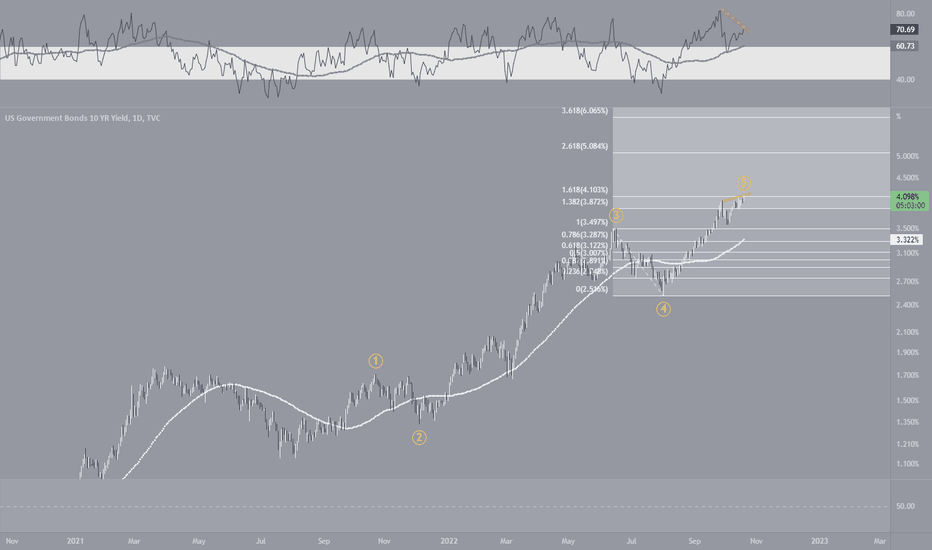

US10Y - Looks like a high is completedUS10Y could be in at its peak in current wave cycle to stary a ABC correction.

RSI on daily is also showing divergence indicating topping out sign. The correction in US10 will be good for equities.

View will be invalid if the high 4.123 is broken and wave 5 might get extended.

User discretion!

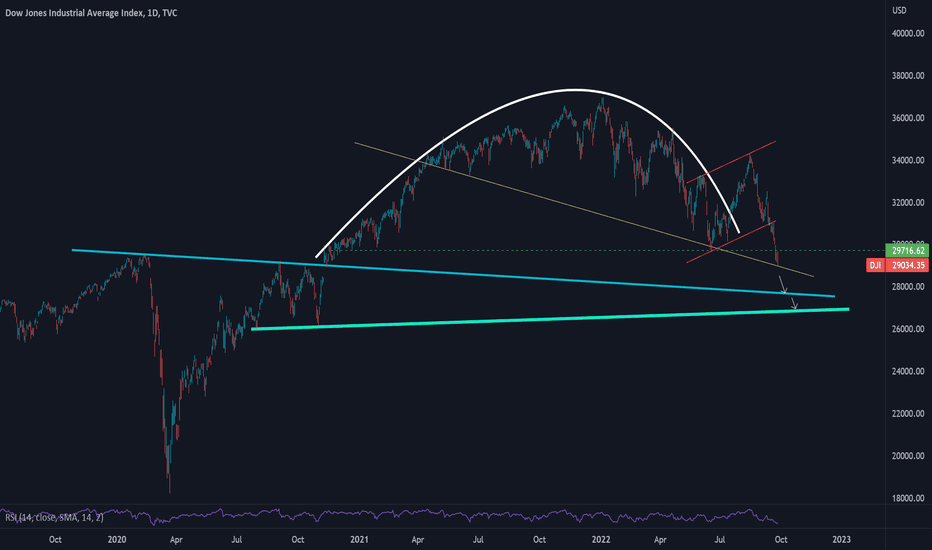

D-DJI

Bullish Divergence in Dow Jones Industrial AverageRSI Bullish Convergence was there on weekly charts of Dow Jones only 5 times in last 20 years, which was always followed by average 15-18% market rally

similar RSI convergence is visible on weekly Dow Jones chart Right now, pre-covid highs are acting as a support

Disclaimer: Chart, data and levels for study purpose only. I am not a financial advisor. Use your intelligence before investing.

Comparison of leading markets to anticipate the future movementAn attempt to anticipate the future movement of different markets over next 5 to 10 years. If we see the movement of 6 markets, we can have some insights.

Among the 6, Germany (DAX- purple) and India (NIFTY50 - red) look like being in the middle zone of the direction of movement since 1991.

Hong Kong (HSI - green ) came down gradually from around early 2018 to 2022, now looks at a fair level (may fall further to form a bottom).

USA(DJI - blue ) has recently started falling after forming a sharp peak, I am expecting a fall probably to 27500 levels or may go to 22000.

India (Nifty50 - red ) looks bullish for long term but may see a pullback to 15000 levels or even to 12000 levels in coming years.

UK (UKX - yellow) looks sideways and lacks long term strength as evident in the economy in recent times for United Kingdom.

France (CAC40-brown) looks sideways from a long term perspective.

Germany(Dax-purple) looks the most balanced in terms of bear and bull phases.

Overall it looks like the bear phase has started for most markets and it may take several years for healthy bull phase to be back.

Inverted Cup & Handle pattern in monthly timeframeHello All,

Market is at very important point where it can take support and go higher and if rejection we have big fall.

My expectation is at least 3000 points if cup and handle broke.

FED hike warnings really bothering the market and on Friday it broke previous low and touches 20% fall from Jan 2022. However if it closed with the same momentum on Friday then we would’ve seen big gap down on Monday opening.

Please note this is just my observation only and for purely for educational purposes.

Trade at your own risk.

BANKNIFTY & NIFTY SUPPORT AND RESISTANCE FOR [16-06-2022]NSE:BANKNIFTY1!

The market has been moving in a range and refusing to break the 33200 support zone multiple times.

the bounce back is expected from this level.

but the downtrend is still intact unless it breaks any swing high and forms a higher low.

please find necessary support and resistance on the chart.

NSE:NIFTY

nifty major support 15650 tested multiple times and rebounded.

sgx nifty signalling a positive start today any long should be only above 15900- 15950.

happy trading , keep learning

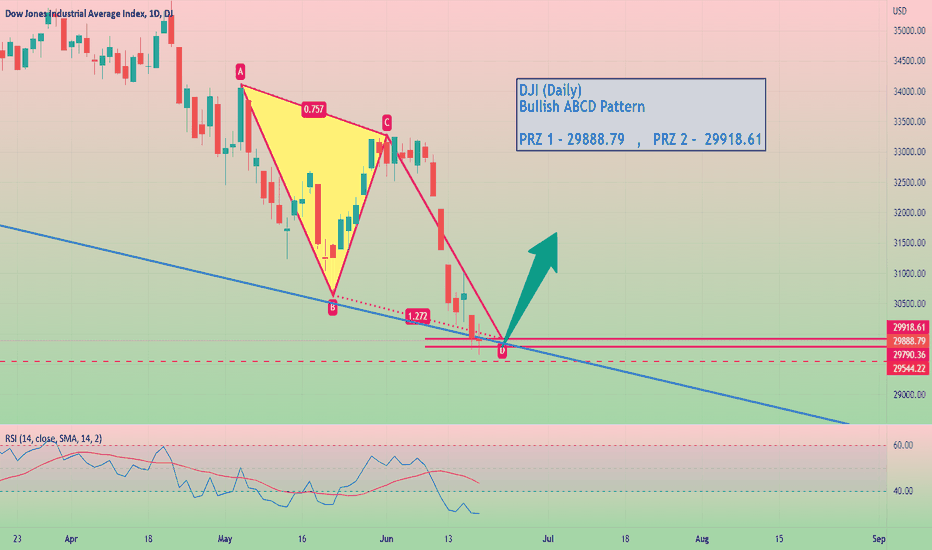

DOW JONES: A leading diagonalIndex is unfolding as a leading diagonal of which 4th wave is already concluded and right now we are into the last stages to complete the 5th wave of this leading diagonal which will bring the index below the level of 30635 in the near term. Traders should remain short for the minimum target region of 30600-30000 in the coming weeks with stop loss of 32600.