M&M Fin (W) - Renewed Strength within a Multi-Year ConsolidationAfter more than two years of trading in a sideways range, M&M Financial Services is showing strong signs of renewed buyer interest, suggesting a potential move towards the top of its long-term consolidation channel.

The Big Picture: A Prolonged Consolidation

Since reaching its All-Time High (ATH) in July 2023, the stock has been locked in a wide consolidation or sideways trend. A classic and often bullish sign during this phase has been the gradual drying up of trading volume , which typically indicates that selling pressure is diminishing.

Recent Bullish Action

The past week marked a significant shift in activity, signaling that bulls are becoming active again:

- The stock surged by +6.38% for the week.

- This move was supported by a strong volume of 15.49 million shares , indicating conviction behind the buying.

This renewed interest is supported by the underlying strength seen in higher timeframe indicators. Both the short-term Exponential Moving Averages (EMAs) and the Relative Strength Index (RSI) are in a bullish state on the *Monthly and Weekly charts.

Outlook and Key Levels

While the ultimate goal for bulls is a breakout above the distant ATH, the immediate battleground is the established trading range.

- Upside Target: The primary target in the near term is the upper limit of the consolidation range, around the ₹333 level. A breakout above this would be the next major bullish signal.

- Key Support: If this recent momentum fades, the stock is likely to find strong support at the lower boundary of its range, near the ₹250 level.

In conclusion, last week's strong performance suggests M&M Financial is preparing to challenge the top of its long-term range. The key now is to watch if this momentum can be sustained for a move towards the ₹333 resistance.

Consolidationzone

Gallant Isp (W) - Consolidates in Bullish Pattern After New ATHFollowing a powerful and sustained uptrend since May 2023, Gallantt Ispat Ltd. reached a new All-Time High (ATH) in August 2025. For the past few weeks, the stock has entered a healthy sideways consolidation phase . This type of consolidation after a strong rally is often a bullish continuation pattern, suggesting the primary uptrend is likely to resume.

Strong Underlying Bullish Indicators 👍

The positive long-term outlook is reinforced by several strong technical signals on higher timeframes:

- Sustained Volume: The average trading volume has been increasing , indicating growing and sustained interest in the stock.

- Long-Term Momentum: Short-term Exponential Moving Averages (EMAs) are in a bullish crossover state on both the monthly and weekly charts.

- Confirmed Strength: The Relative Strength Index (RSI) is also rising on both the monthly and weekly timeframes, confirming strong underlying momentum.

Outlook and Key Price Levels

The price action in the coming weeks will be crucial to determine the next move out of this consolidation.

- Short-Term Range: In the immediate term, the stock could fluctuate between a potential upside target of ₹780 and a downside support level of ₹570 .

- Long-Term Potential 📈: If the bullish momentum resumes and the stock breaks out of the current consolidation, a longer-term price target of ₹1,000 could be achievable.

Prakash Ind (D) - Coils in Major Triangle Pattern, Nearing ApexPrakash Industries is currently in a prolonged consolidation phase, trading within a large Triangle pattern that has been forming since September 2023. This pattern typically acts as a continuation of the prior trend, which in this case was a strong uptrend that began in April 2023.

The stock is now approaching the apex of this triangle, suggesting a significant price move could be imminent. The key boundaries to watch are:

- A formidable long-term resistance trendline dating back to January 2008 . This level has triggered several "fake breakouts" in the past.

- A strong support trendline established since September 2023.

Outlook: A Breakout Awaits Confirmation

The stock is likely to remain range-bound in the immediate short term. A decisive move will only occur upon a breakout or breakdown from the existing pattern, which must be confirmed by a significant increase in trading volume.

- Trading Range: Within the current pattern, the stock could oscillate between the upper resistance near ₹187 and the lower support level around ₹160 .

- Breakout Scenario 📈: A sustained breakout above the multi-year resistance on high volume would signal a continuation of the primary uptrend.

- Breakdown Scenario 📉: Conversely, a breakdown below the support trendline would invalidate the bullish continuation thesis and could lead to a significant correction.

AARTIDRUGSAARTIDRUGS is trading in long consolidation zone with dried volume. Support zone is near 495-500. Currently trading near 515-17. Once it gets market participation then the probability of resuming continuation of uptrend is very high. Risk reward is quite in favor. Keep it in your watch list.

Kamat Hotels: Bullish Breakout from Consolidation RangeThe chart of KAMAT HOTELS has shown breakout from critical consolidation zone, marked on the chart. These levels are essential for assessing the current balance between supply and demand.

1. The Support Level (Marked on Chart)

This level 221 represents a zone of historical demand where buying interest has previously emerged to halt price declines. It acts as a structural floor for the recent price action.

2. The Resistance Level (Marked on Chart)

This level of 281 represents a more formidable area of overhead supply, likely corresponding to a previous significant peak or a major distribution zone. It is the first major target and potential obstacle following a successful breakout.

Disclaimer:

The information provided in this technical analysis is for informational and educational purposes only and should not be construed as financial or investment advice. It is an interpretation of historical price data. Market dynamics can change, and past performance is not indicative of future results. All trading and investment activities involve risk. Always conduct your own thorough due diligence and consult with a qualified financial advisor before making any investment decisions.

CIPLA: Darvas Box Breakout Post Results ReactionNSE:CIPLA Darvas Box Breakout Post Q1 FY 26 Results Reaction: Why This Pharma Giant Could Be Your Next Big Winner Let's Analyze

Price Action:

Price Movement Characteristics:

- Volatility: Compressed volatility within the Darvas Box range

- Price Swings: Controlled swings between ₹1,480-1,532.50 boundaries

- Breakout Attempts: Multiple tests of upper resistance without sustained follow-through

- Support Tests: Clean bounces from the lower boundary showing strong institutional support

Volume Spread Analysis

- Current Volume: 5.23M (above 20-day average)

- Volume Pattern: Declining during consolidation (bullish accumulation sign)

- Volume Spike Required: Need 1.5x average volume for breakout confirmation

- Volume Trend: Steady participation without panic selling

Market Structure Analysis:

- Higher Lows Formation: Gradual increase in swing lows within the consolidation

- Lower Highs Compression: Resistance level holding firm, creating compression

- Price Coiling: Decreasing range suggesting energy buildup for directional move

- Time Compression: Extended sideways movement indicating a major move is pending

Chart Pattern Recognition:

- Primary Pattern: Darvas Box Formation (clearly marked on the chart)

- Box Range: ₹1,480 - ₹1,532.50 consolidation zone

- Pattern Duration: Approximately 3-4 months of sideways consolidation

- Volume Context: Declining volume during the consolidation phase, typical of accumulation

Candlestick Pattern Analysis:

- Recent Candles Formation: Doji and small-bodied candles indicating indecision at resistance

- Candle Bodies: Predominantly small bodies suggesting balanced buying/selling pressure

- Wicks Analysis: Upper wicks at resistance showing selling pressure, lower wicks showing support

- Colour Distribution: Mixed red/green candles within the box showing consolidation

Key Support and Resistance Levels:

- Immediate Support: ₹1,480 (Darvas Box lower boundary)

- Strong Support: ₹1,420 (previous swing low)

- Critical Support: ₹1,335 (yearly low)

- Immediate Resistance: ₹1,532.50 (Darvas Box upper boundary)

- Target Resistance: ₹1,600-1,620 (measured move projection)

- Ultimate Target: ₹1,700+ (analyst consensus target)

Base Formation:

- Base Type: Rectangular consolidation/Darvas Box

- Base Duration: 3-4 months (adequate for institutional accumulation)

- Base Tightness: Well-defined boundaries showing controlled supply

- Breakout Confirmation: Price action at upper boundary with volume expansion needed

Trend Analysis:

- Short-term Trend: Sideways consolidation

- Medium-term Trend: Neutral to slightly bullish

- Long-term Trend: Recovery phase from 2024 lows

Momentum Indicators:

- Current Momentum: Building up for potential breakout

- Price Position: Near upper boundary of consolidation range

- Market Structure: Higher lows formation within the box

Trade Setup Strategy:

Entry Strategy:

- Primary Entry: Breakout above ₹1,535 with volume confirmation

- Secondary Entry: Retest of breakout level around ₹1,520-1,525

- Conservative Entry: Support bounce from ₹1,485-1,490

Target Levels:

- Target 1: ₹1,580 (initial resistance)

- Target 2: ₹1,620 (measured move from box height)

- Target 3: ₹1,700 (analyst target consensus)

- Long-term Target: ₹1,800+ (bull case scenario)

Stop-Loss Levels:

- Aggressive: ₹1,470 (below box support)

- Conservative: ₹1,450 (below key support zone)

- Risk Management: ₹1,420 (major support failure)

Position Sizing Guidelines:

- High Conviction: 2-3% of portfolio (on confirmed breakout)

- Medium Conviction: 1-2% of portfolio (on retest entry)

- Conservative: 0.5-1% of portfolio (support bounce play)

- Maximum Risk per Trade: Not more than 1% of total capital

Risk Management Framework:

- Risk-Reward Ratio: Minimum 1:2 for all entries

- Position Scaling: Add on strength after initial 5% move

- Profit Booking: Book 30% at Target 1, 40% at Target 2, trail rest

- Stop-Loss Management: Trail stop to breakeven after 7-8% profit

Sectoral and Fundamental Backdrop:

Pharmaceutical Sector Outlook:

- Market Size: The Indian pharma market is expected to reach US$18.8 billion by 2028 at an 8% CAGR

- Global Position: 500 facilities approved by the US FDA, the highest number outside the US

- Growth Drivers: Speedy introduction of generic drugs and focus on rural health programmes

CIPLA Fundamental Strengths:

- Market Capitalization: ₹1,23,842 Crore

- Performance: ₹27,548 Cr revenue with ₹5,269 Cr profit

Key Fundamental Concerns:

- Growth Rate: Poor sales growth of 10% over the past five years

- Promoter Holding: Decreased by 4.42% over the last 3 years, currently at 29.19%

Industry Catalysts:

- FDA Approvals: India has received 6,316 USFDA approvals for formulation plants

- Global Market Share: India supplies 40 per cent of generic drugs globally

- Export Potential: Strong positioning as a global generic supplier

Risk Assessment:

Technical Risks:

- Pattern Failure: Box breakdown below ₹1,470 would negate the bullish thesis

- Volume Concerns: Breakout without volume confirmation could lead to a false move

- Market Sentiment: Broader market correction could impact individual stock performance

Fundamental Risks:

- Regulatory Changes: FDA compliance issues or policy changes

- Competition: Intense pricing pressure in the generic segment

- Currency Risk: Rupee fluctuation impact on export revenues

Market Risks:

- Sector Rotation: Money flow away from the pharma sector

- Global Slowdown: Impact on export-dependent business model

- Geopolitical Factors: Trade tensions affecting pharmaceutical exports

My Take:

Trading/Investment Thesis:

The Darvas Box pattern on NSE:CIPLA represents a classic accumulation phase, characterised by institutional buying at lower levels. The pharmaceutical sector's strong fundamentals, combined with CIPLA's established market position, create a favourable environment for a potential breakout.

My Action Plan:

- Watch for breakout above ₹1,535 with 1.5x volume

- Enter in phases rather than a lump-sum investment

- Maintain strict stop-loss discipline

- Book profits in tranches as targets are achieved

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Axisbank near the Bottom of rangeAxis Bank has been in a consolidation range since last 70+ days. Price's been making high of Rs 1240 and low of Rs 1150 since then.

Now, the price has come near 1150 (Range Low). Again price is expected to bounce from the range low to 1240 leaving an opportunity to grab near about 7% profit in a shorter period of time.

With Risk Taking till price reaches below Rs. 1150.

Price breaching below range low i.e. Rs. 1150 with good volume can lead the price to go to 1030 and 1000 price point.

Note: This analysis is for Educational Purpose Only. Please invest after consulting a professional financial advisor.

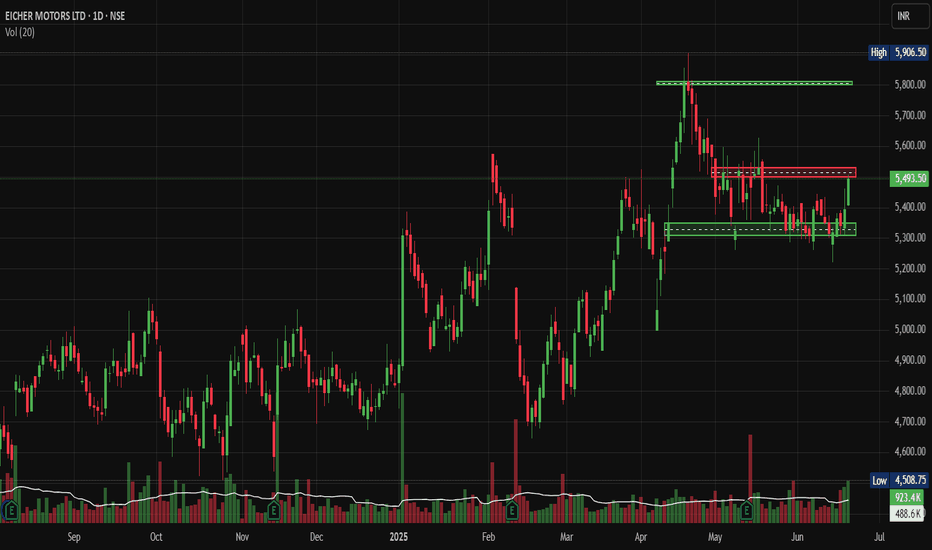

Eicher Motors: Hits Swing Highs, Signal More Upside AheadNSE:EICHERMOT Hits Swing Highs: This Technical Setup Could Signal More Upside Ahead

Price Action Analysis:

- Current Price: ₹5,493.50 (as of June 19, 2025)

- Day's Range: ₹5,410.00 - ₹5,506.50

- Price movement shows strong bullish momentum with recent breakout above resistance

- The stock has gained approximately 100.50 points (+1.86%) in the session

Volume Spread Analysis:

- Current session volume: 923.4K (89% above average)

- Average volume: 488.6K

- Volume surge during breakout phases confirms institutional buying

- Declining volume during consolidation phases shows controlled profit-taking

- Volume spike of 923.4K against average of 488.6K indicates institutional participation

- Volume has been increasing over the past 3 Days.

Volume Pattern Insights:

- Volume expansion on up moves and contraction on down moves

- Accumulation pattern visible in the base formation phase

- Recent volume spike suggests renewed buying interest

Chart Patterns:

- A clear ascending triangle pattern formed between March and May 2025

- Breakout above the ₹5,800 resistance level in April with strong volume confirmation

- Current consolidation phase between ₹5,300-₹5,500 range

- Higher lows pattern since March 2025 indicates underlying bullish sentiment

Key Technical Levels:

Support Levels:

- Immediate Support: ₹5,300 (previous resistance turned support)

- Secondary Support: ₹5,100 (20-day moving average zone)

- Major Support: ₹4,800 (previous consolidation base)

- Critical Support: ₹4,500 (long-term uptrend line)

Resistance Levels

- Immediate Resistance: ₹5,600 (short-term ceiling)

- Key Resistance: ₹5,800 (previous breakout level)

- Major Resistance: ₹5,900 (all-time high zone)

- Extended Target: ₹6,200 (measured move projection)

Base Formation

- Primary base formed between September 2024 - March 2025

- Consolidation range: ₹4,400 - ₹5,200

- Duration: 6 months (healthy accumulation phase)

- Breakout confirmation in April 2025 with volume expansion

Technical Indicators Assessment:

Momentum Indicators:

- Price trading above key moving averages

- Bullish crossover pattern maintained

- Momentum favours bulls in the short to medium term

Trend Analysis:

- Primary trend: Bullish (uptrend intact since September 2024)

- Secondary trend: Consolidation within an uptrend

- Trend strength: Strong (confirmed by volume analysis)

Trade Setup:

Long Position Strategy:

- Entry Strategy: Buy on dips approach

- Accumulation zone: ₹5,300 - ₹5,400

- Momentum entry: Above ₹5,550 with volume confirmation

- Investment horizon: 3-6 months

Entry Levels:

- Conservative Entry: ₹5,320 (near support)

- Aggressive Entry: ₹5,480 (current levels)

- Breakout Entry: ₹5,560 (above resistance)

Exit Strategy:

- Target 1: ₹5,800 (12% upside from current levels)

- Target 2: ₹6,000 (20% upside potential)

- Target 3: ₹6,200 (extended target for long-term holders)

Stop-Loss Levels:

- Conservative SL: ₹5,200 (below key support)

- Aggressive SL: ₹5,350 (tight stop for short-term trades)

- Investment SL: ₹4,800 (major support violation)

Position Sizing & Risk Management:

Position Sizing Guidelines:

- Conservative approach: 2-3% of portfolio allocation

- Moderate approach: 4-5% of portfolio allocation

- Aggressive approach: 6-8% of portfolio allocation (only for high-risk tolerance)

Risk Management Framework:

- Maximum risk per trade: 2% of total capital

- Risk-reward ratio: Minimum 1:2 preferred

- Portfolio correlation: Consider auto sector exposure

- Stop-loss discipline: Strict adherence to predetermined levels

Capital Allocation Strategy:

- Entry in tranches during the consolidation phase

- Average up strategy on breakout confirmation

- Profit booking at predetermined target levels

- Position sizing adjustment based on volatility

Sectoral Backdrop:

Automobile Sector Overview:

- The two-wheeler segment is showing a strong recovery post-COVID

- Rural demand improvement supporting premium motorcycle sales

- Electric vehicle transition creating new opportunities

- Government infrastructure spending boosts commercial vehicle demand

Industry Trends:

- The premium motorcycle segment is growing faster than the mass market

- Export opportunities expanding in international markets

- Supply chain normalisation is improving production efficiency

- Raw material cost pressures are stabilizing

Fundamental Backdrop:

Company Fundamentals:

- May 2025 sales up 26% YoY with a total of 89,429 units sold

- International sales up 82%, showing strong export growth

- Achieved a significant milestone of selling over 100,000 units in March with 33.7% YoY growth

- Fundamentals look strong and suitable for long-term investment

Market Position:

- Continues to dominate >350cc space with >85% market share

- Increased market share from 32.9% in Q4FY22 to ~36% in Q1FY23 in >125cc segment

- Market cap of ₹1,50,676 crores, appearing financially stable compared to competitors

- Average analyst price target of ₹5,426 from 21 research reports

Financial Health:

- Trailing 12-month revenue of $2.19 billion as of March 2025

- Strong balance sheet with healthy cash flows

- Consistent dividend payment track record

- Efficient capital allocation and ROE metrics

Growth Catalysts:

- New product launches, including Hunter 350, are receiving a positive response

- Market share expansion in the premium segment

- International market penetration opportunities

- Electric vehicle portfolio development

Risk Factors:

Company-Specific Risks:

- Dependence on Royal Enfield brand performance

- Raw material cost inflation impact on margins

- Competition intensification in the premium motorcycle segment

- Regulatory changes in emission norms

Market Risks:

- Economic slowdown affecting discretionary spending

- Interest rate changes may impact vehicle financing

- Commodity price volatility

- Currency fluctuation impact on exports

Technical Risks:

- Breakdown below ₹5,200 could trigger selling pressure

- Volume declining during upward moves would be concerning

- Broader market correction affecting sector sentiment

- Profit booking pressure at higher levels

My Take:

Overall Assessment:

The technical setup for NSE:EICHERMOT appears constructive, with the stock maintaining its uptrend structure. The recent consolidation phase provides an opportunity for fresh accumulation. Strong fundamentals support the technical outlook with robust sales growth and market share expansion.

Investment Recommendation

Buy on dips strategy recommended for medium to long-term investors. The risk-reward profile remains favourable with multiple technical targets achievable. However, strict stop-loss discipline and position sizing are crucial for risk management.

Time Horizon:

- Short-term (1-3 months): Consolidation with upward bias

- Medium-term (3-6 months): Bullish with a target of ₹6,000

- Long-term (6-12 months): Positive outlook with potential for new highs

The combination of strong fundamentals, healthy technical setup, and favourable sector dynamics makes NSE:EICHERMOT an attractive investment proposition for quality-focused portfolios.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

ARVINDFASNARVINDFASN showing very good strength on this negative days as well and currently trying to coming out of consolidation. As long as it is closing above 440 then dips are good to accumulate. Positive momentum may fetch the stock up to 600 in near term. And next trigger level can b above 485. Wait for the perfect entry point.

#LLOYDSME - BreakOut Soon Candidate📊 Script: LLOYDSME

Key highlights: 💡⚡

📈 VCP BreakOut in Daily Time Frame.

📈 Price consolidating near Resistance.

📈 Wait for Volume spike during Breakout

📈 MACD Bullish

📈 Can go for a swing trade

BUY ONLY ABOVE 1405 DCB

⏱️ C.M.P 📑💰- 1349

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

⚠️ Important: Market conditions are Okish, Position size 50% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

#QPOWER - IPO Stock Keep In Watch List📊 Script: QPOWER

Key highlights: 💡⚡

📈 Inverse Head & Shoulders in Daily Time Frame.

📈 Price consolidating near Resistance.

📈 Can Enter on BO with Volume spike.

📈 MACD Bounce

📈 One can go for Swing Trade.

BUY ONLY ABOVE 380 DCB

⏱️ C.M.P 📑💰- 376

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

️⚠️ Important: Market conditions are Okish, Position size 50% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

#SBILIFE – Weekly Timeframe Reversal in Play!📊 Script: SBILIFE

Key highlights: 💡⚡

📈 Double Bottom Formation in Weekly Time Frame.

📈 Price consolidation near Resistance in Daily Time Frame.

📈 Can Enter Breakout on if price sustains with volume.

📈 One can go for Swing Trade.

BUY ONLY ABOVE 1600 DCB

⏱️ C.M.P 📑💰- 1545

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

️⚠️ Important: Market conditions are not great, Position size 25% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

#CANTABIL - Breakout Soon Candidate! /Feb'25/ 📊 Script: CANTABIL

Key highlights: 💡⚡

📈 C.E.S.T – refer image

🟢 If you have any questions regarding the setup, please feel free to leave your inquiries in the comments, and I will respond promptly.

BUY ONLY ABOVE 315 DCB

⏱️ C.M.P 📑💰- 284

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅#Boost, #Like & #Follow to never miss a new idea! ✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

#ZENSARTECH - Add to Watchlist📊 Script: ZENSARTECH

Key highlights: 💡⚡

📈 IHNS Formation in Daily chart.

📈 Price gave a good up move.

📈 Went into a Side Ways consolidation for over a Six months.

📈 Volume spike seen.

📈 MACD Cross Over.

📈 One can go for Swing Trade.

🟢 If you have any questions regarding the setup , please feel free to leave your inquiries in the comments , and I will respond promptly.

BUY ONLY ABOVE 850 DCB

⏱️ C.M.P 📑💰- 823

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅#Boost, #Like & #Follow to never miss a new idea! ✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

#BHARTIARTL - Potential Trend Line Break Out📊 Script: BHARTIARTL

Key highlights: 💡⚡

📈 VCP formation in Daily chart.

📈 Price gave a good up move, then went Side Ways

📈 wait for more consolidation near Resistance / Trend Line

📈 Enter on BO when spike in Volume is seen

📈 MACD Bounce

📈 One can go for Swing Trade.

BUY ONLY ABOVE NA DCB

⏱️ C.M.P 📑💰- 1644

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Boost, Like and follow to never miss a new idea! ✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Symmetrical Triangle Setup With Consolidation about to BlastNSE:INDIGOPNTS on the Weekly timeframe is making a Symmetrical Triangle setup that can break on the upside because the price has been consolidated for the past 14 weeks in a Narrow Range after Getting Accumulated Near the Key Zone, Followed By a Volume Blast.

A Close or Breakout of the Setup Next Week will be confirmed if Followed by Similar Volumes.

Keep this on your Watchlist. Meanwhile, Check out my other stock ideas below until this trade gets activated. I would love your feedback.

Disclaimer: This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Just A View - VBL📊 Script: VBL

📊 Sector: FMCG

📊 Industry: Food - Processing - Indian

Key highlights: 💡⚡

📈 Script is trading in consolidation zone since last few trading session.

📈 Script has to give breakout or breakdown to came put of consolidation zone.

📈 For breakout script has to give closing above 1644, and for breakout script has to give closing below 1578

KEEP AN EYE ON STOCK

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

Keep An Eye - Consolidation Zone - QUESS📊 Script: QUESS

📊 Sector: Diversified

📊 Industry: Diversified - Large

Key highlights: 💡⚡

📈 Script is trading in consolidation zone at support.

📈 Script has to break either resistance of 640 or support 620 make it or break it.

📈 Keep An Eye on stock for Breakout or Breakdown.

⏱️ C.M.P 📑💰- 626

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

Keep An Eye - ORIENTHOT📊 Script: ORIENTHOT

📊 Sector: Hotels & Restaurants

📊 Industry: Hotels

Key highlights: 💡⚡

📈 Script is trading in consolidation zone from last 17 days, 140 is resistance level.

📈 We may see rally above 140 level.

⏱️ C.M.P 📑💰- 134

🟢 Target 🎯🏆 - 153

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

BALAJI AMINES - Bullish Consolidation with VolumesNSE: BALAMINES is closing with a bullish consolidation candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 13% to 20% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

Keep An Eye - COLPAL📊 Script: COLPAL

📊 Sector: FMCG

📊 Industry: Personal Care - Multinational

Key highlights: 💡⚡

📈 Script is trading at upper band of BB.

📈 MACD is giving crossover .

📈 Double Moving Averages is giving crossover.

📈 Stock is under Consolidation Zone highlighted into chart breakout is above 2624 level.

📈 Right now RSI is around 60.

📈 One can go for Swing Trade only above 2624.

BUY ONLY ABOVE 2624

⏱️ C.M.P 📑💰- 2606

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

OIL - Bullish Consolidation with VolumesNSE: OIL is closing with a bullish consolidation candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 8% to 12% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade