Compression Before Expansion: Market Awaits Its Next MoveBTCUSD – Compression Before Expansion: Market Awaits Its Next Move

Bitcoin is trading within a compressed structure after rejecting key resistance and retesting support. While the overall sentiment remains cautious, the technical setup is beginning to show signs of strength — if buyers can reclaim control.

🧭 Macro Check-In: Calm Before the Crypto Storm?

No rate cut from the Fed yet, but markets are starting to price in the possibility of a pause in Q3 or Q4.

ETF inflows slowing, but institutional positions are not closing — suggesting long-term conviction remains.

Political momentum in the US is shifting towards crypto adoption, with Bitcoin emerging as a talking point in election debates.

Dollar index (DXY) continues to chop, giving crypto room to breathe if inflation data remains mild.

In short: liquidity is building, but the trigger hasn’t fired — yet.

📊 Chart Structure (H1–H4): Levels That Matter

BTC is holding just above 103,100, a key level where previous demand stepped in.

The mid-range resistance lies at 104,184 — this needs to break for bulls to gain short-term control.

Above that, eyes are on 106,047, then 107,586 (top of the descending channel).

EMA alignment is still bearish → wait for structure shift, not FOMO.

📌 Trade Map

🔵 Buy Setup

Zone: 103,100 – 103,300

Condition: Bullish reaction + rejection wick / engulfing

SL: 102,600

TP: 104,184 → 106,047 → 107,586

🔴 Sell Setup (Only if trap triggers)

Zone: 107,500 – 107,800

Condition: Rejection + volume fade

SL: 108,200

TP: 106,000 → 104,500

🧠 Trader Insight

“When the chart compresses, smart money positions early.”

Bitcoin is not trending — it's accumulating or distributing. Retail is waiting for breakout. Smart traders are preparing for both scenarios.

Watch the reaction, not the prediction.

Stay objective. Let levels lead the logic.

Cryptomarket

Institutions Option Database Trading Part-5 Risk Management in Option Trading

Even with data, risk control is key:

Max 2% capital risk per trade.

Hedge with opposite option.

Avoid low liquidity options.

Always track IV, PCR, OI live.

Building a Custom Option Scanner

With databases and logic, you can create a personal scanner for:

High IV options

OI breakout zones

PCR + Max Pain alert

Theta-rich expiry trades

Institutions Option Database Trading Part-4Advanced traders use machine learning to forecast:

Option price movement

Volatility changes

IV spikes before events

Popular Models:

Random Forest → Trend direction.

LSTM (Deep Learning) → Predict future IV.

Logistic Regression → Probability of ITM expiry.

These are trained on millions of past trades using structured databases.

Institutions Option Database Trading Part-6Deep Dive into Options Basics (For Data Traders)

Options are contracts giving the right but not the obligation to buy or sell an asset at a certain price before a set date. They are used for hedging, speculation, and generating income.

🛠️ Two Types:

Call Option: Right to buy an asset.

Put Option: Right to sell an asset.

Backtesting means testing a strategy using past data to check performance. Key for data-driven option trading.

Example:

Load 1-year option chain data for BANKNIFTY.

Apply rules: Buy Call when IV drops by 10% & PCR < 0.8.

Check PnL for each trade.

Filter for success rate > 65%.

Long Term Database TradingHow Institutions Use Option Databases

🔍 Institutional Insights:

Banks & HFTs (High-Frequency Traders) run option strategies over petabytes of data.

Real-time arbitrage opportunities are found using option databases.

They model Vega, Theta & IV impact per stock and expiry.

Example Institutional Workflow:

Pull 10 years of NIFTY options.

Train ML model to predict next-day IV.

Execute based on high-probability straddles/strangles.

Exit before expiry using trailing delta hedge.

INJ Long Swing Setup – Approaching Fibonacci & Major SupportInjective (INJ) is nearing a key support zone that aligns with the 61.8% Fibonacci retracement level. This confluence area around $10.20–$11.30 offers a strong setup for a potential long swing trade.

📌 Trade Setup:

• Entry Zone: $10.20 – $11.30

• Take Profit Targets:

o 🥇 $14.00 – $16.00

o 🥈 $20.00 – $23.00

• Stop Loss: Daily close below $9.00

Learn Institution Trading Part -6Introduction to Institutional Option Trading

Institutional option trading refers to the sophisticated strategies used by hedge funds, mutual funds, insurance companies, proprietary trading firms, and foreign institutional investors (FIIs) to manage portfolios, hedge risks, and generate consistent alpha from the derivatives market. Unlike retail traders, institutions operate with large capital, access to advanced technology, and deep market insights, allowing them to structure complex trades.

2. Why Institutions Trade Options

Institutions don’t usually trade options for quick profits. Their trades are designed to meet broader objectives:

Hedging Equity Portfolios

Volatility Trading

Generating Yield on Holdings

Market Making and Arbitrage

Directional or Non-directional Speculation

3. Core Institutional Option Strategies

Let’s explore the most popular strategies that institutions use with real-world logic behind them.

A. Covered Call (Buy-Write)

Use: Income generation from long-term stock holdings

Structure: Buy stock + Sell Call Option (OTM or ATM)

Institutional Use Case:

A mutual fund holding Reliance shares might sell monthly call options against its holdings to generate monthly income (premium), enhancing total returns.

Learn Institution Trading What is Institutional Option Trading?

It refers to large-scale option strategies used by hedge funds, banks, and FIIs to manage risk, hedge portfolios, or create directional bets with high precision.

🔹 Key Institutional Strategies:

Buy-Write (Covered Call):

Holding stocks and selling calls to earn premium.

Protective Put:

Buying puts as insurance to hedge stock positions.

Multi-leg Spreads (Iron Condor, Butterfly):

Neutral strategies to profit from range-bound markets.

Put-Call Ratio Analysis (PCR):

Gauging market sentiment from institutional flow.

Advanced Divergence Trading What is Divergence?

Divergence happens when the price moves in the opposite direction of an indicator (like RSI, MACD, or Momentum). It signals a possible trend reversal or trend weakening.

🔹 Types of Divergence:

Regular Divergence (Trend Reversal):

Bullish: Price makes lower lows, but indicator makes higher lows → Reversal up

Bearish: Price makes higher highs, but indicator makes lower highs → Reversal down

Hidden Divergence (Trend Continuation):

Bullish: Price makes higher lows, indicator makes lower lows → Trend continuation up

Bearish: Price makes lower highs, indicator makes higher highs → Trend continuation down

🔹 Advanced Tips:

Use on higher timeframes for accuracy

Confirm with volume, trendlines, or price action

Combine with support/resistance or Fibonacci zones

🔹 Pro Tools to Use:

RSI (Relative Strength Index)

MACD (Moving Average Convergence Divergence)

Stochastic Oscillator

OBV (On Balance Volume)

Support and Resistance ExplainedWhat is Support?

Support is a price level where a stock tends to stop falling due to increased buying interest. Traders view it as a demand zone where bulls often enter the market.

Example: If Reliance repeatedly bounces from ₹2,700, that level is acting as support.

🔹 What is Resistance?

Resistance is a level where a stock tends to stop rising due to selling pressure. It's a supply zone where bears usually take control.

Example: If Nifty keeps failing to cross 23,500, it's a resistance level.

🔹 Why They Matter:

Help in identifying entry and exit points

Show where trend reversals may occur

Aid in setting stop-loss and targets

🔹 How to Spot Them:

Look for price bounces or rejections

Use tools: horizontal lines, moving averages, Fibonacci retracements

Confirm with volume spikes

🔹 Key Strategy:

Buy near support (low risk)

Sell near resistance (high probability)

Trade breakouts or reversals with confirmation

Support and Resistance Support Level:

A price level where demand is strong enough to prevent the price from falling further. It's like a floor—buyers enter here expecting prices to rise.

Example: If Nifty falls to 22,000 repeatedly and bounces back, 22,000 becomes a support level.

🔹 Resistance Level:

A price level where selling pressure overcomes buying, preventing prices from rising. It's like a ceiling—sellers dominate at this level.

Example: If Bank Nifty rises to 50,000 but fails to move above, 50,000 is resistance.

📊 How to Identify Them:

Historical price charts

Trendlines

Moving averages

Fibonacci levels

Volume analysis

📈 Use in Trading:

Buy near support

Sell near resistance

Use breakout strategy when price breaches either level

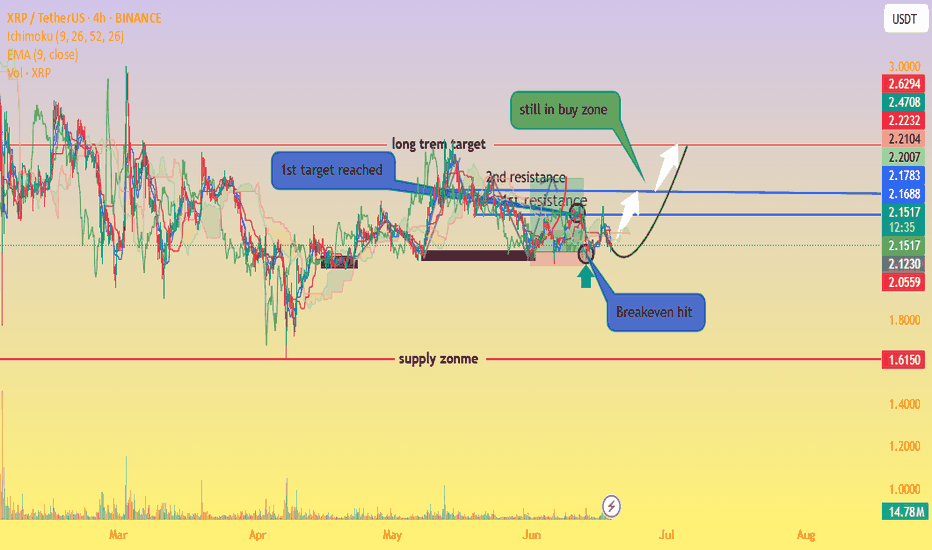

XRP Still in Buy Zone – Eyes on $2.50+our chart clearly marks that XRP has bounced off a strong buy zone (around the $2.10–$2.15 range), aligning well with a classic setup: price hitting support, creating a small base, and starting an upward rotation. 👇

Support area respected – The highlighted circle shows XRP revisiting the demand zone and quickly rebounding, very bullish behavior.

Lower wicks & volume spike – Indicate absorption of selling pressure and possible institutional interest.

Green arrow projection – Suggests a break above the immediate resistance (~$2.17 EMA/Ichimoku levels) could trigger a rally toward the next resistances around $2.22, $2.47, and potentially $2.63.

“Still in buy zone” annotation – Absolutely valid: as long as XRP stays above that key base ($≈$2.10), the bullish case holds.

🔍 Market Context

Range consolidation between ~$2.10–$2.30 has been the dominant theme, awaiting a breakout catalyst (e.g., ETF approvals or legal clarity)

thecryptobasic.com

+14

fxempire.com

+14

crypto.news

+14

.

Analysts highlight a falling wedge and support zone between $2.00–$2.20—if price holds, a move toward $3–$4 is plausible .

A range-bound weekly outlook anticipates a push toward $2.50 resistance before exploring higher targets .

✔️ Summary

Buy zone holding: Bullish pattern confirmed with rebound from support.

Key resistance levels: Watch for a breakout above $2.17/EMA and then $2.22–$2.30/$2.50.

Ideal strategy: Maintain position above support; add on breakout, targeting $2.50–$3.00.

Risk points: A drop below $2.10 could test $2.00 or even $1.85 support.

Advanced Institutions Option Trading - Part 8Institutional Option Trading Strategies

Let’s dive deeper into how big players operate:

🔶 Volatility Arbitrage:

Take advantage of IV mispricing across strikes/months.

Long low IV, short high IV – Net neutral delta.

🔶 Dispersion Trading:

Buy individual stock options, short index options.

Profit from correlation divergence.

🔶 Box Spread (Synthetic Arbitrage):

Arbitrage between synthetic long/short positions.

Very low risk, used by HFT desks.

Institutions use algorithms to run thousands of such strategies in real time.

Advanced Institutions Option Trading - Part 7Time Decay (Theta) Strategies

Options lose value over time due to Theta Decay.

Strategies to Take Advantage of Theta:

Selling options (Covered Calls, Naked Puts)

Calendar Spreads

Iron Butterflies

Caution:

Theta decay accelerates as expiry nears. Option sellers must hedge their deltas to stay safe.

Risk Management in Options

Institutions and pro traders always focus on capital protection.

🔐 Techniques:

Position sizing (no more than 2-3% risk per trade)

Hedging with opposite legs or underlying

Stop-loss on premium or delta exposure

Use of Greeks for real-time adjustment

Risk management > Strategy in the long run.

Advanced Institutions Option Trading - Part 6 Volatility Tools in Options

Understanding volatility is central to success in option trading:

🌀 Types of Volatility:

Historical Volatility (HV): Based on past prices

Implied Volatility (IV): Market’s expectation of future movement

📊 Volatility-Based Strategies:

High IV: Sell premium – strategies like Iron Condor, Credit Spreads

Low IV: Buy premium – strategies like Long Straddle, Long Call/Put

Tools like IV Rank and IV Percentile help traders choose the right strategy based on volatility regime.

Advanced Institutions Option Trading - Part 5Institutional Tools & Platforms

Bloomberg Terminal / Reuters Eikon: Institutional-grade data

FIX Protocols: For high-frequency option order routing

Quant Models: Statistical arbitrage using Python/R

Option Analytics Engines: Measure IV Skew, Smile, Surface modeling

Institutions don’t just trade options—they engineer risk-managed portfolios using AI and predictive analytics.

Option Chain Analysis for Traders

Option Chain provides a list of all available option contracts for a stock/index.

Key Elements:

Strike Prices

Call & Put Prices

Open Interest (OI)

Volume

Implied Volatility (IV)

Change in OI

Interpretation:

High OI + Rising Price = Strong Trend

IV Surge = High Volatility Expectation

PCR (Put-Call Ratio) = Market Sentiment Indicator

PCR > 1: Bearish sentiment

PCR < 1: Bullish sentiment

Advanced Institutions Option Trading - Part 4 Technical and Fundamental Analysis in Option Trading

Fundamental Analysis: Evaluate company value, earnings, sector performance

Technical Analysis: Price action, patterns, indicators like RSI, MACD

IV & HV Tools: Helps in choosing optimal strike prices based on volatility

Understanding market structure is essential for timing entries/exits in options.

Advanced Institutional Options Trading

Institutions like hedge funds, banks, and proprietary desks use options for complex strategies:

Delta Hedging: Maintain a neutral position

Portfolio Insurance: Using puts during economic downturns

Volatility Arbitrage: Capitalizing on volatility mispricing

Structured Products: Combine options with bonds or equities for customized payoff

These strategies require deep understanding of volatility surfaces, risk models, and massive capital.

Advanced Institutions Option Trading - Part 3Why Trade Options?

Hedging against portfolio loss

Leverage with limited capital

Income generation through strategies like covered calls

Directional trading using strategies like long calls or puts

Investment Strategy using Options

LEAPS (Long-Term Equity Anticipation Securities): Investing in long-term call options

Covered Calls: Generate income while holding stocks

Cash-Secured Puts: Earn premium while waiting to buy a stock at lower price

These are often used by investors to add flexibility and income to portfolios.

Advanced Institutions Option TradingFinancial Market is a marketplace where assets such as stocks, bonds, commodities, and derivatives (like options) are bought and sold.

Key components:

Equity Markets – Shares of companies

Debt Markets – Government or corporate bonds

Derivatives Market – Futures, Options

Currency and Commodity Markets

Options are financial contracts giving the buyer the right (not obligation) to buy/sell an asset at a set price before a specific date.

✅ Types of Options:

Call Option: Right to Buy

Put Option: Right to Sell

✅ Key Terminologies:

Strike Price: Agreed price to buy/sell

Premium: Cost of the option

Expiration Date: Validity of the contract

ITM/ATM/OTM: In-the-money / At-the-money / Out-of-the-money

TRX Long Swing Setup – Waiting for Pullback After Bullish RallyTRX has seen a strong rally over the past few days, and we’re now watching for a retracement into support. The $0.260–$0.262 zone offers a potential long spot entry as price cools off.

📌 Trade Setup:

• Entry Zone: $0.260 – $0.262

• Take Profit Targets:

o 🥇 $0.278

o 🥈 $0.292

• Stop Loss: Daily close below $0.249

Option Trading Master class Part -6What is Option Trading?

Definition:

Options are derivative contracts that give the holder the right, but not the obligation, to buy or sell an asset at a pre-decided price within a specific timeframe.

Types of Options:

Call Option: Right to buy

Put Option: Right to sell

Option Participants:

Buyers (Holders): Limited risk, unlimited reward

Sellers (Writers): Limited reward, unlimited risk

How Options Work (With Example)

Imagine Reliance stock is trading at ₹2,500.

Call Buyer: Buys a ₹2,500 Call Option by paying ₹50 premium

Scenario A (Stock goes to ₹2,600):

Intrinsic value = ₹100

Profit = ₹100 – ₹50 = ₹50 per share

Scenario B (Stock goes to ₹2,400):

Option expires worthless

Loss = ₹50 (premium paid)

Option Trading Master class Part -7Fundamentals of Stock Investing

Types of Investors:

Value Investors: Focus on undervalued companies

Growth Investors: Target high-growth potential stocks

Dividend Investors: Prefer regular income from dividends

Research Parameters:

Earnings per Share (EPS)

Price-to-Earnings Ratio (P/E)

Return on Equity (ROE)

Debt-to-Equity Ratio

Industry Trends

Tools for Investing:

Demat and Trading Account

Research Platforms (e.g., TradingView, Screener.in)

Portfolio Tracker (e.g., Zerodha Console)

Option Trading Master classIntroduction to Investing and Option Trading

Investing and option trading are two pillars of wealth creation and risk management in modern finance. Investing focuses on long-term growth by acquiring assets that appreciate over time, while option trading involves strategic bets on price movements within a defined period using derivative contracts. Together, they offer investors a combination of growth, income, and hedging capabilities.

What is Investing?

Definition:

Investing is the process of allocating money into financial instruments (like stocks, bonds, ETFs, or real estate) with the expectation of generating a return over time.

Key Objectives:

Wealth accumulation

Passive income generation

Capital preservation

Beating inflation

Common Asset Classes:

Equity (Stocks): Ownership in companies

Fixed Income (Bonds): Lending capital to earn interest

Real Estate: Physical properties generating rental income

Mutual Funds/ETFs: Pooled investments

Commodities and Gold: Inflation hedges