Community ideas

Investing:Nifty IT is looking good for long term accumulation!If you have been following the tech related news lately, it has been about the new AI "revolutionary" tool named Anthropic.

And the same is visible on charts of Nifty IT.

TCS is available at a price at which it was trading in December 2020.

Infy has just broke a crucial support.

Wipro has always been the weakest of 3.

So what next?

My opinion is that the fall is now almost in the end stage. The accumulation has already started on Friday as we have seen some good recovery by end of the day.

However, A SL hunting move near 32-34 zone might come as a formation of a lower low with RSI divergence in Nifty ITBEES which is where one needs to be careful.

We might also see some rebalancing & restructuring in IT index soon. However, these large companies are operating since past many decades and are here to stay at least for a few more.

These are the kind of dips which should be mouth watering for long term investors as the valuations are now dirty cheap.

The levels which i mentioned are my personal opinion shared for educational purposes and should not be considered as a recommendation.

INDUS TOWER ANALYSISTHIS IS MY CHART OF THE WEEK PICK

FOR LEARNING PURPOSE

INDUS TOWER- The current price of INDUS TOWER is 466.60 rupees

I am going to buy this stock because of the reasons as follows-

1. It is making a new high by breaking the resistance of last 9 years ( we often call this Multi year breakout)

2. This stock has seen some great buying in 2023 to Jun 2024. I have been keeping this stock in my watchlist from last few weeks

3. It has shown better relative strength as it stood strong in volatile times (if you see it 6-9 month comparison)

4. The risk and reward is favourable.

5. Another good part- The overall sector has shown some decent strength and have good momentum. Also, MFs and Insurance have increased their stake in last Q. (This is a good sign)

I am expecting more from this in coming weeks.

I will buy it with minimum target of 35-40% and then will trail after that.

My SL is at 401.30 rupees.

I will be managing my risk.

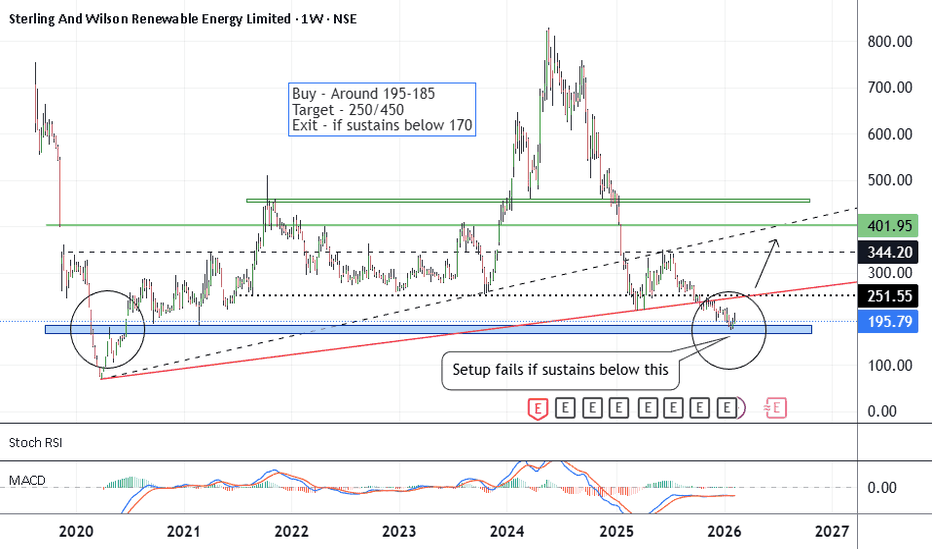

SW Solar - Bottom FishingCMP 195 on 14.02.26

As can be seen on the chart. There has been a big correction in the stock price in the past months. Presently trading near the lowest prices. If a reversal takes place, may go into a bullish phase ahead.

Possible targets may be 250/450.

The setup fails if it sustains below 170.

All these illustrations are my own view, shared only for paper trading and learning purposes. It is not a buy or sell recommendation.

All the best.

#Nifty Weekly 16-02-26 to 20-02-26#Nifty Weekly 16-02-26 to 20-02-26

25450-25650 is the sideways range for next week.

25800 will act as Resistance for next week.

Wait for above range to break on either side for a trending move.

Long level is above 25650 for the targets of 25780/25900.

Short level is below 25450 for the targets of 25300/25080.

View: Sideways to Bearish.

What to do in TCS if we are Holding?What to do in TCS if we are Holding?

Market Sentiment :

- Extremely week: Due to AI disruption Theory

Technical:

- Extremely Week: Daily, Weekly, Monthly Lower Lows formation

Should We Enter at this Level?

- No New Entry suggested unless we see Daily close above 20EMA

But I am already Holding it, Should I Add more as it is cheaper now?

- We can see a Daily Green Candle which means, that Buyers just got active at this price range. But there are people stuck at higher level so one should not add more quantity at this level rather than look for an Exit at Higher level.

Should I sell my TCS at market open?

- Not Recommended, As there is Daily Green Candle, We can put an Stop Loss order below the Green Candle Low and if there is any other green candle appears, we can keep shifting our SL to last Green Candle low so we can Exit when Seller become stronger.

- But I wanted to Hold for long and want to Add More, as I don't want to Exit in Loss and I believe in India Story.

- Good, Hold your stock if you don't need money and Can Add more near 2000 Support Level only which can give you a better price and support structure.

SILVER 1HRSWING TRADE

SILVER (XAGUSD) Looking good for Downside..

When it break level 73.77 and sustain.. it will go Downside...

SELL @ 73.77

Target

1st 63.89

2nd 56.48

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert..

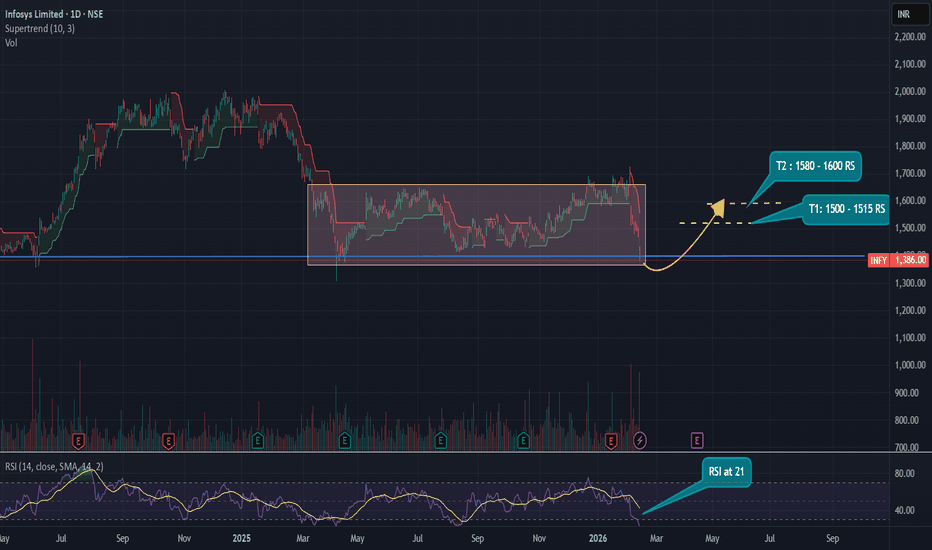

Infosys LimitedInfosys Technical Outlook :

Infosys has been consolidating within the ₹1400–₹1700 range over the past year. Currently, the stock is in the oversold zone, with the RSI at 21, and is testing a strong support level around ₹1400.

From a mid-term perspective, the setup looks attractive:

- Target 1: ₹1500–₹1515

- Target 2: ₹1580–₹1600

This implies a potential return of 9–12% from current levels, provided the support holds.

Disclaimer : The Above shared Content is for information and education purposes only and should not be treated as investment or trading advice. Im not SEBI registered, Contact your financial advisor before any investment.

$ETH has officially lost the 2000–2020 base CRYPTOCAP:ETH has officially lost the 2000–2020 base we highlighted on the 1H chart.

Triple-top rejection (Top 1 → Top 2 → Top 3) played out perfectly — buyers failed at the 2140–2160 supply zone, and breakdown followed.

📍 First reaction target (1980–1950) ✅ Hit

That’s roughly a 2.6–3% move from breakdown level, which is 26–30% profit on 10x leverage 💥

Momentum is clearly tilted downside after repeated rejections.

Next Target zones remain:

➡️ 1900–1850 (previous impulse base)

➡️ 1800–1750 (HTF demand / liquidity)

If you entered on breakdown — shift SL to entry now and protect gains.

Let the rest run risk-free.

Structure delivered. Execution matters.

Hindustan Unilever : Prepared for Upside Hindustan Unilever – Failed Head & Shoulders Turning Bullish (Daily Chart)

On the daily timeframe, Hindustan Unilever was forming a well-structured Head & Shoulders pattern. The left shoulder, head, and right shoulder were clearly visible, with a defined neckline acting as support.

However, instead of breaking below the neckline, price action failed to confirm the bearish reversal. The right shoulder did not lead to downside continuation. Instead, price reversed strongly and has now given a decisive breakout above the right shoulder high, closing above that level.

This failure of a bearish Head & Shoulders pattern indicates a potential bullish reversal. Failed patterns often lead to strong moves in the opposite direction, as trapped short sellers exit their positions.

Target Measurement:

The projected upside target is calculated by measuring the vertical distance from the Head (highest point) down to the neckline low. This distance is then projected upward from the breakout point above the right shoulder.

Price has already given a confirmed daily close above the right shoulder resistance, validating the breakout.

As long as price sustains above the breakout level, the measured move target remains active.

SBILIFE: "Change of Character" Signaling somethingThe Technical Breakdown (Educational Guide)

The chart displays a beautiful confluence of Smart Money Concepts (SMC) and Fibonacci retracement. If you’ve been looking for a textbook "Buy the Dip" setup, this is it! Here are 4 key educational points from this chart:

1. The Choch (Change of Character) ⚡

Notice the label CHoCH on the chart. This occurs when the price breaks the recent lower high in a downtrend. It’s the first signal that the "character" of the market is shifting from Bearish to Bullish. It’s not a full trend reversal yet, but it’s the early warning sign smart traders look for.

2. The ABC Correction Pattern 🔀

After the initial impulsive move up (from the circle), the price entered a three-wave corrective phase labeled a-b-c.

Wave A & B: Short-term volatility.

Wave C: The final "flush out" that traps impatient sellers before the real move starts.

3. Fibonacci "Golden Zone" Confluence 🎯

The price has dipped exactly into the 50.0% (1,999.20) to 78.6% (1,961.60) retracement zone.

This orange box acts as a High-Interest Buy Zone.

Below this, we have a Fresh Demand Zone (extended retracement) between 1,930 – 1,950 for extra safety.

4. Trendline Breakout Anticipation 📉

The grey descending trendline has been capping price for weeks. A breakout above this line, followed by a successful retest, confirms the FNO Target of 2,095 and the Swing Target of 2,152.

📊 Trade Setup Summary

Current Price: ~1,993.60

Entry Zone: 1,960 — 1,995 (Accumulation Zone)

Immediate Target (FNO): 2,095 🎯

Positional Target (Swing): 2,152 🚀

Invalidation: A sustained close below the Fresh Demand Zone (1,930).

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

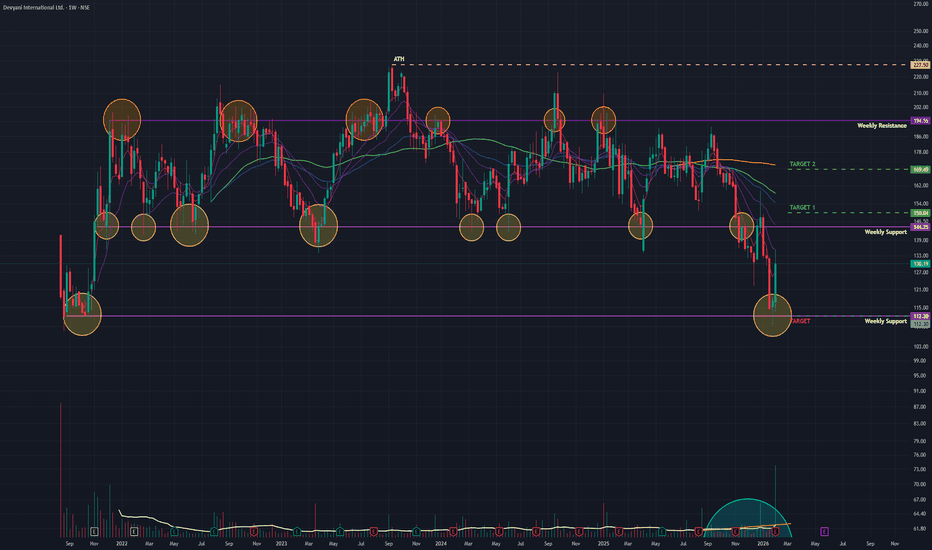

Devyani Int (W): Aggressive Bullish, Turnaround at Major Support(Timeframe: Weekly | Scale: Logarithmic)

The stock has confirmed a major "V-Shape Reversal" from its long-term support zone of ₹110. The surge is backed by "Climax Volume" and a positive reception to its Q3 operational updates, signaling that the 2-year correction might be over.

🚀 1. The Fundamental Catalyst (The "Why")

The technical reversal is driven by a shift in sentiment:

> Q3 FY26 Earnings: The market focused on the positives— Revenue up 11% YoY and operational efficiency improvements—ignoring the bottom-line loss.

> Management Change: The announcement of a new CEO (effective April 1) has been viewed as a positive step for future strategy.

> Valuation Comfort: After falling ~30% in the last year, the stock had priced in most negatives at ₹110.

📈 2. The Chart Structure (The Base)

> The Support (The Floor): At ₹112 level. This zone has been a demand magnet since 2022.

- Confirmation: The Weekly Hammer followed by a massive Green Candle (Marubozu-like) confirms a "Morning Star" type reversal.

> The Volume: The 116 Million volume is an "Institutional Stamp." Retail traders typically cannot generate this volume; it indicates that big funds are "bottom fishing."

📊 3. Technical Indicators

> RSI: Rising from the Oversold zone. This "V-turn" in RSI usually precedes a sharp recovery rally.

> Price Action: The stock has closed above its short-term moving averages (20-Day EMA), signaling a trend shift.

🎯 4. Future Scenarios & Key Levels

The stock is now in "Recovery Mode."

🐂 Bullish Targets (The Pullback Rally):

- Target 1: ₹150.

- Target 2: ₹170.

🛡️ Support (The "Must Hold"):

- Immediate Support: ₹120 – ₹123.

- Stop Loss: A weekly close below ₹110 would invalidate the entire reversal structure.

Conclusion

This is a Grade A Reversal Setup.

> Refinement: The "Hammer" was the signal; the "Earnings Volume" was the confirmation.

> Strategy: The reversal is valid. Use any dip to enter/add.

Nykaa: Descending Trendline BreakoutNykaa respected the rising structure even during the correction and never lost its trend strength.

Price held the sloping support, absorbed selling pressure, and then gave a clean breakout above the key horizontal resistance around 277 with strong volume.

This move shows acceptance above resistance — not a fake spike. Buyers waited patiently, and once price cleared the zone, momentum kicked in.

As long as price holds above the breakout level, the path of least resistance remains upward.

Next zone to watch lies near 313, based purely on structure and price projection.

The crypto has found its supportBitcoin CMP $70690

The beauty of looking at various asset classes is that they rise and fall together. In my view the correction in the crypto is over.

Elliott- The v waves within the C wave is done. Hence to me this correction is over.

Fib- The crypto reversed just shy away from the 59K which is the confluence zone on the chart.

Trendline- the same area is also supported with a trendline. Hence the zone is a strong strong support.

Oscillators- All the oscillators are at support. This is yet another indication of strength.

Bar - the daily chart is showing a railway track which is a directional signal.

Capitulation- the huge volume on the bottom is indicating capitulation.

Conclusion- yesterday it was silver that bounced back strongly and bitcoin too which is indicating a reversal.

NTPC.. Moved outside the channel..NTPC.. Trying its level best to move.

Selling pressure in market pulled it back and retested the support.

Now things can be interesting..

Moved above this channel then first target can be somewhere around 370, the exact level from where it faced resistance today..

Second can be somewhere around 375 followed by 380..

Above 380, no major resistance till 390..

Downside or inside the channel, first target can be around 353 followed by 340..

Pick your trade accordingly..

All the best..

Nifty Energy: Final Bounce Before the Deeper CorrectionThe Nifty Energy Index continues to trade within a higher-degree corrective structure rather than a fresh impulsive uptrend.

The decline from the highs appears to have completed Wave W, followed by an ongoing recovery in Wave X.

In the near term, the structure allows for one more upside phase . After a probable dip in wave (b), the index may attempt a final advance via wave (c) of (Y) of X, which is expected to unfold in three waves.

This move is likely to be selective and constituent-driven. Heavyweights such as Reliance Industries, ONGC, BPCL, Tata Power, SJVN, Suzlon, NTPC, Coal India, and Power Grid Corporation may still show relative strength during this phase, contributing to the final push higher within Wave X.

However, it is important to note that this rise remains corrective in nature . It should be treated as a tactical opportunity rather than the start of a sustained bullish trend.

Once Wave X completes, the larger picture turns decisively bearish.

The index is then expected to enter Wave Y of the higher-degree correction, which could result in a sharp and more brutal decline across energy stocks, particularly if leadership from the heavyweights fades.

Key levels marked on the chart act as reference points, with a clear invalidation level below which the current corrective count would fail.

In summary:

A short-term corrective rise may still be pending, but the dominant risk lies on the downside once Wave X is done .

Disclaimer:

This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

Dead Cat Bounce in Nifty? Heavyweights to Deliver The VerdictDead Cat Bounce in Nifty? Index Heavyweights to Deliver the Verdict Soon…

Both index heavyweights remain structurally weak despite the recent bounce.

On the daily timeframe, Reliance Industries and HDFC Bank have transitioned out of bullish Ichimoku regimes. Crucially, the second daily Kumo breakdown in both stocks overlaps with a failed Kijun-sen reclaim , reinforcing bearish continuation rather than base formation.

The weekly picture strengthens this caution. Price has shown multi-week acceptance below weekly equilibrium across both names, signaling institutional comfort at lower levels . Until price can reclaim and sustain above the weekly mean, the ongoing bounce risks remaining a dead cat rather than evolving into a sustainable trend reversal.

Verdict pending — and it rests squarely with these heavyweights

Long term analysis of Tanla Platforms Ltd.Wrap up:-

As per chart of Tanla Platforms Ltd., it seems that correction in Tanla is over with a wxy pattern in major wave 2 and also, after breakout it has retested the support. Now, major wave 3 is about to start/started.

What I’m Watching for 🔍

As initial breakout is confirmed for a probable target of 961. Complete breakout is confirmed once it breaks and sustains above 756. Low Risk Entry Range is 545-410 for a Probable target of wave y i.e. 961-1221-2097 with a stoploss of 409.

Disclaimer: Sharing my personal view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

Understanding the Down Trend Line Breakout : Base chart GALLANTTUnderstanding the Down Trend Line Breakout : Base chart GALLANTT ISPAT Ltd

Introduction

Gallantt Ispat Limited, currently trading around 580.00 on its daily chart, has been moving below a persistent down trend line since August 2025. Recently, the stock has shown signs of strength by forming a double bottom pattern, a classic reversal signal, and is now attempting to break above this long-standing resistance. This setup provides an interesting case study for traders and investors on how to interpret down trend line breakouts, manage risks, and identify potential entry points.

What is a Down Trend Line?

A down trend line is drawn by connecting successive lower highs on a chart.

It acts as a resistance line, showing the prevailing bearish sentiment.

As long as price remains below this line, sellers dominate.

A breakout above the line often signals a shift in market psychology from bearish to bullish.

Importance of the Down Trend Line Breakout

Psychological Shift: A breakout indicates buyers are gaining control.

Volume Confirmation: Strong volume during breakout adds credibility.

Trend Reversal Potential: Especially when supported by reversal patterns like the double bottom.

Opportunity Zone: Traders often look for such setups to capture early stages of a new uptrend.

Risk Management in Breakout Trading

Trading breakouts can be rewarding but also risky if false signals occur. Key principles:

Wait for Confirmation: Avoid jumping in on the first candle above the line; look for sustained price action.

Use Stop Losses: Place stops below recent swing lows or the breakout level to limit downside.

Position Sizing: Never risk more than a small percentage of capital on a single trade.

Avoid Emotional Trading: Stick to a plan rather than chasing moves.

How to Enter Down Trend Line Breakouts

Aggressive Entry: Buy immediately on breakout with tight stop loss.

Conservative Entry: Wait for a retest of the trend line (now support) before entering.

Volume-Based Entry: Enter only if breakout is accompanied by above-average volume.

Pattern Confirmation: In Gallantt Ispat’s case, the double bottom adds conviction to the breakout attempt.

Key Takeaways for Investors & Traders

Trend lines matter: They reflect collective market psychology.

Breakouts need confirmation: Volume and sustained price action are crucial.

Risk management is non-negotiable: Protect capital with stops and sizing discipline.

Gallantt Ispat’s setup: The double bottom plus breakout attempt makes this chart worth monitoring closely.

Patience pays: Waiting for confirmation often saves traders from false breakouts.

Conclusion

Gallantt Ispat Limited’s daily chart is at a critical juncture. After months of trading under a down trend line, the stock is now attempting to break free, supported by a double bottom formation. For traders, this is a textbook scenario to study the dynamics of breakout trading. The lesson here is clear: respect the trend line, manage risk diligently, and enter with discipline when the breakout is confirmed.

JK Tyre & Industries Ltd – Weekly Chart Breakout WatchJK Tyre & Industries Limited is currently showing strong momentum, and the price action suggests that the stock may be approaching a fresh breakout above the ₹554 level.

Since this analysis is based on the weekly timeframe, the primary focus will be on a weekly breakout and weekly closing above the mentioned resistance (554). A confirmed close above this level will be considered as valid breakout confirmation.

Chart Structure & Price Action

The stock has recently come out of a 30–40 day consolidation phase

Post consolidation, the stock has formed a strong bullish candle, indicating renewed buying interest.

Price action suggests that the stock is respecting the breakout zone

Breakout Perspective

Breakout Level to Watch: ₹554 (weekly closing basis)

This appears to be an all-time high breakout

If sustained, a new upward phase can potentially begin from here

Momentum traders may consider tracking the stock closely once confirmation is received

Trade Planning & Risk Management

Entry should be considered only after a confirmed breakout

The breakout candle low can be used as a reference for risk management

Alternatively, ₹480 can be considered as an invalidation level

Proper position sizing and risk calculation are essential before entering any trade

What to Do Now

Keep the stock on your watchlist

Monitor weekly price action carefully

Avoid premature entries before confirmation

Further updates will be shared as the structure evolves

Disclaimer

This post represents my personal observations and is shared strictly for educational purposes only.

It is not financial advice.

Please:

Do your own analysis

Consult your financial advisor if needed

Always calculate risk before taking any trade

The financial market involves both opportunity and risk, and disciplined decision-making is essential.

Thank you.

See you in the next update.

On the 1H chart, $BNB is forming a Head & ShouldersOn the 1H chart, CRYPTOCAP:BNB is forming a Head & Shoulders after a strong sell-off from the 900+ region.

Left Shoulder: ~785–790

Head: ~728 (marked low on chart)

Right Shoulder: ~770–775

Neckline / Supply Zone: 780–785

Current price is trading below the neckline, which keeps the structure bearish unless invalidated.

🔽 Bearish Scenario (Pattern Confirmation)

If price fails to reclaim 780–785 and shows rejection:

First downside: 745–750

Key support retest: 728

If 728 breaks decisively:

Next downside zones: 700 → 680

This aligns with the measured move of the H&S pattern.

🔼 Bullish Invalidation Scenario

The bearish structure is invalid only if:

Strong 1H close above 785

Follow-through acceptance above 790

If that happens:

Short-term recovery toward 810–830

Still a relief bounce, not trend reversal unless higher timeframes flip

Varun Beverages: Formation Near Support | Multi-Target Study📄 Description

Varun Beverages is currently trading near a strong long-term support zone around ₹440–₹450, where price has formed a stable base after a prolonged correction.

The chart shows a descending trendline breakout attempt along with consolidation near Fibonacci support (0–0.22 zone), indicating possible accumulation.

RSI is in the lower range and approaching oversold territory, which suggests selling pressure is weakening and a potential reversal setup is building.

If price sustains above ₹480–₹500, we may see gradual upside momentum toward:

🎯 Short-term: ₹520+

🎯 Medium-term: ₹600+

🎯 Long-term: ₹680+

This setup offers a favorable risk–reward for positional and swing traders.

📌 View: Bullish above ₹450

🛑 Stop-loss: Below ₹430 (daily close)

📈 Trend: Reversal / Recovery Phase

⚠️ Disclaimer: This is only a technical view for study and learning purposes. Not a recommendation to buy or sell. Please do your own research.

BTCUSD might give Structure Shift Now✅ Pattern: Potential Inverse Head & Shoulders

Look closely:

Left dip → around 76.8k

Deep dip (Head) → around 75k

Right dip → higher low near 76.5k

Now price is pushing back up

This is a classic reversal structure.

✅ Important Level: Neckline Resistance

The dotted zone you marked around:

79,000–79,200

That is the neckline / supply cap.

Price is repeatedly testing it.

📌 Until this breaks, structure is still “building.”

✅ Structure Type: Higher Low Creation

This is the most important:

Previous low = 75k

New low = ~76.2k

That means:

Higher Low → Early Bullish Shift

This is how reversals begin.

🚦What’s Needed for Confirmation?

Bullish Confirmation = Break + Close Above 79.2k

If BTC closes above that zone:

✅ Structure break

✅ Trend reversal likely

✅ Next targets:

80.5k

82k

84.4k (major resistance)

⚠️ Bearish Risk

If price rejects again and breaks below:

76.5k support

Then structure fails and BTC can revisit:

75k

73.8k

📌 Conclusion

BTC is creating a structure:

✅ Base + Range

✅ Higher Low

✅ Possible Inverse H&S

⏳ Waiting for neckline breakout