Predictions and analysis

hello, Today EURINR go up side when it break 89.6000 support its next resistance is 89.7925

As per my Analysis, EURINR is facing strong resistance at level inbetween 90.37-90.62,there could be a reversal from this resistance level, as a positional trader this could be a best opportunity to go short in EURINR either you can wait to reach near marked resistance or trendline resistance then you may go short. also keep tracing 50SMA to get better...

Hello guys, Hope you all are doing well. In my Analysis EURO is loosing its upside potential and uptrend so once the price reached at resistance level we may take a short position in EURINR and we can carry this position till end of this month or end of next month to get better results. Hope this will Help. Thanks. Amit Sharma.

Formation of ........ Chart Pattern. Choose the appropriate one? 1. Inverted Head and Shoulder 2. Head and Shoulder 3. Head and Shoulder Top 4. Bullish Head and Shoulder

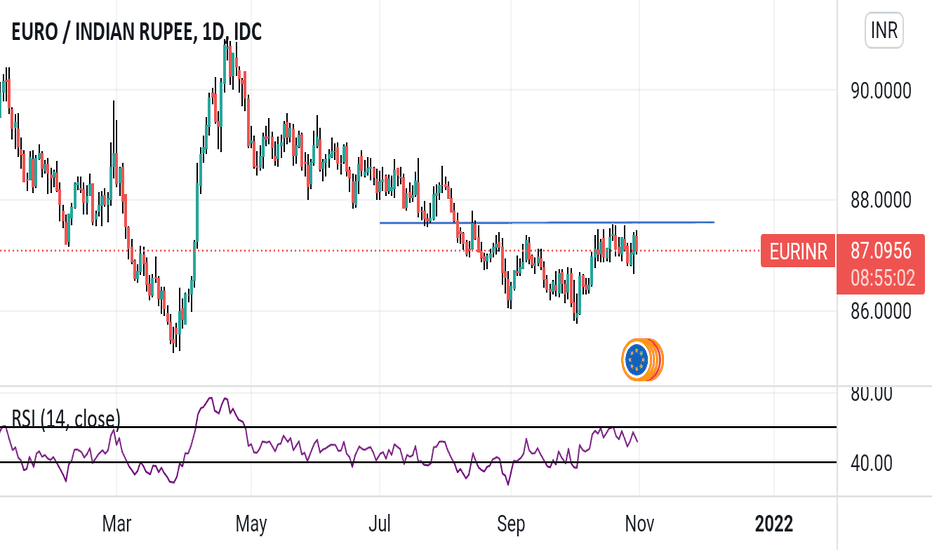

Euro to Indian Rupee pair (EURINR ) has been forming rising wedge for some time on the Daily time frame. This is also supported by fall in momentum as shown in the RSI. The pair has rejected bulls for last few days. Conditions look ripe for a fall in price toward wedge target zone of 86.8 on the EURINR spot pair. SL may be kept above previous high, around 89.30.

EUR/INR Is starting new uptrend. 👀📈 Trending🔥 move is highly possible there. Trigger/Stop 81.

EURINR spot pair has formed inverted head and shoulders on the 2H chart. The currency pair is breaking out of that formation. We can wait for a retracement to enter long for a measured move target of 83.5.

eurinr is nearly break out if you are trading in this currency wait for right entry and enter the right candale Conformation and risk rewardt ratio is 1:5

Short EURINR Entry, SL & Targets on Chart Disclaimer: All charts are for educational purpose. Consult your financial advisor before investing.

EURINR parallel channel near support bounced back with volumes

EUR/INR dupport level- 85.6291 if market take this support level you can buy EUR/INR.

EURINR Inverted Cup and Handle Breakout

Buy Eurinr 87.36/- ,last support for bulls

This is an additional study to my previous recommendation on EURINR. Buy More At Cmp 88.6588, Strict SL 87.59 (DCB)

EURINR has been moving sideways with a downward bias over the last few days post the peak on Dec 3rd. The sideways move has traced an W-X-Y pattern. The pattern also resembles a 'FLAG' pattern as per classical chart analysis. Considering the previous sharp move , one can expect a continued upsurge following a break of the upper trend line The subsequent move...