EUR/USD Breaks 1.1500 — Bulls in Full ControlEUR/USD surged over 1% today as relentless U.S. dollar selling helped push the pair above the 1.1500 mark for the first time since November 2021. Growing concerns over a potential U.S. recession and questions around the Federal Reserve's independence continue to weigh heavily on the greenback, providing strong tailwinds for euro strength.

From a technical standpoint, key resistance and the previous consolidation range have been broken. EMA 34 and 89 continue to flash bullish reversal signals — favoring buy-side strategies moving forward.

The focus now is on buying the dips: look for entries when price breaks new highs and pulls back to key levels such as the previous breakout zone, solid

Wishing you a profitable and exciting trading week ahead! 💶📈

E-signal

Breakout Momentum: GBP/USD Eyes 1.3500+Hey traders! Let’s break down the setup on GBP/USD for this week.

Today, the pair successfully broke above the 1.3290 resistance, completing a classic cup and handle pattern on the H4 chart. Now, price is approaching the key 1.3415 daily high — a historically strong resistance zone.

📌 Technical view: EMA34 and EMA89 are trending upward, clearly supporting the bullish momentum. If a pullback occurs, the 1.3290–1.3210 zone could offer a solid BUY opportunity.

📰 News to watch: All eyes are on Fed Chair Jerome Powell’s speech tonight. The market anticipates a dovish tone, especially with U.S. jobless claims data also being released. Signs of economic softness could strengthen the case for rate cuts — and that’s GBPUSD-friendly.

🎯 Suggested strategy: Wait for a reaction at the support zone before entering long. If 1.3415 breaks, we could see a push towards 1.3500+ in the midterm.

Let’s see how it plays out — trade safe and stay sharp!

Gold Is Back in the SpotlightGold has been drawing renewed attention lately, fueled by the weakening U.S. dollar — a consequence of increasingly erratic U.S. trade policies. While the dollar remains the world’s dominant reserve currency, more and more signs suggest that gold is quietly reclaiming its role as a reliable hedge in an uncertain global environment.

One of the biggest catalysts is China’s recent move allowing insurance companies to increase their allocation into gold. That decision alone could generate hundreds of tons in new annual demand — a game-changer in a market where global supply remains tight.

At the same time, major institutions like Citi, UBS, Goldman Sachs, and Bank of America have all raised their gold forecasts for 2025–2026. Some now see gold reaching as high as $3,500/ounce, signaling growing confidence that we’re entering a long-term bullish cycle — not just a short-term surge.

From my perspective, this isn’t just a reaction to news headlines. It feels like a deep, structural shift in how institutions are approaching gold. Last Wednesday’s $100 spike wasn’t random — it marked a clear surge in momentum and sentiment.

Looking ahead, we might see short-term pullbacks, but the overall trend remains unmistakably bullish. If gold does break into new territory in the coming quarters, this could be a crucial phase for planning, observing, and positioning smart Buy entries.

EUR/USD: Calm Before the Breakout?The EUR/USD pair is starting to attract buying interest as it edges closer to the 1.1370 level in early trading today. Ongoing concerns about the economic impact of trade tariffs continue to weigh on the U.S. dollar, giving the euro room to push higher and fueling bullish momentum for the pair.

While the uptrend remains intact, price action may stay muted today as the pair consolidates around the 34 EMA—a zone thatholiday-driven market slowdown.

The next key target lies near the 1.142 resistance zone, which could be tested early next week. A successful breakout above that level may pave the way for a fresh move toward new highs.

What’s your take? Is EUR/USD gearing up for a breakout or just catching its breath?

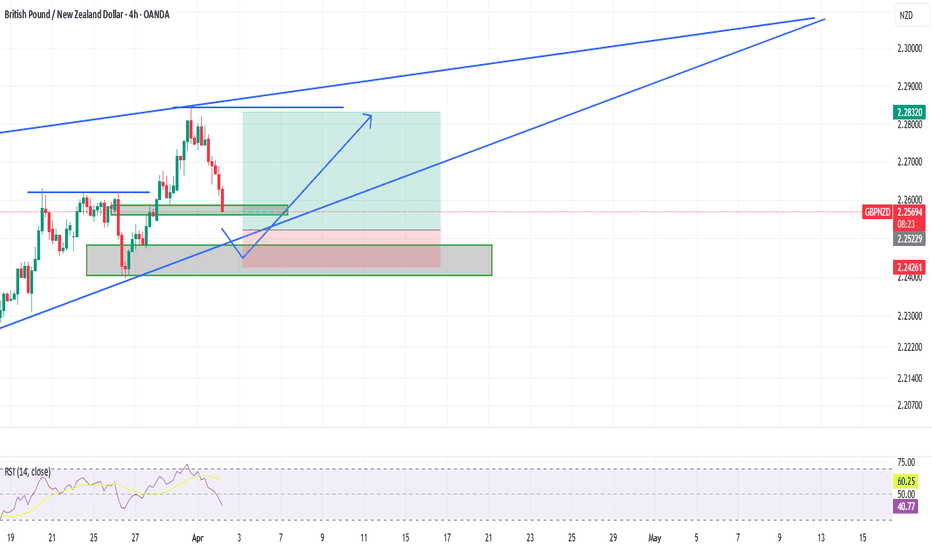

GBPNZD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

Gold Surges Unstoppably, Hits $3,036 – What’s Next?Gold is skyrocketing without brakes, reaching $3,036, making traders as happy as a holiday, while those waiting to buy the dip... can only watch the price soar sadly. 😅

📌 The main reason?

The USD is as weak as a soggy cracker, giving gold a perfect chance to break out.

Safe-haven sentiment keeps pushing gold higher, and even traders who bought at the top still seem happy as prices show no sign of stopping!

📈 Forecast:

If gold holds above $3,020, there's a high chance it will set a new record.

And if it corrects? Just gathering momentum for another big jump!

💡 What about you? Are you already in position or still waiting and watching?

EURUSD today: SELL or BUY ? Hey fellow traders, let’s chat and exchange insights on EUR/USD!

Today, EUR/USD continues to hold its bullish momentum, moving within an upward price channel on the 1-hour chart. In the short term, the pair remains supported, trading above the EMA 34 and 89, signaling further potential upside.

The Euro (EUR) has gained support from progress in peace talks between Russia and Ukraine. However, market sentiment could shift quickly depending on developments in the conflict, making it crucial for traders to monitor geopolitical news and economic data closely in the coming days.

With traders waiting eagerly for new policy updates, USD is not being favored as an investment option, allowing EUR/USD to maintain its advantage.

💡 What’s your take on EUR/USD? Share your thoughts below! ⬇️

$ATH Technical Outlook: Accumulation Opportunity? TSX:ATH Technical Outlook: Accumulation Opportunity? 🚀

#ATH is trading at $0.037, below key resistance at $0.045 – bearish unless it breaks above. A breakout could push it to $0.09 and beyond.

🔹 Accumulation Zone: $0.037 – $0.020

🔹 Targets: $0.1 / $0.3 / $0.5 / $1

Solid project, good dip-buying opportunity. Watch key levels & manage risk!

Not Financial Advice – DYOR! 🚀

#aethir #Alts

Gold Price Today: Sharp Drop Followed by a Sudden SurgeLast night, the global gold price briefly dropped to 2,865 USD/ounce, but it quickly surged back to 2,905 USD/ounce by the morning of February 13, 2025, driven by an increase in demand for safe-haven assets. The initial drop in gold prices was triggered by inflation data from the U.S., with the January 2025 Consumer Price Index (CPI) rising by 0.5%, higher than the expected 0.3%, sparking concerns about the FED's ability to maintain low interest rates. This information dampened expectations of a rate cut, putting pressure on the gold market. However, despite a slight sell-off, concerns about rising inflation and geopolitical tensions continue to fuel strong demand for gold as a safe-haven asset.

The recovery in gold prices indicates that investors still trust the value of this precious metal as a hedge against global economic instability. From a technical chart perspective, gold is currently supported by the 2,879 USD/ounce level, setting the stage for a potential upward trend. The next target is to challenge the resistance level of 2,933 USD/ounce. If gold surpasses this level, it could quickly move toward the 2,950 USD/ounce mark. Breaking through the 2,933 USD/ounce resistance would open the door for a stronger rally in the short term, pushing gold toward higher levels and solidifying its position as an essential safe-haven asset in investment portfolios.

EUR/USD Outlook: Tariff Concerns and Key Technical LevelsEUR/USD is stable around 1.0360 during the Asian trading session, after rising in the previous session. The currency pair may face downward pressure due to President Donald Trump’s plan to impose reciprocal tariffs, which could affect major countries such as Japan, the EU, and China. The Euro faces challenges as the Eurozone is particularly vulnerable to tariffs from the US. Risk-averse sentiment has also increased, compounded by the cautious stance of Fed Chairman Jerome Powell regarding interest rate cuts.

From a technical analysis perspective, EUR/USD is currently trading around 1.0360 and is likely to encounter strong resistance at 1.0400. This is a key level, and if it is surpassed, the pair could continue to rise towards the next target of 1.0450. However, if the price fails to maintain above 1.0400, it is likely that EUR/USD will continue its downward adjustment.

The nearest support level is at 1.0331, which was previously resistance and could now act as a significant support level. If the price breaks this support, the pair could continue its downtrend and find lower levels at 1.0290.

Technical indicators suggest that momentum is weakening, and overbought levels on the hourly chart are gradually declining, indicating the potential for short-term correction. However, if EUR/USD maintains above 1.0400, the pair could return to an uptrend. Investors should keep an eye on signals from indicators such as RSI and MACD to track further changes in the pair’s price direction.

Bearish outlook remains intact near 1.0300The EUR/USD pair continues to extend its decline, reaching around 1.0305 in the early European session on Tuesday. The U.S. dollar strengthened after U.S. President Donald Trump announced a significant increase in tariffs on steel and aluminum imports and stated that he would unveil reciprocal tariffs against other countries in the coming days.

From a technical perspective, the bearish outlook for EUR/USD remains intact, with two key resistance levels at 1.0396 and 1.0329. While the pair is encountering resistance at the 1.0329 level, breaking through this level does not necessarily indicate a strong upward movement, as the pair still faces the previous resistance at 1.0396. If the downtrend continues, the pair could potentially decline towards the 1.0210-1.0200 range.

Recommendation: Given the current bearish outlook and strong resistance levels above, entering a **sell** position around the 1.0329 or 1.0396 levels could offer a profitable opportunity. However, be cautious of fundamental factors that could change rapidly, especially any announcements from the U.S. government regarding tariffs.

Gold price today (February 11): Shocking increaseThe global gold price has seen a strong increase, with spot gold reaching $2,908.3 per ounce, up $47.1, and gold futures climbing to $2,936.9 per ounce, an increase of $49.3. This surge is primarily driven by the demand for safe-haven assets amid concerns over new tariffs announced by U.S. President Donald Trump, which have raised fears of a trade war and inflation. Trump unveiled plans to impose an additional 25% tariff on imported steel and aluminum, while also forecasting the announcement of reciprocal tariffs this week. Experts believe these tariffs could worsen inflation in the U.S., and investors are awaiting the release of the CPI and PPI data to assess the impact. If inflation decreases, gold prices could continue to rise; conversely, if inflation increases, bond yields could rise, applying pressure on gold.

From a technical perspective, gold is currently trending within a rising price channel, with significant support at $2,899 per ounce, which is expected to help maintain its upward momentum. Experts predict that, with the current upward trend, gold could quickly reach a new record high of $3,000 per ounce in the near future.

Gold price today: Continues to rise across the boardGold prices today on the international market continue to rise, despite the increase in the USD value. Over the past week, gold prices have repeatedly set new records, at one point surpassing the 2,880 USD/ounce mark, approaching 3,000 USD/ounce. The main reason for this price increase is concerns about inflation. According to a report from the University of Michigan, inflation expectations for the next year have increased by 1%, prompting many investors to turn to gold as a value-preserving asset.

I believe gold is an effective tool to protect against financial fluctuations, whether inflation, deflation, or recession. Recent indicators such as the CPI and PCE in the U.S. show that inflation remains persistent. At the same time, the stock market is showing signs of weakening, and public debt continues to rise, creating a favorable environment for gold prices to continue increasing.

Looking closely at the technical chart, gold is currently in a strong upward trend with no signs of slowing down. With a solid support level at 2,853 USD/ounce, I predict that gold may continue to rise in the short term. Notably, the previous resistance at 2,880 USD/ounce has been broken, indicating a very strong upward momentum. Currently, gold is fluctuating around 2,896 USD/ounce and may soon reach the 2,900 USD/ounce mark.

In this situation, the stop loss (SL) could be set at 2,860 USD/ounce to limit risk, while the take profit (TP) could be forecasted at 2,920 USD/ounce, assuming gold continues to maintain a stable upward trend.

EUR/USD wobbles ahead of US NFP reportEUR/USD is currently stable around the 1.0400 level, but the outlook for the Euro (EUR) remains uncertain due to concerns that the Eurozone may face losses from higher tariffs imposed by U.S. President Donald Trump. Last weekend, President Trump warned that Europe would certainly face tariffs for not buying enough U.S. goods, although he did not provide many details.

From a technical perspective, the EUR/USD pair could face downward pressure in the short term. The support level at 1.0228 is preventing the pair from dropping further, while the resistance at 1.0418 is the main reason for the temporary decline.

To manage risk, you may set a **Stop Loss (SL)** at 1.0450, just above the resistance level to protect against further upward movement. **Take Profit (TP)** can be set at the support level of 1.0228, where the pair may find stability and potentially recover. However, these levels can be adjusted based on your strategy and trading time frame.

Gold prices have surged despite the strengthening of the USDThis rise is attributed to the weakening of the USD and uncertainty surrounding the policies of US President Donald Trump. Investor concerns about the potential for a trade war and market volatility have driven demand for gold as a safe-haven asset.

President Donald Trump is currently considering imposing a 10% tariff on imports from China, effective February 1st. This is also the same date he previously announced a 25% tariff on imports from Mexico and Canada.

Given these developments, I expect gold prices to continue rising, primarily due to increased buying for safety ahead of new actions by President Trump. Gold prices are now approaching record-high levels.

Key economic data to watch this week:

- Thursday: Weekly Initial Jobless Claims report in the US

- Friday: S&P Flash PMI and Existing Home Sales data in the US

Based on technical analysis, with support levels at 2,621 and 2,658, gold has maintained its upward momentum. With the latest support at 2,694, gold continues to trend higher and may break through resistance at 2,758. The trendline also indicates a short-term bullish trend.

If there are no significant changes, traders may set stop-loss (SP) at 2,680 and take-profit (TP) at 2,750 to protect profits and minimize risk.

EUR/USD rises as Trump’s mild tariff plan reduces USD appealEUR/USD continues to maintain a solid upward trend above the key support level of 1.0400 in the European session on Wednesday, following a strong recovery in the North American session on Tuesday. The pair remains stable as investors assess the new tariff policies of the U.S. to adjust their positions.

Over the past two days, U.S. President Donald Trump announced a 25% tariff on imports from Mexico and Canada, and 10% on China, effective from February 1. Trump also threatened to take measures to address the U.S. trade deficit with the European Union, though he has not provided specific details. Earlier this week, Trump stated that he would tackle the issue by "increasing tariffs or requiring the EU to buy more oil and gas from the U.S."

However, these tariff threats appear less aggressive than market expectations, reducing demand for safe-haven U.S. dollars (USD). The U.S. Dollar Index (DXY), which tracks the value of the greenback against six major currencies, is currently trading near its lowest level in two weeks, around 107.90.

EUR/USD is trading steadily near its two-week high of 1.0430 in the European session on Wednesday, after rebounding from a more than two-year low of 1.0175. The pair has recovered strongly, thanks to a positive momentum divergence and price action. However, a bearish divergence signal would be confirmed if EUR/USD breaks above the immediate resistance level at 1.0440.

Gold Price Today, January 22: Hits 2-Month HighGold prices today rose sharply to the highest level in more than two months due to a drop in the USD, making gold cheaper for holders of other currencies. Investors are flocking to gold due to concerns about the tariffs that U.S. President Donald Trump may impose on goods from Canada and Mexico in February. Trump's policies could also lead to higher inflation, causing the FED to maintain high interest rates, which would impact gold prices.

As you can see, on the technical chart at 4 PM, gold is trading with an upward trend and with support at 2,692, gold could gain momentum and potentially reach the 2,800 target. The stop-loss (SL) can be placed below the support level at 2,680 to minimize risk. With this upward trend, if gold continues its momentum and surpasses 2,700, it is highly likely that the price of gold will keep rising and challenge the 2,800 range in the coming days.

For investors, this is a time to pay close attention and monitor market fluctuations. If gold continues to maintain its upward trend with strong external support, it could be a great opportunity to enter the market and capitalize on the next price increases. However, it is important to adjust strategies in response to changes in the political and economic landscape to protect profits and minimize risk.

EUR/USD stays below 1.0400 after Trump's tariff commentsThe EUR/USD pair is currently facing strong selling pressure, trading around the 1.0380 level during the Asian session on Tuesday, after partially recovering from recent losses. The Euro continues to be negatively impacted by expectations of a dovish stance from the European Central Bank (ECB). The market expects the ECB to continue cutting interest rates by 25 basis points in upcoming policy meetings, due to concerns over the Eurozone's economic outlook and low inflation.

These expectations are further reinforced by the belief that inflation in the Eurozone will remain stable near the ECB's 2% target, while uncertainty surrounding US trade policies is increasing.

Technically, key support levels for EUR/USD are at 1.0260 and 1.0180, with a strong resistance level at 1.0410. If EUR/USD fails to hold above these support levels and breaks through them, the downtrend may continue, with the next target potentially being 1.0100.

Traders may consider selling if the pair continues to decline and fails to break the resistance level at 1.0410. A sell entry could be placed at 1.0400, with profit targets at 1.0260 and 1.0180. Be sure to set a reasonable stop loss (SL) at 1.0450 to protect the account in case of an unexpected market reversal.

In conclusion, with the combination of bearish fundamentals and technical signals, EUR/USD may continue its downtrend if it breaks the key support levels of 1.0260 and 1.0180. Traders should pay close attention to these levels for potential selling opportunities.

JPY eased slightly ahead of Trump's inaugurationThe Japanese Yen (JPY) fluctuated between small losses and slight gains against the US dollar, with the USD/JPY pair trying to stabilize around the 156.15-156.20 range during the early European trading session on Monday. Core machinery orders in Japan increased for the second consecutive month, signaling further recovery in capital spending. This, along with bets that the Bank of Japan (BoJ) will raise interest rates later this week, provided a modest boost for the JPY.

Additionally, a fresh round of US dollar (USD) selling contributed to the day’s decline in USD/JPY. However, a generally positive risk tone and the uncertainty surrounding the trade policy of incoming US President Donald Trump limited any significant upward movement for the safe-haven JPY. Traders also seem hesitant ahead of Trump’s inauguration speech on Monday and the highly anticipated BoJ two-day policy meeting starting on Thursday.

From a technical perspective, Friday’s recovery from the support level marked by the lower boundary of the long-standing uptrend channel is slowing down near the 156.55-156.60 region. This area now serves as the immediate resistance, and a new short-sell position could allow the USD/JPY pair to reclaim the round number of 157.00.

EUR/USD regained the 1.0300 level ahead of Trump's inaugurationDuring the European session on Monday, EUR/USD regained the 1.0300 level, benefiting from market optimism and a weakening US dollar. Investors are currently preparing for the inauguration of President-elect Donald Trump, which has boosted positive sentiment and led to a decline in the greenback. The market's focus on important political and economic events has created an opportunity for the Euro to recover.

From a technical perspective, the pair is maintaining an uptrend, with strong support at 1.019. If the price pulls back towards this support level, it could present a buying opportunity. On the other hand, the key resistance level is at 1.032, where the price might face strong resistance. If EUR/USD manages to break through this resistance, the pair may continue its upward trend towards higher levels.

Traders should closely monitor price action around the support level of 1.019 and the resistance at 1.032. A breakout through these levels could signal clear buy or sell opportunities depending on the market's next move.

Key Levels to Watch:

Support: 1.019

Resistance: 1.032

Trading Strategy:

Stop Loss (BUY): 1.018

Take Profit (BUY): 1.035

Always keep a close eye on market developments and apply sound risk management strategies to optimize profits and minimize losses. Good luck with your trading!

INFY BREAKOUT ON Daily TF and Weekly TFInfosys (INFY) has been in a prolonged phase of consolidation, repeatedly testing a well-established resistance level over time. Despite multiple attempts, the stock consistently retracted from this level without delivering a decisive breakout. However, INFY has now closed convincingly above this resistance on both the Daily and Weekly time frames. This breakout suggests a strong potential for an imminent upside, supported by technical confirmation.

This setup presents a favorable risk-reward trade opportunity, with minimal risk due to the narrow stop-loss range. For investors with a long-term perspective, INFY also offers the possibility of substantial gains, even without relying on a stop-loss strategy. The breakout marks a critical juncture, highlighting its potential for sustained bullish momentum.

BICO/USDT Looks Ready to Pump – Targets Up to $3.50BICO/USDT Looks Ready to Pump – Targets Up to $3.50 🚀

OMXSTO:BICO is showing strong momentum with good volume recently. If it holds the $0.2860 support level, we might see a big upward move.

▪️ Entry Zone: I am looking to accumulate between $0.32 and $0.29.

▪️ Targets: $0.66/$1.00/$1.83/$2.50/$3.50

▪️ Stop Loss: To manage risk, the stop loss is set at $0.2540.

Note: Watch the support level and volume closely for confirmation of the bullish trend.

Not financial advice so DYOR.

BTCUSDT Analysis: Bullish Momentum and Key Support ZonesBTCUSDT is currently trading around 75,740 USDT after a recent bullish push, suggesting strong upward momentum. The chart shows clear support zones (highlighted in purple) that Bitcoin could revisit in case of a pullback, specifically around 74,000 USDT and 72,500 USDT.

If BTC holds above these support levels, it could gain further traction to reach new highs, with targets in the 78,000 USDT - 80,000 USDT range. The current trend suggests that if Bitcoin retraces and tests the support, it could present a buying opportunity for traders looking to join the next potential leg up.

Keep an eye on these critical levels, as a break below the 72,500 USDT support might indicate a shift in trend. However, for now, the bullish scenario remains intact, with promising upside potential if buyers continue to dominate.