Cupandhandlepattern

LANDMARKLANDMARK:- The stock has given a breakout by forming a cup and handle pattern and has come for retesting, keep an eye

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

Fusion Micro Finance LimitedFUSION:- Cup and handle pattern has formed on the daily chart, keep an eye

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

HINDUSTAN PETROLEUM CORPORATION LTD - Keep an Eye + Cup & Handle📊 Script: HINDPETRO (HINDUSTAN PETROLEUM CORPORATION LIMITED)

📊 Nifty50 Stock: NO

📊 Sectoral Index: NIFTY 500 , NIFTY MIDCAP

📊 Sector: Energy Oil Gas & Consumable Fuels

📊 Industry: Petroleum Products Refineries & Marketing

Time Frame - Daily

Script is forming Cup & Handle Pattern as shown in a chart.

Key highlights: 💡⚡

📈 Script is trading at upper band of Bollinger Bands (BB).

📈 MACD giving crossover.

📈 Double Moving Averages also giving crossover.

📈 Volume is increasing along with price.

📈 Keep an eye on Script, it may give breakout of Cup & Handle Pattern.

📈 Current RSI is around 63.

📈 One can go for Swing Trade ONLY ABOVE 254 .

BUY ONLY ABOVE 254

⏱️ C.M.P 📑💰- 249.95

⚠️ Important: Always maintain your Risk & Reward Ratio.

⚠️ Purely technical based pick.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat🔁

Happy learning with trading. Cheers!🥂

Zydus Lifesciences LimitedZYDUSLIFE:- Stock has formed cup and handle pattern wait for breakout till then keep your eye on stock

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

Prozone Intu Properties LimitedPROZONINTU:- Stock has formed cup and handle pattern, give breakout and sustain, only then do some planning but with strict stop loss

You can plan the trade as per your risk appetite now

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

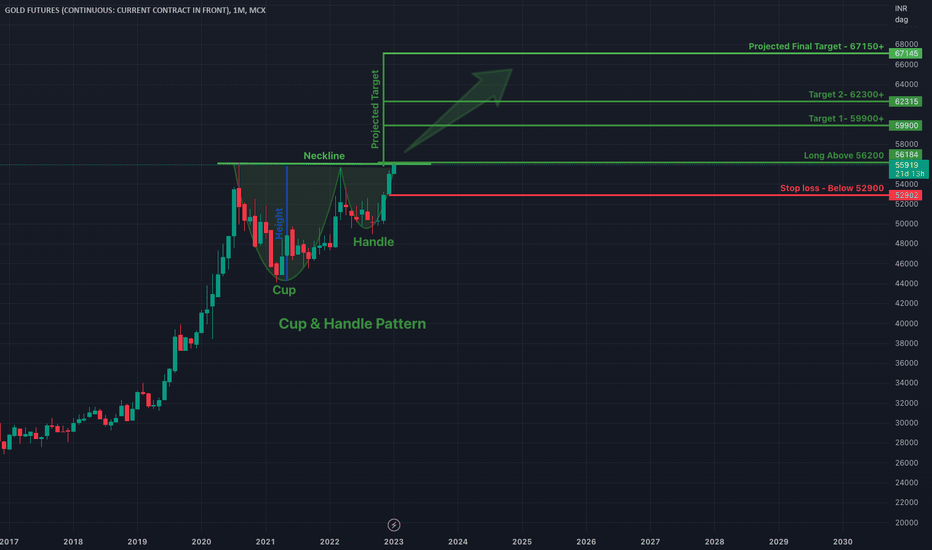

Cup & Handle Pattern In GOLD. Breakout can give 10000+ rally!!!Gold Future indicating the cup and Handle Technical Pattern. According to the pattern if this gives breakout of 56200 level then expected next target upto 67150+ in long term. This pattern will fail if gold started trading below 52900. Can see gold as a good investment opportunity in this downtrend global market session.

Disclaimer: This is my personal view on the GOLD. Consider this post as an education purpose only and not any type of recommendation. Consult your financial advisor before taking any investment decision.

PNC Infratech LimitedPNCINFRA:- The stock has also given a breakout by forming a cup and handle pattern and has come for retesting, keep an eye on it

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

Nelcast LimitedNELCAST:- Stock has given breakout by forming cup and handle pattern keep an eye on it

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

Speciality Restaurants LimitedSPECIALITY:- Cup and handle pattern has formed and the stock has given a breakout, it is showing like a resting pattern. Keep an eye on it.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

Aptech - forming a massive cup and handle patternThe price is now trading at ~360 level, closing above all important EMA on the daily chart and forming a massive cup & handle pattern. The first major resistance is near 381. It could potentially continue its way up to the multiyear BO level once it breaks above 381.

20%-25% potential upside

Lambodhara Textiles LimitedLAMBODHARA:- Stock has formed cup and handle pattern on monthly chart. Volumes are also good. Keep an eye on it.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

manappuram poised for breakoutstock is looking good for breakout on daily time frame. has tested the channel multiple times and also formed cup and handle pattern. RSI is on raise and 50 MA has crossed over 200 MA. stock has also seen recent volumes. CMP 122.35. early entry would be above 125 and confirmed /safe entry will be on break of channel

Stock looks good buy above 125 with SL of 106.80 with target of 160/173/180

Cords Cable Industries LimitedCORDSCABLE:- Has given breakout by making cup and handle, breakout after 4 year, stock had given breakout in middle of May 2021 also but could not sustain and that breakout failed keep your eye.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

HCC - monthly cmp 20Monthly trendline breakout + cup and handle breakout.

Monthly RSI above 60, bullish.

Monthly charts, so it may take time but can give 40-60% returns in 2023

Buying range 17-20

Targets 23-28-32 and if something even better happens, then even 40.

SL - 14 on weekly closing.(around 20-25%)

The Sandesh LimitedSANDESH:- Cup and handle pattern has formed, volumes are also good, wait for breakout, keep an eye on the stock.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.