Dollarindex

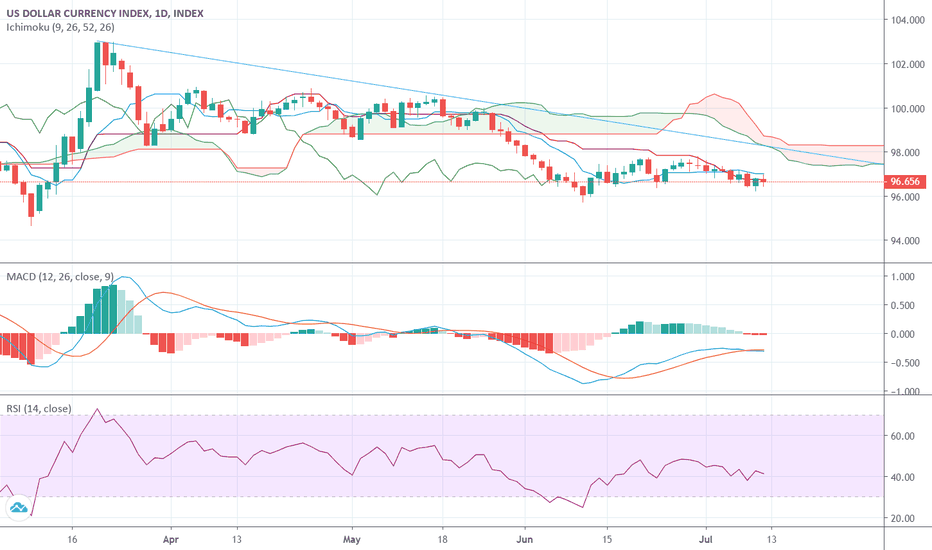

Risk to dollar or the basket currencies ?DXY is on edge of the support at 96. RSI has formed positive divergence but yet not turned up. Circle marks the perfect support which should be touched by 23-26th July, if it has to work. The overall frame of the trend is still pointing 94 but positive divergence can't be ruled out. Better to be on the sideline and see which support is in motion. If it comes to 94 then the overall trend, started at 103, will get complete and we might see a bounce from there towards 96-98 zone.

DXY US dollar index Bearish Flag prepare for Big Crash !!!Disclaimer : This is not financial advice please do your own research before investment.

As you can clearly see right now DXY creating Bear flag if DXY failed to sustain

above and breaks the flag from downside then the next support will be around 95.9

and if the price goes below 95 then the technically support will be around 93.

US Dollar Index Trend Analysis !!TREND ANALYSIS & TRADE SETUP

Possible start of Uptrend.

Follow Chart Instruction.

Do not be Hurry for entry.

Wait for Proper Entry Setup.

Buy/Sell with Best Risk Reward.

Educational Chart Only.

You can Comment and ask the TREND ANALYSIS of any STOCK/SCRIPT/INDEX/FOREX.

Dollar Index: Multi month high continues to hold..On the charts, we find that the MACD is gradually heading higher as prices continue to consolidate with favorable tailwinds leading to strengthening of the greenback. Prices are now rising to challenge the strong resistance developed at 100 levels. This was the top recorded back in Mar 15 and again in Nov 15. Through the first half of the year the prices have remained largely contained but the upward thrust seen in July has now generated a new wave of bullishness. It is obvious that the Dollar bulls are quite dominant and now , are beginning to push ahead. With the currency basket sustaining higher levels it could set off moves across different asset classes in the near term. Immediate supports continue to be around 97 while the upside could test its previous highs in the next few months. A breakout or a failure to do that would both be equally important technical events at this juncture.

Dollar IndexPossibilities of a continued upmove emerges from the higher time frame charts. Once the key resistance zones around 97.95 was overcome the we observe that the strong breakout above the key resistance zone around 97.81 has generated some positive momentum in the currency basket. With the bullish trends getting restored we need to see how long can the momentum sustain . Considering the overall chart setup we are of the opinion that the brief pullback shall continue to witness some buying interest. Momentum setup continues be positive suggesting sustained bullishness in the coming days. With DX biding time to get a hold on the overall situation we could be witnessing some sedate movement for the next few days. With the momentum continuing to favor more upside one should be looking at higher levels around 99.81 in the next few days. A bullish dollar scenario does not spell good news for INR despite the markets showing some mixed reactions.

Idea Sourced From

NeoTrader

trade.chartadvise.com

DXY on a Roller Coaster RideDollar Index has build a strong support base and started breaking major resistance. It is now moving ahead towards the target of

1-- 97.48

2 -- 98

3 -- 99.21

And 4 -- 102 (Major Resistance).

With the support of 1. -- 97.14(Closing basis)

2. -- 96.50

3. --- 95.70

Be cautious with the trade in major pairs. Lots of factor might impact the DXY so don't let it to DITCH you..

Contra Trade: Short the Dollar Index at CMP 92.7, SL93.5 ,TGT 91So Dollar Index has met with its old friend - a downtrendline - after a long time. We can expect an interim fall in the index from current levels of 92.7 to levels of around 91.

Its a contra position to market sentiments, hence extreme caution is adviced, however the gains will be sweet!

The RSI is also dropping from overbought levels to 68 levels, look poised to cool down further.

Dollar Index Weekly Supports proved to be quite determined in producing a strong recovery. However the rally now has tread into median line resistance and this could now hold back further strengthening next week and push the DX into a range until 94.30 is surpassed.