Dxylong

DXY Potential Bullish Reversal – Target 99.456DXY Potential Bullish Reversal – Target 99.456 🎯

Technical Analysis Overview:

🔹 Trend Structure:

The chart illustrates a recent downtrend, which has been broken as price moved above the descending trendline, signaling a potential trend reversal.

🔹 Pattern Insight:

A bullish harmonic pattern is visible (possibly a bullish Bat or Gartley), with the price reacting from the PRZ (Potential Reversal Zone), aligning with key support near 96.500. The market has respected this zone multiple times, evident from the orange highlighted circles showing price rejections.

🔹 Support & Resistance:

Support Zone: ~96.500

Breakout Zone: ~96.985 (current consolidation near this resistance)

Target Zone: Marked at 99.456, which aligns with previous structure and fib projection.

🔹 Market Sentiment:

Price is consolidating after breaking the downtrend, forming a bullish rectangle (accumulation). The green arrows indicate bullish intent from buyers defending support levels.

🔹 Price Action Signal:

Formation of higher lows.

Break of structure and close above previous highs.

Possible breakout pending above consolidation box.

📊 Conclusion:

DXY shows bullish potential as it builds a base around strong support. A confirmed breakout above the rectangle could fuel a rally toward 99.456. Keep an eye on volume and confirmation candles for entry. ✅

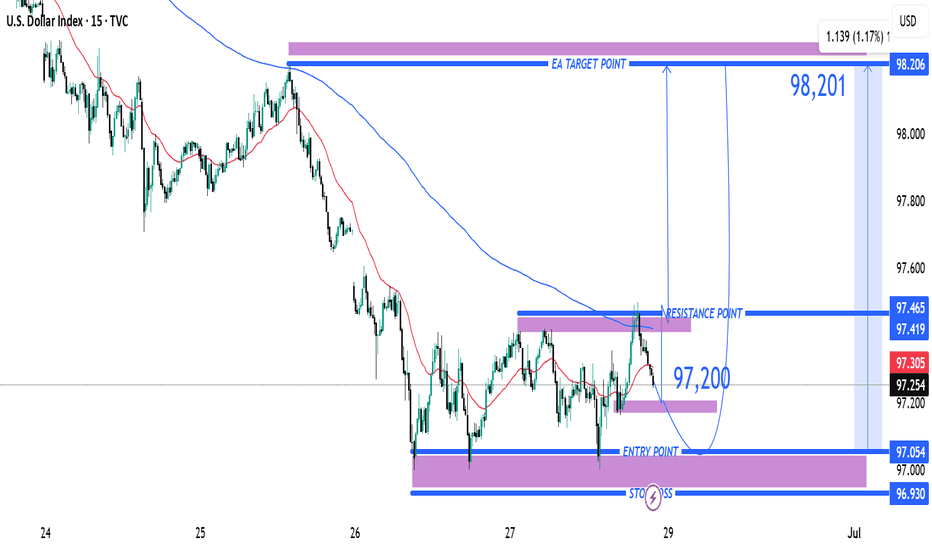

Entry Point Marked at: ~97.200 The price has already reacted m Entry Point

Marked at: ~97.200

The price has already reacted multiple times around this level, suggesting it's a key support zone.

🛑 Stop Loss

Placed at: ~96.930

Just below the support zone, protecting against a breakdown below recent lows.

This implies a risk of about 27 pips from the entry.

🎯 Target Point (TP)

Marked at: ~98.201

Strong resistance zone from previous price action.

Target implies a potential reward of 100+ pips, offering a risk-reward ratio (RRR) of ~3.7:1, which is favorable.

📊 Resistance Area

Around 97.419–97.465

This is the first obstacle the price must break through to confirm bullish continuation.

The 200 EMA (blue curve) is currently acting as dynamic resistance, aligning near this zone.

📉 Indicators

Moving Averages:

Red: Likely 50 EMA

Blue: Likely 200 EMA

Price is currently below both EMAs — so trend is still bearish, but trying to shift.

📌 Strategy Insight

The setup anticipates a bullish reversal from 97.200, aiming for a breakout above the 200 EMA and resistance to reach the 98.201 zone.

For confirmation, watch for a strong bullish candle close above 97.465, which would validate upside continuation.

⚠️ Risks

Price is still under both moving averages → downward momentum may persist.

If support at 97.00 breaks, downside acceleration could occur.

✅ Conclusion:

This is a bullish breakout setup on DXY with:

Defined entry and stop-loss.

Clear target.

High RRR.

But it’s crucial to wait for confirmation above resistance (97.465) before full conviction on the long trade.

DXY Bullish Reversal & Cup FormationThe DXY (US Dollar Index) is exhibiting a strong bullish reversal pattern, with multiple technical signals suggesting upward momentum:

🔍 Technical Analysis Summary:

✅ Support Holding Strong:

Price has respected the horizontal support zone around 98.00–98.50 on multiple occasions (highlighted by orange circles and green arrows), forming a solid base.

✅ Breakout from Downtrend:

A clear breakout above two descending trendlines (black and blue) indicates a shift from bearish to bullish sentiment.

✅ Cup Pattern Formation ☕:

A textbook Cup pattern is visible, where price formed a rounded bottom — a bullish continuation formation. The handle is minor and price has broken above the neckline (around 99.00), signaling a potential continuation toward the target.

✅ Bullish Target 🎯:

Based on the cup pattern and prior resistance, the projected target is around 101.846, aligning with previous major resistance.

📌 Key Levels to Watch:

Support Zone: 98.00 – 98.50

Immediate Resistance: 99.50 – 100.00

Major Resistance/Target: 101.846

🧭 Outlook:

As long as the price remains above the 98.50 zone, the bullish scenario remains intact. The cup breakout indicates strong buying pressure, and momentum could push DXY toward the 101.846 target in the coming sessions.

DXY Technical Outlook – Strong Support Test and Bullish Reversa Chart Summary

The DXY (U.S. Dollar Index) chart illustrates a significant technical structure between strong historical support and resistance zones, with potential for a bullish reversal after a key level retest.

🟢 Key Support Zone: 99.000 – 98.000

📍 Labeled as "STRONG SUPPORT", this zone has held multiple times:

Previous bounce: Early 2023 ✅

Mid-2024 rebound ✅

Current price action once again shows a reaction from this level with a bullish candle forming 🔥

📌 EMA Confluence:

The 200 EMA (blue) sits at 102.401

The 50 EMA (red) at 103.725

Price is currently below both EMAs but near the 200 EMA, suggesting potential for a mean reversion bounce 📈

🔴 Resistance Zones to Watch:

Resistance Zone: 109.000 – 110.000

⛔ Historically rejected in late 2023 and again in early 2025

🧱 Acting as a supply zone — watch for rejection or breakout

ATH Supply Zone: 113.000 – 114.000

🚨 This is a major psychological and technical barrier

🫡 Marked as “NEW ATH” – would need strong momentum and fundamentals for a breakout above this level

📈 Price Action Expectations:

With strong support respected again, a bullish reversal toward 109.000 – 110.000 appears likely (as illustrated by the arrow).

If momentum continues, a retest of ATH zone is on the cards 🔭

However, a failure to hold support could lead to breakdown below 98.000 – watch closely 🔍

🧭 Strategic Insight

Bullish Bias while above support (98.000 zone)

Reversal Confirmation needed above 102.401 (200 EMA) and 103.725 (50 EMA)

Watch for rejection near 110.000 resistance before ATH test

📌 Final Note:

🧊 World Eyes on this Level – As highlighted on the chart, the current support area is under global observation, reinforcing its importance.

🕵️♂️ Stay alert for breakout volume and fundamental catalysts (e.g., Fed decisions, CPI, jobs data).

(DXY) Short Setup: Reversal Expected from Resistance Zone1. Entry Point: ~102.430

The price is currently below this level at 101.583, suggesting a potential short setup once the entry level is reached or confirmed.

2. Stop Loss: ~103.196

This is the price level where losses are limited if the trade moves against the intended direction. It's placed above a strong resistance zone.

3. Resistance Point: ~100.580

This was a previous resistance level which has now been broken, indicating a bullish push. The current price is above this, which may signal a breakout.

4. EA Target Point: ~97.857

The take-profit level, significantly lower, indicating a bearish target. This suggests a short position is intended from the entry point.

Indicators and Signals

The chart uses moving averages (likely 50 EMA and 200 EMA), and the price has surged above them, often a bullish signal.

However, the analysis seems to anticipate a reversal from the 102.430 level, expecting a drop back down toward 97.857.

The move from the current price to the target would be a 4.40% decline, a significant move for an index.

Trade Plan Summary

Trade Type: Likely a short/sell from the 102.430 level.

Risk: ~0.77 (103.196 - 102.430)

Reward: ~4.57 (102.430 - 97.857)

Risk-to-Reward Ratio: Approx. 1:6, which is favorable if the setup works out.

DXY Ready to Soar?📈 DXY Analysis & Forecast (US Dollar Index) 🚀

Current Structure:

The DXY appears to be in the middle of an impulsive wave sequence based on Elliott Wave theory, currently moving within the 4th wave correction phase. The overall structure shows a clear upward trend, supported by a rising trendline that has consistently held as support. We can observe a potential breakout setup, with a contracting triangle pattern indicating a breakout to the upside.

Key Technical Points:

Wave Count Analysis:

🌀 Wave (1) initiated a strong bullish move after breaking out of the downward channel.

🔄 Wave (2) saw a retracement, respecting the previous resistance level that turned into support.

🚀 Wave (3) was an impulsive rally, taking the DXY to new highs and confirming bullish momentum.

📉 Wave (4) is forming a consolidation, resembling a bullish pennant pattern, indicating a continuation of the uptrend.

Key Support & Resistance Levels:

Support: The price is currently holding above the key support zone at 106.20, which aligns with the trendline.

Resistance: The next target for the bulls would be the previous swing high at 107.40, which is the completion zone for Wave (5).

Indicators & Patterns:

📊 The ascending trendline continues to support the bullish bias.

🔼 A breakout above the 106.80 - 107.00 range could trigger a push towards the 107.40 level.

⚡ Watch for potential fake-outs; a break below 106.20 may invalidate the bullish scenario.

📅 Forecast:

The DXY is poised for an upward move as long as the 106.20 support holds. If the breakout above 106.80 is confirmed, we could see the DXY reaching the 107.40 mark, completing the 5th wave of the current bullish cycle. A decisive close above 107.40 might lead to further gains, potentially aiming for the 108.00 level.

📊 What are your thoughts on this setup? Are you bullish on the DXY? Drop yourcomment below! 👇

🔗 Follow for more Forex updates and daily trading insights!

#DXYAnalysis #ForexSignals #ElliottWave #DollarIndex #ForexTrading #TechnicalAnalysis #USD #ForexCommunity #TradingForecast #MarketUpdate

DXY Analysis: Bearish Trend Signals Potential Drop📊 DXY Analysis (2H Chart) 🧐

The U.S. Dollar Index is currently in a consolidation phase around the 104.50 level after a sharp drop from the recent highs. Let’s break down what the technicals are signaling:

1. Bearish Structure 📉:

• The index has been trading within a descending channel, which indicates a prevailing bearish trend.

• A significant Cross Doji candle at the top hints at a potential reversal, followed by strong bearish momentum.

2. Key Levels to Watch 🔍:

• Resistance Zone: The DXY is consolidating below the 104.60 level, which is acting as a key resistance. Multiple rejections around this area could signify strong selling pressure.

• Support Zone: The next major support lies around the 103.60 level, aligning with the lower boundary of the channel.

3. EMA Dynamic Resistance 💡:

• The 50-period EMA (green line) is currently acting as a dynamic resistance. A sustained move below this EMA can add further downside pressure.

4. Potential Scenario 🔮:

• If the DXY fails to break above the 104.60 resistance, we could see a drop towards the 104.00 level initially.

• A break below the 104.00 support might accelerate the move toward the 103.60 zone, completing the bearish leg.

📉 Bearish Outlook: Unless we see a breakout above the consolidation zone and a close above the descending channel, the bias remains bearish for the DXY in the short term.

🔗 Follow for more daily updates on forex market analysis!

#DXY #DollarIndex #ForexAnalysis #TechnicalAnalysis #USD #TradingSignals #ForexTrading #ForexTrader #PriceAction #TradingStrategy #ForexMarket #USDIndex #CurrencyTrading #MarketAnalysis #TradingView #ForexLife #FinancialMarkets #DayTrading #SwingTrading #ForexCommunity #TraderLife #ChartAnalysis #TradingPsychology #Investing #ForexTips #TradingSetups

DXY 1D Timeframe ProjectionDXY 1D Timeframe Projection

DXY - Data Global forecasts say it will decline. Yes, it may, but the dollar is still rising today.

DISCLAIMER: All labelling and wave counts are done by me manually and I will keep changing according to the LIVE MARKET PRICE ACTION. So don't be bias, hope on my trade plans...try to learn, and make your strategy... Following is not that easy...

DXY next week overview - !06.500 or !03.800 ???the upcoming week ahead bring alot of volatility have days with events and major ones

Recap -

the previous week was more based on sharp turns that has tested important level and broken important level

but left behind some imbalance that given a strong sign or outperformance by DXY

What to Expect - 104.300 the price breakout now the upside potential liquidity would be 105

and there after we have higher time frame (M, W) bearish order block

but the price with big bars has left behind some fair value area

which might holding some good liquidity to fuel if the price expect the upside momentum

Key Area -

keep eye on 103.700 > 103.400 > 102.850

conclusion try to buy with limit order on key area rather than going short

Inverse 🥶If Dxy sustain on 103 ( marked in the chart) then a upside momentum to (110 feb 2024)--(115 sep 2024) is possible, which could impact the US stock market and in some cases Indian market too .

Disclaimer :

It's a personal view not a financial advise and I assume no responsibility and liability whatever outcome arises.

Dollar Index Bullish signals - SOONAlthough, jumping a bit earlier, Dollar Index seems readying itself to JUMP UP. COT reports are STARTING to Show Bullish Signs. Daily Momentum has turned UP. BUT weekly momentum is yet to turn Up. Look for BULLISH SIGNS on Lower Time frames in Coming Weeks and Months. (Although, i will more comfortable if it Dips to one more Low on Weekly and then Goes up. But that is not an essential requirement)

EURUSD Short idea Let’s focus on OANDA:EURUSD SELL

The target is marked as per 15M & 1 Day with Fibonacci tool

Calculate by SMC Market Structure.

As per current Eurusd price on 15M chart Major 2nd BOS is complete now it’s time to retrace minimum 38% marked area with Fibbo tool TP1 and TP2 area is 50% marked same with Fibonacci

Thanks for watching.

DXY bullish? ICT Concepts application.Hello Traders!

I mentioned in the last update of the BTC idea, how I started learning ICT concepts, around a month back. This is the first idea to be published based on those concepts. One must understand that these concepts are vast, and I've only begun it. Everything gets better with more and more practice.

1. Let's begin from 14th April 2023, where DXY market made a new swing low on the daily. We see a massive, fast move up. A 4hr swing high (white highlight) is broken. The market makes a double top (red highlights) and falls.

2. Since, a swing high was broken, we could look for potential moves up from the white 4hr POB (potential order block). This block also coincided with the 70.5% percent Fib level. This Fib was taken from an institutional level of 100.50. I know. Those who don't know ICT concepts find this amusing and, at times, even stupid. But it really does work. I initially was wary of using it but, the more I practice, the more I gain the confidence of doing this. Test it out yourself before you take my words.

3. Market moved up drastically just as was originally expected, grabbing the liquidity from above the double tops and creating a new swing high (neon highlight). ICT stresses on looking at equal lows or highs with suspicion. Every trader knows that the stops of the people who shorted and the orders of people willing to go long on the break of the high rest there, creating liquidity.

4. This new swing high gave us another window of likely opportunity. In my understanding, until a new swing low breaking the old swing low (blue highlight) is made, the market is primarily bullish.

5. More liquidity rests below the equal lows where the market has created the current support upon. It may not necessarily go for that liquidity pool, but it definitely can.

6. The new 4hr POB (fluorescent rectangle) could also hold potential for an up move.

I hope this gave you something new to learn today. If you already know ICT concepts, then that is amazing. I still have a long way to go.

All of this is only for educational purposes. Please take advice from your financial advisor before taking any financial risk.

Do use proper risk management.

Happy Trading!

Profits,

Market's Mechanic.