Commodities

(XAUUSD) – Bearish Continuation From Major Supply Zone (45m)

Market Structure

Clear trend reversal from the highs → strong impulsive sell-off.

The curved marking shows a distribution/top formation, followed by aggressive downside momentum.

Overall structure is lower highs & lower lows → bears in control.

Key Zones

Resistance / Supply Zone (~4,700–4,750)

Previous support flipped into resistance.

Price has retested this zone multiple times and failed to break above → strong seller presence.

Target / Demand Zone (~4,350)

Prior demand area and liquidity pool.

Logical downside objective if resistance continues to hold.

Entry Logic (as drawn)

Short entry after rejection inside the resistance zone.

Confirmation comes from:

Weak bullish candles

Long upper wicks

Failure to reclaim the zone

Price Action Read

The small bounces are corrective pullbacks, not reversals.

Each push up is being sold → classic bearish continuation / pullback-to-supply setup.

Bias & Expectation

Bias: Bearish

Expectation:

Rejection from resistance → continuation toward 4,350 target

Invalidation if price accepts and closes above the resistance zone

Summary

This chart shows a textbook support-to-resistance flip after a strong sell-off. As long as price remains below the highlighted resistance, the path of least resistance is down, targeting the lower demand zone.

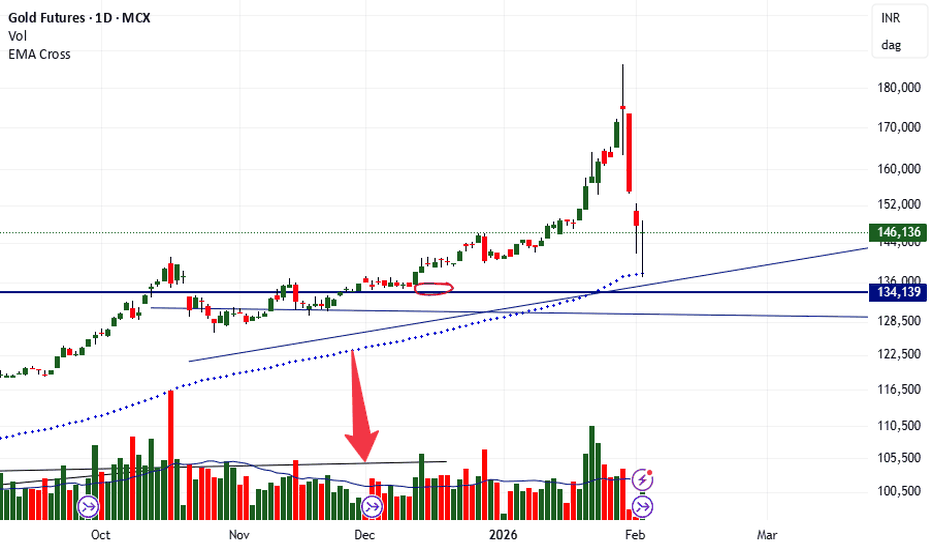

#XAGUSD⚡ Silver – What Happens Next? ⚡

🥈 Silver began a new impulsive cycle in April 2025, with its 1st wave in October. After a flat corrective 2nd wave (C failure), it surged into a powerful 3rd wave, peaking at $84 on 29 Dec 2025.

📈 The 4th wave followed as another flat correction with strong buying pressure, before Silver entered its largest 5th wave, hitting a record high of $121 on 29 Jan 2026.

🚨 But here’s the critical signal: the entire 5th wave was retraced in just one day. In Elliott Wave terms, this invalidates the continuation of the bull run.

📉 Conclusion:

• The $121 peak marks a long-term high.

• Silver is likely to revert to its true value below $60 by mid-March 2026.

XAUUSD (Gold) | TECAHNICAL LEVEL | 3rd FEB'2026Gold trades near 4,930, up +5.8%, with higher timeframes maintaining a bullish structure. Price is holding above the 100 & 200 EMA, while elevated volatility keeps intraday moves sharp. The 4,940–5,000 zone remains a key decision area.

Key Levels

Resistance: 4,990 | 5,080

Support: 4,840 | 4,700

Volatility Zones: Above 4,990 (expansion) | Below 4,840 (pressure)

USD data, Fed commentary, and bond yields remain the primary drivers today.

⚠️ Disclaimer: Educational content only. Markets are risky—manage risk wisely.

What’s Next for Gold?Gold’s sharp rebound from the recent lows has reignited calls for an immediate continuation toward new highs. But the structure tells a more nuanced story.

The rally so far looks less like fresh upside momentum and more like a classic relief move after forced liquidation.

The recent selloff flushed leverage aggressively. Stops were triggered, weak hands exited, and positioning reset fast. What followed wasn’t accumulation — it was short-covering and mean reversion.

This matters because markets that truly want to trend higher don’t need to retrace this violently first.

The key zone: supply above, not support below

Gold is now approaching a well-defined supply band, roughly around the 5,250–5,300 region.

This zone is important for three reasons:

It was a prior distribution area before the breakdown

It aligns with VWAP / value rejection from the last impulse down

It represents the level where trapped longs may look to exit breakeven

In other words, this is where selling interest naturally returns, not where new longs should feel comfortable.

If Gold were truly in a strong continuation phase, it would have:

Built a base

Absorbed supply

Then expanded higher

Instead, price is walking straight back into overhead resistance.

Liquidity behavior doesn’t confirm strength

Despite the bounce, liquidity behavior remains defensive.

• Rallies are corrective, not impulsive

• Volume expands on down moves, not up moves

• Buyers are reactive, sellers are proactive

This is typical of a market inside a larger corrective phase, not the start of a fresh leg higher.

Gold often rallies hardest after fear peaks — but it doesn’t trend sustainably until supply is fully absorbed. That process takes time.

Macro tailwinds aren’t immediate triggers

Yes, long-term macro drivers for gold remain intact.

But markets don’t move on narratives alone — they move on timing and positioning.

If global liquidity remains tight or even mildly restrictive, gold doesn’t collapse — but it also doesn’t trend freely. It oscillates, frustrates, and cleans up positioning.

That’s exactly what current structure suggests.

The probable path from here

From a trader’s perspective, the higher-probability sequence is:

• Price tests the 5,250–5,300 supply zone

• Sellers re-engage into strength

• Volatility compresses or rejection appears

• Market either ranges or pulls back before the next real move

A clean break and acceptance above this zone would invalidate the view — but until then, this is resistance, not confirmation.

Bottom line

Gold’s bounce is real — but bounces are not trends.

This move looks like:

A reaction, not initiation

Short-covering, not accumulation

Repair work, not breakout

Strong markets build value below resistance.

Weak or corrective markets rush into it.

Right now, Gold is doing the latter.

IM LONG IN XAUUSD: HTF 0.5 Fibonacci Magnet in Play (4950–5000)*Gold is holding trendline support and targeting the 0.5 Fibonacci level of the higher timeframe.

What I Have Mentioned is the Clear HTF bias, defined by zone, defined reaction zone, which shows both bullish & corrective scenarios

****Strongly it educates, not hypes***

XAUUSD Price ( 4950 – 5000 ) remains the key upside zone if support continues to hold.

Market Context:

XAUUSD is currently trading around 4810, holding above a rising yellow trendline support.

Technical Confluence:

• Higher timeframe 0.5 Fibonacci retracement lies between 4950 – 5000

• This zone is marked as a major reaction area (highlighted rectangle)

• Trendline support + structure holding adds bullish probability

Price Expectation:

As long as the price respects the trendline support, gold can continue its move higher towards the 0.5 HTF Fibonacci zone.

The green and red projected paths indicate possible market reactions based on support and resistance behavior — not prediction, but preparation.

Trading Insight:

This is a buy-on-support, sell-into-resistance setup.

Strength near 4950–5000 must be watched closely for either continuation or rejection.

Let price confirm at HTF levels — patience pays more than prediction.

Commodity Trading: Energy, Metals & Agricultural MarketsCommodity trading involves buying and selling physical goods or their derivative contracts with the objective of profit, hedging risk, or portfolio diversification. Unlike equities (which represent ownership in companies), commodities are tangible assets such as crude oil, gold, wheat, or natural gas. These markets play a critical role in the global economy because commodities are essential inputs for energy production, manufacturing, construction, and food security.

Commodity trading is broadly divided into three major categories:

Energy Commodities

Metal Commodities

Agricultural (Agri) Commodities

Each category has unique drivers, risks, and trading characteristics.

1. Energy Commodity Trading

Energy commodities are among the most actively traded commodities globally. They are highly sensitive to geopolitical events, economic growth, and supply disruptions.

Major Energy Commodities

Crude Oil (WTI & Brent)

Natural Gas

Heating Oil

Gasoline

Coal (limited exchange trading)

Key Market Drivers

Supply & Demand Balance

OPEC+ production decisions

US shale oil output

Refinery capacity

Geopolitical Factors

Middle East tensions

Russia–Ukraine conflict

Sanctions and trade restrictions

Economic Growth

Strong economies increase fuel demand

Recessions reduce consumption

Seasonality

Natural gas demand rises in winter

Gasoline demand peaks during summer travel

Inventory Data

Weekly reports like EIA crude oil inventories

Trading Characteristics

High volatility

Strong trend-following behavior

Heavy participation by institutions, hedge funds, and governments

Prices often react sharply to news and data releases

Trading Instruments

Futures contracts (most common)

Options on futures

Commodity ETFs

CFDs (in some markets)

Energy trading is popular among short-term traders due to sharp intraday movements, but it also attracts hedgers like airlines and oil producers.

2. Metal Commodity Trading

Metals are divided into Precious Metals and Base (Industrial) Metals, each serving different economic purposes.

A. Precious Metals Trading

Major Precious Metals

Gold

Silver

Platinum

Palladium

Key Drivers

Inflation & Interest Rates

Gold performs well during high inflation

Rising interest rates often pressure prices

Currency Movements

Strong US Dollar usually weakens precious metals

Safe-Haven Demand

Economic crises, wars, or market crashes boost demand

Central Bank Buying

Especially important for gold

Trading Characteristics

Gold is relatively less volatile than energy

Silver is more volatile due to industrial usage

Strong correlation with macroeconomic indicators

Gold is often used as a hedge against inflation and currency risk, making it popular with long-term investors as well as traders.

B. Base (Industrial) Metals Trading

Major Base Metals

Copper

Aluminium

Zinc

Nickel

Lead

Key Drivers

Industrial & Infrastructure Demand

Construction

Manufacturing

Electric vehicles and renewable energy

Economic Growth Indicators

GDP growth

PMI data

Supply Constraints

Mining disruptions

Environmental regulations

China’s Demand

China is the largest consumer of base metals

Trading Characteristics

Strongly cyclical

Move with global economic cycles

Copper is often called “Dr. Copper” because it signals economic health

Base metals are ideal for traders who closely follow macro and industrial trends.

3. Agricultural (Agri) Commodity Trading

Agricultural commodities represent soft commodities derived from farming and livestock. These markets are deeply influenced by natural and seasonal factors.

Major Agricultural Commodities

Grains: Wheat, Corn, Rice

Oilseeds: Soybean, Mustard

Softs: Sugar, Coffee, Cotton

Livestock: Live Cattle, Lean Hogs

Key Market Drivers

Weather Conditions

Rainfall, droughts, floods

El Niño and La Niña effects

Crop Reports

USDA acreage and yield reports

Sowing and harvesting data

Seasonality

Planting and harvest cycles

Government Policies

Minimum Support Prices (MSP)

Export/import restrictions

Global Demand

Population growth

Biofuel usage (corn → ethanol)

Trading Characteristics

Often range-bound, except during supply shocks

Highly seasonal

Can experience sudden spikes due to weather news

Agri trading is popular among farmers and food companies for hedging, as well as speculators who understand seasonal cycles.

Commodity Trading Instruments & Markets

Common Trading Instruments

Futures Contracts (primary instrument)

Options on Futures

Spot Markets

ETFs / ETNs

Commodity Mutual Funds

Indian Commodity Exchanges

MCX (Multi Commodity Exchange) – Energy & Metals

NCDEX – Agricultural commodities

Global Commodity Exchanges

CME Group (USA)

LME (London Metal Exchange)

ICE Exchange

Risk Management in Commodity Trading

Commodity markets are volatile, so risk management is critical:

Use stop-loss orders

Proper position sizing

Avoid over-leveraging

Understand contract specifications (lot size, expiry)

Be aware of rollover risks

Professional traders focus more on capital protection than profit chasing.

Advantages of Commodity Trading

Portfolio diversification

Inflation hedge

High liquidity (especially energy & metals)

Opportunities in both rising and falling markets

Risks Involved

High volatility

Leverage risk

Sudden policy or weather-driven shocks

Global geopolitical uncertainty

Conclusion

Commodity trading in Energy, Metals, and Agricultural markets offers diverse opportunities for traders, investors, and hedgers. Energy commodities provide high volatility and strong trends, metals reflect macroeconomic and industrial health, while agricultural commodities are driven by seasonality and weather. Successful commodity trading requires a solid understanding of fundamental drivers, technical analysis, and strict risk management.

When approached with discipline and knowledge, commodities can be a powerful addition to any trading or investment strategy.

XAUUSD 15M – Bullish Reversal Setup Explained Above 4700 Level After a strong sell-off, Gold is now reacting near a high-probability demand zone.

🔍 My Analysis & Thinking:

• Price has reached the 61.8% Fibonacci retracement of the recent major swing

• RSI (15 Min) is showing a clear bullish divergence

• Selling momentum is weakening after the big fall

• Structure suggests a potential higher low formation

📈 Trade Plan (IF–THEN Logic):

✅ IF price breaks above 4700 (yellow resistance zone)

✅ AND gives a clean retest + bullish confirmation

➡️ THEN BUY

🎯 Upside Targets:

4800 , 4900, 5000 zone (major supply & trendline confluence)

🛑 Invalidation:

Breakdown below 61.8% (4500 -4550 level ) support with strong momentum

⚠️ This is a patience trade — confirmation > prediction.

📊 KEY LEVELS TO MENTION IN CAPTION

Support Zone:

🔹 61.8% Fib – Major demand area

Breakout Level:

🟡 4700 (Yellow Rectangle)

Targets:

🎯 4800 → 4900 → 5000

Bias:

🔄 Short-term bullish after confirmation

XAUUSD 15M – Bullish Reversal Setup Explained Above 4700 Level

XAUUSD "BULLISH" BIAS IDEA.Symbol + Timeframes: XAUUSD — HTF (Daily) & ITF (H4)**

Bias: Bullish (as long as price holds above key support zone)

Structure: – Higher lows intact on HTF

– Intermediate pullbacks LIQUIDATING "fomoing" retailers.

Key Levels: – Support: – 4629.989

And if it breaks , the confluential block at - 4633.96 and marked important swing low at - 4267.383.

– Invalidation: daily candle close below 4267.383

Context: – Price reacting to confluence (fair value gap + structural support + confluential block)

– Dollar bearish pullback adds supporting context

Plan: – Look for corrective pullback to support for continuation setups at smaller timeframe to frame trades, I've marked the path

– Targets based on structural levels

This is analysis, not trade advice.

Silver Weekly Outlook: Post-Exhaustion PhaseSilver has entered a high-volatility post-exhaustion phase after a sharp parabolic rise followed by an equally aggressive correction. The weekly chart clearly shows that price moved too far, too fast, and the recent sell-off is a classic example of mean reversion after euphoric buying. Such phases rarely resolve in a straight line and typically evolve into consolidation, base-building, or deeper corrective structures.

At current levels, Silver is hovering near an immediate demand zone around the 80–85 region, which now acts as a crucial decision area. This zone represents the first major area where buyers are expected to defend aggressively. The way price behaves here will define the next medium-term trend.

Scenario A – Range / Base Formation (High Probability):

The most probable outcome at this stage is sideways consolidation. After a vertical fall, markets often need time to absorb supply and rebuild demand. If Silver manages to hold above the immediate demand zone and starts forming higher lows on lower timeframes, it would indicate base formation rather than trend failure. This scenario favors range traders and patient positional participants, as price may oscillate between support and overhead resistance for several weeks or months.

Scenario B – Breakdown Continuation (Moderate Probability):

If the current support zone fails decisively with strong weekly closes below it, Silver could enter a deeper corrective phase. In such a case, price may gravitate toward the next major demand zone near 73–75, which aligns with prior consolidation and breakout structure. This move would likely be driven by broader risk-off sentiment or macro pressure rather than technical weakness alone. Traders should avoid aggressive longs if this breakdown structure develops.

Scenario C – Bullish Reclaim and Bounce (Low Probability, Needs Confirmation):

A less likely but still possible outcome is a bullish reclaim, where Silver holds current levels, absorbs selling pressure, and reclaims the 90+ zone with strong weekly confirmation. For this scenario to gain credibility, price must show acceptance above resistance with volume and structure. Until then, any bounce should be treated as reactive and corrective, not a confirmed trend reversal.

From a structural perspective, the major resistance remains far above near the 115–120 zone, which was the distribution area before the sharp reversal. This level will act as a long-term supply cap unless Silver builds a strong base over time.

In summary, Silver is no longer in a trending phase but in a transition zone. Patience is critical here. Traders should focus less on prediction and more on reaction to price behavior at key demand levels. Let structure, confirmation, and risk management guide decisions, as this phase can easily trap both early bulls and aggressive bears if approached without discipline.

EURUSD - 4H - SHORTFOREXCOM:EURUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any position . I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied...

Keep trading

Hustle hard

Markets can be Unpredictable, research before trading.

Disclaimer: This trade idea is based on Smart money concept and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions. Informational only!!!

When Gold ETFs Crash, Psychology Crashes Faster Than Price!Hello Traders!

When Gold ETFs start falling sharply, the damage doesn’t begin on the chart. It begins in the mind. Prices may drop in percentages, but psychology collapses much faster. Confidence disappears, patience breaks, and long-term thinking gets replaced by fear-driven decisions.

Right now, we are in one of those phases. Headlines are loud. Charts look heavy. And emotions are running far ahead of logic. This is where most investors don’t lose money because Gold failed, they lose because their mindset did.

Why Gold ETF Falls Feel More Painful Than Spot Moves

ETF investors experience drawdowns differently. Unlike intraday traders, they are mentally invested for the long term. When price drops suddenly, it shakes belief, not just positions.

Long-term conviction starts feeling shaky

Every red candle feels like a warning sign

Investors start questioning decisions made months or years ago

The fall itself may be normal.

The emotional reaction is usually not.

What Panic Really Looks Like in Gold ETFs

Panic rarely shows up as one big decision. It shows up in small mental cracks.

Checking prices more frequently than usual

Reading every negative headline as confirmation

Comparing current drawdowns with worst-case scenarios

This is how psychology collapses quietly, long before price finds stability.

Why Markets Create This Psychological Pressure

Sharp corrections are not just price adjustments. They are tests of belief. Markets use volatility to separate conviction from convenience.

Weak conviction exits during uncertainty

Strong conviction pauses and reassesses

Impatient money provides liquidity for stability

Gold doesn’t need everyone to believe at the same time.

It needs disagreement to function.

What Smart Investors Focus On During This Phase

Experienced investors don’t react immediately. They zoom out and slow down decision-making.

They separate short-term noise from long-term intent

They revisit why Gold was added to the portfolio

They avoid making decisions during emotional peaks

This phase is not about predicting the bottom.

It’s about protecting mindset.

How I Personally Handle These Phases

When Gold ETFs correct sharply, I don’t rush to act. I observe behaviour, both market behaviour and my own.

I reduce information intake instead of increasing it

I avoid reacting to one-day or one-week moves

I remind myself that volatility is part of long-term assets

Markets recover before confidence does.

And that gap is where mistakes usually happen.

Rahul’s Tip

If a Gold ETF fall is disturbing your peace more than your portfolio balance, step back. Good investments don’t require constant emotional attention. If fear is forcing urgency, the decision is probably premature.

Final Thought

When Gold ETFs crash, price moves fast.

Psychology moves faster.

Those who survive this phase are not the ones who predict perfectly, but the ones who stay emotionally stable while others panic.

If this post reflects what you’re feeling right now, drop a like or share your thoughts in the comments.

More real, market-relevant lessons coming.

XAUUSD – Historic Volatility Doji at 1.618 | Exhaustion SignalXAUUSD – HTF Exhaustion at 1.618 | Major Volatility Signal Formed

GOLD HAS PRINTED ITS BIGGEST DOJI IN ENTIRE HISTORY OF DAY CANDLE NEARLY 490$ FROM LOW TO HIGH AND ENDED WITH INDECISION. LETS SEE WHAT HAPPENS NEXT . WAIT FOR LOW AND HIGH OF DOJI.......?

Gold has reacted precisely from the 1.618 Fibonacci extension zone (~5600), where price printed a high at 5597.04 and faced strong rejection.

The current Daily candle is forming an exceptionally large indecision candle (Doji-like structure) after a strong impulsive move.

With an intraday range of nearly 490$, this candle highlights clear exhaustion and aggressive profit-taking at premium prices.

Technical Perspective

Clear rejection from the 1.618 extension resistance

Strong volatility spike following a vertical price expansion

Daily candle structure suggests weakening bullish momentum

Key HTF Levels to Watch

Resistance / Supply: 5580 – 5615

Immediate Reaction Zone: 5350 – 5400

Major Support / Rebalancing Area: 5000 – 4900

HTF Value Area Low: Below 4900 (only if bearish momentum accelerates)

Expectation (Next Sessions / 1–2 Weeks)

As long as price remains below the 1.618 rejection zone, probability favors:

Consolidation or corrective price action

Gradual rotation toward 5000–4900 HTF demand

No immediate V-shaped recovery unless strong acceptance above 5600 is seen

XAUUSD Gold Next Move In Upcoming 2 Weeks ExpectedGold is Now Moving to 5600 to 5615 Which is Retracement level of 1.618 For Golds Previous Swing Extension levels and can expect a retracement of till 5000 to 5100 Levels In Upcoming Weeks Lets See WhatS Going to Happen..........# XAUUSD .. Check My 4hr chart Frame

Silver Futures: Parabolic Breakdown & Bearish LiquidationSilver Futures: Parabolic Breakdown & Bearish Liquidation (Analysis)

Part 1: Historical Context (The "Why") To understand this violent -17% move, we must look at Silver's distinct "personality" compared to Gold.

1. The "Beta" Factor (Silver vs. Gold) Silver is often called "Gold on steroids." While Gold is a monetary metal held by Central Banks for stability, Silver is 50% industrial and 50% speculative. It has a much smaller market cap, meaning it takes less liquidity to push the price up or down violently.

Historical Rule of Thumb: When Gold drops 5%, Silver often drops 10-15%. This chart confirms a classic high-beta liquidation event.

2. Historical Comparisons

The 2011 Crash: In April 2011, Silver went parabolic to nearly $50/oz before crashing ~17.7% in a single day (the "Sunday Night Massacre"). This was caused by exchange margin hikes, forcing leveraged longs to liquidate.

The 2020 Covid Crash: In March 2020, Silver fell ~30% in weeks due to a liquidity crisis where traders sold precious metals to cover equity losses.

Part 2: Visual & Technical Analysis

A. Daily Timeframe (The "Map")

Step 1: The Parabolic Arc Break: The rally followed a steep, unsustainable curve (Blue Arc on chart). When price cuts vertically through such an arc—as the recent Red Candle has done—the bullish momentum is technically broken.

Step 2: The "Supply Zone" Rejection: The long wick at the top (near 422,000) represents a "concrete ceiling." Buyers were exhausted, and trapped longs at this level will likely sell into any recovery to break even.

Step 3: Bearish Engulfing Candle: The massive red candle has "engulfed" (wiped out) the gains of the previous 7-10 trading sessions. This shifts market psychology from "Buy the Dip" to "Sell the Rally."

Step 4: Momentum Warning (RSI Divergence): Before this drop, while price was making Higher Highs, the RSI likely failed to confirm with a Higher High (Bearish Divergence). This signaled buyer exhaustion before the crash occurred.

B. Intraday / Short-Term Strategy (The "Path") Since the daily trend is broken, the strategy shifts to defensive management.

1. The "Dead Cat Bounce" Scenario: After a vertical drop, the RSI is oversold. A bounce is expected, but it is often a trap. We use Fibonacci Retracement levels from the Swing High to Low to identify resistance:

0.382 Level: The first zone where aggressive bears often reload shorts.

0.5 - 0.618 (Golden Pocket): Historically the highest probability area for a "Lower High" to form.

2. The "Bear Flag" Pattern: In strong liquidations, price rarely recovers in a V-shape. Watch for a "Flag" pattern (slow drift upward on low volume). A break below the flag's support triggers the next leg down.

Part 3: Trading Strategy Summary & Risk Management

Volume Confirmation: Check the volume on the breakdown candle. If it is the highest of the year, it indicates "Capitulation" (potential temporary bottom). If volume is average, the "real" panic selling may still be ahead.

Invalidation Level (When is this view wrong?): This bearish outlook is negated ONLY if we get a Daily Candle close back above the 400,000 supply zone. Until then, the market structure remains corrective.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading futures involves significant risk.

If You Want to Catch the Bottom, First Wait for RSI.To Do Nothing.

Right now, staying out is already a win.

The market is moving fast, noisy, and uncomfortable. Both buyers and sellers are getting trapped — not because direction is unclear, but because the market has not finished its process yet.

This is a moment to stay calm and observe, not to force a trade.

Observe how price begins to slow down.

Observe how selling pressure fades.

Note:

Stay focused on RSI behavior. When price decelerates and RSI shows clear convergence / stabilization, that’s when it makes sense to start thinking about potential long ideas — not before.

Until then, observation comes first.

Sometimes, doing nothing is the most disciplined decision you can make.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Short-Term Sell Pressure as Liquidity Gets Cleared | Lana ✨

Gold is showing signs of short-term weakness after an aggressive upside expansion. Price action suggests the market may continue to move lower in the near term, not as a trend reversal, but as a liquidity-driven correction within a broader bullish structure.

At this stage, the focus shifts from continuation to how price behaves while liquidity is being taken below structure.

📈 Market Structure & Price Behavior

The recent vertical rally has left the market overextended, making a corrective phase technically healthy.

Price has broken below short-term support and is now trading under a descending corrective trendline, signaling short-term bearish pressure.

This type of structure often develops when the market needs to clean buy-side positions before rebuilding for the next leg.

While the higher-timeframe trend remains bullish, the intraday bias has shifted to corrective / bearish until liquidity objectives are met.

🔍 Key Liquidity Zones on the Chart

Short-term sell zone: the descending trendline near current price As long as price reacts below this trendline, rallies are more likely to be sold.

Scalping buy liquidity: around 5050–5070 This area may generate temporary bounces, but reactions here should be treated as short-term only.

Key bullish order block: 4825 – 4830 A critical zone where stronger buyer participation may appear if the sell-off extends.

Major swing liquidity zone: 4613 – 4625 This is a high-confidence liquidity pocket where the market could complete a deeper correction and reset the broader bullish structure.

🎯 Trading Scenarios

Primary scenario – Continuation of the pullback: As long as price remains below the descending trendline, gold may continue to move lower to sweep liquidity below recent lows. This favors sell-on-rallies rather than buying strength.

Secondary scenario – Temporary reaction: Short-term bounces may occur around the 5050–5070 area, but without structural reclaim, these moves are more likely corrective than trend-changing.

Structural defense scenario: If price reaches the 4825–4830 or 4613–4625 zones, watch closely for signs of stabilization and absorption, which would signal that the liquidity objective has been completed.

🧠 Lana’s View

This move lower is best seen as liquidity cleanup, not panic selling. Lana stays patient during corrective phases, avoiding early longs and waiting for price to reach clear liquidity zones before reassessing bullish continuation.

✨ Let the market take what it needs, then look for structure to rebuild.

Market Outlook & Trade Setup – Friday, 30th January 2025Major indices showed a sharp recovery yesterday and even crossed the opening day high. Silver and Gold has corrected by more than 6% overnight so some selling pressure could be seen.

We have the Budget on Sunday, 1st Feb, 2026, so heavy positions might not be build in the market today.

🔹 NIFTY

* Previous Close: 25,418

* Expected Range: 25,000 – 25,500

🔹 SENSEX

* Previous Close: 82,566

* Expected Range: 82,500 - 82,600

🌍 Global & Market Sentiment

* DJIA: +55 | S&P: -9

💰 Institutional Activity (Cash Market)

* FII: Net Sellers: - ₹ 394 Cr

* DII: Net Buyers: + ₹ 2639 Cr

🔥 Events this Week: US --- Trump Speech & FED Rate announcement

📌 Sectoral Focus

Metal, Energy

👉 Commodities in Focus: Gold, Silver, Copper, Crude, Natural Gas

💯 Important Quarterly Results: Cupid, GHCL, HUDCO, IEX, ITC,REC, Voltas

📈 Trade smart. Manage risk. Stay disciplined.

Gold: Correction or a Pause Before Continuation?Hello everyone, what’s your view on gold at the moment?

Yesterday, gold posted a strong intraday rally followed by a sharp reversal lower, clearly highlighting the intense battle between short-term capital flows. It was a highly volatile session, but from a professional perspective, there is still insufficient evidence to conclude that the medium-term trend has been broken.

From a news and market-context standpoint, the initial upside move was driven by renewed safe-haven demand as cautious sentiment returned. However, as price reached higher levels, large-scale profit-taking, combined with liquidation pressure from risk assets, quickly pushed gcapital reacted faster than.

On the techn, tkey support zone below acting as the equilibrium area between supply and demand. Price behavior around this area will determine whether gold is consolidating for another leg higher or transitioning into a deeper correction.

At this stage, my preferred approach is to monitor price reaction at the support zone rather than act impulsively. If buying interest returns and structure stabilizes, gold still has room to recover. Conversely, if support is decisively broken, staying on the sidelines becomes the most prudent choice.

What’s your take on XAUUSD?

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Resistance Breakout in OIL

BUY TODAY SELL TOMORROW for 5%

XAUUSD (GOLD) | BREAKOUT VS BREAKDOWN LEVEL | 29th Jan'2026XAU/USD (Gold) Outlook | 29 Jan 2026

Gold (XAU/USD) is trading near 5513, maintaining a strong bullish structure across daily, weekly, and monthly timeframes. Price is holding well above key moving averages, indicating sustained buying momentum. As long as gold stays above the 5515–5495 support zone, the upside bias remains intact with potential continuation toward 5555–5590. A decisive break below 5495 may trigger short-term corrective pressure, but the broader trend remains positive.

Breakout & Breakdown Levels

Bullish Breakout: Above 5555 | Bearish Breakdown: Below 5495

Disclaimer: This content is for educational purposes only and not financial advice. Trading involves risk; manage your position size wisely.