Amara Raja Energy cmp 945.60 by Monthly Chart viewAmara Raja Energy cmp 945.60 by Monthly Chart view

- Support Zone 895 to 930 Price Band

- Resistance Zone 1045 to 1080 >> 1110 Price Band

- Volumes seen closely flat to falling since hitting ATH in June 2024

- Volumes indicate consolidation and accumulation since February 2025

- Darvas Box : Price trending within 910 to 1110 range since February 2025

- Support Zone well respected over past few months but Price retracing at the Resistance Zone

Consolidationpattern

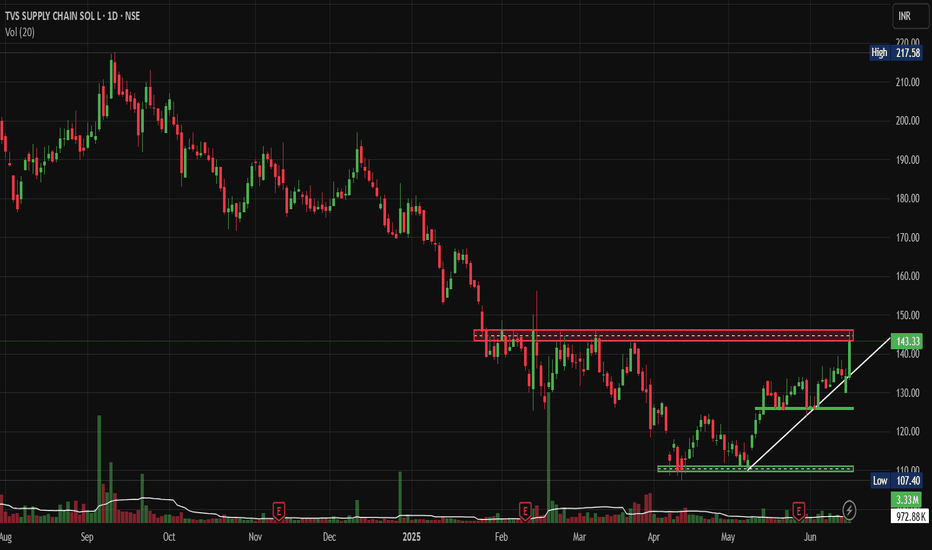

TVS Supply Chain: BO attempt after 6 Month Consolidation.This Supply Chain Giant is attempting to break out. After 6 Months of Consolidation - Is it Time to Load Up? Let's analyse today's Idea.

Price Action Analysis:

Current Market Structure:

• Stock is currently trading at ₹143.33, showing a strong +6.83% gain

• Price has broken above a key resistance zone around the ₹140 level

• Clear uptrend formation with a higher highs and higher lows pattern emerging

• Recent breakout attempt from a prolonged consolidation phase

Historical Price Movement:

• Stock witnessed a sharp decline from highs of ₹217+ in late 2024 to lows around ₹107

• Extended consolidation phase from February to May 2025 between ₹110-145 levels

• Current breakout attempt suggests potential trend reversal from bearish to bullish

Volume Spread Analysis:

Volume Characteristics:

• Significant volume spike visible during the recent breakout session

• Volume of 3.33M is substantially higher than the 20-day average of 972.88K

• Volume confirmation supporting the price breakout attempt above resistance

• Previous volume spikes coincided with major price movements

Volume Price Relationship:

• Healthy volume-price relationship during the current upward move

• Relatively lower volumes accompanied earlier decline phases

• Current breakout attempt volume suggests institutional participation

Key Technical Levels:

Support Levels:

• Primary Support: ₹130-132 (previous resistance turned support)

• Secondary Support: ₹120-125 (consolidation zone low)

• Major Support: ₹110-115 (multi-month consolidation bottom)

Resistance Levels:

• Immediate Resistance: ₹150-155 (psychological level)

• Medium-term Resistance: ₹165-170 (previous swing high)

• Major Resistance: ₹185-190 (Fibonacci retracement level)

Base Formation:

• Rectangle consolidation pattern formed between ₹110-145 levels

• Base duration: Approximately 4-5 months (February to May 2025)

• Breakout from this base suggests potential for sustained upward movement

Technical Patterns:

Primary Patterns:

• Rectangle/Box pattern completion with upward breakout attempt

• Potential inverse head and shoulders pattern on a longer timeframe

• Ascending triangle formation in recent weeks before the breakout

Trend Analysis:

• Short-term trend: Bullish (breakout confirmed)

• Medium-term trend: Transitioning from bearish to bullish

• Long-term trend: Still in recovery phase from major decline

Trade Setup and Strategy:

Entry Strategy:

• Aggressive Entry: ₹143-145 (current levels on any minor pullback)

• Conservative Entry: ₹135-138 (on retest of breakout level)

• Volume confirmation is required for any entry

Position Sizing:

• Risk 1-2% of portfolio capital on this trade

• Position size calculation: Portfolio Value × Risk % ÷ Stop Loss Distance

• Example: For ₹1,00,000 portfolio with 2% risk = ₹2,000 risk capital

Risk-Reward Calculation:

• Risk-Reward Ratio: Minimum 1:2 preferred

• Expected risk per share: ₹15-20 based on stop loss placement

• Potential reward: ₹30-40 per share to the first target

Exit Strategy:

Profit Targets:

• Target 1: ₹165-170 (15-20% upside) - Book 40% position

• Target 2: ₹185-190 (30-35% upside) - Book 40% position

• Target 3: ₹200+ (40 %+ upside) - Trail remaining 20% position

Stop Loss Levels:

• Initial Stop Loss: ₹125-128 (below consolidation support)

• Trailing Stop: Move to breakeven once Target 1 is achieved

• Final Trail: Use 10-day EMA or ₹10-15 trailing stop

Risk Management Framework:

Risk Control Measures:

• Maximum loss per trade: 2% of total capital

• Position sizing based on stop loss distance

• No averaging down if the trade goes against the initial thesis

• Exit if the technical structure breaks down

Portfolio Allocation:

• Maximum exposure to single stock: 5-8% of portfolio

• Sector allocation limit: 15-20% to logistics/supply chain

• Maintain diversification across market caps and sectors

Sectoral Analysis:

Logistics and Supply Chain Sector:

• The sector has shown resilience post-pandemic disruptions

• Growing e-commerce and digitalization are driving demand

• Government infrastructure push benefiting logistics companies

• Increasing focus on supply chain optimization across industries

Sector Positioning:

• NSE:TVSSCS is positioned in the growing third-party logistics market

• Beneficiary of Make in India and manufacturing growth

• Automotive sector recovery supporting the company's core business

Fundamental Backdrop:

Business Overview:

• Leading third-party logistics and supply chain solutions provider

• Strong presence in automotive, consumer goods, and industrial sectors

• Integrated service offerings including warehousing, transportation, and value-added services

Growth Drivers:

• Expansion in new geographies and service offerings

• Technology-driven efficiency improvements

• Growing outsourcing trend in supply chain management

• Recovery in the automotive sector supporting traditional business

Market Outlook and Catalysts:

Positive Catalysts:

• New client acquisitions and contract wins

• Capacity expansion announcements

• Favourable government policies for the logistics sector

Risk Factors:

• Economic slowdown affecting industrial demand

• Fuel price volatility is impacting transportation costs

• Competitive pricing pressure in the logistics industry

• Global supply chain disruptions

My Take:

TVS Supply Chain Solutions presents a compelling technical setup with the recent breakout attempt from a multi-month consolidation. The combination of strong volume confirmation, supportive sectoral trends, and improving fundamental backdrop makes this an attractive opportunity for Short to medium-term investors. However, proper risk management and position sizing remain crucial for the successful execution of this trade setup.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

DYDXUSDT Long Setup: Targeting Key LevelsWe're examining the DYDXUSDT pair for a potential long position, guided by technical analysis on the daily chart. The price action has settled into a consolidation pattern, making a strong base around the 2.979 entry point. This area has acted as a springboard, sending price action upwards with increasing momentum, as indicated by the recent green candles.

The Relative Strength Index (RSI) is currently at 60.59, which is neither overbought nor oversold, suggesting that there is room for upward movement before the market becomes overheated. This is supported by the RSI Divergence Indicator, which is not showing any signs of bearish divergence at this point, implying that the current bullish momentum has the potential to continue.

Our first profit target (TP1) is set at 3.420, which is in line with previous resistance levels that could now serve as a new support in the uptrend. The second profit target (TP2) is at 3.984, just below the significant psychological level of 4.0 and aligns with prior peaks where the price has shown considerable reactions in the past.

For risk management, a stop loss would be wisely placed below the recent consolidation zone to protect against any unexpected downturns. This strategic placement allows for normal price fluctuations without being stopped out prematurely.

In essence, this trade idea is built on the premise of a strong support base, continuous bullish momentum, and the absence of overbought conditions, presenting a compelling case for a long position on DYDXUSDT.

Super consolidation breakout - KANSAINER👑 Drop a follow here: @Averoy_Apoorv_Analysis 👑 ----------------------- 🔥🔥 Target: 2000 Followers 🔥🔥

Self explained chart

⌛ Motivational and psychological area ⌛

✣Trade only if you are in the right mindset, if you have been emotionally weak for some time, take your time and don't trade, trade with a happy and + mindset only.

✣If you want to make money, firstly be prepared to lose it, only that much which you can afford and that much by which you can make a mistake again, learn from them and grow

✣Don't lose hope and keep grinding

✣I have seen my friends on youtube streaming games with watching 10, constantly they streamed for a year or two and now they are buzzing with 1k to 2k watching daily.

✣Focus on the process, you are here to make money not stupid decisions, and lose it all

✣No one will help you climb the mountain, few will tell the path, so follow good people, make good mentors and make good decisions and choices in the stock market.

✣Believe in yourself :)

🎓🎓 Some info about me :)

➼My name is Apoorv and I am a 2nd year Engineering student, I want to pursue trading as my career, and thus whatsoever setups or trades I potentially see on my charting platform, I post it here and share them with you all.

➼I hope you will love my simple analysis style.

➼Feel free to suggest your view on this as learning is earning here :)

➼I take my trades on my Zerodha account :)

➼I don't take all the trades I post

➼These charts are my and only my work, my thought process, just from an educational point of view and no calls.

☃☃☃☃ Thank You Have a Nice Trading Day ☃☃☃☃

Why you should be careful before trading in PRINCEPIPE As many of my followers were asking about PRINCEPIPES, here is my view, Plz read the whole If still, your setups match go for it :)

Logic points --

1) On Monthly charts, It has not given a good retracement

2) On the day chart if you make a Fibonacci retracement from the lowest part till the near term high then u will see a retracement of only 0.2

3) Such retracement either show heavy bullishness for the short term or can be deadly bearish for the long term faking out for the retracement part just like a breakout

4) A good consolidation on the D chart only doesn't mean bullishness, although the chart seems interesting and is consolidating continuously for some days so what to do now?

Answer: Either enter now if you are so attracted towards PRINCEPIPES and only wanted to trade in it as per your setup says, But then do make a good and strict SL and also use less capital ( really less ) just in case.

OR

Wait for some time, let it consolidate for some weeks or days more, and come to FIBONACCI levels retracement of 0.5 or 0.6 in order to get the real bullish momentum in the stock you are looking for.

Thank you, AAA

CEAT | LetsMakeMoneyTogether 💲💲 FOLLOW me @Averoy_Apoorv_Analysis and get these free analysis :) 💲💲

🔰Watch the stock carefully :)

🔰Once you see a good breakout above this line (the pink one ) A good setup is initiated there

🔰DAY candle only ( strictly educational purpose ) :: A tip :: close above the line only on 3:20 pm would be a good setup creation :)

🔰Happy trading everyone :)

🔰 {Some info}

➼My name is Apoorv and I am a 2nd year Engineering student, I want to pursue trading as my career, and thus whatsoever setups or trades I potentially see on my charting platform, I post it here and share them with you all.

➼I hope you will love my simple analysis style.

➼Feel free to suggest your view on this as learning is earning here :)

➼I take my trades on my Zerodha account :)

➼These charts are my and only my work, my thought process, just from an educational point of view and no calls.

<<<<<>>>>>