday if:

Price breaks above ₹1,350–₹1,360 with volume → could test higher around ₹1,375–₹1,390.

Bearish bias intraday if:

Price loses ₹1,290 support → risk of slide toward ₹1,270+ zone.

Range‑bound scenario:

Price oscillates between ₹1,290–₹1,350 if participation stays muted.

HPCL 1 Month Time Frame 📌 Current Price Reference

HPCL’s share price is around ₹410 – ₹435 in late January 2026.

📊 1‑Month Technical Levels

🔵 Support Levels (Downside)

These are zones where the price historically finds buying interest or could rebound if selling increases:

1. Major Support: ~ ₹449–₹454 — key near‑term support zone (weekly lower support).

2. Secondary Support: ~ ₹460 — if price consolidates above this level, trend may hold.

3. Deeper Support Zone: ~ ₹454–₹449 (extended pullback).

4. Additional Lower Band: Recent pivot around ₹440–₹435 from broader charts (may act short‑term cushion).

➡️ Break below these can signal further downside to the 1‑month range.

🔴 Resistance Levels (Upside)

These are levels where price might face selling pressure or may struggle to sustain gains:

1. Immediate Resistance: ~ ₹478–₹481 — short‑term ceiling.

2. Next Key Barrier: ~ ₹484–₹486 — stronger resistance zone.

3. Stretch/Upper Target: ~ ₹490–₹494 (+) — if momentum continues bullishly.

⚖️ Pivot Reference

Pivot Level: ~ ₹449 — central point indicating bias above this tends mildly bullish, below could favor sellers.

HMVL 1 Month Time Frame 📊 Current Price Snapshot (Latest Close)

- Approximate latest price: ₹70.9 – ₹72.2 per share (data from multiple live sources on 23 Jan 2026) showing HMVL trading around ~₹71–₹72 levels.

- Intraday range: ₹69.00 – ₹72.00 recently observed.

- 52‑week range: ₹61.76 (low) to ₹103.40 (high).

📈 1‑Month Performance

- Over the past 1 month, the stock’s performance shows a slight decline or mild sideways move: approx −1 % to −3 % change depending on the exact start/end dates used (TradingView indicated ~‑2.75 % monthly fall).

- Other data suggests very modest monthly change (slight positive/negative depending on source).

📅 Recent Daily Price Levels (Indicative)

From historical price data for the first half of January 2026:

01 Jan 2026: ~₹68.5

06 Jan 2026: ~₹70.4

09–12 Jan 2026: ~₹66‑₹69

16–23 Jan 2026: ~₹69‑₹72

→ This shows a 1‑month trading range roughly between ~₹65 and ~₹72.

📍 1‑Month Key Levels to Watch

Support zone: ~₹65 – ₹67 (recent lows).

Near‑term resistance: ~₹72 – ₹74 (recent highs).

Mid‑range pivot: ~₹69 – ₹71 — recent close vicinity area.

WAAREEENER 1 Week View📍 Live Price Snapshot (Approximate)

The stock is trading around ₹2,590–₹2,600 on the NSE in recent sessions.

📊 1-Week Timeframe Levels

🔼 Resistance (Upside)

These are levels where price may face selling pressure:

₹2,606 – ₹2,610 — Immediate resistance / pivot-R1 zone this week.

₹2,659 – ₹2,660 — next resistance above pivot.

₹2,690 – ₹2,700 — higher weekly resistance zone.

👉 A sustained breakout above ₹2,660–₹2,690 could suggest short-term strength on the weekly chart.

🔽 Support (Downside)

Key support zones where buyers may step in:

₹2,554 – ₹2,550 — first support zone for the week.

₹2,467 – ₹2,470 — next support if the first breaks.

₹2,374 – ₹2,375 — deeper support level below.

📌 Weekly Trend Notes

Current weekly indicators (RSI/MACD etc.) lean bearish or neutral, with RSI low and MACD negative — indicating short-term downward momentum.

The chart is showing below key moving averages (20/50 day) — typically short-term bearish pressure.

Recent news showed a strong earnings rally around Jan 22, 2026, lifting the stock near higher levels, but price remains below longer-term averages.

KFINTECH 1 Week Tme Frame 📌 Current Price Context

Last close / recent price: ~₹1,018–₹1,019 per share on NSE.

The stock has been weakening over the past week (down ~‑4‑5%).

Price range today: high ~₹1,053 / low ~₹1,016.

📊 Key Pivot & Weekly Levels (1‑Week Focus)

🔹 Pivot (Reference)

Weekly pivot: ~₹1,024 area (central weekly level).

📉 Support Levels (Downside Zones)

Level Price Area What it Means

Near‑term support (S1) ₹1,006 Immediate floor — first downside buffer.

Short support (S2) ₹978–₹980 Next support if selling accelerates.

Deeper support (S3) ₹955–₹960 Stronger lower support on weekly chart.

Below ~₹1,006 weakens short‑term structure and increases bearish risk.

📈 Resistance Levels (Upside Barriers)

Level Price Area What it Means

R1 ₹1,056 Immediate resistance — key 1‑week upside test.

R2 ₹1,079 Secondary barrier — sellers often near here.

R3/Strong resistance ₹1,106–₹1,110 Major breakout zone above recent range.

Above ~₹1,056–₹1,060 would signal less bearish pressure and possibly range recovery.

🔍 Quick Reference Levels (1‑Week)

Support: ~₹1,006 → ₹978 → ₹955

Pivot: ~₹1,024

Resistance: ~₹1,056 → ₹1,079 → ₹1,106+

HINDUNILVR 1 Day Time Frame 📊 Live 1‑Day Price Snapshot (Today’s Trading – India NSE)

🔹 Current Price: ₹2,409.50 INR (latest available intra‑day quote)

🔹 Previous Close: ₹2,390.60 INR

🔹 Day’s Trading Range: ₹2,376.80 – ₹2,434.30 INR

🔹 Volume (Approx): ~1.3 M shares traded

🔹 52‑Week Range: ₹2,136.00 – ₹2,750.00 INR

📈 This is live market data for today’s session (latest trading information available from stock exchange and market feeds).

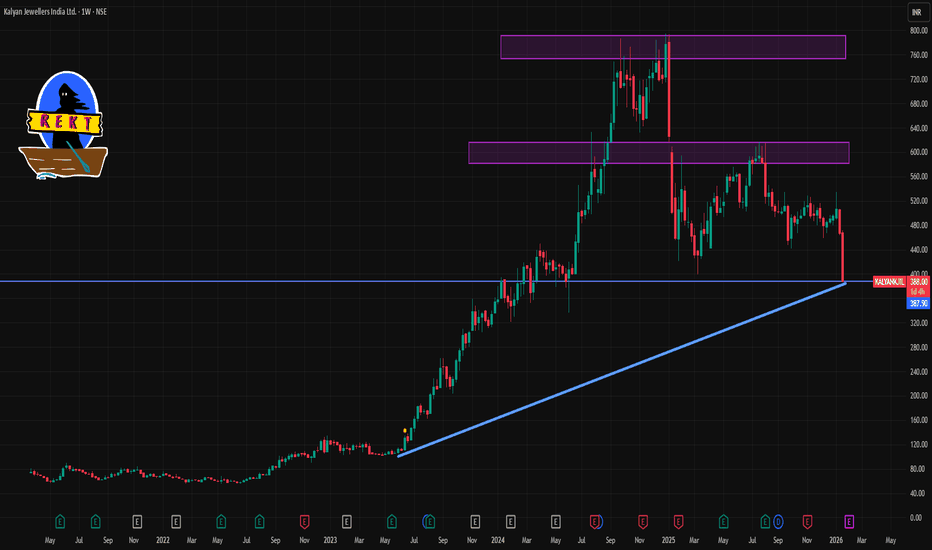

KALYANKJIL 1 Week Time Frame 📌 Current Price Snapshot (Weekly Context)

₹~391–396 — the stock is trading near its 52‑week low range after heavy selling pressure.

NSE/BSE trend is bearish on weekly charts (sell signals and down momentum).

📊 1‑Week Time Frame – Pivot & Key Levels

📉 Weekly Pivot & Levels (from pivot analysis)

(These are derived from weekly pivot point calculations, representing expected turning points for the week)

📌 Weekly Pivot:

Pivot: ~₹479.12

👊 Weekly Resistances:

R1: ~₹495.23

R2: ~₹522.97

R3: ~₹539.08

🛑 Weekly Supports:

S1: ~₹451.38

S2: ~₹435.27

S3: ~₹407.53

👉 The current market price (~₹392–396) is below the first major weekly support (~₹451) and closer to the third weekly support at ~₹407.5 — indicating deep bearish momentum this week.

🧠 Summary – 1‑Week Level Playbook

Bearish near‑term risk:

Break below ~₹407 opens potential towards psychological lower bands.

Key levels for traders this week:

Support to watch: ~₹407 (S3)

Initial resistance to challenge: ~₹451 (S1 on weekly pivot)

Major resistance zones: ~₹495 and ~₹523

VEDL 1 Week Time Frame 📊 Current Price Context (approximate latest)

• Vedanta is trading around ₹660‑₹675 range on NSE as of the latest session.

📈 Weekly Resistance Levels

These are levels where the stock might face selling pressure on an upward move:

Resistance Zones

1. ₹682–₹688 area – near recent intraday highs and 52‑week high cluster.

2. ~₹693–₹700 – broader higher resistance in week ahead.

3. Above ₹700 – extended breakout zone if bullish momentum accelerates.

👉 Bullish breakout triggers shorter‑term targets toward these zones, especially if sustained above daily pivots/resistance.

📉 Weekly Support Levels

These are areas where price might find buyers or pullback cushions:

Support Zones

1. ~₹665–₹658 – immediate weekly support cluster.

2. ~₹647–₹648 – next meaningful support if the price weakens.

3. ~₹620–₹630 – deeper pivot/demand zone from recent action (from broader short‑term analysis).

4. ~₹560–₹570 – more distant support if the stock corrects further from current levels.

👉 A break below ₹658–665 on weekly closes could shift bias toward deeper support ranges.

🔁 1‑Week Bias Summary

Scenario Level to Watch What It Implies

Bullish continuation Above ₹682–₹688 Can target ₹693–₹700+

Neutral / congestion ₹665–₹658 Choppy range, sideways trades

Bearish correction Below ₹658 Deeper support at ₹620–₹570+

CREDITACC 1 Week Time Frame 📌 Current Price Context (21 Jan 2026)

Approx current price: ~₹1,330 – ₹1,370 on NSE as of recent trading session.

📊 Weekly Technical Levels (1-Week Timeframe)

These levels are derived from recent weekly pivot analysis (reflecting highs/lows and average weekly trend):

Weekly Pivot Point: ~ ₹1,300 – ₹1,305

Weekly Resistance Levels:

R1: ~ ₹1,325 – ₹1,330

R2: ~ ₹1,350 – ₹1,360

R3: ~ ₹1,375+

Weekly Support Levels:

S1: ~ ₹1,275 – ₹1,280

S2: ~ ₹1,250 – ₹1,255

S3: ~ ₹1,225 – ₹1,220

(Classic pivot study — see weekly pivot table)

📈 Short Summary of Weekly Bias

Bullish scenario:

if the price sustains above weekly pivot (~₹1,300) and breaks above R1 (~₹1,330), momentum favors moves toward R2 (~₹1,350-1,360) and possibly R3 (~₹1,375) for the coming week.

Neutral / Range scenario:

Between ₹1,275 to ₹1,330, price tends to oscillate within the weekly range with no clear directional bias — traders watch pivot and R1/S1 zones.

Bearish scenario:

A break below S1 (~₹1,275) increases the risk of deeper probes toward S2 (~₹1,250) or S3 (~₹1,220) on the weekly chart.

📌 How to Use These Levels

1. Short-term traders (swing): Watch catalystsensing breaks above R1/R2 for bullish continuation setups or break below S1/S2 for bearish setups.

2. Position traders: Weekly pivot and 50/100 SMA clusters (around ₹1,300-₹1,340) act as key decision zones for holding or trimming positions.

TEJASNET 1 Month Time Frame 📊 Current Price Context (as of mid‑January 2026)

Tejas Networks is trading around ₹370‑₹375 on NSE/BSE.

The stock recently hit a 52‑week low near ₹364 after weak quarterly earnings and sales decline.

📉 Short‑Term Technical Levels (1‑Month View)

🔻 Immediate Support Zones

These are levels where the stock could find buyers or stall further declines:

₹366‑₹370 — current short‑term support (intraday pivot & recent low).

₹362‑₹366 — lower pivot/secondary intraday support.

~₹356‑₹362 — deeper support if momentum remains weak.

📈 Resistance Levels (Upside Hurdles)

For any bounce or recovery attempt:

₹377‑₹380 — near current pivot/resistance range.

~₹390‑₹395 — next resistance zone (prior price congestion).

₹405‑₹410+ — stronger resistance (short‑term target for recovery).

🧠 Trading/Price Action Tips (1‑month)

Bullish Scenario (countertrend bounce):

A break above ₹380‑₹390 with good volume could shift short‑term sentiment and target ₹405‑₹410+.

Bearish/Continued downtrend:

If support at ₹366‑₹370 breaks convincingly, the next zone near ₹362 then ₹356–₹360 becomes focus.

MMTC 1 Week Time Frame 📌 Current Price Snapshot

Latest traded price: ~₹71.5 – ₹72.7 on NSE today with strong intraday volatility. Daily high ~₹72.70 and low ~₹63.86.

This wide daily range suggests higher volatility this week — at least through the next few sessions.

📊 Short‑Term Weekly Levels

🔹 Resistance (Upside)

These are levels where price may face selling pressure or slow gains:

1. ₹72.5 – ₹73.0 — Immediate resistance area (today’s local high).

2. ₹75.0 – ₹76.0 — Next bullish pivot region if the stock holds above ₹72.5 (based on momentum models).

3. ₹78.0 – ₹80.0 — Stronger weekly upward pull target if bullish continuation holds.

👉 Closing above ₹75 on the weekly timeframe would indicate stronger short‑term bullish structure.

🔻 Support (Downside)

Levels where buyers may step in on pullbacks:

1. ₹66.0 – ₹67.0 — First dynamic support (near shorter moving averages).

2. ₹62.0 – ₹63.5 — Key lower support zone (recent daily lows).

3. ₹60.0 – ₹61.0 — Deeper weekly support — important to watch if breakdown accelerates.

👉 A break below ₹62 on weekly closes would weaken the bullish outlook and could open the door toward deeper supports.

📈 Technical Indicator Context

Technical breadth is largely bullish/momentum supportive:

📌 Moving Averages:

5, 10, 20, 50, 100, and 200‑day MAs all skew Buy — suggesting bullish trend alignment.

📌 RSI (14): ~65 — trending up but not yet extremely overbought.

📌 Stoch/RSI: Overbought on shorter timeframes — may hint at near‑term consolidation before higher breakout.

Summary: Momentum still skewed bullish overall, but short‑term traders should watch for near‑term pullbacks or consolidations due to overbought signals.

Nifty 50 1 Week Time Frame📌 Current Weekly Price (Live)

Nifty 50 approx ~25,730–25,740 (latest live level) — slight downside bias today.

📈 Weekly Resistance Levels (Upside)

1. 25,900 – 26,000 zone

• Immediate resistance above current price — key psychological barrier.

2. 26,100 – 26,200 zone

• Strong technical resistance (previous weekly highs & upper band).

3. 26,300+

• If breakout above 26,200 sustains, next upper resistance.

📉 Weekly Support Levels (Downside)

1. 25,600–25,650

• Near-term support from recent weekly structure.

2. 25,300–25,350

• Secondary support; zone where price has bounced previously on weekly charts.

3. 24,800–24,700

• Major structural support — breach here opens deeper correction risk.

📊 Weekly Technical Range to Watch

Neutral/Range-Bound View (Weekly):

⬆️ Bullish: Break & weekly close above 26,000–26,200

⬇️ Bearish: Break & close below 25,300–25,350

Between these levels, the index may consolidate before a clear directional move.

📌 Summary Weekly Levels (2026)

Resistance Zones

• 26,000 (key psychological)

• 26,100–26,200 (secondary)

• 26,300+ (extended)

Support Zones

• 25,600–25,650 (immediate)

• 25,300–25,350 (secondary)

• 24,800–24,700 (major)

REDINGTON 1 Week Time Frame 📌 Weekly Pivot‑Based Levels (from Moneycontrol weekly pivots)

(These are derived from weekly price action, giving support & resistance zones used by chart traders)

Resistance (Weekly)

R1: ~ ₹282.77

R2: ~ ₹289.23

R3: ~ ₹300.12

Pivot (Weekly Reference):

Pivot Point: ~ ₹271.88

Support (Weekly)

S1: ~ ₹265.42

S2: ~ ₹254.53

S3: ~ ₹248.07

📊 Interpretation:

Above ₹282–₹289 zone → broader weekly bullish bias if sustained toward ₹300+.

Below ₹265–₹271 pivot/support zone → weekly downside risk increases.

📊 Current Price Reference

NSE live price is trading around ~ ₹289–₹290+ on 8 Jan 2026.

📊 Summary – Key Weekly Levels to Watch

Level Price (Approx) Significance

Weekly Resistance 3 (R3) ₹300.12 Bullish breakout region

Weekly Resistance 2 (R2) ₹289.23 Near current price – short‑term hurdle

Weekly Resistance 1 (R1) ₹282.77 First weekly resistance

Weekly Pivot ₹271.88 Trend reference – bulls above

Weekly Support 1 (S1) ₹265.42 Key downside support

Weekly Support 2 (S2) ₹254.53 Deeper support

Weekly Support 3 (S3) ₹248.07 Extended downside support

📌 Bullish weekly bias is intact as long as price stays above the weekly pivot (~₹271‑₹272) and clears ₹282‑₹289 convincingly. Below ₹265, the next support zone becomes active.

WIPRO 1 Week Time Frame 🔎 Current Market Price

Approx Current Price: ~₹265–₹272 per share (latest trading range) — price moving around mid‑260s.

📅 1‑Week Timeframe Key Levels

🔥 Resistance (Upside Targets)

Level Meaning

R1: ~₹273.8 First Weekly Resistance — immediate upside ceiling.

R2: ~₹278.7 Higher Weekly Resistance — breakout level for more bullish momentum.

R3: ~₹285.0 Extended Resistance — major top zone for the week if breakout happens.

🛡 Support (Downside Floors)

Level Meaning

S1: ~₹262.7 Immediate Weekly Support — key near‑term buying zone.

S2: ~₹256.4 Secondary Support — next lower cushion if price weakens.

S3: ~₹251.6 Major Weekly Support — broad downside safety zone for this week.

➡️ Weekly Trading Range (expected): ~₹251.6 — ₹285.0 depending on strength and volatility.

📊 What This Implies

📈 Bullish Scenario

Above ~₹273.8: break past this zone could open room toward ~₹278–₹285 resistance.

Bullish continuation may be confirmed if the stock closes the week above ₹278–279.

📉 Bearish Scenario

Below ~₹262.7: breakdown under this support can expose deeper support at ~₹256 and further near ~₹251.6.

A weekly close lower than key supports suggests range continuation or mild negative bias.

CGPOWER 1 Day Time Frame📊 Daily Price Levels (1D Time Frame)

Current price range (recent session)

• Day’s trading range ~ ₹634–₹651 approx on NSE (latest close ~ ₹637–₹647) (as per recent data)

Pivot / Pivot‑based levels

• Daily Pivot: ~ ₹662 (central reference)

(use this as a neutral baseline — above favors bullish bias, below favors bearish bias)

Immediate Resistance

1️⃣ R1 ~ ₹665–₹668 (zone of immediate selling pressure)

2️⃣ R2 ~ ₹675–₹680 (next upside barrier)

3️⃣ Higher resistance (secondary) ~ ₹685–₹695+ (seen in other pivot data)

Immediate Support

1️⃣ S1 ~ ₹656–₹650 (first support zone)

2️⃣ S2 ~ ₹644–₹640 (next downside support)

3️⃣ S3 ~ ₹627–₹630 (deeper support)

📌 Interpretation (1‑Day)

If price holds above ₹656–₹650, the bias may stabilize and test ₹665–₹675 on the upside.

Break below ₹640–₹630 increases risk of further weakness in the short run.

Daily pivot at ~₹662 helps gauge short‑term trend — sustaining above it hints at short‑term buying interest, below it suggests continued pressure.

(These levels are typical pivot/sr zones used by traders; use live charts for exact current quotes.)

🧠 Extra Context (Technical Indicators)

Short‑term technical indicators (RSI & moving averages) have shown mixed to bearish signals recently, with several daily sell signals noted in external analysis.

Chart Patterns (Macro Structure + Psychology + Trading)Chart patterns arise over larger timeframes from the interaction of supply and demand. They help identify continuation or reversal of trends.

⭐ Advantages of Chart Patterns

Helps predict market direction – Shows whether price may continue or reverse.

Easy to understand visually – Patterns are simple shapes (triangles, flags, head & shoulders).

Gives clear entry and exit points – Breakouts and breakdowns guide trading decisions.

Works on all timeframes – Useful for intraday, swing, and long-term trading.

Useful for trend analysis – Helps identify strong or weak trends.

Improves accuracy when combined with volume – Volume confirms true breakouts.

MCX 1 Day Time Frame 📌 MCX Latest Daily Price Snapshot

Approx. Last Traded Price: ~₹10,172 – ₹10,307 range (recent sessions)

Today’s Intraday Range: ~₹10,181 – ₹10,365 (approx)

52‑Week High: ~₹10,847 and 52‑Week Low ~₹4,408

📊 Daily Time‑Frame Levels (1D)

🔹 Pivot Point

Daily Pivot: ~₹10,386 – ₹10,442 zone (central reference)

🔸 Resistance Levels

R1: ~₹10,519 – ₹10,600

R2: ~₹10,596 – ₹10,650

R3: ~₹10,729 – ₹10,800

These levels act as potential upside barriers on daily closes. A sustained breakout above R1/R2 suggests strength into the next resistance zone.

🔻 Support Levels

S1: ~₹10,309 – ₹10,300

S2: ~₹10,176 – ₹10,170

S3: ~₹10,020 – ₹9,993

If price breaks below S1/S2 on daily close, deeper support may be tested near S3.

📈 Trend & Technical Tone

Technical indicators on daily charts signal a bullish bias / strong buy on daily based on moving averages and buy signals vs. sell signals.

📊 How to Use These Levels (1‑Day)

Bullish View

Long/buy setups near S1‑S2 with targets around R1‑R

A breakout above R2 could extend toward R3

Bearish/Correction View

Failure at R1/R2 with reversal momentum could target S1/S2

JAINREC 1 Day Time Frame 📌 Latest price context:

• The stock has been trading around ₹400–₹410 in recent sessions (range today ~396.5–409) with latest close near ₹401.30.

📊 Daily Technical Levels (Approximations)

🔵 Resistance Levels

R1: ~₹418–₹420 — 1st key upside hurdle — pay attention for breakout.

R2: ~₹425–₹430 — Secondary resistance at previous reaction highs.

R3: ~₹435–₹440+ — Strong supply zone from past tops/52‑wk range.

🔴 Support Levels

S1: ~₹400–₹401 — Immediate floor pivot area around current price.

S2: ~₹390–₹392 — Near short‑term support from recent pullbacks.

S3: ~₹383–₹385 — Deeper support zone below recent correction lows.

S4: ~₹370–₹375 — Major support if price loses the current range.

📍 Daily Pivot (approx)

• Pivot ~ ₹400–₹402 — Price around this level gives neutral bias until breakout.

PFC 1 Day Time Frame 📊 Daily Pivot Levels

Pivot Point (Daily): ~₹343.00–₹343.30

Central Pivot (CPR):

• Top: ₹343.60

• Mid: ₹343.00

• Bottom: ₹342.40

📈 Resistance Levels (Daily)

R1: ~₹344–₹346

R2: ~₹347–₹348

R3: ~₹350–₹351

📉 Support Levels (Daily)

S1: ~₹338–₹341 (minor support)

S2: ~₹335–₹337

S3: ~₹332–₹334

🔍 Intraday Range to Watch

Near‑term range: ₹337–₹354, with crucial rejection/resume zones at ~₹337 (support) and ~₹352–₹354 (upper resistance).

📌 How to Use These Levels

Bullish breakout: Sustained close above the pivot ~₹343 with volume could target R1 → R2 (~₹347–₹350).

Bearish continuation: Failure below S1 (~₹338–₹341) increases odds of a drop toward S2/S3 (~₹335 / ₹332).

Pivot flips: Pivot pivots often act as support if price stays above, and as resistance if below.

RIL 1 Day Time Frame 📊 Current Price Context (approx):

RIL is trading near ₹1,540 – ₹1,550 intraday range today.

📈 1‑Day Resistance Levels

These are levels where the stock may face selling pressure or pause on the upside:

Intraday Daily Resistances (Pivots & Speed Levels):

R1: ~₹1,549 – ₹1,550

R2: ~₹1,557 – ₹1,557

R3: ~₹1,562 – ₹1,563

(above current price)

Extended intraday pivot R4 (if breakout):

~₹1,570+ (from broader pivot series)

📉 1‑Day Support Levels

Key levels where buyers may step in on dips:

Intraday Daily Supports:

S1: ~₹1,536 – ₹1,537

S2: ~₹1,531 – ₹1,532

S3: ~₹1,523 – ₹1,524

(below current price)

Weekly pivot support band (if selling accelerates):

Around ₹1,531 – ₹1,505+ (broader support zone)