Elliotwaveanalysis

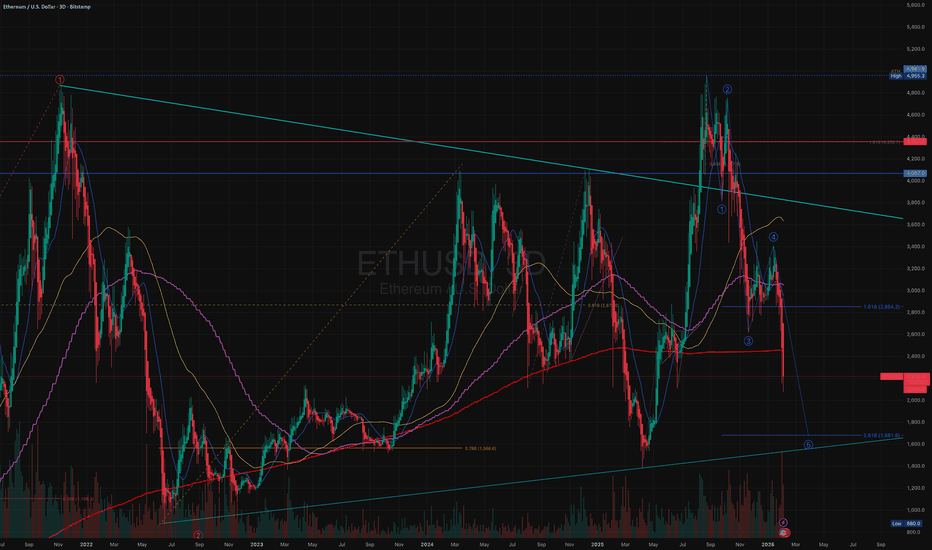

$ETH in a descending impulse wave headed to $,681On the ETH chart, I see an impulse wave headed down to $1,681. It started at the peak on 23 Aug 2025 and Wave 3 completed almost at the 1.618 @ $2,619. Wave 5 will complete at the 2.618 @ $1,681, which aligns with the bottom of the wedge in place since Jun 2022 (and which also tagged the April 2025 bottom)

#XAGUSD⚡ Silver – What Happens Next? ⚡

🥈 Silver began a new impulsive cycle in April 2025, with its 1st wave in October. After a flat corrective 2nd wave (C failure), it surged into a powerful 3rd wave, peaking at $84 on 29 Dec 2025.

📈 The 4th wave followed as another flat correction with strong buying pressure, before Silver entered its largest 5th wave, hitting a record high of $121 on 29 Jan 2026.

🚨 But here’s the critical signal: the entire 5th wave was retraced in just one day. In Elliott Wave terms, this invalidates the continuation of the bull run.

📉 Conclusion:

• The $121 peak marks a long-term high.

• Silver is likely to revert to its true value below $60 by mid-March 2026.

Nifty – Technical Outlook before Budget.Nifty – Technical Outlook

As per the current Nifty weekly and monthly chart analysis, the index is trading within a broad consolidation range between its all-time high zone of 26,300 and the key support area near 25,160. The price structure indicates a flat correction formation as per Elliott Wave theory.

Based on the wave structure and momentum indicators, the ongoing flat correction appears to be in its final stage. Once completed, the market is expected to witness a five-wave downside move, which would mark the next corrective leg in the broader trend.

As per the chart structure, the potential correction from current levels could extend in the range of approximately 6–10%.

On the monthly timeframe, Nifty has formed an Evening Star candlestick pattern, which is a bearish reversal signal and indicates underlying weakness in the market structure.

Budget Session Outlook

During the budget session, Nifty may witness a pullback or bounce toward the 25,650 – 26,063 zone However, this upside is likely to be corrective in nature and may represent Wave 2 of the anticipated five-wave downside structure.

⚠️ Buying should be avoided in this resistance zone, as risk-reward does not favour fresh long positions at these levels.

Shorting Opportunities

Primary short opportunity:

If the index shows rejection or reversal signals in the 25,650 – 26,060 resistance zone , it may provide a favourable setup for short positions.

Confirmation-based short opportunity:

A decisive close below 25,160 (which also coincides with the 200 EMA) would confirm downside strength and offer another high-probability shorting opportunity.

Invalidation Level

This bearish outlook will be invalidated if Nifty closes above 26,350 and sustains above this level, which would negate the current Elliott Wave and corrective structure.

PAYTM (One 97 Communications Ltd.) – Technical Outlook & LevelsPAYTM is currently trading near ₹1,344 and remains in a strong upward Elliott Wave structure.

A clean breakout above ₹1,380–1,400 may trigger Wave-3 momentum toward ₹1,850–₹2,000.

Supports at ₹1,300 and ₹1,225 remain crucial for trend continuation, while ₹1,250 acts as an ideal stop-loss for swing setups. Long-term Wave-5 projections suggest a potential move toward ₹2,150–₹2,250.

🎯 Future Target Levels

🔹 Swing Trading Targets

• Target 1: ₹1,420 – ₹1,450

• Target 2: ₹1,550 – ₹1,600

🔹 Position Trading Targets

• Wave 3 Target Zone:

👉 ₹1,850 – ₹2,000 (Fib 1.618–2.0 extension)

• Wave 5 Extended Target:

👉 ₹2,150 – ₹2,250 (Post Wave-4 completion)

🛑 Key Support Levels

• Major Support: ₹1,300

• Intermediate Support: ₹1,225

• Structural Support: ₹1,100 (previous swing-low zone)

📌 Resistance Levels

• Immediate Resistance: ₹1,380

• Next Resistance: ₹1,450

• Major Resistance Zone: ₹1,550 – ₹1,600 (Breakout above this zone can accelerate the Wave-3 rally)

🔐 Stop-Loss Recommendations

Swing Trades

• SL: ₹1,250 (below trendline & previous corrective low)

Positional Trades

• SL: ₹1,180 (below Wave-2 base level)

📌 Thanks a ton for checking out my idea! Hope it sparked some value for you.

🙏 Follow for more insights

👍 Boost if you found it helpful

✍️ Drop a comment with your thoughts below!

Nifty – Complex Corrective Structure on Lower Timeframe (ElliottThe attached chart illustrates a developing complex correction in Nifty on the lower timeframe, with multiple flat structures and a terminal impulsive sequence.

Wave (a) – Flat Correction

Wave (a) (marked in red) unfolds as a classic flat, where the internal (A)–(B)–(C) subdivision (in blue) follows a 3–3–5 structure. The retracement in wave (B) is relatively deep, consistent with flat correction behavior.

Wave (b) – Flat Correction

Wave (b) again resolves as a flat correction, reinforcing the sideways and overlapping nature of the broader corrective phase. Price action during this segment remains choppy, typical of corrective markets.

Wave (c) – Five-Wave Impulse

Wave (c) progresses as a clear five-wave impulse, adhering to Elliott Wave principles:

Wave 1: Initiates the bullish leg from the wave (b) low.

Wave 2: Forms a flat correction, providing a controlled retracement without violating wave-1 origin.

Wave 3: Extends impulsively, showing strong momentum and range expansion.

Wave 4: Develops as an expanding triangle (A–B–C–D–E), indicating volatility expansion and time correction.

Wave 5: Concludes with an impulsive push to complete wave (c).

Overall View

The structure suggests a mature corrective pattern composed of multiple flats and a final impulsive leg. Such formations often precede either a higher-degree trend resumption or a larger consolidation. Traders should be mindful of false breakouts and overlapping moves, as complex corrections can remain range-bound longer than expected.

GBP/AUD: Corrective Rally, Downtrend IntactGBP/AUD is trading in a clear bearish Elliott Wave structure on the 4H timeframe. The market has already completed a strong impulsive decline and is currently moving in a Wave 4 corrective pullback, which is happening inside a downward channel and near key Fibonacci retracement levels. This correction looks weak and corrective, suggesting sellers are still in control. As long as price remains below the invalidation level around 2.0050 , the bearish bias stays valid. The expectation is for the correction to finish soon, followed by Wave 5 to the downside, targeting the lower channel area and the 1.96–1.95 zone. Overall, the trend remains bearish, and any short-term bounce is likely a selling opportunity before the next leg lower.

Stay tuned!

@Money_Dictators

Thank you :)

USD/CHF Approaching Breakdown from RangeUSD/CHF is moving in a sideways corrective pattern, not a strong trend. The price is forming an A-B-C-D-E structure, which usually happens before the market makes a bigger move. Right now, price is in the last part of this pattern (wave E) and is sitting near a resistance area, where it has failed to move higher and has started to turn down. This behavior often means sellers are becoming stronger. As long as the price stays below 0.795–0.798 , the outlook remains bearish, and the market is expected to move lower toward the 0.782–0.775 support area. If this move happens, it would complete the corrective pattern after a short pause, and then the market can decide its next big direction.

Stay tuned!

@Money_Dictators

Thank you :)

USD/CAD: Elliott Wave Bearish BiasUSD/CAD is showing a bearish Elliott Wave structure on the 4H chart. Price appears to have completed a corrective Wave 2 near the 0.5–0.618 Fibonacci retracement zone, which is a common area for corrections to end. From there, the market has started to turn lower, suggesting the beginning of a new impulsive Wave 3 to the downside, which is usually the strongest bearish wave. As long as price stays below the recent swing high near the retracement zone, the bias remains bearish, with downside targets toward the 1.365–1.360 area. A move above the Wave 2 high would invalidate this count and delay the bearish scenario.

Stay tuned!

@Money_Dictators

Thank you :)

Gold Trapped in Liquidity Range – Expansion PendingGold is currently trading in a post-impulse environment after completing a clear Elliott Wave advance. With the higher-timeframe impulse exhausted, price action has transitioned into a controlled consolidation driven by liquidity, rather than trend continuation.

At this stage, the market is not trending — it is preparing.

Market Structure & Liquidity Context

Price is now boxed between a well-defined Equal High and Equal Low, forming a classic liquidity range. This structure suggests that Smart Money is engineering both sides of liquidity before committing to the next directional move.

The upper range aligns with premium pricing, where buy-side liquidity is resting.

The lower range sits in discount territory, overlapping with higher-timeframe demand.

This environment favors rotation and stop-hunt behavior, not impulsive expansion.

Key Trading Scenarios

🔴 Sell reaction at the highs

If price pushes above the Equal High and taps into the 4688–4690 premium zone , this area is expected to attract sell-side interest. A clear rejection or hesitation here would signal that buy-side liquidity has been taken, opening the door for a rotation back into the range.

🟢 Buy reaction at the lows

If price drops and reaches the 4388–4390 discount zone , this level becomes a key area to watch for support. Strong rejection or stabilization would suggest Smart Money defense, favoring a bounce back toward equilibrium.

Expectation & Bias

This is a rotation market, not a trend market.

Directional continuation should only be expected after a clear break and acceptance outside the range.

Until then:

Patience > prediction

Liquidity > indicators

Reaction > anticipation

Let price show its hand.

💬 Do you expect expansion to come from the highs or the lows first?

Your perspective matters — share your view.

NIFTY Forms Ending Diagonal (EDT): 25,133–25,000 final Target.✅ STRUCTURE CONFIRMATION

1️⃣ Impulse completed

✔ NIFTY has completed a 5-wave impulse as per the chart

✔ Wave (v) showed:

Overlap

Momentum divergence

Channel resistance

➡️ This strongly suggests an Ending Diagonal–type Wave (v), which often leads to sharp ABC corrections

2️⃣ Current phase: ABC correction in progress

Your ABC expectation is correct.

🔹 Wave A

Sharp decline from the top

Impulsive nature ✔

🔹 Wave B (ongoing / upcoming)

Counter-trend bounce

Overlapping, corrective

Lower volume

📌 Important:

👉 Any Wave-B bounce is a shorting opportunity, not a trend resumption

Ideal Wave-B retracement zone:

25,800 – 26,000

Near broken channel / prior resistance

3️⃣ Wave C termination zone (KEY POINT)

Your final buy zone is well identified.

🎯 High-probability Wave-C completion:

25,133 – 25,000

Why this zone matters:

✔ 200-EMA (~25,133)

✔ Ending Diagonal trendline (EDT) support

✔ 50–61.8% Fibonacci retracement

✔ Prior demand + institutional reference level

📌 This is a confluence zone, which is exactly where Elliott Wave corrections typically end.

4️⃣ Trading logic (very clear)

❌ Do NOT buy during Wave B

✅ Use Wave-B rallies to sell / hedge

✅ Final buy should be planned near 25,133 ± 150 pts

Expect volatility and false breakdowns near the bottom

5️⃣ Invalidation (must know)

❌ Weekly close below 24,600

Would imply a deeper, higher-degree correction

Until then → bullish structure intact

Kalyan Jewellers – Elliott Wave analysis for breakout.Kalyan Jewellers – Elliott Wave Validation (Daily Chart, IST)

Big Picture Structure

• Primary trend: Bullish

• Current degree: Wave (5) in progress

• Wave (4): Completed near ₹440–445

• Market is now transitioning from early Wave (5) into impulsive expansion

________________________________________

Role of the Inverted Head & Shoulders (IH&S)

• IH&S has formed after Wave (4) → classic trend-resumption pattern

• This pattern is acting as:

o A reversal from correction

o A launchpad for Wave (5)

Key Pattern Levels

• Head: ~₹440–445 (Wave 4 low)

• Left Shoulder: ~₹495–505

• Right Shoulder: ~₹485–495

• Neckline: ~₹520–525

________________________________________

Breakout Condition (Critical Point)

If today’s candle closes 515 , it confirms breakout

More precisely:

• Daily close above ₹515 with volume

= Confirmed IH&S breakout

= Start of impulse inside Wave (5)

Projected Targets – Elliott-Compliant

Targets are valid Fibonacci expansions from Wave (4) low.

Reference Points

• Wave (4) low: ~₹445

• Breakout zone: ~₹525

🎯 Targets Explained

Target Basis

₹610 0.618 extension of Wave (5)

₹699 Equality with prior Wave (1) / mid expansion

₹799 1.618 extension → typical Wave (5) extreme

✔ All three targets are Elliott-legal and realistic

✔ ₹799 also aligns with previous Wave (3) high, which is common in Wave (5)

Bank of Maharashtra trade for 18-20% upside.**Bank of Maharashtra (Weekly Chart – NSE)**

The stock has **completed its Wave-4 corrective phase** and subsequently formed a **clear Inverse Head & Shoulders (iH&S) pattern**, signalling the start of a **fresh impulsive move (Wave-5)**.

**Technical Observations**

* Wave-4 correction has ended near ₹45–46, respecting Elliott Wave rules

* iH&S neckline breakout confirms trend reversal

* Momentum indicators (RSI & MACD) support bullish continuation

* Price is holding above the breakout zone with healthy structure

**Strategy**

* **Accumulation Zone:** ₹60 – ₹65

* **Upside Target:** ₹75 – ₹80

* **Potential Upside:** ~18–20% from current levels

As long as the price sustains above the accumulation range, the structure remains constructive for further upside in the ongoing **Wave-5**.

This setup favours **accumulate-on-dips** rather than chasing extended candles.

---

Bank Nifty Swing Trading Setup - RRR 1:4Bank Nifty forming ending diagonal wave 3 is running (C- c2) so go long at around 59000 and target is 60200-60500 risk around 300 points ( swing low) reward 1200 points RRR is around 1:4 it's good strategy follow risk management strictly happy trading journey ...

Gold in Final Bullish Wave – Last Push Higher ExpectedGold (XAU/USD 4H) is in a strong bullish trend and is currently moving in the last part of Wave (5). The clear breakout above the previous resistance shows that buyers are in control, and the bullish structure is still valid. As long as the price stays above the main support area, the outlook remains positive, with the next target around 4,580–4,650 , where this upward move is likely to finish. For short-term trades, a sensible stop-loss can be placed below 4,420 , while the bullish view becomes invalid if the price falls below 4,360 . If everything goes as expected, Gold should make one final move higher and then take a normal corrective pullback (A-B-C) after the strong rally.

Stay tuned!

@Money_Dictators

Thank you :)

DXY Breakdown After Major Top – Wave v in ProgressThe DXY chart shows that the U.S. Dollar has completed a larger corrective structure and is now moving inside a new impulsive bearish phase. After forming a major top near the 110 area, the index started a clear five-wave decline, indicating strong downside momentum. The recent sideways movement looks like a corrective pause (wave iv / Y) rather than a trend reversal. As long as the price stays below the key resistance zone around 100–101, the overall structure remains bearish. This suggests the dollar is preparing for the final wave lower (wave v / 3), which could push the index toward deeper support levels. Overall, the Elliott Wave structure favours continued weakness in the U.S. Dollar in the coming months.

Stay tuned!

@Money_Dictators

Thank you :)