XAUUSD (Gold) | Technical Outlook | 22nd Jan'2026Gold continues to trade near 4,831, maintaining a strong bullish structure across all major timeframes. Price remains firmly above key moving averages (20/50/100/200), signaling sustained buyer control and trend continuation.

Momentum indicators support the upside, with RSI in bullish territory, MACD positive, and ADX above 35, confirming strong trend strength. Volatility remains elevated, suggesting sharp and directional price moves.

Key Levels to Watch

Support: 4,800–4,790 | 4,770–4,760 | 4,740–4,730

Resistance: 4,838–4,845 | 4,870–4,888

Major Breakout: Above 4,900

Bullish Bias

As long as Gold holds above 4,770–4,780, the trend remains bullish. A break and close above 4,845 could trigger momentum buying toward 4,870 → 4,900+. Pullbacks are expected to remain corrective.

Bearish / Correction

Bearish pressure emerges only below 4,770, with downside levels at 4,740 → 4,700 → 4,660. Trend reversal only if 4,630 breaks on a daily close.

Trading Focus

Buy on dips near 4,800–4,790

Sell only on breakdown below 4,770

Watch US PMI, GDP, Jobless Claims, Fed commentary & DXY for volatility

Conclusion

Gold remains firmly bullish, with the path of least resistance pointing higher unless key supports fail.

Chart Patterns

Part 11 Trading Master Class With Experts Time Decay (Theta)

Theta represents how much value option will lose per day even if price doesn’t move.

Sellers LOVE Theta

Buyers FEAR Theta

Near expiry:

A ₹200 premium may fall to ₹20 even with little change in spot.

This is how sellers make money consistently.

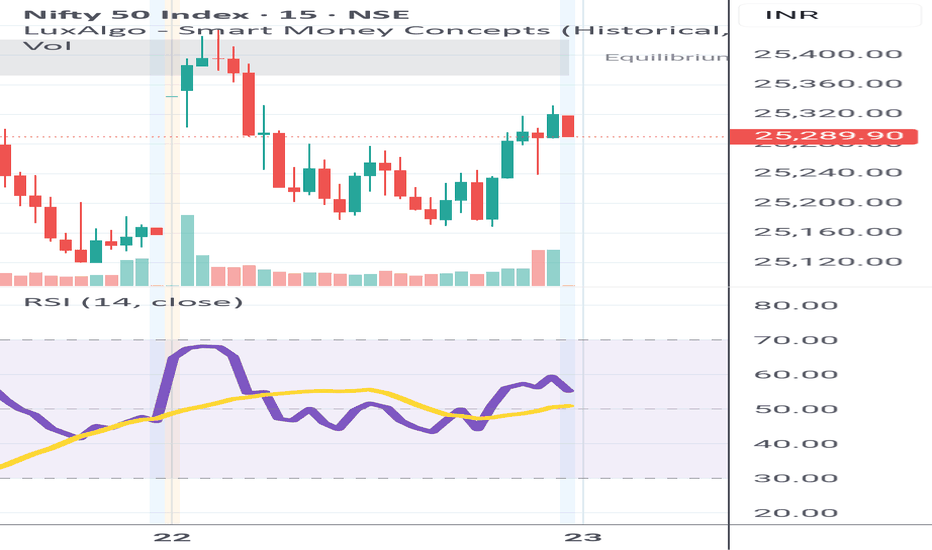

NIFTY – Short-term & Long-term Outlook from Demand ZoneNifty has shown a strong rejection from the 24,900–24,500 historical demand zone.

On the 4H chart:

Long lower wick near 24,900 indicates aggressive buyer participation.

RSI exhaustion and reversal suggests selling pressure has weakened.

Trendline and EMAs remain intact.

Short-term View:

Above 24,900 → upside possible towards 25,600 – 25,900

Below 24,900 (sustained) → downside towards 24,500

Long-term View:

24,500 is the major invalidation level.

Above 24,700–24,900, bias remains bullish on dips.

Upside targets: 26,000 – 26,400+

Disclaimer:

I am not a SEBI registered advisor. This analysis is for educational purposes only. Please do your own research before taking any trades.

Part 12 Trading Master Class With Experts Why Traders Use Options

Options allow traders to benefit from multiple market views:

Directional trading (up or down)

Non-directional trading (markets stay range-bound)

Volatility trading (IV expansion/contraction)

Hedging (protect portfolios)

Income generation (selling options)

This flexibility makes options superior to normal equity trading.

Part 5 Advance Trading Knowledge Introduction to Option Trading

Option trading is a sophisticated financial market activity that allows traders and investors to manage risk, speculate on price movements, and generate income using derivative instruments known as options. Unlike traditional equity trading—where an investor buys or sells shares outright—options derive their value from an underlying asset such as stocks, indices, commodities, currencies, or cryptocurrencies.

An option contract gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period. The seller (writer) of the option, on the other hand, has the obligation to fulfill the contract if the buyer chooses to exercise it.

Option trading is widely used in global financial markets due to its flexibility, leverage, and ability to profit in rising, falling, or even sideways markets.

BANK Of India weekly chart1. Pattern identification: The weekly Bank of India chart shows a rounding bottom marked with a white arc, indicating a potential long‑term reversal from downtrend to uptrend.

2. Current price action:

Price is ₹166.75 (close) with a 5.98% gain.

The stock is approaching the rim of the saucer near ₹170.

3. Breakout analysis:

A clean break above ₹170 on strong volume will confirm the rounding‑bottom completion and trigger a bullish move.

Target can be estimated by measuring the depth of the saucer, rise from bottom to rim.

4. Volume & momentum:

Volume spikes are seen during the bottom formation and recent rise, supporting accumulation.

5. The View :

Initiate a long position on a decisive breakout above ₹170 with a noticeable volume surge (preferably > average volume).

Stop‑loss: Place a protective stop below the lower support, around ₹160, to limit loss if the pattern fails.

The pattern suggests buyers are gaining control; risk‑reward is favorable if the breakout holds.

Bitcoin Bybit chart analysis JENUARY 21Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

The Nasdaq has been acting up lately.

As the Nasdaq is undergoing forced coupling,

please pay close attention to its movements.

*Long Position Strategy:

1. Confirm the touch of the purple finger at the top,

and then switch to a long position at $88,784 at the red finger at the bottom.

/ If the purple support line is broken, set a stop loss.

2. $91,612.7 long position initial target -> Top, then Good in that order.

If the strategy is successful, $90,566.3 is the long position re-entry point.

If the upper level falls immediately without touching the first point,

wait for a final long position at point 2. / If the green support line is broken, set a stop loss.

Today's bottom -> $86,977.3

is a major rebound point on the daily Bollinger Band chart.

Also, the orange resistance line at the top is the center line of the 4-hour Bollinger Band chart.

A strong breakout of this area is necessary for a true rebound.

Please use my analysis to this point for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

MedPlus: Rising Channel Accumulation – Swing Opportunity StudyOn the daily chart, MedPlus Health Services is trading within a well-defined rising channel, indicating controlled accumulation after a prior decline. Price action shows higher lows and stable demand, while upside progress remains capped by a major resistance band.

🔸 Key Support Levels

₹740–760 → Primary channel support & accumulation zone

₹780–800 → Mid-channel support / short-term decision area

Holding above these zones keeps the bullish swing structure intact.

🔸 Key Resistance Levels

₹845–850 → Major horizontal resistance & breakout trigger

₹880–900 → First expansion zone after breakout

₹940–960 → Upper swing projection / prior rejection area

A decisive daily close above ₹850 with volume would indicate trend continuation, while failure to hold channel support would weaken the structure.

🔸 Invalidation Level (Structure Failure)

Below ₹740 (daily close)

Channel breakdown would invalidate the current swing thesis and suggest further consolidation or downside.

🔹 Swing Study Summary

Structure: Higher lows inside rising channel

Bias: Neutral-to-positive while above ₹740

Decision zone: ₹845–850

⚠️ Note

This analysis is for educational and chart-study purposes only.

It is not a buy/sell recommendation.

Decisive Zone in NAUKRI around 1345NAUKRI is currently sitting at a critical technical juncture. After a period of volatile price action, the stock has returned to a well-defined Decisive Zone (approx. 1,332 – 1,354). Historically, this area has acted as a significant ceiling (resistance), and how the price reacts here will likely dictate the trend for the coming sessions.

Success in this zone depends entirely on Volume Confirmation.

🚀 Bullish Scenario: If the price breaks above the zone with a high-volume spike, it confirms that buyers have overwhelmed the sellers. Action: Look for long opportunities on a candle close above resistance. Target 1400

📉 Bearish Scenario: If the price faces rejection at these levels (forming long upper wicks) and breaks back below the immediate support, the historical resistance remains intact. Action: Look for short opportunities or wait for a better base to form. Target 1290

Sensex – Short Term & Long Term Levels (Educational View)

Key Structural Levels:

Immediate Support (Short Term): 81,800

Major Positional Support (Long Term): 81,500

Short Term View (1–2 Days)

As long as 81,800 holds, pullback buys are possible with:

SL: Below 81,800 (sustained break)

Upside Targets:

82,900

83,300 – 83,500

If price breaks today’s high and holds above 82,300,

a move toward 83k–83.5k zone is likely.

If 81,800 breaks and sustains, short-term trend turns bearish

with downside toward 81,500.

Long Term / Positional View

As long as 81,500 holds on higher timeframe,

long-term structure remains intact with upside potential toward:

85,500 – 86,000

If 81,500 breaks and sustains on 4H/Daily,

positional structure turns bearish with further downside expected.

Disclaimer: I am not a SEBI registered advisor/trader.

This view is shared only for educational and learning purposes.

Please do your own analysis before taking any trade.

XAUUSD (Gold) – Short-Term Bullish Rebound Within Broader ConsolPrice Action

Gold has rebounded from the recent swing low near 4775–4780, forming higher lows.

Price is moving along an ascending trendline (blue dashed line), indicating short-term bullish momentum.

However, the broader structure still looks like a range / consolidation after a prior impulsive move.

RSI (14)

RSI is around 54, back above the mid-line (50).

Earlier bearish RSI divergence played out, but momentum is now recovering, suggesting buyers are regaining control.

No overbought condition yet → room for further upside.

Awesome Oscillator (AO)

AO remains below zero, but red bars are shrinking.

This signals waning bearish momentum and a potential shift toward bullish pressure.

MACD (12,26,9)

MACD is still slightly below the signal line, but histogram is contracting upward.

Early signs of a bullish crossover forming if momentum continues.

Key Levels

Immediate Support: 4800 / 4775

Trend Support: Rising trendline from recent low

Resistance: 4850 → 4875

Upside Extension: 4900+ if bullish continuation confirms

DALBHARAT at Resistance of around 2240DALBHARAT is at a high-stakes technical crossroads today. The stock has just surged into a well-defined Decisive Zone (approx. ₹2,195 – ₹2,259), fueled by a stellar Q3 performance.

Today, the company reported a massive 94% surge in YoY Net Profit (₹122 Cr), sending the stock up nearly 2% to test major resistance.

The upper red line (~₹2,259) represents a key historical barrier. A break above this could open the doors toward its 52-week high of ₹2,496.

🚀 The Breakout (BUY): If the price closes above ₹2260 on strong volume, it confirms a breakout from historical resistance. This would likely trigger a fresh rally as buyers take full control towards 2430

📉 The Rejection (SELL): If the stock fails to cross the zone and breaks below immediate support at ₹2,194, expect a period of profit-booking or consolidation back toward the ₹2060 levels.

Part 4 Institutional Option Trading Vs. Technical AnalysisBasic Terminology of Options

Underlying: Asset on which the option is based (Nifty, Bank Nifty, stocks).

Strike Price: The fixed price at which the holder can buy or sell.

Premium: The price paid to buy an option.

Expiry Date: Date on which the option becomes void.

Lot Size: Minimum quantity you must trade (e.g., Nifty lot = 50).

Intrinsic Value: Real value if the option is exercised now.

Time Value: Extra premium due to remaining time until expiry.

Option Buyer: Pays premium, has limited risk and unlimited reward potential.

Option Seller (Writer): Receives premium, has limited reward and potentially high risk.

Geopolitical tensions || XAUSD-Goldcurrent market data for January 22, 2026, gold prices are experiencing a sharp pullback after hitting historic highs. This shift is primarily driven by a "thaw" in geopolitical tensions regarding the US-Greenland situation.

What's Going On?

The Pullback: After surging to a peak of nearly $4,887 per ounce (and over ₹1,58,000 per 10g in India) on Wednesday, gold prices have dropped by roughly 1–2% today.

The Catalyst: President Trump retreated from immediate tariff threats against Europe over the Greenland issue, easing the "geopolitical risk premium." This has caused some investors to "sell the news" and take profits.

Current Price Levels: Spot gold (XAUUSD) is currently hovering around $4,780–$4,815 per ounce.

Strategy for Next Steps

Whether you should buy or sell depends on your time horizon:

1. If You Are Selling (Taking Profits)

The Window: If you bought during the early January consolidation (around $4,500–$4,600), you are still in a strong profit position.

Next Step: Consider trailing your stop-loss or selling a portion of your position now. While the long-term trend is bullish, the "Greenland premium" is deflating, which could push prices down to the $4,712 support level before they stabilize.

2. If You Are Buying (New Entry)

Wait for Support: Do not "catch a falling knife" during today’s drop. Analysts are watching the $4,750 and $4,712 levels as potential zones where buyers might step back in.

Next Step: Look for a "bounce" or stabilization at these support levels. If prices hold above $4,710, it confirms the uptrend is still healthy despite the news.

Long-term Outlook: Major banks like Goldman Sachs and J.P. Morgan have raised their 2026 targets toward $5,000–$5,400, suggesting that pullbacks today are likely "buying opportunities" for long-term holders.

Part 3 Institutional Option Trading Vs. Technical Analysis What Are Options?

Options are derivative contracts whose value is derived from an underlying asset like index (Nifty, Bank Nifty), stocks, commodities, currencies, etc.

They give you the right, but not the obligation, to buy or sell the underlying at a fixed price before a specific date.

Options are mainly of two types:

Call Option (CE): Right to BUY

Put Option (PE): Right to SELL

They are widely used by traders for hedging, speculation, income generation, and risk management.

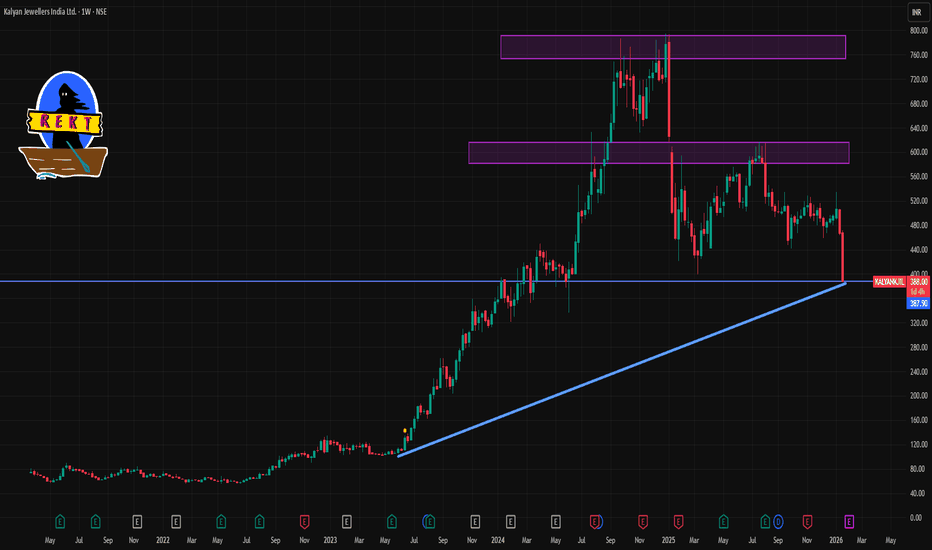

KALYANKJIL 1 Week Time Frame 📌 Current Price Snapshot (Weekly Context)

₹~391–396 — the stock is trading near its 52‑week low range after heavy selling pressure.

NSE/BSE trend is bearish on weekly charts (sell signals and down momentum).

📊 1‑Week Time Frame – Pivot & Key Levels

📉 Weekly Pivot & Levels (from pivot analysis)

(These are derived from weekly pivot point calculations, representing expected turning points for the week)

📌 Weekly Pivot:

Pivot: ~₹479.12

👊 Weekly Resistances:

R1: ~₹495.23

R2: ~₹522.97

R3: ~₹539.08

🛑 Weekly Supports:

S1: ~₹451.38

S2: ~₹435.27

S3: ~₹407.53

👉 The current market price (~₹392–396) is below the first major weekly support (~₹451) and closer to the third weekly support at ~₹407.5 — indicating deep bearish momentum this week.

🧠 Summary – 1‑Week Level Playbook

Bearish near‑term risk:

Break below ~₹407 opens potential towards psychological lower bands.

Key levels for traders this week:

Support to watch: ~₹407 (S3)

Initial resistance to challenge: ~₹451 (S1 on weekly pivot)

Major resistance zones: ~₹495 and ~₹523

XAUUSD H1 – Liquidity Grab Completed, Buy the DipMarket Context

Gold has just completed a strong impulsive rally, leaving behind multiple liquidity pockets and imbalance zones below. The current pullback is technical in nature, serving as a rebalancing phase after expansion rather than a trend reversal.

From a macro perspective, safe-haven demand and a cautious Fed outlook continue to support Gold, keeping the broader bias tilted to the upside.

Technical Structure (H1 – MMF)

Market structure remains bullish with higher highs and higher lows.

The recent sell-off is a liquidity grab into previous demand zones.

No confirmed bearish CHoCH at this stage.

Price is still holding above the major H1 GAP liquidity zone.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Prefer BUY setups on pullbacks into:

BUY zone 1: 4,759 – 4,729

BUY zone 2 (deep): 4,669 – 4,600

Only execute BUYs after clear bullish reaction and structure hold.

Avoid FOMO at premium levels.

Upside Targets

TP1: 4,817

TP2: 4,892

TP3: 4,898 (liquidity sweep zone)

Alternative Scenario

If price fails to hold above 4,729 and sweeps deeper liquidity into the GAP H1 zone, wait for re-accumulation signals before re-entering BUYs.

Invalidation

An H1 close below 4,600 invalidates the bullish setup and requires a full structure reassessment.

Summary

The broader trend remains bullish. The current move is a corrective pullback into liquidity, offering high-quality buy-the-dip opportunities. Patience and confirmation remain key — let price come to you.

HINDZINC 1 Day Time Frame 📌 Current Price (intraday basis):

• ~ ₹667–₹670.8 (range seen today) with highs near ~₹694 and lows near ~₹652.65 earlier in the session.

📈 Intraday Pivot Levels (Daily)

These are calculated from recent price action and are widely used by traders to gauge intraday support and resistance:

📊 Pivot & Levels (Standard Daily)

• Pivot Point (PP): ~₹705.45

• Resistance

• R1: ~₹713.35

• R2: ~₹725.70

• Support

• S1: ~₹685.20

• S2: ~₹672.85

• S3: ~₹664.95

📍 Central Pivot Range (CPR)

• Top CPR: ~₹695.32

• Middle CPR: ~₹693.10

• Bottom CPR: ~₹690.88**

(Note: Pivot and CPR may shift slightly as market updates.)

📍 Summary – 1D Intraday Levels

Level Price (₹) Role

R2 ~725.70 Major upside resistance

R1 ~713.35 Near‑term resistance

Pivot ~705.45 Key directional trigger

CPR Top/Mid/Bottom ~695–690.9 Important intraday range

S1 ~685.20 Near‑term support

S2 ~672.85 Secondary support

S3 ~664.95 Lower support zone

NIFTY – Bearish Structure Playing Out as AnticipatedIn my previous posts, I had clearly highlighted the possibility of a trend shift and warned that the ongoing price action could resolve to the downside. Over the last few sessions, price has started to play out exactly along those lines.

1. Bearish crossover (mini death cross)

A bearish crossover between the short-term and medium-term moving averages has now occurred. This was already anticipated and mentioned in earlier posts, and it marks a loss of bullish momentum after the ATH zone.

2. Clean breakdown below key support

Price has decisively broken below an important support and trendline structure. This confirms the bearish bias and strengthens the view that the broader market is under distribution rather than accumulation.

3. Next immediate support zone

The marked zone below acts as the next immediate support, where we may expect temporary consolidation or a technical bounce. However, unless there is strong follow-through buying, this should be treated cautiously.

4. Caution on bullish moves

Any signs of bullishness from here are likely to be temporary retracements, which may eventually trigger further sell-offs.

➡️ Avoid fresh swing longs until overall market sentiment turns favorable.

➡️ Existing positions should be managed with strict stop-losses and disciplined risk management.

The market is behaving in line with what was discussed earlier. Until structure changes and strength is proven, the risk remains on the downside. Patience and capital protection are more important than chasing trades in such phases.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

DIXON 1 Day Time Frame 📉 Intraday Price Action (Today’s Range)

Day’s Range: ~₹10,274 – ₹10,790

This indicates where the stock has been trading so far today.

📊 Key Intraday Levels for 1‑Day Time Frame

🟢 Support Levels

S1: ~₹10,545 – ₹10,550

S2: ~₹10,359 – ₹10,360

S3: ~₹10,016 – ₹10,020

🔴 Resistance Levels

R1: ~₹11,070 – ₹11,075

R2: ~₹11,410 – ₹11,420

R3: ~₹11,600 – ₹11,605

These pivot‑derived support/resistance levels are typical for intraday reference (classic pivot methodology).

🧠 How to Use These Levels (Intraday)

Bullish bias: A sustained break above R1 ~₹11,070 with volume can open moves toward R2 ~₹11,410.

Bearish bias: If price loses S1 ~₹10,545, next support guards are S2 ~₹10,360 and S3 ~₹10,016.

JINDALSTEL 1 Day Time Frame 📊 Current Price Snapshot

The stock has been trading around ~₹1,030–₹1,070 on recent sessions.

🔑 Daily Pivot & Key Levels (1‑Day Time Frame)

🔼 Resistance Levels

R1: ~₹1,053–₹1,063

R2: ~₹1,062–₹1,071

R3: ~₹1,070–₹1,079+

These are potential daily resistance zones where price may slow or reverse on the upside.

🔁 Pivot/Reference Level

Daily Pivot (central level): ~₹1,045–₹1,046

This is the equilibrium reference; above this suggests slightly bullish bias, below suggests bearish bias for the day.

🔽 Support Levels

S1: ~₹1,034–₹1,056

S2: ~₹1,025–₹1,048

S3: ~₹1,015–₹1,041

These are key intraday support zones where the stock may find buying interest.

📈 How to Use These Levels Today

Bullish scenario: If price holds above the pivot and clears R1/R2 (~₹1,053–₹1,071) with volume, it may test R3 (~₹1,078+).

Bearish scenario: If it breaks below S2 (~₹1,025), watch for deeper pullbacks toward S3 (~₹1,015).

Range‑bound: If staying between pivot and S1/R1, expect sideways movement.

(Typical pivot logic — not investment advice.)