ETH/USD Daily — Support Bounce Setup in a Strong Downtrend

Chart Analysis:

Market Structure:

ETH is clearly in a bearish trend on the daily timeframe. Lower highs and lower lows are intact after a sharp rejection from the major supply zone around 3,300–3,400 (yellow zone).

Impulsive Sell-Off:

The recent move down is strong and aggressive, suggesting capitulation-style selling rather than a slow grind. This often precedes at least a technical relief bounce.

Key Support Zone (Red): ~1,900–2,000

Price has tapped into a well-defined demand/support area, where buyers previously stepped in. The long lower wicks here hint at buying interest and absorption.

Proposed Entry:

The marked entry is based on a support reaction, not a trend reversal. This is a counter-trend long, so it’s tactical, not positional.

Target Zone (Green): ~2,450–2,550

This zone aligns with:

Prior structure support → resistance flip

Likely liquidity resting above

Mean reversion after an extended drop

Bias & Expectations:

Short-term: Bullish relief bounce toward the green zone

Medium-term: Still bearish unless ETH reclaims and holds above ~2,600–2,700

Expect high volatility—clean V-shaped recoveries are rare in this context

Risk Note:

If price loses the 1,900 support decisively, the setup is invalidated and opens the door for continuation toward lower psychological levels.

📌 Summary:

This chart shows a high-risk, counter-trend bounce play off major daily support, targeting a logical resistance zone above. Good for disciplined traders, not for blind bottom-catching.

Ethsignals

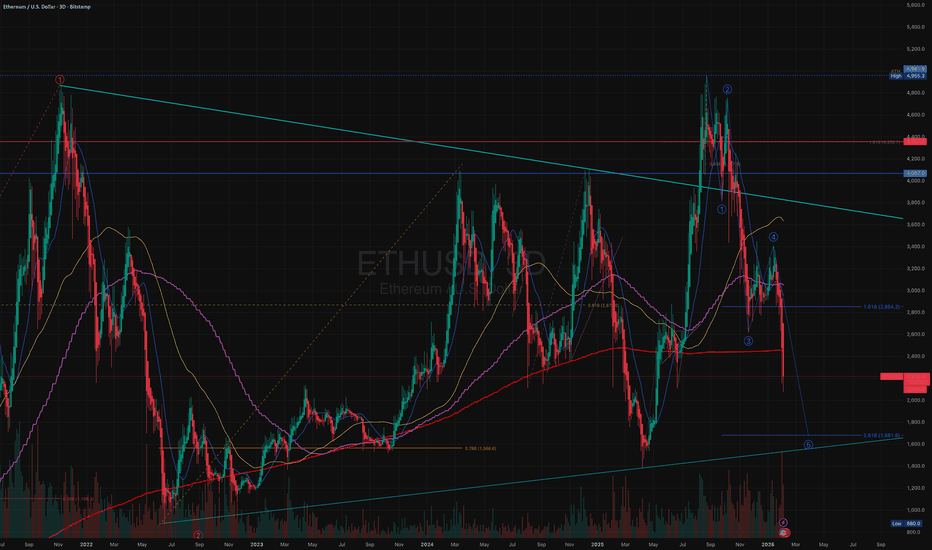

$ETH in a descending impulse wave headed to $,681On the ETH chart, I see an impulse wave headed down to $1,681. It started at the peak on 23 Aug 2025 and Wave 3 completed almost at the 1.618 @ $2,619. Wave 5 will complete at the 2.618 @ $1,681, which aligns with the bottom of the wedge in place since Jun 2022 (and which also tagged the April 2025 bottom)

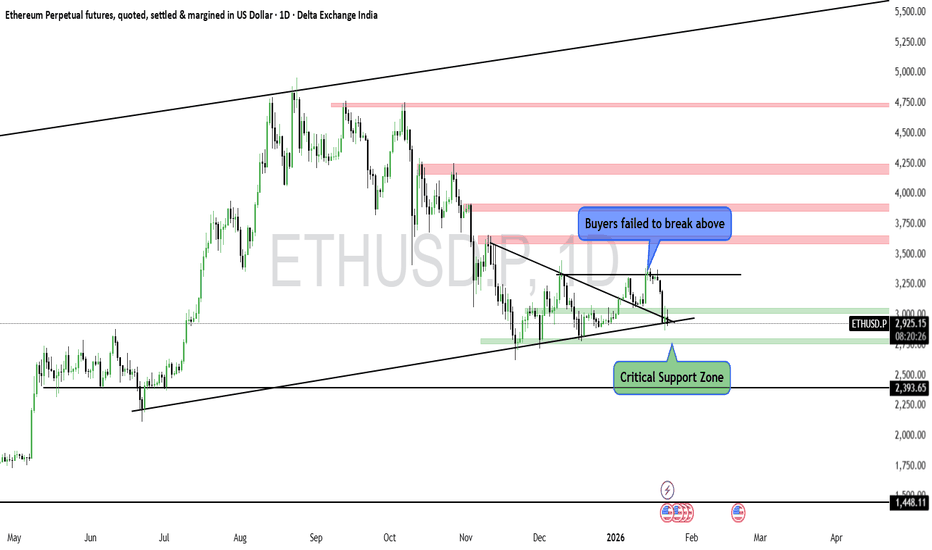

#ETH ON THE EDGE DELTAIN:ETHUSD.P

ETH is on the edge of the cliff. If it breaks below this level, we can see a significant downward move to $2200 easily and worst case of $1500 & $1400.

Long term investors can accumulate on the supports. Follow me for more.

This indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from the use of this indicator.

Trading and investing involve risk. Always do your own analysis and use proper risk management.

#ETH one final hope?

One last hope for a bounce back.

If the price fails to break and hold above $3050, then we may see a downside move. The direction is still not clear.

Disclaimer:

This idea is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from the use of this indicator.

Trading and investing involve risk. Always do your own analysis and use proper risk management.

#ETH lost the bullish momentum?

Seems like ETH failed to break the previous high.

But the trend is still not reversed. Until it holds the "Critical Support" level, we can consider side way movement.

If it breaks below the critical support then the downside may continue.

This indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from the use of this indicator.

Trading and investing involve risk. Always do your own analysis and use proper risk management.

ETH 1H Outlook: Key Support Retest With Potential Downside RiskKey observations:

1. Support Level Under Pressure

ETH is retesting this support multiple times.

The annotation suggests: “SUPPORT IF BREAKS THEN WE CAN SEE MORE DOWNWORD” — meaning a breakdown could trigger further selling.

2. Downside Targets

If the current support fails, the next liquidity zones highlighted are:

FVG (Fair Value Gap) around $2,950–$2,900

Extreme POI zone around $2,880–$2,850

Major support at $2,787 (marked as “next support”).

3. Upside Scenario

If support holds, ETH could bounce toward:

$3,078

$3,134

High resistance around $3,225

4. Market Structure

Several CHoCH and BOS labels indicate mixed structure, showing recent weakness but with potential for rebound if buyers defend support strongly.

ETH Bullish Outlook: Tokenization Boom to $9K in 2026CRYPTO:ETHUSD

Asset: ETH/USD

Timeframe: Weekly

Hey traders! 🚀 Ethereum's dipping into December around $3,100 after some post-ATH consolidation, but the setup screams reversal. Fundstrat's Tom Lee is calling for a monster rally to $9,000 by 2026, fueled by tokenization exploding across finance. That's nearly 190% upside—ETH's about to steal the spotlight from BTC!

Key Analysis:

Macro Tailwinds: ETH's riding BTC's coattails but with extra juice from spot ETF inflows and real-world asset tokenization. As Wall Street piles in, expect ETH to decouple upward—watch for Nasdaq sync and weakening USD to amplify the move.

Technical Setup: Rock-solid support at $2,800, the recent higher low that's holding like a champ. Daily RSI oversold, bullish MACD crossover brewing, and on-chain metrics show whales accumulating. Smash $3,500 resistance, and we're blasting toward $4,500 next.

Risks: Near-term volatility if broader risk assets falter, but ETF demand and layer-2 scaling keep the floor intact for the long haul.

Trade Signal:

Entry: Long ETH/USD at $3,000 (confirmation above $2,800 support).

Target 1: $4,000 (short-term, ~30% gain).

Target 2: $9,000 (Tom Lee tokenization target by mid-2026).

Stop Loss: $2,700 (below key support to guard the downside).

Risk/Reward: 1:4+ on the primary target. Position size: 1-2% of portfolio.

Chart snapshot: Weekly candles forming a bullish pennant at $2,800, with Fibonacci retracement eyeing $9K extension. Overlay ETH ETF flows for that institutional vibe! (Pro tip: Compare with BTC dominance to spot ETH's breakout edge.)

Idea by Signal Squad

Published: December 8, 2025

What do you think, squad? ETH outpacing BTC in 2026, or more sideways grind? Drop your takes below—let's squad up! #ETH #CryptoSignals #SignalSquad

Weekly Analysis BTC with Sell and Buy scenarios..Here is the weekly analysis of BTC including various topics of ICT, Price action etc.

Note – if you liked this analysis, please boost the idea so that other can also get benefit of it.

Also follow me for notification for incoming ideas.

Also Feel free to comment if you have any input to share.

Join me on live stream for real time update.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions.

ETHUSD – Pure Price Action Analysis ETHUSD – Pure Price Action Analysis (Buy | Sell | TP | SL | No-Trade Zone)

🚫 NO-TRADE ZONE (Ranging / Indecision Area)

The shaded box between $3,140 – $3,245 is your no-trade zone.

Reason:

Market is consolidating

No strong direction

Liquidity building

Smart money accumulation area

👉 Inside this box = avoid entries.

Wait for breakout + retest.

✅ BUY SETUP (Breakout → Retest → Long)

Buy Entry Levels

1️⃣ Buy above $3,245 (clean breakout & retest)

2️⃣ Safer buy above $3,290 (strong momentum zone)

Buy-Side Targets (TP)

🎯 TP1 → $3,366

🎯 TP2 → $3,428

🎯 TP3 → $3,502

🎯 TP4 → $3,602

🎯 TP5 → $3,748

🎯 TP6 → $3,915 (high probability supply zone)

STOP LOSS for Buy

🛑 SL → Below breakout candle

Safer → Below $3,200

❌ SELL SETUP (Breakdown → Retest → Short)

Sell Entry Levels

1️⃣ Sell below $3,100

2️⃣ Aggressive sells at each retest shown by red arrows.

Sell-Side Targets (TP)

🎯 TP1 → $2,986

🎯 TP2 → $2,885

🎯 TP3 → $2,719 (major demand zone)

STOP LOSS for Sell

🛑 SL → Above the retest candle

Safer → Above $3,140

🔥 BEST HEADING FOR THIS ANALYSIS

ETHUSD – Breakout Trading Plan | Buy–Sell Zones | TP–SL | No-Trade Zone

📌 SUMMARY (Very Clear)

🚫 No-Trade Zone:

$3,140 – $3,245

✅ Buy only if price breaks → retests → holds above $3,245

TP → 3,366 / 3,428 / 3,502 / 3,602 / 3,748 / 3,915

SL → Below 3,200

❌ Sell only if price breaks → retests → fails below $3,100

TP → 2,986 / 2,885 / 2,719

SL → Above 3,140

ETHUSD Complete Price Action Roadmap (Buy, Sell, Pullback Zones)ETHUSD PRICE ACTION ANALYSIS

Current Market Condition

Price has created a Higher High (HH) directly inside a major supply zone around 3240–3260.

Strong impulse rally from the LL → HL → HH structure (bullish trend).

Price is now overextended into resistance → likely for a pullback.

🔥 1. SELL SETUP (Rejection from Supply Zone)

Price is already inside a big supply zone (3,240 – 3,260).

📍 Sell Entry

3240 – 3255 (inside the blue supply zone)

🛑 SL (Safe Stop)

3275

🎯 TP Targets

1️⃣ 3196

2️⃣ 3071

3️⃣ 2966

4️⃣ 2885 (demand zone)

🟢 2. BUY SETUP (Breakout + Retest)

Only buy if price closes above 3275.

📍 Buy Entry

Above 3275 + retest of 3250–3260

🛑 SL

3220

🎯 TP

1️⃣ 3340

2️⃣ 3380

3️⃣ 3450

🟢 3. PULLBACK BUY (Best & Safe Buy Zone)

Look for price to retrace into demand areas.

📍 Pullback Buy Zones

Zone A:

3196 – 3170

Very strong FVG + demand

SL: 3140

TP: 3240 → 3275

Zone B (Bigger Pullback):

3071 – 3050

Clean structure support + liquidity level

SL: 3010

TP: 3150 → 3240 → 3300

🔻 4. PULLBACK SELL (If price breaks down)

Only if price breaks 3196 and retests.

📍 Pullback Sell Entry

3190 – 3205 retest

🛑 SL

3230

🎯 TP

1️⃣ 3071

2️⃣ 2966

3️⃣ 2885

🚫 5. NO-TRADE ZONE

3210 – 3240

Reason:

This is the mid-range of supply zone

Candles are mixed

Not safe to buy or sell until rejection or breakout

⭐ FINAL SUMMARY (Keep for Your Chart)

🔥 SELL (Current Best Setup)

Entry: 3240–3255

SL: 3275

TP: 3196 → 3071 → 2966 → 2885

🟢 BUY (Breakout)

Entry: above 3275 (retest 3250–3260)

SL: 3220

TP: 3340 → 3380 → 3450

🟢 PULLBACK BUY

Zone A: 3196–3170 (SL 3140)

Zone B: 3071–3050 (SL 3010)

TP: 3240 → 3275 → 3300

🔻 PULLBACK SELL

If price breaks 3196

Entry: 3190–3205

SL: 3230

TP: 3071 → 2966 → 2885

🚫 NO-TRADE ZONE: 3210–3240

ETH/USD – Potential Bullish Reversal from Extreme POI !Analysis:

The chart suggests Ethereum is currently trading inside a strong Extreme Point of Interest (POI) after a series of Breaks of Structure (BOSS) to the downside. Price has entered a demand zone that may trigger a bullish reversal.

Key observations:

Downtrend Structure: Multiple BOSS confirmations show sustained bearish momentum leading into the Extreme POI.

Extreme POI (Demand Zone): Price is consolidating inside a deep demand area marked in red, indicating potential accumulation by buyers.

POI Reaction Expected: If price maintains support here, a bullish reversal is likely.

Fair Value Gaps (FVG):

Two major FVGs above act as logical bullish targets for price inefficiency fill.

Projected Price Path:

The drawn projection suggests:

Short-term bounce from POI

Breakout structure upward

Continuation toward higher FVG fills around $2,962, $3,130, and possibly $3,192 – $3,220.

Bias:

▶ Bullish, as long as price remains above the Extreme POI.

A breakdown below would invalidate the setup and continue the downtrend.

This is a strong smart-money style setup with a clean narrative:

Demand → Break of structure → FVG fill → Higher targets.

ETH Weekly Chart Analysis1. The price has been respecting a weekly trendline for many months. This trendline acts like a support line where buyers usually come in.

2. Recently, the price fell towards this same trendline and created a hammer candle. A hammer at support often shows that sellers pushed the price down, but buyers stepped in strongly and pulled it back up. This is usually a sign of buying interest.

3. The hammer candle formed exactly near the support zone and the Fibonacci 61.8 percent area. This area often works as a strong reversal point.

4. When the hammer candle formed, the volume was very high. Huge volume at support means big players were actively buying at lower levels.

5. The price is still inside a wide range between recent highs and lows. It has not broken out yet, but the support reaction is positive.

In simple words, the chart is showing a strong bounce setup from support with a hammer candle and high volume. This is a sign that buyers may try to take control again as long as the price stays above the trendline and support area.

ETH/USD Technical Analysis – Strong Uptrend with Key Support📈 ETH/USD Technical Analysis – Strong Uptrend with Key Support

Trend Direction ➡️

The chart shows a clear bullish trend supported by an upward sloping trendline (green). Price action is consistently forming higher highs and higher lows, confirming strong upward momentum.

Support Zone 🟪

The highlighted support area (3,600 – 4,000) has been tested successfully. Price bounced strongly from this zone, showing buyers are actively defending this level.

Breakout & Momentum 🚀

After retesting support, ETH broke above the recent consolidation and is now trading around 4,843, pushing towards new highs. This signals bullish continuation if volume supports the move.

Trendline Confirmation 📐

The trendline has acted as a dynamic support multiple times. As long as ETH trades above it, the bullish trend remains intact.

Outlook 🔮

If ETH stays above 4,800, the next potential target could be 5,200+.

If price breaks below the trendline and the 3,600 support zone, bearish correction may begin.

✅ Summary: ETH is in a strong bullish trend 🚀, supported by both the trendline and key support zone. Short-term outlook remains bullish as long as 4,800 holds.

Ethereum (ETH) 1H Chart: Re-testing the All-Time High?Strong Uptrend Channel: The price of Ethereum has been moving within a well-defined ascending channel, indicated by two parallel black trendlines. This strong channel suggests a sustained bullish momentum.

All-Time High: A significant resistance level is marked as the "all-time high" at approximately 4,785.32 USD. The price has recently tested this level.

Support Levels:

Major Support Zone: A broad support zone is identified between approximately 3,300 USD and 3,450 USD. This zone has previously acted as a strong base for a price rally.

Recent Support Zone: A smaller, more recent support zone is marked around 4,200 USD. The price has consolidated within this area after its recent push towards the all-time high.

Price Action and Projections:

The price recently reached a peak near the all-time high and has since pulled back, consolidating within the recent support zone.

A key annotation states, "if breaks then we may see further downward." This highlights the importance of the 4,200 USD support zone. A break below this level could indicate a potential deeper retracement, possibly towards the lower trendline of the channel or the major support zone.

A parabolic arc is drawn (blue line), suggesting a potential trajectory for the price to continue its move higher from the current level, with a goal of re-testing or breaking the all-time high.

Volume: The chart includes a volume indicator, showing significant volume spikes during the major rallies and drops, confirming strong market interest and participation.

Ethereum Accumulation Zones Huge Dip Incoming- Ethereum is currently trading at 2262, down more than 22%

- Ethereum has two important areas to look at, and some important zones like 2110 & the OTEs 1694-1880$

- From an accumulation perspective, I would like to wait for ETH to purge either below the Inefficient gap or start going sideways at the buying zones

- To confirm this bias, we also need to make sure we consider taking a look at USDT D as well once it tops out, ETHs bottom will be near

- Manage risk properly and try to only trade in Spot

"Bearish Reversal Opportunity Following Supply Zone Rejection"1. Double Top Formation (Resistance Level Identified)

The chart displays a clear double top structure at the 2,760–2,800 USDT level.

This level has acted as a strong supply zone (highlighted in red), where price previously reversed, indicating heavy selling interest.

Current price action has retested this resistance zone and shown signs of rejection.

2. Liquidity Sweeps & False Breakouts

On the left side of the chart, an aggressive downward wick (marked with a blue arrow) suggests a liquidity sweep below a key low before strong bullish momentum returned.

This type of price action indicates smart money involvement, designed to remove weak hands before pushing price higher.

3. Accumulation Phases (Sideways Consolidation)

Multiple accumulation ranges are highlighted with blue rectangles.

These ranges show horizontal consolidation, where price builds up energy before breakout.

The most recent breakout led to a vertical rally toward the resistance zone, signaling an end of the accumulation and a start of distribution.

4. Double Bottom Support Structure

Identified near the 2,480 level, marked by red circles.

This level has historically acted as demand/support, evidenced by multiple bounces from this price zone.

Now highlighted with a grey zone, it is projected to act as the next key support area.

5. Bearish Projection

A large black arrow suggests a forecasted bearish move from the current high (~2,800) back to the support zone (~2,480).

This aligns with the idea of a mean reversion or pullback after a strong bullish impulse.

---

Conclusion & Trade Idea:

🔻 Bias: Bearish (Short-term)

The chart presents a classic reversal pattern with a double top at a well-defined supply zone.

Entry could be considered after confirmation of rejection from this level.

🧠 Trade Plan Suggestion:

Entry: Short near 2,780–2,800 after bearish confirmation (e.g., bearish engulfing candle or break of structure).

Target: 2,480 (support zone).

Stop Loss: Above 2,820 (recent high).

Risk-Reward: Approximately 1:2.5 or better depending on execution.

They saw a breakdown. I saw entry precision.ETH just did what it always does before a shift — it delivered into value.

Price rejected from 2,550 cleanly, took out weak buyers, and revisited the same HVN where prior accumulation began. That wasn’t a breakdown — it was completion.

I’m looking at the 2,488.11 zone — right at the 0.786 retracement — as the launchpad. It aligns with a low-volume tail, creating the exact imbalance Smart Money uses to reprice.

Above, I’m watching for a reversion to the mean at 2,511.9 (0.5), followed by a reaction at 2,532 — the last inefficient node before the supply wall at 2,550 gets filled again.

If we break through 2,550 clean, this becomes a much larger redistribution leg. But we trade it one delivery at a time.

Execution setup:

🎯 Entry: 2,488.11–2,474.0

🔑 Target 1: 2,511.9

🎯 Target 2: 2,550

❌ Invalidation: 2,474.0 clean break and continuation — wait for new structure

Nothing about this setup was noisy.

Just price completing its job.

I don’t chase the move. I meet it where it begins.