Will $PYTH go to $1 or drop even lower?Will EURONEXT:PYTH go to $1 or drop even lower?

Chart is still bearish with LL + LH structure.

But $0.0810 is a key level. If it holds, a trend reversal is possible. Accumulation zone: $0.085–$0.110

Risky entry, but R:R is huge. Hold = 10x potential to $1+

Break below $0.0810 = new LL incoming.

NFA & DYOR

ETH-D

$VIRTUAL Gaining strength- hold above $1.30 could send it to $5$VIRTUAL/USDT: SPARKS:VIRTUAL is Gaining strength- hold above $1.30 could send it to $5+

Price is respecting the accumulation range between $1.30–$1.60 with multiple successful retests of the demand zone at the base.

🔹 Structure: Accumulation phase within a descending triangle

🔹 Support: Strong base at $1.30 – bulls defending this level consistently

🔹 Resistance: Descending TL compressing price- breakout imminent

🔹 Bias: Bullish above $1.30

Expectations:

✅ Clean breakout above the TL (~$1.60) will flip structure bullish

✅ Post-breakout targets: $2.00/$2.70/$4.50+

✅ If $1.30 continues to hold as HTF support, I’m expecting $5+ in the coming days.

Invalidation: Any HTF close below $1.30 shifts the bias.

Watch for breakout volume- confirmation will trigger rapid upside movement.

NFa & DYOR

ENA/USDT Now 200% up from our EntryMIL:ENA Update: Strong Momentum in Just a Few Days

I shared an early entry below $0.25, and now MIL:ENA is trading above $0.67 that’s nearly 2.8x your capital from our entry.

Both Target 1 and Target 2 have already been hit.

I remain very bullish on MIL:ENA for the long term, with a potential to reach $5. However, keep in mind the risk is higher at this stage, but the reward could be significant if it reaches that level.

If you entered early, consider booking some profits or at least secure your principal and let the rest ride.

Thanks to everyone who trusted my analysis, slow and steady can bring big returns.

NFA & DYOR

Ethereum Breakout Confirmed – Retest CompletedCRYPTOCAP:ETH has broken out Inverse Head & Shoulders on daily chart.

✅ Neckline breakout above $2,850

✅ Retest successful – strong support confirmed

✅ Targeting full move toward $6,000

Structure is bullish, momentum building. As long as #Ethereum holds above the neckline, continuation is likely.

Note: NFA & DYOR

ETH - Target 4500 to 5000 as per wave theoryETH is showing movement as per wave theory so forecasting end of this bull run or possibility of correction can be arrived. clearly eth is in 3rd wave which could end anywhere at the redlines drawn in chart and based on which wave 4 and 5 can be approximately arrived at. what ever be the 3rd wave level ETH is sure to touch 4500 before showing bigger correction. And i think 5000 is also possible easily. For now holding bigger or decent qty long in ETH is suggested with proper money management.

Everyone’s bullish now… but smart traders are waiting for this EEthereum just tapped a key resistance near $3,672 and is starting to show signs of cooling off.

A healthy retracement could bring ETH back to:

0.382 Fib – $2,970

0.5 Fib – $2,781

0.618 Fib – $2,605 (Strong demand zone)

IMO, we can expect ETH to revisit the $2,700–$3,000 zone before the next leg up.

This area will be the golden re-entry for long-term targets of $6,000–$8,000.

Stop-loss: Recent high and candle close above $3,675

Structure remains bullish:

✅ Previous dips into Fibs triggered strong buybacks

✅ Clean higher highs and higher lows

✅ Demand zone + retracement = opportunity

My View: Let price pull back. Then load up again. Bigger wave incoming.

DYOR | NFA

THENA shows bullish momentum, expanding its community and integrRecent Highlights:

Community Growth: Launched an Italian Telegram community (July 14), signaling localized expansion.

V3.3 Upgrade (May): Enhanced BNB Chain liquidity through modular pools and improved capital efficiency.

Vooi V2 Integration (July 1): THENA's liquidity pools are now accessible via Vooi's chain-abstracted perpetuals platform, potentially boosting protocol fee revenue.

Binance Ecosystem Ties: Vooi's backing by YZi Labs (ex-Binance Labs) suggests strategic alignment with BNB Chain.

Governance Automation: veTHE holders can now vote across chains without bridging, streamlining decentralized decision-making.

Market Performance: Trading volume spiked 307% to $45.9M (24h) alongside Bitcoin's new All-Time High (ATH), indicating correlation with DeFi volume trends.

Outlook: THENA is positioned as a key BNB Chain liquidity provider, but its recent price gains face sustainability tests in a competitive DEX market like PancakeSwap. Its ve3,3 model, with features like modular liquidity and cross-chain voting, aims to differentiate it as chain-abstracted trading becomes standard.

THETA Price Prediction: Can It 20x From This Weekly Support ZoneMYX:THETA is now trading at a strong support area — the same zone where it started big moves in the past.

In previous cycles, from this level:

🔹 THETA went up over 2,700% (to $15.38)

🔹 Later, it again moved up around 570% (to $3.23)

🔹 Now, it's showing signs of a similar bounce from the same level.

Possible Future Price Levels:

Targets: $0.95 / $3.18 / $7.51 / $14.02

These are levels to watch if the upward trend continues.

⚠️ Risk Point:

If THETA falls and stays below $0.65, the setup will no longer be valid and it may go lower.

THETA – Fundamental Overview

🔹 THETA is a blockchain built for decentralized video streaming.

🔹 It lets users share internet bandwidth to help deliver videos and earn TFUEL in return.

Key Use Cases:

🔹 Powering video apps like Theta.tv

🔹 Creator-focused NFTs and content access

🔹 Web3 streaming, gaming, and AI tools

Backed by Big Names:

Google Cloud, Samsung, Sony, CAA, and more.

Real adoption, not just hype.

Token Model:

🔹 THETA: Staking + governance

🔹 TFUEL: Gas + rewards

Fixed supply = No inflation risk

Why It Matters:

As Web3 and AI grow, THETA could become the backbone of content delivery.

Key Takeaway:

🔹 This zone has worked well as a bounce point before.

🔹 THETA is reacting from it again now.

🔹 The potential reward is high, and the risk is limited if managed properly.

Keep an eye on it. This might be a good setup for long-term traders.

Let us know your thoughts & Would you invest in projects like THETA? 👇

Note: NFA & DYOR

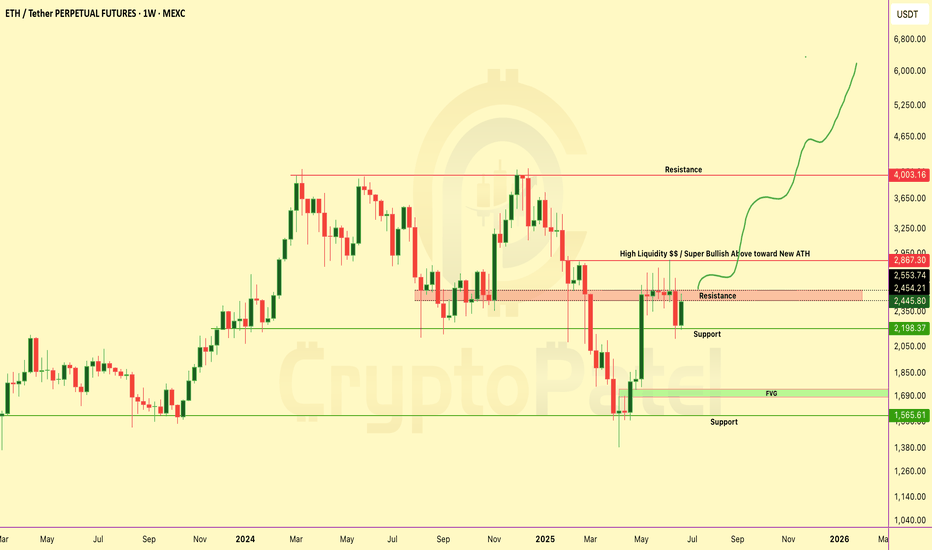

$ETH IS FLIRTING WITH A MASSIVE BREAKOUTCRYPTOCAP:ETH IS FLIRTING WITH A MASSIVE BREAKOUT

Price is hovering just below the HIGH LIQUIDITY ZONE at $2,867 — a major inflection point!

✅ Break above… We could see a parabolic push toward ATHs.

❌ Rejection = A sharp correction might hit hard.

It’s make or break time for Ethereum.

What’s your plan if this breaks?

NFA & DYOR

Weekly Long Setup | Jul 8th 2025 | Valid Until Weekly ClosePrice might retrace to a strong pivot zone (marked by the red box).

Structure remains bullish with potential for continuation after pullback.

The green box represents a high-probability long opportunity with tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation (e.g., bullish engulfing, strong wick rejections) appears.

The setup expires at end of the weekly candle close.

Intraday Long Setup | July 4th 2025 | Valid Until Daily ClosePrice retraced to a strong pivot zone.

Structure remains bullish with potential for continuation after pullback.

Tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation appears

The setup expires at end of the daily candle close.

BCH Could 10x in the Next Bull Run — But Not YetBCH Could 10x in the Next Bull Run — But Not Yet

Bitcoin Cash is still trading inside a big falling channel.

Every time price hits the lower zone at Bull Flag, it bounces back up — this is the strong Support / Entry Zone.

Right now, BCH is near the upper Trendline Resistance (~$550-$580).

But IMO, we could see one more retracement before the next big bull run. I’m expecting price to revisit the $250–$210 zone before the next leg up.

However, if BCH breaks and holds above $640, that would confirm a bull flag breakout — turning the structure fully bullish with potential long-term targets between $1,800 – $4,000+ by 2026–2027.

Stay alert. The setup is big — but timing is key.

Note: NFA & DYOR

ETHEREUM Weekly Chart Breakdown – Massive Move Loading?ETHEREUM Weekly Chart Breakdown – Massive Move Loading?

ETH just pumped +9.9% this week... but it’s what comes next that really matters 👇

Key Resistance Wall → $2,867

🔹 This zone is packed with liquidity traps and past rejections.

🔹 Break this level = Unlocks ATH push toward $4K–$6K-$10k

Why This Chart Matters:

✅ Bullish structure reclaim

✅ Targeting “High Liquidity” zone above

✅ Possible parabolic rally if breakout confirms

Dips = Opportunities

If ETH dips from here... don’t panic.

→ Every dip = fresh accumulation zone

→ Below $2,000 = golden buy zone for long-term bulls

Liquidity Zone Break it = ATH rally incoming

Reject it = Buy the dip and ride the next wave

Comment & tag a friend who needs this alpha!

NFA & Dyor

If you're shorting Ethereum, watch $2570 closely.If you're shorting Ethereum, watch $2570 closely.

If a candle closes above $2570, that invalidates the short — time to exit.

Why?

Because above this level, the risk/reward flips against you.

Better to wait for a cleaner entry with less risk, more reward.

Target: $2000

Retweet if this helps your trade plan.

NFA & DYOR

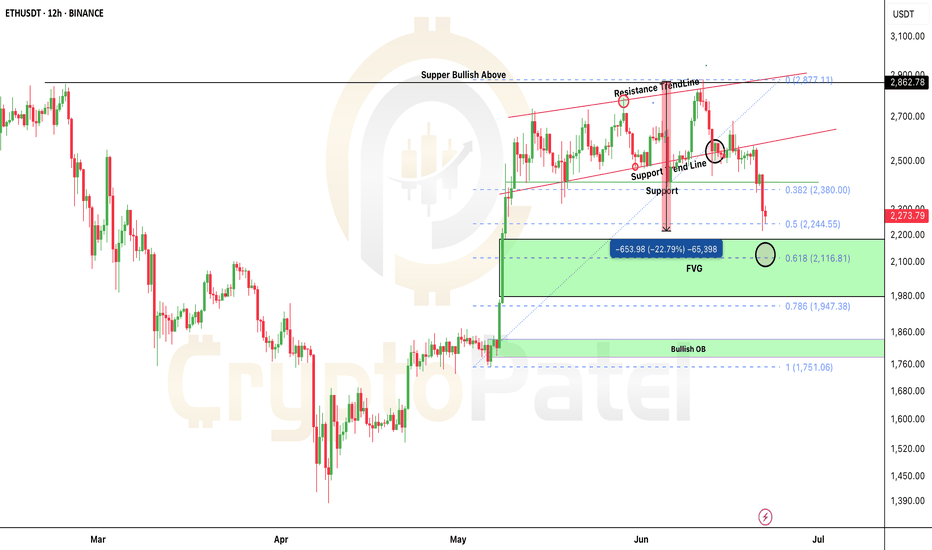

ETH/USDT Dumped hard as I predicted and next Target?ETH SHORT HIT — As Predicted!

Hey fam

Hope you enjoyed the ETH short setup I shared earlier when price was around $2700–$2800

ETH is now down 22% from that level.

Broke support just like we discussed…

And remember I said — if $2500 breaks, we could see $2200.

Well… we’re already there now ✅

What Now?

This is where we start accumulating on spot.

Why?

Because ETH is currently at the 0.5 Fib level — could hold.

If not, we target 0.618 Fib for next entry.

Best Accumulation Zone: $2200–$1800

Strong bullish OB around $1782–$1840

If price drops there, expect a solid bounce!

I’m personally watching this zone for spot entries targeting $8000–$10,000 next run 🚀

Let me know below if you're buying this dip!

And as always… stay tuned for the next sniper setup.

NFA & DYOR

BTC Traders: Crucial Levels Incoming 🚨 BTC Traders: Crucial Levels Incoming 👇

Bitcoin is hovering around $105,399 — and things are heating up.

$106K = Resistance.

A clean break could send us to the Bearish Order Block ($108K–$108.95K).

But here’s the danger zone:

🟥 OB = Last drop's origin.

Rejection here = major sell-off risk.

🔻 $102K = Liquidity pool.

Lose this level, and sub-$100K is on the table.

Current Bias:

– Hold below OB = Bearish

– Reclaim OB = Relief bounce

– Drop below $102K = Trend Accelerates Down

What’s your game plan here?

💬 Comment your next move

🔁 Retweet if useful

🔖 Bookmark for later

$MASK dropped 65% in 12 days — but I’m still buying, here’s why?NASDAQ:MASK Crashed 65% — I Sold at the Top, Buying at the Bottom, and Aiming for 10x

The NASDAQ:MASK token has crashed -65% in just 12 days — that’s a massive drop, and honestly, no one saw it coming. Even I didn’t expect this much of a dump.

But remember — no one can predict the market 100%.

✅ I did post a chart earlier to short NASDAQ:MASK around $3.50, and that call hit perfectly. If you took that short, it was a high-profit setup.

Now here's the important part

I mentioned earlier — if price drops below $1.50, that’s a good entry point for long-term spot buyers (NOT for leverage).

Personally, I’ve started accumulating from $1.30, and if we see a deeper dip, I’ll be buying more for the long run.

My long-term target for NASDAQ:MASK is $10+.

NFA — always DYOR

ZKJ COIN DUMPING HARD — What’s REALLY Going On?ZKJ COIN DUMPING HARD — What’s REALLY Going On?

The price of Polyhedra Network’s $ZKJ has dropped sharply — falling over -87% in just a few days. But what’s really causing this?

A big reason is the token unlock on May 19 — over 15.5 million ZKJ tokens (worth around $30 million) were released into the market. That’s a lot of new supply, and many holders started selling.

At the same time, trading volume fell by 40%+, meaning fewer buyers and more pressure on price.

In total, ZKJ is down about 95% from its all-time high — and panic selling made things worse.

But here’s something most people are missing:

The project itself is still strong.

They have partners like Google Cloud, Revolut, Bima

zkPyTorch is live

📅 Heads up: Another big unlock is coming on June 19, so stay alert!

$ETH BLOODBATH: -15% Dump! Next Stop $2100? CRYPTOCAP:ETH BLOODBATH: -15% Dump! Next Stop $2100?

I shorted right from $2862 — nailed the move.

Now trading below critical $2550 support.

👉 Hold $2550? Reversal towards $3000-$4000 possible.

👉 Lose it? We likely fill $2100-$2200 FVG — 0.618 fib at $2116.

$2860 remains THE level to watch for a New ATH.

💬 Comment your ETH target!

🔁 Retweet if this helps your gameplan.

BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY!🚨 BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY! 🚨

Hope you followed our last BTC analysis — and DID NOT open any longs at the top.

If you followed: Congrats — you either made big profits on the short, or at least saved your money by not longing.

✅ We clearly warned when BTC was around $110K — more correction was coming.

Result? Bitcoin is now 7% DOWN since that call.

❗ Now the situation is DANGEROUS:

👉 BTC broke my Bullish Order Flow at $105K.

👉 If this $105K support doesn’t hold soon → we may see a deep correction towards $90K.

$105K is the level to watch like a hawk.

👉 Iran-Israel news just accelerated the fall — but we already predicted this move before the news.

🚫 NEVER gamble with your hard-earned money.

✅ Always wait for solid confirmation before entering trades.

👉 Stay smart. Stay safe. Stay patient.

💬 Comment your thoughts below.

🔁 Forward this to your crypto friends — they NEED to see this!

ETH Long Swing Setup – Breakout Retest of Key ResistanceETH has broken above the critical $2,750 resistance, signaling bullish momentum. We’re now watching for a retrace into the $2,700–$2,750 zone, which is expected to act as support for a continuation higher.

📌 Trade Setup:

• Entry Zone: $2,700 – $2,750

• Take Profit Targets:

o 🥇 $3,000

o 🥈 $3,200

o 🥉 $3,700

• Stop Loss: Daily close below $2,650