GBPUSD – Breakout Retest Looks Healthy, Bulls in ControlGBP/USD has been trading below a falling resistance trendline for quite some time. Recently, price managed to break above this trendline, which is the first sign that selling pressure is weakening.

After the breakout, price did not continue straight up. Instead, it came back for a retest, and that retest is holding well so far. This is usually a healthy sign, showing that buyers are willing to step in at higher levels instead of letting price fall back below structure.

What Price Is Telling Us:

Price is respecting the previous resistance as support and forming higher lows. Sellers are trying, but they are unable to push price back below the trendline. This behavior often appears when the market is preparing for continuation rather than reversal.

As long as price holds above this zone, the bullish bias remains intact, with upside levels marked on the chart. A clean breakdown below the structure would invalidate this view.

This is a structure-based idea, not a prediction. Let price do the work.

If this analysis helped you, like, follow, and comment for more clean Forex breakdowns.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

Chart Patterns

USDCHF – Gap Down From Resistance, Price Testing Key Support!USD/CHF was trading near a well-defined resistance zone where price has faced repeated rejection in the past. This clearly showed that sellers were active at higher levels and the market was struggling to sustain upside momentum.

From this resistance, the market opened with a gap down, which often signals aggressive selling and position unwinding rather than a slow intraday move. The gap was also supported by short-term U.S. dollar weakness, as the market adjusted expectations around risk sentiment and interest rates. When dollar weakness aligns with technical resistance, price usually reacts sharply.

After the gap down, price moved lower toward a major support zone, an area where buyers have previously stepped in. This makes the current zone a key decision point, either buyers defend again, or further downside continuation opens up.

This move is a result of both technical rejection and fundamental pressure, not random price action.

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

NIFTY- Intraday Levels - 23rd Jan 2026Not confident on today's levels due to Friday factor and also Monday is holiday.

If NIFTY sustain above 25241/243 ( closing is above this is a good sign) above this bullish then 25488/501 then 25522/32/58 or 25628/48 above this wait

If NIFTY sustain below 25197/175 below this bearish then 25153/41 below this more bearish then 25110/105 or 25084/73 then below this wait

Consider some buffer points in above levels.

Please do your due diligence before trading or investment.

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

Gold Trading Strategy for 23rd January 2026🟡 **GOLD (XAUUSD) – Intraday Trading Plan** 🟡

📊 **Timeframe-Based Strategy | Price Action Setup**

### 🔼 **BUY SETUP (Bullish Scenario)**

🟢 **Buy only if price breaks & closes ABOVE**

⏱️ **15-Minute Candle High**

💰 **Above Price:** **$4985**

🎯 **Buy Targets:**

✅ **Target 1:** $4995

✅ **Target 2:** $5005

✅ **Target 3:** $5018

📈 **Logic:**

* Strong bullish confirmation only after a **15-minute candle CLOSE above $4985**

* Indicates momentum continuation & buyer strength

* Trail stop-loss after Target 1 for safer trade management

### 🔽 **SELL SETUP (Bearish Scenario)**

🔴 **Sell only if price breaks & closes BELOW**

⏱️ **1-Hour Candle Low**

💰 **Below Price:** **$4883**

🎯 **Sell Targets:**

✅ **Target 1:** $4870

✅ **Target 2:** $4858

✅ **Target 3:** $4846

📉 **Logic:**

* Valid breakdown only after a **1-hour candle CLOSE below $4883**

* Confirms bearish strength & downside continuation

* Partial profit booking recommended at each target

### ⚠️ **Important Trading Rules**

📌 Trade **ONLY after candle close confirmation**

📌 Do NOT enter in sideways / choppy market

📌 Follow strict **risk management & position sizing**

### 🚨 **DISCLAIMER**

⚠️ This analysis is for **educational and informational purposes only**.

⚠️ **Not financial advice**.

⚠️ Trading in Gold / Forex / Commodities involves **high risk**.

⚠️ Please consult your **financial advisor** before taking any trade.

⚠️ I am **not responsible for profits or losses** incurred.

💡 *Trade smart. Protect capital. Let the market confirm.* 💡

Trading Master classTechnical Analysis is the study of price movements and trading volume to forecast future market behavior. It is widely used by traders and investors to identify entry, exit, and trend direction.

One of the core topics is Price Action, which focuses on analyzing raw price movement without indicators. Traders observe candlestick patterns, market structure, and momentum to understand buyer–seller behavior.

Charts are another foundation. Common chart types include Line Charts, Bar Charts, and Candlestick Charts. Candlestick charts are most popular because they clearly show open, high, low, and close prices along with market psychology.

Trend Analysis helps identify whether the market is in an uptrend, downtrend, or sideways trend. Tools like trendlines, higher highs & higher lows, and lower highs & lower lows are used to confirm trend direction.

Support and Resistance levels represent key price zones where demand or supply is strong. Support acts as a floor where prices may bounce, while resistance acts as a ceiling where prices may face selling pressure.

Technical Indicators are mathematical calculations based on price and volume. Popular indicators include Moving Averages, Relative Strength Index (RSI), MACD, Bollinger Bands, and Stochastic Oscillator. These help measure trend strength, momentum, volatility, and overbought/oversold conditions.

OUTFRONT MEDIA INC AnalysisI am going to buy this stock because.

1. Outperformed SPX500.

2. has got good move and then created nice base.

3.Broken resistance of 2020 high.

4. good breakout

5. good momentum score.and durablity score, mid valuation.

6. quaterly profit & revenue has increased.

7. EPS has increased.

8. Debt is almost constant

9. small decrease institution holding.

10. Made a new high and then consolidating to make a base.

I am managing my risk with a stop loss at 23.51$ ( 5.5%)

gold has made ascending traingle pattern breakoutgold has made ascending traingle pattern breakout , on smaller timeframe there is also a breakout of inverted h&s pattern . Everything bullish. Trend is bullish . Use EMA and 15 min timeframe to catch the trend. 15 min bullish candle above 5 or 9 ema is good trend rider entry with sl at its bottom. It can be hammer, bullish twin, bullish engulfing, bullish sash, etc.

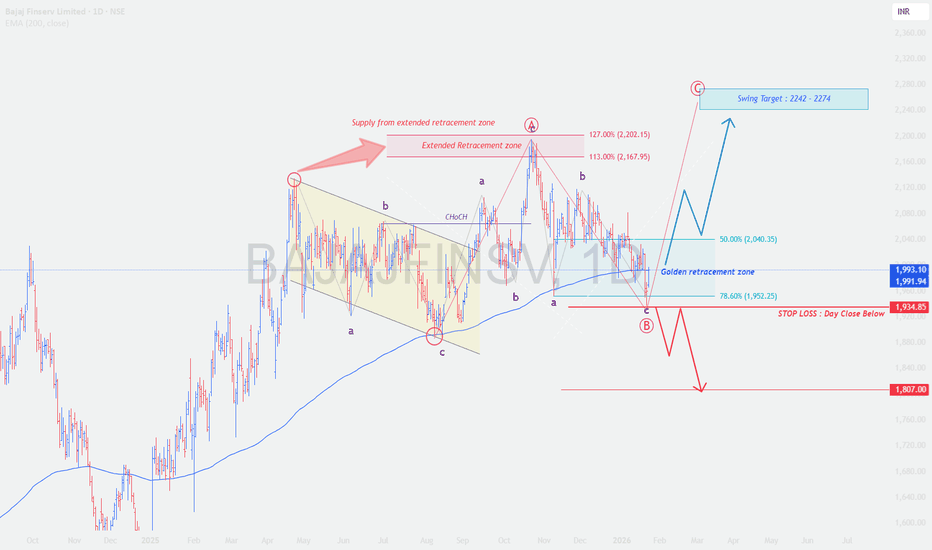

When Fear Meets Structure: Is BAJAJFINSV Preparing for?🧠

📊 Bajaj Finserv Limited – Daily Technical Analysis

Timeframe: 1D

Trend Context: Primary uptrend intact, currently in corrective phase

Structure: ABC correction after supply from extended retracement

CMP Zone: ~₹1,993

EMA (200): ~₹1,992 (acting as dynamic support)

🔍 Big Picture: What’s Happening on the Chart?

Bajaj Finserv rallied strongly earlier and faced profit booking near an extended Fibonacci retracement zone (113%–127%), which is a classic institutional sell area.

After distribution, price has entered a corrective ABC structure, now approaching a high-probability demand zone.

📘 Markets don’t fall because fundamentals vanish — they fall because positions unwind.

📐 Why the Marked Levels Matter (Trading Psychology Explained)

🔴 Supply Zone: ₹2,168 – ₹2,202 (113%–127%)

This zone attracted sellers because:

Early investors booked profits at stretched projections

Risk-reward turned unfavorable for fresh longs

Late breakout buyers got trapped

🧠 Extended Fibonacci zones often mark “greed peaks”.

🟦 Golden Retracement Zone: ₹1,952 – ₹2,040

(50%–78.6% retracement of the prior rally)

This is the most important zone on the chart.

Why reactions are expected here:

Long-term investors look to re-enter at “fair value”

Swing traders cover shorts near known demand

Existing longs defend this zone to protect trend

📌 This zone represents fear vs opportunity, where markets often pause or reverse.

🔵 EMA 200 Confluence (~₹1,992)

Watched by institutions & positional traders

Acts as dynamic support in trending markets

Reinforces confidence for dip buyers

📘 When multiple supports align, reactions become stronger.

🔴 Invalidation / Stop Zone: ₹1,935 (Daily Close Below)

Break below here damages bullish structure

Psychology shifts from “buy the dip” to “capital protection”

📉 Below this, next liquidity pocket opens near ₹1,807.

🟢 Bullish Scenario (Higher Probability)

If price:

Holds above ₹1,952

Stabilizes above EMA 200

Then:

Bounce toward ₹2,040

Acceptance above ₹2,040 → move toward ₹2,168

Momentum continuation targets ₹2,242 – ₹2,274

📈 This would mark completion of correction and start of next impulse.

🔴 Bearish Risk Scenario (If Structure Fails)

If price:

Closes below ₹1,935

Then:

Dip buyers exit

Confidence erodes

Price may slide toward ₹1,807

📉 This reflects fear-driven liquidation, not trend reversal yet.

🎓 Educational Takeaways (Very Important)

Strong stocks correct to invite participation, not to collapse

Fibonacci works because traders collectively believe in it

EMA levels act as psychological anchors

The best trades emerge when news feels worst but structure holds

🧠 Emotion Map Behind the Chart

Zone Dominant Emotion

Highs (2,200+) Greed & Distribution

Pullback Confusion

Golden Zone Fear vs Opportunity

Breakdown Panic

Bounce Relief & Momentum

📘 Charts are stories of emotion, not just price.

🔮 Price Outlook (Educational Projection)

Above ₹1,952: Bullish bias intact

Above ₹2,040: Recovery gains strength

Targets: ₹2,168 → ₹2,242–2,274

Below ₹1,935: Caution, deeper correction

Below ₹1,807: Structure weakens materially

🧾 Conclusion

Bajaj Finserv is currently testing a high-confluence demand zone after a healthy profit-booking phase.

The ₹1,952–2,040 region will decide whether this correction ends as accumulation or turns into extended weakness.

📌 Strong trends don’t die quietly — they test conviction first.

⚠️ Disclaimer

This analysis is for educational purposes only.

I am not a SEBI registered analyst. Markets involve risk, and I can be wrong.

Please consult your financial advisor before taking any trade or investment decision.

Bank of India.. Targets are good but ....Bank of India..

Has formed a quiet clear Cup & Handle pattern..

From here it has the potential to move up and we can book good profit in this ..

BUT..

like i always say, its better to book small profit and Re-Enter once it retraces..

From here, it has the potential to go till 167-168..OR upto 170( incase of WIG )

One can book it around the mentioned levels or trail the profit..

After retracement it can move towards the level of 200..

Don't let the profit slip away ..

Always know your hunger..

Remember!! You can only enjoy the market if u have capital!!

All the best!! :)

Wave 5 Long-Term Target: Fibonacci Projection Indicates 28,867Wave 5 Long-Term Target: Fibonacci Projection Indicates 28,867

Wave 1: 15,214 to 18,893

Wave 3: 16,833 to 26,290

Wave 4 Complete: 22,022 (Correction Phase Ended)

Calculation:

Wave 1-3 Range: 26,290 - 15,214 = 11,076

61.8% of Wave 1-3: 11,076 × 0.618 = 6,844.97

Wave 5 Target: 22,022 + 6,844.97 = 28,867

Conclusion:

Wave 4 has completed, confirming a long-term bullish outlook. If Wave 5 follows the 61.8% Fibonacci extension rule, its estimated target is 28,867. This projection helps us to set long-term price targets and confirmations. You can view my previous analysis of wave 4 published on 20 FEB.

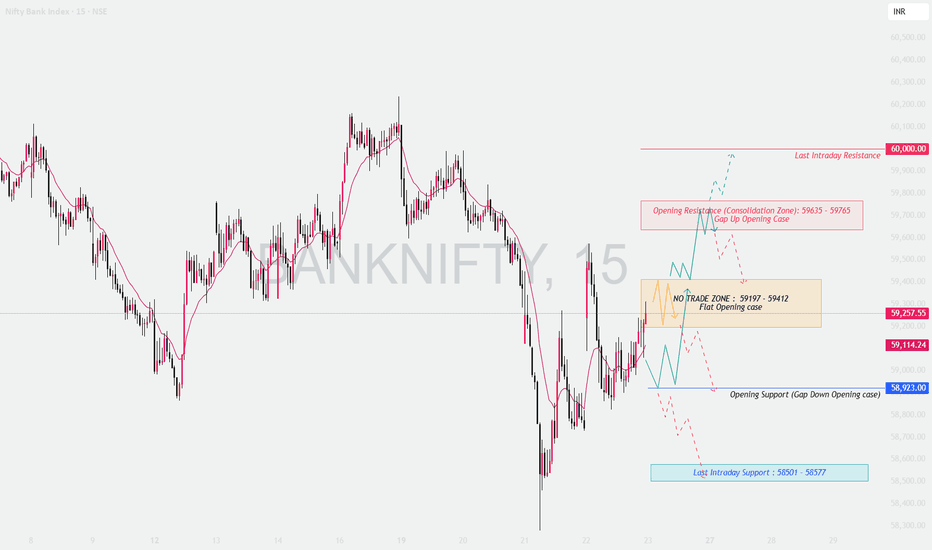

BANKNIFTY : Intraday Trading levels and Plan for 23-Jan-2026📘 BANK NIFTY Trading Plan – 23 Jan 2026

Timeframe: 15-Minute

Gap Consideration: 100+ points

Market Structure: Short-term pullback within a volatile range, key decision zones clearly defined

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If Bank Nifty opens above the previous close with a strong gap-up, price action near resistance becomes crucial.

Opening Resistance / Consolidation Zone: 59,635 – 59,765

This zone may act as supply as it aligns with prior rejection and intraday selling pressure.

Bullish Continuation:

Sustained 15-min close above 59,765 signals strength → upside extension towards 60,000.

Rejection Setup:

Failure to hold above 59,635 may lead to pullback towards the flat opening range.

Options Strategy:

Bull Call Spread (Buy ATM CE + Sell OTM CE) to reduce theta risk.

➡️ SCENARIO 2: FLAT / RANGE OPENING ⚖️

A flat open indicates indecision; patience is key.

No-Trade / Chop Zone: 59,197 – 59,412

Expect whipsaws and option premium decay.

Bullish Bias:

Acceptance above 59,412 → targets 59,635 → 59,765.

Bearish Bias:

Breakdown below 59,197 → drift towards 58,923.

Options Strategy:

Short Strangle / Iron Condor only if price remains inside range with strict SL.

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

A gap-down open tests buyer strength immediately.

Opening Support (Gap Down Case): 58,923

First reaction zone for buyers.

Intraday Support Breakdown:

Below 58,923 → increased probability of move towards 58,501 – 58,577.

Pullback Short Setup:

If price retests 59,197 and rejects, short continuation trades are favored.

Options Strategy:

Bear Put Spread (Buy ATM PE + Sell lower strike PE) to cap risk.

🛡️ OPTIONS RISK MANAGEMENT TIPS 🧠

Avoid naked option buying near no-trade zones.

Use spreads to control theta decay.

Risk only 1–2% of capital per trade.

Book partial profits quickly in volatile markets.

No revenge trades after SL hit.

📌 SUMMARY & CONCLUSION ✨

59,197 – 59,412 remains the key decision zone.

Directional trades only after clear acceptance or rejection.

Gap days demand discipline, not aggression.

Let price confirm, then execute with defined risk.

⚠️ DISCLAIMER

This analysis is for educational purposes only. I am not a SEBI registered analyst. Markets are risky, and trades can go wrong. Please consult your financial advisor before trading. 🙏

NIFTY : Intraday Trading levels and Plan for 23-Jan-2026📘 NIFTY Trading Plan – 23 Jan 2026

Timeframe: 15-Minute

Gap Considered: 100+ Points

Market Context: After a sharp intraday recovery from lower levels, NIFTY is now approaching a key decision-making zone. Trend is still corrective, with range expansion possible on either side.

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If NIFTY opens above 25,498, it indicates follow-through buying and short-covering.

The zone 25,498 – 25,537 will act as the first opening resistance.

Sustained 15-min close above 25,537 can trigger momentum toward:

• 25,666 – 25,718 (Last Resistance Zone)

Above 25,718, trend strength improves and fresh longs may emerge.

Failure to sustain above 25,498 = high probability of rejection and pullback.

📌 Educational Insight:

Gap-up openings near resistance often trap late buyers. Confirmation is mandatory before aggressive longs.

📌 Options View:

• Bull Call Spread preferred over naked CE

• Partial profit booking near resistance

• Avoid chasing premiums 🚀

➡️ SCENARIO 2: FLAT / RANGE OPENING ⚖️

If NIFTY opens between 25,301 – 25,378, expect range-bound and whipsaw price action.

This zone acts as a No-Trade Zone / Balance Area.

Multiple fake breakouts are likely.

Upside confirmation only above 25,498.

Downside weakness below 25,301.

Wait for a 15-min close outside the range before taking trades.

📌 Educational Insight:

Flat opens after volatile sessions usually lead to time correction, not directional moves.

📌 Options View:

• Iron Fly / Short Strangle with strict SL

• Low quantity & fast exits

• Protect capital over profits ⏳

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

If NIFTY opens below 25,301, sellers regain short-term control.

Immediate support lies near 25,177.

Break below 25,177 opens downside toward:

• 25,031 – 25,077 (Last Intraday Support)

Below 25,030, bearish momentum can accelerate.

Any pullback toward 25,301 – 25,378 should be treated as sell-on-rise.

📌 Educational Insight:

Gap-down opens demand patience — let volatility settle before initiating trades.

📌 Options View:

• Bear Put Spread preferred

• Avoid PE selling in falling markets

• Trail stop-loss aggressively 📉

🧠 Risk Management Tips for Options Traders 🛡️

Risk only 1–2% of capital per trade.

Expiry proximity = faster theta decay.

Prefer spreads over naked options.

No candle confirmation = no trade.

Avoid overtrading inside no-trade zones.

📌 Summary & Conclusion ✨

NIFTY is trading near a critical equilibrium zone.

📍 25,301 – 25,378 = decision area

📍 Strength only above 25,498 → 25,718

📍 Weakness below 25,301 → 25,177 → 25,030

Patience, discipline, and level-based execution will be key for 23 Jan.

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Markets are uncertain and I may be wrong.

Please consult your financial advisor before trading.

SUPREMEIND – STWP Equity Snapshot 📊 SUPREMEIND – Technical & Educational Snapshot

Ticker: NSE: SUPREMEIND

Sector: 🧪 Chemicals / Plastics

CMP: 3,500.80 ▲ (+4.15% | 22 Jan 2026)

Learning Rating: ⭐⭐⭐⭐☆ (Neutral–Range with Recovery Bias)

Chart Pattern Observed: 📊 Range Structure with Recovery from Demand

Candlestick Pattern Observed: Bullish Engulfing

📊 Technical Snapshot

SUPREMEIND is attempting a short-term stabilisation after a sharp corrective phase, with the latest daily candle showing a strong bullish response from lower demand zones. RSI is placed near 52.5, indicating neutral momentum with early signs of internal strength but no overbought pressure yet. Stochastic is around the mid-zone, suggesting recovery from oversold conditions rather than trend exhaustion. Bollinger Bands remain wide, reflecting elevated volatility and a market still adjusting after the decline, while price continues to trade below major supply zones — keeping the broader structure range-bound with recovery bias. MACD remains subdued, highlighting that momentum improvement is still developing rather than fully established. Price is currently interacting near the CPR band, which is relatively wide, typically associated with range-bound or two-sided price action. As long as price remains within or below the CPR zone, upside moves may face supply pressure, while sustained acceptance above the CPR pivot would be required to signal any meaningful directional shift.

📊 Volume Analysis

🔹 Current Volume: ~536K

🔹 Average Volume (20-period): ~252K ✅

💥 Volume is running at more than 2× the recent average, confirming active participation during the rebound from demand.

💡 Interpretation: Higher-than-average volume near support zones suggests genuine buying interest and supply absorption. However, for any sustained move toward upper range resistance, similar volume expansion will be required near higher levels to confirm acceptance.

🔑 Key Levels – Daily Timeframe

Support Areas: 3373 | 3258 | 3194

Resistance Areas: 3552 | 3616 | 3731

These are zones where price has paused or reacted earlier.

What’s Catching Our Eye: Sharp demand-led rebound with strong participation.

What to Watch For: Acceptance above CPR and nearby resistance.

Failure Zone: Loss of the recent demand base.

Risks to Watch: Overhead supply and wide CPR.

What to Expect Next: Range-bound move with recovery bias.

Bullish Case: Sustained Demand absorption may support recovery.

Bearish Case: Failure to hold Demand base risks deeper reversion.

Momentum Case: Strong Rebound momentum, needs follow-through.

STWP Equity Snapshot – SUPREMEIND

Intraday Setup:

Entry: 3,500.8

Invalidation level: 3,237.11

Reference 1: 3,817.23

Reference 2: 4,028.18

Swing Setup (Hybrid Model – 2–5 days):

Entry: 3,500.8

Invalidation level: 3,151.67

Reference 1: 4,199.06

Reference 2: 4,722.75

STWP View: Momentum: Strong | Trend: Range | Risk: High |Volume: High

Learning Note: Focus on structure, risk per trade and clean reviews – not prediction.

Disclaimer:

Educational view only. Not a Buy/Sell recommendation. Please consult a SEBI-registered advisor before making any decision. STWP is not responsible for trading decisions based on this post.

💬 Did this help you read the chart better?

🔼 Boost | ✍️ Comment | 🔁 Share with a learner

👉 Follow STWP for clean chart-reading insights

🚀 Stay Calm. Stay Clean. Trade With Patience.

POLICYBZR - STWP Equity Snapshot📊 STWP Equity Snapshot – PB Fintech Ltd (POLICYBZR)

(Educational | Chart-Based Interpretation)

POLICYBZR continues to trade within a well-defined range structure, with repeated rejection from the 1960–2000 supply / distribution zone and consistent buyer activity emerging near the 1650–1609 demand / value zone. The stock has once again reverted from upper supply and is currently attempting a recovery from this demand region. The area around 1720–1740 now acts as a near-term balance zone. Holding above this region keeps the recovery attempt structurally valid and allows price to test higher reaction zones near 1755 and 1790, where selling pressure has appeared previously. However, sustained acceptance above these levels would be required to improve directional confidence. On the downside, continued weakness below 1650, and especially below 1609, would signal structural weakness and increase the probability of deeper mean reversion within the range. Until either boundary is resolved, price action should be viewed as rotation rather than trend development.

Recent market conditions reflect a neutral but stabilising environment. The recent strong bullish candle highlights buyer response from demand, but not trend confirmation. Bollinger Band behaviour shows that price is emerging from a compressed phase, with early expansion attempts visible, though follow-through remains limited. The BB squeeze context indicates potential for movement, but direction remains undecided. RSI near 45–46 reflects balanced momentum, consistent with a range-bound market rather than a trending phase. Price interaction with short-term averages suggests short-term stabilisation, while the wide CPR structure reinforces expectations of two-sided activity, consolidation, and rotational price behaviour instead of immediate directional continuation.

Volume analysis adds important context to the recovery attempt. Participation has improved during the recent bounce from demand, indicating active buyer involvement rather than a low-liquidity reaction. At the same time, volume intensity remains moderate (Vol X near 1.0), with no signs of climax or exhaustion. Selling phases have not been accompanied by aggressive volume expansion, suggesting controlled supply rather than panic distribution. Overall, volume behaviour supports range stability and validates the demand-side response, while still falling short of confirming accumulation or breakout intent.

From a short swing perspective, POLICYBZR remains structurally neutral as long as price trades between the 1650–1609 demand zone and the 1960–2000 supply zone. Acceptance above intermediate resistance would be required to shift bias toward higher range expansion. Conversely, sustained acceptance below 1609 would elevate downside risk and suggest continuation of mean reversion toward lower structural levels. Until such confirmation occurs, consolidation and rotational movement within the range should be expected.

Final Outlook (Condition-Based):

Momentum is improving but not decisive, the trend remains range-bound, risk is elevated due to overhead supply, and volume is supportive but non-confirmatory.

💡 STWP Learning Note

In range markets, demand reactions show interest — only acceptance above supply confirms intent.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes. It is not investment advice or a recommendation. Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.

ASTRAL - STWP Equity Snapshot📊 STWP Equity Snapshot – Astral Ltd (ASTRAL)

(Educational | Chart-Based Interpretation)

ASTRAL continues to trade within a broader range-bound structure, with price oscillating between well-defined supply and demand zones rather than establishing a sustained trend. After facing rejection near the 1593–1600 supply zone, price moved into a corrective phase and recently reacted from the 1333–1293 demand region, where buyers have previously stepped in. The current price is stabilising near the 1424 balance area, which now acts as an important near-term reference. Holding above this zone keeps the structure intact and allows price to retest higher reaction zones near 1441–1470, where selling pressure has emerged earlier. On the downside, sustained weakness below 1367, and more importantly below the 1333 demand zone, would increase downside risk and reinforce the broader range structure. Until price decisively exits either boundary, movement should be viewed as rotation within the range rather than trend development.

Indicator readings reflect a mixed but stabilising environment. The recent strong bullish candle with open near the low signals short-term buyer response from demand rather than trend confirmation. Bollinger Band behaviour highlights prior volatility contraction, with early signs of expansion emerging, though follow-through remains limited. The BB squeeze context suggests the market is transitioning from compression toward potential movement, but direction is still undecided. RSI near 47 indicates balanced momentum, neither weak nor strong, aligning with the ongoing range structure. Price interaction with short-term averages shows attempts at stabilisation, while a wide CPR structure reinforces the expectation of two-sided trade and consolidation rather than immediate directional continuation.

Volume behaviour provides constructive but cautious confirmation. Participation has expanded during the recent rebound, indicating active involvement from buyers near demand rather than a low-volume reaction. At the same time, volume intensity remains within a healthy range (Vol X ~1.4–1.5), with no signs of climax or exhaustion. Selling phases have not shown aggressive volume expansion, suggesting supply pressure is controlled. Overall, volume dynamics support range stability and recovery attempts but stop short of confirming accumulation or breakout intent.

From a short swing perspective, ASTRAL remains structurally neutral as long as price trades between the 1333–1293 demand zone and the 1593–1600 supply zone. Acceptance above intermediate resistance levels would be required to improve directional confidence toward higher range-expansion zones. Conversely, sustained acceptance below 1293 would elevate downside risk and shift focus toward deeper structural demand. Until either boundary is resolved, consolidation and rotation within the range should be expected.

Final Outlook (Condition-Based):

Momentum is improving but not decisive, the trend remains range-bound, risk stays elevated due to proximity to both demand and supply, and volume is supportive but not confirming a directional shift.

💡 STWP Learning Note

Range markets reward patience and structure awareness more than prediction.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes. It is not investment advice or a recommendation. Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.

JINDALSTEL - STWP Equity Snapshot📊 STWP Equity Snapshot – Jindal Steel Ltd (JINDALSTEL)

(Educational | Chart-Based Interpretation)

JINDALSTEL is trading within a broader upward structure while navigating a short-term recovery from a recent corrective phase. Price has rebounded strongly from the 1031–1019 demand zone, an area that has historically attracted buyers and acted as structural support. The current price is stabilising near the 1079 balance area, which now serves as a key near-term reference for structure. Holding above this zone keeps the short-term structure constructive and allows price to test higher reaction zones near 1089–1101, where prior supply has emerged. Acceptance above these zones would be required to improve directional confidence. On the downside, any sustained weakness below 1053 initially, and more importantly below 1031, would increase downside risk toward deeper demand and signal a return to range-bound or corrective behaviour. As long as price remains above the primary demand zone, the broader uptrend framework remains intact.

Indicator readings from the green dashboard support a developing bullish structure but with conditions. The presence of a strong bullish candle reflects renewed buyer initiative after consolidation, while Bollinger Band behaviour highlights a prior compression phase now transitioning into early expansion. The BB squeeze context increases the relevance of the current move, suggesting improving volatility conditions rather than a late-stage rally. RSI near 60 indicates strengthening internal momentum without entering stretched or overbought territory, supporting continuation potential while keeping exhaustion risk contained. Price holding above short-term trend measures and VWAP reinforces near-term stability. However, interaction with a wide projected CPR structure suggests that the market environment still favours balance and consolidation, meaning follow-through and acceptance matter more than single-session strength.

Volume behaviour adds an important layer of confirmation. Participation has expanded during bullish candles, indicating active buyer involvement rather than a low-liquidity bounce. Volume intensity remains around healthy levels (Vol X ~1.3), showing interest without signs of climax or emotional excess. Recent pullbacks have not been accompanied by aggressive selling volume, suggesting that supply is being absorbed rather than distributed. Overall, volume dynamics support a controlled recovery and align with accumulation-type behaviour rather than exhaustion.

From a short swing perspective, JINDALSTEL maintains a constructive bias as long as price holds above the 1031–1019 demand zone. If acceptance improves above nearby supply, higher range-expansion reference zones around 1192–1278 come into focus over the coming sessions. Conversely, sustained acceptance below 1019 would elevate downside risk and indicate a shift from recovery into a deeper corrective or range phase. Until such a failure occurs, consolidation above demand should be viewed as structural digestion rather than weakness.

Final Outlook (Condition-Based):

Momentum is strong and improving, the broader trend remains upward, risk stays elevated due to nearby supply and a wide CPR environment, and volume remains supportive but requires continued follow-through.

💡 STWP Learning Note

Strong candles initiate moves; structure and acceptance decide sustainability.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes. It is not investment advice or a recommendation. Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Bitcoin heading towards next bear cycleYou can add multiple reasons for the current scenario in the crypto market - ongoing trade wars, unstable economies, rising inflationn, toppping stocks, gold, silver or anything.

for the next bear cycle we have two supports that should hold, the lower one is for worst case.

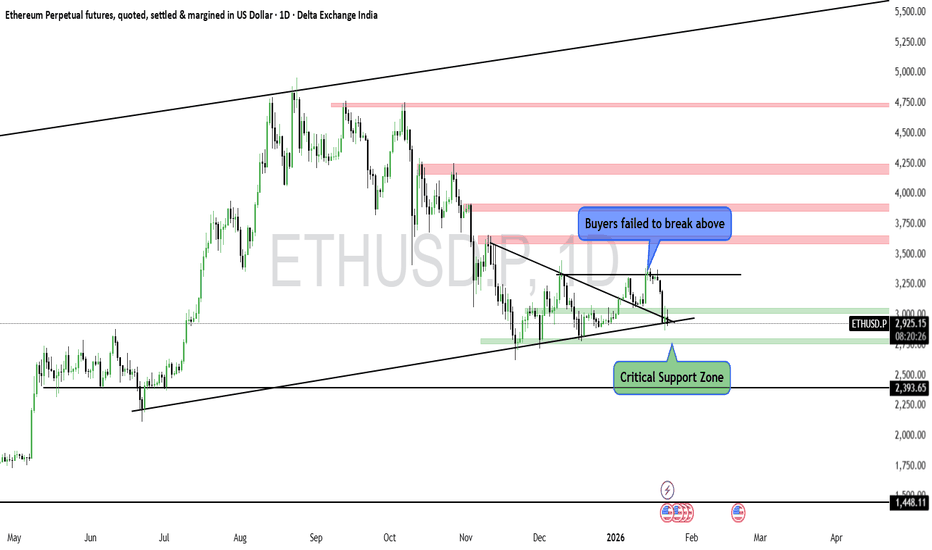

#ETH lost the bullish momentum?

Seems like ETH failed to break the previous high.

But the trend is still not reversed. Until it holds the "Critical Support" level, we can consider side way movement.

If it breaks below the critical support then the downside may continue.

This indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from the use of this indicator.

Trading and investing involve risk. Always do your own analysis and use proper risk management.

COLPAL - STWP Equity Snapshot📊 STWP Equity Snapshot – Colgate-Palmolive (India) Ltd (COLPAL)

(Educational | Chart-Based Interpretation)

COLPAL has transitioned from a corrective phase into a demand-led recovery, with price reacting decisively from the 2097–2074 demand zone. This zone has historically attracted buyers, and the recent rebound reflects active absorption of selling pressure rather than a passive bounce. Price is now stabilising around the 2184 balance area, which acts as an important near-term reference. Sustained holding above this zone keeps the short-term structure stable and allows price to test higher reaction zones between 2288 and 2358, where acceptance will determine continuation quality. On the downside, any weakness below 2184 increases risk toward 2138 initially, followed by a deeper retest of the 2097–2074 primary demand zone, where the broader structure would be reassessed. As long as price remains above this demand band, the larger trend framework stays constructive.

Indicator readings from the dashboard support this developing structure. The presence of a strong bullish candle emerging after a period of consolidation indicates renewed buyer initiative. Bollinger Band behaviour shows prior volatility compression, with early signs of expansion now appearing, suggesting a shift from balance toward directional intent rather than a late-stage move. The BB squeeze context increases the relevance of the current expansion attempt, while RSI near the bullish mid-zone (~60) reflects improving internal strength without signs of exhaustion. Price holding above short-term trend measures reinforces near-term stability. At the same time, interaction with a wide CPR structure suggests that the market remains in a balanced environment, where consolidation, pauses, or controlled pullbacks toward value zones are more likely than immediate acceleration. Acceptance and follow-through remain more important than candle size alone.

Volume behaviour adds important confirmation to the price structure. Participation has expanded during bullish candles, indicating genuine buyer involvement rather than a low-liquidity reaction. Volume intensity remains within a healthy range, with no signs of climax or exhaustion typically associated with late-stage moves. Pullbacks have occurred on relatively lighter volume, suggesting that selling pressure is being absorbed rather than aggressively expanding. Overall, volume dynamics align with a controlled recovery and support the view that the move is being built through participation rather than emotion.

From a short swing perspective, COLPAL maintains a positive structural bias as long as price holds above the 2097–2074 demand zone. If acceptance improves and momentum sustains, higher range-expansion reference zones between 2388 and 2541 come into focus over the coming sessions. Conversely, sustained acceptance below 2074 would elevate downside risk and indicate a transition from recovery into a deeper corrective phase. Until such failure occurs, consolidation above demand should be viewed as healthy digestion of gains rather than structural weakness.

Final Outlook (Condition-Based):

Momentum is moderate and improving, the broader trend remains upward, risk stays elevated due to the recovery nature of the move and nearby supply, and volume remains supportive but requires continued follow-through.

💡 STWP Learning Note

Strong recovery candles show intent — confirmation comes only with acceptance above supply.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes. It is not investment advice or a recommendation. Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.

BEL - STWP Equity Snapshot📊 STWP Equity Snapshot – Bharat Electronics Ltd (BEL)

(Educational | Chart-Based Interpretation)

Market Structure

BEL continues to trade in a structurally strong uptrend, characterized by higher highs and higher lows on the daily timeframe. Recent price action reflects consolidation after a sharp upward expansion, suggesting digestion of gains rather than distribution. The broader structure remains constructive, with price holding above key support zones and maintaining bullish alignment.

Demand–Supply Structure

Price has respected a well-defined demand zone in the 402–397 region, where buyers have consistently defended declines. The recent bullish reaction from this area indicates demand absorption and willingness to support price at higher value levels. Overhead supply is visible near recent highs, but selling pressure appears controlled, indicating healthy supply management rather than aggressive profit booking.

Key Levels – Daily Timeframe

Primary demand zones are placed near 409, followed by deeper structural support around 402–397. These zones represent areas where buyers have previously stepped in with conviction. On the upside, resistance and reaction zones are located near 421, 426, and 434, which may act as pause or acceptance areas during further upside attempts.

What the Chart is Saying

Momentum remains supportive, with RSI holding near 57–58, reflecting healthy strength without signs of exhaustion. Price continues to trade above key moving averages, reinforcing trend integrity. Volume participation remains above average during bullish candles, suggesting continuation interest rather than speculative activity.

CPR Impact

BEL is trading above the CPR pivot with a relatively narrow CPR structure, which generally supports directional continuation rather than range-bound behavior. Acceptance above the CPR zone indicates short-term bullish control. However, the projected CPR ahead appears wider, hinting at the possibility of brief consolidation before the next directional phase.

Additional Structure Observations

Recent pullbacks have been shallow and followed by strong recovery attempts, indicating dip-buying behavior. Short-term moving averages remain positively aligned, while the longer-term structure continues to slope upward. The absence of heavy selling volume during declines suggests effective absorption of supply. Overall, the structure supports continuation, subject to normal consolidation and acceptance checks.

Intraday Reference Levels (Structure-Based)

The 418 zone acts as the near-term balance area and remains the key intraday reference. Sustained holding above 418 keeps the structure stable and supports upside testing toward the 436–449 zone, which represents upside reaction areas where price may pause or require acceptance. On the downside, weakness below 418 increases risk toward the 402–397 demand zone, where intraday structure would be reassessed. These levels define intraday risk versus opportunity, not directional certainty.

Swing Reference Levels (Hybrid Model | 2–5 Days)

From a short-term swing perspective, BEL remains within a positive structural framework as long as price holds above the 402–397 primary demand zone. If strength sustains, the 449–473 zone emerges as a higher range-expansion reference area over the coming sessions. Conversely, sustained acceptance below 397 would elevate downside risk and indicate a shift from consolidation toward deeper corrective behavior. Until such failure occurs, consolidation above demand should be viewed as constructive.

Final Outlook (Condition-Based)

Momentum remains strong and supportive of the prevailing structure. The trend is clearly up, with buyers maintaining control above key demand zones. Risk remains elevated due to proximity to resistance and recent price expansion, while volume stays moderate and healthy, supporting continuation rather than exhaustion.

💡 STWP Learning Note

Strong trends often pause through consolidation, not reversal.

Respect structure and let price confirm continuation.

📘 STWP Approach

Observe price. Respect risk.

Trade structure, not prediction.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.

ZOTA - STWP Equity Snapshot📊 STWP Equity Snapshot – Zota Health Care Ltd

(Educational | Chart-Based Interpretation)

Market Structure

ZOTA witnessed a sharp corrective phase from higher levels, followed by a strong rebound from a well-defined demand zone. The recent candle stands out as a decisive bullish reaction, indicating aggressive buying interest after prolonged selling pressure. Despite the strength of the bounce, price is still trading within a broader range, and the larger trend structure has not yet shifted into a clear uptrend.

Demand–Supply Structure

Price moved deeply into a historical demand zone where buyers stepped in with conviction. The strong bullish candle suggests absorption of selling pressure and short-term buyer dominance. However, overhead supply zones remain active, meaning the current move should be viewed as a recovery from demand rather than a confirmed breakout. Sustained strength is required for further range expansion.

Key Levels – Daily Timeframe

Immediate demand zones are placed near 1376, followed by lower structural supports around 1290 and 1250. These are areas where buyers have previously defended price. On the upside, resistance zones are visible near 1451, 1526, and 1652, where selling pressure has historically emerged. These levels act as reaction zones and help define the current range.

What the Chart is Saying

Momentum has improved significantly after the recent bullish expansion, supported by strong volume participation. RSI is recovering from lower levels, indicating improving internal strength, but it is still not in a trending zone. The structure remains range-bound, suggesting that price may consolidate or oscillate between demand and supply zones before showing directional clarity.

CPR Impact

ZOTA is currently interacting with a wide CPR structure, which typically signals indecision and range-bound behavior. Earlier price action stayed below CPR resistance, reinforcing the lack of strong directional bias. For any sustained bullish shift, price would need to show acceptance above the CPR pivot with follow-through. Until then, the CPR structure supports a cautious, range-based view.

Additional Structure Observations

The rebound candle carries added significance as it formed with an open equal to the low, indicating immediate buyer control and minimal intraday selling pressure. This move was supported by clear volume expansion, suggesting participation beyond short-term traders and pointing toward stronger hands absorbing supply near demand. Short-term moving averages are attempting to turn up, reflecting improving momentum, while price remains below longer-term averages, keeping the broader structure neutral. RSI has recovered from lower levels but is still below bullish expansion zones, indicating support without trend confirmation. Additionally, the projected wide CPR for the next session reinforces the probability of consolidation or two-sided activity rather than immediate directional continuation. Overall, the move reflects strength from demand, but structural acceptance above nearby supply is still required for confirmation.

Intraday Reference Levels (Structure-Based)

The reference price zone near 1400 acts as a short-term decision area. Weakness below this zone may expose price toward lower demand regions around 1290. On the upside, reaction zones near 1450 and above are areas where price may pause or face selling pressure. These are observational levels, not predictions.

Swing Reference Levels (Hybrid Model | 2–5 Days)

For the short swing perspective, the 1400 zone remains the structural reference. Failure to hold demand increases downside risk toward deeper support zones. If strength sustains, higher range-expansion zones above previous resistance come into focus, but only as conditional possibilities within the broader range.

Final Outlook (Condition-Based)

Momentum is strong in the short term, supported by volume expansion. The trend remains range-bound, with no confirmed directional control yet. Risk remains high due to the counter-trend nature of the recovery and nearby supply zones. Volume is elevated, indicating participation, but structure confirmation is still pending.

💡 STWP Learning Note

Strong rebounds from demand show intent — not confirmation.

Let structure and acceptance guide bias, not candle size.

📘 STWP Approach

Observe price. Respect risk.

Trade structure, not excitement.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.