ABSLAMC – Price at a Critical Support Inside a Falling ChannelThe stock has been moving within a clear falling channel, showing a controlled downtrend over time.

Every attempt to move higher has faced rejection near the upper trendline, keeping the overall structure weak.

Recently, price bounced from the lower channel and moved up, but once again got rejected near resistance and is now back near an important support zone.

This level is crucial because buyers have previously reacted from this area.

👉 If the support holds and price stabilizes, a short-term bounce toward the upper channel is possible.

👉 If this support breaks decisively, it could open the door for further downside continuation within the trend.

For now, this is a key decision zone — watching how price behaves here will give the next directional clue.

Chart Patterns

Part 1 Candle Stick Pattern Call Options Explained

A Call Option gives the buyer the right to buy the underlying asset at a specified strike price before or at expiry.

Example:

Stock price: ₹100

Call strike price: ₹105

Expiry: 1 month

Premium paid: ₹3

If the stock rises to ₹115:

Intrinsic value = ₹10

Profit = ₹10 − ₹3 = ₹7

If the stock stays below ₹105:

Option expires worthless

Maximum loss = premium paid (₹3)

Use Cases:

Bullish market view

Leverage with limited downside

Substitute for stock ownership

DCM Shriram Approaches Long-Term Support – Reaction Zone AheadDCM Shriram continues to trade within a well-defined long-term rising channel, respecting higher highs and higher lows over time. Each major rally has been followed by a healthy pullback toward the lower trendline, where buyers have consistently stepped in to defend the trend.

The current move is another structural retracement, not a random sell-off. Price has now returned to the channel’s base — a zone that has previously acted as strong demand and launched multiple upside swings.

This area becomes a crucial reaction zone:

• If price holds and stabilizes here, it keeps the broader uptrend intact and opens room for another move toward the upper boundary of the channel.

• A decisive breakdown below the channel would signal weakening structure and potential trend shift.

Volume behavior also supports a corrective phase, with stronger participation during rallies and lighter activity during pullbacks — typical of healthy trending markets.

For now, patience is key. Let the market show its hand at this support instead of predicting the next move.

Structure will always speak louder than short-term noise.

NIFTY Update Last Support 24500NSE:NIFTY

previously i posted nifty analysis but that became trap

nifty is stand near to support clusters.

there are no pullback in current down trend so pullback can also possibly and that pullback become breakout rally but this is possibility. pullback also continue the down rally that also possibility.

last support is 24500

this is not a any types of advice.

this is a just chart analysis and that can be wrong.

do your own research.

PAYTM KARO ONE97 COMMUNICATIONS NSE:PAYTM

Paytm karo varna stock ko niche karo 😅😅

Paytm take strong resistance from his major resistance and also do classical pattern consolidation after breaking down that is double confirmation for trend direction.

now, 1000 is major support

this is not a any types of advice.

this is just chart analysis

do your own research

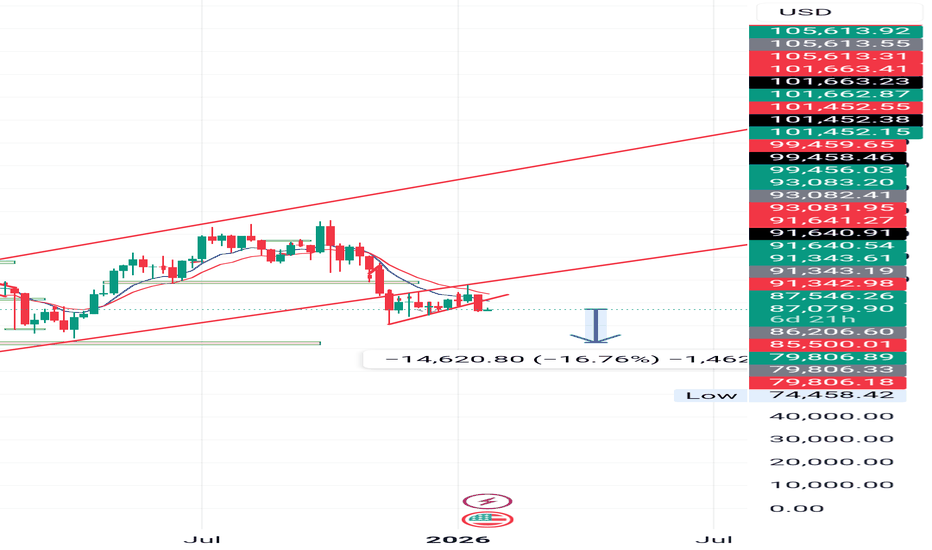

$TVC:SILVER MOON MISSION:2025-29 is History Repeating Again? TP?🚀 Silver Feature Analysis 2026 – 2029: The Historical Repeat 🚀

TVC:SILVER has recently hit its All-Time High (ATH) three times in history with massive rallies. My analysis is based on the duration and percentage returns of these specific periods:

1️⃣ 1980: (1 Aug 1979 to 29 Jan 1980) – A 6-month rally with returns OVER 511% ($6.5 to $48). 📈

2️⃣ 2011: (1 Oct 2008 to 22 Apr 2011) – A 2y 6m 21 days rally with returns OVER 451% ($8.4 to $47.91). 📈

3️⃣ 2021: (2 Mar 2020 to 10 Feb 2021) – An 11m 8 days rally from $11.63 to $30.09. 📈

🔍 The Current Assumption 🔍

The ongoing rally started on 3 Feb 2025 and is continuing to the present day. Based on price action, silver has been manipulated many times (like in 1980, 2011, and 2021), and I expect this to happen again in the upcoming years of 2028-2029. ⚠️

🎯 Near-Term Goal: This rally is projected to go up to $119 – $129.88. 🔄 The Reversal: After hitting those levels, I anticipate a small reversal back to the $102 – $105 per ounce range. 📉 ⚡ The Final Leg: In Sep 2026 to Nov 2026, we could see a continuation, eventually reaching levels of $179 – $185 in the year 2028-2029 as silver repeats its historic data! 🚀🔥

📑 Key Support & Resistance Levels 📑

Based on the cycles, here are the critical levels to watch:

Year Support Resistance

1979-80 $6.5 $48

2008-11 $8 $47.91

2020-21 $11.63 $30.09

2025-28 $30.97 🟢 $129 - $169 🔴

2025-29 $79 - $86 🟢 $110 - $119 🔴

📊 Technical Snapshot (Current Stats) 📊

🟢 Trend: BULLISH (MTF Trend) 💪 ADX: 44.3 (Strong Trend Energy) 🔥 RSI: 94.5 (Extreme Momentum - Use Caution) ✅ Trade Mode: 🟢 LONG ONLY TILL RESISTANCE 🟢 🎯 Target Projection: Rally expected till the $129.44 level.

💡 Conclusion 💡

History is repeating! 🔁 After the accumulation that started on 03 Feb 2025, silver is on a path to mirror its 1980 and 2011 performance. Watch the $129 level closely for the first major milestone. 🏁💎

⚠️ RISK WARNING & DISCLAIMER ⚠️

This analysis is for educational and informational purposes only. Trading precious metals involves high risk. The projections mentioned (such as the $129 and $185 targets) are based on historical fractal data and current technical indicators, but market conditions can change due to global economic factors. Always do your own research (DYOR) and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results. 🛑

USDCHF trading above Decisive zoneThe USDCHF is currently at a critical "decision zone" after a period of significant volatility. Following a sharp decline earlier this week, price action is now signaling a potential shift in momentum.

1. Key Support Validation

The pair successfully tested a major support zone near 0.7870 – 0.7880. This area is historically significant (acting as a base for major rallies in late 2025) and has once again triggered a strong "buy the dip" response. The rejection at these lows suggests that the bears are losing steam at these psychological levels.

2. Rising Channel Formation

On the lower timeframes (15m), we are observing a Junior Ascending Channel.

The Structure: Price is carving out higher highs and higher lows, respecting the lower trendline of this corrective channel.

The Sentiment: This indicates a steady accumulation by bulls, though it remains a "corrective" move within a larger bearish trend.

3. The "Decision Zone" Strategy

The pair is currently approaching a confluence of resistance. For a sustained reversal, traders should watch the following:

Bullish Breakout: A clean break and hold above the 0.7920 resistance zone would confirm the recovery and target 0.7960.

Bearish Continuation: If the price fails at the upper boundary of the rising channel, we could see a "Bear Flag" play out, leading to a retest of the recent 0.7878 lows.

NASDAQ bullish bias on HTF and ITFThe price is currently reacting to THE DAILY FAIR VALUE GAP , which is a good confluence for bullish and long clarity, as the dollar continues to freefall , we can consider the relative strength between the index and the currency to support our long idea.

The closest target would be the recents 4 hour highs.

Wait until 9:30 openin for any manipulation to frame our trade.

Invalidation :- closing below the (dfvg)

Intraday Institutiona TradingWhat Is an Option?

An option is a derivative contract whose value is derived from an underlying asset such as a stock, index, commodity, or currency.

Each option contract gives:

The buyer the right (not obligation)

The seller (writer) the obligation

to transact the underlying asset at a fixed price (strike price) on or before a specified date (expiry).

Key Types of Options

Call Option

Put Option

USDINR at Key Resistance – Break or Rejection?USDINR is currently trading near the upper boundary of a well-defined rising channel — a zone where price has historically faced strong rejection and profit booking.

This rally has been structural, not random. Price has respected the channel multiple times, creating higher highs and higher lows, showing steady demand for dollars over the rupee. However, every strong trend eventually meets a decision zone — and this upper band is one of them.

What makes this level more important is the timing.

The Union Budget is approaching — an event that directly impacts fiscal deficit, foreign flows, inflation expectations, and overall confidence in the Indian economy. Historically, such macro events act as catalysts, increasing volatility in USDINR and often triggering major reactions from key technical levels.

At this stage, USDINR is not about prediction — it’s about reaction.

• A sustained move and acceptance above this resistance zone could signal continuation of the bullish structure with momentum.

• A sharp rejection from here would indicate profit booking and a possible pullback toward the channel support.

In trending markets, price usually respects structure first — news simply accelerates the move.

Right now, structure is stretched, and sentiment is waiting for a trigger.

This zone will decide whether USDINR expands higher or breathes before the next leg.

Patience and price behavior near resistance will reveal the real story.

Intraday Institutiona Trading Introduction to Option Trading

Option trading is a sophisticated financial strategy that allows investors and traders to buy or sell the right—but not the obligation—to trade an underlying asset at a predetermined price within a specific time period. Unlike traditional stock trading, where profits depend primarily on price movement direction, option trading enables participants to profit from price movement, volatility, time decay, and even stagnation.

Options are widely used across global financial markets, including equities, indices, commodities, currencies, and cryptocurrencies. They serve multiple purposes: hedging risk, generating income, speculation, and portfolio optimization.

While option trading can offer high reward potential, it also carries complexity and risk. A deep understanding of its mechanics is essential before participating actively.

HDFC Bank Price Action Analysis for Feb-Mar 2026Analysis date: 26-Jan-26

HDFC Bank seems to have struggled at 990 levels before finally giving in Jan 2026 closing below 950 supportwhich it was holding since June 2025

Next support is likely to be near 875 levels as shown on the chart. Sell on rise strategy till it reaches 875-850 levels.

Keep 1000 as SL

Happy Trading!

Nifty weekly price action analysis for Feb-Mar 2026Analysis Date: 26-Jan-26

Happy Republic Day to all.

After making all time high at 26373 Nifty has nosedived and broken 2 trendlines within couple of weeks. 26000 and 25250 were major support trendlines. Nifty has given a close below the 25250 trendline which confirms downtrend has just begun.

It may go down to 23000 levels soon.

The best area to sell Nifty is 25500 levels for target 24500 and 23000. Keeping SL at 25700. Refer chart for price action analysis

Happy Trading!

MPHASIS – Tight Structure Building Before the Next MoveMPHASIS is currently trading inside a well-defined triangle structure, where price is making lower highs and higher lows.

This clearly shows that the market is moving into a compression phase, with buyers and sellers gradually pushing price into a narrower range. Instead of trending strongly in one direction, the stock is taking time to build energy.

The upper trendline continues to act as resistance, while the rising base is providing consistent support. As price moves closer to the end of this structure, a strong directional move is usually expected.

At this stage, the focus is not on predicting the move, but on waiting for confirmation.

👉 A strong close above resistance may signal upside continuation.

👉 A clear break below support could invite further downside.

Until then, patience is key.

Let price decide the direction — structure only shows that a move is coming.

XAUUSD – Weekend Geopolitical Shock → GAP & Continuation Market Context (Why the GAP?)

Over the weekend, geopolitical tensions escalated sharply, triggering a strong risk-off reaction at the start of the week.

Typical market response:

Capital rotates out of risk assets

USD softens amid uncertainty

Gold opens with a bullish GAP on Monday and continues higher

This is not a low-liquidity weekend GAP, but a safe-haven driven GAP, which historically does not need to be filled immediately.

HTF Structure (H1–H4)

Overall structure remains clearly bullish

Multiple bullish BOS are still intact

The latest impulse created a large FVG above equilibrium

Current pullback is technical rebalancing, not a trend reversal

➡️ Market behavior: Impulse → Pullback → Continuation

Key Zones for the Week

Upper FVG / reaction zone: 5,020 – 5,000

Mid FVG (decision zone): 4,988 – 4,960

Lower FVG / strong support: 4,960 – 4,940

HTF Order Block: around 4,910 – 4,900

As long as price holds above 4,960, the bullish structure remains valid.

Weekly Scenarios (If – Then)

Scenario 1 – Shallow Pullback & Continuation (Primary Bias)

If price pulls back into 4,988 – 4,960 and shows bullish reaction

FVG is respected → trend continuation

Next upside objectives: 5,040 – 5,080

Scenario 2 – Deeper Pullback (Still Corrective)

If price loses 4,960

Expect a deeper retracement toward 4,940 – 4,910 for rebalancing

Only a confirmed H1/H4 close below 4,900 would weaken the bullish structure

Summary

The Monday GAP reflects real defensive capital flows, not technical noise.

With geopolitical risks still elevated, buy-the-dip remains the dominant strategy.

No chasing highs.

No FOMO after the GAP.

Trade the pullback.

React at FVG.

Let structure confirm continuation.

XAUUSD – H1 Outlook: New All-Time HighXAUUSD – H1 Outlook: New ATH, Now Watch the Pullback Structure | Lana ✨

Gold has printed fresh all-time highs and is now trading near the $5,100 psychological area. After six consecutive bullish sessions, the trend is still strong — but at these levels, the market often needs a controlled pullback to rebalance liquidity before the next expansion.

📌 Quick Summary

Trend: Bullish (strong momentum, new ATH)

Timeframe: H1

Focus: Don’t chase highs → wait for pullback into structure

Key idea: Pullback → hold support → continuation toward upper supply

📈 Market Structure & Price Action

Price is moving inside a bullish expansion leg, and the current area is a typical “extended” zone where volatility can increase.

A pullback toward the first clean structural support is healthy and often needed after a steep rally.

As long as price holds above key supports, the bias remains continuation, not reversal.

🔍 Key Zones From the Chart

1) Upper Supply / Profit-taking Area

5100–5130 (approx.)

This is the area where price is likely to face selling pressure / profit-taking, especially after a vertical rally.

2) Primary Support (Pullback Buy Zone)

5000–5020

This is the most important “structure retest” area on the chart — a logical zone for price to rebalance before continuation.

3) Deeper Value Zone (If Pullback Extends)

4750–4800 (Fibo value cluster on chart)

If the market pulls deeper, this becomes the more attractive value zone to watch for stronger reactions.

4) Major Demand Zone (Extreme Support)

4590–4630 (lower purple demand area)

This is a deeper base zone if the market shifts into a larger correction.

🎯 Trading Scenarios (Structure-Based)

✅ Scenario A (Primary): Buy the Pullback Into Structure

Buy Entry: 5005 – 5015

SL: 4995 – 5000 (8–10 points below entry)

TP Targets (scale out):

TP1: 5065 – 5075 (retest of recent high)

TP2: 5100 (psychological milestone)

TP3: 5125 – 5135 (upper supply / extension zone)

TP4: 5150+ (if breakout accepts)

Idea: Let price come back to support, confirm, then ride the trend — no chasing.

✅ Scenario B (Alternative): Deeper Pullback Into Value

If price fails to hold 5000–5020 and dips deeper:

Buy Entry: 4760 – 4790

SL: 4750 – 4755

TP Targets:

TP1: 4900

TP2: 5000

TP3: 5100

TP4: 5125 – 5135

🌍 Macro Context (Short & Relevant)

Gold’s upside momentum is being supported by:

Safe-haven flows amid ongoing geopolitical and trade uncertainty

Expectations of further Fed easing

Continued central bank buying

Strong inflows into ETFs

This backdrop helps explain why pullbacks are more likely to be profit-taking and positioning, not a structural trend change.

✨ Lana’s View

Gold is bullish — but the best trades usually come from patience, not excitement.

At ATH levels, Lana prefers buying pullbacks into structure, scaling out into targets, and letting the market do the work.

#ETH one final hope?

One last hope for a bounce back.

If the price fails to break and hold above $3050, then we may see a downside move. The direction is still not clear.

Disclaimer:

This idea is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from the use of this indicator.

Trading and investing involve risk. Always do your own analysis and use proper risk management.

XAUUSD - ATH confirmed, buy pullbacks to 5,100+Gold continues to trade in a strong ATH expansion phase, not a blow-off move. The latest impulsive rally confirms that buyers remain in control, while pullbacks are being absorbed quickly and efficiently. On the macro side, USD weakness persists, safe-haven flows remain active, and the market still prices only modest Fed easing — a combination that continues to support gold at elevated levels.

At this stage, ATHs are no longer resistance — they are areas of acceptance.

Structure & Price Action

Bullish structure remains intact with clear Higher Highs – Higher Lows.

No bearish CHoCH has formed despite the sharp upside extension.

Current consolidation near the highs suggests continuation, not exhaustion.

Pullbacks are corrective and aligned with the ascending trendline and demand zones.

Key insight: ATH is being defended by structure → trend continuation remains the primary bias.

Trading Plan – MMF Style

Primary Scenario – Buy the Pullback Focus on patience, not chasing price.

BUY Zone 1: 4,984 – 4,970 (Former resistance turned demand + short-term rebalancing)

BUY Zone 2: 4,928 – 4,910 (Trendline confluence + deeper liquidity absorption)

➡️ Only execute BUYs after clear bullish reaction and structure confirmation. ➡️ Avoid FOMO at the highs.

Upside Targets (ATH Extension):

TP1: 5,085

TP2: 5,120+ (extension if momentum sustains)

Alternative Scenario If price holds above 5,085 without a meaningful pullback, wait for a break & retest before looking for continuation BUYs.

Invalidation A confirmed H1 close below 4,910 would weaken the current bullish structure and require reassessment.

Summary Gold remains in a controlled ATH expansion, supported by both structure and macro flow. The edge is not predicting the top, but buying pullbacks into demand while the trend is intact. As long as structure holds, higher prices remain the path of least resistance.