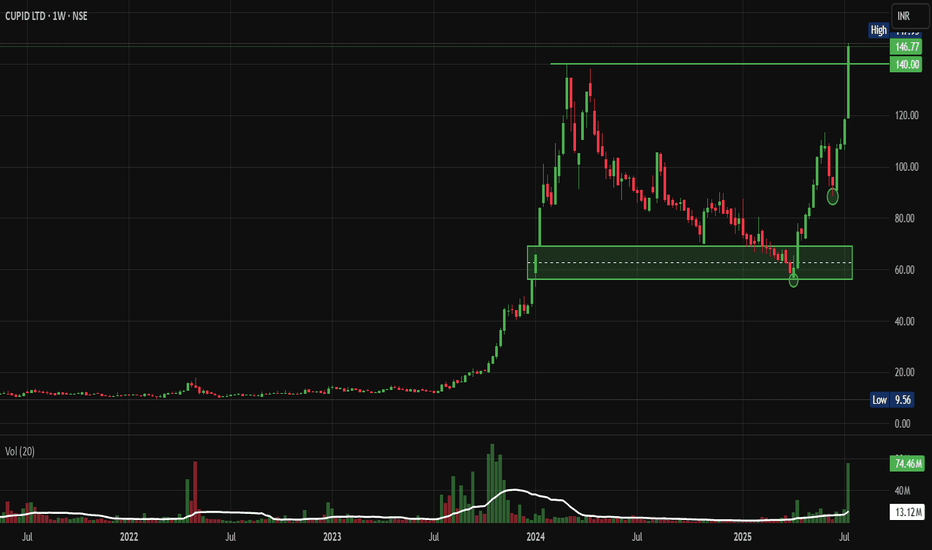

Cupid: Past Multibagger Forming Rounding Bottom BreakoutFrom ₹10 to ₹150: How CUPID Stock Became a Multibagger Dream and What's Next. Let's analyse and Deep Dive into my Chart of the Week Idea.

Price Action Analysis:

Long-term Trend Analysis:

- Primary Trend: Strongly bullish multi-year uptrend since 2023

- Trend Structure: Classic accumulation-markup-distribution pattern visible

- Price Progression: Massive rally from ₹10 levels in 2023 to ₹145+ levels

- Current Phase: Potential early stage of renewed markup phase after consolidation

Volume Spread Analysis:

Volume Profile Assessment:

- Accumulation Phases: High volume during the 2023-2024 markup phase

- Distribution Evidence: Volume spike during 2024 highs suggesting profit-taking

- Current Volume: Recent volume expansion (74.46M) confirming breakout momentum

- Volume Trend: Healthy volume participation during the current breakout phase

Volume-Price Relationship:

- Positive Correlation: Rising prices accompanied by expanding volume

- Breakout Validation: Current breakout supported by above-average volume

- Distribution Concerns: Previous high volume at peaks indicated selling pressure

Key Price Levels:

Support Levels:

- Immediate Support: ₹95-100 (recent consolidation base)

- Critical Support: ₹80-85 (previous resistance turned support)

- Major Support: ₹65-70 (rectangle pattern lower boundary)

- Ultimate Support: ₹50-55 (long-term trend line support)

Resistance Levels:

- Key Resistance: ₹145-150 (previous highs)

- Major Resistance: ₹150-155

- Target Extension: ₹170-180 (measured move projection)

Technical Indicators Assessment:

Trend Indicators:

- Moving Averages: Price clearly above major moving averages, indicatinga bullish bias

- Trend Strength: Strong upward trajectory since the consolidation base

- Momentum: Building positive momentum after prolonged consolidation

Trade Setup & Strategy:

Primary Long Setup:

- Entry Strategy: Buy on dips to ₹115-120 support zone

- Confirmation: Entry above ₹145 for momentum traders

Alternative Strategies:

Conservative Approach:

- Entry: Wait for pullback to ₹100-105 levels

- Timeframe: Medium to long-term holding period (Weekly Charts)

- Risk Profile: Lower risk, moderate reward

Aggressive Approach:

- Entry: Immediate entry at current levels (₹145)

- Timeframe: Short to medium-term momentum play (Daily Charts)

- Risk Profile: Higher risk, higher reward potential

Entry and Exit Levels:

Entry Zones:

- Zone 1: ₹115-120 (Primary entry for dip buyers)

- Zone 2: ₹145-150 (Momentum breakout entry)

- Zone 3: ₹100-105 (Deep pullback opportunity)

Target Levels:

- Target 1: ₹150-155 (Short-term objective)

- Target 2: ₹160-165 (Medium-term target based on pattern)

- Target 3: ₹180-190 (Long-term extension target)

- Ultimate Target: ₹200+ (Bull market extension)

Exit Strategy:

- Profit Booking: Book 30% at Target 1, 40% at Target 2, and the remaining at Target 3

- Trailing Stop: Implement trailing stop-loss above ₹140

- Time Stop: Review position if targets are not achieved in 8-12 months

Stop-Loss Strategy:

Stop-Loss Levels:

- Aggressive Stop: ₹110 (for entries around ₹120)

- Moderate Stop: ₹100 (for swing traders)

- Conservative Stop: ₹85 (for long-term investors)

Stop-Loss Management:

- Initial Risk: Limit to 8-10% of the entry price

- Trailing Mechanism: Move stop-loss to breakeven after 15% gains

- Pattern Stop: Below ₹95 invalidates the breakout setup

- Time-based Stop: Exit if below ₹110 for more than 2 weeks

Position Sizing & Risk Management:

Position Sizing Guidelines:

- Conservative Investors: 2-3% of portfolio

- Moderate Risk Takers: 4-5% of portfolio

- Aggressive Traders: 6-8% of portfolio (maximum)

- Sectoral Exposure: Limit total pharma/healthcare exposure to 15-20%

Risk Management Framework:

- Maximum Loss: Limit loss to 2% of total portfolio per trade

- Diversification: Don't concentrate more than 10% in a single stock

- Sector Allocation: Balance with other defensive sectors

- Time Diversification: Stagger entries over 2-3 weeks

Portfolio Integration:

- Correlation Check: Monitor correlation with other pharma stocks

- Sector Rotation: Consider the pharma sector cycle and rotation

- Market Cap Allocation: Balance small-cap exposure with large-caps

- Liquidity Consideration: Account for small-cap liquidity constraints

Risk Assessment:

Technical Risks:

- Failed Breakout: Risk of false breakout below ₹115

- Distribution Pattern: High volume at peaks may indicate selling

- Overbought Conditions: Rapid rise may lead to consolidation

- Support Breakdown: Break below ₹95 would be technically negative

Fundamental Risks:

- Valuation Concerns: High PE ratio of 96+ indicates premium valuation

- Sales Decline: The Recent 7% sales decline raises growth concerns

- Sector Competition: Increasing competition in the contraceptive market

- Regulatory Changes: Healthcare sector regulatory modifications

Market Risks:

- Small-Cap Volatility: Higher volatility compared to large-caps

- Liquidity Risk: Potential liquidity issues during market stress

- Sentiment Risk: Healthcare sector sentiment shifts

- Global Economic: Impact of global economic conditions on exports

Company Overview & Fundamental Backdrop:

Business Profile:

- NSE:CUPID is India's premier manufacturer of male and female condoms, personal lubricant, and IVD kits, established in 1993

- The company manufactures and exports contraceptives, including male and female condoms, and medical devices, with a focus on sexual health and reproductive safety, serving both domestic and international markets, supplying high-quality products to governments and NGOs

- Market capitalization: ₹3,940 crores as of July 2025, classified as a Small Cap company

Financial Performance:

- Current valuation metrics: PE ratio of 96.3 and PB ratio of 11.5

- Recent performance: Sales declined by 7.24% to Rs 61 crore in Q4 FY25 versus Rs 66 crore in Q4 FY24; however, net profit rose 2.71% to Rs 41 crore for FY25

- Long-term returns: The stock has delivered 133% returns in the last 3 years

Sectoral Growth Outlook:

- The Indian contraceptive devices market is expected to grow at a CAGR of 6.2-6.3% from 2025 to 2030

- Market size estimated at USD 264.01 million in 2025, expected to reach USD 377.61 million by 2030, at a CAGR of 7.42%

- India's pharmaceutical sector aims to grow from the current US$50 billion to US$450 billion by 2047, with India being the 3rd largest producer of drugs globally

Monitoring Parameters:

What to Look Closely at Technically?

- Weekly Close: Monitor weekly closes above ₹115 for trend continuation

- Volume Trends: Watch for volume expansion on up-moves

- Relative Strength: Compare performance with the Nifty Healthcare Index

What to Look Closely at Fundamentally?

- Quarterly Results: Track revenue growth and margin expansion

- Order Book: Monitor new contract wins and export orders

- Sector Trends: Keep track of contraceptive market growth

- Management Commentary: Follow management guidance and outlook

Now, when to exit?

- Technical Breakdown: Close below ₹95 for two consecutive days

- Volume Reversal: High volume selling at resistance levels

- Fundamental Deterioration: Significant decline in business metrics

- Sector Weakness: Broad-based healthcare sector underperformance

So, My Take:

NSE:CUPID presents a compelling technical setup with a confirmed breakout from a year-long consolidation pattern. The stock has transformed from a ₹10 stock to a multibagger, and current technical indicators suggest potential for further upside. However, premium valuation and recent sales decline warrant careful risk management. The trade offers an attractive risk-reward profile for investors willing to accept small-cap volatility in exchange for participation in a growing healthcare subsector.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

CUPID

A Bounce in Nifty but... In the market, it doesn’t work like — “The market has fallen enough, so now it should go up.” Even worse is putting your money into trades just because you feel that way.

Markets fall because of fear, and overcoming fear takes time. In fact, fear often grows stronger before it fades.

That’s exactly what is happening right now.

So don’t trade with the mindset — “The market has dropped a lot, it should rise now.”

Use this time to identify setups that have already broken out and are now giving a retest or have completed one.

For now, just build your watchlist. Trade only when you see stopping volume or a pivot low forming.

Remember — Markets are driven by people. And people trade based on either Fear or Greed. Their fear has no bottom, and greed has no top.

Be patient. I’m sure you will get much better opportunities soon.

That said, a bounce can still be expected because the heaviest sector from the last rally — Defence — is now showing mean reversion.

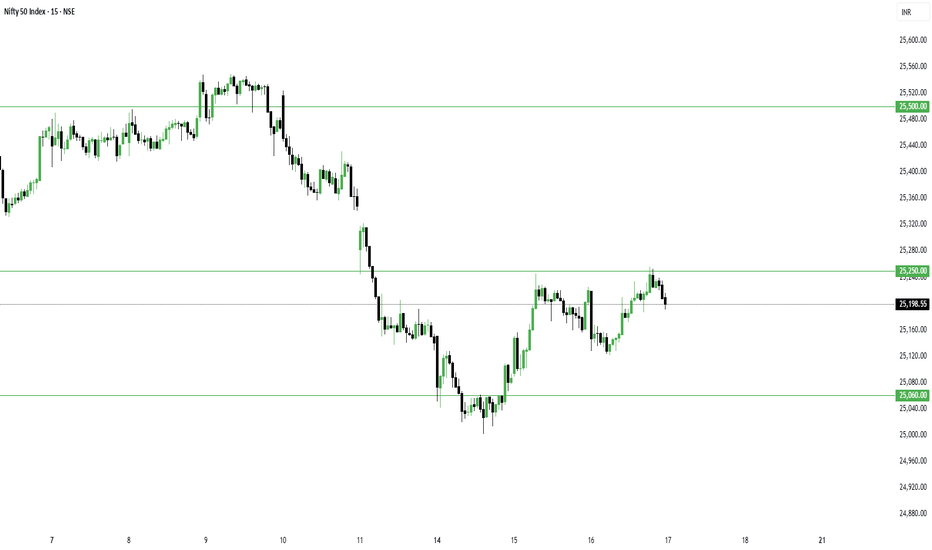

Talking about #Nifty,

On Friday, it formed a Reversion Candle. Interestingly, seller volume was 40 million lower than Thursday’s candle.

A big candle with such low volume usually signals accumulation — which means smart money has started buying.

Since it’s earnings season, our focus will remain on the Earnings Pivot strategy.

NSE:NIFTY levels:

- Support - 24920. Good if consolidate here for 1-2 days.

- Resistance: 25150 — above this, strong short covering can push it to 25400

But I doubt if this bounce will be buyable yet because next week is monthly expiry. Bears may close their shorts, so the market might just move up to grab short-side liquidity around 25333.

However, if we get a monthly close above 25333, that will be a strong bullish sign.

NSE:BANKNIFTY levels:

- Support: 55950

- Resistance: 56750

Sector-wise, NSE:CNXPHARMA and NSE:CNXFINANCE are showing traction.

Still, I strongly suggest sticking to stocks with Earnings Pivot setups.

In this market, that’s the safest strategy.

My this week's trades:

NSE:IXIGO - BOOKED ON UPPER-CIRCUIT

NSE:EIEL - 12% BOOKED

NSE:GARUDA - 19.5% BOOKED

NSE:DENTA - 18% BOOKED

NSE:CUPID - - 23% AND HOLDING

NSE:SPORTKING - 16% AND HOLDING

That’s all for now.

Take care.

Have a profitable week ahead.

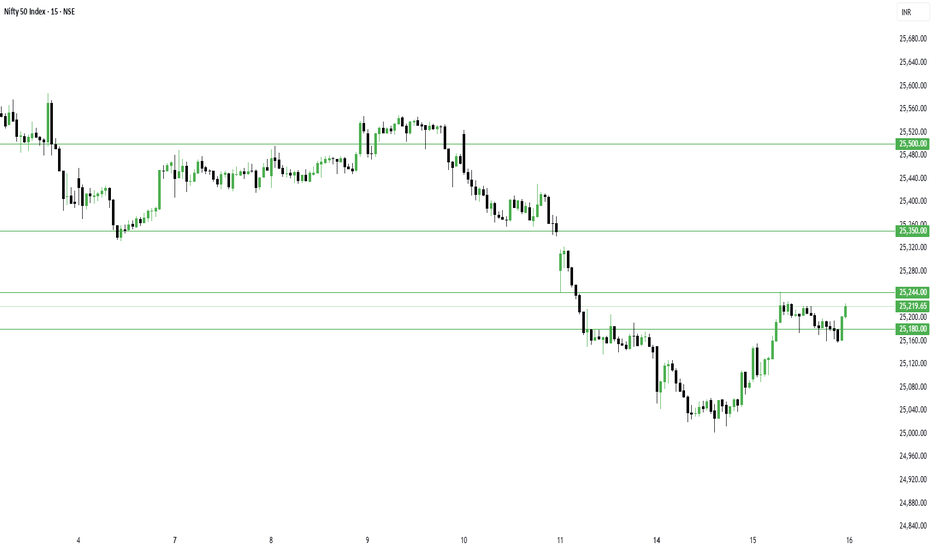

Nifty Holds Positive Trend, BankNifty Eyes New High - Key LevelsThe missing piece we talked about yesterday — a close above 25200 — is now complete.

Selling pressure has reduced, although we didn’t get the strong follow-up buying we expected.

But from a trading perspective, today was superb:

- NSE:SPORTKING , which we bought yesterday, gained another 7% today.

- NSE:EDELWEISS intraday setup delivered a solid 6% move.

- NSE:TATAPOWER ATM options shot up by 100%.

- As mentioned in yesterday’s commentary, NSE:CNXPSUBANK performed well — I’m holding NSE:BANKBARODA and had added #SBIN a few days back.

- NSE:SHYAMMETL closed strong today; I’ve taken it as a positional trade.

- I exited NSE:CUPID today and replaced it with $NSE:MOBIKWIK.

In total, I’m holding 4 open positions, and I’ll continue to hold them until they overextend.

Coming to the market:

Nifty formed a Supply Candle today as sellers’ volume was 33 million higher than buyers.

The positive takeaway is that selling pressure has eased, and the trend has moved back to the positive zone.

Considering these conditions, tomorrow is likely to remain sideways.

NSE:NIFTY levels for tomorrow:

- Resistance: 25250 — a close above this could trigger short covering up to 25500

- Support: 25155

BankNifty looks stronger than Nifty and seems ready for a new all-time high.

NSE:BANKNIFTY levels for tomorrow:

- Support: 57000

- Resistance: 57300 — a breakout above this can push it to fresh highs

Sector-wise, #PSUBANKS remained the strongest today.

That’s all for today.

Take care.

Have a profitable tomorrow.

Pivot Low Formed, Follow-Up Buying Crucial – Nifty and BankniftyYesterday, i mentioned that sellers’ volume was 40 million higher than buyers, and for a new trend to emerge, today’s candle needed to absorb that supply.

And look what happened — today, buyers’ volume surpassed sellers’ by 82 million.

All the setups I traded today blasted exactly as expected:

NSE:SWARAJENG (Earnings Pivot) – +10%

NSE:SPORTKING – +5.92%

NSE:MOBIKWIK – +4.16%

For the short term, I am still holding NSE:CUPID , which has already given a 22% move in the last 3 sessions since my entry!

Now, coming to today’s market action:

NSE:NIFTY formed a Demand Candle today, and along with that, a Pivot Low has also been created.

The only missing piece is that the index hasn’t yet closed above 25200.

The message is clear — if we get follow-up buying tomorrow, the index could be ready for a fresh high.

For tomorrow:

Resistance: 25244 — once crossed, short covering can push it directly to 25350/25500.

Support: will be at 25180.

NSE:BANKNIFTY looks more positive, and this time, NSE:CNXPSUBANK could be the key driver.

For BankNifty:

- Support: 56965

- Resistance: 57260 — a close above this could trigger a move towards a new high.

Talking about sector rotation — in the short-term timeframe, a new sector has emerged: NSE:NIFTY_CONSR_DURBL

NSE:NIFTY_IPO stocks remain strong, and for intraday trades, NSE:CNXAUTO and NSE:NIFTY_EV stocks are at the top of the list. So if you’re planning tomorrow’s intraday trades, focus on these sectors.

That’s all for today.

Take care.

Have a profitable tomorrow.

Miss This Retest and You’ll Miss the Rally – CUPID Setup Explain🔴 A – Supply-Demand Conversion Zone

This is the heart of the setup. When price trades below this zone, we stay cautious or short on weak structures. But if it sustains above this, it becomes the launchpad for longs—provided all system conditions align

🟠 B – Ideal Retest Zone

We anticipate a retracement here. A healthy correction towards A zone to tap into fresh demand. This retest is essential to build a valid higher low before breaking out.

🟣 C – All-Time High (ATH) Supply Zone

The ultimate target and strong resistance zone. If our breakout from E happens cleanly, this becomes the next significant level to watch—potential partial booking zone.

🟡 D – Hidden Resistance (WTF)

Subtle yet powerful. This line isn’t obvious to many but holds weight in our top-down analysis. If price cleanly breaks this, it adds conviction to the momentum.

⚪ E – Weekly CT Line

The main trigger. We want price to pull back (B), form a strong base (A), and then break E with a power candle, backed by strong volume

📊 Current Status:

✅ Price above A (bullish tilt activated)

❌ No proper retest at B yet

🔜 Awaiting clean breakout of E post-retest

📌 Hidden resistance D and supply C remain above as Resistances / Hurdles after our Breakout

Cupid - Long Setup, Move is ON...#CUPID trading above Resistance of 2423

Next Resistance is at 3175

Support is at 1693

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Cupid - Long Setup, Move is ON...#CUPID trading above Resistance of 1334

Next Resistance is at 2423

Support is at 800

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Cupid - Long Setup, Move is ON...#CUPID trading above Resistance of 1003

Next Resistance is at 1334

Support is at 754

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Cupid - Long Setup, Move is ON...#CUPID trading above Resistance of 754

Next Resistance is at 1003

Support is at 506

Here are previous charts:

Chart is self explanatory. Entry, Resistances and Support are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Cupid - Long Setup, Move is ON...#CUPID trading above Resistance of 506

Next Resistance is at 754

Support is at 299

Here are previous charts:

Chart is self explanatory. Entry, Resistances and Support are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

watch for resistance breakoutbuy above 265 in intraday or swing trade.

target for swing 280, 298

keep stoploss 250.

For stoploss in Intraday use 5 minute chart and see nearest support.

for target use 5 min chart and fibonacci pivots as i don't keep predefined target.

try to book partially and trail.

Note: this is not a prediction for LONG/SHORT, trade will trigger only on given level as per technical analysis

NOTE: For Gapup or bo before 9:20

If gapup is more than 1% from bo level than avoid completely.

if less than 1% or gives bo before 9:20 than wait for

first 5 minute candle and entry above 5 minute candle

and revised SL below candle Low.

CUPID at a deciding levels. will it move higher or not?Fresh buying can seen only when there is a weekly close above 256 levels. one can enter above 256 and placing an SL of 215. And possible targets can be 295/320. Volume expansion is required for a breakout to sustain.

DISCLAIMER: Investment/Trading in securities Market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss in trading and investment in Securities markets including Equites, Derivatives, commodity and Currency can be substantial. These are leveraged products that carry a substantial risk of loss up to your invested capital and may not be suitable for everyone. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Please ensure that you understand fully the risks involved and do invest money according to your risk bearing capacity. . Investment in markets is subject to market risk.

P.S- I am not a SEBI registered analyst.

#CUPID .. Is a huge move coming?Stock was trading in a Symmetrical Triangle and had price move today which will likely close with a gap today..

As there are buying volumes with the gap it can be a breakaway if price sustains..

Now the second move should be to close above 260 with volumes and retesting of the support.. Then it can be a BO opportunity to go long for targets of 300, 350+ .. Otherwise price will retrace back maybe to 210-220 levels (will buy at this level for long term)

Full disclaimer: I already own a position in this stock as it was a value investing pick for me.. I bought at around 200-210 levels and keeping it as a long term pick...

For more such updates on your favourite stocks, follow my page.

Please also suggest any stock chart you would like me to analyse for you (NSE, NYSE, NASDAQ, CRYPTO) ..It will be a good way for all of us to learn

Furthermore, provide your feedback on how I should improve my analysis and what more would you like to see from my page here

#CUPID.. What will happen?? ..Short term consolidation or ATHCUPID is a small cap with amazing fundamentals (20% YOY growth, 20% ROIC).. It is a hidden gem with multi-bagger potential (a small cap doesn't need much capital for 2-3X)

Looking at current situation I would say there is a higher chance that the stock may move down to 200-205 levels.. consolidates for a bit and then moves up..

But there is also a chance for a move upwards (albeit small).. The support (short term trend line) is holding well even at high selloff volumes.. So buyers may come in and finally push this stock to ATH

Can go up to 300 if upwards break happens..

Can add to my position around 200 if it comes down...

Not suggesting you do the same, but keep an eye...Can be a great buy.. Also Do your own research, it is important..

Live Challenging Stock Market Analysis Buy CUPID @ 236.55

Target @ 297

Our Unique Features:

—————————————————————

1. Follow our 15 signals ….10% equity will increase in your account for sure.

2. We are not Trailing stop! or average the trades.

3. 2% Risk Management Per trade.

4. Risk vs Reward up to 1:7.

Note:

Trade signals would usually have a risk to reward ratio of 1:2.

It means that even 2 out of 4 signals hits their SL marks, the other two would have closed with profit.

This allows you to be good in overall pips profit.

Signals are usually inter-day (Based on the daily candle) therefore, trades would usually have a holding time of an average minimum of 24 hours.

Note: Everything works with Best money management.

Note: Please leave comments for any query.

Disclaimer: This is my trading experience, it is not an invite or recommendation to trade.

Best Wishes

Forex Tamil