MPHASIS – Tight Structure Building Before the Next MoveMPHASIS is currently trading inside a well-defined triangle structure, where price is making lower highs and higher lows.

This clearly shows that the market is moving into a compression phase, with buyers and sellers gradually pushing price into a narrower range. Instead of trending strongly in one direction, the stock is taking time to build energy.

The upper trendline continues to act as resistance, while the rising base is providing consistent support. As price moves closer to the end of this structure, a strong directional move is usually expected.

At this stage, the focus is not on predicting the move, but on waiting for confirmation.

👉 A strong close above resistance may signal upside continuation.

👉 A clear break below support could invite further downside.

Until then, patience is key.

Let price decide the direction — structure only shows that a move is coming.

Chart Patterns

XAUUSD – Weekend Geopolitical Shock → GAP & Continuation Market Context (Why the GAP?)

Over the weekend, geopolitical tensions escalated sharply, triggering a strong risk-off reaction at the start of the week.

Typical market response:

Capital rotates out of risk assets

USD softens amid uncertainty

Gold opens with a bullish GAP on Monday and continues higher

This is not a low-liquidity weekend GAP, but a safe-haven driven GAP, which historically does not need to be filled immediately.

HTF Structure (H1–H4)

Overall structure remains clearly bullish

Multiple bullish BOS are still intact

The latest impulse created a large FVG above equilibrium

Current pullback is technical rebalancing, not a trend reversal

➡️ Market behavior: Impulse → Pullback → Continuation

Key Zones for the Week

Upper FVG / reaction zone: 5,020 – 5,000

Mid FVG (decision zone): 4,988 – 4,960

Lower FVG / strong support: 4,960 – 4,940

HTF Order Block: around 4,910 – 4,900

As long as price holds above 4,960, the bullish structure remains valid.

Weekly Scenarios (If – Then)

Scenario 1 – Shallow Pullback & Continuation (Primary Bias)

If price pulls back into 4,988 – 4,960 and shows bullish reaction

FVG is respected → trend continuation

Next upside objectives: 5,040 – 5,080

Scenario 2 – Deeper Pullback (Still Corrective)

If price loses 4,960

Expect a deeper retracement toward 4,940 – 4,910 for rebalancing

Only a confirmed H1/H4 close below 4,900 would weaken the bullish structure

Summary

The Monday GAP reflects real defensive capital flows, not technical noise.

With geopolitical risks still elevated, buy-the-dip remains the dominant strategy.

No chasing highs.

No FOMO after the GAP.

Trade the pullback.

React at FVG.

Let structure confirm continuation.

XAUUSD – H1 Outlook: New All-Time HighXAUUSD – H1 Outlook: New ATH, Now Watch the Pullback Structure | Lana ✨

Gold has printed fresh all-time highs and is now trading near the $5,100 psychological area. After six consecutive bullish sessions, the trend is still strong — but at these levels, the market often needs a controlled pullback to rebalance liquidity before the next expansion.

📌 Quick Summary

Trend: Bullish (strong momentum, new ATH)

Timeframe: H1

Focus: Don’t chase highs → wait for pullback into structure

Key idea: Pullback → hold support → continuation toward upper supply

📈 Market Structure & Price Action

Price is moving inside a bullish expansion leg, and the current area is a typical “extended” zone where volatility can increase.

A pullback toward the first clean structural support is healthy and often needed after a steep rally.

As long as price holds above key supports, the bias remains continuation, not reversal.

🔍 Key Zones From the Chart

1) Upper Supply / Profit-taking Area

5100–5130 (approx.)

This is the area where price is likely to face selling pressure / profit-taking, especially after a vertical rally.

2) Primary Support (Pullback Buy Zone)

5000–5020

This is the most important “structure retest” area on the chart — a logical zone for price to rebalance before continuation.

3) Deeper Value Zone (If Pullback Extends)

4750–4800 (Fibo value cluster on chart)

If the market pulls deeper, this becomes the more attractive value zone to watch for stronger reactions.

4) Major Demand Zone (Extreme Support)

4590–4630 (lower purple demand area)

This is a deeper base zone if the market shifts into a larger correction.

🎯 Trading Scenarios (Structure-Based)

✅ Scenario A (Primary): Buy the Pullback Into Structure

Buy Entry: 5005 – 5015

SL: 4995 – 5000 (8–10 points below entry)

TP Targets (scale out):

TP1: 5065 – 5075 (retest of recent high)

TP2: 5100 (psychological milestone)

TP3: 5125 – 5135 (upper supply / extension zone)

TP4: 5150+ (if breakout accepts)

Idea: Let price come back to support, confirm, then ride the trend — no chasing.

✅ Scenario B (Alternative): Deeper Pullback Into Value

If price fails to hold 5000–5020 and dips deeper:

Buy Entry: 4760 – 4790

SL: 4750 – 4755

TP Targets:

TP1: 4900

TP2: 5000

TP3: 5100

TP4: 5125 – 5135

🌍 Macro Context (Short & Relevant)

Gold’s upside momentum is being supported by:

Safe-haven flows amid ongoing geopolitical and trade uncertainty

Expectations of further Fed easing

Continued central bank buying

Strong inflows into ETFs

This backdrop helps explain why pullbacks are more likely to be profit-taking and positioning, not a structural trend change.

✨ Lana’s View

Gold is bullish — but the best trades usually come from patience, not excitement.

At ATH levels, Lana prefers buying pullbacks into structure, scaling out into targets, and letting the market do the work.

#ETH one final hope?

One last hope for a bounce back.

If the price fails to break and hold above $3050, then we may see a downside move. The direction is still not clear.

Disclaimer:

This idea is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from the use of this indicator.

Trading and investing involve risk. Always do your own analysis and use proper risk management.

XAUUSD - ATH confirmed, buy pullbacks to 5,100+Gold continues to trade in a strong ATH expansion phase, not a blow-off move. The latest impulsive rally confirms that buyers remain in control, while pullbacks are being absorbed quickly and efficiently. On the macro side, USD weakness persists, safe-haven flows remain active, and the market still prices only modest Fed easing — a combination that continues to support gold at elevated levels.

At this stage, ATHs are no longer resistance — they are areas of acceptance.

Structure & Price Action

Bullish structure remains intact with clear Higher Highs – Higher Lows.

No bearish CHoCH has formed despite the sharp upside extension.

Current consolidation near the highs suggests continuation, not exhaustion.

Pullbacks are corrective and aligned with the ascending trendline and demand zones.

Key insight: ATH is being defended by structure → trend continuation remains the primary bias.

Trading Plan – MMF Style

Primary Scenario – Buy the Pullback Focus on patience, not chasing price.

BUY Zone 1: 4,984 – 4,970 (Former resistance turned demand + short-term rebalancing)

BUY Zone 2: 4,928 – 4,910 (Trendline confluence + deeper liquidity absorption)

➡️ Only execute BUYs after clear bullish reaction and structure confirmation. ➡️ Avoid FOMO at the highs.

Upside Targets (ATH Extension):

TP1: 5,085

TP2: 5,120+ (extension if momentum sustains)

Alternative Scenario If price holds above 5,085 without a meaningful pullback, wait for a break & retest before looking for continuation BUYs.

Invalidation A confirmed H1 close below 4,910 would weaken the current bullish structure and require reassessment.

Summary Gold remains in a controlled ATH expansion, supported by both structure and macro flow. The edge is not predicting the top, but buying pullbacks into demand while the trend is intact. As long as structure holds, higher prices remain the path of least resistance.

HTF Bullish Context: Buy the Pullback, Not the Market Context

Gold remains in a strong higher-timeframe bullish structure.

Momentum is driven by sustained risk-off flows and persistent demand for safe-haven assets.

In this environment, pullbacks are opportunities, not signs of reversal.

Technical Structure (HTF → LTF Alignment)

Price previously confirmed a BOS (Break of Structure) to the upside.

The latest impulsive leg created a clear bullish FVG.

Current price is consolidating below 4,953, signaling a corrective pullback, not distribution.

Structure remains intact as long as price holds above the key demand zone.

Key Levels (Decision Zones)

Current high: 4,953

Discount pullback zone (FVG): 4,906 – 4,887

Deep support / structure low: 4,810

Upside projection (1.618): 5,061

Scenarios (If – Then)

Primary Scenario – Bullish Continuation

If price reacts and holds above 4,900

FVG is respected → continuation toward 4,953, extension to 5,061

Alternative Scenario – Deeper Pullback

If price loses 4,900

Expect a deeper retracement toward 4,810

Structure remains bullish unless HTF closes below 4,810

Summary

This is a trend continuation environment.

Chasing highs carries poor risk-reward.

Buy the pullback.

Respect the FVG.

Let structure do the work.

XAUUSD – Monday Focus: Buy the Dip Toward 5,020–5,043Market Context

Gold remains firmly supported by a bullish risk environment. The recent impulse leg confirms that buyers are still in control, while pullbacks are being absorbed rather than extended.

This is continuation behavior, not distribution.

The question for Monday is not if Gold is bullish —

but where the dip becomes opportunity.

Technical Structure (H1)

Market has already confirmed bullish BOS

Strong impulsive leg created multiple stacked FVGs below

Current price is consolidating above structure, not breaking it

Pullback is corrective in nature

This is a classic impulse → retracement → continuation setup.

Key Zones to Watch

Immediate resistance / BOS level: 4,969 – 4,970

Intraday BUY zone: 4,933 – 4,940

Upper FVG support: 4,920 – 4,899

Deeper demand (HTF): 4,860 – 4,880

As long as price holds above the upper FVG, bullish bias remains intact.

Scenarios (If – Then)

Scenario 1 – Bullish Continuation (Primary)

If price pulls back into 4,933 – 4,940 and holds

Buyers step in → continuation toward:

5,020

5,043 (1.618 extension)

Scenario 2 – Deeper Pullback (Alternative)

If price loses 4,933

Expect mitigation toward 4,920 – 4,899

Only a sustained H1 close below 4,899 would weaken the bullish structure

Summary

Gold is not overextended — it is rebalancing within a bullish trend.

The structure favors buying pullbacks, not chasing highs.

This is a dip-buying market until structure says otherwise.

Gold Trend and Scalping Strategy for 26th january 2026🟡 GOLD TRADING PLAN (Intraday)

📈 TREND TRADING STRATEGY

🔔 BUY SETUP

💲 Buy Above: High of 30-minute candle

📌 Condition: Candle must close above 5019

🎯 Targets:

Target 1: 5029

Target 2: 5039

Target 3: 5049

🛑 Stop Loss:

Below the 30-minute candle low or as per your risk management

📊 Logic:

Sustained price action above 5019 confirms bullish momentum

Suitable for trend-following traders

🔔 SELL SETUP

💲 Sell Below: Low of 1-hour candle

📌 Condition: Candle must close below 4963

🎯 Targets:

Target 1: 4953

Target 2: 4943

Target 3: 4933

🛑 Stop Loss:

Above the 1-hour candle high

📊 Logic:

Breakdown below 4963 confirms bearish continuation

Ideal for positional intraday trend trades

⚡ SCALPING STRATEGY

🔻 SCALPING SELL

📌 Area: Around 5019 resistance zone

🔔 Entry Rule:

Price moves near 5019,

15-minute candle gets rejected (wick / strong selling pressure),

Sell below the low of the rejected 15-min candle

🛑 Stop Loss:

Above the high of the rejected candle

🎯 Profit Booking:

5 to 10 points, OR

Trail stop loss for extended move

📊 Logic:

5019 acts as a strong supply zone

Best for quick momentum scalps

🔺 SCALPING BUY

📌 Area: Around 4963 support zone

🔔 Entry Rule:

Price approaches 4963,

15-minute candle shows rejection / buying support,

Buy above the high of the rejected candle

🛑 Stop Loss:

Below the low of the rejected candle

🎯 Profit Booking:

5 to 10 points, OR

Trail stop loss

📊 Logic:

4963 acts as a demand zone

Suitable for support-based scalping

⚠️ DISCLAIMER

🚫 This content is only for educational purposes

🚫 Not a buy/sell recommendation

🚫 Trading involves high risk

🚫 Please consult your financial advisor before trading

🚫 Trade strictly with proper risk management

Gold Trend and Scalping Strategy for 26th January 2026🟡 GOLD TRADING PLAN (Intraday)

📈 TREND TRADING STRATEGY

🔔 BUY SETUP

💲 Buy Above: High of 30-minute candle

📌 Condition: Candle must close above 5019

🎯 Targets:

Target 1: 5029

Target 2: 5039

Target 3: 5049

🛑 Stop Loss:

Below the 30-minute candle low or as per your risk management

📊 Logic:

Sustained price action above 5019 confirms bullish momentum

Suitable for trend-following traders

🔔 SELL SETUP

💲 Sell Below: Low of 1-hour candle

📌 Condition: Candle must close below 4963

🎯 Targets:

Target 1: 4953

Target 2: 4943

Target 3: 4933

🛑 Stop Loss:

Above the 1-hour candle high

📊 Logic:

Breakdown below 4963 confirms bearish continuation

Ideal for positional intraday trend trades

⚡ SCALPING STRATEGY

🔻 SCALPING SELL

📌 Area: Around 5019 resistance zone

🔔 Entry Rule:

Price moves near 5019,

15-minute candle gets rejected (wick / strong selling pressure),

Sell below the low of the rejected 15-min candle

🛑 Stop Loss:

Above the high of the rejected candle

🎯 Profit Booking:

5 to 10 points, OR

Trail stop loss for extended move

📊 Logic:

5019 acts as a strong supply zone

Best for quick momentum scalps

🔺 SCALPING BUY

📌 Area: Around 4963 support zone

🔔 Entry Rule:

Price approaches 4963,

15-minute candle shows rejection / buying support,

Buy above the high of the rejected candle

🛑 Stop Loss:

Below the low of the rejected candle

🎯 Profit Booking:

5 to 10 points, OR

Trail stop loss

📊 Logic:

4963 acts as a demand zone

Suitable for support-based scalping

⚠️ DISCLAIMER

🚫 This content is only for educational purposes

🚫 Not a buy/sell recommendation

🚫 Trading involves high risk

🚫 Please consult your financial advisor before trading

🚫 Trade strictly with proper risk management

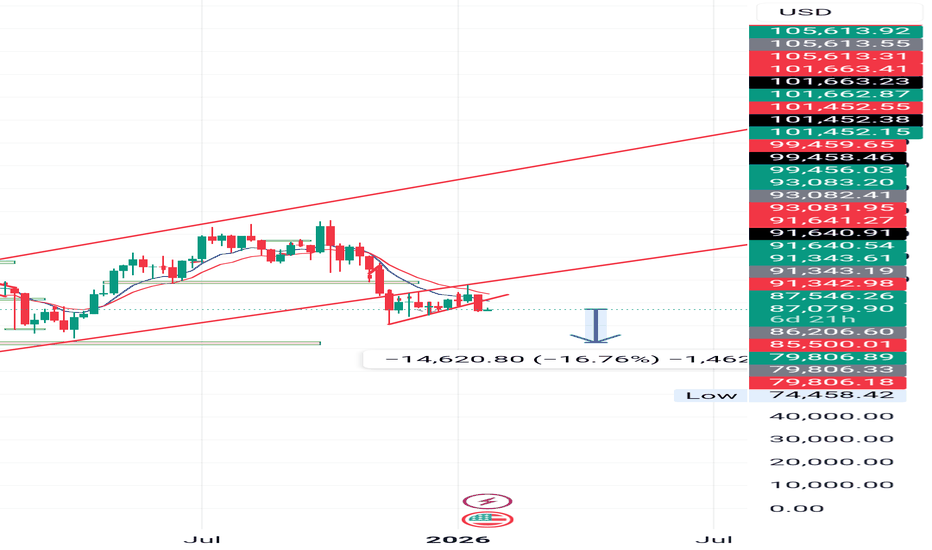

BTCUSDT | Elliott Wave – Bearish Wedge Setup

Price is forming a bearish wedge within an Elliott Wave structure.

Wave (1) and (2) are completed. Current consolidation is part of Wave (3), with a possible final push forming Wave (5) wedge will breakdown, more down side is possible

After Wave (5) completion, price will move towards the years old price trend channel to retest is the best buying opportunity

Key Levels:

Buying zone: ~77,200 USDT

Bias: Bearish after wedge breakdown

Invalidation: Strong breakout above wedge resistance

V2 Retail - Multibagger Stock not to miss for 5x ROIV2 Retail - Multibagger Stock not to miss for 5x ROI in coming 7-8 Years.

Fundamentals:

Company has delivered good profit growth of 84% CAGR over last 5 years

Company has delivered good profit growth of 40% CAGR over last 10 years

Median sales growth is 33.3% of last 10 years

Technical:

Stock has recently broken from Monthly CUP Pattern. Stock is in continuous uptrend.

LTP - 1826

Targets - 9000+

Timeframe - 7-8 Years

Happy Investing.

ETH long term chartETHUSD – Weekly Structure

• Pattern: Long-term range / re-accumulation (Wyckoff-style)

• Trend bias: Bullish (higher lows since 2023)

• Volatility compression → expansion coming

Key Levels

• Resistance: $3,800–4,100

• Support: $1,400–1,600

Bullish Breakout

• Trigger: Weekly close above $4,100 + volume

• Measured move target:

– $5,500–6,000

– $7,200–7,800

– Extension: $9,500–10,000

Bearish Invalidation

• Weekly close below $1,400

• Downside support: $900–1,100

Summary

• ETH is coiling inside a macro range

• Break above range likely leads to strong multi-year expansion

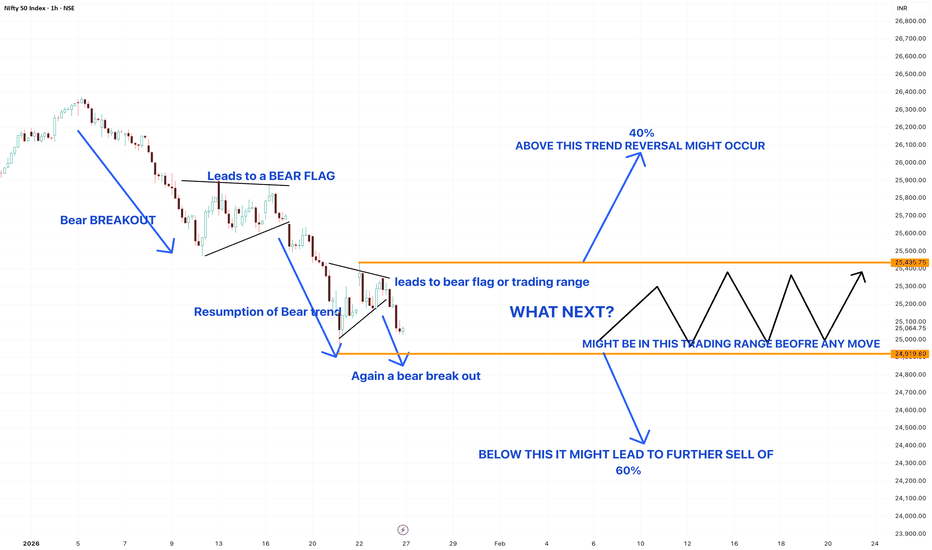

NIFTY- Intraday Levels - 27th Jan 2026Monthly expiry and also trade deal news may impact on market movements so I think market can become volatile

If NIFTY sustain above 25053/95 above this bullish then 25488/501 then 25175/81/97 strong level above this more bullish then 25224/30/245/56 very very strong level above this wait more levels marked on chart

If NIFTY sustain below 25996/89 strong level below this bearis then around 25915 then 25857/41 then25806/744 very very strong level below this more bearish below this wait more levels marked on chart

My view :-

"My viewpoint, offered purely for analytical consideration, The trading thesis is: Nifty (bearish tactical approach: sell on rise)

However don't have a clear view due to trade deal news this may impact the movement of market.

This analysis is highly speculative and is not guaranteed to be accurate; therefore, the implementation of stringent risk controls is non-negotiable for mitigating trade risk."

Consider some buffer points in above levels.

Please do your due diligence before trading or investment.

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

BEL | Range-Bound Structure | Deciding ZoneBharat Electronics is currently trading inside a rising consolidation pattern, with price respecting both ascending trendline support and overhead supply zone.

Momentum has cooled after the prior rally, indicating a pause phase rather than trend reversal.

🔍 Technical Observations:

• Higher-low structure intact

• Price compressing between trendline support & declining resistance

• Volatility contraction → expansion likely next

• Volume neutral – waiting for trigger

📈 What to Watch:

• Break & close above range → Trend continuation

• Break below trendline → Deeper pullback / retest zone

📌 Current Status: ⚖️ Deciding Zone

👉 Patience > Prediction

⚠️ Educational view only. Not a buy/sell recommendation.

#BEL #BharatElectronics #DecidingZone #RangeBound #StockMarketIndia #TechnicalAnalysis #PriceAction #SwingTrading

Next week: Will gold listen to the Fed… or the White House?🔎 Context

Next week could be highly volatile as monetary policy and geopolitics converge.

Donald Trump signaled a potential 100% tariff on Canadian goods if Canada moves closer to trade deals with China—raising trade-war risks.

At the same time, military assets are being deployed en masse around Iran, heightening concerns that tensions could escalate.

👉 Safe-haven flows may return, with gold potentially opening the week gap-up and early buying.

🧠 Quick take

Primary trend: Bullish

At elevated prices: a short, sharp shakeout is possible to absorb liquidity

No top/bottom calls—watch price reactions at key zones

📌 Key levels to watch

🟢 Supports: 4920–4900 | 4890–4882 | 4850–4830 | 4660–4640

🔴 Observation resistances: 5006–5030–5090 | 5110–5115 | Current ATH

🎭 Weekly scenarios (reference only)

Early week: Gap-up / early push

Pre-FOMC: Chop & liquidity sweep

Then: Deep shakeout or base-building and continuation

👉 Distribution at the top—or just a pause before the next leg higher?

Home First Finance: When the Hero Starts Losing StrengthOnce upon a time, this stock was a market hero.

Strong rallies, higher highs, and buyers ready to step in on every dip.

But every hero goes through a phase…

when the energy fades and the story changes.

That phase seems to have arrived for Home First Finance.

📉 The Plot Twist:

After a powerful rally, the stock entered a distribution phase.

Buyers started getting exhausted.

Sellers slowly took control.

Then the structure flipped.

Lower highs. Lower lows.

And a clean falling trendline confirmed who’s in charge now.

— Ayushi Shrivastava

NISM-Certified Research Analyst

⚠️ Disclaimer:

This analysis is for educational and informational purposes only and should not be considered as investment advice or a recommendation to buy or sell any security.

Market investments are subject to risk. Past performance is not indicative of future results.

Please consult your financial advisor before taking any trading or investment decisions.

The bounce we’re seeing today?

It doesn’t look like a comeback.

It looks more like a pause to catch its breath.

📍 Current Scene:

Price has taken temporary support near the 1030–1050 zone

A small relief bounce has emerged from this area

But the falling trendline is still pressing from above

Cummins India cmp 3930.40 by Daily Chart viewCummins India cmp 3930.40 by Daily Chart view

- Support Zone 3885 to 3965 Price Band

- Resistance Zone 4165 to 4250 Price Band

- Support Zone reversal observed for stock price

- Volumes need to increase to push price on upside trend

- Price consolidation seen within 3885 to 4110 since mid Jan 2026